false

0000736012

false

false

false

false

0000736012

2023-09-28

2023-09-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): September 28, 2023

INTRUSION

INC.

(Exact Name of Registrant

as Specified in Its Charter)

| Delaware |

001-39608 |

75-1911917 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File

Number) |

(IRS Employer

Identification No.) |

101

East Park Blvd, Suite

1200

Plano, Texas |

75074 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(888) 637-7770

(Registrant’s Telephone Number,

Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

INTZ |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive

Agreement.

As previously disclosed, on

June 3, 2022, a stockholder derivative complaint (Prawitt v. Blount, et al., Case No. 1:22-cv-00735-MN (D. Del.) (the “Action”))

was filed in U.S. District Court, District of Delaware by plaintiff Nathan Prawitt on behalf of Intrusion Inc. (the “Company”)

against certain of the Company’s current and former officers and directors. The plaintiff alleged that defendants through various

actions breached their fiduciary duties, wasted corporate assets, and unjustly enriched defendants by (a) incurring costs and expenses

in connection with the then-ongoing investigation by the Securities and Exchange Commission (the “SEC”), (b) incurring costs

and expenses to defend us with respect to the previously disclosed consolidated class action, (c) settling class-wide liability with respect

to the consolidated class action, as well as ancillary claims regarding sales of the Company’s common stock by certain of the defendants.

Further, as previously disclosed, on September 28, 2023, the Company agreed to the terms of a settlement contained in that certain Stipulation

of Compromise and Settlement (“Settlement Agreement”) of the Action. The Settlement Agreement is subject to Court approval

and provides in part for (i) an amendment to the Company’s Bylaws, committee Charters, and other applicable corporate policies to

implement certain measures set forth more fully therein, to remain in effect for no less than three years; (ii) attorneys’ fees

and expenses to plaintiff’s counsel of $250,000; and (iii) the dismissal of all claims against the defendants, including the Company,

in connection with the Action. The $250,000 settlement payment will be paid by the Company’s insurance provider under its insurance

policy since the Company’s $0.5 million retention was previously exhausted (the “Settlement Payment”).

The Company also agreed to

adopt amended and restated bylaws providing that when the Company’s Chief Executive Officer and Chairman of the Board of Directors

of the Company are the same individual, the Company will designate a lead independent director. See Item 5.03 of this Current Report on

Form 8-K.

Under the Settlement Agreement,

the plaintiff agreed to release any and all claims that he had, has, or may have against the Company arising out of any event occurring

on or before the effective date of the Settlement Agreement, including claims related to the Action.

In exchange for plaintiff’s

promises and other consideration under the Settlement Agreement, the Company agreed to pay the Settlement Payment. The Company also agreed

to release plaintiff from any and all claims that it had, has, or may have against plaintiff arising out of any event occurring on or

before the effective date of the Settlement Agreement.

On December 21, 2023, the U.S. District Court, District of Delaware

issued a Revised Notice of Pendency And Proposed Settlement Of Action. The hearing on the Court’s approval of the Settlement Agreement

was moved from January 7, 2024, to April 3, 2024. The description of the Settlement Agreement contained herein does not purport to be

complete and is qualified in its entirety by reference to the full text of the Settlement Agreement, which was filed in the Company’s

Current Report on Form 8-K dated October 2, 2023, and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

Forward-Looking Statements

This Current Report on Form

8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

are statements that do not represent historical facts and may be based on underlying assumptions. The Company uses words and phrases such

as “an agreement,” “subject to,” “would,” “provides” “requires” and similar

expressions to identify forward-looking statements in this report. Such forward-looking statements are based on information available

to the Company as of the date of this report and involve a number of risks and uncertainties, some beyond the Company’s control,

that could cause actual results to differ materially from those anticipated by these forward-looking statements, including risks and uncertainties

such as: (i) the ability to overcome any objections or appeals regarding the settlement and (ii) other risks described in the Company’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and future filings and reports by the Company. These forward-looking

statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company is under no

obligation to, and expressly disclaims any responsibility to, update or alter its forward-looking statements, whether as a result of new

information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

INTRUSION INC. |

| |

|

| Dated: January 9, 2024 |

By: |

/s/ Kimberly Pinson |

| |

|

Kimberly Pinson |

| |

|

Chief Financial Officer |

Exhibit 10.1

UNITED

STATES DISTRICT COURT

DISTRICT

OF DELAWARE

|

NATHAN PRAWITT, derivatively on behalf of INTRUSION, INC.,

Plaintiff,

v.

JACK B. BLOUNT, MICHAEL L. PAXTON, B. FRANKLIN BYRD, P. JOE HEAD, GARY

DAVIS, JAMES F. GERO, ANTHONY SCOTT, ANTHONY J. LEVECCHIO, KATRINKA B. MCCALLUM, JAMIE M. SCHNUR, GREGORY K. WILSON,

Defendants,

-and-

INTRUSION, INC.,

Nominal Defendant.

|

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

|

Civil Action No.: 1:22-cv-00735-MN

|

notice of pendency

AND PROPOSED settlement of action

| TO: | ALL PERSONS OR ENTITIES WHO HELD SHARES OF common stock of INTRUSION, INC., EITHER OF RECORD OR BENEFICIALLY,

AS OF SEPTEMBER 28, 2023 |

| | |

| | IF YOU HOLD COMMON STOCK OF INTRUSION, INC. FOR THE BENEFIT OF ANOTHER, PLEASE PROMPTLY TRANSMIT THIS DOCUMENT TO SUCH BENEFICIAL OWNER. |

The purpose of this Notice

is to inform you of (i) the pendency of the above-captioned action (the “Action”), which was brought in the United States

District Court for the District of Delaware (the “Court”) by a stockholder of Intrusion, Inc. (“Intrusion” or

the “Company”) asserting claims derivatively on behalf of the Company; (ii) the proposed settlement of the Action (the “Settlement”),

subject to Court approval as provided for in a Stipulation of Compromise and Settlement dated September 28, 2023 (the “Stipulation”),

which was filed with the Court and is publicly available for review; and (iii) your right to participate in a hearing to be held

on April 3, 2024, at 10:00 a.m., before the Honorable Maryellen Noreika, at the U.S. District Court for the District of Delaware, J. Caleb

Boggs Federal Building, 844 N. King Street, Courtroom 4A, Wilmington, DE 19801-3555 (the “Settlement Hearing”). The purposes

of the Settlement Hearing are to determine whether the Court should: (i) approve the proposed Settlement as fair, reasonable and adequate;

(ii) dismiss the Action with prejudice; (iii) enter an Order and Final Judgment approving the Settlement; (iv) approve a petition

for an award of attorneys’ fees and expenses to counsel for plaintiff Nathan Prawitt (“Plaintiff”) in the Action; (v)

approve an application for a Plaintiff Service Award to Plaintiff in the Action; and (vi) hear and determine any objections to the Settlement,

Plaintiff’s counsel’s application for attorneys’ fees and expenses, or to Plaintiffs’ application for a service

award.

PLEASE

READ THIS NOTICE CAREFULLY AND IN ITS ENTIRETY. THIS NOTICE RELATES TO A PROPOSED SETTLEMENT OF THE LITIGATION REFERRED TO IN THE CAPTION

AND CONTAINS IMPORTANT INFORMATION REGARDING YOUR RIGHTS. IF THE COURT APPROVES THE PROPOSED SETTLEMENT, YOU WILL BE FOREVER BARRED FROM

CONTESTING THE FAIRNESS, REASONABLENESS OR ADEQUACY OF THE PROPOSED SETTLEMENT, AND FROM PURSUING THE RELEASED CLAIMS (as DEFINED BELOW).

The Stipulation was entered

into as of September 28, 2023 by and among (i) Plaintiff; (ii) defendants Jack B. Blount, Michael L. Paxton, B. Franklin Byrd, P.

Joe Head, Gary Davis, James F. Gero, Anthony Scott, Anthony J. Levecchio, Katrinka B. McCallum, Jamie M. Schnur, and Gregory K. Wilson

(collectively, the “Individual Defendants”); and (iii) nominal defendant Intrusion (together with the Individual Defendants,

“Defendants”). Plaintiffs and Defendants are collectively referred to herein as the “Parties.”

This Notice describes the

rights you may have in the Action and pursuant to the Stipulation and what steps you may take, but are not required to take, in relation

to the Settlement. If the Court approves the Settlement, the Parties will ask the Court at the Settlement Hearing to enter an Order and

Final Judgment dismissing the Action with prejudice in accordance with the terms of the Stipulation.

This Action was brought as

a shareholder derivative action on behalf of the Company. The benefits of the Settlement will go to the Company. Other than any award

by the Court of attorneys’ fees and expenses to Plaintiff’s counsel or service award to Plaintiff, there are no monetary payments

under the Settlement.

| WHAT IS THE PURPOSE OF THIS NOTICE? |

1.

The purpose of this Notice is to explain the Action, the terms of the proposed Settlement, and how the Settlement affects the legal

rights of the Company’s stockholders.

2.

In a derivative action, one or more people and/or entities who are current stockholders of a corporation sue on behalf of and for

the benefit of the corporation, seeking to enforce the corporation’s legal rights.

3.

As described more fully in paragraphs 33 and 34 below, current stockholders have the right to object to the proposed Settlement,

the application by Plaintiff’s counsel for an award of fees and expenses and Plaintiffs’ application for a service award.

They have the right to appear and be heard at the Settlement Hearing, which will be held before the Honorable Maryellen Noreika on April

3, 2024, at 10:00 a.m., United States District Court for the District of Delaware, J. Caleb Boggs Federal Building, 844 N. King Street,

Courtroom 4A, Wilmington, DE 19801-3555 or as may be undertaken via a remote proceeding such as Zoom or by telephone. At the Settlement

Hearing, the Court will: (a) determine whether the proposed Settlement should be approved as fair, reasonable and adequate; (b) determine

whether the Court should finally approve the Stipulation and enter the Order and Final Judgment as provided in the Stipulation and dismiss

the Action with prejudice, thereby extinguishing and releasing the Released Claims; (c) determine whether and in what amount an award

of attorneys’ fees (including expenses) should be paid to Plaintiff’s Counsel; (d) determine whether and in what amount a

service award should be paid to Plaintiff; (e) hear and determine any objections to the Settlement, Plaintiff’s Counsel’s

application for attorneys’ fees (including expenses), or Plaintiffs’ application for a service award; and (e) rule on any

other matters the Court may deem appropriate.

4.

The Court has reserved the right to adjourn or continue the Settlement Hearing, including consideration of the application by Plaintiff’s

counsel for an award of attorney’s fees and expenses and/or Plaintiffs’ application for a service award, without further notice

to you other than by announcement at the Settlement Hearing or any adjournment thereof, or notation on the docket in the Action. The Court

has further reserved the right to approve the Settlement, at or after the Settlement Hearing, with such modifications as may be consented

to by the Parties and without further notice of any kind.

| WHAT IS THIS CASE ABOUT? WHAT HAS HAPPENED SO FAR? |

THE FOLLOWING RECITATION

DOES NOT CONSTITUTE FINDINGS OF THE COURT AND SHOULD NOT BE UNDERSTOOD AS AN EXPRESSION OF ANY OPINION OF THE COURT AS TO THE MERITS OF

ANY CLAIMS OR DEFENSES BY ANY OF THE PARTIES. IT IS BASED ON STATEMENTS OF THE PARTIES AND IS SENT FOR THE SOLE PURPOSE OF INFORMING YOU

OF THE EXISTENCE OF THE ACTION AND OF A HEARING ON A PROPOSED SETTLEMENT SO THAT YOU MAY MAKE APPROPRIATE DECISIONS AS TO STEPS YOU MAY,

OR MAY NOT, WISH TO TAKE IN RELATION TO THIS LITIGATION.

5.

Intrusion develops and sells products to protect against cyberattacks through purported advanced threat intelligence and artificial

intelligence. Intrusion’s TraceCop product maintains databases of malicious Internet Protocol and Transmission Control Protocol

addresses and prevents their access to protected networks. Intrusion Savant is a network data capture and analysis tool that records and

reports network activity to product users.

6.

In or about May 2020, it was disclosed that the Company was developing a new product which used artificial intelligence (“AI”)

to identify and stop cyberattacks, including “zero day” attacks that exploit both known and unknown computer software vulnerabilities,

in real time and without the need for human intervention. Purportedly, this new product would be fully compatible with existing security

measures and require minimal adjustments for use on existing networks. This new product, “Shield,” leveraged Intrusion’s

TraceCop database and its Savant product, which does real-time analysis, and combining them with AI capabilities.

7.

Plaintiff alleged that throughout the Relevant Period (October 14, 2020 and August 26, 2021), the Individual Defendants issued

and/or caused the issuance of materially misleading statements concerning the Company’s Shield product, including statements concerning

the design and capabilities of Shield, the parameters and purported success of product testing, and the number and identity of customers

who purportedly purchased Shield.

8.

In April 2021, White Diamond Research (“White Diamond”) issued a report publicizing some of the problems with the Shield

and other issues concerning the Company. While Intrusion publicly refuted the White Diamond report, Intrusion failed to rollout the 50,000

product seats for Shield that it had previously forecast and, therefore, failed to meet revenue expectations from those sales. Thereafter,

Intrusion laid off approximately 20% of its workers and it was subsequently disclosed that SEC had commenced an investigation of the Company.

9.

On April 16, 2021, a securities class action, Celeste v. Intrusion, Inc. et al., Case No. 4:21-cv-00307 (E.D. Tex.), was

filed in the United States District Court for the Eastern District of Texas, for violations of the Securities Exchange Act of 1934 (the

“Exchange Act”). On May 14, 2021, a second securities class action, Neely v. Intrusion, Inc. et al., was filed in the

United States District Court for the Eastern District of Texas, also alleging violations of the Exchange Act. On November 23, 2021, the

securities class actions were consolidated (the “Securities Action”) and, on February 7, 2022, an amended complaint was filed

in the Securities Action (the “Securities Complaint”). On April 13, 2022, the Securities Action was stayed to permit the parties

to file a motion for preliminary approval of class action settlement.

10.

On June 3, 2022, Plaintiff filed the Verified Stockholder Derivative Complaint in the Action, alleging violation of the §

10(b) of the Exchange Act and Rule 10b-5, as well as state law claims for breach of fiduciary duties, unjust enrichment, and waste of

corporate assets against the Individual Defendants on behalf of the Company.

11.

On December 16, 2022, the United States District Court for the Eastern District of Texas entered a Final Judgment approving the

settlement of the Securities Action which, inter alia, provided for the payment of $3,250,000 in cash to the members of the class.

12.

On December 20, 2022, Plaintiff and Defendants (collectively, the “Parties”) filed a Stipulation and Proposed Order

Staying Case to stay the Action for sixty (60) days to permit counsel for the Parties an opportunity to meet and confer about how to proceed

and submit a proposed schedule for the Court’s consideration. That Proposed Order was granted the same day. Thereafter, the Court

entered Orders extending the stay to permit the Parties to discuss possible settlement of the Action.

13.

In or about January 2023, the Parties commenced arm’s-length negotiations concerning a possible resolution of the Action.

After approximately seven (7) months of arduous negotiations, the Parties reached an agreement-in-principle to fully resolve all claims

in the Action on or about July 21, 2023.

14.

The Parties executed the Stipulation on September 28, 2023.

| WHAT ARE THE TERMS OF THE SETTLEMENT? |

15.

Set forth below is a summary of the principal terms of the proposed Settlement, as agreed to by the Parties, subject to the approval

of the Court. The following statements are a summary, and reference is made to the Stipulation, which was filed with the Court and is

publicly available for review, for a full and complete statement of the terms of the Settlement.

16.

In consideration for the full settlement and release of the Released Claims (as defined below), and subject to the terms and conditions

set forth in the Stipulation, within ninety (90) days after entry of Judgment, Intrusion’s Board of Directors (the “Board”)

shall adopt resolutions and amend its Bylaws, committee Charters, and other applicable corporate policies to implement the following reforms

(the “Measures”) set forth below, which shall remain in effect for no less than three (3) years (the “Term”):

The Audit Committee

The Audit Committee

Charter will be amended to provide, among other things, that the Committee shall meet at least four (4) times in separate executive sessions

with Intrusion’s management, the independent auditor and General Counsel outside the presence of the Company’s Chief Financial

Officer (the “CFO”), and the Committee shall meet quarterly in separate sessions with the Company’s General Counsel

and outside counsel to review any relevant legal matters.

In addition, the

Audit Committee, with Intrusion’s independent auditor, will conduct an annual review the adequacy of staffing of the Company’s

accounting department, and shall compile a list of potential independent auditors and shall conduct preemptive due diligence to ensure

that the Company is not without a registered independent auditor for more than thirty (30) days upon the resignation or termination of

its current registered independent auditor

Working with the

Company’s Disclosure Committee, General Counsel and CFO, the Audit shall monitor compliance with public reporting requirements and

other applicable laws and rules, including review of the Company’s periodic reports with the U.S. Securities and Exchange Commission

(the “SEC”) to ensure the complete and accurate disclosure of material information. The Audit Committee, in conjunction with

the General Counsel, shall be responsible for investigating all potential or reported material violations of public reporting requirements,

and other applicable laws, regulations and rules, shall prepare a written report to the full Board whenever any material violations of

public reporting requirements and/or other applicable laws, regulations and rules are identified, which include specific recommendations

and/or proposals for mitigating such violations in the future.

The Audit Committee,

in conjunction with the Nominating and Corporate Governance Committee (the “Governance Committee”), shall monitor compliance

with Intrusion’s Code of Conduct and, if a violation of the Code of Conduct is sufficiently material to trigger a disclosure obligation,

the Audit Committee will report the violation to the full Board. The Audit Committee, in conjunction with the General Counsel, shall monitor

the Company’s compliance with all applicable laws, regulations and/or rules concerning whistleblower complaints. The Audit Committee

shall also conduct an annual review of the effectiveness of Intrusion’s internal controls over the Company’s compliance with

public reporting requirements and/or other applicable laws, regulations and rules. Within six (6) months of the Court’s final approval

of the Settlement, the Audit Committee shall, with the assistance of an independent advisor, review the effectiveness of Intrusion’s

newly implemented controls and procedures.

The Disclosure Committee

The Disclosure Committee

Charter shall be posted on the Company’s website, and amended to provide that Committee shall consult, as necessary, with the Audit

Committee, the Company’s General Counsel, the CFO, Intrusion’s senior officers, independent auditors, internal accountants,

or outside legal counsel, to ensure that the Company’s public statements are accurate and complete in all material respects.

The chair of the

Disclosure Committee, or the chair’s designee, shall report at least quarterly to the Audit Committee concerning the activities

undertaken by the Disclosure Committee to ensure that the Company’s public statements are accurate and complete in all material

respects, and the Committee shall, at least annually, review and assess the nonfinancial metrics disclosed in Intrusion’s SEC Filings.

General Counsel

Intrusion shall

adopt a resolution that, in conjunction with the Audit Committee and the Governance Committee, the General Counsel’s duties shall

include, but are not limited to, oversight and administration of Intrusion’s corporate governance policies (including the Code of

Conduct); fostering a culture that integrates compliance and ethics into business processes and practices through awareness and training;

maintaining and monitoring a system for accurate public and internal disclosures, and reporting and investigating potential compliance

and ethics concerns. General Counsel shall oversee Intrusion’s ethics and compliance program, implement procedures for monitoring

and evaluating the program’s performance, and communicate with and inform the entire Board regarding progress toward meeting program

goals. In addition, General Counsel, in conjunction with the Audit Committee and Governance Committee, shall evaluate and amend, as necessary,

Intrusion’s ethics and compliance program in light of trends and changes in laws which may affect Intrusion’s compliance with

all applicable laws, regulations, and rules. General Counsel will provide a written report to the Audit Committee and Governance Committee

at least four (4) times annually and will promptly report any allegations of compliance and ethics concerns relating to violations of

applicable laws or regulations, financial fraud or reporting violations to those committees.

General Counsel

shall perform an independent review of Intrusion’s draft quarterly and annual reports, filed with the SEC on Forms 10-K and 10-Q,

and related materials prior to their publication, as well as prospective review of the Company’s publicly disseminated statements

to ensure the accuracy, completeness, and timeliness of disclosures relating to Intrusion’s compliance with all applicable laws,

regulations, and rules. General Counsel shall also work with the Audit Committee to evaluate the accuracy, completeness, and timeliness

of disclosures concerning the adequacy of Intrusion’s internal controls over financial reporting, compliance with all applicable

laws, regulations, and rules, and ongoing and potential litigation and compliance issues.

General Counsel

shall also assess organizational risk for misconduct and noncompliance with applicable laws, regulations, and rules; promptly report material

risks relating to compliance or disclosure issues to the Audit Committee following identification of these risks; and make written recommendations

for further evaluation and/or remedial action.

Internal Controls and Compliance Functions

Intrusion’s CFO shall

not have been employed by any of Intrusion’s outside auditor firms during the prior two (2) years or, if involved in the auditor

firm’s audit of Intrusion, during the prior five (5) years.

The Board shall retain

an independent consultant to conduct an annual analysis for each of the next two (2) years regarding appropriate steps Intrusion

should take to test and then strengthen the internal control function, including, but not limited to, the accuracy of public

disclosures and compliance with all applicable laws, regulations, and rules. In that analysis, the Company identify necessary

resources needed to effectively manage internal knowledge of risk exposure, existing laws, regulations, regulations and disclosure

obligations; assess risks of noncompliance with laws and regulations, internal controls, and disclosure obligations, incorporating

such risk assessments into internal audit procedures; and implement technology to improve auditing techniques, data mining, and

predictive modeling with respect to compliance issues and risk exposure.

The consultant shall meet

annually with the Board, CEO, CFO, General Counsel, and Intrusion’s external auditors to present a written report in advance of

Intrusion’s finalization of its annual Form 10-K report (regardless of whether the annual report on Form 10-K is a restatement,

amended filing, or initial filing, and whether it is submitted late or on time) with recommended changes to Intrusion’s Audit Committee,

Governance Committee, and General Counsel. The Board shall consider implementation of each recommendation contained in the report and

decide whether to implement the recommendation. The Board shall prepare minutes setting forth the specific reason(s) for its decisions

(including the results of the Board vote for each recommendation that is not accepted). The consultant’s report shall be attached

to the Board minutes as an exhibit. A copy of such minutes and the consultant’s report shall be maintained by the Audit Committee

for a period of ten (10) years. Moreover, in the final report on Form 10-K issued after the Board’s evaluation of the consultant’s

report, the Board shall include a summary of the consultant’s proposals, the Board’s determination regarding the proposals,

and the reasons for such determination.

Insider Trading Controls

The Company’s Insider

Trading Policy shall be amended, and the amended policy shall be posted on the Company website. To the extent not already required, the

Board shall require all insider transactions to be made subject to 10b5-1 trading plans (“Trading Plans”), which should be

structured to prohibit the commencement of trading until after the next regularly scheduled blackout period following a Trading Plan’s

adoption, and conducted according to specific instructions or formulae with regard to amount, price, and date of transactions (i.e., an

insider may not give his or her broker the right to determine whether and how to make transactions).The Trading Plans shall have a minimum

length of six (6) months, and shall not be subject to cancellation, and the adoption of a Trading Plan, and the aggregate number of shares

involved, shall be publicly disclosed. All Trading Plans shall be approved by the Company’s Audit Committee.

A 10b5-1 Trading Plan will

not be required if the stock is sold in the open window period.

The Governance Committee

The Governance Committee Charter

shall be amended, and the amended charter shall be posted on the Company’s website. The amended charter shall provide that the Committee

shall meet with each prospective new Board member prior to his or her nomination to the Board and then recommend whether such individual

shall be nominated for membership to the Board. Such review shall require, inter alia, a background check of each candidate. Final

approval of a director candidate shall be determined by the full Board. The decision on whether to recommend such person to the Board

shall be disclosed to shareholders after a full review by the Board.

Potential disqualifying conflicts

of interests to be considered by the Committee shall include familial relationships with Company officers or directors, interlocking directorships,

and/or substantial business, civic, and/or social relationships with other members of the Board that could impair the prospective Board

member’s ability to act independently from the other Board members.

The Committee shall work with

the Audit Committee and General Counsel in fulfilling its duties related to the Company’s corporate governance guidelines and policies,

and compliance therewith.

The Compensation Committee

The Compensation Committee Charter

shall be amended, and the amended charter shall be posted on the Company’s website. The amended charter shall provide that in determining,

setting, or approving termination benefits and/or separation pay to executive officers, the Committee shall consider the circumstances

surrounding the particular executive officer’s departure and the executive’s performance as it relates to both legal compliance

and compliance with the Company’s internal policies and procedures. This shall not affect payments or benefits that are required

to be paid pursuant to the Company’s plans, policies, or agreements

Executive Reports

The Company’s CFO (or

designee) shall provide quarterly written reports to the Board regarding the Company’s financial condition and prospects, including,

but not limited to, a discussion of all reasons for material increases in expenses and liabilities, if any, and material decreases in

revenues and earnings, if any, management plans for ameliorating or reversing such negative trends, and the success or failure of any

such plans presented in the past.

All Section 16 officers shall

make written reports to the Board regarding their respective areas of responsibility at least quarterly and shall meet at least quarterly

with the Board.

Employee Training in Risk Assessment and Compliance

Intrusion shall ensure that

its existing training program provides that the Company’s General Counsel shall be charged with primary responsibility for education,

and annual training shall be mandatory for all directors, officers, employees, independent contractors, and agents of Intrusion. In the

event a person is appointed or hired after the annual training for a particular year, a special training session shall be held for such

individual within fourteen (14) business days of their appointment or hiring;

Training shall include coverage

of risk assessment and compliance, Intrusion’s Code of Conduct, corporate governance guidelines and policies, policies regarding

“related party transactions,” and all other manuals or policies established by Intrusion concerning legal or ethical standards

of conduct to be observed in connection with work performed for Intrusion (“Intrusion’s Policies”). Training for employees

involved in (i) preparing the Company’s financial statements; (ii) communications with the Company’s independent auditor;

(iii) data collection, aggregation, analysis, and reporting; and (iv) disseminating or producing the Company’s public statements

shall include, but not be limited to, issuing appropriate guidance and the laws and regulations regarding public disclosures.

Training shall be in person

where practicable. In the limited circumstances where training in person is not practicable, training should be interactive, Internet-based

training. Upon completion of training, the person receiving the training shall provide a written certification as to his or her receipt

and understanding of the obligations under Intrusion’s Policies. Each written certification shall be maintained by Intrusion’s

General Counsel for a period of ten (10) years from the date it was executed.

Director Education

Intrusion shall suggest that

each member of the Board shall annually attend four (4) hours of continuing education programs designed for directors of publicly-traded

companies. Such training shall include coverage of rules and regulations regarding public disclosures, standards governing internal controls

over financial reporting including those promulgated in the Committee of Sponsoring Organizations of the Treadway Commission Framework,

corporate governance, assessment of risk, compliance, auditing, and reporting requirements for publicly-traded corporations.

Board Composition and Practices

The Board, currently has five

(5) members, shall add one (1) additional independent director who shall meet the independence standards set forth herein within one (1)

year of the Effective Date of the Settlement,

The Board shall include a

provision in the Company’s Bylaws that, in the “unusual circumstances as determined by the Board” in which the CEO and

Chairman of the Board are the same individual, the Company shall have a lead independent director. and

The Board shall have no more than two (2)

directors who are active CEOs at any company, including Intrusion.

Director Independence

At least two-thirds of the

Board shall consist of directors who meet the criteria for director independence set forth in NASDAQ Listing Rule 5605(a)(2), and any

other statutory director independence requirement. In addition, no director: (a) shall have personal services contract(s) with Intrusion

or any member of the Company’s senior management, (b) shall be employed by a public company at which an executive officer of Intrusion

serves as a director, (c) shall be affiliated with a non-profit entity that receives significant contributions from Intrusion, (d) shall

have any of the relationships described in subsections (a)–(c) above with any affiliate of Intrusion, and shall be a member of the

immediate family of any person described in (a)–(d) above.

If the Company fails to comply

with the independence requirements set forth herein due to one or more vacancies of the Board, Intrusion shall within thirty (30) days

regain compliance with these requirements.

Whistleblower Policy

The Company’s Code of

Conduct shall provide that Intrusion does not tolerate retaliation against whistleblowers and, to further protect and incentivize employees

coming forward with concerns, the Board shall require management to adopt a specific written policy protecting whistleblowers (the “Whistleblower

Policy”) and include this policy on the Company’s website. The Company’s Whistleblower Policy shall encourage interested

parties to bring forward ethical and legal violations and/or a reasonable belief that ethical and legal violations have occurred to the

Audit Committee, Human Resources, and/or Legal Department so that action may be taken to resolve the problem. These complaints shall be

reviewed by the Audit Committee, in consultation with and under the supervision of the Company’s legal counsel and presented to

the full Board.

The Whistleblower Policy must

effectively communicate that Intrusion is serious about adherence to its corporate governance policies and that whistleblowing is an important

tool in achieving this goal. The Whistleblower Policy, with the endorsement of the Board and the most senior management of the Company,

must adequately notify employees, independent contractors and vendors of Intrusion that (a) executives are subject to criminal penalties,

including imprisonment, for retaliation against whistleblowers; that whistleblower complaints may be directed to the Audit Committee,

Human Resources, and/or the Legal Department, and the complaints will be handled by these parties anonymously and in confidence; (b) if

a whistleblower brings their complaint to an outside regulator or other governmental entity, they will be protected by the terms of the

Whistleblower Policy just as if they directed the complaint to the Audit Committee, Human Resources, and/or Legal Department; (c) employees

may be rewarded for top performance and satisfying the stated values, business standards, and ethical standards of the Company in the

performance review process; and (f) it is both illegal and against Intrusion’s policy to discharge, demote, suspend, threaten, intimidate,

harass, or in any manner discriminate against whistleblowers. The Company shall remind employees of whistleblower options and whistleblower

protections in employee communications provided at least once a year.

17.

In addition to the Measures, Defendants acknowledge that the Action was a precipitating, substantial and material factor in the

adoption and implementation of these Measures by Intrusion’s Board, and that the Measures confer substantial benefits upon Intrusion

and its current shareholders.

18.

Defendants do not object to the payment of any attorneys’ fees (including expenses) awarded by the Court to Plaintiffs’

counsel, provided that such award does not exceed two hundred and fifty thousand dollars ($250,000.00) and take no position of the payment

of a Plaintiff Service Award of $2,000.00 to be paid from the attorneys’ fees awarded by the Court.

19.

The Company shall pay, or shall cause to be paid, the reasonable and necessary costs and expenses incurred in providing this Notice

to the Public Shareholders (the “Notice Costs”).

20.

The Company shall not have any monetary obligation to Plaintiff, any stockholder of the Company, or Plaintiffs’ counsel,

except for the payment of the award of attorneys’ fees and expenses as specified in the Stipulation.

21.

Plaintiff, the Individual Defendants (provided they unanimously agree or if only certain Defendants are affected by the occurrence

of any event set forth in clauses (b) through (e) below, provided that such Defendants as are affected agree), and Intrusion shall each

have the right to terminate the Settlement and this Stipulation by providing written notice of their election to do so (“Termination

Notice”) to the other parties to this Stipulation within thirty (30) calendar days of: (a) the Court’s declining to enter

the Preliminary Approval Order in any material respect; (b) the Court’s refusal to approve this Stipulation or any part of it that

materially affects any party’s rights or obligations hereunder; (c) the Court’s declining to enter the Judgment in any material

respect; or (d) the date upon which the Judgment is modified or reversed in any material respect by an appellate court. Neither a modification

nor a reversal on appeal of the amount of fees, costs, and expenses awarded by the Court to Plaintiff’s Counsel or of the amount

of Plaintiff Service Award (if granted by the Court) shall be deemed a material modification of the Judgment or this Stipulation.

| WHAT ARE THE PARTIES’ REASONS FOR THE SETTLEMENT? |

22.

The Settlement set forth in the Stipulation reflects the results of the Parties’ negotiations and the terms of the Stipulation,

and an agreement-in-principle was reached only after arm’s-length negotiations by counsel with extensive experience and expertise

in shareholder derivative litigation.

23.

Plaintiff believes that the Released Claims had merit when filed and continue to have merit, and Plaintiff is settling the Released

Claims because Plaintiff believes that the Settlement will provide substantial value to the Company and its stockholders. Plaintiff has

concluded that the Settlement is fair, reasonable, and in the best interests of the Company and its shareholders, and that it is reasonable

to pursue the Settlement based on the terms and procedures outlined in the Stipulation.

24.

Defendants have denied, and continue to deny, that they have committed or threatened to commit any violations of law, breaches

of duty, breaches of contract, or other wrongdoing toward the Company, Plaintiffs, or anyone else concerning any of the claims, allegations,

or requests for relief set forth in the complaint filed in this Action.

WHAT WILL HAPPEN IF THE SETTLEMENT IS APPROVED?

WHAT CLAIMS WILL THE SETTLEMENT RELEASE? |

25.

If the Settlement is approved, the Court will enter an order approving the Settlement in accordance with the Stipulation, at which

time the Action will be dismissed with prejudice on the merits. The first date by which such order is finally affirmed on appeal or is

no longer subject to appeal, and the time for any petition for re-argument, appeal or review, by leave, writ of certiorari, or otherwise,

has expired, constitutes “Final Approval.” Upon receipt of Final Approval, and subject to the conditions set forth in the

Stipulation, including the termination provisions set forth in paragraph 21 above, the following releases will become effective:

“Released Claims”

means Released Plaintiff’s Claims and Released Defendants’ Claims.

“Released Defendants’ Claims”

means any and all manner of claims, demands, rights, liabilities, losses, obligations, duties, damages, costs, debts, expenses, interest,

penalties, sanctions, fees, attorneys’ fees, actions, potential actions, causes of action, suits, agreements, judgments, decrees,

matters, issues, and controversies of any kind, nature, or description whatsoever, whether known or unknown, disclosed or undisclosed,

accrued or unaccrued, apparent or not apparent, foreseen or unforeseen, matured or not matured, suspected or unsuspected, liquidated or

not liquidated, fixed or contingent, including Unknown Claims, whether based on state, local, foreign, federal, statutory, regulatory,

common, or other law or rule (including claims within the exclusive jurisdiction of the federal courts), that arise out of or relate in

any way to the institution, prosecution, or settlement of the claims against Defendants in the Action, except for claims relating to the

enforcement of the Settlement. For the avoidance of doubt, the Released Defendants’ Claims do not include claims based on the conduct

of the Plaintiff’s Releasees after the Effective Date.

“Released Plaintiffs’

Claims” means any and all manner of claims, demands, rights, liabilities, losses, obligations, duties, damages, costs, debts, expenses,

interest, penalties, sanctions, fees, attorneys’ fees, actions, potential actions, causes of action, suits, agreements, judgments,

decrees, matters, issues and controversies of any kind, nature, or description whatsoever, whether known or unknown, disclosed or undisclosed,

accrued or unaccrued, apparent or not apparent, foreseen or unforeseen, matured or not matured, suspected or unsuspected, liquidated or

not liquidated, fixed or contingent, including Unknown Claims, whether based on state, local, foreign, federal, statutory, regulatory,

common, or other law or rule (including claims within the exclusive jurisdiction of the federal courts, such as, but not limited to, federal

securities claims or other claims based upon the purchase or sale of Intrusion stock), that are, have been, could have been, could now

be, or in the future could, can, or might be asserted, in the Action or in any other court, tribunal, or proceeding by Plaintiff or any

other Intrusion stockholder derivatively on behalf of Intrusion or by Intrusion directly against any of the Defendants’ Releasees,

which, now or hereafter, are based upon, arise out of, relate in any way to, or involve, directly or indirectly, any of the actions, transactions,

occurrences, statements, representations, misrepresentations, omissions, allegations, facts, practices, events, claims or any other matters,

things or causes whatsoever, or any series thereof, that relate in any way to, or could arise in connection with, the Action (or relate

to or arise as a result of any of the events, acts or negotiations related thereto), including but not limited to those alleged, asserted,

set forth, claimed, embraced, involved, or referred to in, or related to the complaints filed in the Action, except for claims relating

to the enforcement of the Settlement. For the avoidance of doubt, the Released Plaintiff’s Claims include all of the claims asserted

in the Action, but do not include claims based on conduct of Defendants’ Releasees after the Effective Date.

“Releasees”

means Plaintiff’s Releasees and Defendants’ Releasees.

“Defendants’

Releasees” means Intrusion, the Individual Defendants, and any other current or former officer, director, or employee of Intrusion,

and their respective past, present, or future family members, spouses, heirs, trusts, trustees, executors, estates, administrators, beneficiaries,

distributees, foundations, agents, employees, fiduciaries, partners, partnerships, general or limited partners or partnerships, joint

ventures, member firms, limited liability companies, corporations, parents, subsidiaries, divisions, affiliates, associated entities,

stockholders, principals, officers, directors, managing directors, members, managing members, managing agents, predecessors, predecessors-in-interest,

successors, successors-in-interest, assigns, financial advisors, advisors, consultants, attorneys, personal or legal representatives,

auditors, accountants, associates and insurers, co-insurers and re-insurers.

“Plaintiffs’

Releasees” means Plaintiff, all other Intrusion stockholders, and any current or former officer or director of any Intrusion stockholder,

and their respective past, present, or future family members, spouses, heirs, trusts, trustees, executors, estates, administrators, beneficiaries,

distributees, foundations, agents, employees, fiduciaries, partners, partnerships, general or limited partners or partnerships, joint

ventures, member firms, limited liability companies, corporations, parents, subsidiaries, divisions, affiliates, associated entities,

stockholders, principals, officers, directors, managing directors, members, managing members, managing agents, predecessors, predecessors-in-interest,

successors, successors-in-interest, assigns, financial advisors, advisors, consultants, attorneys, personal or legal representatives (including

Plaintiff’s Counsel), auditors, accountants, and associates.

The releases given by the Released Parties

in the Stipulation and Settlement extend to “Unknown Claims,” which means any Released Plaintiff’s Claims that

Intrusion, Plaintiff, or any other Intrusion stockholder does not know or suspect to exist in his, her, or its favor at the time of the

release of the Defendants’ Releasees, and any Released Defendants’ Claims that any of the Defendants or any of the other Defendants’

Releasees does not know or suspect to exist in his, her, or its favor at the time of the release of the Plaintiffs’ Releasees, which,

if known by him, her, or it, might have affected his, her, or its decision(s) with respect to the Settlement. With respect to any and

all Released Plaintiff’s Claims and Released Defendants’ Claims, the Parties stipulate and agree that Intrusion, Plaintiff

and each of the Defendants shall expressly waive, and each of the other Intrusion stockholders and each of the other Defendants’

Releasees shall be deemed to have waived, and by operation of the Judgment shall have expressly waived, any and all provisions, rights,

and benefits conferred by California Civil Code §1542, which provides:

A GENERAL RELEASE DOES NOT EXTEND TO

CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE

AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY

and any law of any state

or territory of the United States, or principle of common law or foreign law, which is similar, comparable, or equivalent to California

Civil Code §1542. Intrusion, Plaintiffs and each of the Defendants acknowledge, and each of the other Intrusion stockholders and

each of the other Defendants’ Releasees and Plaintiffs’ Releasees shall be deemed by operation of law to have acknowledged,

that the foregoing waiver was separately bargained for and is a key element of the Settlement.

26.

Upon entry of the Judgment, Plaintiff, and each and every other Intrusion shareholder, on behalf of themselves and any other person

or entity who could assert any of the Released Plaintiff’s Claims on their behalf, in such capacity only, shall fully, finally,

and forever release, settle, and discharge, and shall forever be enjoined from prosecuting, the Released Plaintiff’s Claims against

Defendants and any other Defendants’ Releasees.

27.

Upon entry of the Judgment, Defendants and the other Defendants’ Releasees, on behalf of themselves and any other person

or entity who could assert any of the Released Defendants’ Claims on their behalf, in such capacity only, shall fully, finally,

and forever release, settle, and discharge, and shall forever be enjoined from prosecuting, the Released Defendants’ Claims against

Plaintiffs’ Releasees. For the avoidance of doubt, notwithstanding anything to the contrary herein, nothing in the Stipulation is

intended to release, and nothing herein shall operate as a release of, any (i) rights, claims or actions that Intrusion or any Defendant

may have against any insurer for payment of the Settlement amount or (ii) rights, claims or actions that Intrusion or any of the

Defendants may have with respect to any insurance policy implicated by the actions.

28.

Pending Court approval of the Stipulation, the Parties agree to stay any and all proceedings in the Action other than those incident

to the Settlement. Except as necessary to pursue the Settlement and determine a Fee and Expense Award, pending final determination of

whether the Stipulation should be approved, all Parties to the Action (including Plaintiff, the Defendants, and Intrusion) agree not to

institute, commence, prosecute, continue, or in any way participate in, whether directly or indirectly, representatively, individually,

derivatively on behalf of Intrusion, or in any other capacity, any action or other proceeding asserting any Released Claims. Nothing herein

shall in any way impair or restrict the rights of any Party to defend the Stipulation or to otherwise respond in the event any Person

objects to the Stipulation, the proposed Judgment to be entered, and/or the Fee and Expense Application or Service Award Application.

29.

“Effective Date” means the date that the Judgment, which approves in all material respects the releases provided for

in the Stipulation and dismisses the Action with prejudice, becomes Final.

| HOW WILL THE ATTORNEYS BE PAID? |

30.

Concurrent with seeking final approval of the Settlement, Plaintiff’s Counsel intend to petition the Court for an award of

attorneys’ fees and litigation expenses, which is no greater than two hundred and fifty thousand dollars ($250,000.00) (the “Fee

and Expense Award”). Any Fee and Expense Award will be paid by Intrusion. Defendants and Intrusion will not object to or otherwise

take any position on the Fee and Expense Application, provided that it does not seek an amount in aggregate in excess of two hundred and

fifty thousand dollars ($250,000.00).

31.

Plaintiff’s Counsel also intend to apply to the Court for a service award to Plaintiff for the time and expenses they expended

in the prosecution of the Actions of up to two thousand dollars ($2,000.00) for Plaintiff to be payable from the fees and expenses the

Court awards to Plaintiff’s Counsel in connection with the Fee and Expense Award (the “Plaintiff Service Award”). Defendants

and Intrusion take no position on the Plaintiff Service Award.

32.

Any award to Plaintiff’s Counsel for fees and expenses and any service award to Plaintiff shall be determined by the Court.

WHEN AND WHERE WILL THE SETTLEMENT HEARING BE HELD?

DO I HAVE THE RIGHT TO APPEAR AT THE SETTLEMENT HEARING? |

33.

The Court will consider the Settlement and all matters related to the Settlement at the Settlement Hearing. The Settlement Hearing

will be held before The Honorable Maryellen Noreika on April 3, 2024 at 10:00 a.m., United States District Court, J. Caleb Boggs Federal

Building,844 N. King Street, Wilmington, Delaware 19801-3555, Courtroom 4A, or as may be undertaken via a remote proceeding such as Zoom

or by telephone. Any current shareholder who objects to the Settlement, the Attorneys’ Fee and Expense Application by Plaintiff’s

Counsel, or Plaintiffs’ Service Award Application, or who otherwise wishes to be heard, may appear in person or through his, her,

or its attorney at the Settlement Hearing and present any evidence or argument that may be proper and relevant; provided, however, that

no such person shall be heard or entitled to contest the approval of the terms and conditions of the Settlement, or, if approved, the

Order and Final Judgment to be entered thereon, or the allowance of fees and expenses to Plaintiff’s Counsel, or otherwise be heard

with respect to the matters considered at the Settlement Hearing unless, no later than twenty (20) calendar days before the Settlement

Hearing, such person files with the Clerk of the Court, United States District Court, J. Caleb Boggs Federal Building,844 N. King Street,

Wilmington, Delaware 19801-3555, the following: (a) proof of ownership of the Company’s stock as of October 14, 2020 and continuously

to the present; (b) a written and signed notice of the Objector’s intention to appear, which states the name, address and telephone

number of the Objector and, if represented, his, her, or its counsel; (c) a detailed statement of the objections to any matter before

the Court; and (d) a detailed statement of all of the grounds thereon and the reasons for the Objector’s desire to appear and to

be heard, as well as all documents or writings which the Objector desires the Court to consider. Any such filings with the Court must

also be served upon each of the following counsel (by e-service, hand, or overnight mail) such that they are received no later than twenty

(20) calendar days prior to the Settlement Hearing:

|

Herbert W. Mondros

Timothy J. MacFall

RIGRODSKY LAW, P.A.

300 Delaware Avenue, Suite 210

Wilmington, DE 19801

(302) 295-5310

hwm@rl-legal.com

tjm@rl-legal.com

Counsel for Plaintiff Nathan Prawitt

Steven T. Margolin

GREENBERG TRAURIG, LLP

222 Delaware Avenue, Suite 1600

Wilmington, DE 19801

Telephone: (302) 661-7376

David Klaudt

GREENBERG TRAURIG, LLP

2200 Ross Avenue, Suite 5200

Dallas, Texas 75201

Telephone: (214) 665-3616

Email: David.Klaudt@gtlaw.com

Counsel for Individual Defendant Jack B. Blount

Andrew Dupre

MCCARTER & ENGLISH, LLP

Renaissance Centre

405 North King Street, 8th Floor

Wilmington, Delaware 19801

Telephone: (302) 984-6328

Email: adupre@mccarter.com

Counsel for Nominal Defendant Intrusion, Inc. and Individual

Defendants Michael L. Paxton, B. Franklin Byrd, P. Joe Head, Gary Davis, James Gero, Anthony Scott, Anthony J. LeVecchio, Katrinka B.

McCallum, Jamie M. Schnur, and Gregory K. WilsonCounsel for Intrusion |

34.

Any person or entity who fails to object in the manner prescribed above shall be deemed to have waived such objection (including

the right to appeal), unless the Court in its discretion allows such objection to be heard at the Settlement Hearing, and shall forever

be barred from raising such objection in this Action or any other action or proceeding or otherwise contesting the Settlement and the

application for attorneys’ fees (including expenses) and a service award to Plaintiff in the Action or any other proceeding, and

will otherwise be bound by the Order and Final Judgment to be entered and the releases to be given.

CAN I SEE THE COURT FILE?

WHOM SHOULD I CONTACT IF I HAVE QUESTIONS? |

35.

This Notice does not purport to be a comprehensive description of the Action, the allegations related thereto, the terms of the

Settlement, or the Settlement Hearing. For a more detailed statement of the matters involved in the Action, you may inspect the pleadings,

the Stipulation, the Orders entered by the Court, and other papers filed in the Action at the Clerk of the Court, United States District

Court, J. Caleb Boggs Federal Building,844 N. King Street, Wilmington, Delaware 19801-3555, during regular business hours of each business

day. If you have questions regarding the Settlement, you may write or call Plaintiff’s Counsel: Timothy J. MacFall, RIGRODSKY LAW,

P.A., 300 Delaware Avenue, Suite 210, Wilmington, DE 19801, (302) 295-5310.

DO NOT CALL OR WRITE THE

COURT OR THE OFFICE OF THE CLERK OF THE COURT REGARDING THIS NOTICE

NOTICE TO PERSONS OR ENTITIES HOLDING

RECORD OWNERSHIP ON BEHALF OF OTHERS |

36.

Brokerage firms, banks, and other persons or entities who hold shares of the Company’s common stock as record owners, but

not as beneficial owners, are directed to either (a) promptly request from the Company sufficient copies of this Notice to forward to

all such beneficial owners and after receipt of the requested copies promptly forward such Notices to all such beneficial owners; or (b)

promptly provide a list of the names and addresses of all such beneficial owners to the Company, after which the Company will promptly

send copies of the Notice to such beneficial owners. Copies of this Notice may be obtained by calling Intrusion Investor Relations at

831.768.4365.

BY ORDER OF THE COURT:

Dated: December 21, 2023

HONORABLE MARYELLEN NOREIKA

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

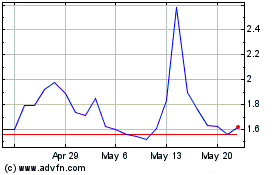

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Dec 2023 to Dec 2024