FILED BY HUT 8 MINING CORP.

COMMISSION FILE NO. 001-40487

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF

1933, AS AMENDED

SUBJECT COMPANY: U.S. DATA MINING GROUP, INC. AND

HUT 8 CORP.

The following is a partial transcript of an interview

made available by Hashrate Happy Hour Podcast on Apple Podcasts on July 12, 2023.

Transcript: Ep. 21 Bitcoin Mining and Artificial

Intelligence

…

Interviewer: No, that was, that was perfect. Yeah. Um, I want

to go all the way back to the data centres that you guys actually acquired and then started bringing that into the fold. The reason I

want to go back to that is you mentioned it Compute North, they're like a neighbor to me personally, I'm in Minnesota. So, I live not

10 minutes from their old, old headquarters. They coined the term “tier-zero”. I would love to hear a little bit more about

that dynamic of operating tier-zero through, I'm not sure if your data centres are tier four, but what is the dynamic there? And I ask

that because I think the industry, the Bitcoin mining industry still has kind of this perception of running kind of grungy, you know,

shell of old manufacturing plant style operations. Could you maybe touch on how you guys are folding in traditional data centres to digital

mining assets?

Sue Ennis: Yeah, so in Canada right now, our traditional data

centres are completely separate from where our mining assets are located. But what we've been doing within those traditional data centres

is enabling Web3 customers to use them to toggle between different iterations of compute. We also just had our customer finish their first

generative text AI project in our data centres. So, but I think, you know, where we see really the worlds converging is one of the benefits,

at least from an infrastructure operator perspective of AI and machine learning is that it's a lot less latent, latency-sensitive than

a traditional, you know, high performance cloud and colo user is. And so, what that means is there’s not as much bells and whistles

that are needed other than, I mean, cooling in particular is very, very important.

So our perspective is, you know, when you have an operator like Hut

that, especially in a post-merger world, has a tremendous amount of access to power, understands how to scale infrastructure quickly.

So, for example, the team at US Bitcoin Corp, they were able to stand up I believe it was an EH within 43 days. And then you bring in

Hut’s, high performance computing expertise, so we understand these chips, we know how fast and how hot they can get. We know the

nuances of how these data centres need to be built is really where we see these two worlds converging and also standing up mining infrastructure

and then converting it into being able to support AI and ML is a lot cheaper capex than, let's just say, standing up traditionally to

sort of cater it to grow the AI side of the business. But then also in our traditional data centre business, we do have, I believe it's

about, like two thirds of our data centres are full and we are equipped with very robust cooling systems in our centers in Mississauga

and in our centres in Kelowna. As I said, these AI and machine learning training chips need a lot of cooling. That is a very important

piece of the operation. So, we are already able to you know, plug some in there and meet that demand. But yeah, moving forward, we think,

and we believe our expertise, our access to power, our understanding of space, our proximity to the AI and ML chip supply chain is very

unique as well. And again, it's really what we think is going to be a real, continue to be a real killer strategy. Moving past the halving,

again, given all the growth and demand in AI. And effectively, at the end of the day, Hut 8 is a call option on the growth of the AI space

and also if you're bullish on Bitcoin. So that's how we're looking at it.

…

Sue Ennis: Yeah, well, again, this merger that we're in the

middle of doing is incredibly transformative for our business. So, it would redomicile us to the US. We would pick up I think immediately

in a post pro forma post-merger world, it's 825 megawatts of power under management and that business again would have our traditional

5 vanilla data centres. We'd have a self-mining component of about 7 EH/s. We have about 220 megawatts of hosted infrastructure, so hosting

clients, and then 680 megawatts of infrastructure that is being managed by a piece of our business called Manage Infrastructure Operations.

And so that is effectively like, I don't know if this is the right analogy. I'm still sort of workshopping my analogy, but it's like a

We Work of mining services. So, you know, We Work, they would provide like the office maintenance, the suite of services, and just make

it very comfortable for customers or for We Work members to go in and do their work. So that is effectively what this managed infrastructure

operations business is. You know, we host the machines, we run our software platform on top of that to help clients achieve increased

efficiency.

It's really liked a white glove mining services offering. If you look

at the amount of non-publicly traded mining infrastructure that's being set up, in particular in the Middle East. There is quite a bit

of demand from sovereigns and other countries that are standing up this infrastructure where people are coming to us and saying, look,

we know that we need to get into this. We know we've got unlimited pockets to spend and cash to spend on ASICs and infrastructure and

all of that. But we need people who understand how to get this efficient, keep our operations efficient and effectively run these machines.

And so, this managed infrastructure operations piece of the business is a real strategic advantage for us, particularly going into the

next halving. Because again, the thinking was, do we continue to try and compete against the UAE to capture more hash rate? Or do we,

because that's incredibly capex intensive, or do we go and partner with them, earn revenue from being their partner, helping them maintain

maximum uptime and efficiency versus again, trying to go toe to toe with people who have unlimited cash. Right? And then again, while

we build out this data center strategy and continue to add to our stack, et cetera, et cetera. So that was our thinking. And that's a

piece of the business that we think is a major strategic advantage for us.

…

Sue Ennis: Yeah, I think honestly, you're going to see us be

a major, major player. Again, this is not an outlook. I'm not disclosing any formal outlook. I'm just saying philosophically, we are very,

very bullish on the fact that we're effectively in inning zero of AI. Like AI is disrupting all industry in the way that, you know, going

from sort of the way that mobile internet did is how we're looking at what AI is doing. And we effectively feel like we're in inning zero

and that all of this demand for this very unique non-latency sense of like AI, it doesn't have a home. And we are going to be able to

provide it with the tremendous amount of infrastructure and support that this, that this growing industry is going to, that this growing

technology is going to need. So, we're very, very bullish on that. It would not surprise me to be see Hut as being one of the major players.

And, yeah, so I would say you're definitely going to see, I would say philosophically, five years from now, Hut is a major infrastructure

provider, and really like an enterprise infrastructure as a service provider, a leading enterprise infrastructure as a service provider

that includes all iterations of compute, both traditional and nascent, is where you're going to see us in five years.

…

Cautionary Note Regarding Forward–Looking

Information

This communication includes “forward-looking

information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities

laws, respectively (collectively, “forward-looking information”). All information, other than statements of historical facts,

included in this communication that address activities, events or developments that the Company expects or anticipates will or may occur

in the future, including such things as future business strategy, competitive strengths, goals, expansion and growth of the Company’s

businesses, operations, plans and other such matters is forward-looking information. Forward-looking information is often identified by

the words “may”, “would”, “could”, “should”, “will”, “intend”,

“plan”, “anticipate”, “allow”, “believe”, “estimate”, “expect”,

“predict”, “can”, “might”, “potential”, “predict”, “is designed to”,

“likely” or similar expressions. In addition, any statements in this communication that refer to expectations, projections

or other characterizations of future events or circumstances contain forward-looking information and include, among others, statements

regarding: Bitcoin network dynamics; the Company’s ability to advance its longstanding HODL strategy; the Company’s ability

to produce additional Bitcoin and maintain existing rates of productivity at all sites; the Company’s ability to continue mining

digital assets efficiently; the sale of the Company’s Bitcoin production and the proposed use of proceeds from such sale; the Company’s

expected recurring revenue and growth rate from its high performance computing business; expectations related to Hut 8 Corp.’s hashrate

and self-mining capacity; the ability of Hut 8 and USBTC to complete the Transaction, including, receipt of required regulatory approvals,

shareholder approvals, court approvals, stock exchange approvals and satisfaction of other closing customary conditions; the expected

outcomes of the Transaction, including New Hut's assets and financial position; the expected synergies related to the Transaction in respect

of strategy, operations and other matters; and the Company’s ability to successfully navigate the current market.

Statements containing forward-looking information

are not historical facts, but instead represent management’s expectations, estimates and projections regarding future events based

on certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 as of the date of

this communication, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause

the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such

forward-looking information, including but not limited to, security and cybersecurity threats and hacks, malicious actors or botnet obtaining

control of processing power on the Bitcoin network, further development and acceptance of the Bitcoin network, changes to Bitcoin mining

difficulty, loss or destruction of private keys, increases in fees for recording transactions in the Blockchain, erroneous transactions,

reliance on a limited number of key employees, reliance on third party mining pool service providers, regulatory changes, classification

and tax changes, momentum pricing risk, fraud and failure related to digital asset exchanges, difficulty in obtaining banking services

and financing, difficulty in obtaining insurance, permits and licenses, internet and power disruptions, geopolitical events, uncertainty

in the development of cryptographic and algorithmic protocols, uncertainty about the acceptance or widespread use of digital assets, failure

to anticipate technology innovations, the COVID19 pandemic, climate change, currency risk, lending risk and recovery of potential losses,

litigation risk, business integration risk, changes in market demand, changes in network and infrastructure, system interruption, changes

in leasing arrangements, failure to achieve intended benefits of power purchase agreements, potential for interrupted delivery,

or suspension of the delivery, of energy to the Company’s mining sites, and other risks related to the digital asset and data centre

business. For a complete list of the factors that could affect the Company, please see the “Risk Factors” section of the Company’s

Annual Information Form dated March 9, 2023, and Hut 8’s other continuous disclosure documents which are available on the Company’s

profile on the System for Electronic Document Analysis and Retrieval at www.sedar.com and on the EDGAR section of the U.S. Securities

and Exchange Commission’s website at www.sec.gov.

These factors are not intended to represent a

complete list of the factors that could affect Hut 8; however, these factors should be considered carefully. There can be no assurance

that such estimates and assumptions will prove to be correct. Should one or more of these risks or uncertainties materialize, or should

assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described in this

communication as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted and

such forward-looking statements included in this communication should not be unduly relied upon. The impact of any one assumption, risk,

uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent

and Hut 8’s future decisions and actions will depend on management’s assessment of all information at the relevant time. The

forward-looking statements contained in this communication are made as of the date of this communication, and Hut 8 expressly disclaims

any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them,

whether as a result of new information, future events or otherwise, except as required by law.

Additional Information About the Transaction

and Where to Find It

In connection with the Transaction, that, if completed,

would result in New Hut becoming a new public company, Hut 8 Corp. ("New Hut”) has filed a registration statement on Form S-4

(the “Form S-4”) with the U.S. Securities and Exchange Commission (the “SEC”). USBTC and Hut 8 urge investors,

shareholders, and other interested persons to read the Form S-4, including any amendments thereto, the Hut meeting circular, as well as

other documents to be filed with the SEC and documents to be filed with Canadian securities regulatory authorities in connection with

the Transaction, as these materials will contain important information about USBTC, Hut 8, New Hut and the Transaction. New Hut also has,

and will, file other documents regarding the Transaction with the SEC. This communication is not a substitute for the Form S-4 or any

other documents that may be sent to Hut’s shareholders or USBTC's stockholders in connection with the Transaction. Investors and

security holders will be able to obtain free copies of the Form S-4 and all other relevant documents filed or that will be filed with

the SEC by New Hut through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Hut

8 at info@hut8.io and of USBTC at info@usbitcoin.com.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”) or in a transaction

exempt from the registration requirements of the Securities Act.

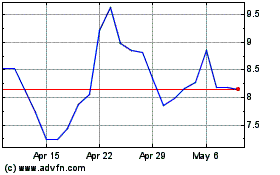

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

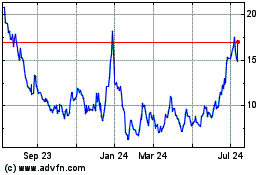

Hut 8 (NASDAQ:HUT)

Historical Stock Chart

From Jul 2023 to Jul 2024