false

0001506983

0001506983

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 15, 2024

GLUCOTRACK,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41141 |

|

98-0668934 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 301

Rte 17 North, Ste. 800, Rutherford, NJ |

|

07070 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (201) 842-7715

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

GCTK |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure

On

May 15, 2024, Glucotrack, Inc., a Delaware corporation (the “Company”) issued a press release (the “Press Release”)

which announced a 1-for-5 reverse stock split. The Press Release is furnished as Exhibit 99.1 and incorporated into this Item 7.01 by

reference.

The

information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing with the Securities and Exchange

Commission, except as expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

May 15, 2024 |

|

| |

|

| |

GLUCOTRACK,

INC. |

| |

|

|

| |

By: |

/s/

Paul Goode |

| |

Name: |

Paul

Goode |

| |

Title: |

Chief

Executive Officer |

Exhibit 99.1

GLUCOTRACK

ANNOUNCES REVERSE STOCK SPLIT

1-for-5

reverse stock split to become effective as of the opening of trading on

May

20, 2024

Rutherford,

NJ, May 15, 2024 (GLOBE NEWSWIRE) – Glucotrack, Inc. (Nasdaq: GCTK) (“Glucotrack” or the “Company”), a

medical device company focused on the design, development, and commercialization of novel technologies for people with diabetes, today

announced that it will effect a 1-for-5 reverse stock split (the “Reverse Stock Split”) of its issued and outstanding common

stock (the “Common Stock”), effective with the opening of trading on Monday, May

20, 2024.

Glucotrack’s

Common Stock will continue to trade on the Nasdaq Capital Market (“Nasdaq”) under the symbol “GCTK”. The new

CUSIP number for the Common Stock following the Reverse Stock Split will be 45824Q606.

The

material effects of the Reverse Stock Split are:

| ● | Every

five (5)

shares of Glucotrack’s issued and outstanding Common Stock has been combined into one

(1) share of Common Stock. |

| ● | The

number of outstanding shares of Common Stock has been proportionally reduced from 27,392,996

shares to approximately 5,478,599 shares. |

| ● | The

Reverse Stock Split will proportionally reduce the total number of Glucotrack’s authorized

shares of Common Stock from 500,000,000 shares to 100,000,000 shares. |

| ● | The

ownership percentage of each Glucotrack stockholder will remain unchanged, other than as

a result of fractional shares. No fractional shares of Common Stock will be issued in connection

with the Reverse Stock Split. In lieu of any fractional shares to which a stockholder would

otherwise be entitled as a result of the Reverse Stock Split, Glucotrack will pay cash (without

interest) equal to such fraction multiplied by the average of the closing sales prices of

its Common Stock on Nasdaq during regular trading hours for the five consecutive trading

days immediately preceding the effective date of the Reverse Stock Split (with such average

closing sales prices being adjusted to give effect to the Reverse Stock Split). After the

Reverse Stock Split, a stockholder otherwise entitled to a fractional interest will not have

any voting, dividend or other rights with respect to such fractional interest except to receive

payment as described above. |

At

the annual meeting of stockholders held on April 26, 2024, the stockholders of the Company approved a proposal to authorize the Company’s

Board of Directors (the “Board”) to file a Certificate of Amendment to effect the Reverse Stock Split at a ratio between

1-for-5 and 1-for-30, as determined by the Board in its sole discretion. On April 30, 2024, the Board approved the Reverse Stock Split.

Among

other considerations, the Reverse Stock Split is intended to assist in bringing Glucotrack into compliance with the $1.00 minimum bid

price requirement for maintaining the listing of its Common Stock on the Nasdaq Capital Market, and to make the prevailing prices of

its Common Stock more attractive to a broader group of institutional investors.

The

combination of, and reduction in, the number of issued shares of Common Stock as a result of the Reverse Stock Split occurred automatically

on May 20, 2024 without any additional action on the part of Glucotrack’s stockholders. Glucotrack’s transfer agent, Equiniti

Trust Company LLC, is acting as the exchange agent for the Reverse Stock Split and will send each stockholder a transaction statement

indicating the number of shares of Common Stock the stockholder holds after the Reverse Stock Split. Stockholders owning shares via a

broker, bank, trust or other nominee will have their positions automatically adjusted to reflect the Reverse Stock Split, subject to

such broker’s particular processes. Such stockholders will not be required to take any action in connection with the Reverse Stock

Split.

Additional

information regarding the Reverse Stock Split can be found in the Company’s Definitive Proxy Statement on Schedule 14A, filed with

the U.S. Securities and Exchange Commission on April 1, 2024. A link to this document is available at https://www.sec.gov and on Glucotrack’s

website at https://glucotrack.com/investor-relations.

For

more information about Glucotrack, visit glucotrack.com.

Information on the Company’s website does not constitute a part of and is not incorporated by reference into this press release.

#

# #

About

Glucotrack, Inc.

Glucotrack,

Inc. (NASDAQ: GCTK) is focused on the design, development, and commercialization of novel technologies for people with diabetes. The

Company is currently developing a long-term implantable continuous blood glucose monitoring system for people living with diabetes.

Glucotrack’s

CBGM is a long-term, implantable system that continually measures blood glucose levels with a sensor longevity of 2+ years, no on-body

wearable component and with minimal calibration. For

more information, please visit http://www.glucotrack.com.

Forward-Looking

Statements

This

news release and any statements of the Company’s management and partners related to the subject matter hereof includes statements

that constitute “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended), which are statements other than historical facts. You can identify forward-looking

statements by words such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “plan,” “position,” “should,”

“strategy,” “target,” “will,” and similar words. All forward-looking statements in this press release

speak only as of the date hereof. Although the Company believes that the plans, intentions, and expectations reflected in or suggested

by the forward-looking statements are reasonable, there is no assurance that these plans, intentions, or expectations will be achieved.

Therefore, actual outcomes and results could materially and adversely differ from what is expressed, implied, or forecasted in such statements.

The Company’s business may be influenced by many factors that are difficult to predict, involve uncertainties that may materially

affect results, and are often beyond our control. Actual results (including, without limitation, the anticipated benefits of the Reverse

Stock Split, including the effect the Reverse Stock Split will have on the Company’s ability to regain compliance with the Nasdaq

Listing standards) may differ materially and adversely from those expressed or implied by such forward-looking statements. Factors that

could cause or contribute to such differences include, but are not limited to: (i) uncertainties relating to the Company’s ability

to stay compliant with Nasdaq continuing listing requirements, (ii) circumstances or developments that may make the Company unable to

implement or realize anticipated benefits, or that may increase the costs, of the Company’s current and planned business initiatives,

and (iii) other factors detailed by us in the Company’s public filings with the Securities and Exchange Commission, including the

disclosures under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed with the Securities and Exchange Commission (“SEC”) on March 28, 2024, and the Company’s Quarterly

Report on Form 10-Q for the first quarter of 2024, filed with the SEC on May 15, 2024, accessible at www.sec.gov. All forward-looking

statements included in this press release are expressly qualified in their entirety by such cautionary statements. Except as required

under the federal securities laws and the SECs rules and regulations, the Company does not have any intention or obligation to update

any forward-looking statements publicly, whether as a result of new information, future events, or otherwise.

Contacts:

Investor

Relations:

investors@glucotrack.com

Media:

GlucotrackPR@icrinc.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

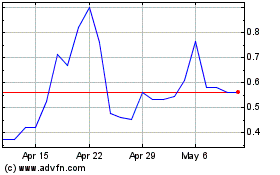

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Oct 2024 to Nov 2024

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Nov 2023 to Nov 2024