SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

| Intrusion Inc. |

| (Name of Registrant as Specified In Its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

INTRUSION INC.

101 EAST PARK BLVD., SUITE 1200

PLANO, TEXAS 75074

(972) 234-6400

_____________________

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held March 15, 2024

_____________________

To the Stockholders of Intrusion Inc.:

NOTICE IS HEREBY GIVEN

that a Special Meeting of Stockholders (the “Special Meeting”) of Intrusion Inc. (“Intrusion”) will be held

on Friday, March 15, 2024, at 9:00 a.m., local time, at 101 East Park Blvd, Plano, Texas 75074. The Special Meeting will be held for

the following purposes:

| (1) |

To approve the amendment of Intrusion’s Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to effectuate a reverse stock split of Intrusion’s outstanding shares of common stock, at a ratio of no less than 1-for-2 and no more than 1-for-20, with such ratio to be determined at the sole discretion of the Board; |

| |

|

| (2) |

To approve the amendment of Intrusion’s Certificate of Incorporation to eliminate Series 1, Series 2, and Series 3 preferred shares; |

| |

|

| (3) |

To approve the amendment of Intrusion’s Certificate of Incorporation to create a right of stockholders to take action by written consent; |

| |

|

| (4) |

To approve the amendment of Intrusion’s Certificate of Incorporation to add a Delaware forum selection provision; |

| |

|

| (5) |

To approve the amendment of Intrusion’s Certificate of Incorporation to update, clarify and remove outdated provisions; and |

| |

|

| (6) |

To transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

The foregoing items of business

are more fully described in the proxy statement accompanying this notice. The record date for determining those stockholders who will

be entitled to notice of, and to vote at, the Special Meeting and at any adjournment thereof is January 16, 2024. A list of stockholders

entitled to vote at the Special Meeting will be available for inspection at the offices of the Company during the 10 days prior to the

Special Meeting.

All stockholders are cordially

invited to attend the Special Meeting in person. Stockholders are urged, whether or not they plan to attend the Meeting, to complete,

date and sign the enclosed proxy and return it promptly in the enclosed postage prepaid envelope. Your proxy may be revoked at any time

prior to the Special Meeting.

| |

By Order of the Board of Directors |

| |

|

| |

|

| |

/s/ Anthony J. LeVecchio |

| |

Anthony J. LeVecchio |

| |

Chairman of the Board |

Plano, Texas

January 25, 2024

Important Notice Regarding

the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on March 15, 2024: This notice and the accompanying

proxy statement are available at www.intrusion.com.

INTRUSION INC.

101 EAST PARK BLVD., SUITE 1200

PLANO, TEXAS 75074

PROXY STATEMENT

for

SPECIAL MEETING OF STOCKHOLDERS

to be Held March 15, 2024

The enclosed proxy is being

solicited on behalf of the Board of Directors (the “Board”) of Intrusion Inc. (“Intrusion” or the “Company”)

for use at the Special Meeting of Stockholders (the “Special Meeting”) to be held at 101 East Park Blvd., Plano, Texas 75074, at

9:00 a.m., local time, on Friday, March 15, 2024, or at such other time and place to which the Special Meeting may be adjourned. Proxies,

together with copies of this proxy statement (the “Proxy Statement”), are being mailed on or about January 25, 2024, to stockholders

of record entitled to vote at the Special Meeting.

Execution and return of the

enclosed proxy will not affect a stockholder’s right to attend the Special Meeting and to vote in person. Any stockholder executing

a proxy retains the right to revoke such proxy at any time prior to exercise at the Special Meeting. A proxy may be revoked by delivery

of written notice of revocation to Intrusion’s Secretary, by execution and delivery of a later proxy or by voting the shares in

person at the Special Meeting. If you attend the Special Meeting and vote in person by ballot, your proxy will be revoked automatically

and only your vote at the Special Meeting will be counted. A proxy, when executed and not revoked, will be voted in accordance with the

instructions thereon. In the absence of specific instructions, proxies will be voted by those named in the proxy “FOR”

the approval of each of the proposals described in this Proxy Statement, and in accordance with their best judgment on all other matters

that may properly come before the Special Meeting.

RECORD DATE AND VOTING SECURITIES

Only stockholders of record

at the close of business on January 16, 2024 (the “Record Date”), are entitled to notice of, and to vote at, the Special Meeting.

The stock transfer books of the Company will remain open between the Record Date and the date of the Special Meeting. A list of stockholders

entitled to vote at the Special Meeting will be available for inspection at Intrusion’s executive offices. On the Record Date, the

Company had 36,268,942 shares of common stock, $0.01 par value, and no shares of Series 1, Series 2 or Series 3 preferred stock outstanding.

QUORUM AND VOTING

The presence at the Special

Meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding is necessary to constitute a quorum.

Holders of common stock are entitled to one vote for each share of common stock held on each matter to be voted on at the Special Meeting.

All votes will be tabulated by the inspector of election appointed for the Special Meeting, who will separately tabulate affirmative and

negative votes, abstentions, and broker non-votes. Abstentions and broker non-votes are counted as present for purposes of determining

the presence or absence of a quorum for the transaction of business. Abstentions will be counted toward the tabulations of votes cast

on matters presented at the Special Meeting and will have the same effect as negative votes, whereas broker non-votes will not be counted

for purposes of determining whether a matter has been approved.

Assuming the presence of a

quorum, the following paragraphs describe the vote required by stockholders to approve each of the proposals set forth in this Proxy Statement.

| · |

Proposal 1. The affirmative vote of the holders of a

majority of the outstanding shares of common stock present in person or represented by proxy at the Special Meeting and entitled to

vote is required for approval of the amendment of Intrusion’s Restated Certificate of Incorporation, as amended (the

“Certificate of Incorporation”), to effectuate a reverse stock split of Intrusion’s outstanding shares of common

stock, at a ratio of no less than 1-for-2 and no more than 1-for-20, with such ratio to be determined at the sole discretion of the

Board. |

| |

|

| · |

Proposal 2. The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy at the Special Meeting and entitled to vote is required for approval of the amendment of Intrusion’s Certificate of Incorporation to eliminate Series 1, Series 2, and Series 3 preferred shares. |

| |

|

| · |

Proposal 3. The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy at the Special Meeting and entitled to vote is required for approval of the amendment of Intrusion’s Certificate of Incorporation to create a right of stockholders to take action by written consent. |

| |

|

| · |

Proposal 4. The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy at the Special Meeting and entitled to vote is required for approval of the amendment of Intrusion’s Certificate of Incorporation to add a Delaware forum selection provision. |

| |

|

| · |

Proposal 5. The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy at the Special Meeting and entitled to vote is required for approval of the amendment of Intrusion’s Certificate of Incorporation to update, clarify and remove outdated provisions. |

Each proposal above is being

voted on separately. The approval of any one proposal is not conditioned upon approval of any other proposal.

The Board unanimously recommends a vote “FOR”

each of Proposals 1 through 5, each as set forth in this Proxy Statement.

PROPOSAL 1 –

AMENDMENT OF CERTIFICATE OF INCORPORATION TO

EFFECTUATE

REVERSE STOCK SPLIT

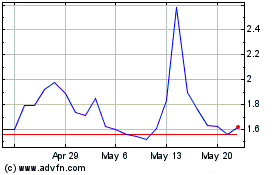

On September 26, 2023, the

Company received a written notice (the “Notification Letter”) from The Nasdaq Stock Market LLC (“NASDAQ”) notifying

the Company that the closing bid price of the Company’s common stock over the 30 consecutive trading days from August 14, 2023,

through September 25, 2023, had fallen below $1.00 per share, which is the minimum closing bid price required to maintain listing on the

NASDAQ Capital Market under Listing Rule 5550(a)(2) (the “Minimum Bid Requirement”).

In accordance with NASDAQ

Listing Rule 5810(c)(3)(A), the Company has 180 calendar days to regain compliance with the Minimum Bid Requirement (the “Grace

Period”), or until March 25, 2024, subject to a potential 180 calendar day extension, as described below. To regain compliance,

the closing bid price of the Company’s common stock must be at least $1.00 per share for a minimum of 10 consecutive business days

within the Grace Period.

If the Company does not achieve

compliance with the Minimum Bid Requirement by March 25, 2024, the end of the Grace Period, the Company may be eligible for an additional

180 calendar day period to regain compliance. To qualify, the Company would be required, among other things, to meet the continued listing

requirement for the market value of its publicly held shares and all other NASDAQ initial listing standards for the Nasdaq Capital Market,

with the exception of the Minimum Bid Requirement, and would need to provide written notice to NASDAQ of its intention and plan to cure

the deficiency during the second compliance period by effectuating a reverse stock split, if necessary. However, if it appears to NASDAQ

staff that the Company will not be able to cure the deficiency, or if the Company does not meet the other listing standards, NASDAQ could

provide notice that the Company’s common stock will be subject to delisting. In the event the Company receives notice that its common

stock is being delisted, the Company would be entitled to appeal the determination to a NASDAQ Listing Qualifications Panel and request

a hearing.

There can be no assurance

that the Company will be able to regain compliance with the minimum bid price requirement, even if it maintains compliance with the other

listing requirements.

In response to the Notification

Letter and in an attempt to increase the share price of our common stock, we are asking stockholders to adopt and approve an amendment

to our Certificate of Incorporation (the “Reverse Stock Split Amendment”) to effectuate the Reverse Stock Split of our issued

and outstanding common stock. On December 15, 2023, our Board unanimously approved and declared advisable the proposed Reverse Stock Split

Amendment and recommends that our stockholders adopt and approve the proposed Reverse Stock Split Amendment. If approved by stockholders,

this Proposal 1 will authorize the amendment of our Certificate of Incorporation to effectuate the Reverse Stock Split at a ratio of no

less than 1-for-2 and no more than 1-for-20, with such ratio to be determined at the sole discretion of the Board, with any fractional

shares being rounded up to the next higher whole share.

Assuming stockholders approve

the Reverse Stock Split Amendment, the effective date of the Reverse Stock Split will be determined at the sole discretion of the Board

and may occur as soon as the day of the Special Meeting. The effective date of the Reverse Stock Split will be publicly announced by us.

The Board may determine, in its sole discretion, not to effectuate the Reverse Stock Split and not to file any amendment to our Certificates

of Incorporation.

If we effectuate the Reverse

Stock Split, then, except for adjustments that may result from the treatment of fractional shares as described below, each stockholder

will hold the same percentage of the then-outstanding shares of common stock immediately following the Reverse Stock Split that such stockholder

held immediately prior to the Reverse Stock Split. The par value of our common stock will remain unchanged at $0.01 per share. No fractional

shares of common stock will be issued as a result of the Reverse Stock Split.

If the proposed Reverse Stock

Split Amendment is adopted and approved by our stockholders and the Board elects to effectuate the Reverse Stock Split, we will file an

amendment to our Certificate of Incorporation with the Delaware Secretary of State that sets forth the Reverse Stock Split Amendment and

the Reverse Stock Split ratio as determined by the Board. The Reverse Stock Split Amendment will be effective immediately upon filing

with the Delaware Secretary of State or such later time as is set forth therein. The Board also may determine in its discretion to abandon

such an amendment, and to not effectuate the Reverse Stock Split. The Board reserves the right to withdraw Proposal 1 relating to the

Reverse Stock Split and, if such proposal is withdrawn, all references in the Company’s proxy materials to voting for Proposal 1

should be disregarded.

Background and Reasons for the Reverse Stock

Split

Our Board of Directors’

primary reason for approving and recommending the Reverse Stock Split is to increase the share price of our common stock to a level that

will enable the Company to comply with the Minimum Bid Requirement. The Board of Directors believes that maintaining the Company’s

Nasdaq listing is in the best interests of the Company and its stockholders. Among other things, the Board of Directors believes that

the Company’s Nasdaq listing may enable the Company to achieve better access to capital, encourage investor interest and improve

the marketability of our common stock to a broader range of investors. In addition, we believe the Reverse Stock Split will make our common

stock more attractive to a broader range of institutional and other investors, as we believe the current market price of our common stock

may affect its acceptability to certain institutional investors, professional investors, and other members of the investing public. Many

brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced

stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies

and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because

brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced

stocks, the current average price per share of our common stock can result in individual stockholders paying transaction costs representing

a higher percentage of their total share value than would be the case if the share price were substantially higher. We believe that the

Reverse Stock Split will make our common stock a more attractive and cost-effective investment for many investors, which should enhance

the liquidity available to the holders of our common stock. Accordingly, we believe that approval of the Reverse Stock Split is in the

Company’s and its stockholders’ best interests.

However, despite approval

of the Reverse Stock Split by our stockholders and the implementation thereof by our Board of Directors, there is no assurance that the

price of our common stock would be, or remain, following the Reverse Stock Split at a level high enough to enable us to comply with the

Minimum Bid Requirement or to attract capital investment in our company. There can be no assurance that the Company will be able to regain

compliance with the Minimum Bid Requirement, even if it maintains compliance with the other listing requirements.

Reducing the number of outstanding

shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of

our common stock. However, other factors, such as our financial results, general market conditions and the market perception of our company,

may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed,

will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock

Split or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market

price per share of our common stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares

of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after

the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

After undertaking a thorough

analysis of the advisability of the Reverse Stock Split and considering the totality of the circumstances, our Board of Directors believes

that it is fair to the stockholders of the Company, from a financial point of view, and in the best interests of us and our stockholders.

The effectuation of the Reverse Stock Split is conditioned on our Board’s consideration of the totality of the circumstances. The

Board reserves the right to withdraw Proposal 1 relating to the Reverse Stock Split and, if such proposal is withdrawn, all references

in the Company’s proxy materials to voting for Proposal 1 should be disregarded.

Board Discretion to Implement the Reverse Stock

Split

The Board believes that stockholder

adoption and approval of the Reverse Stock Split at a ratio of no less than 1-for-2 and no more than 1-for-20 is in the best interests

of our stockholders because it provides the Board and the Company with the flexibility to achieve the desired results of the Reverse Stock

Split and because it is not possible to predict market conditions at the time the Reverse Stock Split is implemented. If our stockholders

approve Proposal 1, the Board will implement the Reverse Stock Split only upon a determination that the Reverse Stock Split is in the

best interests of the stockholders at that time. The Board will then select the ratio for the Reverse Stock Split within the range approved

by stockholders that the Board determines to be advisable and in the best interests of the stockholders, considering relevant market conditions

at the time the Reverse Stock Split is to be implemented. The factors that the Board may consider in determining the Reverse Stock Split

ratio include, but are not limited to, the following:

| · |

The historical and projected trading price and trading volume of our common stock; |

| |

|

| · |

General economic and other related conditions prevailing in our industry and in the marketplace; and |

| |

|

| · |

Our ability to meet Nasdaq’s Minimum Bid Requirement. |

The Board intends to select

the Reverse Stock Split ratio that it believes will be most likely to achieve the anticipated benefits of the Reverse Stock Split described

above. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered

by Rule 13e-3 under the Exchange Act. Following the implementation of the Reverse Stock Split, we will continue to be subject to the periodic

reporting requirements of the Exchange Act.

The Board reserves the right

to withdraw Proposal 1 relating to the Reverse Stock Split and, if such proposal is withdrawn, all references in the Company’s proxy

materials to voting for Proposal 1 should be disregarded.

Certain Risks and Potential Disadvantages Associated

with the Reverse Stock Split

We cannot assure you that

the proposed Reverse Stock Split will increase our common stock price. We expect that the Reverse Stock Split will increase the

per share trading price of our common stock. However, the effect of the Reverse Stock Split on the per share trading price of our common

stock cannot be predicted with any certainty, and the history of reverse stock splits for other companies is varied. It is possible that

the per share trading price of our common stock after the Reverse Stock Split will not increase in the same proportion as the reduction

in the number of our outstanding shares of common stock following the Reverse Stock Split. In addition, although we believe the Reverse

Stock Split may enhance the marketability of our common stock to certain potential investors, we cannot assure you that, if implemented,

our common stock will be more attractive to investors. Even if we implement the Reverse Stock Split, the per share trading price of our

common stock may decrease due to factors unrelated to the Reverse Stock Split, including our future performance. If the Reverse Stock

Split is consummated and the per share trading price of our common stock declines, the percentage decline as an absolute number and as

a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Despite approval

of the Reverse Stock Split by our stockholders and the implementation thereof by our Board of Directors, there is no assurance that the

price of our common stock would be, or remain, following the Reverse Stock Split at a level high enough to enable us to comply with the

Minimum Bid Requirement or to attract capital investment in our company.

The proposed Reverse Stock

Split may decrease the liquidity of our common stock and result in higher transaction costs. The liquidity of our common stock may

be negatively impacted by the Reverse Stock Split, given the reduced number of shares that will be outstanding after the Reverse Stock

Split, particularly if the per share trading price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse

Stock Split is implemented, it may increase the number of our stockholders who own “odd lots” of fewer than 100 shares of

common stock. Brokerage commissions and other costs of transactions in odd lots are generally higher than the costs of transactions of

more than 100 shares of common stock. Accordingly, the Reverse Stock Split may not result in increasing the marketability of our common

stock.

Effects of the Reverse Stock Split

General

The principal effect of the

Reverse Stock Split, if implemented by the Board, would be to proportionately decrease the number of issued and outstanding shares of

our common stock based on the ratio selected by our Board, which will result in each stockholder owning a reduced number of shares of

common stock after the effective date of the Reverse Stock Split. The actual number of shares issued and outstanding and ultimately owned

by each stockholder after giving effect to the Reverse Stock Split, if implemented, would depend on the ratio for the Reverse Stock Split

that is ultimately determined by our Board. The Reverse Stock Split would affect all holders of our common stock uniformly and would not

affect any stockholder’s percentage ownership interest in the Company, except that, as described below under “Mechanics of

the Reverse Stock Split-Fractional Shares,” In addition, the Reverse Stock Split would not affect any stockholder’s proportionate

voting power, subject to the treatment of fractional shares.

The Reverse Stock Split may

result in some stockholders owning “odd lots” of less than 100 shares of common stock. Odd lot shares may be more difficult

to sell, and brokerage commissions and other costs of transactions in odd lots may be higher than the costs of transactions in “round

lots” of even multiples of 100 shares.

After the effective time of

the Reverse Stock Split, our common stock will have a new Committee on Uniform Securities Identification Procedures, or CUSIP, number,

which is a number used to identify our common stock.

Effect on Capital Stock

The Company’s Certificate

of Incorporation authorizes the issuance of up to 80,000,000 shares of common stock and 5,000,000 shares of preferred stock, $0.01 par

value per share. The proposed Reverse Stock Split will have no impact on the total authorized number of shares of common stock or preferred

stock, or the par value of the common stock or preferred stock. See, however, “Proposal 2—Approval of the amendment of Intrusion’s

Certificate of Incorporation to eliminate Series 1, Series 2, and Series 3 Preferred Shares.” As of the Record Date, there were

three series of preferred stock designated: Series 1 (1,000,000 shares authorized), Series 2 (1,200,000 shares authorized), and Series

3 (565,000 shares authorized), with no shares of preferred stock outstanding. If Proposal 2 is approved by stockholders, the designated

series of preferred stock will be eliminated.

Accounting Matters

As a result of the Reverse

Stock Split, at the effective time of the Reverse Stock Split, the stated capital on the Company’s balance sheet attributable to

our common stock, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common

stock issued and outstanding, will be reduced in proportion to the Reverse Stock Split ratio chosen by the Board. Correspondingly, the

Company’s additional paid-in capital account, which consists of the difference between the Company’s stated capital and the

aggregate amount paid to the Company upon issuance of all currently outstanding shares of common stock, will be credited with the amount

by which the stated capital is reduced. The Company’s stockholders’ equity, in the aggregate, will remain unchanged. The historical

earnings or loss per share of our common stock reported in all financial reports published after the effective date of the Reverse Stock

Split will be restated to reflect the proportionate decrease in the number of outstanding shares of common stock for all periods presented

so that the results are comparable.

Mechanics of the Reverse Stock Split

In the case of common

stock registered directly on the books of Computershare, Inc., our transfer agent, only, no fractional shares of common stock will

be issued as a result of the Reverse Stock Split. Rather, any fractional shares will be rounded up to the next higher whole

share.

In the case of common stock

held through a broker, bank or nominee, your broker, bank, or nominee will determine the process for dealing with any entitlements to

fractional shares of common stock.

Upon the effectiveness of

the Reverse Stock Split, we intend to treat shares of common stock held by stockholders in “street name,” through a bank,

broker, or other nominee, in the same manner as registered stockholders whose shares of common stock are registered in their names. Banks,

brokers, or other nominees will be instructed to effectuate the Reverse Stock Split for their beneficial holders holding the common stock

in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders

for processing the Reverse Stock Split. If a stockholder holds shares of common stock with a bank, broker or other nominee and has any

questions in this regard, stockholders are encouraged to contact their bank, broker, or other nominee.

Effect on Registered “Book-Entry”

Holders of Common Stock (i.e., stockholders that are registered on the transfer agent’s books and records)

All of our registered holders

of common stock hold their shares electronically in book-entry form with our transfer agent. They are provided with a statement reflecting

the number of shares registered in their accounts.

If a stockholder holds registered

shares in book-entry form with the transfer agent, no action needs to be taken to receive post-Reverse Stock Split shares. If a stockholder

is entitled to post-Reverse Stock Split shares, a transaction statement will automatically be sent to the stockholder’s address

of record indicating the number of shares of common stock held following the Reverse Stock Split.

Effective Time

The effective time of the

Reverse Stock Split, if the proposed Reverse Stock Split Amendment is adopted and approved by stockholders and the Reverse Stock Split

is implemented at the direction of the Board, will be the date and time that the Reverse Stock Split Amendment effecting the amendment

with the ratio selected by the Board is filed with the Delaware Secretary of State or such later time as is specified therein. Such filing

may occur as soon as the day of the Special Meeting or at any time prior to the one-year anniversary of stockholder approval of the Reverse

Stock Split. The exact timing of the Reverse Stock Split will be determined by our Board based on its evaluation as to when such action

will be the most advantageous to the Company and its stockholders, and the effective date will be publicly announced by the Company.

The Board reserves the right

to withdraw Proposal 1 relating to the Reverse Stock Split and, if such proposal is withdrawn, all references in the Company’s proxy

materials to voting for Proposal 1 should be disregarded. In addition, the Reverse Stock Split may be delayed or abandoned without further

action by the stockholders at any time prior to effectiveness of the Reverse Stock Split Amendment with the Delaware Secretary of State,

notwithstanding stockholder adoption and approval of the Reverse Stock Split Amendment, if the Board, in its sole discretion, determines

that it is in the best interests of the Company and its stockholders to delay or abandon the Reverse Stock Split. If the Reverse Stock

Split Amendment implementing the Reverse Stock Split has not been filed with the Delaware Secretary of State on or before the one-year

anniversary of stockholder approval of the Reverse Stock Split, the Board will be deemed to have abandoned the Reverse Stock Split.

Appraisal Rights

Under Delaware law, our stockholders

are not entitled to dissenter’s rights or appraisal rights with respect to the Reverse Stock Split and we will not independently

provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be

Acted Upon

No officer or director has

any substantial interest, direct or indirect, by security holdings or otherwise, in the Reverse Stock Split that is not shared by all

of our other stockholders.

Certain U.S. Federal Income Tax Consequences

of the Reverse Stock Split

The following discussion is

a general summary of certain U.S. federal income tax consequences of the Reverse Stock Split that may be relevant to stockholders for

U.S. federal income tax purposes. This summary is based upon the provisions of the Code, Treasury Regulations promulgated thereunder,

administrative rulings and judicial decisions as of the date of this proxy statement, all of which may change, possibly with retroactive

effect, resulting in U.S. federal income tax consequences that may differ from those discussed below.

This discussion applies only

to holders of our common stock that are U.S. Holders (as defined below) and does not address all aspects of federal income taxation that

may be relevant to such holders in light of their particular circumstances or to holders that may be subject to special tax rules, including:

(i) holders subject to the alternative minimum tax; (ii) banks, insurance companies, or other financial institutions; (iii) tax-exempt

organizations; (iv) dealers in securities or commodities; (v) regulated investment companies or real estate investment trusts; (vi) partnerships

(or other flow-through entities for U.S. federal income tax purposes and their partners or members); (vii) traders in securities that

elect to use a mark-to-market method of accounting for their securities holdings; (viii) U.S. Holders whose “functional currency”

is not the U.S. dollar; (ix) persons holding our common stock as a position in a hedging transaction, “straddle,” “conversion

transaction” or other risk reduction transaction; (x) persons who acquire shares of our common stock in connection with employment

or other performance of services; or (xi) U.S. expatriates. If a partnership (including any entity or arrangement treated as a partnership

for U.S. federal income tax purposes) holds shares of our common stock, the tax treatment of a holder that is a partner in the partnership

generally will depend upon the status of the partner and the activities of the partnership.

We have not sought, and will

not seek, an opinion of counsel or a ruling from the Internal Revenue Service (“IRS”) regarding the U.S. federal income tax

consequences of the Reverse Stock Split and there can be no assurance that the IRS will not challenge the statements and conclusions set

forth below or that a court would not sustain any such challenge. The following summary does not address any U.S. state or local or any

foreign tax consequences, any estate, gift or other non-U.S. federal income tax consequences, or the Medicare tax on net investment income.

EACH HOLDER OF COMMON STOCK

SHOULD CONSULT SUCH HOLDER’S OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH

HOLDER.

For purposes of the discussion

below, a “U.S. Holder” is a beneficial owner of shares of our common stock that for U.S. federal income tax purposes is: (1)

an individual citizen or resident of the United States; (2) a corporation (including any entity taxable as a corporation for U.S. federal

income tax purposes) created or organized in or under the laws of the United States, or any state or political subdivision thereof; (3)

an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (4) a trust, if (i) a court within

the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority

to control all substantial decisions of the trust or (ii) the trust has a valid election in effect to be treated as a U.S. person.

The Board intends the Reverse

Stock Split to be treated as a “recapitalization” under Section 368(a)(1)(E) of the Code, although no assurances are provided

in this regard. In such case, we should not recognize gain or loss in connection with the Reverse Stock Split. Also, a U.S. Holder generally

should not recognize gain or loss upon the Reverse Stock Split. A U.S. Holder’s aggregate tax basis in the shares of our common

stock received pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of our common stock surrendered

(excluding any portion of such basis that is allocated to any fractional share of our common stock), and such U.S. Holder’s holding

period in the shares of our common stock received should include the holding period in the shares of our common stock surrendered. Holders

of shares of our common stock acquired on different dates and at different prices should consult their own tax advisors regarding the

allocation of the tax basis and holding period of such shares.

Vote Required

Adoption of Proposal 1 requires

an affirmative vote of a majority of the outstanding common stock entitled to vote thereon. You may vote “FOR,” “AGAINST,”

or “ABSTAIN” from voting concerning Proposal 1. Abstentions will count toward the quorum and will have the same effect as

a vote against Proposal 1. Approval of Proposal 1 is not conditioned upon approval of any other proposal.

Recommendation

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE REVERSE STOCK SPLIT PROPOSAL.

PROPOSAL 2 -

AMENDMENT OF CERTIFICATE OF INCORPORATION TO

ELIMINATE SERIES 1, SERIES 2 AND SERIES 3 PREFERRED

SHARES

The Board has recommended

that stockholders approve the amendment of the Company’s Certificate of Incorporation in order to eliminate references to Series

1, Series 2 and Series 3 preferred shares (the “Preferred Share Elimination Amendment”), as they are no longer outstanding.

Purpose and Effect of the Amendment

The Board believes it is in

the best interests of the Company and its stockholders to remove the Series 1, Series 2 and Series 3 preferred shares and all references

thereto, as they are no longer outstanding. As a result, if Proposal 2 is approved by stockholders and the Preferred Share Elimination

Amendment is implemented, the Certificate of Incorporation will reflect only our current outstanding capital stock.

If stockholders approve Proposal

2 and the Preferred Share Elimination Amendment is implemented, the only authorized capital stock of the Company will be common stock

and undesignated preferred stock.

Effective Time

If Proposal 2 is approved

by stockholders and the Preferred Share Elimination Amendment is implemented at the direction of the Board, the effective date of the

Preferred Share Elimination Amendment will be the date and time that the Preferred Share Elimination Amendment is filed with the Delaware

Secretary of State or such later time as is specified therein. Such filing may occur as soon as the day of the Special Meeting or at any

time prior to the one-year anniversary of stockholder approval of the Preferred Share Elimination Amendment. The exact timing of the Preferred

Share Elimination Amendment will be determined by our Board based on its evaluation as to when such action will be the most advantageous

to the Company and its stockholders.

The Board reserves the right

to withdraw Proposal 2 and, if such proposal is withdrawn, all references in the Company’s proxy materials to voting for Proposal

2 should be disregarded. In addition, effectuation of the Preferred Share Elimination Amendment may be delayed or abandoned without further

action by the stockholders at any time prior to effectiveness of the Preferred Share Elimination Amendment with the Delaware Secretary

of State, notwithstanding stockholder adoption and approval thereof, if the Board, in its sole discretion, determines that it is in the

best interests of the Company and its stockholders to delay or abandon the Preferred Share Elimination Amendment. If the Preferred Share

Elimination Amendment has not been filed with the Delaware Secretary of State on or before the one-year anniversary of stockholder approval

thereof, the Board will be deemed to have abandoned the Preferred Share Elimination Amendment.

Appraisal Rights

Under Delaware law, our stockholders

are not entitled to dissenter’s rights or appraisal rights with respect to the Preferred Share Elimination Amendment and we will

not independently provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be

Acted Upon

No officer or director has

any substantial interest, direct or indirect, by security holdings or otherwise, in the Preferred Share Elimination Amendment that is

not shared by all of our other stockholders.

Vote Required

Adoption of Proposal 2 requires

an affirmative vote of a majority of the outstanding common stock present in person or represented by proxy at the Meeting and entitled

to vote thereon. You may vote “FOR,” “AGAINST,” or “ABSTAIN” from voting concerning Proposal 2. Abstentions

will count toward the quorum and will have the same effect as a vote against Proposal 2. Approval of Proposal 2 is not conditioned upon

approval of any other proposal.

Recommendation

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 2.

PROPOSAL 3

-

AMENDMENT OF CERTIFICATE OF INCORPORATION TO

CREATE A RIGHT OF STOCKHOLDERS TO TAKE ACTION BY WRITTEN CONSENT

Our Board is submitting for

stockholder approval a proposal to amend our Certificate of Incorporation to allow stockholders to act by written consent (the “Written

Consent Amendment”). Our Certificate of Incorporation currently prohibits stockholders from acting by written consent in lieu of

a special meeting. Our Board has determined it is in the best interests of the Company and our stockholders to amend our Certificate of

Incorporation to reflect the Written Consent Amendment, insofar as it can provide a more efficient (and less costly for the Company) means

to vote on permitted matters. If Proposal 3 is approved, future actions approved by the holders of outstanding shares of the relevant

class or series having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting

at which all shares entitled to vote thereon were present and voted will not require the Company to expend the time and resources required

to hold a special meeting of stockholders.

This description of the Written

Consent Amendment is qualified in its entirety by reference to the text of the Written Consent Amendment. See Section 13 of the Proposed

A&R Certificate (as hereinafter defined), attached hereto as Appendix A.

Effective Time

If Proposal 3 is approved

by stockholders and the Written Consent Amendment is implemented at the direction of the Board, the effective date of the Written Consent

Amendment will be the date and time that the Written Consent Amendment is filed with the Delaware Secretary of State or such later time

as is specified therein. Such filing may occur as soon as the day of the Special Meeting or at any time prior to the one-year anniversary

of stockholder approval of the Written Consent Amendment. The exact timing of the Written Consent Amendment will be determined by our

Board based on its evaluation as to when such action will be the most advantageous to the Company and its stockholders.

The Board reserves the right

to withdraw Proposal 3 and, if such proposal is withdrawn, all references in the Company’s proxy materials to voting for Proposal

3 should be disregarded. In addition, effectuation of the Written Consent Amendment may be delayed or abandoned without further action

by the stockholders at any time prior to effectiveness of the Written Consent Amendment with the Delaware Secretary of State, notwithstanding

stockholder adoption and approval thereof, if the Board, in its sole discretion, determines that it is in the best interests of the Company

and its stockholders to delay or abandon the Written Consent Amendment. If the Written Consent Amendment has not been filed with the Delaware

Secretary of State on or before the one-year anniversary of stockholder approval thereof, the Board will be deemed to have abandoned the

Written Consent Amendment.

Appraisal Rights

Under Delaware law, our stockholders

are not entitled to dissenter’s rights or appraisal rights with respect to the Written Consent Amendment and we will not independently

provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be

Acted Upon

No officer or director has

any substantial interest, direct or indirect, by security holdings or otherwise, in the Written Consent Amendment that is not shared by

all of our other stockholders.

Vote Required

Adoption of Proposal 3 requires

an affirmative vote of a majority of the outstanding common stock present in person or represented by proxy at the Meeting and entitled

to vote thereon. You may vote “FOR,” “AGAINST,” or “ABSTAIN” from voting concerning Proposal 3. Abstentions

will count toward the quorum and will have the same effect as a vote against Proposal 3. Approval of Proposal 3 is not conditioned upon

approval of any other proposal.

Recommendation

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 3.

PROPOSAL 4

-

AMENDMENT OF CERTIFICATE OF INCORPORATION TO

ADD A DELAWARE FORUM SELECTION PROVISION

The Board

voted to approve, and to recommend to our stockholders that they approve, an amendment to the Certificate of Incorporation to add a Delaware

forum selection provision (the “Forum Selection Amendment”).

Proposed

Amendment

The Forum

Selection Amendment, if approved by stockholders, would provide that, unless the Company consents in writing to the selection of an alternative

forum, the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting

a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s

stockholders, (iii) an action asserting a claim arising pursuant to any provision of the DGCL, or (iv) any action asserting a claim governed

by the internal affairs doctrine shall be a state or federal court located within the state of Delaware, in all cases subject to the court’s

having personal jurisdiction over the indispensable parties named as defendants. Notwithstanding the foregoing, the exclusive forum provision

will not apply to suits brought to enforce any liability or duty created by the Securities Exchange Act of 1934, as amended, the Securities

Act of 1933, as amended, or any claim for which the federal courts have exclusive or concurrent jurisdiction.

This description of the Forum

Selection Amendment is qualified in its entirety by reference to the text of the Forum Selection Amendment. See Section 21 of the Proposed

A&R Certificate (as hereinafter defined), attached hereto as Appendix A.

Reasons

for Amendment

We believe

the Company and our stockholders would benefit from having any claims described above resolved in a Delaware court. We believe that this

provision would promote efficiencies in the Company's management of litigation involving matters governed by Delaware law by:

| · | Limiting forum-shopping by plaintiffs; |

| · | Enabling the Company to avoid litigating actions involving the

same matter in multiple jurisdictions, with the associated duplication of litigation expenses and the possibility of inconsistent outcomes;

and |

| · | Facilitating submission of matters governed by Delaware corporate

law to a forum widely regarded as the preeminent U.S. court for corporate law and related business disputes, such that the Company and

its stockholders would benefit from experienced jurists who have a deep understanding of Delaware corporate law, as well as procedures

that can provide relatively quick decisions, both of which can increase predictability regarding the outcome of these disputes and can

limit the time, cost and uncertainty of litigation for all parties. |

The DGCL

explicitly permits companies, like the Company, that are incorporated in Delaware to adopt Delaware forum selection provisions in their

certificate of incorporation. In addition, exclusive forum provisions are prevalent for U.S. companies. For example, 51% of S&P 500

companies have adopted an exclusive forum provision.

The Forum

Selection Amendment is not being proposed in reaction to any specific litigation confronting the Company and is being proposed on a prospective

basis to help mitigate potential future harm to the Company and its stockholders.

Effective Time

If Proposal 4 is approved

by stockholders and the Forum Selection Amendment is implemented at the direction of the Board, the effective date of the Forum Selection

Amendment will be the date and time that the Forum Selection Amendment is filed with the Delaware Secretary of State or such later time

as is specified therein. Such filing may occur as soon as the day of the Special Meeting or at any time prior to the one-year anniversary

of stockholder approval of the Forum Selection Amendment. The exact timing of the Forum Selection Amendment will be determined by our

Board based on its evaluation as to when such action will be the most advantageous to the Company and its stockholders.

The Board reserves the right

to withdraw Proposal 4 and, if such proposal is withdrawn, all references in the Company’s proxy materials to voting for Proposal

r should be disregarded. In addition, effectuation of the Forum Selection Amendment may be delayed or abandoned without further action

by the stockholders at any time prior to effectiveness of the Forum Selection Amendment with the Delaware Secretary of State, notwithstanding

stockholder adoption and approval thereof, if the Board, in its sole discretion, determines that it is in the best interests of the Company

and its stockholders to delay or abandon the Forum Selection Amendment. If the Forum Selection Amendment has not been filed with the Delaware

Secretary of State on or before the one-year anniversary of stockholder approval thereof, the Board will be deemed to have abandoned the

Forum Selection Amendment.

Appraisal Rights

Under Delaware law, our stockholders

are not entitled to dissenter’s rights or appraisal rights with respect to the Forum Selection Amendment and we will not independently

provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be

Acted Upon

No officer or director has

any substantial interest, direct or indirect, by security holdings or otherwise, in the Forum Selection Amendment that is not shared by

all of our other stockholders.

Vote Required

Adoption of Proposal 4 requires

an affirmative vote of a majority of the outstanding common stock present in person or represented by proxy at the Meeting and entitled

to vote thereon. You may vote “FOR,” “AGAINST,” or “ABSTAIN” from voting concerning Proposal 4. Abstentions

will count toward the quorum and will have the same effect as a vote against Proposal 4. Approval of Proposal 4 is not conditioned upon

approval of any other proposal.

Recommendation

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 4.

PROPOSAL 5 -

AMENDMENT AND RESTATEMENT OF OUR CERTIFICATE

OF INCORPORATION TO UPDATE, CLARIFY AND REMOVE OUTDATED PROVISIONS

Background and Reasons for the Amendment and

Restatement

The Board voted to approve,

and to recommend to our stockholders that they approve, amendment and restatement of our Certificate of Incorporation to integrate any

and all amendments approved at this Meeting and all prior amendments into a single document, and to make various immaterial, miscellaneous

changes to clarify, streamline and modernize the Certificate of Incorporation, as described below.

If our stockholders approve

this Proposal 5, the Company intends to amend and restate the Certificate of Incorporation to combine into one document each of the amendments

contemplated by Proposals 2 through 4, insofar as each is approved by our stockholders, and all prior amendments, and to make largely

technical, clarifying and modernizing changes to the Certificate of Incorporation. Below is a summary of the changes to the Certificate

of Incorporation proposed pursuant to this Proposal 5, in addition to the consolidation of the Certificate of Incorporation into a single

document:

| · | Section 3: Expressly stating general purpose and powers

of the Company, consistent with provisions of the DGCL, but not broadening in any substantive manner. |

| · | Section 12: Expressly addressing removal of directors,

consistent with the DGCL (no substantive differences). |

| · | Section 19: Expressly setting forth limitations on liability

of directors, consistent with applicable provisions of DGCL (no material substantive differences). |

| · | Section 20: Expanding the discussion of officer and director

indemnification, consistent with provisions of the DGCL, but not broadening in any material substantive manner. |

| · | Section 4: Adding the DGCL 242(b) election and expressly

stating that, consistent with the applicable provisions of the DGCL, all shares of capital stock will vote together as one class, such

that (i) the number of authorized shares of common stock may be increased or decreased (but not below the number of shares thereof then

outstanding) by the affirmative vote of the holders of a majority of the Company’s stock entitled to vote irrespective of Section

242(b)(2) of the DGCL, with no vote of any holders of a particular class or series of stock, voting as a separate class or series, being

required; and (ii) unless otherwise set forth in a certificate of designations for the applicable series of preferred stock, the number

of authorized shares of any series of preferred stock may be increased or decreased (but not below the number of shares thereof then

outstanding) by the affirmative vote of the holders of a majority of the Company’s stock entitled to vote irrespective of Section

242(b)(2) of the DGCL, with no vote of any holders of a particular class or series of stock, voting as a separate class or series, being

required. |

| · | Section 8: Expressly stating general powers of the Board,

consistent with the applicable provisions of the DGCL. |

| · | Section 14: Expressly stating that a special meeting of

stockholders may be called by the Board, consistent with the DGCL (no substantive differences). |

| · | Section 15: Adding that stockholder meetings may be held

in or outside of Delaware as determined by the Board, consistent with the DGCL. |

| · | Section 16: Expressly stating that the private property

of the Company’s stockholders will not be subject to the payment of corporate debts and the stockholders will not be personally

liable for payment of the Company’s debts, consistent with the DGCL (no substantive differences). |

| · | Section 21: Adding a forum selection clause providing

that, unless the Company consents to an alternative forum, the sole and exclusive forum will be a state or federal court located within

the state of Delaware. |

| · | Organizing the document into clearer sections, and making other

immaterial changes to clarify and/or streamline the document, and to conform to Delaware law. |

Unless otherwise indicated,

all section references above refer to the Certificate of Incorporation, as amended and restated as described herein (the “Proposed

A&R Certificate”), and the general description of the proposed amendments set forth above is qualified in its entirety by reference

to the text of the Proposed A&R Certificate, which is attached as Appendix A to this Proxy Statement.

Reasons for Amendment

We believe the changes described

in this Proposal 5 would streamline and clarify the Certificate of Incorporation to make it easier for stockholders and others to read

and understand, modernize the document, and align it more closely with relevant Delaware law.

Effective Time

If Proposal 5 is approved

by stockholders and the Proposed A&R Certificate is implemented at the direction of the Board, the effective date of the Proposed

A&R Certificate will be the date and time that the Proposed A&R Certificate is filed with the Delaware Secretary of State or such

later time as is specified therein. Such filing may occur as soon as the day of the Special Meeting or at any time prior to the one-year

anniversary of stockholder approval of the Proposed A&R Certificate. The exact timing of the Proposed A&R Certificate will be

determined by our Board based on its evaluation as to when such action will be the most advantageous to the Company and its stockholders.

The Board reserves the right

to withdraw Proposal 5 and, if such proposal is withdrawn, all references in the Company’s proxy materials to voting for Proposal

5 should be disregarded. In addition, effectuation of the Proposed A&R Certificate may be delayed or abandoned without further action

by the stockholders at any time prior to effectiveness of the Proposed A&R Certificate with the Delaware Secretary of State, notwithstanding

stockholder adoption and approval thereof, if the Board, in its sole discretion, determines that it is in the best interests of the Company

and its stockholders to delay or abandon the Proposed A&R Certificate. If the Proposed A&R Certificate has not been filed with

the Delaware Secretary of State on or before the one-year anniversary of stockholder approval thereof, the Board will be deemed to have

abandoned the Proposed A&R Certificate.

Appraisal Rights

Under Delaware law, our stockholders

are not entitled to dissenter’s rights or appraisal rights with respect to the Proposed A&R Certificate and we will not independently

provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be

Acted Upon

No officer or director has

any substantial interest, direct or indirect, by security holdings or otherwise, in the Proposed A&R Certificate that is not shared

by all of our other stockholders.

Vote Required

Adoption of Proposal 5 requires

an affirmative vote of a majority of the outstanding common stock present in person or represented by proxy at the Meeting and entitled

to vote thereon. You may vote “FOR,” “AGAINST,” or “ABSTAIN” from voting concerning Proposal 5. Abstentions

will count toward the quorum and will have the same effect as a vote against Proposal 5. Approval of Proposal 5 is not conditioned upon

approval of any other proposal.

Recommendation

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 5.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth

information regarding the beneficial ownership of the Company’s common stock as of the Record Date, unless otherwise indicated,

by:

| · | Each person known by the Company to be the beneficial owner of

more than 5% of the outstanding shares of our common stock; |

| · | Each Named Executive Officer; and |

| · | All current directors and executive officers of the Company as

a group. |

The persons and entities named in the table have

sole voting and investment power with respect to all such shares owned by them, unless otherwise indicated.

| Name of Beneficial Owner (1) |

|

Amount and

Nature of Beneficial

Ownership |

|

|

Percent

of Class (2) |

|

| Directors and Named Executive Officers: |

|

|

|

|

|

|

|

|

| Anthony Scott |

|

|

1,050,646 |

(3) |

|

|

2.84% |

|

| Kimberly Pinson |

|

|

109,833 |

(4) |

|

|

*% |

|

| Anthony J. LeVecchio |

|

|

422,206 |

(5) |

|

|

1.16% |

|

| James F. Gero |

|

|

1,648,733 |

(6) |

|

|

4.45% |

|

| Katrinka B. McCallum |

|

|

260,258 |

(7) |

|

|

*% |

|

| Gregory K. Wilson |

|

|

169,634 |

(8) |

|

|

*% |

|

| T. Joe Head |

|

|

1,143,755 |

(9) |

|

|

3.15% |

|

| All directors and executive officers as a group (7 persons) |

|

|

4,805,065 |

(10) |

|

|

12.58% |

|

| |

|

|

|

|

|

|

|

|

| 5% or Greater Stockholders: |

|

|

|

|

|

|

|

|

| Raymond T. Hyer (11) |

|

|

4,248,619 |

(12) |

|

|

11.50% |

|

| Streeterville |

|

|

2,478,322 |

(13) |

|

|

6.59% |

|

| Michael L. Paxton (14) |

|

|

2,652,847 |

|

|

|

7.18% |

|

___________________

* Represents beneficial ownership of less than 1% of the outstanding

shares of common stock.

| (1) |

The address of the persons or entities shown in the foregoing table who are beneficial owners of more than 5% of the common stock is 101 East Park Blvd, Suite 1200, Plano Texas 75074, except for (i) Patsy A. Paxton, whose address is P.O. Box 227, Allen, TX 75002, (ii) James W. Harpel, whose address is c/o Palm Beach Capital, 525 South Flagler Drive, Suite 201, West Palm Beach, FL 33401; (iii) Michael L. Paxton, whose address is 1421 Huron Trail, Plano, TX 75075; and (iv) The Goldman Sachs Group, Inc., whose address is 200 West Street, New York, NY 12082. |

| (2) |

Beneficial ownership is calculated in accordance with Rule 13d-3(d)(1) promulgated under the Exchange Act. The percentage of beneficial ownership is based on 36,268,942 shares of common stock issued outstanding as of the Record Date, and the number of shares beneficially owned by a person subject to restricted awards, options or warrants held that are currently exercisable, or will become exercisable or vest on or before March 16, 2024, the date that is 60 days following the Record Date. However, these shares are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated in the footnotes to this table, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. |

| (3) |

Includes 666,666 shares that Mr. Scott may acquire upon exercise of warrants that are currently exercisable or will become exercisable on or before March 16, 2024. |

| (4) |

Includes 75,000 shares that Ms. Pinson may acquire upon exercise of options and warrants that are currently exercisable or will become exercisable on or before March 16, 2024. |

| (5) |

Includes 176,666 shares that Mr. LeVecchio may acquire upon exercise of options and warrants that are currently exercisable or will become exercisable on or before March 16, 2024. |

| (6) |

Includes 782,167 shares that Mr. Gero may acquire upon exercise of options and warrants that are currently exercisable or will become exercisable on or before March 16, 2024 |

| (7) |

Includes 116,666 shares that Ms. McCallum may acquire upon exercise of warrants that are currently exercisable or will become exercisable on or before March 16, 2024 |

| (8) |

Includes 56,250 shares that Mr. Wilson may acquire upon exercise of warrants that are currently exercisable or will become exercisable on or before March 16, 2024 |

| (9) |

Includes 50,000 shares that Mr. Head may acquire upon exercise of options that are currently exercisable or will become exercisable on or before March 16, 2024. Also includes 100,000 shares held by the Biblical Studies Foundation, of which Mr. Head is President. |

| (10) |

Includes an aggregate of 1,923,415 shares that may be acquired upon exercise of options and warrants of officers and directors that are currently exercisable or will become exercisable on or before March 16, 2024. |

| (11) |

Mr. Hyer’s address is 3919 E. 7th Ave, Tampa, Florida 33605. |

| (12) |

Of this amount, 250,000 shares are held of record by Hyer Family Partnership,

LLC, which is approximately 29% owned by Raymond T. Hyer. Mr. Hyer disclaims beneficial ownership over the 250,000 shares except to the

extent of his pecuniary interest in these securities. Mr. Hyer’s beneficial ownership includes 666,666 shares that Mr. Hyer may

acquire upon exercise of warrants that are currently exercisable or will become exercisable on or before March 16, 2024. |

| (13) |

Includes 1,335,334 shares that may be acquired upon exercise of warrants that are currently exercisable or will become exercisable on or before March 16, 2024. |

| (14) |

Includes shares owned by Paxton Living Trust, Michael L. Paxton and Kathryn A. Paxton, Trustees, and shares owned by MKP Family Ltd., Paxton Living Trust, General Partner. |

STOCKHOLDER PROPOSALS

Stockholders may submit proposals

on matters appropriate for stockholder action at subsequent annual meetings of the stockholders consistent with Rule 14a-8 promulgated

under the Exchange Act. For such proposals to be considered for inclusion in the Proxy Statement and proxy relating to the 2024 Annual

Meeting of Stockholders, such proposals must have been received by the Company not later than December 8, 2023. Such proposals should

be directed to Intrusion Inc., 101 East Park Blvd., Suite 1200, Plano, Texas 75074, Attention: Secretary (telephone: (972) 234-6400;

telecopy: (972) 234-1467).

Pursuant to Rule 14a-4(c)

of the Exchange Act of 1934, if a stockholder who intends to present a proposal at the 2024 Annual Meeting of Stockholders does not notify

the Company of such proposal on or prior to February 9, 2024, then management proxies would be allowed to use their discretionary voting

authority to vote on the proposal when the proposal is raised at the annual meeting, even though there is no discussion of the proposal

in the 2024 proxy statement.

In order for stockholders

to give timely notice of nominations for directors for inclusion on a universal proxy card in connection with the 2024 Annual Meeting,

notice must be submitted by the same deadline as disclosed above under the advance notice provisions of our Bylaws and must include the

information in the notice required by our Bylaws and by Rule 14a-19(b)(2) and Rule 14a-19(b)(3) under the Exchange Act.

OTHER BUSINESS

As of the date of this Proxy

Statement, the Board and management are not aware of any other matter, other than those described herein, which will be presented for

consideration at the Special Meeting. Should any other matter requiring a vote of the stockholders properly come before the Special Meeting

or any adjournment thereof, the enclosed proxy confers upon the persons named in and entitled to vote the shares represented by such proxy

discretionary authority to vote the shares represented by such proxy in accordance with their best judgment in the interest of the Company

on such matters. The persons named in the enclosed proxy also may, if it is deemed advisable, vote such proxy to adjourn the Special Meeting

from time to time.

Please sign, date, and

return promptly the enclosed proxy at your earliest convenience in the enclosed envelope, which requires no postage if mailed in the United

States.

| By Order of the Board of Directors |

|

| |

|

| |

|

| /s/ Anthony J. LeVecchio |

|

| Anthony J. LeVecchio |

|

| Chairman of the Board |

|

Plano, Texas

January 25, 2024

APPENDIX

A

AMENDED

AND RESTATED CERTIFICATE OF INCORPORATION

AMENDED

AND RESTATED Certificate of Incorporation

of

Intrusion Inc.

Intrusion Inc. (hereinafter

referred to as the “Corporation”), a corporation organized and existing under the laws of the State of Delaware, hereby certifies

as follows:

FIRST: The date of filing

of the original Certificate of Incorporation of the Corporation, in the name of Optical Data Systems, Inc. (the “Certificate”)

with the Secretary of State of the State of Delaware is August 30, 1995.

SECOND: On June 14, 2010,

the Certificate, as amended to such date, was amended and restated pursuant to the Restated Certificate of Incorporation filed with Secretary

of State of the State of Delaware on such date (the “Current Certificate”).

THIRD: This Amended and Restated

Certificate of Incorporation amends and restates the Current Certificate in its entirety.

FOURTH: This Amended and Restated

Certificate of Incorporation has been duly approved and adopted by the Board of Directors of the Corporation on December 15, 2023,

and by the stockholders of the Corporation on [_________], 2024, in accordance with the provisions of Sections 141, 228, 242 and 245 of

the General Corporation Law of the State of Delaware.

FIFTH: The Current Certificate

is hereby amended and restated in its entirety to read as follows:

Section

1. Name. The name of the corporation is Intrusion Inc. (the “Corporation”).

Section

2. Registered Office and Agent. The name and address of the registered agent of the Corporation in the State of Delaware is

The Corporation Trust Company, Corporation Trust Center, 1209 Orange St., Wilmington DE 19801, New Castle County, or such other

agent and address as the Board of Directors of the Corporation (the “Board”) shall from time to time select.

Section

3. Purpose and Business. The purpose of the Corporation is to engage in any lawful act or activity for which corporations may

now or hereafter be organized under the Delaware General Corporation Law (the “DGCL”), including, but not limited to the

following:

| (a) | The Corporation may at any time exercise such rights, privileges,

and powers, when not inconsistent with the purposes and object for which this Corporation is organized. |

| (b) | The Corporation shall have the power to have succession by its

corporate name in perpetuity, or until dissolved and its affairs wound up according to law. |

| | |

| (c) | The Corporation shall have the power to sue and be sued in any

court of law or equity. |

| (d) | The Corporation shall have the power to make contracts. |

| (e) | The Corporation shall have the power to hold, purchase and convey

real and personal estate and to mortgage or lease any such real and personal estate with its franchises. The power to hold real and personal

estate shall include the power to take the same by devise or bequest in the State of Delaware, or in any other state, territory or country. |

| (f) | The Corporation shall have the power to appoint such officers

and agents as the affairs of the Corporation shall require and allow them suitable compensation. |

| (g) | The Corporation shall have the power to make bylaws not inconsistent

with the constitution or laws of the United States, or of the State of Delaware, for the management, regulation and government of its

affairs and property, the transfer of its stock, the transaction of its business and the calling and holding of meetings of stockholders. |

| (h) | The Corporation shall have the power to wind up and dissolve

itself, or be wound up or dissolved. |

| (i) | The Corporation shall have the power to adopt and use a common

seal or stamp, or to not use such seal or stamp and if one is used, to alter the same. The use of a seal or stamp by the Corporation

on any corporate documents is not necessary. The Corporation may use a seal or stamp, if it desires, but such use or non-use shall not

in any way affect the legality of the document. |

| (j) | The Corporation shall have the power to borrow money and contract

debts when necessary for the transaction of its business, or for the exercise of its corporate rights, privileges or franchises, or for

any other lawful purpose of its incorporation; to issue bonds, promissory notes, bills of exchange, debentures and other obligations

and evidence of indebtedness, payable at a specified time or times, or payable upon the happening of a specified event or events, whether

secured by mortgage, pledge or otherwise, or unsecured, for money borrowed, or in payment for property purchased, or acquired, or for

another lawful object. |

| (k) | The Corporation shall have the power to guarantee, purchase,

hold, sell, assign, transfer, mortgage, pledge or otherwise dispose of the shares of the capital stock of, or any bonds, securities or

evidence in indebtedness created by any other corporation or corporations in the State of Delaware, or any other state or government

and, while the owner of such stock, bonds, securities or evidence of indebtedness, to exercise all the rights, powers and privileges

of ownership, including the right to vote, if any. |

| (l) | The Corporation shall have the power to purchase, hold, sell

and transfer shares of its own capital stock and use therefore its capital, capital surplus, surplus or other property or fund. |

| (m) | The Corporation shall have the power to conduct business, have

one or more offices and hold, purchase, mortgage and convey real and personal property in the State of Delaware and in any of the several

states, territories, possessions and dependencies of the United States, the District of Columbia and in any foreign country. |

| (n) | The Corporation shall have the power to do all and everything

necessary and proper for the accomplishment of the objects enumerated in this Amended and Restated Certificate of Incorporation, or any

amendments thereof (as so amended from time to time, the “Certificate of Incorporation”), or necessary or incidental to the

protection and benefit of the Corporation and, in general, to carry on any lawful business necessary or incidental to the attainment

of the purposes of the Corporation, whether or not such business is similar in nature to the purposes set forth in the Certificate of

Incorporation of the Corporation, or any amendment thereof. |

| (o) | The Corporation shall have the power to make donations for the

public welfare or for charitable, scientific or educational purposes. |

| (p) | The Corporation shall have the power to enter partnerships, general

or limited, or joint ventures, in connection with any lawful activities. |

Section

4. Capital Stock.

| (a) | Classes and Number of Shares. The total number of

shares of all classes of stock, which the Corporation shall have authority to issue shall be eighty million (80,000,000) shares of common

stock, par value of $0.01 per share (the “Common Stock”) and five million (5,000,000) shares of preferred stock, par value

of $0.01 per share (the “Preferred Stock”). |

| (b) | Powers and Rights of Common Stock. |

| (i) | Preemptive Right. No shareholders of the Corporation

holding Common Stock shall have any preemptive or other right to subscribe for any additional unissued or treasury shares of stock or

for other securities of any class or series, or for rights, warrants or options to purchase stock, or for scrip, or for securities of

any kind convertible into stock or carrying stock purchase warrants or privileges unless so authorized by the Corporation. |

| (ii) | Voting Rights and Powers. With respect to all matters

upon which stockholders are entitled to vote or to which stockholders are entitled to give consent, the holders of the outstanding shares

of the Common Stock shall be entitled to cast thereon one (1) vote in person or by proxy for each share of the Common Stock standing

in his/her name. |

| (iii) | Dividends and Distributions. |