UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number 001-40848

GUARDFORCE AI CO., LIMITED

(Translation of registrant’s name into English)

10 Anson Road, #28-01 International Plaza

Singapore 079903

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Material Definitive Agreement

On May 10, 2023, Guardforce AI Co., Limited (the

“Company”) entered into an Underwriting Agreement (the “Underwriting Agreement”) with EF Hutton,

division of Benchmark Investments, LLC, as the representative (the “Representative”) for the underwriters listed on

Schedule 1 thereto (the “Underwriters”), relating to the underwritten public offering (the “Offering”)

of 2,580,600 ordinary shares, par value $0.12 per share (the “Ordinary Shares”) of the Company (the “Offered

Securities”), at a public offering price of $4.65 per share, for aggregate gross proceeds of approximately $12.0 million, prior

to deducting underwriting discounts and other offering expenses. In addition, the Company has granted the underwriters a 45-day option

to purchase up to an additional 387,090 Ordinary Shares at the public offering price per share, less the underwriting discounts to cover

over-allotments, if any. EF Hutton, division of Benchmark Investments, LLC, is acting as the lead book-running manager for the Offering.

Spartan Capital Securities, LLC is acting as the co-manager for the Offering.

On May 12, 2023, the Representative exercised

the over-allotment option in full to purchase an additional 387,090 Ordinary Shares at $4.65 per share (the “Over-Allotment Shares”).

As a result, the aggregate gross proceeds of the Offering, including the over-allotment, are approximately $13.8 million, prior to deducting

underwriting discounts and other Offering expenses.

The Offering was closed on May 15, 2023. The Company

delivered the Offered Securities and Over-Allotment Shares (together, the “Shares”) to the Representative on the same

day.

The Shares were offered under the Company’s

registration statement on Form F-3 (File No. 333-261881), initially filed with the U.S. Securities and Exchange Commission on December

23, 2021 and was declared effective on January 5, 2022 (the “Registration Statement”). A prospectus supplement to the

Registration Statement in connection with the Offering was filed with the U.S. Securities and Exchange Commission on May 12, 2023.

The Offering raised net cash proceeds of approximately

$12.68 million (after deducting the underwriters’ discounts, non-accountable expense allowance and expenses of the Offering). The

Company intends to use the net cash proceeds from the Offering for research and development to further advance AI and robotic business

and technology capabilities; business development, including sales, marketing, and business expansion; corporate management, talent recruitment

and general working capital purposes.

Pursuant to the Underwriting Agreement, the Company

agreed to pay the Underwriters a cash fee equal to 7.0% of the gross proceeds of the Offering, an additional cash fee equal to 0.5% of

the gross proceeds raised by the Company in the Offering for non-accountable expenses, and also agreed to pay the expenses of the underwriters

in connection with the offering, including filing fees and investor presentation expenses, as well as underwriters’ counsel legal

fees, up to an aggregate of $80,000.

The Company has agreed, subject to limited exceptions,

for a period of 180 days after the closing of this Offering, not to offer, sell, contract to sell, pledge, grant any option to purchase,

make any short sale or otherwise dispose of, directly or indirectly any Ordinary Shares or any securities convertible into or exchangeable

for our Ordinary Shares either owned as of the date of the Underwriting Agreement or thereafter acquired without the prior written consent

of the Representative, subject to certain exceptions. The Representative may, in their sole discretion and at any time or from time to

time before the termination of the lock-up period, without notice, release all or any portion of the securities subject to lock-up agreements.

The foregoing description of the Underwriting

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Underwriting Agreement,

a copy of which is attached hereto as Exhibit 1.1 and is incorporated herein by reference. A copy of the opinion of Conyers Dill &

Pearman, as special counsel in the Cayman Islands to the Company, regarding the legality of the issuance and sale of Shares is attached

hereto as Exhibit 5.1.

The Company issued press releases on May 10, 2023

in connection with the announcement of the Offering, May 10, 2023 in connection with the pricing of the Offering, and on May 15, 2023

in connection with the closing of the Offering. Copy of all press releases are furnished herewith as Exhibit 99.1, Exhibit 99.2 and Exhibit

99.3, respectively, and are incorporated herein by reference.

This report shall not constitute an offer to sell

or the solicitation to buy nor shall there be any sale of the securities in any state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

This report on Form 6-K is incorporated by reference

into (i) the prospectus contained in the Company’s registration statement on Form F-3 (SEC File No. 333-261881) declared effective

by the Securities and Exchange Commission (the “Commission”) on January 5, 2022; (ii) the prospectus dated February 9, 2022

contained in the Company’s registration statement on Form F-3 (SEC File No. 333-262441) declared effective by the Commission on

February 9, 2022; and (iii) the prospectus contained in the Company’s Post-Effective Amendment No. 1 to Form F-1 on Form F-3 (SEC

File No. 333-258054) declared effective by the Commission on June 14, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: May 15, 2023 |

Guardforce AI Co., Limited |

| |

|

|

| |

By: |

/s/ Lei Wang |

| |

|

Lei Wang |

| |

|

Chief Executive Officer |

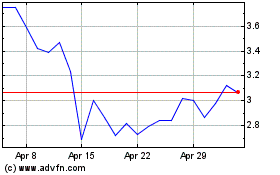

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Feb 2024 to Feb 2025