false0001294133Inogen Inc00012941332023-09-012023-09-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 01, 2023 |

INOGEN, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36309 |

33-0989359 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

301 Coromar Drive |

|

Goleta, California |

|

93117 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (805) 562-0500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

INGN |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Separation of Chief Financial Officer

On September 1, 2023, Kristin Caltrider, Executive Vice President, Finance, Chief Financial Officer and Treasurer, notified Inogen, Inc. (the “Company”) of her intention to step down as an officer of the Company effective upon the date a new Executive Vice President, Chief Financial Officer and Treasurer commences employment, which will occur on September 11, 2023. Ms. Caltrider’s decision was not related to any disagreements with the Company or its management on any matters relating to the Company’s operations, policies, or practices. Ms. Caltrider has agreed to remain in a non-executive employee role to assist with the transition of her duties through September 29, 2023.

Appointment of Interim Chief Financial Officer

Effective as of September 11, 2023, the Company’s board of directors (the “Board”) appointed Michael K. Sergesketter to serve as the Company’s interim Executive Vice President, Chief Financial Officer and Treasurer.

Mr. Michael K. Sergesketter, previously served as the Company’s interim Executive Vice President, Chief Financial Officer and Treasurer from December 2021 until May 2022. Mr.Sergesketter served as the Vice President and Chief Financial Officer at Kimball Electronics, Inc., an electronics manufacturing company, from October 2014 to July 2021. Prior to the spin-off of Kimball Electronics, Mr. Sergesketter served as the Vice President and Chief Financial Officer for Kimball Electronics Group, Inc., an electronics manufacturing company, from July 1996 to October 2014. Prior to Kimball Electronics Group, Mr. Sergesketter served as Vice President of Audit and Management Services at Kimball International, Inc., a commercial furnishings company, from January 1991 to June 1996. Prior to that, Mr. Sergesketter held various internal audit roles at Kimball International, Inc. from June 1981 to January 1991. Mr. Sergesketter holds a B.S. in accounting from University of Southern Indiana.

Interim Chief Financial Officer Compensation Arrangements

On September 5, 2023, the Board, upon the recommendation of the Company’s Compensation Committee, approved Mr. Sergesketter’s offer letter. The offer letter has an initial term of six months and automatically extends on a month-to-month basis thereafter and provides that Mr. Sergesketter is an at-will employee. The offer letter provides that Mr. Sergesketter’s base compensation shall be $40,000 per month in cash, that he shall be eligible to receive employment benefits pursuant to the Company’s benefit plans as in effect, and that upon satisfactorily completing the employment term and returning all company property, Mr. Sergesketter will be eligible to receive a $10,000 gross completion bonus in cash.

The summary of Mr. Sergesketter’s offer letter set forth above does not purport to be complete and is qualified in its entirety by reference to the full text of the offer letter, which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference herein.

In addition, the Company has entered into its standard form of indemnification agreement with Mr. Sergesketter. The form indemnification agreement was filed with the Securities and Exchange Commission on November 27, 2013 as Exhibit 10.1 to the Company’s Registration Statement on Form S-1 and is incorporated herein by reference. Mr. Sergesketter has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor are any such transactions currently proposed. There is no arrangement or understanding between Mr. Sergesketter or any other person pursuant to which Mr. Sergesketter was selected as an officer of the Company. There are no family relationships between Mr. Sergesketter and any of the Company’s directors or executive officers.

Item 7.01. Regulation FD Disclosure.

On September 7, 2023, the Company issued a press release announcing the resignation and appointment described in this Current Report on Form 8-K. A copy of the press release is furnished herewith as Exhibit 99.1.

The information set forth under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

INOGEN, INC. |

|

|

|

|

Date: |

September 7, 2023 |

By: |

/s/ Nabil Shabshab |

|

|

|

Nabil Shabshab

Chief Executive Officer and President

(Principal Executive Officer) |

Exhibit 10.1

September 6, 2023

Michael K. Sergesketter

9501 S 720 W

Holland, IN 47541

VIA E-MAIL to mserges@psci.net

Dear Michael,

Inogen, Inc. (the "Company" or "lnogen") is pleased to make the following offer of employment to you for the position of interim Executive Vice President, Chief Financial Officer, reporting to the Company's President and Chief Executive Officer ("CEO"). You will render such business and professional services in the performance of your duties, consistent with your position within the Company, as will reasonably be assigned to you by the President & CEO and lnogen's Board of Directors. This position is based out of your home office located in Holland, Indiana, although you will be required to travel from time-to-time in connection with your role and responsibilities.

Your first day of employment with the Company is anticipated to be Monday, September 11, 2023.

Employment Term: Subject to the terms of this letter, your employment with Inogen will have an initial term of six months (the "Initial Term" and together with any extension of the employment term, the "Employment Term"), and the Employment Term will be automatically extend by additional month at the end of the Initial Term and at the end of month thereafter (each, an "Extension Date"), unless the Company or you provide the other party written notice at least 30 calendar days before the Extension Date that the Employment Term will not be extended.

In the event that a permanent CFO is hired during this initial term of employment or subsequent extensions, your title will transition immediately to CFO Advisor with the same terms and conditions noted below with the presumption that you will continue in a full-time capacity. If extensions occur on a partial or part-time basis, then a prorated portion of the compensation can be agreed to in writing by both parties at that time with no less than a 30-day notice period.

Compensation: The base compensation being offered for this position is $40,000 per month in cash, less applicable tax withholding, and payable at a biweekly rate of $18,461.54 in accordance with the Company's standard pay practices. You will not be eligible or entitled to receive any bonuses or equity compensation during the Employment Term.

Completion Bonus: Within 30 days of satisfactorily completing your Employment Term and returning all company property, you will be eligible to receive a $10,000 gross completion bonus subject to standard withholdings.

Benefits: As a full-time employee, you will be eligible to receive employee benefits made available by Inogen to its employees to the full extent of your eligibility, subject to the terms and conditions of the benefit plans. You will become eligible for coverage on the first of the month following your first day of employment. The Company reserves the right to modify its benefits at any time.

859 Ward Dr, Suite 200

Goleta, CA 93117

Expenses: Subject to the terms of the Company's expense reimbursement policy, the Company will pay or reimburse all reasonable business expenses incurred in the performance of your duties, which are substantiated in accordance with the policy.

At-Will Employment: You should be aware that your employment with Inogen is for no specified period and constitutes at-will employment. As a result, you are free to resign at any time, for any reason or for no reason. Similarly, Inogen is free to conclude its employment relationship with you at any time, with or without cause.

Conflict of Interest: You agree that, during the term of your employment with Inogen, you will not engage in any other employment, occupation, consulting or other business activity directly related to the business in which Inogen is now involved or becomes involved during the term of your employment, nor will you engage in any other activities that conflict with your obligations to Inogen.

Employment, Confidential Information, and Invention Assignment Agreement: As a condition of your employment with Inogen, you must sign and comply with an Employment, Confidential Information, and Invention Assignment Agreement, which requires, among other provisions, the assignment of patent rights to any invention made during your employment at Inogen and non-disclosure of proprietary information. See Exhibit 1, A-C.

Arbitration Agreement; Governing Law: In the event of any dispute or controversy arising out of, relating to, or in connection with your employment, it is the Company's policy that all such disputes shall be settled by arbitration held in Dubois County, Indiana. As a condition of your employment with Inogen, you must sign an Arbitration Agreement prior to beginning employment with the Company. This Agreement will be governed by the laws of the State of lndiana.

General: This offer is made contingent upon a satisfactory background investigation and your ability to provide proof of identification and authorization to work in the United States, in accordance with the Immigration and Control Act of 1986. This letter, along with the other aforementioned employment related agreement, set forth the terms of your employment with Inogen and supersedes any prior representations or agreements, whether written or oral. This letter may not be modified or amended except by written agreement, signed by you and the Company's President & CEO.

If any provision hereof becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable, or void, the remainder of this letter agreement will continue in full force and effect without said provision.

This offer expires on Wednesday, September 6, 2023. To indicate your acceptance of this offer, please sign and date this letter in the space provided below, and scan back to me no later than that

date. It is a pleasure extending this offer to you, and we look forward to you joining the team.

859 Ward Dr, Suite 200

Goleta, CA 93117

Sincerely,

Nabil Shabshab President & CEO

Accepted:

___________________

Michael K. Sergesketter

859 Ward Dr, Suite 200

Goleta, CA 93117

Exhibit 99.1

FOR IMMEDIATE RELEASE

INOGEN ANNOUNCES CFO TRANSITION PLAN

– Names Mike Sergesketter as Interim Chief Financial Officer–

–Reaffirms 2023 Financial Guidance–

Goleta, CA – September 7, 2023 – Inogen, Inc. (NASDAQ: INGN), a medical technology company offering innovative respiratory products for use in the homecare setting, today announced the appointment of Mike Sergesketter as Interim Chief Financial Officer, effective immediately. Mr. Sergesketter last served as Interim Chief Financial Officer of the company between December 2021 and March 2022, and previously served as CFO of Kimball Electronics, Inc. where he was instrumental in helping to develop and execute the company’s globalization strategy while also building a robust finance function to support the company’s growth. He succeeds Kristin Caltrider who has stepped down for personal reasons. Ms. Caltrider’s decision was not related to any disagreements with the Company or its management on any matters relating to the Company’s operations, policies, or practices. The Company has retained a leading executive search firm to help with the search for a permanent replacement.

Nabil Shabshab, President and Chief Executive Officer of Inogen, said, “I would like to thank Kristin for her contributions to Inogen and share my optimism for the future of the company as we continue our strategic evolution to become a more prominent player in respiratory care. Mike has brought value to Inogen as an accomplished CFO and partner to me, and I am pleased to welcome him back to the company. His decades of experience across finance, M&A, and strategic manufacturing, as well as his track record of being a partner and advisor cross-functionally are strong assets as we continue to execute against our 2023 plans and prepare for 2024.”

Mr. Sergesketter brings over forty years of finance experience in the manufacturing services industry. He brings expertise working across business functions, including with the CEO and Board of Directors, Audit Committee and Compensation and Governance Committee. As part of his role as the CFO of Kimball Electronics, Inc. following its spin-off in 2014 and through June 2021, Mr. Sergesketter led the transformation of the finance and reporting functions to support the newly formed public company, helping to formulate and execute on the strategy that led to global expansion. During his tenure at Kimball Electronics and its predecessors, Mr. Sergesketter had the responsibility for a number of critical finance functions, including SEC reporting, Treasury, Investor Relations, Tax, Financial Planning & Analysis, Internal Audit while playing a leading role in various M&A transactions in the US and abroad.

1

Financial Guidance

Inogen is reaffirming expectations for 2023 annual revenue of $315 million to $320 million and Adjusted EBITDA loss of $20 million to $25 million for the full year.

About Inogen

Inogen, Inc. (Nasdaq: INGN) is a leading global medical technology company offering innovative respiratory products for use in the homecare setting. Inogen supports patient respiratory care by developing, manufacturing, and marketing innovative best-in-class portable oxygen concentrators used to deliver supplemental long-term oxygen therapy to patients suffering from chronic respiratory conditions. Inogen partners with patients, prescribers, home medical equipment providers, and distributors to make its oxygen therapy products widely available allowing patients the chance to remain ambulatory while managing the impact of their disease.

For more information, please visit www.inogen.com.

Inogen has used, and intends to continue to use, its Investor Relations website, http://investor.inogen.com/, as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. For more information, visit http://investor.inogen.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, among others, Inogen’s expectations for our 2023 revenue and Adjusted EBITDA expectations. Any statements contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements. Words such as “believes,” “anticipates,” “plans,” “expects,” “will,” “intends,” “potential,” “possible,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks arising from the possibility that Inogen will not realize anticipated revenue or expenses will not decrease; risks related to cost inflation; the risks our innovation pipeline will not produce meaningful results; risks related to our pending acquisition of Physio Assist including on expenses; the impact of changes in reimbursement rates and reimbursement and regulatory policies; and the possible loss of key employees, customers, or suppliers; the risk that expenses and costs will exceed Inogen’s expectations. Information on these and additional risks, uncertainties, and other information affecting Inogen’s business operating results are contained in its Annual Report on Form 10-K for the year ended December 31, 2022, its Quarterly Report on Form 10-Q for the calendar quarter ended June 30, 2023, and in its other filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof. Inogen disclaims any obligation to update these forward-looking statements except as may be required by law.

2

Non-GAAP Financial Measures

Management believes that non-GAAP financial measures, taken in conjunction with U.S. GAAP financial measures, provide useful information for both management and investors by excluding certain non-cash and other expenses that are not indicative of Inogen’s core operating results. Management uses non-GAAP measures to compare Inogen’s performance relative to forecasts and strategic plans, to benchmark Inogen’s performance externally against competitors, and for certain compensation decisions. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Inogen's operating results as reported under U.S. GAAP. Inogen encourages investors to carefully consider its results under U.S. GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand its business. Reconciliations between U.S. GAAP and non-GAAP results are presented in the accompanying tables of this release. For future periods, Inogen is unable to provide a reconciliation of non-GAAP measures without unreasonable effort as a result of the uncertainty regarding, and the potential variability of, the amounts of interest income, interest expense, depreciation and amortization, stock-based compensation, provision for income taxes, and certain other infrequently occurring items, such as acquisition-related costs, that may be incurred in the future.

Investor Contact

ir@inogen.net

3

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

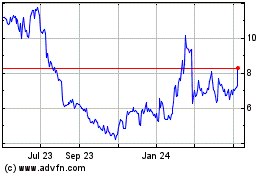

Inogen (NASDAQ:INGN)

Historical Stock Chart

From Oct 2024 to Nov 2024

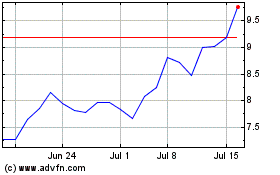

Inogen (NASDAQ:INGN)

Historical Stock Chart

From Nov 2023 to Nov 2024