false2023FY0000930420http://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityCurrenthttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrentP2Y0MP1Yhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpenseP1Y1003005030000009304202023-01-012023-12-3100009304202023-06-30iso4217:USD00009304202024-02-20xbrli:shares00009304202022-01-012022-12-3100009304202021-01-012021-12-31iso4217:USDxbrli:shares00009304202023-12-3100009304202022-12-310000930420us-gaap:CommonStockMember2020-12-310000930420us-gaap:AdditionalPaidInCapitalMember2020-12-310000930420us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000930420us-gaap:RetainedEarningsMember2020-12-310000930420us-gaap:TreasuryStockCommonMember2020-12-3100009304202020-12-310000930420us-gaap:RetainedEarningsMember2021-01-012021-12-310000930420us-gaap:CommonStockMember2021-01-012021-12-310000930420us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000930420us-gaap:TreasuryStockCommonMember2021-01-012021-12-310000930420us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000930420us-gaap:CommonStockMember2021-12-310000930420us-gaap:AdditionalPaidInCapitalMember2021-12-310000930420us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000930420us-gaap:RetainedEarningsMember2021-12-310000930420us-gaap:TreasuryStockCommonMember2021-12-3100009304202021-12-310000930420us-gaap:RetainedEarningsMember2022-01-012022-12-310000930420us-gaap:CommonStockMember2022-01-012022-12-310000930420us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000930420us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000930420us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000930420us-gaap:CommonStockMember2022-12-310000930420us-gaap:AdditionalPaidInCapitalMember2022-12-310000930420us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000930420us-gaap:RetainedEarningsMember2022-12-310000930420us-gaap:TreasuryStockCommonMember2022-12-310000930420us-gaap:RetainedEarningsMember2023-01-012023-12-310000930420us-gaap:CommonStockMember2023-01-012023-12-310000930420us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000930420us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000930420us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000930420us-gaap:CommonStockMember2023-12-310000930420us-gaap:AdditionalPaidInCapitalMember2023-12-310000930420us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000930420us-gaap:RetainedEarningsMember2023-12-310000930420us-gaap:TreasuryStockCommonMember2023-12-31xbrli:pure0000930420kfrc:WorkLLamaLLCMember2019-06-300000930420kfrc:WorkLLamaLLCMember2023-01-012023-12-310000930420kfrc:WorkLLamaLLCMember2022-01-012022-12-310000930420kfrc:WorkLLamaLLCMemberus-gaap:NotesReceivableMember2022-01-012022-12-310000930420kfrc:WorkLLamaLLCMember2023-02-232023-02-230000930420kfrc:WorkLLamaLLCMemberkfrc:WorkLLamaLLCMember2023-02-230000930420srt:MinimumMember2023-12-310000930420srt:MaximumMember2023-12-310000930420kfrc:ComputersAndSoftwareMembersrt:MinimumMember2023-12-310000930420kfrc:ComputersAndSoftwareMembersrt:MaximumMember2023-12-3100009304202022-08-162022-08-1600009304202022-08-160000930420kfrc:TechnologySegmentMember2023-01-012023-12-310000930420kfrc:FinanceAndAccountingSegmentMember2023-01-012023-12-310000930420kfrc:TechnologySegmentMember2022-01-012022-12-310000930420kfrc:FinanceAndAccountingSegmentMember2022-01-012022-12-310000930420kfrc:TechnologySegmentMember2021-01-012021-12-310000930420kfrc:FinanceAndAccountingSegmentMember2021-01-012021-12-310000930420kfrc:FlexRevenueMemberkfrc:TechnologySegmentMember2023-01-012023-12-310000930420kfrc:FlexRevenueMemberkfrc:FinanceAndAccountingSegmentMember2023-01-012023-12-310000930420kfrc:FlexRevenueMember2023-01-012023-12-310000930420kfrc:DirectHireRevenueMemberkfrc:TechnologySegmentMember2023-01-012023-12-310000930420kfrc:DirectHireRevenueMemberkfrc:FinanceAndAccountingSegmentMember2023-01-012023-12-310000930420kfrc:DirectHireRevenueMember2023-01-012023-12-310000930420kfrc:FlexRevenueMemberkfrc:TechnologySegmentMember2022-01-012022-12-310000930420kfrc:FlexRevenueMemberkfrc:FinanceAndAccountingSegmentMember2022-01-012022-12-310000930420kfrc:FlexRevenueMember2022-01-012022-12-310000930420kfrc:DirectHireRevenueMemberkfrc:TechnologySegmentMember2022-01-012022-12-310000930420kfrc:DirectHireRevenueMemberkfrc:FinanceAndAccountingSegmentMember2022-01-012022-12-310000930420kfrc:DirectHireRevenueMember2022-01-012022-12-310000930420kfrc:FlexRevenueMemberkfrc:TechnologySegmentMember2021-01-012021-12-310000930420kfrc:FlexRevenueMemberkfrc:FinanceAndAccountingSegmentMember2021-01-012021-12-310000930420kfrc:FlexRevenueMember2021-01-012021-12-310000930420kfrc:DirectHireRevenueMemberkfrc:TechnologySegmentMember2021-01-012021-12-310000930420kfrc:DirectHireRevenueMemberkfrc:FinanceAndAccountingSegmentMember2021-01-012021-12-310000930420kfrc:DirectHireRevenueMember2021-01-012021-12-310000930420us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310000930420us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-310000930420us-gaap:FurnitureAndFixturesMember2023-12-310000930420us-gaap:FurnitureAndFixturesMember2022-12-310000930420us-gaap:ComputerEquipmentMembersrt:MinimumMember2023-12-310000930420us-gaap:ComputerEquipmentMembersrt:MaximumMember2023-12-310000930420us-gaap:ComputerEquipmentMember2023-12-310000930420us-gaap:ComputerEquipmentMember2022-12-310000930420srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2023-12-310000930420srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2023-12-310000930420us-gaap:LeaseholdImprovementsMember2023-12-310000930420us-gaap:LeaseholdImprovementsMember2022-12-310000930420us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberkfrc:WorkLLamaLLCMemberus-gaap:FinanceReceivablesMember2022-12-310000930420kfrc:TechnologySegmentMember2022-12-310000930420kfrc:TechnologySegmentMember2023-12-310000930420kfrc:TechnologySegmentMember2021-12-310000930420kfrc:FinanceAndAccountingSegmentMember2022-12-310000930420kfrc:FinanceAndAccountingSegmentMember2021-12-310000930420kfrc:FinanceAndAccountingSegmentMember2023-12-310000930420us-gaap:EmployeeStockMember2023-01-012023-12-31kfrc:executive0000930420us-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMember2021-10-200000930420us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberkfrc:CreditFacilityMember2021-10-202021-10-200000930420us-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMember2021-10-202021-10-2000009304202021-10-202021-10-200000930420us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberkfrc:CreditFacilityMembersrt:MinimumMember2021-10-202021-10-200000930420us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberkfrc:CreditFacilityMembersrt:MaximumMember2021-10-202021-10-200000930420us-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMembersrt:MinimumMember2021-10-202021-10-200000930420us-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMembersrt:MaximumMember2021-10-202021-10-200000930420us-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMembersrt:MinimumMember2021-10-20utr:Rate0000930420us-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMembersrt:MaximumMember2021-10-200000930420us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-12-310000930420us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310000930420us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2023-12-310000930420us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2022-12-310000930420us-gaap:DesignatedAsHedgingInstrumentMemberkfrc:InterestRateSwapAMember2020-05-310000930420us-gaap:DesignatedAsHedgingInstrumentMemberkfrc:InterestRateSwapAMember2017-05-310000930420kfrc:InterestRateSwapBMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-03-170000930420kfrc:InterestRateSwapBMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-05-310000930420kfrc:InterestRateSwapBMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMember2022-05-310000930420kfrc:InterestRateSwapBMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:RevolvingCreditFacilityMemberkfrc:CreditFacilityMember2022-05-012022-05-310000930420us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310000930420us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310000930420us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310000930420kfrc:TwoThousandTwentyThreeStockIncentivePlanMember2023-04-200000930420kfrc:OptionOrStockAppreciationRightMember2023-04-200000930420us-gaap:CommonStockMember2023-04-200000930420us-gaap:RestrictedStockMembersrt:MinimumMember2023-01-012023-12-310000930420srt:MaximumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310000930420us-gaap:RestrictedStockMember2022-12-310000930420us-gaap:RestrictedStockMember2023-01-012023-12-310000930420us-gaap:RestrictedStockMember2023-12-310000930420us-gaap:RestrictedStockMember2022-01-012022-12-310000930420us-gaap:RestrictedStockMember2021-01-012021-12-310000930420srt:MinimumMember2023-01-012023-12-310000930420srt:MaximumMember2023-01-012023-12-310000930420us-gaap:AllowanceForCreditLossMember2020-12-310000930420us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000930420us-gaap:AllowanceForCreditLossMember2021-12-310000930420us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310000930420us-gaap:AllowanceForCreditLossMember2022-12-310000930420us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310000930420us-gaap:AllowanceForCreditLossMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________________________________________

FORM 10-K

_____________________________________________________________________________

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 000-26058

_____________________________________________________________________________

Kforce Inc.

(Exact name of Registrant as specified in its charter)

_____________________________________________________________________________ | | | | | | | | |

| Florida | | 59-3264661 |

| State or other jurisdiction of incorporation or organization | | IRS Employer Identification No. |

| | | | | | | | |

1150 Assembly Drive, Suite 500, Tampa, Florida | | 33607 |

| Address of principal executive offices | | Zip Code |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (813) 552-5000

_____________________________________________________________________________

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 per share | KFRC | NASDAQ |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

_____________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | Smaller reporting company | | ☐ |

| | | Emerging growth filer | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.): Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2023, was $911,384,374. For purposes of this determination, common stock held by each officer and director and by each person who owns 10% or more of the registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding (in thousands) of the registrant’s common stock as of February 20, 2024 was 19,518.

DOCUMENTS INCORPORATED BY REFERENCE: | | | | | | | | |

| Document | | Parts Into Which

Incorporated |

Portions of the Proxy Statement for the Annual Meeting of Shareholders scheduled to be held on April 24, 2024 (“Proxy Statement”) | | Part III |

KFORCE INC.

TABLE OF CONTENTS | | | | | | | | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| Item 15. | | |

| Item 16. | | |

| |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

References in this document to the “Registrant,” “Kforce,” the “Company,” “we,” the “Firm,” “management,” “our” or “us” refer to Kforce Inc. and its subsidiaries, except where the context otherwise requires or indicates.

This report, particularly Item 1. Business, Item 1A. Risk Factors and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), and the documents we incorporate into this report, contain certain statements that are, or may be deemed to be, forward-looking statements within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are made in reliance upon the protections provided by such acts for forward-looking statements. Such statements may include, but may not be limited to: expectations of financial or operational performance, including our expectations regarding the future changes in revenue of each segment of our business; the impact of the economic environment on our business; our ability to control discretionary spending and decrease operating costs; the Firm’s commitment and ability to return significant capital to its shareholders; our ability to meet capital expenditure and working capital requirements of our operations; the intent and ability to declare and pay quarterly dividends; growth rates in temporary staffing; a constraint in the supply of consultants and candidates or the Firm’s ability to attract such individuals; changes in client demand for our services and our ability to adapt to such changes; the ability of the Firm to maintain and attract clients in the face of changing economic or competitive conditions; our expected investments in certain service areas or programs; our expectations regarding the impacts of technological development on our business; our beliefs regarding the expected future benefits of our flexible working environment; our ability to maintain compliance with our credit facility's covenants; potential government actions or changes in laws and regulations; anticipated costs and benefits of acquisitions, divestitures, joint ventures and other investments; effects of interest rate variations; financing needs or plans; estimates concerning the effects of litigation or other disputes; the occurrence of unanticipated expenses; as well as assumptions as to any of the foregoing and all statements that are not based on historical fact, but rather reflect our current expectations concerning future results and events. For a further list and description of various risks, relevant factors and uncertainties that could cause future results or events to differ materially from those expressed or implied in our forward-looking statements, refer to the Risk Factors and MD&A sections. In addition, when used in this discussion, the terms “anticipate,” “assume,” “estimate,” “expect,” “intend,” “plan,” “believe,” “will,” “may,” “likely,” “could,” “should,” “future” and variations thereof and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted. Future events and actual results could differ materially from those set forth in or underlying the forward-looking statements. Readers are cautioned not to place undue reliance on any forward-looking statements contained in this report, which speak only as of the date of this report. Kforce undertakes no obligation to update any forward-looking statements.

PART I

ITEM 1. BUSINESS.

COMPANY OVERVIEW

Kforce Inc., along with its subsidiaries (collectively, “Kforce”), is a solutions firm specializing in technology and finance and accounting professional staffing services. Our KNOWLEDGEforce® empowers industry-leading companies to achieve their digital transformation goals. We curate teams of technical experts who build solutions custom-tailored to each client's needs. These scalable, flexible outcomes are shaped by deep market knowledge, thought leadership and our multi-industry expertise. Our integrated approach is rooted in 60 years of proven success deploying highly skilled professionals on a temporary (“Flex”) and permanent (“Direct Hire”) basis.

Kforce serves clients across a diverse set of industries and organizations of all sizes, but we place a particular focus on serving Fortune 500 and other large companies. Each year, over 20,000 talented consultants provide services to a significant majority of the Fortune 500. Together, we deliver Great Results Through Strategic Partnership and Knowledge Sharing®.

Over the last decade, we have driven significant, strategic change at Kforce, including but not limited to, streamlining the focus of our business on providing technology talent solutions. In alignment with this goal, since 2008, we have completed various divestitures of businesses that did not relate to our core business.

Our Technology and Finance and Accounting (“FA”) businesses represent our two operating segments. Our Technology business comprises 90% of our overall revenues, and the remainder is generated by our FA business. For our Flex services, we provide our clients with qualified individuals (“consultants”), or teams of consultants, on a finite basis when the consultant's set of skills and experience is the right match for our clients. For our Direct Hire services, we identify qualified individuals (“candidates”) for permanent placement with our clients. We further describe our two operating segments below.

Our operating results can be affected by:

•the number of billing days;

•the seasonality of our clients’ businesses;

•changes in holidays and vacation days taken, which is usually highest in the fourth quarter of each calendar year; and

•increased costs as a result of certain annual U.S. state and federal employment tax resets that occur at the beginning of each calendar year, which negatively impact our gross profit and overall profitability in the first fiscal quarter of each calendar year.

Our Technology Business

We provide talent solutions to our clients in highly skilled areas including, but not limited to, systems/applications architecture and development (mobility and/or web); data management and analytics; cloud architects and engineers; business and artificial intelligence (“AI”); machine learning; project and program management; and network architecture and security.

We provide services to clients across virtually every industry with a diversified footprint in, among others, financial and business services, communications, insurance, retail and technology.

We have continued to broaden our service offerings beyond traditional staffing to include managed teams and project

solutions. We believe our clients consider access to the right talent to be essential to their success and see our services as a cost-effective solution for their project requirements as demonstrated by more than 90% of our managed teams and project solutions being executed within existing clients. Kforce has been successfully winning more complex engagements due to the strong, long-standing partnerships we have built with our clients, our capability in identifying quality technology talent, and our reputation for delivering quality services. We are continuing to further integrate this capability into our Technology business.

The September 2023 report published by Staffing Industry Analysts (“SIA”) stated that temporary technology staffing was forecasted to decline by 3% in 2023 and grow by 5% in 2024. Technology, as a discipline, continues to be project driven, even amidst generational changes like AI. There are a multitude of technology projects that need to be addressed to remain competitive, irrespective of economic performance.

Our Technology revenues declined 8.2% year-over-year (7.8% per billing day), to $1.4 billion in 2023. Although we experienced a decline in 2023, our Technology business grew 18% in 2022 on a year-over-year billing day basis after growing more than 22% in 2021 on a year-over-year billing day basis. The average bill rate in the fourth quarter of 2023 was approximately $90 per hour, which remained stable as compared to the fourth quarter of 2022. Our average assignment duration has been steadily increasing over the last several years and is currently 10 months.

The strength of the secular drivers of demand in technology accelerated significantly coming out of both the Great

Recession, with advancements in mobility and cloud computing, among many others, and the 2020 COVID-19 Pandemic, with further digitalization of businesses and the continued headlines around Generative AI technologies. What remains clear to us is that the broad and strategic uses of technology, including AI technologies, will continue to evolve and play an increasingly instrumental role in powering businesses. Over the long term, we believe that AI and other technologies will continue to drive demand for, rather than replace technology resources, and that the pace of change will accelerate.

While our Technology business is not immune to economic turbulence, we believe there is a critical need for innovation to support business strategies and sustain relevancy in today’s rapidly changing marketplace.

Our FA Business

Over the last several years, we have been strategically repositioning our FA business to focus on more highly skilled assignments that are less susceptible to technological change and automation and that more closely aligned with our Technology business. The talent solutions we offer our clients in our FA business include traditional finance and accounting roles, such as: finance, planning and analysis; business intelligence analysis; general accounting; transactional accounting (e.g., payables, billing, cash applications, receivables, etc.); business and cost analysis; and taxation and treasury. We will continue to support certain clients with whom we have long-standing relationships and that are strategically important to our overall success by providing consultants in lower skill roles (i.e. loan servicing; customer and call center support; data entry; and other administrative roles).

We believe we have made solid progress in this repositioning effort as evidenced by our overall average bill rate in our FA business of $51 per hour in the fourth quarter of 2023, which improved from $46 per hour, or 9.8%, as compared to the fourth quarter of 2022 and from $37 per hour, or 37.8%, as compared to the fourth quarter of 2019.

We provide services to clients in a variety of industries with a diversified footprint in, among others, the financial services, business services, healthcare and manufacturing sectors.

Revenue for our FA business decreased 27.5% to $147.2 million in 2023 compared to 2022, which was primarily driven by the repositioning efforts of our business towards higher skill roles and the continued uncertainty in the macroeconomic environment.

Our Consultants

The majority of our consultants are directly employed by Kforce, including domestic workers and foreign workers whose visas are sponsored by Kforce. As the employer of the vast majority of our consultants, Kforce is responsible for the employer’s share of applicable payroll taxes (“FICA”), federal and state unemployment taxes, workers’ compensation insurance and other direct labor costs. The more significant health, welfare and retirement benefits include comprehensive health insurance, workers’ compensation benefits, and retirement plan options.

A key ingredient to our overall success in attracting and retaining our consultants is fostering a positive experience for our consultants and offering rewarding assignments with world-class companies.

We measure the quality of our service to and support of our consultants using staffing industry benchmarks and net promoter score (“NPS”) surveys conducted by a specialized, independent third-party provider. Additionally, we continually seek direct feedback from our consultants to help us identify opportunities to refine our services. Our 2023 consultant NPS are well above current industry averages and near the world class designation.

Industry Overview and Addressable Market Opportunity

We assist our clients, which are principally market-leading companies in their respective industries, in solving their complex business challenges and digitally transform their businesses. We continue to believe that technology is at the epicenter of how business is conducted and investments in technology are simply not optional in today’s competitive and disruptive business climate. Our core competency is rooted in the ability to identify and provide qualified and highly-skilled consultants to our clients under a spectrum of engagement structures from traditional staff augmentation to delivering technology solutions.

From a traditional staff augmentation standpoint, the staffing industry is made up of thousands of companies, most of which are small local firms providing limited service offerings to relatively small local client bases. A report based on revenues published by SIA in 2023 indicated that, in the United States, Kforce is one of the largest publicly-traded specialty staffing firms, the sixth largest technology temporary staffing firm and the eleventh largest finance and accounting temporary staffing firm.

According to the September 2023 SIA report, the technology temporary staffing industry and finance and accounting temporary staffing industry are expected to generate projected revenues of $43 billion and $9 billion, respectively, in 2024. Based on these projected revenues, our current market share is nearly 3%. Our business strategies are focused on continuing to penetrate our share of the U.S. temporary staffing industry and continue investing in our capability to provide higher level technology services and solutions while also integrating that capability within our overall Technology business. We believe that the organic investments that we have made in our managed teams and project solutions capabilities over the last several years continues to expand Kforce’s total addressable market into the information technology solutions space. While reports differ in the size of the information technology solutions addressable market, IBIS World has indicated it is greater than $500 billion. While the portion that is addressable by Kforce is debatable, what is clear to us is that our addressable market is significantly greater than the $43 billion and $9 billion for the technology and finance and accounting temporary staffing industries, respectively.

Based on data published by the U.S. Bureau of Labor Statistics and SIA, temporary employment figures and trends are important indicators of staffing demand from an economic standpoint. The penetration rate (the percentage of temporary staffing to total employment) decreased to 1.8% in December 2023, from 2.0% in December 2022, while the unemployment rate, increased to 3.7% in December 2023 from 3.5% in December 2022. In addition, the college-level unemployment rate, which we believe serves as a better proxy for professional employment, and therefore aligns well with the consultant and candidate population that Kforce most typically serves, increased to 2.1% in December 2023, from 1.9% in December 2022.

Business Strategies

Our primary business strategies are driving long-term shareholder value by achieving above-market revenue growth within the domestic technology solutions space, making prudent investments to enhance our efficiency and effectiveness within our consistent operating model, and significantly improving our profitability as we progress towards double digit operating margins. We believe the following strategic priorities will help us achieve our objectives.

Back-Office Transformation. Over the last five to ten years, we have been investing in high quality technologies that have significantly bolstered our associates’ productivity and enhanced our ability to effectively and efficiently support our clients, consultants and candidates. Our customer relationship management (“CRM”) and talent relationship management (“TRM”) capabilities are now on the Microsoft Dynamics platform, which went live in March 2017 and June 2020, respectively. We are continuing to make investments in these technologies, and others, to enhance our capabilities and processes in ways we believe will allow us to better evaluate and shape business opportunities with our clients and more seamlessly match candidates to assignments and projects.

We have not made meaningful investments in our back-office technologies in more than 15 years while the complexities of our business and client requirements have increased significantly. We have been meeting these complexities and requirements by adding dedicated Firm resources, which is not a scalable solution as we continue to grow. Our multi-year transformation program for our back-office technology will enhance the support to our Firm, including our clients, candidates and consultants. Overall, the benefits of streamlining our processes will create a positive impact resulting in increased client satisfaction and improved consultant productivity. This multi-year effort was initiated following a comprehensive assessment of our current state, and this assessment confirmed our belief that we have a tremendous opportunity to fundamentally transform and create advancements in our back office functions. In 2023, we made tremendous progress advancing this program by selecting Workday as our future state enterprise cloud application for human capital management and financial reporting, and also selected our systems integrator to support us in the design, configuration and implementation of these solutions. In 2024, we expect to continue allocating significant investments towards this initiative as we initiate detailed design and implementation steps.

We are incredibly fortunate to be partnering with Workday and Microsoft, two companies at the forefront of investing in AI, which puts us in an ideal position to take advantage of these technologies as they become available.

Integrated Strategy. Our clients are increasingly looking to us to deliver services across a spectrum from traditional staff augmentation to managed project solutions. We have been organically investing in our managed teams and project solutions capabilities over the last five years, and this offering has been positively contributing to our financial results. We expect to continue to make investments in advancing our capabilities in this service offering and further integrating this capability within our overall Technology business. Our integration strategy is intended to harness the longevity of our relationships, primarily with Fortune 500 companies, and execute a unified account pursuit and delivery approach that broadly leverages our capabilities across the Firm.

Evolving our Nearshore and Offshore Delivery Strategy. Virtually all of our revenues are generated by helping our clients solve their most complex technology challenges through our onshore delivery model. Thus, the predominant worksite for our consultants is within the U.S. We have experienced an increasing desire by our clients in certain engagements for a blended delivery model leveraging onshore, nearshore and offshore resources to gain cost efficiencies and increase the speed of technological change. In these cases, we leverage our qualified partner network where we have long-standing relationships and proven track records. In the longer-term, we believe there is a tremendous opportunity for us to develop a more scalable nearshore and offshore delivery capability.

Competition

We operate in a highly competitive and fragmented staffing industry comprised of large national and local staffing and solutions firms. The local firms are typically operator-owned, and generally each geographic market has at least one significant competitor. Within our managed teams and project solutions offerings, we also face competition from global, national and regional accounting, consulting and advisory firms, as well as national and regional strategic consulting and systems implementation firms. We believe that our physical presence in larger markets, concentration of service offerings in areas of greatest demand (especially technology), national delivery teams, centralized delivery channels for foreign consultants (including those obtained via visa programs that optimize distribution and strengthen compliance), longevity of our brand and reputation in the market, along with our dedicated compliance and regulatory infrastructure, all provide a competitive advantage.

Managed Service Providers (“MSP”) or Vendor Management Organizations (“VMO”) are utilized by certain of our clients for the management and procurement of our services. We do not consider these organizations as a competitive threat. Generally, MSPs and VMOs standardize processes through the use of Vendor Management Systems (“VMS”), which are tools used to aggregate spend and measure supplier performance. VMS’ are also offered through independent providers. Typically, MSPs, VMOs and/or VMS providers charge staffing firms administrative fees ranging from 1% to 4% of revenue. In addition, the aggregation of services by MSPs for their clients into a single program can result in significant buying power and, thus, pricing power. Therefore, the use of MSPs by our clients has, in certain instances, resulted in gross margin compression, but has also led to incremental client share through our client’s vendor consolidation efforts. Kforce does not currently provide MSP or VMO services directly to our clients; rather, our strategy has been to work with MSPs, VMOs and VMS providers that enable us to better extend our services to current and prospective clients.

We believe that the principal elements of competition in our industry are differentiated offerings; reputation; the ability of consultants to work on assignments with innovative and leading companies; the availability and quality of associates, consultants and candidates; the level of service provided; effective monitoring of job performance; scope of geographic service; the types of service offerings; and compliance orientation. To attract consultants and candidates, we emphasize our ability to provide competitive compensation and benefits; quality and varied assignments; scheduling flexibility and permanent placement opportunities, all of which are important to Kforce being the employer of choice. Because individuals pursue other employment opportunities on a regular basis, it is important that we respond to market conditions affecting these individuals and focus on our consultant relationship objectives. Additionally, in certain markets, from time to time we have experienced significant pricing pressure as a result of our competitors’ pricing strategies, which may result in us not being able to effectively compete or choosing to not participate in certain business that does not meet our profitability standard.

Regulatory Environment

Staffing and solutions firms are generally subject to one or more of the following types of government regulations: (1) regulation of the employer/employee relationship, such as wage and hour regulations, payroll tax withholding and reporting, immigration/visa regulations, as well as social security and other retirement, anti-discrimination, employee benefits and workers’ compensation regulations; (2) registration, licensing, recordkeeping and reporting requirements; and (3) worker classification regulations.

As the employer, Kforce is responsible for the employer’s share of FICA, federal and state unemployment taxes, workers’ compensation insurance and other direct labor costs relating to our employees. The more pertinent health, welfare and retirement benefits provided to employees and consultants employed directly by us include: comprehensive health insurance, workers’ compensation benefits and retirement plan options. We also provide paid leave for our associates and certain consultants. We have no collective bargaining agreements covering any of our employees, have never experienced any material labor disruption and are unaware of any current efforts or plans of our employees to organize.

Because we operate in a complex regulatory environment, one of our top priorities is compliance. For more discussion of the potential impact that the regulatory environment could have on Kforce’s financial results, refer to Item 1A. Risk Factors.

Insurance

Kforce maintains a number of insurance policies, including general liability, automobile liability, workers’ compensation and employers’ liability, liability for certain foreign exposure, umbrella and excess liability, property, crime, fiduciary, directors and officers, employment practices liability, cybersecurity, professional liability and excess health insurance coverage. These policies provide coverage, subject to certain terms, conditions, and limits of liability and deductibles, for certain liabilities that may arise from Kforce’s operations. There can be no assurance that any of the above policies will be adequate for our needs, or that we will maintain all such policies in the future.

Human Capital Management and Environmental, Social and Governance (“ESG”) Matters

For over 60 years, Kforce has been rooted in stewardship, integrity and compassion. As a human capital solutions business, we are driven by the desire to serve others, provide meaningful work and opportunities to a diverse workforce, strengthen our communities and shape a more sustainable world.

Our 2023 Sustainability Report recognizes achievements in our ESG-related initiatives, and also outlines opportunities for continued growth and evolution. For a detailed discussion of our ESG initiatives, achievements and commitments, please refer to our 2023 Sustainability Report and 2023 Supplemental Greenhouse Gas (“GHG”) Report, publicly available on our website: https://www.kforce.com/about/kforce-corporate-social-responsibility/.

We are grounded by our people-first approach with a set of Core Values that serves as a solid foundation. Our Core Values, as described below, are the foundation for how we positively impact our communities, the environment and the governance of our Firm.

The following sections provide a high-level overview of our strategic initiatives related to each of the ESG pillars.

Governance

We believe that our governance principles add value to our shareholders, associates, consultants, clients and communities. These principles provide a framework for our culture, strategy, people and policy. This section includes an overview of our commitment to oversight, ethics and integrity, and risk management.

Oversight - Our Board of Directors (“Board”) meets regularly to assess strategic plans and manage risks to our business and people, as well as to promote sound corporate governance practices and policies. These practices and policies include firm-wide compliance with our Commitment to Integrity - Kforce’s Code of Business Conduct - that intends to set the highest ethical standards for how we conduct business (“Code of Conduct”). The Board is responsible for the oversight of our ESG policies and strategy. The Board delegates certain aspects to Board committees who inherently play an active role and are jointly responsible for ESG compliance and oversight. The Board’s Audit Committee (the “Audit Committee”) oversees the Firm’s cybersecurity and data privacy strategies and practices, regularly reviews the Firm’s cybersecurity roadmaps and framework progress and receives updates on relevant activities and measures. Refer to Item 1C. Cybersecurity for additional details regarding the oversight of cybersecurity.

Code of Conduct - Our Code of Conduct reflects our commitment to operate in a fair, honest, responsible and ethical manner, and it covers various topics, including, but not limited to, cybersecurity, insider trading, data privacy, equal opportunity employment and acceptable pay practices. Our associates receive annual training on our Code of Conduct and are required to certify compliance. Everyone who works with us—from our directors and executives to our associates, consultants, suppliers and business partners—is trained on and expected to abide by our Code of Conduct.

People

As of December 31, 2023, Kforce employed approximately 1,800 associates and had 8,600 consultants on assignment with our clients, of which a significant majority of these consultants are employed directly by Kforce.

Our work environment is shaped by our people. We maintain a commitment to well-being, flexibility and balance; learning and development; and diversity, equity and inclusion. We believe these initiatives are a testament to how much we value and invest in our people.

Well-Being, Flexibility and Balance - The success of our business is fundamentally connected to the well-being of our people. We provide our associates and consultants, and their families, with access to a variety of flexible and convenient health and wellness programs. These programs are part of our thoughtful and comprehensive response to support the physical and mental health of our employees by providing tools and resources that each employee can use to improve or maintain their health.

Shaped by the feedback of our associates, our Office Occasional® remote-first, hybrid work model is supported by flexibility and choice, and empowered by trust and technology. We have successfully transitioned many of our offices to align with our Office Occasional® strategy and will continue to transition our remaining offices as they come up for renewal. The shift in strategy to Office Occasional® has allowed us to introduce a new design and streamline our overall physical footprint, which has led to a decline in overall square footage compared to pre-pandemic periods. We believe that our Office Occasional® model allows our associates to design their workdays; thus, additionally contributing to their health and well-being.

Learning and Development - To turn a job into a career, we believe people need clear and attainable paths to grow. We are committed to investing in the tools, resources and trainings necessary for our people to excel in all stages of their career. We believe our leadership development programs help people grow their skills from the moment they join our Firm through the most senior level of their careers.

Diversity, Equity and Inclusion (“DE&I”) - Our DE&I mission is to advocate for and support the inclusion, growth and success of all people connected to Kforce. The ultimate goal is to weave DE&I seamlessly into our overall firm strategy using a variety of approaches including creating an inclusive culture, ensuring an equitable talent journey for all, establishing policies that support our people, building an increasingly robust pipeline of diverse candidates, enhancing our supplier diversity practices, and instituting training programs to meet our DE&I objectives.

Refer to our 2023 Sustainability Report, which includes trends related to employee turnover rates and workforce demographics.

Environmental

As a people-focused solutions business, our impact on the environment is relatively low. With that said, we regularly look

for opportunities to reduce our impact on the environment. We saw some of the greatest environmental benefits to date as a result of the continued rollout of our Office Occasional® work model, which resulted in a significant reduction in office space, business travel, in-office electricity usage and employee commutes.

During 2023, we engaged a third-party specialist to calculate our greenhouse gas emissions (“GHG”) for Scopes 1, 2 and 3 for 2023, which indicated a decline of approximately 55% compared to our 2019 baseline. This information is more fully detailed in our 2023 Sustainability Report.

Availability of Reports and Other Information

Our internet address is www.kforce.com. We post our filings, free of charge, at https://investor.kforce.com the same day they are electronically filed with, or furnished to, the SEC, including our annual and quarterly reports on Forms 10-K and 10-Q, current reports on Form 8-K, our proxy statements, and any amendments to those reports or statements. The content on any website referred to in this Form 10-K is not incorporated by reference in this Form 10-K unless expressly noted.

ITEM 1A. RISK FACTORS.

Our business, financial condition, results of operations and cash flows are subject to, and could be materially adversely affected by, various risks and uncertainties, including, without limitation, those set forth below, any one of which could cause our actual results to vary materially from recent results or our anticipated future results. These risk factors are grouped by category and are presented in order of their relative priority in each respective category.

Risks Related to Our Business

The U.S. professional staffing and solutions industry in which we operate is significantly affected by fluctuations in general economic and employment conditions.

Demand for our services, generally speaking, can be significantly affected by the general level of economic activity and employment in the U.S. Even in a strong demand environment, without significant uncertainty and volatility, it is difficult for us to forecast future demand for our services due to the inherent challenge in forecasting the strength of economic cycles, availability of consultants and candidates and the short-term nature of many of our agreements. As economic activity slows, companies may defer or terminate projects for which they utilize our services or reduce their use of consultants. In addition, an economic downturn or recession could result in an increase in the unemployment rate and a deceleration of growth in the segments in which we and our clients operate. We may also experience more competitive pricing pressures during periods of economic downturn. Any substantial economic downturn, including an environment with significant inflationary and/or recessionary pressures, in the U.S. or global impact on the U.S., could have a material adverse effect on our business, financial condition and operating results.

Significant declines in business or a loss of a significant client could have a material adverse effect on our revenues and financial results.

Part of our business strategy includes enhancing our service offerings and relationships with larger consumers of our services, which is intended to provide relative durability to our revenue stream during adverse economic environments and enable us to grow our revenues more profitably. However, it also creates the potential for concentrating a significant portion of our revenues among our largest clients and exposes us to increased risks arising from decreases in the volume of business from, the pricing of business with, or the possible loss of business, with these clients. Organizational changes occurring within those clients, a deterioration of their financial condition or business prospects, or a change in their business strategies could reduce their need for our services and result in a significant decrease in the revenues we derive from those clients, which could have a material adverse effect on our financial results.

Kforce’s current market share may decrease as a result of limited barriers to entry for new competitors and discontinuation of clients looking to outside providers to support their talent needs.

The staffing services market is highly competitive with limited barriers to entry. The competition among staffing and solutions firms is intense and we face significant competition in the markets we serve. We compete in national, regional and local markets with full-service and specialized temporary staffing and consulting companies. Additionally, the emergence and popularity of online staffing platforms as well as internal recruiting functions used by some clients as an alternative, may pose a competitive threat to our services. Some of our competitors possess substantially greater resources than we do and others may develop new and unique technologies, which may better position these competitors in certain markets. As a result, we may face increased competitive pricing pressures. We also face the risk that certain of our current and prospective clients will decide to provide similar services internally. Furthermore, many clients are retaining third parties to provide vendor management services, which may subject us to greater risks or lower margins.

New business initiatives and strategic changes may divert management’s attention from normal business operations or may not be successful, which could have an adverse effect on our performance.

We expect to continue allocating significant investments towards our multi-year transformation program for our back-office technology, investing in our managed teams and project solutions capabilities, and evolving our nearshore and offshore delivery strategy. These improved capabilities are expected to help deliver exceptional service to our clients, consultants and candidates and improve the productivity of our associates and the scalability of our organization.

New business strategies and initiatives, such as these, can be distracting to our management team and associates, and can also be disruptive to our operations. New business initiatives could also involve significant unanticipated challenges and risks, including not advancing our business strategy, not realizing the expected return on the investment, experiencing difficulty in implementing initiatives, or diverting management’s attention from our other businesses. New business initiatives and strategic changes in the composition of our business mix can be a diversion to our management’s attention from other business concerns and could be disruptive to our operations, which could cause our business and results of operations to suffer materially.

Kforce may not be able to recruit and retain qualified consultants and candidates.

Kforce depends upon its ability to attract and retain consultants and candidates, particularly in technology disciplines, who possess the skills and experience necessary to meet the requirements of our clients. We must continually evaluate and upgrade our methods of attracting qualified consultants and candidates to keep pace with changing client needs and emerging technologies. We expect significant competition for individuals with proven technical or professional skills to continue or increase for the foreseeable future given the scarcity of highly skilled consultants and candidates, especially in our Technology business. If qualified individuals are not available to us in sufficient numbers and upon economic terms acceptable to us, it could have a material adverse effect on our business.

Kforce faces significant employment-related legal risk.

Kforce employs consultants either in the workplaces of our clients or virtually. Inherent risks in our business include possible claims of or relating to: discrimination and harassment; wrongful termination; violations of employment rights related to employment screening or privacy issues; misclassification of workers as employees or independent contractors; violations of wage and hour requirements and other labor laws; employment of illegal aliens; criminal activity; torts; breach of contract; failure to protect confidential personal information; intentional criminal misconduct; misuse or misappropriation of client intellectual property; employee benefits; or other claims. U.S. courts in recent years have been receiving large numbers of wage and hour class action claims alleging misclassification of overtime-eligible workers and/or failure to pay overtime-eligible workers for all hours worked. In some situations, as a practical matter, we may not be in control of the work environment. Additionally, in some circumstances, we are contractually obligated to indemnify our clients against such risks. Such claims may result in negative publicity, injunctive relief, criminal investigations and/or charges, civil litigation, payment by Kforce of defense costs, monetary damages or fines that may be significant, discontinuation of client relationships or other material adverse effects on our business.

To reduce our exposure, we maintain policies, procedures and guidelines to promote compliance with laws, rules, regulations and best practices applicable to our business. Even claims without merit could cause us to incur significant expense or reputational harm. We also maintain insurance coverage for professional liability, fidelity, employment practices liability and general liability in amounts and with deductibles that we believe are appropriate for our operations. However, our insurance coverage may not cover all potential claims against us, may require us to meet a deductible or may not continue to be available to us at a reasonable cost. In this regard, we face various employment-related risks not covered by insurance, such as wage and hour laws and employment tax responsibility.

Kforce may not be able to utilize the services of our third-party suppliers.

Our third-party suppliers may be impacted by economic conditions and cycles as well as changing laws and regulatory requirements, which could impact their ability to do business with us, or cause us to terminate our relationship with them, and require us to find replacements, which we may have difficulty doing. Without the use of our third-party suppliers, we may be unable to provide a sufficient number of consultants with the required skills and expertise to our clients, which may result in reduced client satisfaction. A reduced pool of candidates may prevent us from expanding into new markets. This lack of flexibility and adaptability can hinder the Firm’s growth potential, which could have a material adverse effect on our business.

Kforce may be adversely affected by utilizing third-party software providers.

An inherent risk of using a third-party software provide is dependency on their performance, reliability and availability. Any issues or downtime experienced by the provider may impact our operations and productivity. Third-party software solutions may not always fully align with our specific business requirements or workflows. Customization options might be limited, making it challenging to tailor the software to our exact needs, which may hinder our ability to optimize processes and achieve maximum efficiency. Relying on third-party solutions may result in higher costs over time, due to subscription fees and licensing costs for support or upgrades, which could have a material adverse effect on our financial results.

Kforce may be exposed to unforeseeable negative acts by our personnel that could have a material adverse effect on our business.

An inherent risk of employing people is that they may have access or may gain access to information systems and confidential information. The risks of such activity include possible acts of errors and omissions; intentional misconduct; release, misuse or misappropriation of client intellectual property, confidential information, personally identifiable information, funds, or other property; data privacy or cybersecurity breaches affecting our clients and/or us; or other acts. Misconduct by our employees could include intentional or unintentional failures to comply with federal government regulations, engaging in unauthorized activities, or improper use of our clients’ sensitive or classified information, potentially in collusion with third parties, which could result in regulatory or criminal sanctions against us and serious harm to our reputation. It is not always possible to deter employee misconduct, and precautions to prevent and detect any such misconduct may not be effective in controlling such risks or losses, which could have a material adverse effect on our business.

In addition, any such misconduct may give rise to litigation, which could be time-consuming and expensive. To reduce our exposure, we maintain policies, procedures and insurance coverage for types and amounts we believe are appropriate in light of the aforementioned potential exposures. There can be no assurance that the corporate policies and practices we have in place to help reduce our exposure to these risks will be effective or that we will not experience losses as a result of these risks. In addition, our insurance coverage may not cover all potential claims against us, may require us to meet a deductible or may not continue to be available to us at a reasonable cost.

Kforce’s success depends upon retaining the services of its management team and key operating employees.

Kforce is highly dependent on the efforts, expertise and abilities of its leaders to drive the Firm’s strategic objectives and achieve future success. The loss of the services of any key executive for any reason could have a material adverse effect on Kforce. To attract and retain executives and other key employees (particularly management, client servicing and consultant and candidate recruiting employees) in a competitive marketplace, we must provide a competitive compensation package, including a mix of cash-based and equity-based compensation. Kforce expends significant resources in the recruiting and training of its employees, as the pool of available applicants for these positions is limited. The loss or any sustained attrition of our key operating employees could have a material adverse effect on our business, including our ability to establish and maintain client, consultant and candidate, professional and technical relationships.

Risk Related to Cybersecurity and Technology

Cybersecurity risks and cyber incidents could adversely affect our business and disrupt operations.

We are continuously exposed to unauthorized attempts to compromise sensitive information from network or information technology used by our associates and consultants. Attacks on information technology systems continue to grow in frequency and sophistication. These attacks include, but are not limited to, attempts to gain unauthorized access to digital systems for purposes of misappropriating assets or sensitive information, corrupting data or causing operational disruption. While we have policies, procedures and systems in place to prevent, deter and detect cyberattacks or security incidents, and, although we have not experienced a material data breach, we remain vulnerable to sophisticated techniques used to obtain unauthorized access, or cause system interruption, that change frequently and may not produce immediate signs of intrusion. As a result, we may be unable to anticipate these incidents or techniques, timely discover them or implement adequate preventative measures. Any cyberattack, unauthorized intrusion, malicious software infiltration, network disruption, corruption of data, misuse or theft of private or other sensitive information, or inadvertent acts by our associates, consultants or third-party independent contractors, could result in the disclosure or misuse of confidential or proprietary information, and could adversely impact our systems, services, operations, financial results and reputation with clients and potential clients.

The collection, possession and use of personal information and data in conducting our business subjects us to legislative and regulatory burdens and compliance risk. Other results of these incidents could include, but are not limited to, increased cybersecurity protection costs, litigation, regulatory penalties, monetary damages and reputational damage adversely affecting client or investor confidence. We may be required to incur significant expenses to comply with mandatory privacy and security standards and protocols imposed by law, regulation, industry standards or contractual obligations. We maintain cyber risk insurance, but this insurance may not be sufficient to cover all of our losses suffered as a result of a breach of our systems or information. Our information technology may not provide sufficient protection, and as a result we may lose significant information about us, our employees, candidates, consultants, vendors, or clients.

Additionally, many of our information technology systems and networks are cloud-based or managed by third parties, whose future performance and reliability we cannot control. The risk of a cyberattack or security breach on a third party carries the same risks to Kforce as those associated with our internal systems. We seek to reduce these risks by performing vendor due diligence procedures prior to engaging with any third-party vendor who will have access to sensitive data. Additionally, we require audits of certain third parties’ information technology processes on an annual basis. However, there can be no assurance that such parties will not experience cybersecurity incidents that could adversely affect our employees, consultants, customers and businesses, or that our audit or diligence processes will successfully deter or prevent such breach.

Kforce depends on the proper functioning of its information systems.

Kforce is dependent on the proper functioning of information systems in operating our business. Critical information systems are used in every aspect of our daily operations, perhaps most significantly, in the identification and matching of resources to client assignments and in the client billing and consultant or vendor payment functions. Kforce’s information systems may not perform as expected and are vulnerable to damage or interruption, including natural disasters, fire or casualty, theft, technical failures, terrorist acts, cybersecurity breaches, power outages, telecommunications failures, physical or software intrusions, computer viruses, employee errors or other events. While many of our systems are cloud-based, certain of our systems are still on location. Our corporate headquarters and data center are located in a hurricane-prone area. Failure or interruption of our critical information systems may require significant additional capital and management resources to resolve, which could have a material adverse effect on our business.

Our failure to keep pace with technological change in our industry could potentially place us at a competitive disadvantage.

Our future success is likely to depend in part on our ability to successfully keep pace with technological changes and advances occurring across our industry. Our business is reliant on a variety of systems and technologies, including those that support consultant and candidate searching and matching, hiring and tracking, order management, billing and client data analytics. Our success depends in part on our ability to keep pace with rapid technological advancements in the development and implementation of these services. If our systems become outdated, or if our investments in technology fail to provide the expected results, then we may be unable to maintain our technological capabilities relative to our competitors and our business could be negatively affected.

Risks Related to Legal, Compliance and Regulatory Matters

Kforce may be adversely affected by immigration restrictions and reform.

Our Technology business utilizes a significant number of foreign nationals employed by us on work visas, primarily under the H-1B visa classification. While Kforce engages persons with multiple types of legal work authorizations and visas, the H-1B visa is of particular use in our industry and enables U.S. employers to hire qualified foreign nationals, subject to legislative and administrative changes, as well as changes in the application of standards and enforcement. Immigration laws and regulations can be significantly affected by changes in administration, other political developments and levels of economic activity. Current and future restrictions on the availability of such work visas could restrain our ability to employ the skilled professionals we need to meet our clients’ needs, which could have a material adverse effect on our business.

The U.S. Citizenship and Immigration Service (“USCIS”) continues to closely scrutinize companies seeking to sponsor, renew or transfer H-1B status, including Kforce and Kforce’s third-party independent contractors, and has issued internal guidance to its field offices that appears to narrow the eligibility criteria for H-1B status in the context of staffing services. In addition to USCIS restrictions, certain aspects of the H-1B program are also subject to regulation and review by the U.S. Department of Labor and U.S. Department of State, which have recently increased enforcement activities in the program.

Vigorous enforcement and legislative or executive action relating to immigration could adversely affect our ability to recruit or retain foreign national consultants, and consequently, reduce our supply of skilled consultants and candidates, and subject us to fines, penalties and sanctions, or result in increased labor and compliance costs.

Reclassification of our independent contractors by tax or regulatory authorities could have a material adverse effect on our business model and/or could require us to pay significant retroactive wages, taxes and penalties.

We utilize individuals to provide services in connection with our business as qualified third-party independent contractors rather than our direct employees. Heightened state and federal scrutiny of independent contractor relationships could adversely affect us given that we utilize independent contractors to perform our services. An adverse determination related to the independent contractor status of these subcontracted personnel could result in substantial taxes or other liabilities to us, which could result in a material adverse effect upon our business.

Significant increases in wages or payroll-related costs could have a material adverse effect on our financial results.

Kforce is required to pay a number of federal, state and local payroll and related costs or provide certain benefits such as paid time off, sick leave, unemployment taxes, workers’ compensation and insurance premiums and claims, FICA and Medicare, among others, related to our employees. Costs could also increase as a result of health care reforms or the possible imposition of additional requirements and restrictions related to the placement of personnel. We may not be able to increase the fees charged to our clients in a timely manner or in a sufficient amount to cover these potential cost increases.

Adverse results in tax audits or interpretations of tax laws could have an adverse impact on our business.

Kforce is subject to periodic federal, state and local tax audits for various tax years. We are also required to comply with new, evolving or revised tax laws and regulations. The Tax Cuts and Jobs Act, enacted in December 2017, provided a significant reduction in the corporate tax rate, but the current administration continues to scrutinize and could potentially modify key aspects of the tax code, which could materially affect our tax obligations and the effective tax rate. Although Kforce attempts to comply with all taxing authority regulations, adverse findings or assessments made by taxing authorities as the result of an audit could have a material adverse effect on Kforce.

Kforce may be adversely affected by government regulation of our business and of the workplace.

Our business is subject to regulation and licensing in many states. There can be no assurance that we will be able to continue to obtain all necessary licenses or approvals or that the cost of compliance will not prove to be material. If we fail to comply, such failure could have a material adverse effect on our financial results.

A large part of our business entails employing individuals on a temporary basis and placing such individuals in client workplaces. Increased government regulation of the workplace or of the employer/employee relationship could have a material adverse effect on Kforce. For example, changes to government regulations, including changes to statutory hourly wage and overtime regulations, could adversely affect the Firm’s results of operations by increasing its costs. Due to the substantial number of state and local jurisdictions in which we operate and the disparity among state and local laws that continues to accelerate, there also is a risk that we may be unaware of, or unable to adequately monitor, actual or proposed changes in, or the interpretation of, the laws or governmental regulations of such states and localities. Any delay in our compliance with changes in such laws or governmental regulations could result in potential fines, penalties or other sanctions for non-compliance.

Significant loss or suspension of our facility security clearances with the federal government could lead to a reduction in our revenues, cash flows and operating results.

We act as a subcontractor to the U.S. federal government and many of its agencies. Some government subcontracts require us to maintain facility security clearances and require some of our employees to maintain individual security clearances. If our employees lose or are unable to timely obtain security clearances, or we lose a facility clearance, a government agency client may terminate the subcontract or decide not to renew it upon its expiration. In addition, a security breach by us could cause serious harm to our business, damage our reputation and prevent us from being eligible for further work on sensitive or classified systems for federal government clients.

General Risk Factors

Failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting.

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our disclosure controls and internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable assurance that the objectives of the control system are met. If our management is unable to certify the effectiveness of our internal controls, including those over our third-party vendors, our independent registered public accounting firm cannot render an opinion on the effectiveness of our internal controls over financial reporting, or if material weaknesses in our internal controls are identified, we could be subject to regulatory scrutiny and a loss of public confidence, which could cause our stock price to decline.

Provisions in Kforce’s articles and bylaws and Florida law may have certain anti-takeover effects.

Kforce’s articles of incorporation and bylaws and Florida law contain provisions that may have the effect of inhibiting a non-negotiated merger or other business combination. In particular, our articles of incorporation provide for staggered Board terms and permit the removal of directors only for cause. Additionally, the Board may issue up to 15 million shares of preferred stock, and fix the rights and preferences thereof, without a further vote of the shareholders. In addition, certain of our officers and managers have employment agreements containing certain provisions that call for substantial payments to be made to such employees in certain circumstances after a change in control. Some or all of these provisions may discourage a future acquisition of Kforce, including an acquisition in which shareholders might otherwise receive a premium for their shares. As a result, shareholders who might desire to participate in such a transaction may not have the opportunity to do so. Moreover, the existence of these provisions could negatively impact the market price of our common stock.

Our business could be negatively affected as a result of activist shareholders.

We may be subject, from time to time, to legal and business challenges in the operation of our company due to actions instituted by activist shareholders or others. Responding to such actions could be costly and time-consuming, may not align with our business strategies and could divert the attention of the Board and management from the pursuit of our business strategies. Perceived uncertainties as to our future direction as a result of shareholder activism may lead to the perception of a change in the direction of the business or other instability and may affect our relationships with vendors, customers and prospective and current employees and consultants.

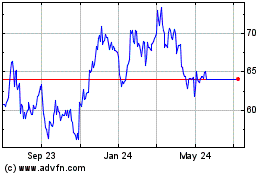

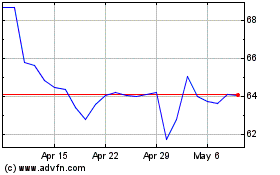

Kforce’s stock price may be volatile.

The market price of our stock has fluctuated substantially in the past and could fluctuate substantially in the future based on a variety of factors, including our operating results, changes in general conditions in the economy, the financial markets, the staffing industry, a decrease in our outstanding shares or other developments affecting us, our clients, or our competitors; some of which may be unrelated to our performance.

In addition, the stock market in general, especially NASDAQ, along with market prices for staffing companies, has experienced historical volatility that has often been unrelated to the operating performance of these companies. These broad market and industry fluctuations may adversely affect the market price of our common stock, regardless of our operating results.

Among other things, volatility in our stock price could mean that investors will not be able to sell their shares at or above the prices they pay. The volatility also could impair our ability in the future to offer common stock as a source of additional capital or as consideration in the acquisition of other businesses, or as compensation for our key employees.

Kforce may be negatively affected by outbreaks of disease, such as epidemics or pandemics.

The COVID-19 economic and health crisis (including all of its variants) impacted many of our clients’ business operations due to reduced demand, which in some cases was caused by government closures and/or initiatives to reduce costs or preserve cash, thereby decreasing demand for our services and/or adversely affecting our profitability and collectability of our accounts receivable.

Outbreaks of disease, including epidemics and pandemics, can affect our operations and financial performance if potential new variants are declared, vaccines are mandated, and government actions to prevent and manage disease spread. Outbreaks of diseases could negatively affect our business, financial position, results of operations and/or cash flows in the future.