Greenlight Capital Re, Ltd. (NASDAQ:GLRE) today announced financial

results for the third quarter ended September 30, 2016.

Greenlight Re reported net income of $30.0 million for the third

quarter of 2016, compared to a net loss of $219.7 million for the

same period in 2015. The net income per share for the third

quarter of 2016 was $0.80, compared to a net loss per share of

$5.98 for the same period in 2015.

Fully diluted adjusted book value per share was

$22.04 as of September 30, 2016, a 5.4% decrease from $23.29 per

share as of September 30, 2015.

“We are pleased to report positive performance

from both our underwriting and investment operations during the

third quarter,” said Bart Hedges, Chief Executive Officer of

Greenlight Re. “While we saw a slight reduction in our reported

premiums written, primarily due to our non-renewal of certain

Florida home-owners business, we continue to find attractive

opportunities to grow profitably.”

Financial and operating highlights for

Greenlight Re for the third quarter and nine months ended September

30, 2016 include:

- Gross written premiums of $128.2 million, a decrease from

$134.6 million in the third quarter of 2015; net earned premiums

were $112.8 million, an increase from $102.0 million reported in

the prior-year period.

- Underwriting income of $0.6 million, compared to an

underwriting loss of $31.7 million in the third quarter of

2015.

- A composite ratio for the nine months ended September 30, 2016

of 101.9% compared to 111.0% for the prior year period. The

combined ratio for the nine months ended September 30, 2016 was

105.3% compared to 115.5% for the prior year period.

- A net investment gain of 3.1% on Greenlight Re’s investment

portfolio, compared to a net investment loss of 14.2% in the third

quarter of 2015. For the first nine months of 2016 net investment

income was $23.3 million, representing a gain of 2.1%, compared to

a net investment loss of $236.5 million during the comparable

period in 2015 when Greenlight Re reported a 16.9% loss.

On November 3, 2016 A.M. Best revised Greenlight

Re’s rating from “A” (Excellent) with a negative outlook to “A-”

(Excellent) stable. A.M. Best has indicated that the

lower rating is the result of Greenlight Re’s underwriting results

falling short of A.M. Best’s expectations but notes that the

Company’s risk-adjusted capital position remains robust.

Hedges added, “We have experienced several years

of adverse development on construction defect contracts, which have

negatively affected financial year results. We have novated these

contracts to limit further exposure to this business. The remainder

of our underwriting portfolio continues to perform in line with our

expectations.”

“Our investment portfolio performed adequately

during the quarter,” stated David Einhorn, Chairman of the Board of

Directors. “While we are disappointed with the rating action taken

by A.M. Best, we will continue to leverage our underwriting

relationships and strong capital position and focus on identifying

and fostering new profitable opportunities.”

Conference Call Details

Greenlight Re will hold a live conference call

to discuss its financial results for the third quarter ended

September 30, 2016 on Tuesday, November 8, 2016 at 9:00 a.m.

Eastern time. The conference call title is Greenlight Capital

Re, Ltd. Third Quarter 2016 Earnings Call.

To participate in the Greenlight Capital Re,

Ltd. Third Quarter 2016 Earnings Call, please dial in to the

conference call at:

U.S. toll free 1-888-336-7152International

1-412-902-4178

Telephone participants may avoid any delays by

pre-registering for the call using the following link to receive a

special dial-in number and PIN.

Conference Call registration

link: http://dpregister.com/10095266

The conference call can also be accessed via webcast at:

http://services.choruscall.com/links/glre161108.html

A telephone replay of the call will be available

from 11:00 a.m. Eastern time on November 8, 2016 until 9:00

a.m. Eastern time on November 15, 2016. The replay of the

call may be accessed by dialing 1-877-344-7529 (U.S. toll free) or

1-412-317-0088 (international), access code 10095266. An audio file

of the call will also be available on the Company’s website,

www.greenlightre.ky.

Regulation GFully diluted

adjusted book value per share is considered a non-GAAP measure and

represents basic adjusted book value per share combined with the

impact from dilution of share based compensation including

in-the-money stock options and RSUs as of any period end.

Book value is adjusted by subtracting the amount of the

non-controlling interest in joint venture from total shareholders’

equity to calculate adjusted book value. We believe that long

term growth in fully diluted adjusted book value per share is the

most relevant measure of our financial performance because it

provides management and investors a yardstick by which to monitor

the shareholder value generated. In addition, fully diluted

adjusted book value per share may be of benefit to our investors,

shareholders and other interested parties to form a basis of

comparison with other companies within the property and casualty

reinsurance industry.

Net underwriting income (loss) is considered a

non-GAAP financial measure because it excludes items used in the

calculation of net income before taxes under U.S. GAAP. The

measure includes underwriting expenses which are directly related

to underwriting activities as well as an allocation of other

general and administrative expenses. Net underwriting income (loss)

is calculated as net premiums earned, less net loss and loss

adjustment expenses incurred, less, acquisition costs and less

underwriting expenses. The measure excludes, on a recurring basis:

(1) net investment income; (2) any foreign exchange gains or

losses; (3) corporate general and administrative expenses; (4)

other income (expense) not related to underwriting, and (5) income

taxes and income attributable to non-controlling interest. We

exclude net investment income and foreign exchange gains or losses

as we believe these are influenced by market conditions and other

factors not related to underwriting decisions. We exclude corporate

general and administrative expenses because these expenses are

generally fixed and not incremental to or directly related to our

underwriting operations. We believe all of these amounts are

largely independent of our underwriting process and including them

distorts the analysis of trends in our underwriting operations. Net

underwriting income should not be viewed as a substitute for U.S.

GAAP net income.

Forward-Looking StatementsThis

news release contains forward-looking statements within the meaning

of the U.S. federal securities laws. We intend these

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements in the U.S. Federal

securities laws. These statements involve risks and uncertainties

that could cause actual results to differ materially from those

contained in forward-looking statements made on behalf of the

Company. These risks and uncertainties include the impact of

general economic conditions and conditions affecting the insurance

and reinsurance industry, the adequacy of our reserves, our ability

to assess underwriting risk, trends in rates for property and

casualty insurance and reinsurance, competition, investment market

fluctuations, trends in insured and paid losses, catastrophes,

regulatory and legal uncertainties and other factors described in

our annual report on Form 10-K filed with the Securities Exchange

Commission. The Company undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

About Greenlight Capital Re,

Ltd.Greenlight Re (www.greenlightre.ky) is a NASDAQ listed

company with specialist property and casualty reinsurance companies

based in the Cayman Islands and Ireland. Greenlight Re

provides a variety of custom-tailored reinsurance solutions to the

insurance, risk retention group, captive and financial

marketplaces. Established in 2004, Greenlight Re selectively

offers customized reinsurance solutions in markets where capacity

and alternatives are limited. With a focus on deriving

superior returns from both sides of the balance sheet, Greenlight

Re’s assets are managed according to a value-oriented

equity-focused strategy that complements the Company’s business

goal of long-term growth in book value per share.

| |

| GREENLIGHT CAPITAL RE, LTD. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| |

| September 30, 2016 and December 31,

2015 |

| (expressed in thousands of U.S. dollars, except

per share and share amounts) |

| |

|

|

|

| |

September

30, 2016 |

|

December 31,

2015 |

| |

(unaudited) |

|

(audited) |

|

Assets |

|

|

|

| Investments |

|

|

|

| Debt instruments, trading,

at fair value |

$ |

74,058 |

|

|

$ |

39,087 |

|

| Equity securities,

trading, at fair value |

834,281 |

|

|

905,994 |

|

| Other investments, at fair

value |

176,480 |

|

|

119,083 |

|

| Total investments |

1,084,819 |

|

|

1,064,164 |

|

| Cash and cash

equivalents |

39,163 |

|

|

112,162 |

|

| Restricted cash and cash

equivalents |

1,098,718 |

|

|

1,236,589 |

|

| Financial contracts

receivable, at fair value |

42,478 |

|

|

13,215 |

|

| Reinsurance balances

receivable |

227,425 |

|

|

187,940 |

|

| Loss and loss adjustment

expenses recoverable |

3,220 |

|

|

3,368 |

|

| Deferred acquisition

costs, net |

55,818 |

|

|

59,823 |

|

| Unearned premiums

ceded |

3,131 |

|

|

3,251 |

|

| Notes receivable, net |

34,102 |

|

|

25,146 |

|

| Other assets |

4,878 |

|

|

6,864 |

|

| Total

assets |

$ |

2,593,752 |

|

|

$ |

2,712,522 |

|

| Liabilities and

equity |

|

|

|

|

Liabilities |

|

|

|

| Securities sold, not yet

purchased, at fair value |

$ |

802,863 |

|

|

$ |

882,906 |

|

| Financial contracts

payable, at fair value |

2,570 |

|

|

28,245 |

|

| Due to prime brokers |

398,711 |

|

|

396,453 |

|

| Loss and loss adjustment

expense reserves |

282,941 |

|

|

305,997 |

|

| Unearned premium

reserves |

213,835 |

|

|

211,954 |

|

| Reinsurance balances

payable |

33,115 |

|

|

18,326 |

|

| Funds withheld |

5,930 |

|

|

7,143 |

|

| Other liabilities |

12,824 |

|

|

12,725 |

|

| Total

liabilities |

1,755,202 |

|

|

1,863,749 |

|

|

Equity |

|

|

|

| Preferred share capital

(par value $0.10; authorized, 50,000,000; none issued) |

— |

|

|

— |

|

| Ordinary share capital

(Class A: par value $0.10; authorized, 100,000,000; issued and

outstanding, 31,103,618 (2015: 30,772,572): Class B: par value

$0.10; authorized, 25,000,000; issued and outstanding, 6,254,895

(2015: 6,254,895)) |

3,736 |

|

|

3,703 |

|

| Additional paid-in

capital |

499,497 |

|

|

496,401 |

|

| Retained earnings |

320,972 |

|

|

325,287 |

|

| Shareholders’

equity attributable to shareholders |

824,205 |

|

|

825,391 |

|

| Non-controlling interest

in joint venture |

14,345 |

|

|

23,382 |

|

| Total

equity |

838,550 |

|

|

848,773 |

|

| Total liabilities

and equity |

$ |

2,593,752 |

|

|

$ |

2,712,522 |

|

| |

|

|

|

|

|

|

|

| GREENLIGHT CAPITAL RE, LTD. |

| CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

| (UNAUDITED) |

| |

| For the three and nine months ended September 30, 2016

and 2015 |

| (expressed in thousands of U.S. dollars, except per

share and share amounts) |

| |

|

|

|

| |

Three months ended September 30 |

|

Nine months ended September 30 |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

|

Revenues |

|

|

|

|

|

|

|

| Gross premiums

written |

$ |

128,205 |

|

|

$ |

134,568 |

|

|

$ |

387,234 |

|

|

$ |

357,240 |

|

| Gross premiums ceded |

(2,119 |

) |

|

(2,288 |

) |

|

(7,748 |

) |

|

(5,782 |

) |

| Net premiums written |

126,086 |

|

|

132,280 |

|

|

379,486 |

|

|

351,458 |

|

| Change in net unearned

premium reserves |

(13,294 |

) |

|

(30,286 |

) |

|

(3,000 |

) |

|

(62,986 |

) |

| Net premiums earned |

112,792 |

|

|

101,994 |

|

|

376,486 |

|

|

288,472 |

|

| Net investment income

(loss) |

32,945 |

|

|

(191,322 |

) |

|

23,326 |

|

|

(236,456 |

) |

| Other income (expense),

net |

(192 |

) |

|

(542 |

) |

|

(181 |

) |

|

(2,714 |

) |

| Total revenues |

145,545 |

|

|

(89,870 |

) |

|

399,631 |

|

|

49,302 |

|

|

Expenses |

|

|

|

|

|

|

|

| Loss and loss adjustment

expenses incurred, net |

81,467 |

|

|

97,421 |

|

|

283,511 |

|

|

237,281 |

|

| Acquisition costs,

net |

25,844 |

|

|

32,146 |

|

|

100,291 |

|

|

82,926 |

|

| General and administrative

expenses |

6,937 |

|

|

5,382 |

|

|

18,930 |

|

|

18,436 |

|

| Total expenses |

114,248 |

|

|

134,949 |

|

|

402,732 |

|

|

338,643 |

|

| Income (loss) before

income tax |

31,297 |

|

|

(224,819 |

) |

|

(3,101 |

) |

|

(289,341 |

) |

| Income tax (expense)

benefit |

(305 |

) |

|

1,233 |

|

|

(251 |

) |

|

1,394 |

|

| Net income (loss)

including non-controlling interest |

30,992 |

|

|

(223,586 |

) |

|

(3,352 |

) |

|

(287,947 |

) |

| Loss (income)

attributable to non-controlling interest in joint venture |

(981 |

) |

|

3,909 |

|

|

(963 |

) |

|

4,627 |

|

| Net income

(loss) |

$ |

30,011 |

|

|

$ |

(219,677 |

) |

|

$ |

(4,315 |

) |

|

$ |

(283,320 |

) |

| Earnings (loss)

per share |

|

|

|

|

|

|

|

| Basic |

$ |

0.80 |

|

|

$ |

(5.98 |

) |

|

$ |

(0.12 |

) |

|

$ |

(7.73 |

) |

| Diluted |

$ |

0.80 |

|

|

$ |

(5.98 |

) |

|

$ |

(0.12 |

) |

|

$ |

(7.73 |

) |

| Weighted average number of ordinary

shares used in the determination of earnings and loss per

share |

|

|

|

|

|

|

|

| Basic |

37,323,575 |

|

|

36,710,216 |

|

|

36,928,283 |

|

|

36,636,464 |

|

| Diluted |

37,385,481 |

|

|

36,710,216 |

|

|

36,928,283 |

|

|

36,636,464 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

The following table provides the ratios for the nine months

ended September 30, 2016 and 2015:

| |

Nine months ended September 30 |

| |

|

|

2016 |

|

|

|

|

|

2015 |

|

|

| |

Frequency |

|

Severity |

|

Total |

|

Frequency |

|

Severity |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss ratio |

76.4 |

% |

|

62.9 |

% |

|

75.3 |

% |

|

87.4 |

% |

|

5.4 |

% |

|

82.3 |

% |

| Acquisition cost

ratio |

27.0 |

% |

|

21.9 |

% |

|

26.6 |

% |

|

27.9 |

% |

|

41.3 |

% |

|

28.7 |

% |

| Composite ratio |

103.4 |

% |

|

84.8 |

% |

|

101.9 |

% |

|

115.3 |

% |

|

46.7 |

% |

|

111.0 |

% |

| Underwriting expense

ratio |

|

|

|

|

3.4 |

% |

|

|

|

|

|

4.5 |

% |

| Combined ratio |

|

|

|

|

105.3 |

% |

|

|

|

|

|

115.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact:

Garrett Edson

ICR

(203) 682-8331

IR@greenlightre.ky

Media:

Brian Ruby

ICR

(203) 682-8268

Brian.ruby@icrinc.com

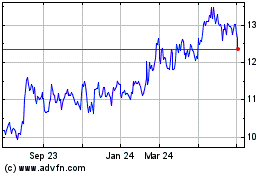

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

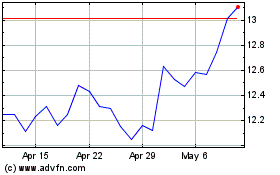

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Nov 2023 to Nov 2024