Same Store Sales increased 12.5%

year-over-year

Proprietary brand sales increased to 23.8%; Up

from 19.4% in the same period of 2023

Cash balance of $55.2 million and no debt

GrowGeneration Corp. (NASDAQ: GRWG) (“GrowGeneration,”

“GrowGen,” or the “Company”), one of the largest retailers and

distributors of specialty hydroponic and organic gardening products

in the United States, today announced financial results for the

third quarter ended September 30, 2024.

Third Quarter 2024 Summary

- Net sales decreased 10.2% year over year to $50.0 million for

the third quarter 2024, due to 25 less retail locations;

- Positive same-store sales of 12.5% in the third quarter of 2024

compared to the prior year;

- Proprietary brand sales as a percentage of Cultivation and

Gardening net sales increased to 23.8% as compared to 19.4% in the

third quarter of 2023;

- Gross profit margin of 21.6%, a 750 basis point decrease from

the 29.1% in the year ago period mainly due to restructuring

related activities;

- Operating expenses decreased $1.3 million, or 5.4%, to $22.9

million in the third quarter of 2024 compared to the same prior

year period;

- Net loss of $11.4 million the third quarter of 2024 compared to

a net loss of $7.3 million in the year ago period;

- Adjusted EBITDA(1) loss of $2.4 million for the third quarter

of 2024, a decrease of $1.5 million from the year ago period;

and

- Cash, cash equivalents, and marketable securities of $55.2

million and no debt.

Darren Lampert, GrowGen’s Co-Founder and Chief Executive

Officer, commented, “Our third quarter results were consistent with

our expectations and reflect the substantial progress we have made

executing on our strategic restructuring plan. In particular, we

exceeded our near-term targets for proprietary brand sales as a

percentage of Cultivation and Gardening net sales, which grew to

23.8%, compared to 19.4% for the third quarter last year. This is

tracking well against our goal to grow proprietary brand sales to

35% in 2025. Additionally, same-store sales grew 12.5%

year-over-year in the third quarter, reflecting the strong

performance of our core store locations as we right-size our retail

footprint. In addition, we met our store closures target, even as

we maintained our focus on improving efficiencies, reducing store

and other operating expenses by 13.9% during the quarter. Our

financial position also remains strong, with $55.2 million in cash,

cash equivalents, and marketable securities and no debt.”

“Our same-store sales growth, reduction in expenses and the

improvement in our proprietary brand sales all demonstrate, our

actions to date have proven successful in positioning GrowGen for

sustainable growth in 2025. In line with these priorities, we are

also on track to launch our e-commerce portal in the fourth quarter

of this year, which is a key part of our digital transformation and

B2B customer focus. We are well-positioned in the industry to

capitalize on growth opportunities, and our restructuring plan has

put us on a stronger footing to drive revenue growth, optimize

margins, and build a leaner, more profitable company,” added Mr.

Lampert.

Third Quarter 2024 Consolidated Results

Net sales declined $5.7 million, or 10.2%, to $50.0 million for

the third quarter 2024 compared to $55.7 million for the third

quarter 2023.

The decrease in net sales was primarily related to our

Cultivation and Gardening segment, which had net sales of $41.4

million for the third quarter 2024 compared to $48.0 million for

the same prior year period. Cultivation and Gardening’s decrease in

net sales was primarily driven by the fiscal 2023 consolidation of

6 retail locations after the third quarter 2023 in addition to 19

retail locations to date in fiscal 2024, which include the 12

redundant or underperforming retail locations consolidated in

conjunction with our strategic restructuring plan announced in July

2024. Additionally, we estimate that sales discounts offered as

part of our strategic restructuring plan at those 12 retail

locations negatively impacted net sales by approximately $0.9

million in the third quarter 2024. Cultivation and Gardening’s

same-store sales increased 12.5%, primarily attributable to

commercial sales growth, customer retention in markets where there

were retail location closures, and improvements in our e-commerce

site sales volume. Proprietary brand sales as a percentage of

Cultivation and Gardening net sales for the third quarter 2024

increased to 23.8% as compared to 19.4% for the same prior year

period largely driven by our strategic initiatives to increase

sales volume with our expanded portfolio of proprietary brands and

products and various proprietary product launches. The percentage

of Cultivation and Gardening net sales related to consumable

products remained relatively flat at 73.3% and 73.5% for the third

quarter 2024 and 2023, respectively.

Additionally, net sales of commercial fixtures within our

Storage Solutions segment increased by 12.9% to $8.6 million for

the third quarter 2024 compared to $7.6 million for the year ago

period, primarily due to increased demand from retail customers and

timing differences of various projects being pushed into the third

quarter of 2024 from the prior quarter.

Gross profit was $10.8 million for the third quarter 2024

compared to $16.2 million for the third quarter 2023, a decrease of

$5.4 million or 33.2%. The decrease in gross profit was driven

primarily by our Cultivation and Gardening segment, which decreased

$5.5 million, or 43.3%, largely as a result of the 25 store

consolidations since the end of the third quarter 2023 as well as

the effects of our strategic restructuring plan, which include the

$0.9 million in sales discounts and an additional $1.0 million of

inventory disposal costs incurred in the third quarter 2024. Gross

profit from our Storage Solutions segment increased $0.1 million,

or 2.7%, to $3.6 million for the third quarter 2024 compared to

$3.5 million for the third quarter 2023.

Gross profit margin decreased to 21.6% for the third quarter

2024, compared to 29.1% for the year ago period. The decrease in

gross profit margin was largely driven by our Gardening and

Cultivation segment, which had a gross profit margin of 17.3% for

the third quarter 2024 as compared to 26.3% for the third quarter

2023, due to the effects of the strategic restructuring plan,

including the inventory disposal costs and inventory sales

discounts, reduced inventory discounts from vendors, and continued

industry pricing compression on distributed products. Gross profit

margin also decreased for our Storage Solutions segment to 42.2% in

the third quarter 2024 from 46.4% in the same prior year period

primarily driven by higher costs of inventory.

Adjusted Gross Profit(2) and Adjusted Gross Profit Margin(2),

which exclude the effects of the strategic restructuring plan

announced in July 2024, were $12.7 million and 25.4% for the third

quarter 2024, respectively, compared to $16.2 million and 29.1% for

the third quarter 2023.

Store and other operating expenses for the third quarter 2024

were $10.0 million compared to $11.7 million in the year ago

period, a decrease of 13.9%, primarily driven by the 25 store

consolidations since the end of the third quarter 2023.

Selling, general, and administrative expenses in the third

quarter 2024 were $7.4 million compared to $7.6 million in the

third quarter 2023, a decrease of 2.3%.

GAAP net loss was $11.4 million for the third quarter 2024, or a

loss of $0.19 per diluted share, compared to $7.3 million in the

year ago period, or a loss of $0.12 per diluted share.

Adjusted EBITDA(1) was a loss of $2.4 million in the third

quarter 2024, compared to Adjusted EBITDA(1) loss of $0.9 million

in the same prior year period.

Cash, cash equivalents, and marketable securities as of

September 30, 2024 were $55.2 million. Inventory as of September

30, 2024 was $48.0 million, and prepaid and other current assets

were $7.7 million.

Total current liabilities, including accounts payable, accrued

payroll, and other liabilities as of September 30, 2024 were $24.5

million.

Geographical Footprint

Our geographic footprint for our Cultivation and Gardening

segment spans 724,000 square feet of retail and warehouse space and

includes 31 retail locations across 12 states. To date in fiscal

2024, we have consolidated 19 retail stores where we generally

expect to be able to serve the same customer base through a single

location, thereby reducing redundancies in cost structure.

Fiscal Year 2024 Financial Outlook(3)

As a result of its previously announced restructuring plan,

GrowGen expects full-year 2024 net sales in the range of $190

million to $195 million. In the prior quarter, we had removed our

full-year 2024 Adjusted EBITDA guidance as we assessed the impact

of the restructuring, and we expect to provide updated Adjusted

EBITDA guidance at a later date.

Footnotes

(1) Adjusted EBITDA represents earnings before interest, income

taxes, depreciation, and amortization as adjusted for certain items

as set forth in the reconciliation table of U.S. GAAP to non-GAAP

information and is a measure calculated and presented on the basis

of methodologies other than in accordance with GAAP. Please refer

to the Use of Non-GAAP Financial Information herein for further

discussion and reconciliation of this measure to GAAP measures.

(2) Adjusted Gross Profit represents gross profit as adjusted

for certain items as set forth in the reconciliation table of U.S.

GAAP to non-GAAP information, and Adjusted Gross Profit Margin is

calculated as Adjusted Gross Profit as a percentage of net sales.

These measures are calculated and presented on the basis of

methodologies other than in accordance with GAAP. Please refer to

the Use of Non-GAAP Financial Information herein for further

discussion and reconciliation of these measures to GAAP

measures.

(3) Sales and Adjusted EBITDA guidance metrics are inclusive of

any acquisitions and store openings completed in 2024 and 2023, but

do not include any unannounced acquisitions.

Conference Call

The Company will host a conference call today, November 12,

2024, at 4:30PM Eastern Time. To participate in the call, please

dial 1(888) 699-1199 (domestic) or 1(416) 945 7677 (international).

The conference code is 87243. This call is being webcast and can be

accessed at https://app.webinar.net/eLnb9eDMG3N or on the Investor

Relations section of GrowGen’s website at:

https://ir.growgeneration.com. A replay of the webcast will be

available two hours after the conclusion of the call and remain

available for 90 calendar days.

About GrowGeneration Corp:

GrowGen is a leading developer, marketer, retailer, and

distributor of products for both indoor and outdoor hydroponic and

organic gardening, as well as customized storage solutions. GrowGen

carries and sells thousands of products, such as nutrients,

additives, growing media, lighting, environmental control systems,

and benching and racking, including proprietary brands such as

Charcoir, Drip Hydro, Power Si, Ion lights, The Harvest Company,

and more. Incorporated in Colorado in 2014, GrowGen is the largest

chain of specialty retail hydroponic and organic garden centers in

the United States. The Company also operates an online superstore

for cultivators at growgeneration.com, as well as a wholesale

business for resellers, HRG Distribution, and a benching, racking,

and storage solutions business, Mobile Media or MMI.

To be added to the GrowGeneration email distribution list,

please email GrowGen@kcsa.com with GRWG.

Forward Looking Statements:

This press release may include predictions, estimates or other

information that might be considered forward-looking within the

meaning of applicable securities laws. While these forward-looking

statements represent current judgments, they are subject to risks

and uncertainties that could cause actual results to differ

materially. You are cautioned not to place undue reliance on these

forward-looking statements, which reflect opinions only as of the

date of this release. Please keep in mind that the Company does not

have an obligation to revise or publicly release the results of any

revision to these forward-looking statements in light of new

information or future events. When used herein, words such as “look

forward,” “expect,” “believe,” “continue,” “building,” or

variations of such words and similar expressions are intended to

identify forward-looking statements. Factors that could cause

actual results to differ materially from those contemplated in any

forward-looking statements made by us herein are often discussed in

filings made with the United States Securities and Exchange

Commission, available at: www.sec.gov, and on the Company’s

website, at: www.growgeneration.com.

GROWGENERATION CORP. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited, in thousands,

except shares)

September 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

27,436

$

29,757

Marketable securities

27,787

35,212

Accounts receivable, net of allowance for

credit losses of $1,800 and $1,363 at September 30, 2024 and

December 31, 2023, respectively

10,324

8,895

Notes receivable, current, net of

allowance for credit losses of $— and $1,732 at September 30, 2024

and December 31, 2023, respectively

1,106

193

Inventory

48,025

64,905

Prepaid income taxes

201

516

Prepaid and other current assets

7,688

7,973

Total current assets

122,567

147,451

Property and equipment, net

21,119

27,052

Operating leases right-of-use assets,

net

36,453

39,933

Notes receivable, long-term

—

106

Intangible assets, net

11,152

16,180

Goodwill

7,525

7,525

Other assets

823

843

TOTAL ASSETS

$

199,639

$

239,090

LIABILITIES &

STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

8,183

$

11,666

Accrued liabilities

2,536

2,530

Payroll and payroll tax liabilities

2,354

2,169

Customer deposits

2,631

5,359

Sales tax payable

1,310

1,185

Current maturities of operating lease

liabilities

7,523

8,021

Total current liabilities

24,537

30,930

Operating lease liabilities, net of

current maturities

31,620

34,448

Other long-term liabilities

317

317

Total liabilities

56,474

65,695

Commitments and contingencies

Stockholders' equity:

Common stock; $0.001 par value;

100,000,000 shares authorized, 59,242,200 and 61,483,762 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively

59

61

Additional paid-in capital

375,407

373,433

Accumulated deficit

(232,301

)

(200,099

)

Total stockholders' equity

143,165

173,395

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

199,639

$

239,090

GROWGENERATION CORP. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited, in thousands,

except per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net sales

$

50,006

$

55,678

$

151,430

$

176,430

Cost of sales (exclusive of depreciation

and amortization shown below)

39,196

39,490

113,835

126,816

Gross profit

10,810

16,188

37,595

49,614

Operating expenses:

Store operations and other operational

expenses

10,032

11,658

30,876

36,288

Selling, general, and administrative

7,405

7,582

22,417

21,923

Estimated credit losses (recoveries)

272

257

(210

)

681

Depreciation and amortization

4,972

4,721

12,329

12,477

Impairment loss

220

—

220

—

Total operating expenses

22,901

24,218

65,632

71,369

Loss from operations

(12,091

)

(8,030

)

(28,037

)

(21,755

)

Other income (expense):

Other (expense) income

(50

)

(23

)

(13

)

786

Interest income

663

705

2,002

1,886

Interest expense

—

(1

)

(70

)

(6

)

Total other income

613

681

1,919

2,666

Net loss before taxes

(11,478

)

(7,349

)

(26,118

)

(19,089

)

Benefit (provision) for income taxes

43

—

(50

)

(93

)

Net loss

$

(11,435

)

$

(7,349

)

$

(26,168

)

$

(19,182

)

Net loss per share, basic

$

(0.19

)

$

(0.12

)

$

(0.43

)

$

(0.31

)

Net loss per share, diluted

$

(0.19

)

$

(0.12

)

$

(0.43

)

$

(0.31

)

Weighted average shares outstanding,

basic

59,268

61,272

60,479

61,127

Weighted average shares outstanding,

diluted

59,268

61,272

60,479

61,127

Use of Non-GAAP Financial Information

The following non-GAAP financial measures of EBITDA, Adjusted

EBITDA, Adjusted Gross Profit, and Adjusted Gross Profit Margin are

not in accordance with, or an alternative for, generally accepted

accounting principles ("GAAP") and should be considered in addition

to, and not as a substitute for, the most directly comparable GAAP

financial measures. We believe these non-GAAP financial measures,

when used in conjunction with their most directly comparable GAAP

financial measures, net income (loss), gross profit, and gross

profit margin, provide meaningful supplemental information to both

management and investors, facilitating the evaluation of

performance across reporting periods, identify trends affecting our

business, and project future performance. Management uses these

non-GAAP financial measures for internal planning and reporting

purposes, and we believe that these non-GAAP financial measures may

be useful to investors in their assessment of our operating

performance, our ability to generate cash, and valuation. In

addition, these non-GAAP financial measures address questions

routinely received from analysts and investors and, in order to

ensure that all investors have access to the same data, we have

determined that it is appropriate to make this data available to

all investors. These non-GAAP financial measures may be different

from non-GAAP financial measures used by other companies.

EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA are non-GAAP financial measures

commonly used in our industry and should not be construed in

isolation as substitutions to net income (loss) as indicators of

operating performance or as alternatives to cash flow provided by

operating activities as a measure of liquidity (each as determined

in accordance with GAAP). GrowGeneration defines EBITDA as net

income (loss) before interest income, interest expense, income tax

expense, depreciation and amortization, and Adjusted EBITDA as

further adjusted to exclude certain items such as stock-based

compensation, impairment losses, restructuring and corporate

rationalization costs, and other non-core or non-recurring expenses

and to include income from our marketable securities as these

investments are part of our operational business strategy and

increase the cash available to us.

Set forth below is a reconciliation of EBITDA and Adjusted

EBITDA to net loss (in thousands):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss

$

(11,435

)

$

(7,349

)

$

(26,168

)

$

(19,182

)

(Benefit) provision for income taxes

(43

)

—

50

93

Interest income

(663

)

(705

)

(2,002

)

(1,886

)

Interest expense

—

1

70

6

Depreciation and amortization

4,972

4,721

12,329

12,477

EBITDA

$

(7,169

)

$

(3,332

)

$

(15,721

)

$

(8,492

)

Share-based compensation

672

938

2,104

2,452

Investment income

623

705

1,921

1,886

Impairment loss (1)

220

—

220

—

Restructuring plan (2)

2,699

—

2,699

—

Consolidation and other charges (3)

567

781

2,375

2,300

Adjusted EBITDA

$

(2,388

)

$

(908

)

$

(6,402

)

$

(1,854

)

(1) Impairment loss related to the

restructuring plan for operating lease right-of-use assets

impairments

(2) Includes the $1.8 million incurred in

the Condensed Consolidated Statements of Operations related to the

restructuring plan as well as an estimated additional $0.9 million

loss in gross profit due to inventory discounts offered in

conjunction with the restructuring plan

(3) Consists primarily of expenditures

related to the activity of store and distribution consolidation and

one-time severances outside of the restructuring plan announced

July 2024

Adjusted Gross Profit and Adjusted Gross Profit

Margin

Adjusted Gross Profit and Adjusted Gross Profit Margin are

non-GAAP financial measures commonly used in our industry and

should not be construed in isolation as substitutions to gross

profit or gross profit margin, defined as our gross profit as a

percentage of net sales, as indicators of operating performance

(each as determined in accordance with GAAP). GrowGeneration

calculates Adjusted Gross Profit as gross profit adjusted to

exclude the effects related to the strategic restructuring plan,

and Adjusted Gross Profit Margin is calculated as Adjusted Gross

Profit as a percentage of net sales.

Set forth below is a reconciliation of Adjusted Gross Profit and

Adjusted Gross Profit Margin to gross profit and gross profit

margin (in thousands):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net sales

$

50,006

$

55,678

$

151,430

$

176,430

Cost of sales

39,196

39,490

113,835

126,816

Gross profit

$

10,810

$

16,188

$

37,595

$

49,614

Gross profit margin

21.6

%

29.1

%

24.8

%

28.1

%

Restructuring plan (1)

$

1,903

$

—

$

1,903

$

—

Adjusted Gross Profit

$

12,713

$

16,188

$

39,498

$

49,614

Adjusted Gross Margin

25.4

%

29.1

%

26.1

%

28.1

%

(1) Includes the $1.0 million incurred in

Cost of sales within the Condensed Consolidated Statements of

Operations related to the restructuring plan as well as an

estimated additional $0.9 million loss in gross profit due to

inventory discounts offered in conjunction with the restructuring

plan

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112764559/en/

KCSA Strategic Communications Philip Carlson Managing Director

T: 212-896-1233 E: GrowGen@kcsa.com

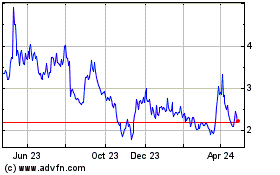

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Dec 2024 to Jan 2025

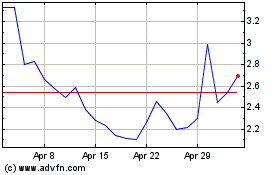

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Jan 2024 to Jan 2025