Proxy Statment - Contested Solicitations (definitive) (defc14a)

August 05 2013 - 11:37AM

Edgar (US Regulatory)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [x]

Bulldog Investors, LLC

Attn: Phillip Goldstein

250 Pehle Avenue, Suite 708

Saddle Brook, NJ 07663

Phone: 201 881-7100

Fax: 201 556-0097

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

Definitive Proxy Statement [x]

Definitive Additional Materials

Soliciting Material Pursuant to ss.240.14a-11(c) or ss.240.14a-

12

Gladstone Investment CorporationDE

(Name of Registrant as Specified in Its Charter)

Bulldog Investors, LLC

Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required [x].

Fee computed on table below per Exchange Act Rules 14a-6(i)(4)

and 0-11.

(1) Title of each class of securities to which transaction

applies:

(2) Aggregate number of securities to which transaction

applies:

(3) Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the

amount on which the filing fee is calculated and state how it

was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

Fee paid previously with preliminary materials [].

Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11 (a) (2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule

and the date of its filing [].

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Bulldog Investors, LLC,

250 Pehle Avenue, Suite 708

Saddle Brook, NJ 07663

(201) 556-0092 //

Fax: (201) 556-0097 //

info@bulldoginvestors.com

August 5, 2013

Dear Fellow Shareholder of Gladstone Investment Corporation (GAIN):

There is a reason why the board of directors of a closed-end fund like

GAIN cannot unilaterally issue additional shares below NAV. They have a

huge conflict of interest because such an offering dilutes the net asset

value of the existing shares while management's fees increase considerably.

Conversely, when the shares of a closed-end fund are trading at a big

discount to NAV, share repurchases benefit shareholders by increasing the

NAV per share but reduce management's fees.

We recently asked David Gladstone to commit to implement a meaningful share

repurchase program for GAIN. He said "no" because he claimed GAIN had no

cash. Therefore, we were surprised to hear him tell shareholders on the

quarterly earnings conference call that "we've got plenty of room under our

line of credit to borrow, so we're very active obviously and looking for new

deals." He also said: "I know people get hung up on the discount but that's

really not as relevant as some other statistics." Count me as one of those

people "hung up on the discount" because it represents a real loss to

shareholders. That is why, instead of looking for new deals, we think GAIN

should be using any excess cash to repurchase its own shares at a 17%

discount from NAV.

The discount on GAIN's shares reflects a supply-demand imbalance.

Therefore, it makes no sense to add to the problem by issuing additional

shares at a discount. Is Mr. Gladstone thinking about his own fees by

recommending that shareholders vote to permit a secondary offering that will

dilute existing shareholders, and by rejecting a share buyback program that

will be accretive to NAV? It sure looks that way.

We urge all shareholders to send Mr. Gladstone and the board a message

that, with GAIN trading at a large discount to NAV, this is the time to be

repurchasing shares, not issuing more shares.

PLEASE VOTE AGAINST THE PROPOSAL TO ISSUE MORE SHARES BELOW NAV.

Very truly yours,

/S/Phillip Goldstein

Phillip Goldstein

Principal

|

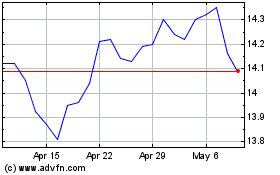

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From Jul 2024 to Aug 2024

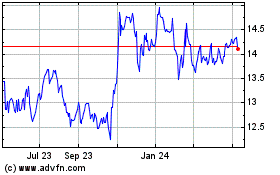

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From Aug 2023 to Aug 2024