UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 5, 2016

IRADIMED CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

001-36534 |

|

73-1408526 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

1025 Willa Springs Dr., Winter Springs, FL |

|

32708 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(407) 677-8022

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On February 5, 2016, IRADIMED CORPORATION (the “Company”) issued a press release announcing its financial results for the fourth quarter ended December 31, 2015. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press release dated February 5, 2016 announcing the Company’s results of operations for its fourth quarter ended December 31, 2015.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

IRADIMED CORPORATION |

|

|

|

|

Date: February 5, 2016 |

|

|

|

By: |

/s/ Chris Scott |

|

|

Name: |

Chris Scott |

|

|

Title: |

Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit No. |

|

Document |

|

|

|

|

|

99.1 |

|

Press release dated February 5, 2016 announcing the Company’s results of operations for its fourth quarter ended December 31, 2015. |

4

Exhibit 99.1

IRADIMED CORPORATION Announces Fourth Quarter 2015 Financial Results

· Revenue grows 145.5% compared to the same quarter last year

· Reports fourth quarter 2015 non-GAAP diluted EPS of $0.22

Winter Springs, Florida, February 5, 2016 — IRADIMED CORPORATION (NASDAQ:IRMD), the only known provider of non-magnetic intravenous (IV) infusion pump systems that are designed to be safe for use during magnetic resonance imaging (MRI) procedures, today announced financial results for the three months and full year ended December 31, 2015.

For the fourth quarter ended December 31, 2015, the Company reported revenue of $8.8 million, an increase of 145.5% compared to $3.6 million for the fourth quarter of 2014. Net income was $2.4 million, or $0.19 per diluted share, compared with net income of $0.3 million, or $0.02 per diluted share for the fourth quarter of 2014.

The Company reported non-GAAP net income of $2.7 million for the fourth quarter ended December 31, 2015, an increase of 572.8% over the fourth quarter of 2014. Non-GAAP earnings per diluted share increased 523.9% to $0.22 per diluted share for the fourth quarter 2015, compared to $0.03 in the fourth quarter 2014. Free cash flow was $2.5 million for the quarter ended December 31, 2015, a 350.9% increase over the fourth quarter 2014.

Gross profit margin was 83.0% for the fourth quarter of 2015, compared to 74.4% for the fourth quarter of 2014. Domestic sales were 86.6% of total revenue for the fourth quarter 2015, compared to 32.4% for the fourth quarter 2014.

For the full year ended December 31, 2015, the Company reported revenue of $31.6 million, an increase of 101.8% compared to $15.7 million for the prior year. Net income was $7.5 million, or $0.60 per diluted share, compared with net income of $2.1 million, or $0.20 per diluted share for the prior year.

The Company reported non-GAAP net income of $8.7 million for the year ended December 31, 2015, an increase of 245.9% over the prior year. Non-GAAP earnings per diluted share increased 181.5% to $0.69 per diluted share for the year ended December 31, 2015, compared to $0.25 in the prior year. Free cash flow was $7.4 million for the year ended December 31, 2015, a 267.2% increase over the prior year.

Gross profit margin was 81.5% for the full year 2015, compared to 78.3% for the prior year. Domestic sales were 91.3% of total revenue for the full year 2015, compared to 72.6% for the prior year.

As of December 31, 2015, backlog was approximately $13.9 million.

The Company’s financial results for the quarter and full year ended December 31, 2014 were negatively impacted by the domestic stop ship of their MRI compatible IV pumps that resulted from the FDA Warning Letter received on September 2, 2014. On December 22, 2014, the Company announced that it had resumed domestic shipments.

“I continue to be pleased with the performance of IRADIMED. Our products continue to gain acceptance as well as remain the exclusive non-magnetic MRI IV pump solution. We see continued growth and achievement of solid financial results. For the fourth quarter, revenue was $8.8 million and our non-GAAP diluted earnings per share increased to $0.22. Both of these metrics grew impressively over the prior year, even after considering the favorable impact in 2015 resulting from the FDA Warning Letter and related domestic shipping hold during 2014. During the year, we made significant progress on a number of initiatives throughout the Company, from development of our MRI compatible patient monitoring system, to expanding our sales capability, as well as with FDA and regulatory efforts that we expect will give us additional momentum as we move deeper into 2016,” said Roger Susi, President and Chief Executive Officer of the Company.

“We continue improving our performance in both manufacturing and sales while preparing for the launch of our major new product line, and I remain optimistic about 2016 and the plans we have established to ensure our success this year and in the years to come,” said Susi.

Financial Guidance

On January 11, 2016, the Company provided revenue and non-GAAP diluted earnings guidance for the first quarter and full year 2016.

For the first quarter 2016, the Company expects revenue of approximately $9.0 million to $9.1 million and non-GAAP diluted earnings per share of $0.17 to $0.18. For the full year 2016, the Company expects revenue of $39.0 million to $40.0 million and non-GAAP diluted earnings per share of $0.83 to $0.85.

Use of non-GAAP Financial Measures

The Company believes the use of non-GAAP net income, free cash flow and infrequent income tax items are helpful to our investors. These measures, which we refer to as our non-GAAP financial measures, are not prepared in accordance with GAAP. We calculate non-GAAP net income as net income excluding stock-based compensation expense, net of tax. Because of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact a company’s non-cash expenses, we believe that providing non-GAAP financial measures that exclude stock-based compensation expense allow for meaningful comparisons between our operating results from period to period. We calculate free cash flow as net cash provided by operating activities less net cash used in investing activities for purchases of property and equipment. We consider free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by our business that can be used for strategic opportunities, including investing in our business, making strategic acquisitions, strengthening our balance sheet and returning cash to our shareholders via share repurchases. Infrequent tax items are considered based on their nature and are excluded from the provision for income taxes as these costs or benefits are not indicative of our normal or future provision for income taxes. All of our non-GAAP financial measures are important tools for financial and operational decision making and for evaluating our operating results.

A reconciliation of the non-GAAP financial measures used in this release to the most comparable U.S. GAAP measures for the respective periods can be found in the table later in this release immediately following the condensed statements of cash flows. These non-GAAP financial measures should not be considered in isolation or as a substitute for a measure of the Company’s operating performance or liquidity prepared in accordance with U.S. GAAP and are not indicative of net income or cash provided by operating activities.

Conference Call

IRADIMED has scheduled a conference call to discuss this announcement beginning at 11:00 a.m. Eastern Time today, February 5, 2016. Individuals interested in listening to the conference call may do so by dialing 1-844-413-1781 for domestic callers, or 1-716-247-5767 for international callers, and entering the reservation code 37106645.

The conference call will also be available real-time via the internet at www.iradimed.com/en-us/investors/index.php and selecting Events & Presentation. A recording of the call will be available on the Company’s website following the completion of the call.

About IRADIMED CORPORATION

IRADIMED CORPORATION is the only known provider of non-magnetic intravenous (IV) infusion pump systems that are specifically designed to be safe for use during magnetic resonance imaging (MRI) procedures. We were the first to develop an infusion delivery system that neutralizes the dangers and problems present during MRI procedures. Standard infusion pumps contain magnetic and electronic components which can create radio frequency (RF) interference and are dangerous to operate in the presence of the powerful magnet that drives an MRI system. Our MRidium MRI compatible IV infusion pump system has been designed with a patented non-magnetic ultrasonic motor, uniquely-designed non-ferrous parts and other special features in order to safely and predictably deliver anesthesia and other IV fluids during various MRI procedures. Our pump solution provides a seamless approach that enables accurate, safe and dependable fluid delivery before, during and after an MRI scan, which is important to critically-ill patients who cannot be removed from their vital medications, and children and infants who must generally be sedated in order to remain immobile during an MRI scan.

MRidium is a trademark of IRADIMED CORPORATION.

For more information please visit www.iradimed.com.

Forward-Looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Act of 1995, particularly statements regarding our expectations, beliefs, plans, intentions, future operations, financial condition and prospects, and business strategies. These statements relate to future events or our future financial performance or condition and involve unknown risks, uncertainties and other factors that could cause our actual results, level of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. The risks and uncertainties referred to above include, but are not limited to, risks associated with the Company’s ability to receive clearance of its 510(k) submission, additional actions by or requests from the FDA (including a request to cease domestic distribution of products) and unanticipated costs or delays associated with resolution of these matters; our reliance on a single product; unexpected costs, expenses and diversion of management attention resulting from the FDA warning letter; potential disruptions in our limited supply chain for our products; a reduction in international distribution as we focus on fulfilling orders from our U.S. backlog; actions of the FDA or other regulatory bodies that could delay, limit or suspend product development, manufacturing or sales; the effect of recalls, patient adverse events or deaths on our business; difficulties or delays in the development, production, manufacturing and marketing of new or existing products and services; changes in laws and regulations or in the interpretation or application of laws or regulations.

Further information on these and other factors that could affect the Company’s financial results is included in filings we make with the Securities and Exchange Commission from time to time. All forward-looking statements are based on information available to us on the date hereof, and we assume no obligation to update forward-looking statements.

IRADIMED CORPORATION

CONDENSED BALANCE SHEETS

|

|

|

December 31,

2015 |

|

December 31,

2014 |

|

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

19,368,114 |

|

$ |

9,454,150 |

|

|

Investments |

|

7,602,204 |

|

7,913,793 |

|

|

Accounts receivable, net |

|

3,863,632 |

|

1,960,214 |

|

|

Inventory, net |

|

2,383,158 |

|

2,125,838 |

|

|

Prepaid expenses and other current assets |

|

317,957 |

|

276,540 |

|

|

Prepaid income taxes |

|

273,968 |

|

320,941 |

|

|

Deferred income taxes |

|

141,446 |

|

116,339 |

|

|

Total current assets |

|

33,950,479 |

|

22,167,815 |

|

|

Property and equipment, net |

|

905,622 |

|

794,835 |

|

|

Intangible assets, net |

|

175,513 |

|

250,836 |

|

|

Deferred income taxes |

|

88,398 |

|

76,557 |

|

|

Other assets |

|

124,195 |

|

19,676 |

|

|

Total assets |

|

$ |

35,244,207 |

|

$ |

23,309,719 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,005,460 |

|

$ |

629,167 |

|

|

Accrued payroll and benefits |

|

1,288,248 |

|

1,244,898 |

|

|

Other accrued taxes |

|

30,687 |

|

65,790 |

|

|

Warranty reserve |

|

34,081 |

|

27,925 |

|

|

Deferred revenue |

|

536,924 |

|

308,341 |

|

|

Total current liabilities |

|

2,895,400 |

|

2,276,121 |

|

|

Deferred revenue |

|

415,782 |

|

142,902 |

|

|

Total liabilities |

|

3,311,182 |

|

2,419,023 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock |

|

1,118 |

|

1,082 |

|

|

Additional paid-in capital |

|

19,332,023 |

|

15,785,838 |

|

|

Retained earnings |

|

12,655,169 |

|

5,125,249 |

|

|

Accumulated other comprehensive loss |

|

(55,285 |

) |

(21,473 |

) |

|

Total stockholders’ equity |

|

31,933,025 |

|

20,890,696 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

35,244,207 |

|

$ |

23,309,719 |

|

IRADIMED CORPORATION

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

Three Months Ended

December 31, |

|

Years Ended

December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Revenue |

|

$ |

8,799,256 |

|

$ |

3,583,503 |

|

$ |

31,593,720 |

|

$ |

15,653,057 |

|

|

Cost of revenue |

|

1,499,977 |

|

918,696 |

|

5,840,407 |

|

3,404,400 |

|

|

Gross profit |

|

7,299,279 |

|

2,664,807 |

|

25,753,313 |

|

12,248,657 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

2,140,810 |

|

1,331,922 |

|

7,769,881 |

|

4,816,973 |

|

|

Sales and marketing |

|

1,306,397 |

|

792,101 |

|

4,705,977 |

|

3,297,120 |

|

|

Research and development |

|

499,997 |

|

315,407 |

|

1,764,306 |

|

1,068,674 |

|

|

Total operating expenses |

|

3,947,204 |

|

2,439,430 |

|

14,240,164 |

|

9,182,767 |

|

|

Income from operations |

|

3,352,075 |

|

225,377 |

|

11,513,149 |

|

3,065,890 |

|

|

Other income (expense), net |

|

(36,274 |

) |

(54,824 |

) |

121,385 |

|

(48,549 |

) |

|

Income before provision for income taxes |

|

3,315,801 |

|

170,553 |

|

11,634,534 |

|

3,017,341 |

|

|

Provision (benefit) for income taxes |

|

911,095 |

|

(100,267 |

) |

4,104,614 |

|

966,975 |

|

|

Net income |

|

$ |

2,404,706 |

|

$ |

270,820 |

|

$ |

7,529,920 |

|

$ |

2,050,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.22 |

|

$ |

0.03 |

|

$ |

0.68 |

|

$ |

0.23 |

|

|

Diluted |

|

$ |

0.19 |

|

$ |

0.02 |

|

$ |

0.60 |

|

$ |

0.20 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

11,101,444 |

|

10,804,854 |

|

11,003,272 |

|

8,743,461 |

|

|

Diluted |

|

12,656,735 |

|

11,737,104 |

|

12,556,887 |

|

10,219,143 |

|

IRADIMED CORPORATION

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

Years Ended

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

Operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

7,529,920 |

|

$ |

2,050,366 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Bad debt expense |

|

3,553 |

|

(108,852 |

) |

|

Provision for excess and obsolete inventory |

|

51,089 |

|

62,069 |

|

|

Depreciation and amortization |

|

223,942 |

|

149,056 |

|

|

Excess tax benefit on the exercise of stock options |

|

(1,728,595 |

) |

(165,228 |

) |

|

Stock-based compensation |

|

1,220,118 |

|

724,063 |

|

|

Impairment of intangible assets |

|

55,433 |

|

— |

|

|

Loss (gain) on sale of securities |

|

3,575 |

|

(7,316 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(1,906,971 |

) |

130,721 |

|

|

Inventory |

|

(308,409 |

) |

(847,576 |

) |

|

Prepaid expenses and other current assets |

|

(31,977 |

) |

(154,912 |

) |

|

Other assets |

|

(113,959 |

) |

(15,433 |

) |

|

Deferred income taxes |

|

(16,116 |

) |

(167,305 |

) |

|

Accounts payable |

|

376,293 |

|

201,693 |

|

|

Accrued payroll and benefits |

|

43,350 |

|

589,536 |

|

|

Other accrued taxes |

|

(35,103 |

) |

(14,997 |

) |

|

Warranty reserve |

|

6,156 |

|

15,923 |

|

|

Deferred revenue |

|

501,463 |

|

186,172 |

|

|

Accrued income taxes, net of prepaid income taxes |

|

1,775,568 |

|

(48,188 |

) |

|

Other |

|

— |

|

5,928 |

|

|

Net cash provided by operating activities |

|

7,649,330 |

|

2,585,720 |

|

|

Investing activities: |

|

|

|

|

|

|

Purchases of investments |

|

— |

|

(7,951,497 |

) |

|

Proceeds from the sale or maturities of investments |

|

253,370 |

|

255,109 |

|

|

Purchases of property and equipment |

|

(298,723 |

) |

(583,977 |

) |

|

Capitalized intangible assets |

|

(16,116 |

) |

(22,311 |

) |

|

Net cash used in investing activities |

|

(61,469 |

) |

(8,302,676 |

) |

|

Financing activities: |

|

|

|

|

|

|

Proceeds from stock option exercises |

|

597,508 |

|

105,000 |

|

|

Income tax benefits credited to equity |

|

1,728,595 |

|

165,228 |

|

|

Proceeds from the sale of common stock pursuant to initial public offering |

|

— |

|

14,490,000 |

|

|

Payment of initial public offering costs |

|

— |

|

(2,044,348 |

) |

|

Repayment of officer note payable |

|

— |

|

(6,333 |

) |

|

Net cash provided by financing activities |

|

2,326,103 |

|

12,709,547 |

|

|

Net increase in cash and cash equivalents |

|

9,913,964 |

|

6,992,591 |

|

|

Cash and cash equivalents, beginning of period |

|

9,454,150 |

|

2,461,559 |

|

|

Cash and cash equivalents, end of period |

|

$ |

19,368,114 |

|

$ |

9,454,150 |

|

IRADIMED CORPORATION

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (UNAUDITED)

Non-GAAP Net Income and Diluted EPS

|

|

|

Three Months Ended

December 31, |

|

Years Ended

December 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Net income |

|

$ |

2,404,706 |

|

$ |

270,820 |

|

$ |

7,529,920 |

|

$ |

2,050,366 |

|

|

Excluding: |

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense, net of tax expense |

|

340,499 |

|

139,795 |

|

953,357 |

|

459,131 |

|

|

Infrequent tax item |

|

17,305 |

|

— |

|

198,192 |

|

— |

|

|

Non-GAAP net income |

|

$ |

2,762,510 |

|

$ |

410,615 |

|

$ |

8,681,469 |

|

$ |

2,509,497 |

|

|

Weighted average shares outstanding — diluted |

|

12,656,735 |

|

11,737,104 |

|

$ |

12,556,887 |

|

10,219,143 |

|

|

Non-GAAP net income per share — diluted |

|

$ |

0.22 |

|

$ |

0.03 |

|

$ |

0.69 |

|

$ |

0.25 |

|

Free Cash Flow

|

|

|

Three Months Ended

December 31, 2015 |

|

Year Ended

December 31, 2015 |

|

|

Net cash provided by operating activities |

|

$ |

2,566,720 |

|

$ |

7,649,330 |

|

|

Less: |

|

|

|

|

|

|

Purchases of property and equipment |

|

105,355 |

|

298,723 |

|

|

Free cash flow |

|

$ |

2,461,365 |

|

$ |

7,350,607 |

|

Media Contact:

Chris Scott

Chief Financial Officer

IRADIMED CORPORATION

(407) 677-8022

InvestorRelations@iradimed.com

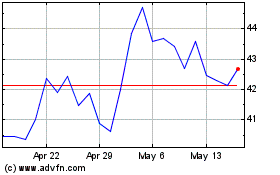

iRadimed (NASDAQ:IRMD)

Historical Stock Chart

From Jun 2024 to Jul 2024

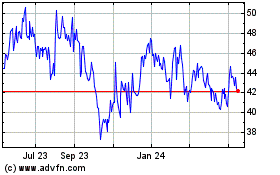

iRadimed (NASDAQ:IRMD)

Historical Stock Chart

From Jul 2023 to Jul 2024