INmune Bio Inc. Announces First Quarter 2024 Results and Provides Business Update

May 09 2024 - 4:05PM

INmune Bio Inc. (NASDAQ: INMB) (the

“Company”), a clinical-stage immunology company focused on

developing treatments that harness the patient’s innate immune

system to fight disease, today announces its financial results for

the quarter ended March 31, 2024 and provides a business update.

Q1 2024 and

Recent Corporate Highlights

DN-TNF Platform Highlights (XPro™):

- The AD02 randomized, blinded program for patients with Early

Alzheimer's Disease remains on schedule to reach its final

enrollment target by mid-2024, with top-line data expected to be

presented approximately six months after the last patient is

enrolled. The trial is currently active in North America, UK, EU,

and the Pacific Rim. The Company anticipates having its Phase II

FDA meeting in the first half of 2025 before transitioning to the

global Phase III trial in the latter portions of next year.

- The Company successfully completed extended stability

validation for XPro™ at continuous storage in solution at

2C-8C. The 24 and 30-month stability test samples passed all

chemistry and potency assays allowing the Company to make a

conservative claim of 24-month stability and positioning it to meet

the dosing demands envisioned in the Phase III trial.

- On April 30th, the Company issued a press release highlighting

the progress of two patients from the Phase 1b AD trial in

Australia who have continued to receive XPro™ treatment under

an open-label program administered by their treating physician. The

testimonials underscore XPro’s™ unique attributes that may

prevent progression cognitive impairment versus existing treatments

that appears to slow the pace of but do not stop the progression of

cognitive dysfunction.

- INB03 cancer platform – two posters were presented at the

annual American Association of Cancer Research in San Diego on

April 8, 2024. The posters extends ongoing research led by Roxana

Schillaci, Ph.D., of Instituto de Biología y Medicina Experimental

in Buenos Aries, Argentina on the importance of MUC4 expression in

high-risk breast cancer subtypes is a predictor of progression and

resistance to therapy. Tumors that express MUC4 have an unfavorable

immunobiology of the tumor microenvironment (TME) and increased

metastatic potential all driven by soluble TNF. Neutralization of

soluble TNF with INB03 resulted in down-regulation of immune

checkpoint proteins on T cells (PD1, TIGIT, LAG3 and CTLA4) and

macrophages (CD47 and SIRPꭤ) in the TME. The data suggests testing

for MUC4 before treatment will predict resistance to first-line

therapy which may allow better treatment choices that may improve

patient outcomes.

INKmune™ Platform:

- The first cohort in the Phase I/II open label trial of

INKmune™ in metastatic castration-resistant prostate cancer (mCRPC)

successfully completed the first dosing. Following review by the

Safety Review Committee (SRC), approval was granted to proceed with

the second dose level (cohort 2) and two patients have been

enrolled. The first patient of the middle dose cohort is

expected to be treated this month.

- Safety of INKmune remains on track. There have been nine

administrations of INKmune in the mCRPC study given on an

out-patient basis, with no significant adverse events. Combining

the experience with INKmune from the MDS/AML and mCRPC trials, over

20 infusions of INKmune have been given safely without the need for

conditioning therapy, pre-medication, or cytokine

support. Patients receive three infusions of INKmune™ per

dosing over two weeks and are monitored for four months for

immunological and clinical responses. Three dose levels of INKmune™

are being tested in a modified Bayesian Phase I/II trial.

Corporate:

- The Company successfully raised a combined $14.5 million of

equity capital before placement agent fees and expenses in two

separate transactions in late April. Of note, in the first $4.8

million offering, management, employees and members of the Board of

Directors purchased over 20% of the offering. Excluding shares and

warrants acquired by insiders, both offerings were priced at the

market. The warrants terminate on the earlier of (1) the two (2)

year anniversary of the initial exercise date of the warrant or (2)

thirty (30) trading days following the reporting of top line data

(EMACC) in the Phase 2 Alzheimer's program of XPro1595, (the

“Termination Date”). Should the warrants be exercised for cash, the

Company would receive additional funding.

Upcoming Events and Milestones:

- Full enrollment in the Phase II XPro™ trial for treatment

of neuroinflammation as a cause of Alzheimer’s Disease are expected

mid-2024 followed by top-line data approximately six months from

the last patient enrolled.

- Initiate a Phase II trial of XPro™ in patients with

Treatment-Resistant Depression 2H 2024.

- Expect to complete enrollment in the Phase I portion of the

mCRPC trial by end of Q3 2024. The Phase II portion is expected to

complete enrollment in Q2, 2025. Because the trial is open-label,

we expect to provide periodic data updates on the immunologic and

therapeutic response to INKmune in the participants of the CaRePC

trial in mCPRC.

Financial Results for the First

Quarter Ended March 31, 2024:

- Net loss attributable to common stockholders for the quarter

ended March 31, 2024 was approximately $11.0 million, compared to

approximately $6.5 million during the quarter ended March 31,

2023.

- Research and development expenses totaled approximately $8.7

million for the quarter ended March 31, 2024, compared to

approximately $4.1 million during the quarter ended March 31,

2023.

- General and administrative expenses were approximately $2.3

million for the quarter ended March 31, 2024, compared to

approximately $2.3 million during the quarter ended March 31,

2023.

- As of March 31, 2024, the Company had cash and cash equivalents

of approximately $26.0 million. Subsequent to the end of the

quarter, the Company raised gross proceeds of approximately $16.6

million from the sale of common stock and warrants.

- As of May 9, 2024, the Company had approximately 19.8 million

common shares outstanding.

Earnings Call Information

To participate in this event, dial approximately 5 to 10 minutes

before the beginning of the call. Please ask for the INmune Bio

First Quarter Conference Call when reaching an operator.

Date: May 9, 2024Time: 4:30 PM Eastern TimeParticipant Dial-in:

1-800-343-5172Participant Dial-in (international):

1-203-518-9856Conference ID: INMUNE

A live audio webcast of the call can be accessed by

clicking here or using this

link:https://viavid.webcasts.com/starthere.jsp?ei=1666877&tp_key=6505d73fc4

A transcript will follow approximately 24 hours from the

scheduled call. A replay will also be available through May 15 by

dialing 1-844-512-2921 or 1-412-317-6671 (international) and

entering PIN no. 1155727.

About XPro™

XPro™ is a next-generation inhibitor of tumor necrosis factor

(TNF) that is currently in clinical trial and acts differently than

currently available TNF inhibitors in that it neutralizes soluble

TNF (sTNF), without affecting trans-membrane TNF (tmTNF) or TNF

receptors. XPro™ could have potential substantial beneficial

effects in patients with neurologic disease by decreasing

neuroinflammation. For more information about the importance of

targeting neuroinflammation in the brain to improve cognitive

function and restore neuronal communication

visit this section of the INmune Bio’s website.

About INKmune™

INKmune™ is a pharmaceutical-grade, replication-incompetent

human tumor cell line which conjugates to resting NK cells and

delivers multiple, essential priming signals to convert the cancer

patient’s resting NK cells into tumor killing memory-like NK cells

(mlNK cells). INKmune™ treatment converts the patient’s own NK

cells into mlNK cells. In patients, INKmune™ primed tumor killing

NK cells have persisted for more than 100 days. These cells

function in the hypoxic TME because due to upregulated nutrient

receptors and mitochondrial survival proteins.

INKmune™ is a patient friendly drug treatment that does not

require pre-medication, conditioning or additional cytokine therapy

to be given to the patients. INKmune™ is easily transported, stored

and delivered to the patient by a simple intravenous infusion as an

out-patient. INKmune™ is tumor agnostic; it can be used to treat

many types of NK-resistant tumors including leukemia, lymphoma,

myeloma, lung, ovarian, breast, renal and nasopharyngeal cancer.

INKmune™ is treating patients in an open label Phase I/II trial in

metastatic castration-resistant prostate cancer in the US this

year.

About INmune Bio Inc.

INmune Bio Inc. is

a publicly traded (NASDAQ: INMB), clinical-stage biotechnology

company focused on developing treatments that target the innate

immune system to fight disease. INmune Bio has two product

platforms that are both in clinical trials: The Dominant-Negative

Tumor Necrosis Factor (DN-TNF) product platform utilizes

dominant-negative technology to selectively neutralize soluble TNF,

a key driver of innate immune dysfunction and a mechanistic driver

of many diseases. DN-TNF product candidates are in clinical trials

to determine if they can treat cancer (INB03™), Early

Alzheimer’s disease and treatment-resistant depression (XPro™). The

Natural Killer Cell Priming Platform includes INKmune™ developed to

prime a patient’s NK cells to eliminate minimal residual disease in

patients with cancer. INmune Bio’s product platforms utilize a

precision medicine approach for the treatment of a wide variety of

hematologic and solid tumor malignancies, and chronic inflammation.

To learn more, please

visit www.inmunebio.com.

Forward-Looking Statements

Clinical trials are in early stages and there is no assurance

that any specific outcome will be achieved. Any statements

contained in this press release that do not describe historical

facts may constitute forward-looking statements as that term is

defined in the Private Securities Litigation Reform Act of 1995.

Any statements contained in this press release that do not describe

historical facts may constitute forward-looking statements as that

term is defined in the Private Securities Litigation Reform Act of

1995. Any forward-looking statements contained herein are based on

current expectations but are subject to a number of risks and

uncertainties. Actual results and the timing of certain events and

circumstances may differ materially from those described by the

forward-looking statements as a result of these risks and

uncertainties. INB03™, XPro1595 (XPro™), and INKmune™ are still in

clinical trials or preparing to start clinical trials and have not

been approved by the US Food and Drug Administration (FDA) or any

regulatory body and there cannot be any assurance that they will be

approved by the FDA or any regulatory body or that any specific

results will be achieved. The factors that could cause actual

future results to differ materially from current expectations

include, but are not limited to, risks and uncertainties relating

to the Company’s ability to produce more drug for clinical trials;

the availability of substantial additional funding for the Company

to continue its operations and to conduct research and development,

clinical studies and future product commercialization; and, the

Company’s business, research, product development, regulatory

approval, marketing and distribution plans and strategies. These

and other factors are identified and described in more detail in

the Company’s filings with the Securities and Exchange Commission,

including the Company’s Annual Report on Form 10-K, the Company’s

Quarterly Reports on Form 10-Q and the Company’s Current Reports on

Form 8-K. The Company assumes no obligation to update any

forward-looking statements in order to reflect any event or

circumstance that may arise after the date of this release.

INmune Bio Contact:David

Moss, CFO (858) 964-3720info@inmunebio.com

Investor Contact:Jason

NelsonCore IR(516) 842-9619 x-823

The following tables summarize our results of operations

for the periods indicated:

|

INMUNE BIO INC.CONDENSED CONSOLIDATED BALANCE SHEETS(In

thousands, except share and per share

amounts)(Unaudited) |

|

|

|

March 31,2024 |

|

|

December 31,2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

26,002 |

|

|

$ |

35,848 |

|

|

Research and development tax credit receivable |

|

|

2,133 |

|

|

|

1,905 |

|

|

Other tax receivable |

|

|

557 |

|

|

|

537 |

|

|

Prepaid expenses and other current assets |

|

|

1,109 |

|

|

|

1,510 |

|

|

Prepaid expenses – related party |

|

|

23 |

|

|

|

142 |

|

|

TOTAL CURRENT ASSETS |

|

|

29,824 |

|

|

|

39,942 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease – right of use asset |

|

|

389 |

|

|

|

414 |

|

|

Other assets |

|

|

106 |

|

|

|

131 |

|

|

Acquired in-process research and development intangible assets |

|

|

16,514 |

|

|

|

16,514 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

46,833 |

|

|

$ |

57,001 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES, REDEEMABLE COMMON STOCK AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

9,294 |

|

|

$ |

7,901 |

|

|

Accounts payable and accrued liabilities – related parties |

|

|

56 |

|

|

|

35 |

|

|

Deferred liabilities |

|

|

520 |

|

|

|

489 |

|

|

Current portion of long-term debt |

|

|

7,455 |

|

|

|

9,921 |

|

|

Operating lease, current liabilities |

|

|

125 |

|

|

|

119 |

|

|

TOTAL CURRENT LIABILITIES |

|

|

17,450 |

|

|

|

18,465 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term operating lease liability |

|

|

360 |

|

|

|

397 |

|

|

TOTAL LIABILITIES |

|

|

17,810 |

|

|

|

18,862 |

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable common stock, $0.001 par value; 75,697 issued and

outstanding, respectively (Note 9) |

|

|

799 |

|

|

|

799 |

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Preferred stock, $0.001 par

value, 10,000,000 shares authorized, 0 shares issued and

outstanding |

|

|

- |

|

|

|

- |

|

| Common stock, $0.001 par

value, 200,000,000 shares authorized, 17,950,776 shares issued and

outstanding, respectively |

|

|

18 |

|

|

|

18 |

|

|

Additional paid-in capital |

|

|

160,922 |

|

|

|

159,143 |

|

|

Accumulated other comprehensive loss |

|

|

(669 |

) |

|

|

(799 |

) |

|

Accumulated deficit |

|

|

(132,047 |

) |

|

|

(121,022 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY |

|

|

28,224 |

|

|

|

37,340 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES,

REDEEMABLE COMMON STOCK AND STOCKHOLDERS’ EQUITY |

|

$ |

46,833 |

|

|

$ |

57,001 |

|

|

INMUNE BIO INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS(In thousands, except share and

per share amounts)(Unaudited) |

|

|

|

For the Three Months EndedMarch

31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

REVENUE |

|

$ |

14 |

|

|

$ |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

2,338 |

|

|

|

2,328 |

|

|

Research and development |

|

|

8,693 |

|

|

|

4,133 |

|

|

Total operating expenses |

|

|

11,031 |

|

|

|

6,461 |

|

|

|

|

|

|

|

|

|

|

|

|

LOSS FROM OPERATIONS |

|

|

(11,017 |

) |

|

|

(6,423 |

) |

|

|

|

|

|

|

|

|

|

|

|

OTHER EXPENSE, NET |

|

|

(8 |

) |

|

|

(113 |

) |

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

|

$ |

(11,025 |

) |

|

$ |

(6,536 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share – basic and diluted |

|

$ |

(0.61 |

) |

|

$ |

(0.36 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – basic and diluted |

|

|

18,026,473 |

|

|

|

17,945,995 |

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(11,025 |

) |

|

$ |

(6,536 |

) |

|

Other comprehensive income (loss) – foreign currency

translation |

|

|

130 |

|

|

|

(9 |

) |

|

Total comprehensive loss |

|

$ |

(10,895 |

) |

|

$ |

(6,545 |

) |

|

INMUNE BIO INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(In thousands)(Unaudited) |

|

|

|

For the Three Months EndedMarch

31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(11,025 |

) |

|

$ |

(6,536 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

1,779 |

|

|

|

1,737 |

|

|

Accretion of debt discount |

|

|

34 |

|

|

|

67 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Research and development tax credit receivable |

|

|

(228 |

) |

|

|

6,285 |

|

|

Other tax receivable |

|

|

(20 |

) |

|

|

(34 |

) |

|

Prepaid expenses |

|

|

401 |

|

|

|

394 |

|

|

Prepaid expenses – related party |

|

|

119 |

|

|

|

(1 |

) |

|

Other assets |

|

|

25 |

|

|

|

- |

|

|

Accounts payable and accrued liabilities |

|

|

1,393 |

|

|

|

(3,129 |

) |

|

Accounts payable and accrued liabilities – related parties |

|

|

21 |

|

|

|

- |

|

|

Deferred liabilities |

|

|

31 |

|

|

|

(25 |

) |

|

Accrued liability – long-term |

|

|

- |

|

|

|

88 |

|

|

Operating lease liabilities |

|

|

(6 |

) |

|

|

13 |

|

| Net cash used in operating

activities |

|

|

(7,476 |

) |

|

|

(1,141 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Repayments of debt |

|

|

(2,500 |

) |

|

|

- |

|

| Net used in financing

activities |

|

|

(2,500 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Impact on cash from foreign

currency translation |

|

|

130 |

|

|

|

(9 |

) |

| |

|

|

|

|

|

|

|

|

| NET DECREASE IN CASH AND CASH

EQUIVALENTS |

|

|

(9,846 |

) |

|

|

(1,150 |

) |

| CASH AND CASH EQUIVALENTS AT

BEGINNING OF PERIOD |

|

|

35,848 |

|

|

|

52,153 |

|

| CASH AND CASH EQUIVALENTS AT

END OF PERIOD |

|

$ |

26,002 |

|

|

$ |

51,003 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOWS INFORMATION: |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

- |

|

|

$ |

- |

|

|

Cash paid for interest expense |

|

$ |

302 |

|

|

$ |

450 |

|

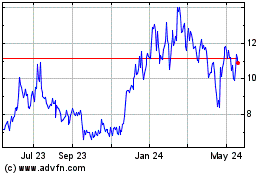

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Jan 2025 to Feb 2025

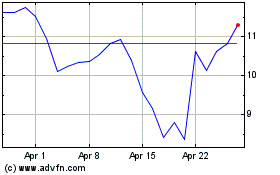

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Feb 2024 to Feb 2025