0001932393false00019323932024-10-302024-10-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 30, 2024

GE HEALTHCARE TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| Delaware | | 001-41528 | | 88-2515116 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | |

| 500 W. Monroe Street, | Chicago, | IL | | | | 60661 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | | |

(Registrant’s telephone number, including area code) (833) 735-1139

______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, par value $0.01 per share | | GEHC | | The Nasdaq Stock Market LLC |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 7.01 Regulation FD Disclosure.

GE HealthCare Technologies Inc. (the “Company”) is filing this Current Report on Form 8-K to provide recast unaudited historical financial information related to a previously announced change in reportable segments. Effective July 1, 2024, Image Guided Therapies (“IGT”), previously part of the Imaging segment, was realigned to the Ultrasound segment to better match its clinical usage and realize stronger business and customer impact by providing the right image guidance in the right care setting. The Ultrasound segment was subsequently renamed Advanced Visualization Solutions (“AVS”).

The AVS segment has a portfolio that serves customers across two core areas: Specialized Ultrasound and Procedural Guidance. Specialized Ultrasound includes Radiology, Primary Care, and Point of Care, and Women’s Health Ultrasound. Procedural Guidance includes CardioVascular and Interventional Solutions, and Surgical Innovations.

•Radiology, Primary Care, and Point of Care Ultrasound includes systems that produce images to support precise screening, diagnosis, monitoring, and treatment across the whole body, including liver, thyroid, kidney, breast, vascular, and transcranial applications. These systems include point of care and handheld ultrasound devices to support clinical decision-making throughout various care pathways in diverse sites of care. Our systems combine high image quality with comprehensive clinical tools including measurement quantification, workflow automation, cross-modality networking, real-time and artificial intelligence-enabled scan guidance, and cloud-based technologies with versatility, accessibility, and portability required to deliver care.

•Women’s Health Ultrasound is comprised of systems to support obstetrics, gynecology, and assisted reproductive medicine. These care areas require specially designed ultrasound products that account for patient comfort and workflow constraints to enable practitioners to provide higher-quality screening, exams, and procedural care, and give clinicians images with the clarity and definition they need to focus on early detection and intervention.

•CardioVascular and Interventional Solutions provides clinicians with tools to diagnose, treat, and monitor cardiovascular conditions with precision and confidence as well as technologies to help assist clinicians and surgeons during open surgeries and minimally invasive and interventional procedures. This includes ultrasound systems used to assess the structure and function of the heart, as well as real-time advanced X-ray imaging that integrates with ultrasound and other imaging and diagnostic systems. These technologies support planning, guiding, and assessing a variety of surgical procedures like cardiac interventions and those that involve insertion of devices like deep brain stimulators, spinal implants, and other neurological devices.

•Surgical Innovations products are used in the operating environment and include a broad portfolio of advanced mobile surgical C-arms that meet clinical needs for surgical imaging and are designed to be easily maneuverable in crowded operating rooms and adaptable for various surgical procedures. Surgical visualization and guidance technology expands the use of ultrasound beyond diagnostics to provide real-time information during surgical procedures to help guide interventions and navigate inside the human body.

Under the new structure, IGT is reported within the Procedural Guidance business in AVS. Outside of the IGT realignment described above, our Imaging, Patient Care Solutions (“PCS”) and Pharmaceutical Diagnostics (“PDx”) reportable segments operate as described in the “Business” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Following this realignment, the Company continues to have four reportable segments: Imaging, AVS, PCS, and PDx. These segments have been identified based on the nature of the products sold and how the Company manages its operations. We have not aggregated any of our operating segments to form reportable segments.

Exhibit 99, attached hereto, presents supplemental recast unaudited financial information reflecting the Company’s new reportable segment structure for the first two interim periods of the fiscal year ended December 31, 2024 and for the fiscal years ended December 31, 2023 and 2022. This recast financial information is being provided to aid in comparability and has no impact on previously reported consolidated or combined financial statements for any period.

The information furnished pursuant to Item 7.01, including Exhibit 99, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of GE HealthCare under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit | Description |

| |

| 104 | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | GE HealthCare Technologies Inc. |

| | | (Registrant) |

| | | |

Date: October 30, 2024 | | /s/ George A. Newcomb |

| | | George A. Newcomb, Controller & Chief Accounting Officer (authorized signatory) |

GE HealthCare

Recast Unaudited Historical Financial Information Reflecting the Company’s New Reportable Segment Structure

Effective July 1, 2024, Image Guided Therapies (“IGT”), previously part of the Imaging segment, was realigned to the Ultrasound segment to better match its clinical usage and realize stronger business and customer impact by providing the right image guidance in the right care setting. The Ultrasound segment was subsequently renamed Advanced Visualization Solutions (“AVS”).

The AVS segment has a portfolio that serves customers across two core areas: Specialized Ultrasound and Procedural Guidance. Specialized Ultrasound includes Radiology, Primary Care, and Point of Care, and Women’s Health Ultrasound. Procedural Guidance includes CardioVascular and Interventional Solutions, and Surgical Innovations.

•Radiology, Primary Care, and Point of Care Ultrasound includes systems that produce images to support precise screening, diagnosis, monitoring, and treatment across the whole body, including liver, thyroid, kidney, breast, vascular, and transcranial applications. These systems include point of care and handheld ultrasound devices to support clinical decision-making throughout various care pathways in diverse sites of care. Our systems combine high image quality with comprehensive clinical tools including measurement quantification, workflow automation, cross-modality networking, real-time and artificial intelligence-enabled scan guidance, and cloud-based technologies with versatility, accessibility, and portability required to deliver care.

•Women’s Health Ultrasound is comprised of systems to support obstetrics, gynecology, and assisted reproductive medicine. These care areas require specially designed ultrasound products that account for patient comfort and workflow constraints to enable practitioners to provide higher-quality screening, exams, and procedural care, and give clinicians images with the clarity and definition they need to focus on early detection and intervention.

•CardioVascular and Interventional Solutions provides clinicians with tools to diagnose, treat, and monitor cardiovascular conditions with precision and confidence as well as technologies to help assist clinicians and surgeons during open surgeries and minimally invasive and interventional procedures. This includes ultrasound systems used to assess the structure and function of the heart, as well as real-time advanced X-ray imaging that integrates with ultrasound and other imaging and diagnostic systems. These technologies support planning, guiding, and assessing a variety of surgical procedures like cardiac interventions and those that involve insertion of devices like deep brain stimulators, spinal implants, and other neurological devices.

•Surgical Innovations products are used in the operating environment and include a broad portfolio of advanced mobile surgical C-arms that meet clinical needs for surgical imaging and are designed to be easily maneuverable in crowded operating rooms and adaptable for various surgical procedures. Surgical visualization and guidance technology expands the use of ultrasound beyond diagnostics to provide real-time information during surgical procedures to help guide interventions and navigate inside the human body.

Under the new structure, IGT is reported within the Procedural Guidance business in AVS. Outside of the IGT realignment described above, our Imaging, Patient Care Solutions (“PCS”) and Pharmaceutical Diagnostics (“PDx”) reportable segments operate as described in the “Business” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Following this realignment, the Company continues to have four reportable segments: Imaging, AVS, PCS, and PDx. These segments have been identified based on the nature of the products sold and how the Company manages its operations. We have not aggregated any of our operating segments to form reportable segments.

Tables throughout this document are presented in millions of U.S. dollars unless otherwise stated and certain columns and rows may not sum due to the use of rounded numbers. Percentages presented are calculated from the underlying whole-dollar amounts.

The tables below reflect our unaudited historical financial results recast to conform to the new segment structure.

| | | | | | | | |

| Total Revenues by Segment | For the three months ended |

Unaudited | March 31, 2024 | June 30, 2024 |

| Total Imaging | $ | 2,062 | | $ | 2,171 | |

| AVS: | | |

| Procedural Guidance | 651 | | 668 | |

| Specialized Ultrasound | 576 | | 581 | |

| Total AVS | 1,227 | | 1,249 | |

| PCS: | | |

| Monitoring Solutions | 527 | | 538 | |

| Life Support Solutions | 220 | | 235 | |

| Total PCS | 747 | | 772 | |

| Total PDx | 599 | | 639 | |

Other(1) | 15 | | 9 | |

| Total revenues | $ | 4,650 | | $ | 4,839 | |

| | |

| | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the year ended |

Unaudited | March 31, 2023 | June 30, 2023 | September 30, 2023 | December 31, 2023 | | December 31, 2023 |

| Total Imaging | $ | 2,088 | | $ | 2,228 | | $ | 2,236 | | $ | 2,392 | | | $ | 8,944 | |

| AVS: | | | | | | |

| Procedural Guidance | 662 | | 635 | | 641 | | 727 | | | 2,666 | |

| Specialized Ultrasound | 605 | | 596 | | 573 | | 655 | | | 2,428 | |

| Total AVS | 1,267 | | 1,231 | | 1,214 | | 1,382 | | | 5,094 | |

| PCS: | | | | | | |

| Monitoring Solutions | 552 | | 563 | | 573 | | 595 | | | 2,283 | |

| Life Support Solutions | 229 | | 207 | | 191 | | 232 | | | 859 | |

| Total PCS | 781 | | 770 | | 764 | | 827 | | | 3,142 | |

| Total PDx | 558 | | 568 | | 589 | | 591 | | | 2,306 | |

Other(1) | 13 | | 20 | | 19 | | 14 | | | 66 | |

| Total revenues | $ | 4,707 | | $ | 4,817 | | $ | 4,822 | | $ | 5,206 | | | $ | 19,552 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the year ended |

Unaudited | March 31, 2022 | June 30, 2022 | September 30, 2022 | December 31, 2022 | | December 31, 2022 |

| Total Imaging | $ | 1,918 | | $ | 2,064 | | $ | 2,118 | | $ | 2,295 | | | $ | 8,395 | |

| AVS: | | | | | | |

| Procedural Guidance | 548 | | 560 | | 583 | | 635 | | | 2,327 | |

| Specialized Ultrasound | 660 | | 653 | | 638 | | 735 | | | 2,685 | |

| Total AVS | 1,208 | | 1,213 | | 1,221 | | 1,370 | | | 5,012 | |

| PCS: | | | | | | |

Monitoring Solutions | 521 | | 512 | | 506 | | 553 | | | 2,092 | |

| Life Support Solutions | 195 | | 201 | | 195 | | 233 | | | 824 | |

| Total PCS | 716 | | 713 | | 701 | | 786 | | | 2,916 | |

| Total PDx | 484 | | 478 | | 522 | | 473 | | | 1,958 | |

Other(1) | 17 | | 16 | | 14 | | 14 | | | 60 | |

| Total revenues | $ | 4,343 | | $ | 4,484 | | $ | 4,576 | | $ | 4,938 | | | $ | 18,341 | |

| | | | | | |

(1) Financial information not presented within the reportable segments, shown within the Other category, represents HealthCare Financial Services (“HFS”) which does not meet the definition of an operating segment.

| | | | | | | | |

Segment EBIT | For the three months ended |

Unaudited | March 31, 2024 | June 30, 2024 |

| Segment EBIT | | |

| Imaging | $ | 166 | | $ | 208 | |

| AVS | 257 | | 255 | |

| PCS | 81 | | 78 | |

| PDx | 178 | | 200 | |

Other(1) | (1) | | 1 | |

| 681 | | 742 | |

| Restructuring costs | (40) | | (29) | |

Acquisition and disposition-related benefits (charges) | — | | 3 | |

Gain (loss) on business and asset dispositions | — | | — | |

| Spin-Off and separation costs | (60) | | (67) | |

| Amortization of acquisition-related intangible assets | (31) | | (35) | |

| Investment revaluation gain (loss) | (20) | | (6) | |

| Interest and other financial charges – net | (122) | | (131) | |

| Non-operating benefit income (costs) | 102 | | 101 | |

Income from continuing operations before income taxes | $ | 512 | | $ | 578 | |

| | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the year ended |

Unaudited | March 31, 2023 | June 30, 2023 | September 30, 2023 | December 31, 2023 | | December 31, 2023 |

| Segment EBIT | | | | | | |

| Imaging | $ | 116 | | $ | 207 | | $ | 243 | | $ | 255 | | | $ | 821 | |

| AVS | 282 | | 262 | | 254 | | 326 | | | 1,124 | |

| PCS | 109 | | 84 | | 80 | | 110 | | | 383 | |

| PDx | 155 | | 152 | | 166 | | 144 | | | 617 | |

Other(1) | 2 | | 6 | | 1 | | 2 | | | 11 | |

| 664 | | 711 | | 744 | | 837 | | | 2,956 | |

| Restructuring costs | (12) | | (19) | | (3) | | (20) | | | (54) | |

Acquisition and disposition-related benefits (charges) | (1) | | 2 | | 14 | | — | | | 15 | |

Gain (loss) on business and asset dispositions | — | | — | | — | | — | | | — | |

| Spin-Off and separation costs | (58) | | (72) | | (45) | | (95) | | | (270) | |

| Amortization of acquisition-related intangible assets | (31) | | (32) | | (32) | | (32) | | | (127) | |

| Investment revaluation gain (loss) | 5 | | (6) | | 2 | | — | | | 1 | |

| Interest and other financial charges – net | (136) | | (137) | | (138) | | (131) | | | (542) | |

| Non-operating benefit income (costs) | 115 | | 123 | | 94 | | 50 | | | 382 | |

Income from continuing operations before income taxes | $ | 546 | | $ | 570 | | $ | 636 | | $ | 609 | | | $ | 2,361 | |

(1) Financial information not presented within the reportable segments, shown within the Other category, primarily represents HFS which does not meet the definition of an operating segment.

| | | | | | | | | | | | | | | | | | | | |

Segment EBIT | For the three months ended | | For the year ended |

Unaudited | March 31, 2022 | June 30, 2022 | September 30, 2022 | December 31, 2022 | | December 31, 2022 |

| Segment EBIT | | | | | | |

| Imaging | $ | 132 | | $ | 222 | | $ | 191 | | $ | 235 | | | $ | 780 | |

| AVS | 266 | | 304 | | 287 | | 371 | | | 1,228 | |

| PCS | 65 | | 81 | | 65 | | 130 | | | 341 | |

| PDx | 138 | | 115 | | 159 | | 109 | | | 520 | |

Other(1) | (2) | | (3) | | (2) | | (1) | | | (8) | |

| 599 | | 719 | | 700 | | 844 | | | 2,861 | |

| Restructuring costs | (12) | | (10) | | (88) | | (36) | | | (146) | |

Acquisition and disposition-related benefits (charges) | (15) | | (14) | | 49 | | 14 | | | 34 | |

Gain (loss) on business and asset dispositions | 3 | | — | | (2) | | — | | | 1 | |

| Spin-Off and separation costs | — | | — | | (7) | | (7) | | | (14) | |

| Amortization of acquisition-related intangible assets | (33) | | (30) | | (28) | | (31) | | | (121) | |

| Investment revaluation gain (loss) | (8) | | (14) | | (1) | | (8) | | | (31) | |

| Interest and other financial charges – net | (4) | | (12) | | (2) | | (59) | | | (77) | |

| Non-operating benefit income (costs) | 2 | | 1 | | 1 | | 1 | | | 5 | |

Income from continuing operations before income taxes | $ | 533 | | $ | 639 | | $ | 622 | | $ | 718 | | | $ | 2,512 | |

(1) Financial information not presented within the reportable segments, shown within the Other category, primarily represents HFS which does not meet the definition of an operating segment.

NON-GAAP FINANCIAL MEASURES

The non-GAAP financial measures presented in this Exhibit 99 are supplemental measures of our performance that we believe will help investors understand our results of operations, and assess our future prospects. When read in conjunction with our U.S. GAAP results, these non-GAAP financial measures provide a baseline for analyzing trends in our underlying businesses and can be used by management as one basis for making financial, operational, and planning decisions.

We report Organic revenue and Organic revenue growth rate to provide management and investors with additional understanding and visibility into the underlying revenue trends of our established, ongoing operations, as well as provide insights into overall demand for our products and services. To calculate these measures, we exclude the effect of acquisitions, dispositions, and foreign currency rate fluctuations.

| | | | | | | | | | | | | | | |

Organic Revenue* | For the three months ended June 30 | | |

Unaudited | 2024 | 2023 | % Change | | | | |

Imaging revenues | $ | 2,171 | $ | 2,228 | (3)% | | | | |

Less: Acquisitions(1) | 13 | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (33) | — | | | | | |

Imaging Organic revenue* | $ | 2,191 | $ | 2,228 | (2)% | | | | |

AVS revenues | $ | 1,249 | $ | 1,231 | 1% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (11) | — | | | | | |

AVS Organic revenue* | $ | 1,260 | $ | 1,231 | 2% | | | | |

PCS revenues | $ | 772 | $ | 770 | —% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (2) | — | | | | | |

PCS Organic revenue* | $ | 775 | $ | 770 | 1% | | | | |

PDx revenues | $ | 639 | $ | 568 | 12% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (7) | — | | | | | |

PDx Organic revenue* | $ | 646 | $ | 568 | 14% | | | | |

Other revenues | $ | 9 | $ | 20 | (53)% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | — | — | | | | | |

Other Organic revenue* | $ | 9 | $ | 20 | (53)% | | | | |

Total revenues | $ | 4,839 | $ | 4,817 | —% | | | | |

Less: Acquisitions(1) | 13 | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (54) | — | | | | | |

Organic revenue* | $ | 4,881 | $ | 4,817 | 1% | | | | |

| | | | | |

(1) | Represents revenues attributable to acquisitions from the date the Company completed the transaction through the end of four quarters following the transaction. |

(2) | Represents revenues attributable to dispositions for the four quarters preceding the disposition date. |

____________________

*Non-GAAP Financial Measure

| | | | | | | | | | | |

Organic Revenue* | For the three months ended March 31 |

Unaudited | 2024 | 2023 | % Change |

Imaging revenues | $ | 2,062 | $ | 2,088 | (1)% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (24) | — | |

Imaging Organic revenue* | $ | 2,086 | $ | 2,088 | —% |

AVS revenues | $ | 1,227 | $ | 1,267 | (3)% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (8) | — | |

AVS Organic revenue* | $ | 1,235 | $ | 1,267 | (3)% |

PCS revenues | $ | 747 | $ | 781 | (4)% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (1) | — | |

PCS Organic revenue* | $ | 748 | $ | 781 | (4)% |

PDx revenues | $ | 599 | $ | 558 | 7% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (1) | — | |

PDx Organic revenue* | $ | 600 | $ | 558 | 8% |

Other revenues | $ | 15 | $ | 13 | 12% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | — | — | |

Other Organic revenue* | $ | 14 | $ | 13 | 11% |

Total revenues | $ | 4,650 | $ | 4,707 | (1)% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (34) | — | |

Organic revenue* | $ | 4,684 | $ | 4,707 | —% |

| | | | | |

(1) | Represents revenues attributable to acquisitions from the date the Company completed the transaction through the end of four quarters following the transaction. |

(2) | Represents revenues attributable to dispositions for the four quarters preceding the disposition date. |

____________________

*Non-GAAP Financial Measure

| | | | | | | | | | | | | | | | | | | | | | | |

Organic Revenue* | For the three months ended December 31 | | For the year ended December 31 |

Unaudited | 2023 | 2022 | % Change | | 2023 | 2022 | % Change |

Imaging revenues | $ | 2,392 | $ | 2,295 | 4% | | $ | 8,944 | $ | 8,395 | 7% |

Less: Acquisitions(1) | 1 | — | | | 1 | — | |

Less: Dispositions(2) | — | — | | | — | — | |

Less: Foreign currency exchange | 12 | — | | | (131) | — | |

Imaging Organic revenue* | $ | 2,379 | $ | 2,295 | 4% | | $ | 9,074 | $ | 8,395 | 8% |

AVS revenues | $ | 1,382 | $ | 1,370 | 1% | | $ | 5,094 | $ | 5,012 | 2% |

Less: Acquisitions(1) | — | — | | | — | — | |

Less: Dispositions(2) | — | — | | | — | — | |

Less: Foreign currency exchange | 14 | — | | | (56) | — | |

AVS Organic revenue* | $ | 1,368 | $ | 1,370 | —% | | $ | 5,150 | $ | 5,012 | 3% |

PCS revenues | $ | 827 | $ | 786 | 5% | | $ | 3,142 | $ | 2,916 | 8% |

Less: Acquisitions(1) | — | — | | | — | — | |

Less: Dispositions(2) | — | — | | | — | — | |

Less: Foreign currency exchange | 6 | — | | | (16) | — | |

PCS Organic revenue* | $ | 821 | $ | 786 | 4% | | $ | 3,158 | $ | 2,916 | 8% |

PDx revenues | $ | 591 | $ | 473 | 25% | | $ | 2,306 | $ | 1,958 | 18% |

Less: Acquisitions(1) | — | — | | | — | — | |

Less: Dispositions(2) | — | — | | | — | — | |

Less: Foreign currency exchange | 9 | — | | | (14) | — | |

PDx Organic revenue* | $ | 582 | $ | 473 | 23% | | $ | 2,320 | $ | 1,958 | 18% |

Other revenues | $ | 14 | $ | 14 | —% | | $ | 66 | $ | 60 | 10% |

Less: Acquisitions(1) | — | — | | | — | — | |

Less: Dispositions(2) | — | — | | | — | — | |

Less: Foreign currency exchange | 1 | — | | | 1 | — | |

Other Organic revenue* | $ | 13 | $ | 14 | (7)% | | $ | 65 | $ | 60 | 8% |

Total revenues | $ | 5,206 | $ | 4,938 | 5% | | $ | 19,552 | $ | 18,341 | 7% |

Less: Acquisitions(1) | 1 | — | | | 1 | — | |

Less: Dispositions(2) | — | — | | | — | — | |

Less: Foreign currency exchange | 42 | — | | | (216) | — | |

Organic revenue* | $ | 5,163 | $ | 4,938 | 5% | | $ | 19,767 | $ | 18,341 | 8% |

| | | | | |

(1) | Represents revenues attributable to acquisitions from the date the Company completed the transaction through the end of four quarters following the transaction. |

(2) | Represents revenues attributable to dispositions for the four quarters preceding the disposition date. |

____________________

*Non-GAAP Financial Measure

| | | | | | | | | | | | | | | |

Organic Revenue* | For the three months ended September 30 | | |

Unaudited | 2023 | 2022 | % Change | | | | |

Imaging revenues | $ | 2,236 | $ | 2,118 | 6% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (13) | — | | | | | |

Imaging Organic revenue* | $ | 2,249 | $ | 2,118 | 6% | | | | |

AVS revenues | $ | 1,214 | $ | 1,221 | (1)% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | — | — | | | | | |

AVS Organic revenue* | $ | 1,214 | $ | 1,221 | (1)% | | | | |

PCS revenues | $ | 764 | $ | 701 | 9% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | 1 | — | | | | | |

PCS Organic revenue* | $ | 763 | $ | 701 | 9% | | | | |

PDx revenues | $ | 589 | $ | 522 | 13% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | 2 | — | | | | | |

PDx Organic revenue* | $ | 587 | $ | 522 | 12% | | | | |

Other revenues | $ | 19 | $ | 14 | 36% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | — | — | | | | | |

Other Organic revenue* | $ | 19 | $ | 14 | 36% | | | | |

Total revenues | $ | 4,822 | $ | 4,576 | 5% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (10) | — | | | | | |

Organic revenue* | $ | 4,832 | $ | 4,576 | 6% | | | | |

| | | | | |

(1) | Represents revenues attributable to acquisitions from the date the Company completed the transaction through the end of four quarters following the transaction. |

(2) | Represents revenues attributable to dispositions for the four quarters preceding the disposition date. |

____________________

*Non-GAAP Financial Measure

| | | | | | | | | | | | | | | |

Organic Revenue* | For the three months ended June 30 | | |

Unaudited | 2023 | 2022 | % Change | | | | |

Imaging revenues | $ | 2,228 | $ | 2,064 | 8% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (43) | — | | | | | |

Imaging Organic revenue* | $ | 2,271 | $ | 2,064 | 10% | | | | |

AVS revenues | $ | 1,231 | $ | 1,213 | 1% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (19) | — | | | | | |

AVS Organic revenue* | $ | 1,250 | $ | 1,213 | 3% | | | | |

PCS revenues | $ | 770 | $ | 713 | 8% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (6) | — | | | | | |

PCS Organic revenue* | $ | 776 | $ | 713 | 9% | | | | |

PDx revenues | $ | 568 | $ | 478 | 19% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (6) | — | | | | | |

PDx Organic revenue* | $ | 574 | $ | 478 | 20% | | | | |

Other revenues | $ | 20 | $ | 16 | 25% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | — | — | | | | | |

Other Organic revenue* | $ | 20 | $ | 16 | 25% | | | | |

Total revenues | $ | 4,817 | $ | 4,484 | 7% | | | | |

Less: Acquisitions(1) | — | — | | | | | |

Less: Dispositions(2) | — | — | | | | | |

Less: Foreign currency exchange | (74) | — | | | | | |

Organic revenue* | $ | 4,891 | $ | 4,484 | 9% | | | | |

| | | | | |

(1) | Represents revenues attributable to acquisitions from the date the Company completed the transaction through the end of four quarters following the transaction. |

(2) | Represents revenues attributable to dispositions for the four quarters preceding the disposition date. |

____________________

*Non-GAAP Financial Measure

| | | | | | | | | | | |

Organic Revenue* | For the three months ended March 31 |

Unaudited | 2023 | 2022 | % Change |

Imaging revenues | $ | 2,088 | $ | 1,918 | 9% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (87) | — | |

Imaging Organic revenue* | $ | 2,175 | $ | 1,918 | 13% |

AVS revenues | $ | 1,267 | $ | 1,208 | 5% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (51) | — | |

AVS Organic revenue* | $ | 1,318 | $ | 1,208 | 9% |

PCS revenues | $ | 781 | $ | 716 | 9% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (17) | — | |

PCS Organic revenue* | $ | 798 | $ | 716 | 11% |

PDx revenues | $ | 558 | $ | 484 | 15% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (19) | — | |

PDx Organic revenue* | $ | 577 | $ | 484 | 19% |

Other revenues | $ | 13 | $ | 17 | (24)% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | — | — | |

Other Organic revenue* | $ | 13 | $ | 17 | (24)% |

Total revenues | $ | 4,707 | $ | 4,343 | 8% |

Less: Acquisitions(1) | — | — | |

Less: Dispositions(2) | — | — | |

Less: Foreign currency exchange | (174) | — | |

Organic revenue* | $ | 4,881 | $ | 4,343 | 12% |

| | | | | |

(1) | Represents revenues attributable to acquisitions from the date the Company completed the transaction through the end of four quarters following the transaction. |

(2) | Represents revenues attributable to dispositions for the four quarters preceding the disposition date. |

____________________

*Non-GAAP Financial Measure

v3.24.3

Cover Page

|

Oct. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity Registrant Name |

GE HEALTHCARE TECHNOLOGIES INC.

|

| Entity Central Index Key |

0001932393

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41528

|

| Entity Tax Identification Number |

88-2515116

|

| Entity Address, Address Line One |

500 W. Monroe Street,

|

| Entity Address, City or Town |

Chicago,

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60661

|

| City Area Code |

833

|

| Local Phone Number |

735-1139

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

GEHC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

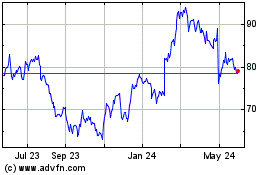

GE HealthCare Technologies (NASDAQ:GEHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

GE HealthCare Technologies (NASDAQ:GEHC)

Historical Stock Chart

From Nov 2023 to Nov 2024