CardioNet, Inc. Updates Full Year 2009 Guidance, Industry Dynamics and Future Strategies

June 30 2009 - 8:05PM

Business Wire

CardioNet (Nasdaq:BEAT), a leading wireless medical technology

company with an initial focus on the diagnosis and monitoring of

cardiac arrhythmias, announced today an adjustment to its

previously stated full year 2009 financial guidance.

The Company is revising its revenue guidance for full year 2009

to reflect growth of 30%-33% compared to the full year 2008 and now

expects revenue for 2009 to be in the range of $156 million to $160

million. The revenue guidance is based on lower than anticipated

commercial reimbursement rates. Volume growth continues to be

significant, but is expected to be somewhat lower than the Company

had anticipated. The Company believes that the long-term outlook

for its business and the wireless healthcare industry remains

highly attractive, and CardioNet intends to continue its previously

announced investments in its sales and marketing organization,

product development and clinical research programs. Other areas of

spending will be curtailed and restructured to partially offset the

negative price and volume dynamics. Accordingly, the Company is now

expecting adjusted earnings per diluted share for full year 2009 to

be in the range of $0.30 to $0.35 excluding any impact of NOLs,

other tax related items and any nonrecurring charges, with the

majority of the impact affecting results in the second half of

2009. At this time, the Company is not in a position to provide

revenue or earnings guidance for 2010 and 2011. The Company may

issue such guidance if greater certainty develops with respect to

long-term reimbursement and physician adoption. CardioNet�s balance

sheet remains strong with no debt and substantial cash.

Randy Thurman, Chairman, President and Chief Executive Officer

of CardioNet said, �With nearly 250,000 patients monitored, over

200 million covered lives and 28 completed clinical research

studies, CardioNet is the unquestioned leader in mobile cardiac

outpatient telemetry. The Company continues to develop clinically

relevant product innovations, as demonstrated by the recent

introduction of SomNetTM, a new clinical indicator for common sleep

disorders. While only on the market for two weeks, CardioNet has

seen over 100 physician practices enroll in the program.

Additionally, the Company just completed training for its expanded

sales organization and expects to have over 140 experienced

cardiology account executives fully deployed beginning in the third

quarter of 2009. CardioNet believes this will be the largest sales

organization in the world dedicated to wireless healthcare. The

second half of the year will also be marked by the Company�s entry

into the hospital and cardiac thoracic surgery markets and by the

nationwide introduction of new physician programs aimed at

accelerating the use of MCOT.�

The Company also intends to expand its business base with the

previously announced acquisition of Biotel Inc., which includes the

leading wireless event monitor and accelerates development of

CardioNet�s wireless MCOT technology. In addition to giving

CardioNet what the Company sees as the best array of product

technology in the industry, Biotel positions the Company to enter

the clinical research industry through Biotel�s Agility division.

To illustrate the attractiveness of this strategy, CardioNet was

just selected by a major global pharmaceutical company to provide

clinical research support for drug development. Biotel�s Agility

division will accelerate growth of this attractive source of

revenue that is not directly subject to reimbursement dynamics.

Strategic and synergistic acquisitions are likely to be an

important aspect of the Company�s future.

Randy Thurman added, �Year to date our MCOT� patient volume is

up over 60% compared to prior year and projected to be up over 60%

for the full year. While revenue is somewhat lower than planned,

earnings will also reflect our investments for long-term growth and

the anticipated lower commercial reimbursements rates. We believe

the dynamics of robust growth in a highly cost conscious healthcare

reform market will continue long-term. As such, CardioNet will be

structured to produce long-term shareholder value in that

environment.

�CardioNet is the pioneer in the field of wireless cardiac

arrhythmia monitoring and diagnosis. In contrast to healthcare

technologies that have long existed, we are in the challenging

position of forecasting the future growth of a revolutionary new

technology in the midst of dramatic healthcare reform and

overwhelming pressure on costs. As we continue to build our

leadership position with MCOT�, forecasting the business results

will become more certain.

�We remain confident that wireless healthcare technologies will

be one of the most dramatic, revolutionary changes in human health

for the next decade and beyond. We believe that the cost benefit

advantages and superior clinical outcomes of technologies such as

MCOT� will prevail even in this cost driven reimbursement

environment. With our proven platform technology, expanding

wireless applications and entry into new related business segments,

CardioNet, our physicians, patients and shareholders are positioned

to benefit from our strategy over the long term.�

Conference Call

CardioNet, Inc. will host an earnings conference call on

Wednesday, July 1, 2009, at 8:30 AM Eastern Time. The call will be

simultaneously webcast on the investor information page of the

Company�s website, www.cardionet.com. The call will be archived on

the Company�s website and will also be available for two weeks via

phone at 1-888-286-8010, access code 51216355.

CardioNet is the leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual's health.

CardioNet's initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias, or heart rhythm disorders, with

a solution that it markets as Mobile Cardiac Outpatient TelemetryTM

(MCOT�). More information can be found at

http://www.cardionet.com.

Forward-Looking Statements

This press release includes certain forward-looking statements

within the meaning of the "Safe Harbor" provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our growth prospects, the prospects for our products and

our confidence in the Company's future. These statements may be

identified by words such as "expect," "anticipate," "estimate,"

"intend," "plan," "believe," "promises" and other words and terms

of similar meaning. Such forward-looking statements are based on

current expectations and involve inherent risks and uncertainties,

including important factors that could delay, divert, or change any

of them, and could cause actual outcomes and results to differ

materially from current expectations. These factors include, among

other things, the success of our sales and marketing initiatives,

our ability to attract and retain talented executive management and

sales personnel, our ability to identify acquisition candidates,

acquire them on attractive terms and integrate their operations

into our business, the commercialization of new products, market

factors, internal research and development initiatives, partnered

research and development initiatives, competitive product

development, changes in governmental regulations and legislation,

changes to reimbursement levels for our products, the continued

consolidation of payors, acceptance of our new products and

services and patent protection and litigation. For further details

and a discussion of these and other risks and uncertainties, please

see our public filings with the Securities and Exchange Commission,

including our latest periodic reports on Form 10-K and 10-Q. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

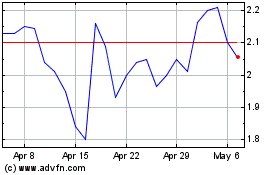

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

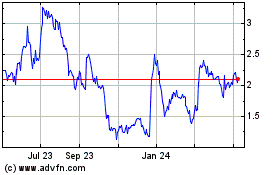

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024