Fusion Fuel Green Announces Strategic Tranched Financing from Belike Nominees Pty Ltd., a Macquarie Group Company

November 27 2023 - 6:00AM

Fusion Fuel Green PLC (Nasdaq: HTOO) (“

Fusion

Fuel” or the “

Company”), an emerging

leader in the green hydrogen sector, today announced that it has

entered into an agreement with Macquarie Group’s Commodities and

Global Markets business (“

Macquarie”) for

financing of up to $20 million of senior convertible notes (the

“

Financing”) pursuant to a securities subscription

agreement (“

Subscription Agreement”), subject to

the satisfactions of certain conditions, as further set forth

therein. The Financing will be conducted in several tranches based

on the specific needs of the Company and the conditions set forth

in the Subscription Agreement, with each tranche size, including

the initial tranche size, to be determined by mutual agreement of

Macquarie and the Company. Although subject to change, based on

current market conditions, the initial tranche is not expected to

be greater than 10% of the total Financing. Until the conditions

precedent as described herein are satisfied or waived, there can be

no assurance that any portion of the Financing will be consummated.

Highlights of the Financing

The Financing is expected to support the Company

for its near-term objectives and milestones of delivering HEVO

solutions to contracted clients and achieving its 2023 revenue

guidance and further developing the Company’s project portfolio and

the sale of these projects to infrastructure investors, as well as

to provide additional funding for general working capital

needs.

The Financing will be conducted in multiple

tranches in which Macquarie purchases from the Company and the

Company issues and sells to Macquarie (a) convertible notes at an

issue price equal to 98% of the principal amount of the notes and

(b) warrants to purchase such number of the Company’s ordinary

shares as shall equal (x) 30% of the aggregate amount funded by

Macquarie in consideration for the related convertible notes

issued, divided by (y) the initial exercise price of the warrants.

The timing and size of each tranche will be mutually agreed upon by

Fusion Fuel and Macquarie, subject to the satisfaction of certain

closing conditions, and there are no minimum funding obligations.

Given the various criteria necessary to consummate the initial and

further tranches, the Company continues to consider available

financing options that may complement this transaction.

Frederico Figueira de Chaves, CEO of Fusion

Fuel, stated, “We are excited to enter into this agreement with

Macquarie. The Financing, when consummated, will provide the

Company with near-term financing and will allow the team to focus

on delivering its near-term objectives and create value for our

shareholders.

Details of the Financing

Pursuant to the terms of the Purchase Agreement,

Fusion Fuel will issue to Macquarie convertible notes with a term

of two years that bear interest at 4% per annum over the Secured

Overnight Financing Rate (the “Convertible

Notes”) and two-year immediately

exercisable warrants (the “Warrants”) to purchase

ordinary shares of the Company. For each tranche of Convertible

Notes issued, the Company will issue to the holder Warrants to

purchase ordinary shares as calculated above, with an exercise

price equal to 130% of the Volume Weighted Average Price for the 5

trading days immediately preceding any tranche

issuance. The holder will have the right, at its sole

option, to convert the Convertible Notes into ordinary shares of

the Company, pursuant to the terms and conditions of the

Convertible Notes based on a conversion price equal to the higher

of (i) Ninety Percent (90%) of the VWAP of the Company’s ordinary

shares on a single trading day selected by Macquarie out of the

five trading days immediately prior to the conversion date and (ii)

$0.20 per ordinary share, subject to adjustment.

Additional information about the Financing,

including a copy of the Purchase Agreement, form of Convertible

Note and form of Warrant, will be provided in a Report of Foreign

Private Issuer on Form 6-K to be filed by Fusion Fuel with the

Securities and Exchange Commission and available at

www.sec.gov.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

The securities to be sold in the private

placement have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), or any

state or other applicable jurisdiction’s securities laws, and may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements of the

Securities Act and applicable state or other jurisdictions’

securities laws. There can be no assurance that the Company

will be able to complete the private placement on the terms

described herein or at all.

About Fusion Fuel Green plc

Fusion Fuel is rapidly emerging as a leader in

the green hydrogen sector committed to accelerating the energy

transition through the development of disruptive, clean hydrogen

solutions. Fusion Fuel’s patented miniaturized Proton Exchange

Membrane (PEM) electrolyzer, the HEVO, and building-block approach

to green hydrogen production, unlock unprecedented modularity and

flexibility in the design and deployment of cost-competitive,

decentralized green hydrogen solutions. Its business lines include

the sale of its electrolyzer technology to customers interested in

building their own green hydrogen production, the development of

turnkey hydrogen plants to be owned and operated by Fusion Fuel,

and the sale of green hydrogen as a commodity to end-users through

long-term hydrogen purchase agreements. Learn more about Fusion

Fuel by visiting our website at https://www.fusion-fuel.eu, and by

following us on LinkedIn.

About Macquarie Group

Macquarie Group Limited (Macquarie) is a global

financial services group providing clients with asset management,

retail and business banking, wealth management, leasing and asset

financing, market access, commodity trading, renewables

development, specialist advice, access to capital and principal

investment. Founded in 1969, Macquarie employs over 21,000 people

in 34 markets. At September 30, 2023, Macquarie had assets under

management of €542.5 billion. For further information, visit

www.macquarie.com.

Investor Relations

Contactir@fusion-fuel.eu

Media Contactfusionfuel@celicourt.uk

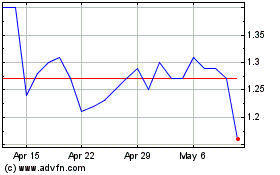

Fusion Fuel Green (NASDAQ:HTOO)

Historical Stock Chart

From Oct 2024 to Nov 2024

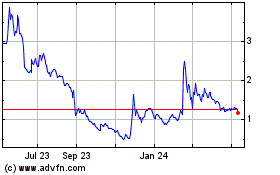

Fusion Fuel Green (NASDAQ:HTOO)

Historical Stock Chart

From Nov 2023 to Nov 2024