FALSE000178976900017897692025-03-042025-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2025

Instil Bio, Inc.

(Exact name of registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 001-40215 | 83-2072195 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| | |

3963 Maple Avenue, Suite 350 Dallas, Texas | | 75219 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(972) 499-3350

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.000001 par value | | TIL | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 4, 2025, Instil Bio, Inc. (the “Company”) issued a press release providing a corporate update and announcing its financial results for the fourth quarter and full year ended December 31, 2024, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

The Company from time to time presents and/or distributes to the investment community presentations related to its business. A copy of its most recent presentation is attached hereto as Exhibit 99.2 to this Current Report on Form 8-K. The Company undertakes no obligation to update, supplement or amend the materials attached hereto as Exhibit 99.2.

The information in Item 2.02 and Item 7.01, including Exhibit 99.1 and Exhibit 99.2 hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | The cover page of this report has been formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Instil Bio, Inc. |

| | | |

Dated: March 4, 2025 | | | | By: | | /s/ Sandeep Laumas, M.D. |

| | | | | | Sandeep Laumas, M.D. |

| | | | | | Chief Financial Officer and Chief Business Officer

(Principal Financial Officer and Principal Accounting Officer) |

Instil Bio Reports Fourth Quarter and Full Year 2024 Financial Results and

Provides Corporate Update

Clinical data for AXN-2510/IMM2510 monotherapy in relapsed/refractory NSCLC in China by ImmuneOnco, as well as additional safety data in other solid tumors, anticipated in 1H 2025

Enrollment of 1L NSCLC patients in trial of AXN-2510/IMM2510 and chemotherapy by ImmuneOnco in China anticipated to begin in Q2 2025 with initial clinical data by ImmuneOnco expected in 2H 2025

Initiation of U.S. clinical study of AXN-2510/IMM2510 in combination with chemotherapy in 1L NSCLC anticipated before the end of 2025, assuming receipt of necessary regulatory approvals

DALLAS, TX, March 4, 2025 (GLOBE NEWSWIRE) Instil Bio, Inc. (“Instil”) (Nasdaq: TIL), a clinical-stage biopharmaceutical company focused on developing a pipeline of novel therapies, today reported its fourth quarter and full year 2024 financial results and provided a corporate update.

Recent Highlights:

•Clinical data for AXN-2510 (formerly SYN-2510) /IMM2510 anticipated in 1H 2025: Instil announced today that ImmuneOnco anticipates providing a clinical data update for AXN-2510/IMM2510 monotherapy in relapsed or refractory (R/R) non-small cell lung cancer (“NSCLC”) in the first half of 2025. Instil anticipates that ImmuneOnco will also release safety data from a total of approximately 100 patients treated with AXN-2510/IMM2510 as monotherapy across multiple solid tumors.

•Initiation by ImmuneOnco of Phase 1b/2 trial of AXN-2510/IMM2510 in combination with chemotherapy in NSCLC in China: ImmuneOnco announced enrollment of the first patient in the safety run-in of a Phase 1b/2 trial of AXN-2510/IMM2510 in combination with chemotherapy in NSCLC in China in January 2025. ImmuneOnco anticipates enrollment of first-line NSCLC patients in this study to initiate in Q2 2025, with initial clinical data anticipated in 2H 2025.

•U.S. clinical study of AXN-2510/IMM2510 in combination with chemotherapy in 1L NSCLC anticipated to commence before the end of 2025: Instil anticipates initiating a U.S. clinical trial of AXN-2510/IMM2510 in combination with chemotherapy for 1L NSCLC patients before the end of 2025, assuming the necessary regulatory approvals are obtained.

Fourth Quarter and Full Year 2024 Financial and Operating Results:

As of December 31, 2024, Instil had $115.1 million in total cash, cash equivalents, restricted cash and marketable securities, which consisted of $8.8 million in cash and cash equivalents, $1.8 million in restricted cash and $104.5 million in marketable securities, compared to $175.0 million in total cash, cash equivalents, restricted cash and marketable securities, which consisted of $9.2 million in cash and cash equivalents, $1.5 million in restricted cash, $141.2 million in marketable securities and $23.2 million in long-term investments, as of December 31, 2023. Instil expects that its cash, cash

equivalents, restricted cash and marketable securities as of December 31, 2024 will enable it to fund its current operating plan beyond 2026.

In-process research and development expenses were nil and $10.0 million for the fourth quarter and full year ended December 31, 2024, respectively, compared to nil for the fourth quarter and full year ended December 31, 2023.

Research and development expenses were $1.1 million and $11.8 million for the fourth quarter and full year ended December 31, 2024, respectively, compared to $2.0 million and $39.6 million for the fourth quarter and full year ended December 31, 2023, respectively.

General and administrative expenses were $10.4 million and $44.2 million for the fourth quarter and full year ended December 31, 2024, respectively, compared to $10.9 million and $47.6 million for the fourth quarter and full year ended December 31, 2023, respectively.

Restructuring and impairment charges were $0.3 million and $7.5 million for the fourth quarter and full year ended December 31, 2024, respectively, compared to $0.2 million and $72.0 million for the fourth quarter and full year ended December 31, 2023, respectively.

Net loss per share, basic and diluted was $1.82 and $11.39 for the fourth quarter and full year ended December 31, 2024, respectively, compared to $1.99 and $24.00 for the fourth quarter and full year ended December 31, 2023, respectively. Non-GAAP net loss per share, basic and diluted was $1.08 and $7.59 for the fourth quarter and full year ended December 31, 2024, respectively, compared to $1.26 and $10.14 for the fourth quarter and full year ended December 31, 2023, respectively.

Note Regarding Use of Non-GAAP Financial Measures

In this press release, Instil has presented certain financial information that has not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures include non-GAAP net loss and non-GAAP net loss per share, which are defined as net loss and net loss per share, respectively, excluding non-cash stock-based compensation expense and restructuring and impairment charges. Instil believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of Instil’s financial performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of Instil’s operating results. In addition, these non-GAAP financial measures are among the indicators Instil’s management uses for planning purposes and to measure Instil’s performance. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by Instil may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies. Please refer to the below reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures.

About Instil Bio

Instil Bio is a clinical-stage biopharmaceutical company focused on developing a pipeline of novel therapies. Instil Bio’s subsidiaries include Axion Bio, Inc. (formerly SynBioTx, Inc.) whose lead asset AXN-2510/IMM2510 (formerly SYN-2510/IMM2510) is a novel and differentiated PD-L1xVEGF bispecific antibody in development for the treatment of multiple solid tumor cancers. For more information, visit www.instilbio.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “expects,” “exploring,” “future,” “intends,” “may,” “plans,” “potential,” “projects,” “targets” and “will” or similar expressions are intended to identify forward-looking statements. Forward-looking statements include express or implied statements regarding our expectations with respect to the license and collaboration agreement with ImmuneOnco; the therapeutic potential of AXN-2510/IMM2510; clinical development of AXN-2510/IMM2510, including the initiation of clinical trials for AXN-2510/IMM2510 and the generation of clinical data for AXN-2510/IMM2510 and the timing thereof; our research, development, regulatory and clinical plans for AXN-2510/IMM2510; our expectations regarding our capital position, resources, and balance sheet, including our cash runway; and other statements that are not historical fact. Forward-looking statements are based on management's current expectations and are subject to various risks and uncertainties that could cause actual results to differ materially and adversely from those expressed or implied by such forward-looking statements, including risks and uncertainties associated with the costly and time-consuming drug product development process and the uncertainty of clinical success; the risks inherent in relying on collaborators and other third parties, including for manufacturing and generating clinical data, and the ability to rely on any such data from clinical trials in China in regulatory filings submitted to regulatory authorities outside of China; the risks and uncertainties related to successfully making regulatory submissions and initiating, enrolling, completing and reporting data from clinical studies, particularly collaborator-led clinical trials, as well as the risks that results obtained in any clinical trials to date may not be indicative of results obtained in ongoing or future trials and that our product candidates may otherwise not be effective treatments in their planned indications; risks related to macroeconomic conditions, including as a result of international conflicts and U.S.-China trade and political tensions, as well as interest rates, inflation, and other factors, which could materially and adversely affect our business and operations and those of our collaborators; the risks and uncertainties associated with the time-consuming and uncertain regulatory approval process and the sufficiency of our cash resources; and other risks and uncertainties affecting us and our plans and development programs, including those discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 to be filed with the SEC, as well as our other filings with the SEC. These forward-looking statements do not constitute guarantees of future performance, and you are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements speak only as the date hereof, and we disclaim any obligation to update these statements except as may be required by law.

Contacts:

| | |

Investor Relations: 1-972-499-3350 investorrelations@instilbio.com www.instilbio.com |

INSTIL BIO, INC.

SELECTED FINANCIAL DATA

(Unaudited; in thousands, except share and per share amounts)

Selected Consolidated Balance Sheet Data

| | | | | | | | | | | |

| | December 31, 2024 | | December 31, 2023 |

| Cash, cash equivalents, restricted cash, marketable securities and long-term investments | $ | 115,145 | | | $ | 175,018 | |

| Total assets | $ | 263,567 | | | $ | 325,630 | |

| Total liabilities | $ | 94,131 | | | $ | 99,801 | |

| Total stockholders’ equity | $ | 169,436 | | | $ | 225,829 | |

Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Operating expenses: | | | | | | | |

| In-process research and development | $ | — | | | $ | — | | | $ | 10,000 | | | $ | — | |

| Research and development | 1,099 | | | 1,983 | | | 11,838 | | | 39,604 | |

| General and administrative | 10,373 | | | 10,872 | | | 44,210 | | | 47,553 | |

| Restructuring and impairment charges | 348 | | | 165 | | | 7,493 | | | 72,012 | |

| Total operating expenses | 11,820 | | | 13,020 | | | 73,541 | | | 159,169 | |

| Loss from operations | (11,820) | | | (13,020) | | | (73,541) | | | (159,169) | |

| Interest income | 1,352 | | | 2,195 | | | 6,987 | | | 8,866 | |

| Interest expense | (3,005) | | | (1,980) | | | (8,992) | | | (5,209) | |

| Other rental income | 2,774 | | | — | | | 4,267 | | | — | |

| Other expense, net | (1,196) | | | (120) | | | (2,856) | | | (575) | |

| Net loss | $ | (11,895) | | | $ | (12,925) | | | $ | (74,135) | | | $ | (156,087) | |

| Net loss per share, basic and diluted | $ | (1.82) | | | $ | (1.99) | | | $ | (11.39) | | | $ | (24.00) | |

| Weighted-average shares used in computing net loss per share, basic and diluted | 6,525,885 | | | 6,503,913 | | | 6,510,138 | | | 6,503,913 | |

Reconciliation of GAAP to Non-GAAP Net Loss and Net Loss per Share

(Unaudited; in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (11,895) | | | $ | (12,925) | | | $ | (74,135) | | | $ | (156,087) | |

| Adjustments: | | | | | | | |

| Non-cash stock-based compensation expense | 4,501 | | | 4,553 | | | 17,257 | | | 18,166 | |

| Restructuring and impairment charges | 348 | | | 165 | | | 7,493 | | | 72,012 | |

| Non-GAAP net loss | $ | (7,046) | | | $ | (8,207) | | | $ | (49,385) | | | $ | (65,909) | |

| Net loss per share, basic and diluted | $ | (1.82) | | | $ | (1.99) | | | $ | (11.39) | | | $ | (24.00) | |

| Adjustments: | | | | | | | |

| Non-cash stock-based compensation expense per share | 0.69 | | | 0.70 | | | 2.65 | | | 2.79 | |

| Restructuring and impairment charges | 0.05 | | | 0.03 | | | 1.15 | | | 11.07 | |

| Non-GAAP net loss per share, basic and diluted* | $ | (1.08) | | | $ | (1.26) | | | $ | (7.59) | | | $ | (10.14) | |

| Weighted-average shares outstanding, basic and diluted | 6,525,885 | | | 6,503,913 | | | 6,510,138 | | | 6,503,913 | |

______________________________________________________________

* Non-GAAP net loss per share, basic and diluted may not total due to rounding.

###

March 4, 2025 Nasdaq: TIL │ www.instilbio.com AXN-2510 3rd -Most Advanced PD-L1xVEGF Bispecific Antibody in Clinical Development *Axion Bio, Inc. (fka SynBioTx, Inc.) is a wholly owned subsidiary of Instil Bio, Inc.

Forward Looking Statements 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “expects,” "expected,” “future,” “intends,” “may,” “plans,” “potential,” “projects,” and “will” or similar expressions are intended to identify forward-looking statements. Forward-looking statements include express or implied statements regarding our expectations with respect to the license and collaboration agreement with ImmuneOnco, the therapeutic potential of AXN-2510/IMM2510 and AXN-27M/IMM27M, our global development strategy for AXN-2510 and AXN-27M, clinical development of AXN-2510 and AXN-27M, including the timing, scope and designs of clinical trials and the generation and release of clinical data therefrom, regulatory submissions, including IND submissions and clearances, interactions and approvals and the timing thereof, and the potential of AXN-2510 to be best-in-class; the market opportunity in the indications we seek to treat; and other statements that are not historical fact. Forward-looking statements are based on management's current expectations and are subject to various risks and uncertainties that could cause actual results to differ materially and adversely from those expressed or implied by such forward-looking statements, including risks and uncertainties associated with in-licensing or acquiring additional product candidates and clinical trial collaborations; the costly and time-consuming drug product development process and the uncertainty of clinical success; the risks inherent in relying on collaborators and other third parties, including for manufacturing and generating clinical data, and the ability to rely on any such data from clinical trials in China in regulatory filings submitted to regulatory authorities outside of China; the risks and uncertainties related to successfully initiating, enrolling, completing and reporting data from clinical studies, particularly collaborator-led clinical trials, as well as the risks that results obtained in any preclinical studies or clinical trials to date may not be indicative of results obtained in ongoing or future trials and that our product candidates may otherwise not be effective treatments in their planned indications; risks related to macroeconomic conditions, including as a result of international conflicts and U.S.-China trade and political tensions, as well as interest rates, inflation, and other factors, which could materially and adversely affect our business and operations; the risks and uncertainties associated with the time-consuming and uncertain regulatory approval process for product candidates across multiple indications and multiple regulatory authorities; the impact of product candidates that may compete with those that we develop; and the sufficiency of our cash resources; and other risks and uncertainties affecting us and our plans and development programs, including those discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 to be filed with the SEC, as well as our other filings with the SEC. Additional information will be made available in other filings that we make from time to time with the SEC. Accordingly, these forward-looking statements do not constitute guarantees of future performance, and you are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements speak only as the date hereof, and we disclaim any obligation to update these statements except as may be required by law.

AXN-2510/IMM2510*: Clinical-stage PD-L1xVEGF Bispecific Antibody 3 • Composition of matter coverage into 2040 in US • PD-L1 inhibitor • VEGF blockade • PD-(L)1xVEGF bispecific Differentiated design • PD-L1 targeting • VEGF “trap” • ADCC-enhanced Collaboration with ImmuneOnco** Validated oncology mechanisms Intellectual property • Opportunity to accelerate clinical development ➢ 3rd-most advanced clinical-stage PD-(L)1xVEGF bispecific antibody ➢ 1L NSCLC data anticipated in 2025 *AXN-2510 rights are owned by Axion Bio, Inc. (f.k.a. SynBioTx, Inc.), a wholly-owned subsidiary of Instil Bio, Inc. **ImmuneOnco Biopharmaceuticals (Shanghai) Inc. (“ImmuneOnco”) is a publicly traded company in Hong Kong (HKEX: 1541) NSCLC: non-small cell lung cancer

AXN-2510/IMM2510 development strategy in NSCLC 4 2025 20262H 2024 Ph1b Monotherapy (2L+) NSCLC Ph1b/2 Chemotherapy Combo* Ph1b/2 1L Chemotherapy Combo. *Subject to regulatory discussions China (ImmuneOnco) US (Axion Bio (Instil Bio)) • 3rd-most advanced PD-(L)1xVEGF bispecific antibody in clinical development • NSCLC: largest market opportunity in oncology • Proof of concept with responses in heavily pre-treated NSCLC patients in dose escalation of AXN- 2510/IMM2510 • Competitor datasets validate activity of PD-(L)1xVEGF bispecific antibodies in NSCLC • US Phase 1b/2 trial of AXN-2510 in combination with chemotherapy in 1L NSCLC anticipated to start before the end of 2025, subject to regulatory approval • Opportunity to be best-in-class with differentiated molecular structure: VEGF trap and ADCC-enhancement

Anticipated Catalysts for PD-(L)1xVEGF Antibodies 5 1Summit Therapeutics, Inc. presentation 2Citi (C Chen) & Jefferies (K Shi) equity research reports AXN-2510 / IMM2510 Other PD-(L)1xVEGF bispecific Abs 1H 2025 2H 2025 • Enrollment of 1L NSCLC patients in Phase 1b/2 trial of IMM2510/AXN- 2510 + chemotherapy (China) • Clinical data from Phase 1b trial of IMM2510/AXN-2510 monotherapy in NSCLC (China) • Initial clinical data from Phase 1b trial of AXN-2510 + chemotherapy in 1L NSCLC (China) • Initiation of Phase 1b/2 trial of AXN- 2510 + chemotherapy in 1L NSCLC, subject to regulatory approval (US) • Mid-2025: Ivonescimab Harmoni (2L+ EGFRm NSCLC) OS data1 • Additional clinical readouts from BioNTech’s BNT327 & Summit’s ivonescimab anticipated • Ivonescimab Harmoni-2 (1L NSCLC) OS data2 • Additional clinical readouts from BioNTech’s BNT327 & Summit’s ivonescimab anticipated

AXN-2510: Differentiated PD-L1xVEGF Bispecific Antibody 6 VEGF receptor binds multiple VEGFR ligands beyond VEGF-A for broader VEGF blockade ADCC-enhanced antibody designed to induce direct killing of immune- suppressive PD-L1+ tumor cells PD-L1 binding designed for targeting of TME AXN-2510

AXN-2510/IMM2510 in multiple solid tumors clinical trials* 7 Phase 1b/2 RightsIndication *All trials shown above are being conducted by ImmuneOnco in China TNBC: triple-negative breast cancer; HCC: hepatocellular carcinoma; RCC: renal cell carcinoma AXN-2510/IMM2510 – PD-L1xVEGF bispecific antibody Phase 3Preclinical Solid tumorsMonotherapy AXN-27M/IMM27M – Next-generation CTLA-4 antibody Axion Bio (Instil Bio) (Global ex-Gr. China) Solid tumors+ AXN-2510 + Chemo TNBC NSCLC 1L data: 2H 2025 Monotherapy TNBC RCC Other solid tumors HCC NSCLC 2L+ data: 1H 2025

Recent PD-(L)1xVEGF Bispecific Antibody Developments 2024 2025 August September October November December January February • Instil Bio announces licensing of IMM2510/AXN- 2510 anti-PD- L1/VEGF bispecific antibody.1 • Instil Bio announces global registrational strategy of AXN- 2510 in NSCLC.2 • World Lung Conf.: Summit Therapeutics presents superiority of PD- 1xVEGF bispecific over pembrolizumab (Harmoni-2 trial).3 • Crescent BioPharma announces reverse-merger with GlycoMimetics (Nasdaq:GLYC) and concurrent ~$200M financing to advance development of PD-1xVEGF bispecific.4 • Merck announces $588M upfront for licensing from LaNova Medicines of PD-1/VEGF bispecific antibody.5 • ImmuneOnco announces clinical data update for IMM2510/AXN- 2510 monotherapy anticipated in 1H 2025.6 • Ottimo Pharma raises over $140M Series A financing to advance PD- 1xVEGFR2 bispecific antibody.7 • Instil Bio and ImmuneOnco announce first NSCLC patient dosed with IMM2510/AXN- 2510 in combination with chemotherapy in a phase 1b/2 trial in China.8 • Summit Therapeutics Announces Clinical Trial Collaboration with Pfizer to Evaluate Ivonescimab in Combination with Pfizer Antibody Drug Conjugates (ADCs).9 8 References: [1] Instil Bio and ImmuneOnco Announce License and Collaboration Agreement for Development of IMM2510, a Potentially Best-in-Class PD-L1xVEGF Bispecific Antibody, and IMM27M, a Novel Next-Generation Anti-CTLA-4 Antibody [2] Instil Bio and ImmuneOnco Announce Global Registrational Strategy for PD-L1xVEGF Bispecific Antibody, SYN-2510/IMM2510, in Non-Small Cell Lung Cancer and Triple-Negative Breast Cancer [3] Ivonescimab Monotherapy Reduced the Risk of Disease Progression or Death by 49% Compared to Pembrolizumab Monotherapy in First-Line Treatment of Patients with PD-L1 Positive Advanced NSCLC in China [4] GlycoMimetics Enters Into Acquisition Agreement With Crescent Biopharma [5] Merck Enters into Exclusive Global License for LM-299, An Investigational Anti-PD-1/VEGF Bispecific Antibody from LaNova Medicines Ltd. [6] Instil Bio Reports Third Quarter 2024 Financial Results and Provides Corporate Update [7] Ottimo Pharma Raises over $140 Million in Series A Financing [8] Instil Bio Announces Clinical Progress in China for IMM2510/SYN-2510, a Clinical-Stage PD-L1xVEGF Bispecific Antibody [9] Summit Therapeutics Announces Clinical Trial Collaboration with Pfizer to Evaluate Ivonescimab in Combination with Pfizer Antibody Drug Conjugates (ADCs)

9 Clinical-stage PD-(L)1xVEGF Bispecific Antibodies Anti-PD-L1 VHH Silenced Fc (LALA) Anti-VEGF-A Anti-VEGF-A Anti-PD-1 Anti-PD-L1 VEGF “Trap” ADCC- enhanced AXN-2510 (ImmuneOnco / Axion Bio) BNT327 (Biotheus / BioNTech) Ivonescimab (Akeso / Summit) VEGF receptor ligand binding VEGF-A, VEGF-B, PlGF VEGF-A VEGF-A PD-1 or PD-L1 PD-L1 PD-L1 PD-1 ADCC activity Enhanced ADCC Silenced Silenced

v3.25.0.1

Cover

|

Mar. 04, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 04, 2025

|

| Entity Registrant Name |

Instil Bio, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40215

|

| Entity Tax Identification Number |

83-2072195

|

| Entity Address, Address Line One |

3963 Maple Avenue, Suite 350

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75219

|

| City Area Code |

972

|

| Local Phone Number |

499-3350

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.000001 par value

|

| Trading Symbol |

TIL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001789769

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

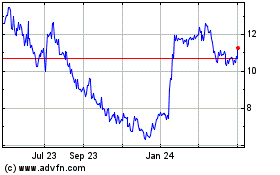

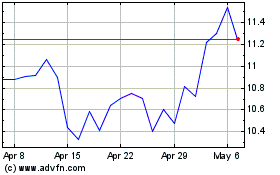

Instill Bio (NASDAQ:TIL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Instill Bio (NASDAQ:TIL)

Historical Stock Chart

From Mar 2024 to Mar 2025