UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under § 240.14a-12 |

| Future

FinTech Group Inc. |

| (Name

of Registrant as Specified In Its Charter) |

| N/A |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid

previously with preliminary materials. |

| ☐ |

Fee computed

on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11. |

LETTER FROM THE CHIEF EXECUTIVE OFFICER

Dear Shareholder:

You are cordially invited

to attend the 2024 Annual Meeting of Shareholders of Future FinTech Group Inc., a Florida corporation (the “Company” or “Future

FinTech”), which will be held at our office, located at Room 603, Floor 5, Block A, Dong Fang Mei Di Ya, No. 4 Guang Hua Road, Chaoyang

District, Beijing, China on Thursday, December 5, 2024 at 10:00 A.M., local time.

The Notice of Annual Meeting

of Shareholders and Proxy Statement describes the formal business to be transacted at the annual meeting. Our directors and officers

will be present to respond to appropriate questions from shareholders. A shareholder must complete the attached proxy card or be present

in person to vote at the meeting. The proxy statement and proxy card are expected to be mailed to all stockholders of record on or about

October 18, 2024.

Whether or not you plan to

attend the meeting, please vote as soon as possible. You can vote by returning the proxy card in the enclosed postage-prepaid envelope.

This will ensure that your shares will be represented and voted at the meeting, even if you do not attend. If you attend the meeting,

you may revoke your proxy and personally cast your vote. Attendance at the meeting does not of itself revoke your proxy.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Hu Li |

| |

Hu Li |

| |

Chief Executive Officer and Director |

| |

October 11, 2024 |

FUTURE FINTECH GROUP INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held Thursday, December 5, 2024

NOTICE IS HEREBY GIVEN that the Annual Meeting

of Shareholders of Future FinTech Group Inc., a Florida corporation (the “Company” or “Future FinTech”), will

be held at our office, located at Room 603, Floor 5, Block A, Dong Fang Mei Di Ya, No. 4 Guang Hua Road, Chaoyang District, Beijing, China, on

Thursday, December 5, 2024 at 10:00 A.M., local time, for the following purposes, as set forth in the attached Proxy Statement:

| |

(1) |

To elect five directors

to hold office until the next Annual Meeting of Shareholders and until their successors are elected and qualified; and |

| |

(2) |

To ratify Fortune CPA,

Inc., as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| (3) | To

adopt and approve the Future FinTech Group Inc. 2024 Omnibus Equity Plan; and |

| (4) | To approve the compensation

of the named executive officers as disclosed in this Proxy Statement in a non-binding, advisory

vote; and |

| (5) | To transact such other

business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors of the Company (the “Board

of Directors” or the “Board”) and the Company’s management have fixed the close of business on October 10, 2024

as the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment and

postponements thereof (the “Record Date”).

After careful consideration, the Board of Directors

recommends a vote IN FAVOR OF the nominees for director named in the accompanying proxy statement, a vote IN FAVOR OF the ratification

of Fortune CPA, Inc., as our independent registered public accounting firm for the fiscal year ending December 31, 2024, a vote IN FAVOR

OF the Future FinTech Group Inc. 2024 Omnibus Equity Plan and a vote IN FAVOR OF the compensation of our named executive officers described

in this Proxy Statement.

Shareholders are cordially

invited to attend the Annual Meeting in person. Whether you plan to attend the Annual Meeting or not, please complete, sign and date

the enclosed Proxy Card and return it without delay in the enclosed postage-prepaid envelope. If you do attend the Annual Meeting, you

may withdraw your proxy and vote personally on each matter brought before the meeting. YOUR VOTE IS VERY IMPORTANT.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Hu

Li |

| |

Hu Li |

| |

Chief Executive Officer and Director |

| |

October 11, 2024 |

| |

Beijing, China |

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL

MEETING, YOU ARE REQUESTED TO MARK, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE-PREPAID

RETURN ENVELOPE. SIGNING AND RETURNING A PROXY WILL NOT PREVENT YOU FROM VOTING IN PERSON AT THE MEETING.

THANK YOU FOR ACTING PROMPTLY

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting of Shareholders to be held on December 5, 2024. This Proxy Statement and our 2023 Annual Report

to Shareholders are also available on our website at http://www.ftft.com.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS OF

FUTURE FINTECH GROUP

INC.

To be Held on Thursday, December 5, 2024

The Board of Directors of Future FinTech Group

Inc., a Florida corporation (“Future FinTech” or the “Company”), is soliciting proxies for the Annual Meeting

of Shareholders of the Company (the “Annual Meeting”) to be held at our office, located at Room 603, Floor 5, Block A, Dong Fang Mei Di Ya, No. 4 Guang Hua Road, Chaoyang District, Beijing, China, on Thursday, December 5, 2024, at 10:00 A.M., local time, and at any

adjournments thereof. You are receiving a proxy statement because you own shares of the Company’s common stock on the Record Date

that entitle you to vote at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the Annual Meeting. The proxy

statement describes the matters we would like you to vote on and provides information on those matters so you can make an informed decision.

THE 2024 ANNUAL MEETING

Date, Time and Place

of the Annual Meeting

The Annual Meeting will

be held at 10:00 a.m., local time, on Thursday, December 5, 2024, at the Company’s office at Room 603, Floor 5, Block A, Dong Fang Mei Di Ya, No. 4 Guang Hua Road, Chaoyang District, Beijing, China 100026.

Matters to be Voted

Upon at the Annual Meeting

At the Annual Meeting,

Future FinTech is asking its shareholders as of the record date of October 10, 2024 (the “Record Date”) to consider and vote

upon proposals:

| |

(1) |

To elect five directors

to hold office until the next Annual Meeting of Shareholders and until their successors are elected and qualified; and |

| |

(2) |

To ratify Fortune CPA,

Inc., as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| (3) | To adopt and approve

the Future FinTech Group Inc. 2024 Omnibus Equity Plan; and |

| (4) | To approve the compensation

of the named executive officers as disclosed in this Proxy Statement in a non-binding, advisory

vote; and |

| (5) | To transact such other

business as may properly come before the meeting or any adjournment thereof. |

Record Date; Shares

Entitled to Vote

Shareholders will be

entitled to vote or direct votes to be cast at the Annual Meeting if they owned shares of Future FinTech common stock on the Record Date.

Shareholders will have one vote for each share of Future FinTech common stock owned at the close of business on the Record Date. If your

shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes

related to the shares you beneficially own are properly counted. At the close of business on October 10, 2024, we had 20,747,527 shares

of common stock outstanding.

Quorum

A quorum is the minimum number of shares required

to hold a meeting. A majority of the shares of our common stock issued and outstanding and entitled to vote must be represented in person

or by proxy at the meeting to establish a quorum. Both abstentions and broker non-votes are counted as present for determining the presence

of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which

the broker has not voted. Thus, broker non-votes will not affect the outcome of any of the matters to be voted on at the Annual Meeting.

Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal

because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power

to vote such shares.

Voting Generally

Holders of record of shares of the Company’s

Common Stock as of the Record Date are entitled to one vote per share on each matter to be considered and voted upon at the Annual Meeting.

Our Second Amended and Restated Articles of Incorporation,

as amended, state that there is no cumulative voting in the election of directors. The affirmative vote of the holders of shares of Common

Stock representing a plurality of the votes cast at the Annual Meeting at which a quorum is present is required for the election of the

directors listed below. Abstentions and non-votes will be counted for purposes of determining the presence of a quorum, but will not

be counted as a vote for the election as a director of any nominee.

Votes cast in person or by proxy at the Annual

Meeting will be tabulated at the Annual Meeting. All valid, unrevoked proxies will be voted as directed. In the absence of instructions

to the contrary, properly executed proxies will be voted (i) for the election of each of the nominees for director set forth herein,

(ii) for the ratification of Fortune CPA, Inc., as our independent registered public accounting firm for the fiscal year ending December

31, 2024, (iii) for the adoption of Future FinTech Group Inc. 2024 Omnibus Equity Plan, and (iv) To approve the compensation of the named

executive officers as disclosed in this Proxy Statement in a non-binding, advisory vote.

If any matters other than those addressed on

the proxy card are properly presented for action at the Annual Meeting, the persons named in the proxy card will have the discretion

to vote on those matters in their best judgment, unless authorization is withheld.

Many of our shareholders hold their shares through

a stockbroker, bank or other nominee rather than directly in their own names. As summarized below, there are some distinctions between

shares held of record and those owned beneficially.

Shareholder of Record. If your shares

are registered directly in your name with our transfer agent, Transhare Corporation, you are considered the shareholder of record with

respect to those shares. As a shareholder of record, you have the right to grant your voting proxy directly to us or to vote in person

at the Annual Meeting. As the shareholder of record, you may vote in person at the Annual Meeting or vote by proxy using the accompanying

proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may

still attend the Annual Meeting and vote in person even if you have already voted by proxy.

By Mail — shareholders will receive a proxy

card and can follow the instructions given for mailing. A paper copy of the proxy materials may also be obtained by following the instructions

given on the notice and proxy card. To vote using the proxy card, simply print the proxy card, complete, sign and date it and return

it promptly to Annual Meeting & Proxy Services, Transhare Corporation, Bayside Center 1, 17755 US Highway 19 N, Suite 140, Clearwater

FL 33764. In the alternative, the proxy card can be mailed directly to the Company: Corporate Secretary at Americas Tower, 1177 Avenue

of The Americas, Suite 5100, New York, NY 10036.

Online — shareholders may submit

a proxy online using the website listed on the proxy card. Please have your proxy card in hand when you log onto the website. Online

voting facilities will close and no longer be available on the date and time specified on the proxy card.

In Person — shareholders may vote in person

at the Annual Meeting. To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. The Board recommends

that you vote using one of the other voting methods, given that it is not practical for most stockholders to attend the Annual Meeting.

Please note that the notice letter you received

directing you to the website at which the proxy materials are available is not the proxy card and should not be used to submit your vote.

If you do not return a signed proxy card,

vote online or attend the meeting and vote in person, your shares will not be voted. Shares of our common stock represented by properly

executed proxies that are received by us and are not revoked will be voted at the Annual Meeting in accordance with the instructions

contained therein. If you return a signed and dated proxy card and instructions are not given, such proxies will be voted FOR

the election of each nominee for director named herein, FOR ratification of the selection of Fortune CPA, Inc., as our

independent registered public accounting firm for the fiscal year ending December 31, 2024, FOR the adoption of Future FinTech

Group Inc. 2024 Omnibus Equity Plan and FOR the approval of the compensation of the named executive officers as disclosed in this Proxy Statement in a non-binding, advisory vote.

In addition, we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by us, in our sole discretion,

on any matters brought before the Annual Meeting for which we did not receive adequate notice under the proxy rules promulgated by the

Securities and Exchange Commission (“SEC”).

Beneficial Holder. If your shares are

held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of the shares held in street name,

and these proxy materials are being forwarded to you by your broker or nominee who is considered the shareholder of record with respect

to those shares. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the

meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the meeting unless you obtain

a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote those shares at the

meeting.

Required Vote

The nominees for election as directors at the

Annual Meeting will be elected by a plurality of the votes cast at the meeting. This means that the director nominee with the most votes

for a particular slot is elected for that slot. Votes withheld from one or more director nominees will have no effect on the election

of any director from whom votes are withheld. The approval of each of the other proposals require the affirmative vote of a majority

of the shares represented at the meeting and entitled to vote on that proposal.

If you are a beneficial owner and do not provide

the shareholder of record with voting instructions, your shares may constitute “broker non-votes.” A “broker non-vote”

occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because

that holder does not have discretionary voting power and has not received instructions from the beneficial owner.

Under applicable regulations, if a broker holds

shares on your behalf, and you do not instruct your broker how to vote those shares on a matter considered “routine,” the

broker may generally vote your shares for you. A “broker non-vote” occurs when a broker has not received voting instructions

from you on a “non-routine” matter, in which case the broker does not have authority to vote your shares with respect to

such matter. Unless you provide voting instructions to a broker holding shares on your behalf, your broker may not use discretionary

authority to vote your shares on any of the matters to be considered at the Annual Meeting other than the ratification of our independent

registered public accounting firm. Please vote your proxy so your vote can be counted.

Unless otherwise required by the Company’s

Second Amended and Restated Articles of Incorporation, as amended, Bylaws, the Florida Business Corporation Act, or by other applicable

law, any other proposal that is properly brought before the Annual Meeting will require approval by the affirmative vote of a majority

of all votes cast at the Annual Meeting. With respect to any such proposal, neither abstentions nor broker non-votes will be counted

as votes cast for purposes of determining whether the proposal has received sufficient votes for approval.

Directors and executive officers of the Company

beneficially hold approximately 133,400 shares of Company Common Stock, or 0.64 % of all the votes entitled to be cast at the Annual

Meeting. Mr. Zeyao Xue directly and indirectly owns 3,652,850 shares of Company Common Stock or 17.6% of all the votes that will be entitled

to be cast at the Annual Meeting.

Deadline for Voting by Proxy

In order to be counted, votes cast by proxy must

be received prior to the Annual Meeting.

Revocability of Proxies

Shareholders are requested to date, sign and

return the enclosed proxy card to make certain their shares will be voted at the Annual Meeting. Any proxy given may be revoked by the

shareholder at any time before it is voted by delivering written notice of revocation to the Secretary of the Company, by filing with

the Secretary of the Company a proxy bearing a later date, or by attending the Annual Meeting and voting in person. All proxies properly

executed and returned will be voted in accordance with the instructions specified thereon.

Householding

The SEC has adopted rules that permit companies

and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy materials with respect to two or more shareholders

sharing the same address by delivering a single set of proxy materials. This process, which is commonly referred to as “householding,”

potentially results in extra convenience for shareholders and cost savings for companies. The Company has adopted the SEC-approved “householding”

procedure.

Upon written or oral request, the Company will

deliver promptly a separate copy of the proxy statement and proxy materials of Annual Meeting of Shareholders to any shareholder at a

shared address to which the Company delivered a single copy of any of these documents. If, at any time, you no longer wish to participate

in “householding” and would prefer to receive a separate set of proxy materials, you may:

| |

● |

Send a written request

to the Company’s Corporate Secretary at Americas Tower, 1177 Avenue of The Americas, Suite 5100, New York, NY 10036, or call

888-622-1218 if you are a shareholder of record; or |

| |

● |

Notify your broker, if

you hold your shares of common stock under street name. |

If you are receiving more than one copy of the

proxy materials at a single address and would like to participate in householding, please contact the Company using the mailing address

and phone number above. Shareholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other similar

organization to request information about householding.

Future FinTech Information

Our principal executive offices are located at

Americas Tower, 1177 Avenue of The Americas, Suite 5100, New York, NY 10036. The telephone number of our principal offices is 888-622-1218.

PROPOSAL 1 – ELECTION OF BOARD OF DIRECTORS

Directors

Based on the Company’s nominations process,

a majority of the independent members of the Board shall recommend to the Board for nomination by the Board such candidates as said majority

of the independent directors, in the exercise of their judgment, have found to be well qualified and willing and available to serve.

A majority of our independent directors of the Board has recommended and the Board has nominated the persons listed below for election

to the Board at the Annual Meeting, to hold office until the next Annual Meeting and until their respective successors are elected and

qualified. It is not contemplated that any of the nominees will be unable or unwilling to serve as a director, but, if that should occur,

the persons designated as proxies will vote in accordance with their best judgment. In no event will proxies be voted for a greater number

of persons than the number of nominees named in this Proxy Statement.

All shares represented by valid proxies, and

not revoked before they are exercised, will be voted in the manner specified therein. If a valid proxy is submitted but no vote is specified,

the Proxy will be voted FOR the election of each of the five nominees for election as directors. Please note that your broker

will not be permitted to vote on your behalf on the election of directors unless you provide specific instructions by completing and

returning the voting instruction form. For your vote to be counted, you will need to communicate your voting decisions to your broker

or other nominee before the date of the Annual Meeting or obtain a legal proxy to vote your shares at the meeting. Although all nominees

are expected to serve if elected, if any nominee is unable to serve, then the persons designated as proxies will vote for the remaining

nominees and for such replacements, if any, as may be nominated by our Board, who currently serves the functions of a nominating committee

as the Board does not have a standing nominating committee. Proxies cannot be voted for a greater number of persons than the number of

nominees specified herein (five persons). Cumulative voting is not permitted.

The affirmative vote of the holders of shares

of Common Stock representing a plurality of the votes cast at the Meeting at which a quorum is present is required for the election of

the directors listed below.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE ELECTION OF

ALL FIVE NOMINEES LISTED BELOW.

The following sets forth the information regarding

our director nominees as of October 10, 2024, including the names of each of the five nominees for election as a director, such person’s

position, age, the year such person became a director of the Company, and additional biographical data.

| Name

of Directors |

|

Age |

|

Position(s) |

|

Service

Since |

| Fuyou Li (1) |

|

71 |

|

Chairman of the Board

and Independent Director |

|

May

2015 |

| Hu Li (2) |

|

50 |

|

Chief Executive Officer,

President and Director |

|

August

2024 |

| Ying Li |

|

36 |

|

Vice President and Director |

|

June

2021 |

| Mingyong Hu (1)(3) |

|

46 |

|

Independent Director |

|

October

2024 |

| Mingjie Zhao (1) |

|

60 |

|

Independent Director |

|

July

2020 |

| (1) | Member of the audit committee

and compensation committee of the Board. |

| (2) | Mr. Hu Li was appointed

as a member of the Board, President and Chief Executive Officer of the Company on August

5, 2024. |

| (3) | Mr. Mingyong Hu was appointed

as a member of the Board on October 1, 2024. |

Fuyou Li, Director and Chairman of the Board

Mr. Fuyou Li has served as a member of the Board

and a member of the audit and compensation committees of the Board since May 8, 2015. Mr. Li was appointed as the Chairman of the Board

on June 23, 2021. Mr. Li graduated from Xi’an Jiaotong University with a doctor’s degree in economics. He has taught international

finance as a professor at Xi’an Jiaotong University from 2000 to July 2023. The Board believes his qualifications, professional

background and expertise in international finance are important to the Company and the Board.

Hu Li, Director, President and Chief Executive Officer

Mr. Hu Li has served as the Chief Executive Officer

and President of the Company and a member of the Board since August 5, 2024. Mr. Hu Li has served as the Corporate Secretary of the Company

since June 2019. Mr. Li has served as a director and Chief Executive Officer of FTFT International Securities and Futures Limited, a

wholly owned subsidiary of the Company since January 2024. Mr. Li has served as a director of the Board of Directors of Shineco, Inc.

(Nasdaq: SISI) since September 2021. Mr. Li served as the chief supervisor of Anhui Yihai Mining Equipment Co., Ltd., a public company

in China NEEQ Market (Stock Symbol: 831451) from February 2018 to July 2021. From September 2015 to February 2018, Mr. Li served as the

Vice General Manager of Shaanxi Huipu Financial Leasing Co., Ltd. Mr. Li obtained his master’s degree in Business Administration

(MBA) from Xi’an Technology University in 2008 and bachelor’s degree from Xi’an Fanyi University in 1996. The Board

believes that Mr. Li’s extensive experience with the Company and its business operations will be an asset to the Company and the

Board.

Ying Li, Director and Vice President

Ms. Ying Li was appointed as a member of the

Board on June 23, 2021 and she has served as a director of Alpha International Securities (HONG KONG) Limited since September 9, 2020

and as a director of Alpha International Financial Holdings Limited since February 5, 2020. The Company acquired FTFT International Securities

and Futures Limited in November 2023 and changed its name to FTFT International Securities and Futures Limited. Ms. Li has served as

the vice president of the Company and a director of Future FinTech (Hong Kong) Limited, a wholly owned subsidiary of the Company since

July 2016. From October 2011 to December 2019, Ms. Li served as the secretary of the Board of the Company. Ms. Li received her bachelor’s

degree in English from Xi’an International Studies University in July 2010. The Board believes that Ms. Li’s extensive business

and operational knowledge of the Company qualifies her as a member of the Board.

Mingyong Hu, Director

On October 1, 2024, the Board appointed Mingyong

Hu as a member of the Board , Chairman of Audit committee of the Board and a member of the Compensation Committee of the Board. Mr. Mingyong

Hu was the founder and CFO of Beijing Xiaowu Supply Chain Technology Co., Ltd. from August 2021 to April 2024. From March 2019 to July

2021, Mr. Hu was the executive vice president of Zhenghua Guotai International Trading Co., Ltd. From October 2017 to March 2019, Mr.

Hu was the general manager of Zhongrong Dinghui (Beijing) Equity Investment Fund Management Co., Ltd. From January 2016 to October 2017,

Mr. Hu was the executive vice president of Zhongsheng Wantong Equity Investment Fund Management (Beijing) Co., Ltd. From June 2007 to

December 2015, Mr. Hu was a partner and executive deputy general manager of Zhonghao Investment Group Co., Ltd. Mr. Mingyong Hu received

his bachelor’s degree in accounting from Hunan University in July 2001. Mr. Hu is a Certified Public Accountant of China, and he

also holds Certification of Securities Professional and Fund Qualification Certificate in China. The Board believes that Mr. Hu’s

extensive knowledge and experience in accounting and investment is important to the Company’s financial reporting and business.

Mingjie Zhao, Director

Mr. Mingjie Zhao was appointed as a member of

the Board and Chairman of the Compensation Committee and a member of Audit Committee of the Board on July 15, 2020. Mr. Zhao has served

as a director of New York Hua Yang, Inc. since April 2018. From July 2016 to March 2018, Mr. Zhao served as Chief Executive Officer of

TD Holdings, Inc. (formerly known as China Commercial Credit Inc. and Nasdaq: GLG). Mr. Zhao was the Chief Operating Officer and

a director of New York Hua Yang, Inc. from September 2011 to July 2016. Mr. Zhao obtained his Master of Business Administration degree

from University of Bridgeport in Connecticut in May 2003 and his Bachelor of Science degree from China Eastern Normal University in Shanghai,

China in July 1985. The Board believes that Mr. Zhao’s experience and extensive knowledge in management and public company is essential

to the Company.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS

VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT.

CORPORATE GOVERNANCE

Pursuant to the Company’s Bylaws and the

Florida Business Corporation Act, the Company’s business and affairs are managed under the direction of the Board. Directors are

kept informed on the Company’s business through discussions with management, including the Chief Executive Officer and other senior

officers, by reviewing materials provided to them and by participating in meetings.

Our Board meets on a regular basis during the

year to review significant developments affecting us and to act on matters requiring Board approval. It also holds special meetings when

an important matter requires Board action between scheduled meetings. Members of senior management regularly attend Board meetings to

report on and discuss their respective areas of responsibility. The Board held 11 regularly scheduled and special meetings during fiscal

year 2023. All of the directors attended (in person or by telephone) all of the Board meetings and any committees of the Board on which

they served during the fiscal year. Directors are expected to use their best efforts to be present at the shareholders annual meeting.

All of our directors attended the December 5, 2023 shareholders annual meeting by tele-conference or in person.

Independent Directors

The Company’s Common Stock is listed on

the NASDAQ Capital Market. NASDAQ requires that a majority of the Company’s directors be “independent,” as defined

by the NASDAQ’s rules. Generally, a director does not qualify as an independent director if the director (or, in some cases, a

member of the director’s immediate family) has, or in the past three years had, certain relationships or affiliations with the

Company, its external or internal auditors, or other companies that do business with the Company. The Board of Directors has determined

that a majority of the Company’s directors are independent directors under the NASDAQ rules. The Company’s independent directors

are: Fuyou Li, Mingyong Hu and Mingjie Zhao.

Our Board of Directors, which is elected by our

shareholders, is our ultimate decision-making body, except with respect to those matters reserved to our shareholders. The Board selects

the officers who are charged with the conduct of our business, and has responsibility for establishing broad corporate policies and for

our overall performance. The Board is not involved in operating details on a day-to-day basis. The Board is advised of our business through

regular reports and analyses and discussions with our principal executive officer and other officers.

Code of Ethics and Governance Program

We have adopted a code of business conduct and

ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our

code of business conduct and ethics is available on our website at www.ftft.com and may be found by first clicking on “Investors,”

then “Corporate Governance” and then “Governance Documents.” We intend to disclose any amendments to the code,

or any waivers of its requirements, on our website.

Committees of the Board and Attendance at

Meetings

The Board held 11 regularly scheduled and special

meetings during fiscal year 2023. All of the directors attended (in person or by telephone) all of the Board meetings and any committees

of the Board on which they served during the fiscal year. Directors are expected to use their best efforts to be present at the shareholders

annual meeting. All of our directors attended the December 5, 2023 shareholders annual meeting by tele-conference or in person.

Audit Committee and Report of the Audit Committee

On April 25, 2008, the Board formed an audit

committee. Messrs. Mingyong Hu, Fuyou Li and Mingjie Zhao currently serve on the audit committee, which is chaired by Mr. Hu. Each member

of the audit committee is “independent” as that term is defined in the rules of the SEC and within the meaning of such term

as defined under the rules of the NASDAQ Capital Market. The Board has determined that each audit committee member has sufficient knowledge

in financial and auditing matters to serve on the audit committee. The audit committee held 6 meetings during fiscal year 2023, and all

audit committee members attended each of those meetings. Our Board has determined that Mr. Hu is an “audit committee financial

expert,” as defined under the applicable SEC rules. The audit committee has a written charter, which is available on the Company’s

website at http://www.ftft.com.

Management is responsible for the Company’s

internal controls and the financial reporting process. The independent accounting firm is responsible for performing an independent audit

of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight

Board (United States) (“PCAOB”) and issuing reports thereon. The audit committee’s responsibility is to monitor these

processes. The audit committee meets with management, the leader of the internal audit function, and the independent accounting firm

to facilitate communication. In addition, the audit committee appoints the Company’s independent accounting firm and pre-approves

all audit and non-audit services to be performed by the independent accounting firm.

In this context, the audit committee has discussed

with the Company’s independent accounting firm the overall scope and plans for the independent audit. The audit committee reviewed

and discussed the audited financial statements with management. Management represented to the audit committee that the Company’s

consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles (“GAAP”).

Discussions about the Company’s audited financial statements included the independent accounting firm’s judgments about the

quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures

in the financial statements. The audit committee also discussed with the independent accounting firm the other matters required to be

discussed by PCAOB Auditing Standard No. 16 (Communications with Audit Committees). The Company’s independent accounting firm provided

to the audit committee the written disclosures and the letter required by the PCAOB, and the committee discussed the independent accounting

firm’s independence with management and the independent accounting firm.

Based on: (i) the audit committee’s discussion

with management and the independent accounting firm; (ii) the audit committee’s review of the representations of management; and

(iii) the report of the independent accounting firm to the audit committee, the audit committee recommended to the Board that the audited

consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31,

2023 filed with the SEC.

Compensation Committee

On April 25, 2008, the Board formed a

compensation committee. Messrs. Mingyong Hu, Mingjie Zhao and Fuyou Li currently serve on the compensation committee, which is

chaired by Mr. Zhao. Each member of the compensation committee is “independent” as that term is defined in the SEC rules

and within the meaning of such term as defined under the rules of the NASDAQ Capital Market, a “nonemployee director”

for purposes of Section 16 of the Exchange Act. No interlocking relationship exists between the Board or the compensation committee

and the Board or compensation committee of any other company, nor has any interlocking relationship existed during the last fiscal

year. The compensation committee held 2 meetings during fiscal year 2023, and all compensation committee members attended those

meetings. The compensation committee has a written charter, which is available on the Company’s website

at http://www.ftft.com/.

Our Board has delegated to the compensation committee

the responsibility, among other things, to determine any and all compensation payable to our executive officers, including annual salaries,

incentive compensation, long-term incentive compensation and any other compensation, and to administer our equity and incentive compensation

plans applicable to our executive officers. Decisions regarding executive compensation made by the compensation committee are considered

final and are not generally subject to Board review or ratification. Under the terms of its written charter, the compensation committee

has the power and authority to delegate any of its duties and responsibilities to subcommittees as the compensation committee may deem

appropriate in its sole discretion. Historically, the compensation committee has not generally delegated any of its duties and responsibilities

to subcommittees, but rather has taken such actions as a committee, as a whole. Deliberations and decisions by the compensation committee

concerning executive officers are made by the compensation committee, without the presence of the any executive officer of the Company.

Other Committees

The Board may on occasion establish other committees,

as it deems necessary or required. We do not currently have a standing nominating committee, or a committee performing similar functions.

The full Board currently serves this function. Our directors believe that it is not necessary to have such committees, at this time,

because the functions of such committees can be adequately performed by the Board. The Board will assess all candidates, whether submitted

by management or shareholders, and make recommendations for election or appointment. There have been no material changes to the procedures

by which security holders may recommend nominees to the Board.

Board Leadership Structure

Our Board of Directors is currently comprised

of five members, including three independent directors who serve as members of our audit committee and compensation committee. Our Board

leadership structure consists of a Chairman of the Board. Currently, Mr. Fuyou Li, an independent director, serves as Chairman of

the Board. The Board of Directors believes that this leadership structure, with Mr. Fuyou Li serving as the Chairman and Mr. Hu

Li serving as Chief Executive Officer, is appropriate at this time because it enables the Board, as a whole, to engage in oversight of

management, promote communication and collaboration between management and the Board, and oversee governance matters, while allowing

our Chief Executive Officer to focus on his primary responsibility, the operational leadership and strategic direction of the Company.

In addition to chairing the Board, Mr. Fuyou Li is a member of the Audit and Compensation Committees.

Board independence and oversight of the senior

management of the Company are enabled by the presence of independent directors who have a wide range of expertise and skills and have

oversight over critical functions of the Company, such as the review of business development, evaluation and compensation of executive

management, the nomination of directors. Our independent directors collectively provide additional strength and balance to our Board

leadership structure.

Risk Management

The Chief Executive Officer and senior management

are primarily responsible for identifying and managing the risks facing the Company under the oversight and supervision of the Board.

The Chief Executive Officer reports to the Board of Directors regarding any risks identified and steps it is taking to manage those risks.

In addition, the Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the areas of

financial reporting and internal controls. The Compensation Committee assists the Board in fulfilling its oversight responsibilities

with respect to risk in the area of compensation policies and practices. Other general business risks such as economic, regulatory and

permitting are monitored by the full Board.

Communications with Directors

Shareholders may communicate with the Board or

to one or more individual members of the Board by writing Future FinTech Group Inc., at Americas Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036, Attention: Corporate Secretary. As appropriate, communications received from shareholders are forwarded

directly to the Board, or to any individual member or members, depending on the facts and circumstances outlined in the communication.

The Board has authorized the Secretary, in his discretion, to exclude communications that are patently unrelated to the duties and responsibilities

of the Board, such as spam, junk mail and mass mailings. In addition, material that is unduly hostile, threatening, illegal or similarly

unsuitable will be excluded, with the provision that any communication that is filtered out by the Secretary pursuant to the policy will

be made available to any non-management director upon request. Individual directors are not permitted to communicate with shareholders

or others outside the Company unless they are deemed authorized persons under the Company’s corporate disclosure policy.

Compensation Committee Interlocks and Insider Participation

None of the Company’s executive officers

has served as a member of a compensation committee, or other committee serving an equivalent function, of any other entity whose executive

officers serve as a director of the Company or member of the Company’s compensation committee.

Family Relationships

There are no family relationships among any current

executive officer or director of the Company.

Board Diversity Matrix

Board

Diversity Matrix (As of October 10, 2024)

| Total Number of Directors |

5 |

| |

|

Female |

|

|

Male |

|

|

Non-Binary |

|

|

Did

Not

Disclose

Gender |

|

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

|

| Directors |

|

1 |

|

|

4 |

|

|

0 |

|

|

0 |

|

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

| Asian (other than South Asian) |

|

|

|

|

|

|

|

5 |

|

|

|

|

| LGBTQ+ |

|

|

|

|

|

|

|

0 |

|

|

|

|

| Did Not Disclose Demographic Background |

|

|

|

|

|

|

|

0 |

|

|

|

|

Executive Officers

The following table sets forth as of October

10, 2024, the names, positions and ages of our current executive officers. Our officers are elected by the Board of Directors and their

terms of office are, except to the extent governed by an employment contract, at the discretion of the Board of Directors.

| Name

|

|

Age |

|

Principal

Occupation |

| Hu Li (1) |

|

50 |

|

Chief Executive Officer,

President and Director |

| Ming Yi (2) |

|

44 |

|

Chief Financial Officer |

| Peng Lei (3) |

|

47 |

|

Chief Operating Officer |

| (1) |

Hu Li was appointed as

Chief Executive Officer and President of the Company on August 5, 2024 and Mr. Shanchun Huang resigned as CEO and President of the

Company on August 5, 2024. |

| (2) |

Ming Yi was appointed as Chief Financial Officer of

the Company on November 30, 2020. |

| |

|

| (3) |

Peng Lei was appointed

as Chief Operating Officer of the Company (“COO”) on July 28, 2023 and Mr. Yang Liu resigned as COO of the Company on

July 27, 2023. |

Hu Li, Chief Executive Officer, President and Director

Mr. Hu Li’s biography is set forth above

under the Section entitled “Board of Directors.”

Ming Yi, Chief Financial Officer

On November 30, 2020,

the Board of the Directors appointed Mr. Ming Yi as the Chief Financial Officer (“CFO”) of the Company.

Mr. Yi served as an independent director of Freight

Technologies, Inc. (Nasdaq: FRGT and formerly known as Hudson Capital Inc.) from March 31, 2020 to February 14, 2022. Mr. Yi was

the Chief Financial Officer of SSLJ.com Limited from July 2018 to July 2019. From June 2011 to August 2018, Mr. Yi was the Chief Financial

Officer and a board member of Wave Sync Corp. (formerly known as China Bio-Energy Corp). From September 2009 to April 2011, he served

as a senior manager at Qi He Certified Public Accountants Co. Ltd. Form July 2007 to August 2010, Mr. Yi was a senior auditor at Ernst

& Young. Mr. Yi received his Bachelor of Science degree in Accounting from School of Business Administrations of Liaoning University

in 2004 and his Master of Science degree in Accounting and Finance from Victory University, Australia in 2006. Mr. Yi is a Certified

Public Accountant in Australia.

Peng Lei, Chief Operating Officer

On July 28, 2023, the Company appointed Mr. Peng

Lei as the Chief Operating Officer (“COO”) of the Company.

Mr. Peng Lei has served as general manager of

Future Commercial Management Co., Ltd., a wholly owned subsidiary of the Company since July 2022. From July 2019 to July 2022, Mr. Lei

served as the general manager of Xi'an Dingtaiheng Supply Chain Management Co., Ltd. and Ningbo Tielin Supply Chain Management Co., Ltd.

From March 2014 to July 2019, Mr. Lei served as a director and general manager of Changan Parking Investment Management (Shanghai) Co.,

Ltd. From April 2010 to March 2014, Mr. Lei was the manager of Xi'an Zhonglou Sub-branch of Shanghai Pudong Development Bank. Mr. Lei

received his Ph.D. degree and master’s degree in finance from the School of Economics and Finance of Xi'an Jiaotong University

in September 2011 and July 2009, respectively. Mr. Lei received his bachelor’s degree in international finance from the School

of Management of Xi'an Jiaotong University in July 1999.

Section 16(a) Beneficial Ownership Reporting

Compliance

Section 16(a) of the Exchange Act, requires that

directors, certain officers of the Company and more than ten percent shareholders file reports of ownership and changes in ownership

with the Commission as to the Company’s securities beneficially owned by them. Such persons are also required by SEC rules to furnish

the Company with copies of all Section 16(a) forms they file.

Based solely on its review of copies of such forms received by the Company, or on written representations from certain reporting persons,

the Company believes that, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent shareholders

were complied with during the fiscal year ended December 31, 2023, except for the following: Mr. Shanchun Huang, the CEO of the Company,

did not file a Form 4 for the grant of stock award for 200,000 shares on December 23, 2023 until January 2, 2024; Mr. Peng Lei, Chief

Operating Officer (“COO”) of the Company, did not file Form 3 for appointed as COO of the Company and Form 4 for the grant

of stock award for 40,000 shares on December 23, 2023 until April 5, 2024; and Mr. Zeyao Xue, a 10% more shareholder did not file Form

4 for three transactions that occurred on August 3, 2023 and December 11, 2024, respectively, until April 5, 2024.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Review, Approval or Ratification of Transactions with Related Parties

On September 30, 2008, our Board of Directors

approved a statement of policies and procedures with respect to related party transactions, which was amended on July 11, 2011. A copy

of the amended and restated statement of policies and procedures is available on the Company’s website at http://www.ftft.com/.

The statement of policies and procedures with

respect to related party transactions, as amended, requires the audit committee to review the material facts of all interested transactions,

as further described below, unless an exception applies, and either approve or disapprove of our entry into an interested transaction.

If the audit committee’s advance approval of an interested transaction is not feasible, then such interested transaction shall

be considered at the audit committee’s next regularly scheduled meeting and, if the audit committee determines it to be appropriate,

then such interested transaction shall be ratified.

In determining whether to approve or ratify a

transaction with related party, the audit committee will take into account, among other factors it deems appropriate, whether the interested

transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances

and the extent of the related party’s interest in the transaction, as described below. Pursuant to the statement of policies and

procedures with respect to related party transactions, no director shall participate in any discussion or approval of an interested transaction

for which he or she is a related party, except that such director shall provide all material information concerning the interested transaction

to the audit committee. If an interested transaction is ongoing, the audit committee may establish guidelines for our management to follow

in our ongoing dealings with the related party. Thereafter, the audit committee, on at least an annual basis, shall review and assess

ongoing relationships with the related party to see that such related party is in compliance with the audit committee’s guidelines

and that the interested transaction remains appropriate.

For purposes of the statement of policies and procedures with respect

to related party transactions:

| |

● |

a “transaction with

related party” is a transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated under the Securities

and Exchange Act of 1934, as amended, and |

| |

● |

a “related party”

has the meaning ascribed to the term “related person” under Item 404 of Regulation S-K promulgated under the Securities

and Exchange Act of 1934, as amended. |

Notwithstanding the foregoing, each of the following

interested transactions shall be deemed to be pre-approved by the audit committee, even if the aggregate amount involved exceeds $50,000:

| |

● |

Employment of executive

officers. Any employment of an executive officer if either (i) the related compensation is required to be reported in our

proxy statement under Item 402 of the Commission’s compensation disclosure requirements generally applicable to “named

executive officers” or (ii) the executive officer is not an immediate family member of another executive officer or director,

the related compensation would be reported in our proxy statement under Item 402 of the Commission’s compensation disclosure

requirements if the executive officer was a “named executive officer” and our compensation committee approved or recommended

that the board of directors approve such compensation. |

| |

● |

Director compensation. Any

compensation paid to a director if the compensation is required to be reported in our proxy statement under Item 402 of the Commission’s

compensation disclosure requirements. |

| |

● |

Certain transactions

with other companies. Any transaction with another company at which a related party’s only relationship is as an employee

other than an executive officer, director or beneficial owner of less than 10% of that company’s shares, if the aggregate amount

involved does not exceed 2% of that company’s total annual revenue. |

| |

● |

Certain charitable contributions. Any

charitable contribution, grant or endowment by us to a charitable organization, foundation or university at which a related party’s

only relationship is as an employee other than an executive officer or a director, if the aggregate amount involved does not exceed

the lesser of $50,000 or 2% of the charitable organization’s total annual receipts. |

| |

● |

Transactions where all

shareholders receive proportional benefits. Any transaction where the related party’s interest arises solely from

the ownership of our Common Stock and all holders of our Common Stock received the same benefit on a pro rata basis, such as dividends. |

| |

● |

Transactions involving

competitive bids. Any transaction involving a related party where the rates or charges involved are determined by competitive

bids. |

| |

● |

Regulated transactions. Any

transaction with a related party involving the rendering of services as a common or contract carrier or public utility, at rates

or charges fixed in conformity with law or governmental authority. |

| |

● |

Certain banking-related

services. Any transaction with a related party involving services as a bank depositary of funds, transfer agent, registrar,

trustee under a trust indenture or similar services. |

Related Party Transactions in 2023

As of December 31, 2023, the amount due to the related parties was consisted

of the followings:

| Name | |

Amount | | |

Relationship | |

Note |

| Chao Li | |

$ | 73,893 | | |

Corporate legal representative | |

Other payables, interest free and payment on demand. |

| Ming Yi | |

| 29,513 | | |

Chief Financial Officer of the Company | |

Accrued expenses, interest free and payment on demand. |

| Xiaochen Zhao | |

| 124 | | |

Corporate legal representative | |

Accrued expenses, interest free and payment on demand. |

| Chan Siu Kei | |

| 401,516 | | |

NTAM’s Director | |

Other payables, interest free and payment on demand. |

| Total | |

$ | 505,046 | | |

| |

|

As of December 31, 2023, the amount due from the related parties was

consisted of the followings:

| Name | |

Amount | | |

Relationship | |

Note |

| Kai Xu | |

$ | 12,151 | | |

Deputy General Manager of a subsidiary of the Company | |

Loan receivables*, interest free and payment on demand. |

| Total | |

$ | 12,151 | | |

| |

|

During 2023, the Company had the following transactions with related

parties:

| Name | |

Amount | | |

Relationship | |

Note |

| JKNDC Limited | |

$ | 7,664 | | |

A company owned by the minority shareholder of NTAM | |

Other income, net |

| JKNDC Limited | |

| 978,801 | | |

A company owned by the minority shareholder of NTAM | |

Cost of revenue- Asset management service |

| Nice Talent Partner Limited | |

| 459,867 | | |

A company owned by the minority shareholder of NTAM | |

Consultancy fee |

During fiscal year 2023, the Company extended

advances amounting to $351,004 to five key management personnel, and a total of $341,190 had been either repaid or classified

as business expenses.

During fiscal year 2023, one key management personnel

advanced a total of $4,330 to the Company.

During fiscal year 2023, the Company did not

pay a bonus to a key management personnel a total of $401,516.

SECURITY OWNERSHIP OF DIRECTORS, OFFICERS AND

CERTAIN BENEFICIAL OWNERS OF FUTURE FINTECH

GROUP INC.

The following table provides information concerning

beneficial ownership of our capital stock as of October 10, 2024, by:

| |

● |

each shareholder or group

of affiliated shareholders who owns more than 5% of our outstanding capital stock; |

| |

|

|

| |

● |

each of our named executive

officers; |

| |

|

|

| |

● |

each of our directors;

and all of our directors and |

| |

|

|

| |

● |

executive officers as a

group. |

The following table lists the number of shares

and percentage of shares beneficially owned based on 20,747,527 shares of our Common Stock outstanding as of October 10, 2024.

Beneficial ownership is determined in accordance

with the SEC rules, and generally includes voting power and/or investment power with respect to the securities held. Shares of Common

Stock subject to options and warrants currently exercisable or exercisable within 60 days of October 10, 2024 or issuable upon conversion

of convertible securities which are currently convertible or convertible within 60 days of October 10, 2024 are deemed outstanding and

beneficially owned by the person holding those options, warrants or convertible securities for purposes of computing the number of shares

and percentage of shares beneficially owned by that person, but are not deemed outstanding for purposes of computing the percentage beneficially

owned by any other person. Except as indicated in the footnotes to this table, and subject to applicable community property laws, the

persons or entities named have sole voting and investment power with respect to all shares of our Common Stock shown as beneficially

owned by them.

Unless otherwise indicated in the footnotes,

the principal address of each of the shareholders, named executive officers, and directors below is c/o Future FinTech Group, Inc., Americas

Tower, 1177 Avenue of The Americas, Suite 5100, New York, NY 10036.

Shares Beneficially Owned

| Name of Beneficial Owner | |

Number | | |

Percent | |

| Directors and Named Executive Officers | |

| | |

| |

| Hu Li | |

| - | | |

| - | |

| Ming Yi | |

| 24,000 | | |

| * | |

| Ying Li | |

| - | | |

| - | |

| Mingjie Zhao | |

| - | | |

| - | |

| Peng Lei | |

| 109,400 | | |

| * | |

| Fuyou Li | |

| - | | |

| - | |

| Mingyong Hu | |

| - | | |

| - | |

| All current directors and name executive officers as a group (7 persons) | |

| 133,400 | | |

| * | |

| 5% or Greater Shareholders | |

| | | |

| | |

| Zeyao Xue (1) | |

| 3,652,850 | | |

| 17.6 | % |

| Ye Yuan (2) | |

| 1,085,268 | | |

| 5.2 | % |

| Rong Bai (3) | |

| 1,075,268 | | |

| 5.2 | % |

| All 5% or Greater Shareholders | |

| 5,813,386 | | |

| 28.0 | % |

| (1) | Consists of (i) 293,416 shares owned directly by Golden Dawn

International Limited, a British Virgin Islands company, (ii) 36,677 shares owned directly by China Tianren Organic Food Holding. Each

of Golden Dawn International Limited and China Tianren Organic Good Holding are indirect subsidiaries of V.X. Fortune Capital Limited,

a British Virgin Islands company. Mr. Zeyao Xue, holds all of the issued and outstanding capital stock of Fancylight Limited, which is

the indirect owner of those shares held by Golden Dawn International Limited and China Tianren Organic Food Holding. The address of Zeyao

Xue is No.3, Xijuyuan Xiang, Lianhu District, Xi’an City, Shaanxi Province, China. |

| (2) | The address for Ye Yuan is 3501, A Block, Xin Tian Shi Ji Shang Wu Zhong Xin, Futian, Shenzhen,

China. |

| (3) | The address for Rong Bai is 201, Floor 10, NO.500 Rui Jin Nan Road, Xu Hui Distric, Shanghai, China. |

Equity Compensation Plan

The following table sets forth information as

of December 31, 2023, with respect to our equity compensation plans previously approved by shareholders and equity compensation plans

not previously approved by shareholders.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as

of December 31, 2023, with respect to our equity compensation plans previously approved by stockholders and equity compensation plans

not previously approved by stockholders.

| | |

Equity Compensation Plan Information | |

| Plan Category | |

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights | | |

Weighted average exercise

price of outstanding options,

warrants and rights | | |

Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities reflected

in column (a)) | |

| | |

(a) | | |

(b) | | |

(c) | |

| Equity compensation plans approved by stockholders (1) | |

| - | | |

$ | - | | |

| 2,110,000 | |

| Equity compensation plans not approved by stockholders | |

| - | | |

$ | - | | |

| - | |

| Total | |

| - | | |

$ | - | | |

| 2,110,000 | |

| (1) | As of December 31, 2023,

there was 2,110,000 shares available for issuance under equity compensation plan. |

The Board has previously

approved and adopted the Future FinTech Group, Inc. 2023 Omnibus Equity Plan on October 12, 2023, which was approved at annual meeting

of stockholders on December 5, 2023, to provide equity awards to employees, directors and consultants of the Company (the “2023

Plan”). The 2023 Plan has a total of 5,000,000 shares of Common Stock. The Company granted 2,890,000 shares under the 2023 Plan

to sixteen officers and employees of the Company and its subsidiaries on December 23, 2023.

COMPENSATION

Summary Compensation of Named Executive Officers

Our executive officers do not receive any compensation

from the Company for also serving as directors of the Company. The following table sets forth information concerning cash and non-cash

compensation paid by the Company to our named executive officers for the years ended December 31, 2023 and 2022.

| Name

and Principal Position | |

Year

Ended | |

Salary

($) | | |

Bonus

($) | | |

Stock

Awards

($) | | |

Option

Awards | | |

Non-Equity

Incentive Plan

Compensation

($) | | |

Non-Qualified

Deferred

Compensation

Earnings

($) | | |

All

Other

Compensation

($) | | |

Total

($) | |

| Yongke Xue (1) | |

12/31/2023 | |

$ | 4,683 | | |

| - | | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 4,683 | |

| | |

12/31/2022 | |

$ | 5,352 | | |

| - | | |

$ | 336,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 341,352 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shanchun Huang (2) | |

12/31/2023 | |

$ | 1 | | |

| - | | |

$ | 248,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 248,001 | |

| | |

12/31/2022 | |

$ | 1 | | |

| - | | |

| 336,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 336,001 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ming Yi (3) | |

12/31/2023 | |

$ | 44,276 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 44,276 | |

| | |

12/31/2022 | |

$ | 48,000 | | |

| - | | |

$ | 42,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 90,000 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Kai Xu (4) | |

12/31/2022 | |

$ | 35,682 | | |

| | | |

$ | 210,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 223,462 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Peng Lei (5) | |

12/31/2023 | |

$ | 51,213 | | |

| | | |

$ | 49,600 | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 100,813 | |

| | |

12/31/2022 | |

$ | 53,582 | | |

| | | |

| 229,740 | | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 283,322 | |

| (1) | On

March 4, 2020, Mr. Yongke Xue resigned as the CEO of the Company and on June 23, 2021, Mr.

Xue was appointed as the president of the Company. The compensation committee of the Board

granted him a stock award for 160,000 shares of common stock of the Company under 2020 Equity

Plan on July 12, 2022. Mr. Yongke Xue passed away on November 24, 2023. |

| (2) | On

March 4, 2020, Mr. Shanchun Huang was appointed as the CEO of the Company. The compensation

committee of the Board granted him a stock award for 200,000 shares of common stock of the

Company under 2023 Equity Plan on December 23, 2023 and a stock award for 160,000 shares

of common stock of the Company under 2020 Equity Plan on July 12, 2022. |

| (3) | On

November 30, 2020, the Board of the Directors appointed Mr. Ming Yi as the CFO of the Company.

The compensation committee of the Board granted him a stock award for 20,000 shares of common

stock of the Company under 2020 Equity Plan on July 12, 2022. |

| (4) | On

February 28, 2019, the board of directors appointed Mr. Kai Xu as the COO

of the Company. Since February 2020, Mr. Xu has no longer served as the COO of the Company,

and he continues to serve as deputy general manager in a subsidiary of the Company and the

vice president of blockchain division of the Company. The compensation committee of

the Board granted him a stock award for 100,000 shares of common stock of the Company under

2020 Equity Plan on July 12, 2022. |

| (5) | The

compensation committee of the Board granted him a stock award for 109,400 shares of common

stock of the Company under 2020 Equity Plan on July 12, 2022. Mr. Peng Lei served as general

manager of Future Commercial Management Co., Ltd., a wholly owned subsidiary of the Company

since July 2022 and was appointed as COO of the Company on July 28, 2023. On December 23,

2023, the compensation committee of the Board granted him a stock award of 40,000 shares

of common stock of the Company under 2023 Equity Plan. |

| * | All share

granted before January 31, 2023 have been retroactively restated to reflect Reverse Stock

Split effected on February 1, 2023. |

Outstanding Equity Awards at December 31, 2023

No outstanding equity awards held by named executive officers as of

December 31, 2023.

PAY VERSUS PERFORMANCE

As required by Section 953(a) of the Dodd-Frank

Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are providing the following information about the

relationship of “compensation actually paid” (“CAP”) to our principal executive officer (“PEO”) and

other named executive officers (“Non-PEO NEOS”) and our performance.

Pay Versus Performance Table

As required by Section 953(a) of the Dodd-Frank

Wall Street Reform and Customer Protection Act, and item 402(v) of Regulation S-K promulgated under the Exchange Act, we are providing

the following information about the relationship between executive compensation actually paid and certain financial performance of the

Company.

For purposes of the tables below, the principal

executive officer (“PEO”) and non-PEO named executive officers for 2023 and 2022 are the following:

| Year |

|

PEO |

|

Non-PEO

named executive officers |

| 2023 |

|

Shanchun Huang |

|

Ming Yi, Yongke Xue, Peng Lei |

| 2022 |

|

Shanchun Huang |

|

Ming Yi, Yongke Xue, Peng Lei, Kai Xu |

| Year | |

Summary Compensation

table total for PEO (1)

($) | | |

Compensation Actually

Paid to PEO(2)

($) | | |

Average Summary

Compensation Table Total

for Non-PEO NEOs(3)

($) | | |

Average Compensation

Actually Paid to Non-PEO

NEOs(4)

($) | | |

Value of Initial Fixed $100

Investment Based On

Total Shareholder

Return (5)

($) | | |

Net Loss(6)

($) | |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(e) | | |

(f) | | |

(g) | |

| 2022 | |

| 336,001 | | |

| 336,001 | | |

| 960,356 | | |

| 960,356 | | |

| (67.93 | ) | |

| (16,652,688 | ) |

| 2023 | |

| 248,001 | | |

| 248,001 | | |

| 149,772 | | |

| 149,772 | | |

| (3.76 | ) | |

| (34,124,499 | ) |

| (1) |

The dollar amounts reported

in column (b) are the amounts of total compensation reported for the PEO for each corresponding year in the “Total” column

of the Summary Compensation Table. |

| |

|

| (2) |

The dollar amounts reported

in column (c) represent the amount of “compensation actually paid” to the PEO, as computed in accordance with Item 402(v)

of Regulation S-K. No adjustments were required to be made to the PEO’s total compensation for each year to determine the compensation

actually paid pursuant to the requirements of Item 402(v) of Regulation S-K. |

| |

|

| (3) |

The dollar amounts reported

in column (d) represent the average of the amounts reported for the Company’s non-PEO named executive officers as a group in

the “Total” column of the Summary Compensation Table in each applicable year. |

| |

|

| (4) |

The dollar amounts reported

in column (e) represent the average amount of “compensation actually paid” to the non-PEO named executive officers as

a group, as computed in accordance with Item 402(v) of Regulation S-K. No adjustments were required to be made to average total compensation

for the non-PEO named executive officers as a group for each year to determine the compensation actually paid pursuant to the requirements

of Item 402(v) of Regulation S-K. |

| |

|

| (5) |

Cumulative total shareholder

return (“TSR”) is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming

dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement

period by the Company’s share price at the beginning of the measurement period. |

| |

|

| (6) |

The dollar amounts reported

represent the amount of net loss reflected in the Company’s audited financial statements for the applicable year. |

Description of Relationships Between Information

Presented

In accordance with Item 402(v) of Regulation

S-K, the Company is providing the following descriptions of the relationships between information presented in the Pay versus Performance

table.

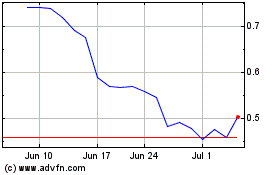

COMPENSATION

ACTUALLY PAID AND CUMULATIVE TSR

COMPENSATION ACTUALLY PAID AND NET INCOME

COMPENSATION ACTUALLY PAID AND STOCK PRICE PERFORMANCE

Compensation of Directors

The following table sets forth information concerning

cash and non-cash compensation paid by us to our directors during 2023.

| Name | |

Fees Paid

in Cash

($) | | |

Stock

Awards | | |

Option

Awards | | |

Non-Equity

Incentive Plan

Compensation

($) | | |

Non-Qualified

Deferred

Compensation

Earnings

($) | | |

All Other

Compensation

($) | | |

Total

($) | |

| Shanchun Huang | |

$ | — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | — | |

| Ying Li (1) | |

$ | — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | — | |

| Fuyou Li (2) | |

$ | 18,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | 18,000 | |

| Johnson Lau (3) | |

$ | 25,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | 25,000 | |

| Mingjie Zhao(4) | |

$ | 25,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | 25,000 | |

| (1) |

Ying Li was appointed as

a director of the Board on June 23, 2021. |

| |

|

| (2) |

On May 8, 2015, the Board

appointed Mr. Fuyou Li as a member of the Board of Directors and a member of both the audit committee and compensation committee.

Before June 30, 2021, Mr. Li was entitled for $8,850 per annum as compensation for his service as director of the Company and a member

of the audit committee and compensation committee. On June 23, 2021, the Board appointed Mr. Fuyou Li as the Chairman of the Board

and his annual compensation increased to $18,000 after June 30, 2021. |

| |

|

| (3) |

On December 23, 2014, the

Board appointed Johnson Lau as a member of the Board of Directors of the Company and he currently serves as the Chairman of Audit

Committee and a member of Compensation Committee of the Board. Mr. Lau is entitled for $25,000 per annum as compensation for his

current services as a director of the Company and chair of the audit committee and a member of compensation committee. Mr. Lau resigned

as a director, Chairman of Audit Committee and a member of Compensation Committee on September 30, 2024. |

| |

|

| (4) |

On July 15, 2020, the Board

appointed Mr. Mingjie Zhao as a member of the Board and Chairman of the Compensation Committee and a member of Audit Committee of

the Board. Mr. Zhao is entitled for $25,000 per annum as compensation for his current services as a director of the Company and chair

of the compensation committee and a member of audit committee. |

SUBMISSION OF SHAREHOLDER PROPOSALS

To be considered for inclusion