A.M. Best Affirms Credit Ratings of Greenlight Capital Re, Ltd. and Its Subsidiaries

October 11 2018 - 3:03PM

Business Wire

A.M. Best has affirmed the Financial Strength Rating of

A- (Excellent) and the Long-Term Issuer Credit Rating (Long-Term

ICR) of “a-” of Greenlight Reinsurance, Ltd. (Greenlight Re)

(Cayman Islands) and Greenlight Reinsurance Ireland, Designated

Activity Company (Ireland). A.M. Best also has affirmed the

Long-Term ICR of “bbb-” of Greenlight Capital Re, Ltd. (Cayman

Islands) (GLRE) [NASDAQ: GLRE], the ultimate holding company. The

outlook of these Credit Ratings (ratings) is stable.

The ratings reflect GLRE’s balance sheet strength, which A.M.

Best categorizes as very strong, as well as its marginal operating

performance, neutral business profile and appropriate enterprise

risk management (ERM).

GLRE’s risk-adjusted capitalization level of very strong, as

measured by Best’s Capital Adequacy Ratio (BCAR), its financial

flexibility, robust liquidity and quality of capital contribute to

A.M. Best’s overall balance sheet assessment of very strong. GLRE's

capitalization was stressed under various scenarios, including

further investment portfolio losses. Capital levels remain

supportive of the 'very strong' risk-adjusted capitalization

designation under all scenarios. Additionally, in August of 2018,

the company issued $100 million of convertible senior notes - net

proceeds from the sale are available to the operating subsidiaries,

if needed.

GLRE's operating performance is deemed marginal due to an

unfavorable loss reserve development trend in recent years and its

inability to generate operating profitability consistently over the

past five years. Like many of its peers, GLRE’s 2017 underwriting

results were impacted by losses from hurricanes Harvey, Irma and

Maria, the Mexico earthquakes and the California wildfires. The

losses were offset partially by $20.2 million of investment income

generated during 2017. Although GLRE reported an underwriting

profit for the first six months of 2018, it was overshadowed by the

substantial losses generated by the company's investment portfolio

during the same period. Further outsized investment losses or

adverse loss reserve development could lead to negative rating

pressure.

GLRE’s business profile was assessed as neutral. The company was

incorporated in the Cayman Islands in 2004 and is one of the

longest tenured total return carriers among its peers. Through its

two operating subsidiaries, GLRE provides property and casualty

reinsurance on a global scale. Historically, GLRE was somewhat

concentrated geographically and by line of business; however, the

company has taken steps to diversify its platform while maintaining

solid pipelines in key lines of business. The company - under the

leadership of Simon Burton, CEO – maintains strict underwriting

discipline and enters new lines of business prudently.

Additionally, GLRE’s ERM is deemed appropriate for the company’s

business complexity and overall risk profile. ERM has been tested

recently; as investment losses manifested in 2018, the company took

actions to decrease investment risk to lower levels. One such

noteworthy action included deleveraging the investment portfolio

further to a level at which net reserves are held, for the time

being, in fixed income securities or cash.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings. For information on the proper media use of Best’s

Credit Ratings and A.M. Best press releases, please view

Guide for Media - Proper Use of Best’s Credit Ratings and A.M.

Best Rating Action Press Releases.

A.M. Best is a global rating agency and information provider

with a unique focus on the insurance industry. Visit

www.ambest.com for more information.

Copyright © 2018 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181011005855/en/

A.M. BestVictoria OhorodnykFinancial

Analyst+1 908 439 2200, ext.

5326victoria.ohordnyk@ambest.comorSteven M. Chirico,

CPADirector+1 908 439 2200, ext.

5087steven.chirico@ambest.comorChristopher

SharkeyManager, Public Relations+1 908 439 2200, ext.

5159christopher.sharkey@ambest.comorJim

PeavyDirector, Public Relations+1 908 439 2200, ext.

5644james.peavy@ambest.com

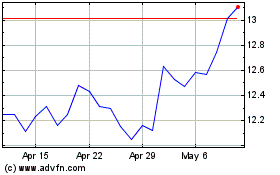

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

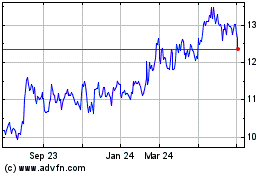

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Nov 2023 to Nov 2024