Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

June 14 2022 - 2:59PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-263593 and 333-263725

PROSPECTUS SUPPLEMENT NO. 5

(TO PROSPECTUS DATED

April 8, 2022)

IMPERIAL PETROLEUM INC.

This is a supplement (“Prospectus Supplement”) to the prospectus, dated April 8, 2022 (“Prospectus”) of Imperial

Petroleum Inc. (the “Company”), which forms a part of the Company’s Registration Statements

on Form F-1 (Registration Nos. 333-263593 and 333-263725), as amended or

supplemented from time to time.

On June 14, 2022, the Company furnished a Report on Form 6-K (the “Form 6-K”) to the U.S. Securities and Exchange Commission (the “Commission”) as set forth below.

This Prospectus Supplement should be read in conjunction with, and delivered with, the Prospectus and is qualified by reference to the

Prospectus except to the extent that the information in this Prospectus Supplement supersedes the information contained in the Prospectus. This Prospectus Supplement is not complete without, and may not be delivered or utilized except in connection

with, the Prospectus, including any amendments or supplements to it.

Investing in

our securities involves a high degree of risk. See “Risk Factors” beginning on page 15 of the Prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus supplement is June 14, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2022

Commission File Number 001-41095

IMPERIAL PETROLEUM INC.

(Translation of registrant’s name into English)

331 Kifissias

Avenue Erithrea 14561 Athens, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

The press release issued by Imperial Petroleum Inc. on June 14, 2022 announcing its financial and operating results for the three months ended

March 31, 2022, is attached hereto as Exhibit 99.1.

EXHIBIT INDEX

|

|

|

| 99.1 |

|

Imperial Petroleum Inc. Press Release dated June 14, 2022 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: June 14, 2022

|

|

|

| IMPERIAL PETROLEUM INC. |

|

|

| By: |

|

/s/ Harry Vafias |

| Name: |

|

Harry Vafias |

| Title: |

|

Chief Executive Officer |

Exhibit 99.1

IMPERIAL PETROLEUM INC.

IMPERIAL PETROLEUM INC. REPORTS FIRST QUARTER 2022 FINANCIAL AND OPERATING RESULTS

ATHENS, GREECE, June 14, 2022—IMPERIAL PETROLEUM INC. (NASDAQ: IMPP), the “Company”), a ship-owning company providing petroleum product

and crude oil seaborne transportation services, announced today its unaudited financial and operating results for the first quarter ended March 31, 2022.

OPERATIONAL AND FINANCIAL HIGHLIGHTS

| |

• |

|

As of June 10, 2022, we had raised $135 million in total net proceeds, after underwriting discounts,

from our public offerings. In addition, on June 13, 2022, we entered into agreements for warrant exercises expected to result in additional net proceeds to us of $21 million. |

| |

• |

|

On March 28, 2022, we took delivery of the product tanker Clean Nirvana. |

| |

• |

|

Subsequent to March 31, 2022 we took delivery of three additional tanker vessels: the product tanker Clean

Justice was delivered on May 31, 2022, while our recently acquired suezmax vessels, the Suez Protopia and the Suez Enchanted, were each delivered on June 3, 2022. |

| |

• |

|

Within the course of five months we doubled the number of our vessels to 8 and tripled fleet capacity to 682,000

dwt. |

| |

• |

|

Fleet operational utilization of 98.9% in Q1 22’— only 4 days commercial and 0 days technical off-hire. |

| |

• |

|

Revenues of $5.1 million in Q1 22’, same level as in Q1 21’ but approximately 28% higher than our

revenues in Q4 21’ as a result of improved market rates. |

| |

• |

|

Net income of $0.2 million and EBITDA1 of $2.6 million in Q1 22’ compared to net loss of $0.4 million in Q1 21’ and net loss of $1.5 million in Q4 21’. |

| |

• |

|

Cash to date of about $55 million expected to increase to $76 million with the conclusion of the

warrant transaction recently announced. |

First Quarter 2022 Results:

| ◾ |

Revenues for the three months ended March 31, 2022 and 2021 amounted to $5.1 million.

|

| ◾ |

Voyage expenses and vessels’ operating expenses for the three months ended March 31, 2022 were

$0.5 million and $1.8 million, respectively, compared to $1.4 million and $1.7 million, respectively, for the three months ended March 31, 2021. The $0.9 million decrease in voyage expenses is mainly due to the decrease

of spot days by 120 days (81.6%) partially offset by the year on year increase in bunker costs. Vessels’ operating expenses remained stable. |

| ◾ |

General and administrative expenses for the three months ended March 31, 2022 and 2021 were

$0.1 million. |

| ◾ |

Depreciation for the three months ended March 31, 2022 and 2021 was $2.2 million.

|

| 1 |

EBITDA is a non-GAAP measure. Refer to the reconciliation of this

measure to the most directly comparable financial measure in accordance with GAAP set forth later in this release. |

| ◾ |

Interest and finance costs for the three months ended March 31, 2022 and 2021 were

$0.2 million and $0.002 million, respectively. The increase is attributable to the interest expense incurred relating to our loan agreement entered into in November 2021. |

| ◾ |

As a result of the above, for the three months ended March 31, 2022, the Company reported net income

of $0.2 million, compared to net loss of $0.4 million for the three months ended March 31, 2021. Dividends paid on Series A Preferred Shares amounted to $0.4 million for the three months ended March 31, 2022. The

weighted average number of shares of common stock outstanding, basic, for the three months ended March 31, 2022 was 17.7 million. |

| ◾ |

Loss per share, basic and diluted, for the three months ended March 31, 2022 amounted to $0.01.

EBITDA for the three months ended March 31, 2022 amounted to $2.6 million. Reconciliations of EBITDA to Net (Loss)/Income are set forth below. |

| ◾ |

An average of 4.0 vessels were owned by the Company during the three months ended March 31, 2022 and 2021.

|

| ◾ |

As of March 31, 2022, cash and cash equivalents amounted to $82.2 million and total debt

amounted to $27.8 million. During the three months ended March 31, 2022 no debt repayments occurred. |

CEO Harry

Vafias Commented

Having raised a total of $135 million from our equity offerings we considered a number of acquisition candidates to acquire and

grow our fleet; we managed within a brief period of time to identify, acquire and take delivery of four tankers, doubling our fleet size and almost tripling our fleet’s cargo carrying capacity.

The outbreak of war in Ukraine shocked shipping markets and altered oil trading patterns resulting in an improvement in the charter market. For Imperial

Petroleum the first quarter of 2022 was transitional; the vessels we acquired were added to our fleet towards and after the end of this first quarter while improved charter rates for our existing vessels materialized from the beginning of the second

quarter. Nevertheless, this was a profitable quarter with a significant improvement in revenue and earnings from the last quarter of 2021; the strong tanker market, the dynamic fleet expansion, along with improved charter rates bodes well for the

second quarter to be even more profitable.

Our remaining cash balance is about $55 million following the $78 million spent on vessel

acquisitions and before we incur debt for these acquisitions which will increase our cash balance even further, as will the warrant exercise transaction we recently announced that is expected to result in additional net proceeds of $21 million.

We are committed to growing our Company further and will seek to expand our fleet so that Imperial Petroleum becomes a true pioneer in the field of energy shipping.

Conference Call details:

On June 14, 2022 at 11:00

am ET, the company’s management will host a conference call to discuss the results and the company’s operations and outlook.

Conference Call

details:

Participants should dial into the call 10 minutes before the scheduled time using the following numbers: +1 8778709135 (US Toll Free Dial In)

or 08002796619 (UK Toll Free Dial In).

Access Code:

1732718

In case of any problems with the above

numbers, please dial +1 6467413167 (US Toll Dial In), +44 (0) 2071 928338 (Standard International Dial In).

Access Code: 1732718

Slides and audio webcast:

There will also be a live and then archived webcast of the conference call, through the IMPERIAL PETROLEUM INC. website (www.ImperialPetro.com). Participants

to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

About IMPERIAL PETROLEUM

INC.

Imperial Petroleum Inc. is a ship-owning company providing petroleum product and crude oil seaborne transportation

services. The Company owns a total of eight tanker vessels; five M.R. product tankers, one Aframax oil tanker and two Suezmax tankers with a total capacity of approximately 682,000 deadweight tons (dwt). Imperial Petroleum Inc.’s shares of

common stock and 8.75% Series A Cumulative Redeemable Perpetual Preferred Stock are listed on the Nasdaq Capital Market and trade under the symbols “IMPP” and “IMPPP”, respectively.

Forward-Looking Statements

Matters discussed in this

release may constitute forward-looking statements. Forward-looking statements reflect our current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events

or performance, or impact or duration of the COVID-19 pandemic and underlying assumptions and other statements, which are other than statements of historical facts. The forward-looking statements in this

release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and other data

available from third parties. Although IMPERIAL PETROLEUM INC. believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or

impossible to predict and are beyond our control, IMPERIAL PETROLEUM INC. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. Important factors that, in our view, could cause actual results to differ

materially from those discussed in the forward-looking statements include the impact of the COVID-19 pandemic and efforts throughout the world to contain its spread, the strength of world economies and

currencies, general market conditions, including changes in charter hire rates and vessel values, charter counterparty performance, changes in demand that may affect attitudes of time charterers to scheduled and unscheduled drydockings, shipyard

performance, changes in IMPERIAL PETROLEUM INC’s operating expenses, including bunker prices, drydocking and insurance costs, ability to obtain financing and comply with covenants in our financing arrangements, or actions taken by regulatory

authorities, potential liability from pending or future litigation, domestic and international political conditions, the conflict in Ukraine and related sanctions, potential disruption of shipping routes due to accidents and political events or acts

by terrorists.

Risks and uncertainties are further described in reports filed by IMPERIAL PETROLEUM INC. with the U.S. Securities and Exchange

Commission.

Fleet List and Fleet Deployment

For information on our fleet and further information:

Visit our

website at www.ImperialPetro.com

Company Contact:

Fenia Sakellaris

IMPERIAL PETROLEUM INC.

00-30-210-6250-001

E-mail: fs@ImperialPetro.com

Fleet Data:

The following key indicators highlight the Company’s operating performance during the periods ended March 31, 2021 and March 31, 2022.

|

|

|

|

|

|

|

|

|

| FLEET DATA |

|

Q1 2021 |

|

|

Q1 2022 |

|

| Average number of vessels (1) |

|

|

4.00 |

|

|

|

4.04 |

|

| Period end number of owned vessels in fleet |

|

|

4 |

|

|

|

5 |

|

| Total calendar days for fleet (2) |

|

|

360 |

|

|

|

364 |

|

| Total voyage days for fleet (3) |

|

|

359 |

|

|

|

364 |

|

| Fleet utilization (4) |

|

|

99.7 |

% |

|

|

100.0 |

% |

| Total charter days for fleet (5) |

|

|

212 |

|

|

|

337 |

|

| Total spot market days for fleet (6) |

|

|

147 |

|

|

|

27 |

|

| Fleet operational utilization (7) |

|

|

87.8 |

% |

|

|

98.9 |

% |

| 1) |

Average number of vessels is the number of owned vessels that constituted our fleet for the relevant

period, as measured by the sum of the number of days each vessel was a part of our fleet during the period divided by the number of calendar days in that period. |

| 2) |

Total calendar days for fleet are the total days the vessels we operated were in our possession for the

relevant period including off-hire days associated with major repairs, drydockings or special or intermediate surveys. |

| 3) |

Total voyage days for fleet reflect the total days the vessels we operated were in our possession for

the relevant period net of off-hire days associated with major repairs, drydockings or special or intermediate surveys. |

| 4) |

Fleet utilization is the percentage of time that our vessels were available for revenue generating

voyage days, and is determined by dividing voyage days by fleet calendar days for the relevant period. |

| 5) |

Total charter days for fleet are the number of voyage days the vessels operated on time or bareboat

charters for the relevant period. |

| 6) |

Total spot market charter days for fleet are the number of voyage days the vessels operated on spot

market charters for the relevant period. |

| 7) |

Fleet operational utilization is the percentage of time that our vessels generated revenue, and is

determined by dividing voyage days excluding commercially idle days by fleet calendar days for the relevant period. |

Reconciliation

of EBITDA:

EBITDA represents net (loss)/income before interest and finance costs, interest income and depreciation.

EBITDA is not a recognized measurement under U.S. GAAP. Our calculation of EBITDA may not be comparable to that reported by other companies in the shipping

industry or other industries.

EBITDA measurement is included herein because it is a basis, upon which our investors and we assess our financial

performance. It allows us to present our performance from period to period on a comparable basis and provides investors with a means of better evaluating and understanding our operating performance.

|

|

|

|

|

|

|

|

|

| (Expressed in United States Dollars,

except number of

shares) |

|

Three Months Period Ended

March 31st, |

|

| |

|

2021 |

|

|

2022 |

|

| Net (loss)/income - EBITDA |

|

|

|

|

|

|

|

|

| Net (loss)/income |

|

|

(426,275 |

) |

|

|

218,382 |

|

| Plus interest and finance costs |

|

|

1,926 |

|

|

|

209,014 |

|

| Less interest income |

|

|

(4 |

) |

|

|

— |

|

| Plus depreciation |

|

|

2,168,666 |

|

|

|

2,168,666 |

|

| EBITDA |

|

|

1,744,313 |

|

|

|

2,596,062 |

|

Imperial Petroleum Inc.

Unaudited Consolidated Statements of Operations

(Expressed in United States Dollars, except for number of shares)

|

|

|

|

|

|

|

|

|

| |

|

For The Three Months

Ended March 31, |

|

| |

|

2021 |

|

|

2022 |

|

| Revenues |

|

|

|

|

|

|

|

|

| Revenues |

|

|

5,069,525 |

|

|

|

5,116,378 |

|

| Expenses |

|

|

|

|

|

|

|

|

| Voyage expenses |

|

|

1,290,532 |

|

|

|

457,428 |

|

| Voyage expenses—related party |

|

|

64,872 |

|

|

|

61,871 |

|

| Vessels’ operating expenses |

|

|

1,728,520 |

|

|

|

1,744,016 |

|

| Vessels’ operating expenses—related party |

|

|

15,000 |

|

|

|

15,000 |

|

| Management fees |

|

|

130,050 |

|

|

|

131,810 |

|

| General and administrative expenses |

|

|

90,532 |

|

|

|

115,316 |

|

| Depreciation |

|

|

2,168,666 |

|

|

|

2,168,666 |

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

|

5,488,172 |

|

|

|

4,694,107 |

|

|

|

|

|

|

|

|

|

|

| (Loss)/Income from operations |

|

|

(418,647 |

) |

|

|

422,271 |

|

|

|

|

|

|

|

|

|

|

| Other (expenses)/income |

|

|

|

|

|

|

|

|

| Interest and finance costs |

|

|

(1,926 |

) |

|

|

(209,014 |

) |

| Interest income |

|

|

4 |

|

|

|

— |

|

| Foreign exchange (loss)/gain |

|

|

(5,706 |

) |

|

|

5,125 |

|

|

|

|

|

|

|

|

|

|

| Other expenses, net |

|

|

(7,628 |

) |

|

|

(203,889 |

) |

|

|

|

|

|

|

|

|

|

| (Loss)/Net Income |

|

|

(426,275 |

) |

|

|

218,382 |

|

|

|

|

|

|

|

|

|

|

| Loss per share, Basic |

|

|

(0.09 |

) |

|

|

(0.01 |

) |

| Weighted average number of shares, Basic |

|

|

4,775,272 |

|

|

|

17,700,385 |

|

Imperial Petroleum Inc.

Unaudited Consolidated Balance Sheets

(Expressed in

United States Dollars)

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

March 31, |

|

| |

|

2021 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

3,389,834 |

|

|

|

82,202,037 |

|

| Restricted cash |

|

|

451,225 |

|

|

|

1,804,898 |

|

| Receivables from related party |

|

|

355,023 |

|

|

|

644,448 |

|

| Trade and other receivables |

|

|

1,400,275 |

|

|

|

1,765,270 |

|

| Inventories |

|

|

258,846 |

|

|

|

1,328,812 |

|

| Advances and prepayments |

|

|

150,544 |

|

|

|

184,051 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

6,005,747 |

|

|

|

87,929,516 |

|

|

|

|

|

|

|

|

|

|

| Non current assets |

|

|

|

|

|

|

|

|

| Vessels, net |

|

|

119,962,984 |

|

|

|

130,419,318 |

|

| Other receivables |

|

|

— |

|

|

|

6,442 |

|

| Restricted cash |

|

|

2,500,000 |

|

|

|

2,500,000 |

|

|

|

|

|

|

|

|

|

|

| Total non current assets |

|

|

122,462,984 |

|

|

|

132,925,760 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

128,468,731 |

|

|

|

220,855,276 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Trade accounts payable |

|

|

1,430,251 |

|

|

|

2,794,331 |

|

| Payable to related parties |

|

|

1,119,055 |

|

|

|

1,160,971 |

|

| Accrued liabilities |

|

|

486,674 |

|

|

|

1,391,940 |

|

| Customer deposits |

|

|

368,000 |

|

|

|

368,000 |

|

| Deferred income |

|

|

482,321 |

|

|

|

535,782 |

|

| Current portion of long-term debt |

|

|

4,747,616 |

|

|

|

4,746,393 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

8,633,917 |

|

|

|

10,997,417 |

|

|

|

|

|

|

|

|

|

|

| Non current liabilities |

|

|

|

|

|

|

|

|

| Long-term debt |

|

|

23,088,971 |

|

|

|

23,090,194 |

|

|

|

|

|

|

|

|

|

|

| Total non current liabilities |

|

|

23,088,971 |

|

|

|

23,090,194 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

31,722,888 |

|

|

|

34,087,611 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

| Capital stock |

|

|

47,753 |

|

|

|

700,802 |

|

| Preferred stock |

|

|

7,959 |

|

|

|

7,959 |

|

| Additional paid-in capital |

|

|

97,161,688 |

|

|

|

186,312,079 |

|

| Accumulated deficit |

|

|

(471,557 |

) |

|

|

(253,175 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

96,745,843 |

|

|

|

186,767,665 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

|

128,468,731 |

|

|

|

220,855,276 |

|

|

|

|

|

|

|

|

|

|

Imperial Petroleum Inc.

Unaudited Consolidated Statements of Cash Flows

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

| |

|

For The Three Months

Ended March 31, |

|

| |

|

2021 |

|

|

2022 |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

| Net (loss)/income for the period |

|

|

(426,275 |

) |

|

|

218,382 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

2,168,666 |

|

|

|

2,168,666 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| (Increase)/decrease in |

|

|

|

|

|

|

|

|

| Trade and other receivables |

|

|

(1,495,773 |

) |

|

|

(371,437 |

) |

| Other current assets |

|

|

104,415 |

|

|

|

— |

|

| Inventories |

|

|

109,711 |

|

|

|

(1,069,966 |

) |

| Advances and prepayments |

|

|

(35,738 |

) |

|

|

(33,507 |

) |

| Increase/(decrease) in |

|

|

|

|

|

|

|

|

| Trade accounts payable |

|

|

— |

|

|

|

1,364,080 |

|

| Balances with related parties |

|

|

547,062 |

|

|

|

(247,509 |

) |

| Accrued liabilities |

|

|

52,339 |

|

|

|

905,266 |

|

| Deferred income |

|

|

444,375 |

|

|

|

53,461 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

1,468,782 |

|

|

|

2,987,436 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Acquisition and improvement of vessels |

|

|

(142,600 |

) |

|

|

(12,625,000 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(142,600 |

) |

|

|

(12,625,000 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Net transfers to former Parent Company |

|

|

(1,964,785 |

) |

|

|

— |

|

| Proceeds from follow-on offerings |

|

|

— |

|

|

|

96,772,890 |

|

| Stock issuance costs |

|

|

— |

|

|

|

(6,534,204 |

) |

| Dividends paid on preferred shares |

|

|

— |

|

|

|

(435,246 |

) |

| Net cash (used in)/provided by financing activities |

|

|

(1,964,785 |

) |

|

|

89,803,440 |

|

|

|

|

|

|

|

|

|

|

| Net (decrease)/ increase in cash, cash equivalents and restricted cash |

|

|

(638,603 |

) |

|

|

80,165,876 |

|

| Cash, cash equivalents and restricted cash at beginning of year |

|

|

7,616,555 |

|

|

|

6,341,059 |

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash at end of period |

|

|

6,977,952 |

|

|

|

86,506,935 |

|

|

|

|

|

|

|

|

|

|

| Cash breakdown |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

5,812,921 |

|

|

|

82,202,037 |

|

| Restricted cash, current |

|

|

1,165,031 |

|

|

|

1,804,898 |

|

| Restricted cash, non current |

|

|

— |

|

|

|

2,500,000 |

|

|

|

|

|

|

|

|

|

|

| Total cash, cash equivalents and restricted cash shown in the statements of cash

flows |

|

|

6,977,952 |

|

|

|

86,506,935 |

|

|

|

|

|

|

|

|

|

|

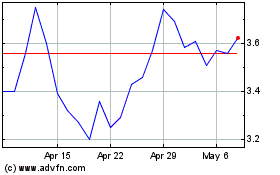

Imperial Petroleum (NASDAQ:IMPP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Imperial Petroleum (NASDAQ:IMPP)

Historical Stock Chart

From Nov 2023 to Nov 2024