HighPeak Energy, Inc. (“HighPeak” or the “Company”) (NASDAQ: HPK)

today announced the successful completion of a transformative debt

refinancing. The Company entered into a senior secured term loan

credit agreement (the “2023 Term Loan”) among the Company, as

borrower, Texas Capital Bank (“Texas Capital”), as Administrative

Agent, and Chambers Energy Management, LP (“Chambers”), as

Collateral Agent. The 2023 Term Loan has an aggregate principal

amount of $1.2 billion and a maturity date of September 30, 2026.

In addition, the 2023 Term Loan provides us with the ability to

enter into a super senior revolving credit facility in an amount up

to $100 million, providing HighPeak with flexibility to further

increase our committed financing.

Financing Update

The Company used a portion of the net proceeds

from the 2023 Term Loan to fully repay its 10.000% Senior Notes due

February 2024, its 10.625% Senior Notes due November 2024, its

outstanding borrowings under its reserve-based credit facility

dated as of December 17, 2020 (as amended from time to time, the

“2020 Credit Agreement”), and intends to utilize the remaining

proceeds for general corporate purposes. In connection with the

termination of the 2020 Credit Agreement, all outstanding

obligations for principal, interest and fees under the 2020 Credit

Agreement were paid in full, and all liens securing such

obligations and any letters of credit and hedging obligations, and

guarantees of such obligations, were released.

Loans under the 2023 Term Loan bear interest at

a rate per annum equal to the Adjusted Term SOFR (as defined in the

2023 Term Loan) plus an applicable margin of 7.50%. The loans are

guaranteed by the Company and are secured by a first lien security

interest in substantially all assets of the Company.

Key highlights of this milestone

refinancing include:

Debt Maturity Extension: The

2023 Term Loan streamlines the Company’s capital structure, extends

its debt maturities to September 2026 and secures its financial

position in an everchanging banking market by providing financial

certainty and removing the risks associated with standard borrowing

base redeterminations.

Increased Liquidity: The

refinancing, coupled with the ongoing increase in commodity prices,

has significantly increased the Company’s liquidity and financial

flexibility. HighPeak is currently generating free cash flow and

expects to begin reducing its debt balance moving forward. Proforma

for this refinancing and our recent public equity offering, our

liquidity at June 30, 2023 would have been approximately $200

million.

Jack Hightower, HighPeak Chairman and CEO,

commented on this significant development, saying, “This

refinancing marks a pivotal moment in our company's journey. The

combination of this debt refinancing and the equity offering

completed in July demonstrates that stakeholders on all sides of

the capital structure have a high level of confidence in our team

and our asset base. We would like to thank Texas Capital, Chambers

Energy, and the diversified, sophisticated energy lender group who

did a tremendous amount of due diligence and analysis on our

assets. This unparalleled transaction is one of the largest

privately arranged financings for a public energy company. The

unique structure provides the company with the ability to have a

long-term capital plan, financial security, and great flexibility

to repay the loan in advance. We are stronger, more resilient and

equipped to seize opportunities in this dynamic energy market. We

believe this newfound financial strength will enable the company to

pursue strategic opportunities and drive shareholder value.”

Company Update

In connection with the announcement of the

refinancing transaction, the Company provided the following

operational update. The Company’s third-quarter production has

continued to average over 50,000 Boe per day in line with our

expectations. The Company also provided the following update to its

proved developed reserves:

|

Proved Developed Reserves at August 1,

2023(1) |

|

|

|

|

|

|

| |

Net Proved Developed Reserves |

|

|

|

Reserve Category |

Oil(MMBbl) |

Gas(Bcf) |

NGL(MMBbl) |

Total (MMBoe) |

%Liquids |

PV-10(2)

($B) |

| Proved Developed Producing

(PDP) |

59.6 |

44.1 |

10.6 |

77.5 |

91% |

$2.37 |

| Proved Developed Non-Producing

(PDNP) |

11.2 |

4.3 |

1.2 |

13.1 |

95% |

$0.43 |

| Total Proved Developed

Reserves |

70.8 |

48.3 |

11.7 |

90.6 |

91% |

$2.81 |

|

|

|

|

|

|

|

|

| (1) Management estimates based

on flat pricing of $80/bbl and $3/mcf |

|

|

|

|

|

|

| (2) PV-10 is a non-GAAP

measure |

|

|

|

|

|

|

Hightower continued, “At current prices of

around $90 per barrel, the value of our proved developed reserves

increases to approximately $3.2 billion on a PV-10 basis. Our

proved developed reserves have increased approximately 50% from

year-end, which demonstrates the quality of our assets and our

ability to effectively develop our acreage position. Our ongoing

drilling campaign continues to highlight the value of our oil rich

reservoirs and the differentiated economics associated with our

large recoverable resource base. In response to favorable commodity

conditions and increased financial resources, we are planning on

adding a third drilling rig in the fourth quarter, further

bolstering our capacity to develop and extract valuable energy

resources. Our current third-quarter production of over 50,000 Boe

per day would generate an annualized EBITDA run-rate of

approximately $1.2 billion at current prices. The addition of

another drilling rig underscores our commitment to responsible and

efficient resource extraction, while our enhanced profitability

will benefit our shareholders.”

TCBI Securities, Inc., doing business as Texas

Capital Securities, served as financial advisor to HighPeak and

sole arranger of the 2023 Term Loan. Texas Capital Bank is serving

as Administrative Agent and Chambers Energy Management, LP, is

serving as Collateral Agent for the 2023 Term Loan.

HighPeak remains dedicated to adhering to

industry best practices in environmental sustainability, safety,

and corporate responsibility throughout its operations. For more

information about HighPeak Energy and its recent refinancing,

please visit www.highpeakenergy.com.

About HighPeak Energy, Inc.

HighPeak Energy, Inc. is a publicly traded

independent crude oil and natural gas company, headquartered in

Fort Worth, Texas, focused on the acquisition, development,

exploration and exploitation of unconventional crude oil and

natural gas reserves in the Midland Basin in West Texas.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, with respect to

the offering and the use of proceeds. These forward-looking

statements represent the Company’s expectations or beliefs

concerning future events. These forward-looking statements are

subject to risks and uncertainties related to market conditions and

the satisfaction of customary closing conditions related to the

offering. There can be no assurance that the Company will be able

to complete the offering. When used in this document, including any

oral statements made in connection therewith, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” the negative of such terms and

other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. These forward-looking statements are based

on management’s current expectations and assumptions about future

events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required

by applicable law, the Company disclaims any duty to update any

forward-looking statements, all of which are expressly qualified by

the statements in this section, to reflect events or circumstances

after the date on which they are made. The Company cautions you

that these forward-looking statements are subject to all of the

risks and uncertainties, most of which are difficult to predict and

many of which are beyond the control of the Company, incident to

the development, production, gathering and sale of oil, natural gas

and natural gas liquids.

These risks and uncertainties include, among

other things, the results of the strategic review being undertaken

by the Company’s Board and the interest of prospective

counterparties, the Company’s ability to realize the results

contemplated by the updated 2023 guidance, volatility of commodity

prices, product supply and demand, the impact of a widespread

outbreak of an illness, such as the coronavirus disease pandemic,

on global and U.S. economic activity, competition, the ability to

obtain environmental and other permits and the timing thereof,

other government regulation or action, the ability to obtain

approvals from third parties and negotiate agreements with third

parties on mutually acceptable terms, litigation, the costs and

results of drilling and operations, availability of equipment,

services, resources and personnel required to perform the Company's

drilling and operating activities, access to and availability of

transportation, processing, fractionation, refining and storage

facilities, HighPeak Energy's ability to replace reserves,

implement its business plans or complete its development activities

as scheduled, access to and cost of capital, the financial strength

of counterparties to any credit facility and derivative contracts

entered into by HighPeak Energy, if any, and purchasers of HighPeak

Energy's oil, natural gas liquids and natural gas production,

uncertainties about estimates of reserves, identification of

drilling locations and the ability to add proved reserves in the

future, the assumptions underlying forecasts, including forecasts

of production, expenses, cash flow from sales of oil and gas and

tax rates, quality of technical data, environmental and weather

risks, including the possible impacts of climate change,

cybersecurity risks and acts of war or terrorism. These and other

risks are described in the Company's Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K and

other filings with the SEC. The Company undertakes no duty to

publicly update these statements except as required by law.

Investor Contact:

Ryan HightowerVice President, Business

Development817.850.9204rhightower@highpeakenergy.com

Source: HighPeak Energy, Inc.

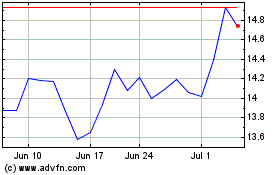

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Nov 2024 to Dec 2024

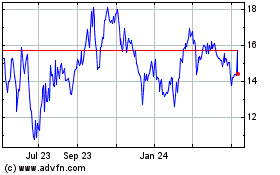

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Dec 2023 to Dec 2024