0001172222false00011722222024-07-242024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 24, 2024

HAWAIIAN HOLDINGS INC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-31443 | | 71-0879698 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

3375 Koapaka Street, Suite G-350

Honolulu, HI 96819

(Address of principal executive offices, including zip code)

(808) 835-3700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock | HA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Indenture Governing 11.000% Senior Secured Notes due 2029

On July 26, 2024, Hawaiian Airlines, Inc. (“Hawaiian”), a direct wholly owned subsidiary of Hawaiian Holdings, Inc. (“Holdings” or the “Company”) announced that Hawaiian Brand Intellectual Property, Ltd. (the “Brand Issuer”), an exempted company incorporated with limited liability under the laws of the Cayman Islands and an indirect wholly owned subsidiary of Hawaiian, and HawaiianMiles Loyalty, Ltd. (the “Loyalty Issuer”), an exempted company incorporated with limited liability under the laws of the Cayman Islands and an indirect wholly owned subsidiary of Hawaiian (and, together with the Brand Issuer, the “Issuers” and each, an “Issuer”), completed their previously announced offer to exchange (the “Exchange Offer”) any and all of their outstanding 5.750% Senior Secured Notes due 2026 (the “Existing Notes”) for the Issuers’ 11.000% Senior Secured Notes due 2029 (the “New Notes”) and cash.

In connection with the Exchange Offer, the Issuers issued $984,829,525 aggregate principal amount of New Notes. The New Notes are fully and unconditionally guaranteed, jointly and severally, by (i) Hawaiian Finance 1, Ltd., a direct wholly owned subsidiary of Hawaiian (“HoldCo 1”), (ii) Hawaiian Finance 2, Ltd., a direct subsidiary of HoldCo 1 and indirect wholly owned subsidiary of Hawaiian (“HoldCo 2” and, together with HoldCo 1, the “Cayman Guarantors”), (iii) Hawaiian and (iv) Holdings (Holdings, together with Hawaiian, the “Parent Guarantors” and the Parent Guarantors, together with the Cayman Guarantors, the “Guarantors”). The New Notes were issued pursuant to an Indenture, dated as of July 26, 2024 (the “New Notes Indenture”), among the Issuers, the Guarantors and Wilmington Trust, National Association, as trustee, collateral agent and collateral custodian. The Issuers will not receive any cash proceeds from the Exchange Offer and Consent Solicitation (as defined below). The New Notes will mature on April 15, 2029. The New Notes bear interest at a rate of 11.000% per year, payable quarterly in arrears on January 20, April 20, July 20 and October 20 of each year, beginning on October 20, 2024.

Hawaiian previously contributed to the Brand Issuer, which is a subsidiary structured to be bankruptcy remote, all worldwide rights, owned or purported to be owned, or later developed or acquired and owned or purported to be owned, by Hawaiian or any of its subsidiaries, in and to all intellectual property, including all trademarks, service marks, brand names, designs, and logos that include the word “Hawaiian” or any successor brand and the “hawaiianairlines.com” domain name and similar domain names or any successor domain names (the “Brand IP”).

Further, Hawaiian previously contributed to the Loyalty Issuer its rights to certain other collateral owned by Hawaiian, including, to the extent permitted by such agreements or otherwise by operation of law, any of Hawaiian’s rights under the HawaiianMiles Agreements and the IP Agreements (each as defined in the New Notes Indenture), together with HawaiianMiles program (“HawaiianMiles”) customer data and certain other intellectual property owned or purported to be owned, or later developed or acquired and owned or purported to be owned, by Hawaiian or any of its subsidiaries (including the Issuers) and required or necessary to operate HawaiianMiles (the “Loyalty Program IP”) (all such collateral being, the “Loyalty Program Collateral”).

Terms of the New Notes

The terms of the New Notes are described below.

The New Notes are secured on a senior basis by first-priority security interests in substantially all of the assets of the Brand Issuer and the Cayman Guarantors, other than Excluded Property (as defined in the New Notes Indenture) and subject to certain permitted liens (collectively, the “Brand Collateral”), and by a first priority security interest in the Loyalty Collateral (as defined in the New Notes Indenture). The note guarantees of Hawaiian are secured by (i) a first-priority security interest in 100% of the equity (other than the special share issued to the Special Shareholder (as defined in the New Notes Indenture)) of HoldCo 1 and (ii) the Brand IP and the Loyalty Program Collateral (collectively, the “Hawaiian Collateral”). The note guarantees of the Cayman Guarantors are secured by first-priority security interests in substantially all of the assets of the Cayman Guarantors, including pledges of the equity of their respective subsidiaries (other than (i) the equity interests in the Loyalty Issuer and (ii) the special share issued to the Special Shareholder (as defined in the New Notes Indenture)) (collectively, the “Subsidiary Collateral” and, together with the Brand Collateral, the Loyalty Collateral and the Hawaiian Collateral, the “Collateral”). The note guarantee of Holdings is unsecured.

The New Notes and the note guarantees of the Guarantors (i) rank equally in right of payment with all of the Issuers’ and the Guarantors’ existing and future senior indebtedness (including the Existing Notes and related guarantees of the Guarantors thereunder), (ii) other than with respect to the Holdings note guarantee, which is unsecured, are effectively senior to all existing and future indebtedness of the Issuers and the Guarantors that is not secured by a

lien, or is secured by a junior-priority lien, on the Collateral (as defined in the New Notes Indenture), to the extent of the value of the Collateral securing the New Notes, (iii) are effectively subordinated to any existing or future indebtedness of the Issuers and the Guarantors that is secured by liens on assets that do not constitute a part of the Collateral, to the extent of the value of such assets, (iv) rank senior in right of payment to the Issuers’ and the Guarantors’ future subordinated indebtedness and (v) rank equally and ratably with the Existing Notes with respect to the Loyalty Collateral (as defined in the New Notes Indenture). Because holders of Existing Notes not tendered in the Exchange Offer and Consent Solicitation will continue to be secured on a pari passu basis with the New Notes in the Loyalty Collateral (as defined in the New Notes Indenture), but will not be secured by the Separate Collateral (as defined in the New Notes Indenture), the New Notes will be effectively senior to any Existing Notes not tendered in the Exchange Offer and Consent Solicitation to the extent of the value of the Separate Collateral. The Issuers and Cayman Guarantors are currently Hawaiian’s only material subsidiaries and Hawaiian is Holdings’ only material subsidiary. To the extent Hawaiian creates or acquires any other subsidiaries in the future, the New Notes and note guarantees will also be structurally subordinated to all existing and future obligations, including trade payables, of any such newly formed or after-acquired subsidiaries that do not guarantee the New Notes.

The New Notes are redeemable at the option of the Issuers, in whole or in part, at any time and from time to time, after January 15, 2027 at the redemption prices set forth in the New Notes Indenture. In addition, the New Notes are redeemable, at the option of the Issuers, at any time and from time to time, in whole or in part, prior to January 15, 2027 at a price equal to 100% of their principal amount plus the Prepayment Premium (as defined in the New Notes Indenture) and accrued and unpaid interest, if any, thereon to, but excluding, the redemption date. The Issuers may also redeem the New Notes, in whole or in part, during the period beginning on the closing date of the Merger (as defined in the New Notes Indenture) and ending on the 180th calendar day following the closing date of the Merger, at a price equal to 100% of their principal amount plus accrued and unpaid interest, if any, thereon to, but excluding, the redemption date. Additionally, from time to time on or prior to January 15, 2027, the Issuers may also redeem up to 40% of the original outstanding principal amount of the New Notes with proceeds from any one or more equity offerings of Hawaiian at a redemption price equal to 111% of the principal amount of New Notes to be redeemed, plus accrued and unpaid interest, if any, thereon to, but excluding, the redemption date, subject to certain restrictions. Upon the occurrence of certain mandatory prepayment events and mandatory repurchase offer events, the Issuers will be required to make a prepayment on the New Notes, or offer to repurchase the New Notes, pro rata to the extent of any net cash proceeds received in connection with such events, at a price equal to 100% of the principal amount to be prepaid, plus, in some cases, an applicable premium. In addition, upon a change of control of Hawaiian (other than the Merger), the Issuers may be required to make an offer to prepay the New Notes at a price equal to 101% of the respective principal amounts thereof, plus accrued and unpaid interest, if any, to, but not including, the purchase date.

The New Notes Indenture contains certain covenants that limit the ability of the Issuers, the Cayman Guarantors and, in certain circumstances, Hawaiian to, among other things: (i) make Restricted Payments (as defined in the New Notes Indenture), (ii) incur additional indebtedness, (iii) create certain liens on the Collateral, (iv) sell or otherwise dispose of the Collateral and (v) consolidate, merge, sell or otherwise dispose of all or substantially all of the Issuers’ assets.

The New Notes Indenture also requires the Issuers and, in certain circumstances, Hawaiian, to comply with certain affirmative covenants, including depositing the Transaction Revenues (as defined in the New Notes Indenture) in collection accounts, with amounts to be distributed for the payment of fees, principal and interest on the New Notes pursuant to a payment waterfall described in the New Notes Indenture, and certain financial reporting requirements. In addition, the New Notes Indenture requires Hawaiian to maintain minimum liquidity at the end of any business day of at least $300 million.

Subject to certain materiality thresholds, qualifications, exceptions, “baskets” and grace and cure periods, the New Notes Indenture also includes certain customary events of default, including payment defaults, covenant defaults, cross-defaults to certain indebtedness, bankruptcy events, and a change of control of an Issuer. Upon the occurrence of an event of default, at the discretion of the Permitted Noteholders (as defined in the New Notes Indenture), the outstanding obligations under the New Notes Indenture may be accelerated and become due and payable immediately.

The foregoing summary of the New Notes Indenture and the New Notes is not complete and is qualified in its entirety by reference to the full and complete text of the New Notes Indenture and the New Notes, which the Company intends to file with the Securities and Exchange Commission (“SEC”) with its Quarterly Report on Form 10-Q.

Amendments to Indenture Governing 5.750% Senior Secured Notes due 2026

In connection with the Exchange Offer, the Issuers solicited (the “Consent Solicitation” and, together with the Exchange Offer, the “Exchange Offer and Consent Solicitation”) consents (the “Consents”) to the adoption of certain amendments described below (the “Proposed Amendments”) to the indenture governing the Existing Notes. Eligible Holders who tendered their Existing Notes pursuant to the Exchange Offer also were required to deliver Consents to the Proposed Amendments. Eligible Holders could not deliver Consents to the Proposed Amendments without also validly tendering their Existing Notes.

In connection with the Exchange Offer and Consent Solicitation, the Issuers received the necessary Consents to effect the Proposed Amendments which were effected by the First Supplemental Indenture, dated July 26, 2024 (the “Supplemental Indenture”), to the Indenture dated as of February 4, 2021, by and among the Issuers, the Guarantors and Wilmington Trust, National Association, as trustee (the “Existing Notes Trustee”), collateral agent (the “Existing Collateral Agent”) and collateral custodian (the “Existing Notes Indenture”). The Proposed Amendments (i) eliminate substantially all restrictive covenants and certain of the default provisions contained in the Indenture, dated as of February 4, 2021 (“Existing Notes Indenture”) and (ii) remove the Separate Collateral currently securing the Existing Notes. In addition, the Issuers, the Existing Notes Trustee and Existing Collateral Agent, as applicable, entered into amendments to the Existing Notes (the “Amended Existing Notes”) and the Transaction Documents (as defined in the Existing Notes Indenture) necessary to effect the Proposed Amendments and the release of the Separate Collateral currently securing the Existing Notes.

The foregoing summary of the Supplemental Indenture and the Amended Existing Notes is not complete and is qualified in its entirety by reference to the full and complete text of the Supplemental Indenture and the Amended Existing Notes, which the Company intends to file with the SEC with its Quarterly Report on Form 10-Q.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information described under Item 1.01 above is hereby incorporated by reference into this Item 2.03.

Item 7.01. Regulation FD Disclosure.

On July 24, 2024, the Company announced that the Issuers released the final results for the Exchange Offer and Consent Solicitation following the expiration thereof.

The Exchange Offer and Consent Solicitation was made solely to Eligible Holders upon the terms and subject to the conditions set forth in the confidential offering memorandum and solicitation statement, and the related letter of transmittal, each dated June 24, 2024. The Exchange Offer and Consent Solicitation was made only (a) in the United States, to holders of Existing Notes who were reasonably believed to be “qualified institutional buyers,” as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and (b) outside the United States, to holders of Existing Notes who are not “U.S. persons” (as defined in Regulation S under the Securities Act) in offshore transactions in compliance with Regulation S (“Eligible Holders”).

On July 24, 2024, the Company issued a press release announcing the expiration of and final results for the Exchange Offer (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

The information furnished in this Item 7.01 and in Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and unless expressly set forth by specific reference in such filings, shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and regardless of any general incorporation language in such filings.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | |

| | | |

| Exhibit No. | | Exhibit Description | |

| | |

| | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: July 26, 2024 | |

| | |

| | HAWAIIAN HOLDINGS, INC. |

| | |

| | | | |

| | By: | /s/ Aaron J. Alter |

| | | Name: | Aaron J. Alter |

| | | Title: | Executive Vice President, Chief Legal Officer and Corporate Secretary |

NEWS

| | | | | | | | |

FOR IMMEDIATE RELEASE

July 24, 2024 | | Contact: Hawaiian Airlines Public Relations News@HawaiianAir.com |

HAWAIIAN AIRLINES ANNOUNCES EXPIRATION OF AND RESULTS FOR PREVIOUSLY ANNOUNCED PRIVATE EXCHANGE OFFER FOR ITS OUTSTANDING 5.750% SENIOR SECURED NOTES DUE 2026 AND CONSENT SOLICITATION

Honolulu, Hawai‘i – July 24, 2024 – Hawaiian Airlines, Inc. (the “Company”) today announced that Hawaiian Brand Intellectual Property, Ltd. (the “Brand Issuer”), an exempted company incorporated with limited liability under the laws of the Cayman Islands and an indirect wholly owned subsidiary of the Company, and HawaiianMiles Loyalty, Ltd. (the “Loyalty Issuer”), an exempted company incorporated with limited liability under the laws of the Cayman Islands and an indirect wholly owned subsidiary of the Company (and, together with the Brand Issuer, the “Issuers” and each, an “Issuer”), have released the final results for their previously announced offer to exchange (the “Exchange Offer”) any and all of their outstanding 5.750% Senior Secured Notes due 2026 (the “Existing Notes”) held by Eligible Holders, as defined below, for the Issuers’ 11.000% Senior Secured Notes due 2029 (the “New Notes”) and cash following the expiration of the Exchange Offer.

In connection with the Exchange Offer, the Issuers solicited (the “Consent Solicitation” and, together with the Exchange Offer, the “Exchange Offer and Consent Solicitation”) consents (the “Consents”) to the adoption of certain amendments (the “Proposed Amendments”) to the indenture governing the Existing Notes. Eligible Holders who tendered their Existing Notes pursuant to the Exchange Offer also were required to deliver Consents to the Proposed Amendments. Eligible Holders could not deliver Consents to the Proposed Amendments without also validly tendering their Existing Notes.

As of the Expiration Time of 5:00 p.m., New York City time, on July 24, 2024, according to information provided by Global Bondholder Services Corporation, the Information and Exchange Agent for the Exchange Offer and Consent Solicitation, $1,193,732,902 aggregate principal amount (or approximately 99.5% of the outstanding principal amount) of the Existing Notes had been validly tendered and not validly withdrawn in the Exchange Offer. Subject to satisfaction or waiver of the conditions set forth in the Exchange Offer Materials (as defined below), settlement of the Exchange Offer is expected to occur on July 26, 2024 (the “Settlement Date”).

The Exchange Consideration (as defined in the Offering Memorandum, which is defined below) will be paid to holders of Existing Notes validly tendered after the Early Exchange Time but at or prior to the Expiration Time and accepted by the Issuers for exchange, which will result in a payment on the Settlement Date to such holders of $825.0 of New Notes and $125.0 in cash for every $1,000 principal amount of Existing Notes tendered.

The Total Exchange Consideration (as defined in the Offering Memorandum), which includes the Early Exchange Payment (as defined in the Offering Memorandum) of $50.0 in cash per $1,000 principal

amount of Existing Notes, will be paid to holders of Existing Notes validly tendered on or prior to the Early Exchange Time and accepted by the Issuers for exchange, which will result in a payment on the Settlement Date to such holders of $825.0 of New Notes and $175.0 in cash for every $1,000 principal amount of Existing Notes tendered.

Holders of Existing Notes accepted in the Exchange Offer as of the Early Exchange Time will also receive a cash interest payment for each $1,000 principal amount of Existing Notes exchanged, representing interest, if any, that has accrued from the most recent interest payment date in respect of the Existing Notes up to, but not including, the Settlement Date.

The Exchange Offer was made solely to Eligible Holders upon the terms and subject to the conditions set forth in the confidential offering memorandum and solicitation statement (the “Offering Memorandum”) and the related letter of transmittal, each dated June 24, 2024 (“Exchange Offer Materials”).

The Exchange Offer and Consent Solicitation was made only (a) in the United States, to holders of Existing Notes who were reasonably believed to be “qualified institutional buyers,” as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and (b) outside the United States, to holders of Existing Notes who are not “U.S. persons” (as defined in Regulation S under the Securities Act) in offshore transactions in compliance with Regulation S. We refer to the holders of Existing Notes who have certified that they were eligible to participate in the Exchange Offer and Consent Solicitation pursuant to at least one of the foregoing conditions as “Eligible Holders.”

This press release is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any securities. The Exchange Offer and Consent Solicitation is being made and the New Notes are being offered only to “qualified institutional buyers” and holders that are not “U.S. persons” as such terms are defined under the Securities Act. The New Notes have not been registered under the Securities Act or under any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act, and, accordingly, are subject to significant restrictions on transfer and resale as more fully described in the Exchange Offer Materials. The Exchange Offer and Consent Solicitation is subject to the terms and conditions set forth in the Exchange Offer Materials.

About the Company

Now in its 95th year of continuous service, Hawaiian is Hawaiʻi's largest and longest-serving airline. Hawaiian offers approximately 150 daily flights within the Hawaiian Islands, and nonstop flights between Hawaiʻi and 16 U.S. gateway cities – more than any other airline – as well as service connecting Honolulu and American Samoa, Australia, Cook Islands, Japan, New Zealand, South Korea and Tahiti.

Consumer surveys by Condé Nast Traveler and TripAdvisor have placed Hawaiian among the top of all domestic airlines serving Hawaiʻi. The carrier was named Hawaiʻi's best employer by Forbes in 2022 and has topped Travel + Leisure’s World’s Best list as the No. 1 U.S. airline for the past two years. Hawaiian has also led all U.S. carriers in on-time performance for 18 consecutive years (2004-2021) as reported by the U.S. Department of Transportation.

The airline is committed to connecting people with aloha by offering complimentary meals for all guests on transpacific routes and the convenience of no change fees on Main Cabin and Premium Cabin seats. HawaiianMiles members also enjoy flexibility with miles that never expire. As Hawai‘i’s hometown airline, Hawaiian encourages guests to Travel Pono and experience the islands safely and respectfully.

Hawaiian Airlines, Inc. is a subsidiary of Hawaiian Holdings, Inc. (NASDAQ: HA). Additional information is available at HawaiianAirlines.com. Follow Hawaiian’s Twitter updates (@HawaiianAir), become a fan on Facebook (Hawaiian Airlines), and follow us on Instagram (hawaiianairlines). For career postings and updates, follow Hawaiian’s LinkedIn page.

For media inquiries, please visit Hawaiian Airlines’ online newsroom.

Forward-Looking Statements

This press release may contain “forward-looking statements.” These forward-looking statements include, but are not limited to, the satisfaction of the conditions to the Exchange Offer and Consent Solicitation and the completion of the proposed Exchange Offer and Consent Solicitation.

v3.24.2

Cover Page Cover Page

|

Jul. 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 24, 2024

|

| Entity Registrant Name |

HAWAIIAN HOLDINGS INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31443

|

| Entity Tax Identification Number |

71-0879698

|

| Entity Address, Address Line One |

3375 Koapaka Street,

|

| Entity Address, Address Line Two |

Suite G-350

|

| Entity Address, City or Town |

Honolulu,

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96819

|

| City Area Code |

808

|

| Local Phone Number |

835-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

HA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001172222

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

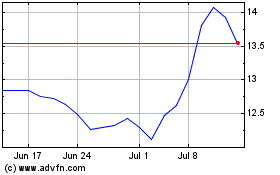

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From Jul 2023 to Jul 2024