Ichor Holdings, Ltd. (NASDAQ: ICHR), a leader in the design,

engineering, and manufacturing of critical fluid delivery

subsystems and components for semiconductor capital equipment,

today announced fourth quarter and fiscal year 2023 financial

results.

Fourth quarter 2023 highlights:

- Revenues of $203 million, at the upper end of the guidance

range communicated in November;

- Gross margin of 10.0% on a GAAP basis and 10.4% on a non‑GAAP

basis;

- Earnings per share ("EPS") of $(0.40) on a GAAP basis and

$(0.06) on a non-GAAP basis;

- $38 million of cash flow from operations; and

- $32 million reduction in total debt outstanding during the

quarter.

"Within a relatively stable demand environment, revenues at the

upper end of guidance exceeded our expectations; however, product

and customer mix became less favorable, resulting in a temporary

setback in our strategies to deliver consistent improvement in

gross margins," commented Jeff Andreson, chief executive officer.

"We anticipate our revenues will continue at similar levels through

mid-2024, during which time we expect to drive meaningful

improvements in gross margins and profitability. Looking forward,

we are encouraged by early indications of an improvement in overall

fab investment levels as we progress through the year. Within the

currently challenging business environment, we continue to focus

our R&D investments on new products that will drive gross

margin accretion and strong operating leverage as revenue levels

rebound. We are engaged with multiple customers in various stages

of tool evaluations, qualifications, and design wins that we

anticipate will enable Ichor to outperform overall industry growth

as spending levels improve, and we look forward to delivering

improved year-over-year financial performance, both for this year

as well as the expected strong growth year for our industry in

2025."

Q4 2023

Q3 2023

Q4 2022

FY 2023

FY 2022

(dollars in thousands, except per

share amounts)

U.S. GAAP Financial Results:

Net sales

$

203,481

$

196,761

$

301,720

$

811,120

$

1,280,069

Gross margin

10.0

%

12.2

%

16.2

%

12.7

%

16.6

%

Operating margin

(3.9

)%

(2.5

)%

6.0

%

(1.3

)%

6.7

%

Net income (loss)

$

(11,899

)

$

(10,425

)

$

14,197

$

(42,985

)

$

72,804

Diluted EPS

$

(0.40

)

$

(0.36

)

$

0.49

$

(1.47

)

$

2.51

Q4 2023

Q3 2023

Q4 2022

FY 2023

FY 2022

(dollars in thousands, except per

share amounts)

Non-GAAP Financial Results:

Gross margin

10.4

%

13.1

%

16.7

%

13.4

%

17.0

%

Operating margin

0.0

%

2.2

%

8.9

%

2.9

%

9.8

%

Net income (loss)

$

(1,675

)

$

2,097

$

21,005

$

12,257

$

104,863

Diluted EPS

$

(0.06

)

$

0.07

$

0.72

$

0.42

$

3.62

U.S. GAAP Financial Results

Overview

For the fourth quarter of 2023, revenue was $203.5 million, net

loss was $11.9 million, and net loss per diluted share (“diluted

EPS”) was $0.40. This compares to revenue of $196.8 million and

$301.7 million, net income (loss) of $(10.4) million and $14.2

million, and diluted EPS of $(0.36) and $0.49, for the third

quarter of 2023 and fourth quarter of 2022, respectively.

For 2023, revenue was $811.1 million, net loss was $43.0

million, and diluted EPS was $(1.47). This compares to revenue of

$1,280.1 million, net income of $72.8 million, and diluted EPS of

$2.51 for 2022.

Non-GAAP Financial Results

Overview

For the fourth quarter of 2023, non-GAAP net loss was $1.7

million and non-GAAP diluted EPS was $(0.06). This compares to

non-GAAP net income of $2.1 million and $21.0 million, and non-GAAP

diluted EPS of $0.07 and $0.72, for the third quarter of 2023 and

fourth quarter of 2022, respectively.

For 2023, non-GAAP net income was $12.3 million and non-GAAP

diluted EPS was $0.42. This compares to non-GAAP net income of

$104.9 million, and non-GAAP diluted EPS of $3.62 for 2022.

First Quarter 2024 Financial

Outlook

For the first quarter of 2024, we expect revenue to be in the

range of $190 million to $210 million. We expect GAAP diluted EPS

to be in the range of $(0.24) to $(0.14) and non-GAAP diluted EPS

to be in the range of $(0.05) to $0.05.

This outlook for non‑GAAP diluted EPS excludes amortization of

intangible assets of approximately $2.1 million and share-based

compensation expense of approximately $3.9 million, as well as the

related income tax effects. Non-GAAP diluted EPS should be

considered in addition to, but not as a substitute for, our

financial information presented in accordance with GAAP.

Balance Sheet and Cash Flow

Results

We ended the fourth quarter of 2023 with cash and cash

equivalents of $80.0 million, an increase of $4.0 million from the

prior quarter, and a decrease of $6.5 million from 2022.

The increase of $4.0 million in the fourth quarter was primarily

due to net cash provided by operating activities of $37.6 million,

partially offset by net payments on our credit facilities of $31.9

million.

The decrease of $6.5 million in 2023 was primarily due to net

payments on our credit facilities of $52.5 million and capital

expenditures of $15.5 million, partially offset by cash provided by

operating activities of $57.6 million.

Our cash provided by operating activities of $57.6 million in

2023 consisted of net loss of $43.0 million and net non-cash

charges of $61.7 million, which consisted primarily of depreciation

and amortization of $34.6 million, share-based compensation expense

of $17.3 million, and deferred income taxes of $9.3 million.

The decrease in our net operating assets and liabilities of

$38.9 million in 2023 was primarily due to a decrease in accounts

receivable and inventories of $69.6 million and $37.8 million,

respectively, partially offset by a decrease in accounts payable

and accrued and other liabilities of $51.0 million and $27.7

million, respectively.

Use of Non-GAAP Financial

Results

In addition to U.S. GAAP results, this press release also

contains non-GAAP financial results, including non‑GAAP gross

profit, non‑GAAP operating income, non‑GAAP net income, non‑GAAP

diluted EPS, and free cash flow. Management uses non-GAAP metrics

to evaluate our operating and financial results. We believe the

presentation of non-GAAP results is useful to investors for

analyzing business trends and comparing performance to prior

periods, along with enhancing investors’ ability to view our

results from management’s perspective. Non-GAAP gross profit,

operating income, and net income are defined as: gross profit,

operating income (loss), or net income (loss), respectively,

excluding (1) amortization of intangible assets, share-based

compensation expense, and discrete or infrequent charges and gains

that are outside of normal business operations, including

acquisition-related costs, contract and legal settlement gains and

losses, facility shutdown costs, and severance costs associated

with reduction-in-force programs, to the extent they are present in

gross profit, operating income (loss), and net income (loss),

respectively; and (2) the tax impacts associated with these

non-GAAP adjustments, as well as non-recurring discrete tax items,

including the impact of deferred tax asset valuation allowances.

All non-GAAP adjustments are presented on a gross basis; the

related income tax effects, including current and deferred income

tax expense, are included in the adjustment line under the heading

"Tax adjustments related to non-GAAP adjustments." Non-GAAP diluted

EPS is defined as non-GAAP net income divided by weighted average

diluted ordinary shares outstanding during the period. Non-GAAP

gross margin and non-GAAP operating margin are defined as non-GAAP

gross profit and non-GAAP operating income, respectively, divided

by net sales. Free cash flow is defined as cash provided by or used

in operating activities, less capital expenditures. Tables showing

these metrics on a GAAP and non-GAAP basis, with reconciliation

footnotes thereto, are included at the end of this press

release.

Non-GAAP results have limitations as an analytical tool, and you

should not consider them in isolation or as a substitute for our

results reported under GAAP. Other companies may calculate non-GAAP

results differently or may use other measures to evaluate their

performance, both of which could reduce the usefulness of our

non-GAAP results as a tool for comparison.

Because of these limitations, you should consider non-GAAP

results alongside other financial performance measures and results

presented in accordance with GAAP. In addition, in evaluating

non-GAAP results, you should be aware that in the future we will

incur expenses such as those that are the subject of adjustments in

deriving non-GAAP results, and you should not infer from our

presentation of non-GAAP results that our future results will not

be affected by these expenses or other discrete or infrequent

charges and gains that are outside of normal business

operations.

Conference Call

We will conduct a conference call to discuss our fourth quarter

and fiscal year 2023 results and business outlook today at 1:30

p.m. PT.

To listen to a live webcast of the call, please visit our

investor relations website at https://ir.ichorsystems.com, or go to

the live link at https://www.webcast-eqs.com/ichor020624/en.

To listen via telephone, please call (877) 407‑0989 (domestic)

or +1 (201) 389‑0921 (international), conference ID: 13743811.

After the call, an on-demand replay will be available at the same

webcast link.

About Ichor

We are a leader in the design, engineering and manufacturing of

critical fluid delivery subsystems and components primarily for

semiconductor capital equipment, as well as other industries such

as defense/aerospace and medical. Our primary product offerings

include gas and chemical delivery subsystems, collectively known as

fluid delivery subsystems, which are key elements of the process

tools used in the manufacturing of semiconductor devices. Our gas

delivery subsystems deliver, monitor and control precise quantities

of the specialized gases used in semiconductor manufacturing

processes such as etch and deposition. Our chemical delivery

subsystems precisely blend and dispense the reactive liquid

chemistries used in semiconductor manufacturing processes such as

chemical-mechanical planarization, electroplating, and cleaning. We

also provide precision-machined components, weldments, e-beam and

laser welded components, precision vacuum and hydrogen brazing,

surface treatment technologies, and other proprietary products. We

are headquartered in Fremont, CA. https://ir.ichorsystems.com.

We use a 52- or 53-week fiscal year ending on the last Friday in

December. The three-month periods ended December 29, 2023,

September 29, 2023, and December 30, 2022 were each 13 weeks.

References to the fourth quarter of 2023, third quarter of 2023,

and fourth quarter of 2022 relate to the three-month periods then

ended. Our fiscal years ended December 29, 2023 and December 30,

2022 are each 52 weeks. References to 2023 and 2022 relate to the

fiscal years then ended.

Safe Harbor Statement

Certain statements in this release are "forward-looking

statements" made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. The

words “anticipate,” “believe,” “contemplate,” “designed,”

“estimate,” “expect,” “forecast,” “goal,” “guidance,” “intend,”

“may,” “outlook,” “plan,” “predict,” “project,” “see,” “seek,”

“target,” “would” and similar expressions or variations or

negatives of these words are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words".

Examples of forward-looking statements include, but are not

limited to, statements regarding our outlook for our first fiscal

quarter of 2024, statements regarding the current business

environment, revenue levels in 2024, manufacturers’ investment in

water fabrication equipment, our investment in research and

development of new products, acquiring new business, and company

and industry growth and performance in 2024 and 2025, as well as

any other statement that does not directly relate to any historical

fact. Such forward-looking statements are based on our management’s

current expectations about future events as of the date hereof and

involve many risks and uncertainties that could cause our actual

results to differ materially from those expressed or implied in our

forward-looking statements. Our actual results and outcomes could

differ materially from those included in these forward-looking

statements as a result of various factors, including, but not

limited to: (1) geopolitical, economic and market conditions,

including high inflation, changes to fiscal and monetary policy,

high interest rates, currency fluctuations, challenges in the

supply chain and any disruptions in the global economy as a result

of the conflicts in Ukraine and the Middle East, (2) dependence on

expenditures by manufacturers and cyclical downturns in the

semiconductor capital equipment industry, (3) reliance on a very

small number of original equipment manufacturers for a significant

portion of sales, (4) negotiating leverage held by our customers,

(5) competitiveness and rapid evolution of the industries in which

we participate, (6) risks associated with weakness in the global

economy and geopolitical instability, (7) keeping pace with

developments in the industries we serve and with technological

innovation generally, (8) designing, developing and introducing new

products that are accepted by original equipment manufacturers in

order to retain our existing customers and obtain new customers,

(9) managing our manufacturing and procurement process effectively,

(10) defects in our products that could damage our reputation,

decrease market acceptance and result in potentially costly

litigation, and (11) our dependence on a limited number of

suppliers. Additional information concerning these and other

factors can be found in our filings with the Securities and

Exchange Commission (the “SEC”), including other risks, relevant

factors, and uncertainties identified in the "Risk Factors" section

of our Annual Report on Form 10‑K for the year ended December 30,

2022 and any other periodic reports that we may file with the

SEC.

All forward-looking statements in this press release are based

upon information available to us as of the date hereof, and

qualified in their entirety by this cautionary statement. We

undertake no obligation to update or revise any forward-looking

statements contained herein, whether as a result of actual results,

changes in our expectations, future events or developments, or

otherwise, except as required by law.

ICHOR HOLDINGS, LTD.

Consolidated Balance

Sheets

(in thousands, except share and

per share amounts)

(unaudited)

December 29,

2023

September 29,

2023

December 30,

2022

Assets

Current assets:

Cash and cash equivalents

$

79,955

$

75,933

$

86,470

Accounts receivable, net

66,721

103,350

136,321

Inventories

245,885

266,900

283,660

Prepaid expenses and other current

assets

8,804

5,142

7,007

Total current assets

401,365

451,325

513,458

Property and equipment, net

92,755

96,240

98,055

Operating lease right-of-use assets

36,611

36,948

40,557

Other noncurrent assets

11,912

12,079

12,926

Deferred tax assets, net

3,148

1,934

11,322

Intangible assets, net

57,288

60,456

72,022

Goodwill

335,402

335,402

335,402

Total assets

$

938,481

$

994,384

$

1,083,742

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$

60,490

$

74,011

$

110,165

Accrued liabilities

14,871

16,176

23,616

Other current liabilities

6,638

8,588

15,815

Current portion of long-term debt

7,500

7,500

7,500

Current portion of lease liabilities

9,463

9,393

9,196

Total current liabilities

98,962

115,668

166,292

Long-term debt, less current portion,

net

241,183

272,942

293,218

Lease liabilities, less current

portion

28,187

28,556

31,828

Deferred tax liabilities, net

1,169

29

29

Other non-current liabilities

4,303

4,510

4,879

Total liabilities

373,804

421,705

496,246

Shareholders’ equity:

Preferred shares ($0.0001 par value;

20,000,000 shares authorized; zero shares issued and

outstanding)

—

—

—

Ordinary shares ($0.0001 par value;

200,000,000 shares authorized; 29,435,398, 29,375,388, and

28,861,949 shares outstanding, respectively; 33,872,837,

33,812,827, and 33,299,388 shares issued, respectively)

3

3

3

Additional paid in capital

451,581

447,684

431,415

Treasury shares at cost (4,437,439

shares)

(91,578

)

(91,578

)

(91,578

)

Retained earnings

204,671

216,570

247,656

Total shareholders’ equity

564,677

572,679

587,496

Total liabilities and shareholders’

equity

$

938,481

$

994,384

$

1,083,742

ICHOR HOLDINGS, LTD.

Consolidated Statement of

Operations

(in thousands, except share and

per share amounts)

(unaudited)

Three Months Ended

Year Ended

December 29,

2023

September 29,

2023

December 30,

2022

December 29,

2023

December 30,

2022

Net sales

$

203,481

$

196,761

$

301,720

$

811,120

$

1,280,069

Cost of sales

183,136

172,692

252,809

707,724

1,068,205

Gross profit

20,345

24,069

48,911

103,396

211,864

Operating expenses:

Research and development

5,534

5,188

4,947

20,223

19,564

Selling, general, and administrative

19,601

20,066

22,007

79,334

88,572

Amortization of intangible assets

3,169

3,639

3,942

14,734

17,905

Total operating expenses

28,304

28,893

30,896

114,291

126,041

Operating income (loss)

(7,959

)

(4,824

)

18,015

(10,895

)

85,823

Interest expense, net

4,663

5,136

4,212

19,379

11,056

Other expense (income), net

(109

)

29

111

804

(563

)

Income (loss) before income taxes

(12,513

)

(9,989

)

13,692

(31,078

)

75,330

Income tax expense (benefit)

(614

)

436

(505

)

11,907

2,526

Net income (loss)

$

(11,899

)

$

(10,425

)

$

14,197

$

(42,985

)

$

72,804

Net income (loss) per share:

Basic

$

(0.40

)

$

(0.36

)

$

0.49

$

(1.47

)

$

2.54

Diluted

$

(0.40

)

$

(0.36

)

$

0.49

$

(1.47

)

$

2.51

Shares used to compute net income (loss)

per share:

Basic

29,404,548

29,297,347

28,830,505

29,200,796

28,714,550

Diluted

29,404,548

29,297,347

29,046,802

29,200,796

28,963,031

ICHOR HOLDINGS, LTD.

Consolidated Statements of

Cash Flows

(in thousands)

(unaudited)

Three Months Ended

Year Ended

December 29,

2023

September 29,

2023

December 30,

2022

December 29,

2023

December 30,

2022

Cash flows from operating activities:

Net income (loss)

$

(11,899

)

$

(10,425

)

$

14,197

$

(42,985

)

$

72,804

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

8,541

8,891

8,357

34,577

35,100

Share-based compensation

4,672

4,752

3,799

17,338

13,924

Deferred income taxes

(74

)

(661

)

(193

)

9,314

(3,215

)

Amortization of debt issuance costs

116

116

116

465

465

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable, net

36,629

(7,590

)

46,976

69,600

6,669

Inventories

21,015

(710

)

6,998

37,775

(47,527

)

Prepaid expenses and other assets

1,594

2,624

477

10,204

4,508

Accounts payable

(16,218

)

10,291

(31,667

)

(50,974

)

(50,175

)

Accrued liabilities

(2,660

)

(1,145

)

(3,175

)

(9,766

)

3,648

Other liabilities

(4,142

)

(2,155

)

(7,111

)

(17,916

)

(4,748

)

Net cash provided by operating

activities

37,574

3,988

38,774

57,632

31,453

Cash flows from investing activities:

Capital expenditures

(2,257

)

(2,405

)

(6,975

)

(15,496

)

(29,433

)

Cash paid for acquisitions, net of cash

acquired

—

—

—

—

500

Net cash used in investing activities

(2,257

)

(2,405

)

(6,975

)

(15,496

)

(28,933

)

Cash flows from financing activities:

Issuance of ordinary shares under

share-based compensation plans

1,370

2,170

675

7,521

3,768

Employees' taxes paid upon vesting of

restricted share units

(790

)

(553

)

(592

)

(3,672

)

(2,813

)

Borrowings on revolving credit

facility

—

—

—

—

25,000

Repayments on revolving credit

facility

(30,000

)

(10,000

)

—

(45,000

)

(10,000

)

Repayments on term loan

(1,875

)

(1,875

)

(1,875

)

(7,500

)

(7,500

)

Net cash provided by (used in) financing

activities

(31,295

)

(10,258

)

(1,792

)

(48,651

)

8,455

Net increase (decrease) in cash

4,022

(8,675

)

30,007

(6,515

)

10,975

Cash at beginning of period

75,933

84,608

56,463

86,470

75,495

Cash at end of period

$

79,955

$

75,933

$

86,470

$

79,955

$

86,470

Supplemental disclosures of cash flow

information:

Cash paid during the period for

interest

$

5,236

$

5,281

$

4,133

$

20,368

$

10,590

Cash paid during the period for taxes, net

of refunds

$

25

$

512

$

950

$

3,877

$

3,285

Supplemental disclosures of non-cash

activities:

Capital expenditures included in accounts

payable

$

625

$

145

$

1,543

$

625

$

1,543

Right-of-use assets obtained in exchange

for new operating lease liabilities, including those acquired

through acquisitions

$

1,686

$

—

$

6,731

$

4,789

$

17,889

ICHOR HOLDINGS, LTD.

Reconciliation of U.S. GAAP

Gross Profit to Non-GAAP Gross Profit

(dollars in thousands)

(unaudited)

Three Months Ended

Year Ended

December 29,

2023

September 29,

2023

December 30,

2022

December 29,

2023

December 30,

2022

U.S. GAAP gross profit

$

20,345

$

24,069

$

48,911

$

103,396

$

211,864

Non-GAAP adjustments:

Share-based compensation

778

840

501

3,130

2,056

Fair value adjustment to inventory from

acquisitions (1)

—

—

—

—

2,492

Other (2)

130

774

933

2,191

933

Non-GAAP gross profit

$

21,253

$

25,683

$

50,345

$

108,717

$

217,345

U.S. GAAP gross margin

10.0

%

12.2

%

16.2

%

12.7

%

16.6

%

Non-GAAP gross margin

10.4

%

13.1

%

16.7

%

13.4

%

17.0

%

(1)

As part of the purchase price allocation

of our acquisition of IMG Companies, LLC (“IMG”) in November 2021,

we recorded acquired-inventories at fair value, resulting in a fair

value step-up. This amount represents the release of the step-up to

cost of sales as acquired-inventories were sold.

(2)

Included in this amount are severance

costs associated with our global reduction-in-force programs.

ICHOR HOLDINGS, LTD.

Reconciliation of U.S. GAAP

Operating Income (Loss) to Non-GAAP Operating Income

(dollars in thousands)

(unaudited)

Three Months Ended

Year Ended

December 29,

2023

September 29,

2023

December 30,

2022

December 29,

2023

December 30,

2022

U.S. GAAP operating income (loss)

$

(7,959

)

$

(4,824

)

$

18,015

$

(10,895

)

$

85,823

Non-GAAP adjustments:

Amortization of intangible assets

3,169

3,639

3,942

14,734

17,905

Share-based compensation

4,672

4,752

3,799

17,338

13,924

Settlement loss (1)

—

—

—

—

4,146

Fair value adjustment to inventory from

acquisitions (2)

—

—

—

—

2,492

Acquisition costs (3)

—

—

—

—

296

Other (4)

181

793

1,144

2,298

1,144

Non-GAAP operating income

$

63

$

4,360

$

26,900

$

23,475

$

125,730

U.S. GAAP operating margin

(3.9

)%

(2.5

)%

6.0

%

(1.3

)%

6.7

%

Non-GAAP operating margin

0.0

%

2.2

%

8.9

%

2.9

%

9.8

%

(1)

During the first and third quarters of

2022, we recorded loss accruals of $3.1 million and $1.0 million,

respectively, relating to expected settlements of

employment-related legal matters.

(2)

As part of the purchase price allocation

of our acquisition of IMG, we recorded acquired-inventories at fair

value, resulting in a fair value step-up. This amount represents

the release of the step-up to cost of sales as acquired-inventories

were sold.

(3)

Included in this amount are

transaction-related costs incurred in connection with our

acquisition of IMG.

(4)

Included in this amount are severance

costs associated with our global reduction-in-force programs.

ICHOR HOLDINGS, LTD.

Reconciliation of U.S. GAAP

Net Income (Loss) to Non-GAAP Net Income (Loss)

(in thousands, except share and

per share amounts)

(unaudited)

Three Months Ended

Year Ended

December 29,

2023

September 29,

2023

December 30,

2022

December 29,

2023

December 30,

2022

U.S. GAAP net income (loss)

$

(11,899

)

$

(10,425

)

$

14,197

$

(42,985

)

$

72,804

Non-GAAP adjustments:

Amortization of intangible assets

3,169

3,639

3,942

14,734

17,905

Share-based compensation

4,672

4,752

3,799

17,338

13,924

Settlement loss (1)

—

—

—

—

4,146

Fair value adjustment to inventory from

acquisitions (2)

—

—

—

—

2,492

Acquisition costs (3)

—

—

—

—

296

Other (4)

181

793

1,144

2,298

1,144

Tax adjustments related to non-GAAP

adjustments (5)

2,202

3,338

(2,077

)

9,778

(7,848

)

Tax expense from valuation allowance

(6)

—

—

—

11,094

—

Non-GAAP net income (loss)

$

(1,675

)

$

2,097

$

21,005

$

12,257

$

104,863

U.S. GAAP diluted EPS

$

(0.40

)

$

(0.36

)

$

0.49

$

(1.47

)

$

2.51

Non-GAAP diluted EPS

$

(0.06

)

$

0.07

$

0.72

$

0.42

$

3.62

Shares used to compute diluted non-GAAP

EPS

29,404,548

29,733,904

29,046,802

29,514,553

28,963,031

(1)

During the first and third quarters of

2022, we recorded loss accruals of $3.1 million and $1.0 million,

respectively, relating to expected settlements of

employment-related legal matters.

(2)

As part of the purchase price allocation

of our acquisition of IMG, we recorded acquired-inventories at fair

value, resulting in a fair value step-up. This amount represents

the release of the step-up to cost of sales as acquired-inventories

were sold.

(3)

Included in this amount are

transaction-related costs incurred in connection with our

acquisition of IMG.

(4)

Included in this amount are severance

costs associated with our global reduction-in-force programs.

(5)

Adjusts U.S. GAAP income tax expense for

the impact of our non-GAAP adjustments, which are presented on a

gross basis, including the impacts of excluding share-based

compensation and amortization of intangible assets. The adjustment

reflects income tax benefits generated from U.S. taxable losses, on

a non-GAAP basis, as we do not have a valuation allowance against

our U.S. federal and state deferred tax assets on a non-GAAP basis.

Refer to footnote 6 below.

(6)

During the second quarter of 2023, we

recorded a valuation allowance of $11.1 million against our U.S.

federal and state deferred tax assets. The valuation allowance was

recorded based on an assessment of available positive and negative

evidence, including an estimate of being in a three-year cumulative

loss position in the U.S. by the end of 2023, projections of future

taxable income, and other quantitative and qualitative information.

On a non-GAAP basis, we added back the expense associated with our

recognition of a valuation allowance against our U.S. federal and

state deferred tax assets, because recording a valuation allowance

would not have been appropriate, as we were, and expect to remain,

in a three-year cumulative U.S. income position on a non-GAAP

basis.

ICHOR HOLDINGS, LTD.

Reconciliation of U.S. GAAP

Net Cash Provided by Operating Activities to Free Cash Flow

(in thousands)

(unaudited)

Three Months Ended

Year Ended

December 29,

2023

September 29,

2023

December 30,

2022

December 29,

2023

December 30,

2022

Net cash provided by operating

activities

$

37,574

$

3,988

$

38,774

$

57,632

$

31,453

Capital expenditures

(2,257

)

(2,405

)

(6,975

)

(15,496

)

(29,433

)

Free cash flow

$

35,317

$

1,583

$

31,799

$

42,136

$

2,020

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206414919/en/

Greg Swyt, CFO 510-897-5200 Claire McAdams, IR & Strategic

Initiatives 530-265-9899 ir@ichorsystems.com

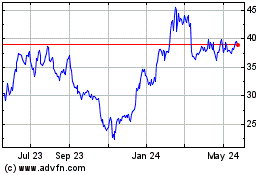

Ichor (NASDAQ:ICHR)

Historical Stock Chart

From Jan 2025 to Feb 2025

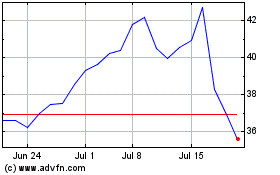

Ichor (NASDAQ:ICHR)

Historical Stock Chart

From Feb 2024 to Feb 2025