Form 8-K - Current report

July 09 2024 - 7:30AM

Edgar (US Regulatory)

false

0000825324

0000825324

2024-07-09

2024-07-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 9, 2024

Good Times Restaurants Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-18590 |

|

84-1133368 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

651 Corporate Circle, Suite 200, Golden, CO 80401 |

| (Address of principal executive offices including zip code) |

| |

| Registrant’s telephone number, including area code: (303) 384-1400 |

| |

| Not applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2.):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value |

|

GTIM |

|

Nasdaq Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On July 9, 2024, Good Times

Restaurants Inc. issued a press release announcing same store sales for its third fiscal quarter ended June 25, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed as part of this report.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

GOOD TIMES RESTAURANTS INC. |

| |

|

|

|

| Date: |

July 9, 2024 |

By: |

|

| |

|

|

Ryan M. Zink |

| |

|

|

Chief Executive Officer |

3

Exhibit 99.1

FOR IMMEDIATE RELEASE

| July 9, 2024 |

Nasdaq Capital Markets - GTIM |

GOOD TIMES RESTAURANTS REPORTS

THIRD FISCAL QUARTER SAME STORE SALES

(GOLDEN, CO) Good Times Restaurants Inc. (GTIM),

operator of Bad Daddy’s Burger Bar and Good

Times Burgers & Frozen Custard, today announced that same store sales1

increased 5.8% for its Good Times brand and increased 1.2% for its Bad Daddy’s brand compared to the same prior-year fiscal quarter

and average weekly sales2 were $31,780 and $52,555

for its Good Times and Bad Daddy’s brands, respectively, for its third fiscal quarter ended June 25, 2024.

Ryan Zink, President and CEO, said “The

positive same store sales trends at Good Times demonstrate the strength of the brand. In May, we completed the remodel of one of our restaurants

in Lakewood, Colorado and we closed on the purchase of the Good Times restaurant in the Denver suburb of Parker, Colorado and are extremely

pleased with its first few weeks of operations as a company-owned restaurant. Further, as of the first day of the fourth fiscal quarter,

we have installed our next generation point-of-sale system in eleven of our twenty-six company-owned Good Times Restaurants.”

“The improvement in Bad Daddy’s sales

performance is encouraging, with the concept generating same store sales gains for the quarter. We are seeing progressive improvements

in sales across all geographic regions, the result of a sharp focus on the guest and elevated operating standards,” Zink continued.

Mr. Zink concluded, “Our strategy continues

to combine re-investment in our existing restaurants to drive organic sales growth, cautious and measured new-unit development, and return

of capital to shareholders through share repurchases. We continue to believe that the market will ultimately recognize the value we are

creating with this disciplined approach centered around delivering enjoyable and memorable guest experiences through excellent operations.”

About Good Times Restaurants Inc.: Good

Times Restaurants Inc. owns, operates, and licenses 41 Bad Daddy’s Burger Bar restaurants through its wholly owned subsidiaries.

Bad Daddy’s Burger Bar is a full-service “small box” restaurant concept featuring a chef-driven menu of gourmet signature

burgers, chopped salads, appetizers and sandwiches with a full bar and a focus on a selection of local and craft beers in a high-energy

atmosphere that appeals to a broad consumer base. Additionally, through its wholly owned subsidiaries, Good Times Restaurants Inc. owns,

operates and franchises 31 Good Times Burgers & Frozen Custard restaurants primarily in Colorado. Good Times is a regional quick-service

concept featuring 100% all-natural burgers and chicken sandwiches, signature wild fries, green chili breakfast burritos and fresh frozen

custard desserts.

| 1 | Same store sales include all company-owned restaurants currently open with at least 18 full fiscal months

of operating history. Same store sales do not include the impact of revenue recognition related to the GT Rewards loyalty program

which is immaterial and exclude restaurants closed for remodel in the current or prior year, during the fiscal periods of full or partial

period closure. |

| 2 | Average weekly sales include all company-owned restaurants open for the full fiscal quarter. |

Forward Looking Statements Disclaimer: This

press release contains forward looking statements within the meaning of federal securities laws. The words “intend,” “may,”

“believe,” “will,” “should,” “anticipate,” “expect,” “seek”, “plan”

and similar expressions are intended to identify forward looking statements. These statements involve known and unknown risks, which may

cause the Company’s actual results to differ materially from results expressed or implied by the forward-looking statements. Such

risks and uncertainties include, among other things, the market price of the Company's stock prevailing from time to time, the nature

of other investment opportunities presented to the Company, the disruption to our business from pandemics and other public health emergencies,

the impact and duration of staffing constraints at our restaurants, the impact of supply chain constraints and the current inflationary

environment, the uncertain nature of current restaurant development plans and the ability to implement those plans and integrate new restaurants,

delays in developing and opening new restaurants because of weather, local permitting or other reasons, increased competition, cost increases

or shortages in raw food products, other general economic and operating conditions, risks associated with our share repurchase program,

risks associated with the acquisition of additional restaurants, the adequacy of cash flows and the cost and availability of capital or

credit facility borrowings to provide liquidity, changes in federal, state, or local laws and regulations affecting the operation of our

restaurants, including minimum wage and tip credit regulations, and other matters discussed under the Risk Factors section of Good Times’

Annual Report on Form 10-K for the fiscal year ended September 26, 2023 filed with the SEC, and other filings with the SEC.

Good Times Restaurants Inc

CONTACTS:

Ryan M. Zink, President and Chief Executive Officer (303) 384-1432

Christi Pennington (303) 384-1440

Category: Financial

v3.24.2

Cover

|

Jul. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 09, 2024

|

| Entity File Number |

000-18590

|

| Entity Registrant Name |

Good Times Restaurants Inc.

|

| Entity Central Index Key |

0000825324

|

| Entity Tax Identification Number |

84-1133368

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

651 Corporate Circle, Suite 200, Golden, CO 80401

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Golden

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80401

|

| City Area Code |

(303)

|

| Local Phone Number |

384-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

GTIM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

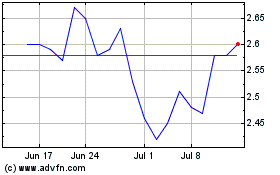

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Nov 2023 to Nov 2024