FILED BY HUT 8 MINING CORP.

COMMISSION FILE NO. 001-40487

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF

1933, AS AMENDED

SUBJECT COMPANY: U.S. DATA MINING GROUP, INC.

AND HUT 8 CORP.

The following is a partial transcript of the Hut

8 Mining Corp. Financial Results Analyst and Investor Call, dated November 14, 2023.

…

Jaime Leverton: “…You are all very well acquainted

with our commitment to hoddling our Bitcoin mines. And this year, while we worked to close the transaction with U.S. BTC, we continue

to have maintained our stack above 9,000 bitcoin, only selling production at opportune points throughout 2023 when we felt prices were

particularly strong, such as in the last month. We have not dipped into anything mine or huddled prior to 2023, which has been very intentional.

We remain bullish on Bitcoin, are committed to our treasury strategy and know that it remains a powerful differentiator for us…

…In addition, we made considerable progress as we work toward

closing our transaction with USBTC, which has been our North Star since we first announced the merger. On September 13, we announced

that our shareholders overwhelmingly approved the transaction through a special vote, which is incredibly encouraging because it reflects

how engaged and supportive they are of our merger of equals.

Five days later, we announced that we obtained a final order approving

the plan of arrangement with USBTC from the Supreme Court of British Columbia. We also continued to file updated amendment to our S-4

with the SEC. And on November 9, the SEC declared Hut 8 Corp.'s registration statement effective, which is a significant milestone

that we've been collectively working towards. Now that we have the effectiveness declaration between the SEC, we are very pleased to share

that we expect to close our transaction by November 30, subject to USBTC obtaining its required stockholder approval and the satisfaction

of other customary closing conditions.”

…

Shenif Visram: “As previously announced, the company has

continued to sell Bitcoin production to help fund operations while we work on closing the merger with USBTC.”

…

Joseph Vafi: “Nice to see progress here on the USBTC merger,

really great news. Maybe you could kind of outline for us the playbook there. I mean it's been a while. I'm sure you've got some good

plans in place. Do you have an outline or a playbook that you could share with us over the next few months as that merger closes?

And I would imagine you start to ramp some of that exahash capacity

at the USBTC facilities? And then I'll have a quick follow-up.”

Jaime Leverton: “Yes. I mean we've got quite a bit of

information about the deal, which we've shared in the past and it continues to be available on our website. So I encourage those of you

that want to refamiliarize yourselves with the details of the deal to refresh that deal deck. And as we touched on, so a very, very critical

milestone for us was achieving the effectiveness declaration from the SEC. And as I also mentioned earlier, assuming successful USBTC

stakeholder vote and other closing items we expect it to close by the end of November.

So really looking forward to getting things underway. And as we've

touched on, it's very much a merger of equals. Our facility is, obviously, entirely Canadian based between the mining sites and the data

centers. USBTC team focused on assets in the U.S. and both of us with a diversified strategy when it comes to revenue.

So a mix of fee-based revenue streams for us in -- with respect to

high-performance computing. And then as we think about the stack down the road, as I've touched on earlier as well. And then USBTC mix

of South mining of Bitcoin denominated revenue streams as well as their managed services business or managed infrastructure operations

as they've historically referred to it, which is a fee-based revenue stream as well as their hosting business. So really excited in a

pro forma where we continue to have the ability to kind of flex between our different lines of business and really take advantage of the

different momentum and swings we see in the market across high-performance computing and (inaudible) going into the halving. And then,

of course, very excited about the potential here with the power assets that we're working on in conjunction with Macquarie.”

…

George Sutton: “And my congrats on getting through the

SEC process. I know how challenging that's been. So I am curious from the USBTC side, they've made a lot of progress, including the Celsius

network deal. Can you just walk through sort of what's your -- what they're bringing to the table that may have changed since the announcement

and how that improves the value of the deal from your perspective?”

Jaime Leverton: “Yes. We're certainly very, very excited

with the progress that the team has made with the Southeast transaction. I'm not going to get into details on this call, but it is publicly

available information where things stand with respect to the Celsius transaction. Certainly that -- if that is ultimately successful and

close it out will be a nice addition to the new Hut (inaudible) internally. And again, as I touched on earlier, really like the diversified

nature of the USBTC business, and they've certainly been growing their fee-based revenue lines since we first started talking to them

almost a year ago with the managed services business, as I referenced and then the work that's being done on Celsius.

So certainly, very, very pleased with the progress that the team has

made over there and really looking forward to just bringing a whole team together and continuing the growth that we've been pursuing independently

together as one team.”

…

Cautionary Note Regarding Forward–Looking

Information

This press release includes “forward-looking

information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities

laws, respectively (collectively, “forward-looking information”). All information, other than statements of historical facts,

included in this press release that address activities, events or developments that the Company expects or anticipates will or may occur

in the future, including such things as future business strategy, competitive strengths, goals, expansion and growth of the Company’s

businesses, operations, plans and other such matters is forward-looking information. Forward-looking information is often identified by

the words “may”, “would”, “could”, “should”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions.

In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain

forward-looking information. Specifically, such forward-looking information included in this press release include, but are not limited

to, statements with respect to the following: the Company’s position and ability to seize opportunities in the digital asset industry;

the Company’s ability to advance the HODL strategy in the long-term; the Company’s growth strategy; expectations for other

economic, business, regulatory and/or competitive factors related to the Company or the Bitcoin industry generally; projected hash rate,

expenses and profitability; the ability of the Company to react to digital asset price volatility; fluctuating power and energy costs;

the ability of the Company to navigate increased network difficulty; the remediation of the operational issues at the Company’s

Drumheller facility, and the timing thereof; the expected outcomes of the Transaction, including New Hut's assets and financial position;

the ability of Hut 8 and USBTC to complete the Transaction on the terms described herein, or at all, including, receipt of required regulatory

approvals, USBTC stockholder approval, stock exchange approvals and satisfaction of other closing customary conditions; the expected timing

of the closing of the Transaction; the expected synergies related to the Transaction in respect of strategy, operations and other matters;

projections related to expansion; expectations related to New Hut’s hashrate and self-mining capacity; expected ESG efforts and

commitments; and the ability of New Hut to execute on future opportunities; the timing and completion (if at all) of a Stalking Horse

Bid; the timing and completion (if at all) of a proposed sale and investment solicitation process; the timing of the proceedings in respect

of the Receiver; and the expected resolution of litigation claims between Hut 8 and certain Validus Entities.

Statements containing forward-looking information

are not historical facts, but instead represent management’s expectations, estimates and projections regarding future events based

on certain material factors and assumptions at the time the statement was made. Material assumptions include: assumptions regarding the

level of demand and financial performance of the digital asset industry; effective tax rates; the U.S./Canadian dollar exchange rate;

inflation; access to capital; timing and receipt of regulatory approvals; acquisition and divestiture activities, operational expenses,

returns on investments, transaction costs, fluctuations in energy prices and the Company’s energy requirements, the ability to obtain

requisite approvals and the satisfaction of other conditions to the consummation of the Transaction and the Stalking Horse Bid on the

proposed terms or at all; the anticipated timeline for the completion of the Transaction and the Stalking Horse Bid; the ability to realize

the anticipated benefits of the Transaction and the Stalking Horse Bid; the ability to implement the business plan for New Hut, including

as a result of a delay in completing the Transaction or difficulty in integrating the businesses of the companies involved (including

the retention of key employees); the potential impact of the consummation of the Transaction on relationships, including with regulatory

bodies, employees, suppliers, customers, competitors and other key stakeholders; and the outcome of any litigation proceedings in respect

of the Company’s legal dispute with Validus.

Forward-looking information is necessarily based

on a number of opinions, assumptions and estimates that, while considered reasonable by Hut 8 as of the date of this press release, are

subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity,

performance or achievements to be materially different from those expressed or implied by such forward-looking information, including

but not limited to: security and cybersecurity threats and hacks; malicious actors or botnet obtaining control of processing power on

the Bitcoin network; further development and acceptance of the Bitcoin network; changes to Bitcoin mining difficulty; loss or destruction

of private keys; increases in fees for recording transactions in the Blockchain; erroneous transactions; reliance on a limited number

of key employees; reliance on third party mining pool service providers; regulatory changes; classification and tax changes; momentum

pricing risk; fraud and failure related to digital asset exchanges; difficulty in obtaining banking services and financing; difficulty

in obtaining insurance, permits and licenses; internet and power disruptions; geopolitical events; uncertainty in the development of

cryptographic and algorithmic protocols; uncertainty about the acceptance or widespread use of digital assets; failure to anticipate

technology innovations; climate change; currency risk, lending risk and recovery of potential losses; litigation risk; business integration

risk; changes in market demand; inflationary pressures and the rising cost of capital; changes in network and infrastructure; system

interruption; changes in leasing arrangements; counterparty risk; failure to achieve intended benefits of power purchase agreements;

potential for interrupted delivery, or suspension of the delivery, of energy to the Company’s mining sites; the Company’s

and USBTC’s ability to establish and maintain strategic collaborations, licensing or other arrangements, and the terms of and timing

such arrangements; the timing to consummate the Transaction; the failure to satisfy the conditions to close the Transaction; the inherent

risks, costs and uncertainties associated with not achieving all or any of the anticipated benefits and synergies of the Transaction,

or the risk that the anticipated benefits and synergies of the Transaction may not be fully realized or take longer to realize than expected;

the timing and completion (if at all) of the Stalking Horse Bid; statements with respect to the SISP; and the expected resolution of

litigation claims between Hut 8 and certain Validus Entities; the ability to implement business plans, forecasts, and other expectations;

the ability to identify and realize additional opportunities and other risks related to the digital asset mining and data centre business.

For a complete list of the factors that could affect the Company, please see the “Risk Factors” section of the Company’s

Annual Information Form dated March 9, 2023, and Hut 8’s other continuous disclosure documents which are available on

Company’s website at hut8.com, under the Company’s SEDAR+ profile at www.sedarplus.ca and under the Company’s

EDGAR profile at www.sec.gov.

These factors are not intended to represent a

complete list of the factors that could affect Hut 8, USBTC, or New Hut; however, these factors should be considered carefully. There

can be no assurance that such estimates and assumptions will prove to be correct. Should one or more of these risks or uncertainties materialize,

or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described

in this press release as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted

and such forward-looking statements included in this press release should not be unduly relied upon. The impact of any one assumption,

risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent

and Hut 8’s future decisions and actions will depend on management’s assessment of all information at the relevant time. The

forward-looking statements contained in this press release are made as of the date of this press release, and Hut 8 expressly disclaims

any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them,

whether as a result of new information, future events or otherwise, except as required by law. Except where otherwise indicated herein,

the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and will

not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring

after the date of preparation.

Additional Information About the Transaction

and Where to Find It

In connection with the transaction, that, if

completed, would result in New Hut becoming a new public company, New Hut has filed a registration statement on Form S-4 (as amended,

the “Registration Statement”) with the U.S. Securities and Exchange Commission’s ("SEC"). USBTC and Hut 8

urge investors, shareholders, and other interested persons to read the Registration Statement, including any amendments thereto, the

Hut 8 meeting circular, as well as other documents filed or to be filed with the SEC and documents to be filed with Canadian securities

regulatory authorities in connection with the transaction, as these materials do and will contain important information about USBTC,

Hut 8, New Hut and the transaction. New Hut also has, and will, file other documents regarding the transaction with the SEC. This press

release is not a substitute for the Registration Statement or any other documents that may be sent to Hut 8’s shareholders or USBTC's

stockholders in connection with the transaction. Investors and security holders are or will be able to obtain free copies of the Registration

Statement and all other relevant documents filed or that will be filed with the SEC by New Hut through the website maintained by the

SEC at www.sec.gov or by contacting the investor relations department of Hut 8 at info@hut8.io and of USBTC at info@usbitcoin.com.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction

exempt from the registration requirements of the Securities Act.

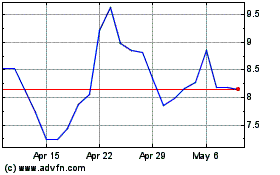

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

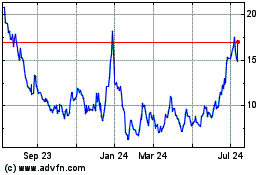

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024