Current Report Filing (8-k)

June 21 2023 - 5:26PM

Edgar (US Regulatory)

0001529113

false

0001529113

2023-06-16

2023-06-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 16, 2023

INPIXON

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-36404 |

|

88-0434915 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

2479 E. Bayshore Road, Suite 195

Palo Alto, CA |

|

94303 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (408) 702-2167

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock |

|

INPX |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

On June 20, 2023, Inpixon

(the “Company”) entered into an amendment agreement (the “Amendment”) with the holders (each, including its successors

and assigns, a “Holder” and collectively, the “Holders”) of the Common Stock Purchase Warrants issued by the Company

on May 17, 2023 (as amended from time to time in accordance with their terms, the “Warrants”) pursuant to the terms and conditions

of that certain Warrant Purchase Agreement, dated May 15, 2023, by and among the Company and the Holders (as amended from time to time

in accordance with its terms, the “Purchase Agreement”).

Pursuant to the Amendment, the

parties amended the Purchase Agreement and the Warrants in order to, among other things, (i) grant the Holders the right to participate

in certain subsequent equity financings by the Company, from the effective date of the Amendment until the earlier of (a) the 12-month

anniversary of the closing date of the sale of the Warrants (the “Closing Date”) or (b) the date on which the Holder’s

Warrant has been redeemed in full or such Holder otherwise no longer beneficially owns any Warrants, on a pro-rata basis (with respect

to other participating Holders and the Subscription Amount (as defined in the Purchase Agreement) of Warrants purchased by them on the

Closing Date) in up to an aggregate amount equal to 20% of such financing; (ii) extend the period the Company has to file a registration

statement covering the resale by the Holders of the shares (the “Shares”) of the Company’s common stock, par value $0.001

per share (the “Common Stock”), issuable upon the exercise of the Warrants, or issuable upon exercise of rights for shares

of Common Stock (the “Rights”) that are issuable to the Holders upon exercise of such Rights in lieu of Common Stock in accordance

with the terms of the Warrants, from 30 calendar days to 45 days of the date of the Purchase Agreement, and providing that the Company

is required to use commercially reasonable efforts to file such registration statement within this period; (iii) provide that in the event

that the staff of the U.S. Securities and Exchange Commission (the “Staff”) determines that the full amount of the Shares

cannot be registered on the registration statement due to limitations under Rule 415 of the Securities Act of 1933, as amended (the “Securities

Act”), then the Company will be required to (a) register the resale of that portion of the Shares as the Staff may permit under

its interpretations of Rule 415, and (b) undertake to register the remaining portion of the Shares as soon as registration would be permitted

under Rule 415, as determined by the Company in good faith based on the Staff’s publicly available interpretations of Rule 415;

(iv) subject the Adjusted Exercise Price to a floor price of $0.10; (v) limit the circumstances under which adjustments are made to the

exercise price of the Warrants and the number of shares issuable upon exercise of the Warrants pursuant to Section 3(a) of the Warrants,

and (vi) remove provisions granting rights to the Holders in connection with certain subsequent rights offerings and pro rata distributions.

The foregoing is only a brief

description of the material terms of the Amendment, does not purport to be a complete description of the rights and obligations of the

parties thereunder and is qualified in its entirety by reference to the form of Amendment that is filed as Exhibit 10.1 to this Current

Report on Form 8-K and incorporated by reference herein.

Item 3.02 Unregistered Sales of Equity Securities.

The Company issued an aggregate

of 1,995,573 shares of Common Stock (the “Exchange Common Shares”) to the holder of that certain outstanding promissory note

of the Company issued on July 22, 2022 (the “July 2022 Note”), at a price between $0.195 and $0.2062 per share, in each case

at a price per share equal to the Minimum Price as defined in Nasdaq Listing Rule 5635(d) in connection with the terms and conditions

of certain Exchange Agreements, dated June 2, 2023 and June 16, 2023 pursuant to which the Company and the holder agreed to (i) partition

new promissory notes in the form of the July 2022 Note in the aggregate original principal amount equal to approximately $400,000 and

then cause the outstanding balance of the July 2022 Note to be reduced by an aggregate of approximately $400,000; and (ii) exchange the

partitioned notes for the delivery of the Exchange Common Shares.

The offer and sale of the Exchange

Common Shares was not registered under the Securities Act in reliance on an exemption from registration under Section 3(a)(9) of the Securities

Act, in that (a) the Exchange Common Shares were issued in exchanges for partitioned notes which are other outstanding securities of the

Company; (b) there was no additional consideration of value delivered by the holder in connection with the exchanges; and (c) there were

no commissions or other remuneration paid by the Company in connection with the exchanges.

As of June 21, 2023, after taking

into account the issuance of the Exchange Common Shares, the Company has 40,296,799 shares of Common Stock outstanding.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

INPIXON |

| |

|

| Date: June 21, 2023 |

By: |

/s/ Nadir Ali |

| |

Name: |

Nadir Ali |

| |

Title: |

Chief Executive Officer |

2

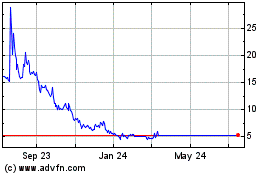

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

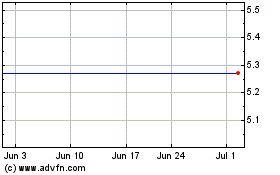

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Dec 2023 to Dec 2024