Freshworks Inc. (NASDAQ: FRSH), a leading software company

empowering businesses to delight their customers and employees,

today announced financial results for its third quarter ended

September 30, 2021.

“Our strong third quarter results reflect the

continued adoption of our modern and easy-to-use products by

companies of all sizes,” said Girish Mathrubootham, CEO and founder

of Freshworks. “We grew 46% year over year, and saw healthy

expansion activity from our customer base.”

Third Quarter 2021 Financial Summary

Results

- Revenue: Total

revenue was $96.6 million, representing growth of 46% compared to

the third quarter of 2020.

- GAAP (Loss) Income from

Operations: GAAP (loss) from operations was $(140.3)

million, compared to GAAP income from operations of $0.1 million in

the third quarter of 2020.

- Non-GAAP (Loss) Income from

Operations: Non-GAAP (loss) from operations was $(1.5)

million, compared to non-GAAP income from operations of $1.2

million in the third quarter of 2020.

- GAAP Net (Loss) Per

Share: GAAP net (loss) per share was $(24.72) based on

95.9 million weighted-average shares outstanding, compared to

$(3.49) based on 76.9 million weighted-average shares outstanding

in the third quarter of 2020.

- Non-GAAP Net (Loss) Income

Per Share: Non-GAAP basic and diluted net (loss) per share

was $(0.04) based on 95.9 million weighted-average shares

outstanding; compared to a non-GAAP basic and diluted net income

per share of $0.03 and $0.01, respectively, based on 76.9 million

and 233.6 million weighted-average shares outstanding,

respectively, in the third quarter of 2020.

- Net Cash (Used in) Provided

by Operating Activities: Net cash (used in) operating

activities was $(2.0) million, compared to net cash provided by

operating activities of $12.8 million in the third quarter of

2020.

- Free Cash Flow:

Free cash flow was $(4.2) million, compared to $10.3 million in the

third quarter of 2020.

- Cash, Cash Equivalents and

Restricted Cash and Marketable Securities: Cash, cash

equivalents, and restricted cash and marketable securities were

$1.3 billion as of September 30, 2021.

A description of non-GAAP financial measures is

contained in the section titled "Explanation of Non-GAAP Financial

Measures" below and a reconciliation of GAAP to non-GAAP financial

measures is contained in the tables below.

Third Quarter Key Metrics and Recent Business

Highlights

- Number of customers contributing

more than $5,000 in ARR was 14,079, an increase of 31%

year-over-year.

- Net dollar retention rate was 117%,

compared to 118% in the second quarter of 2021 and 109% in the

third quarter of 2020.

- Completed an Initial Public Offering and listed as FRSH on

NASDAQ.

- Welcomed new customers to the

Freshworks community including: Double Diamond Resorts, ForgeRock,

Hunter College NY, Lucidworks, Phillips, Scotch and Soda,

Smashburger, Toyota Connected India, Watsons, and more.

- Included in the 2021 Gartner Magic Quadrant for IT Service

Management (ITSM) Tools as a "Challenger".

- Promoted Pam Sergeeff as its Chief Legal Officer & General

Counsel.

- Appointed former CEO of NetSuite, Zach Nelson, and SVP and

Chief Product Officer at Cloudflare, Jennifer Taylor, to the board

of directors.

- Announced Refresh, the Freshworks annual user conference, to be

held November 11, with customer speakers from African Bank,

Carrefour, Clopay, Dwyer, PowerSchool, Shopify, and more.

- Realized gain from an equity investment in a private company

resulting in cash proceeds of $24 million.

Financial Outlook

We are providing estimates for the fourth

quarter and full year 2021 based on current market conditions and

expectations. We emphasize that these estimates are subject to

various important cautionary factors referenced in the section

entitled “Forward-Looking Statements” below, including risks and

uncertainties associated with the ongoing COVID-19 pandemic.

For the fourth quarter and full year 2021,

Freshworks currently expects the following results:

Fourth Quarter 2021Total revenue of $99.0

million - $101.0 millionNon-GAAP loss from operations of $13.5

million - $11.5 millionNon-GAAP net loss per share(1) of $0.07 -

$0.05

Full Year 2021Total revenue of $364.5 million -

$366.5 millionNon-GAAP loss from operations of $21.0 million -

$19.0 millionNon-GAAP net loss per share(1) of $0.22 - $0.20

(1) Non-GAAP net loss per share was estimated

assuming 269.1 million and 130.4 million weighted-average shares

outstanding for the fourth quarter and full year 2021,

respectively.

These statements are forward-looking and actual

results may differ materially. Refer to the “Forward-Looking

Statements” safe harbor section below for information on the

factors that could cause our actual results to differ materially

from these forward-looking statements.

Freshworks has not reconciled its estimates for

non-GAAP loss from operations to GAAP loss from operations or

non-GAAP net loss per share to GAAP net loss per share due to the

uncertainty and potential variability of expenses that may be

incurred in the future. Accordingly, a reconciliation is not

available without unreasonable effort. Freshworks has provided a

reconciliation of other GAAP to non-GAAP financial measures in the

financial statement tables for its third quarter 2021 non-GAAP

results included in this press release.

Webcast and Conference Call Information

Freshworks will host a conference call for

investors on November 2, 2021 at 2:00 p.m. Pacific Time / 5:00 p.m.

Eastern Time to discuss the company’s financial results and

business highlights. Investors are invited to listen to a live

audio webcast of the conference call by visiting the investor

relations website at ir.freshworks.com. A replay of the audio

webcast will be available shortly after the call on the Freshworks

Investor Relations website.

Explanation of Non-GAAP Financial Measures

In addition to financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables contain

non-GAAP financial measures, including, non-GAAP gross profit,

non-GAAP gross margin, non-GAAP sales and marketing expense,

non-GAAP research and development expense, non-GAAP general and

administrative expense, non-GAAP loss from operations, non-GAAP

operating margin, non-GAAP net loss, non-GAAP net loss per share,

non-GAAP net loss attributable to common stockholders, and free

cash flow. The presentation of these financial measures is not

intended to be considered in isolation or as a substitute for, or

superior to, financial information prepared and presented in

accordance with GAAP.

We use these non-GAAP measures in conjunction

with GAAP measures as part of our overall assessment of our

performance, including the preparation of our annual operating

budget and quarterly forecasts, to evaluate the effectiveness of

our business strategies and to communicate with our board of

directors concerning our financial performance. We believe these

non-GAAP measures provide investors consistency and comparability

with our past financial performance and facilitate period-to-period

comparisons of our operating results. We believe these non-GAAP

measures are useful in evaluating our operating performance

compared to that of other companies in our industry, as they

generally eliminate the effects of certain items that may vary for

different companies for reasons unrelated to overall operating

performance.

Investors are cautioned that there are material

limitations associated with the use of non-GAAP financial measures

as an analytical tool. The non-GAAP measures we use may be

different from non-GAAP financial measures used by other companies,

limiting their usefulness for comparison purposes. We compensate

for these limitations by providing specific information regarding

the GAAP items excluded from these non-GAAP financial measures.

We exclude the following items from one or more

of our non-GAAP financial measures, including the related income

tax effect of these adjustments:

- Stock-based compensation expense.

We exclude stock-based compensation, which is a non cash expense,

from certain of our non-GAAP financial measures because we believe

that excluding this item provides meaningful supplemental

information regarding operational performance. In particular,

stock-based compensation expense is not comparable across companies

given the variety of valuation methodologies and subjective

assumptions.

- Employer payroll taxes on employee

stock transactions. We exclude the amount of employer payroll taxes

on stock-based compensation because they are dependent on our stock

price at the time of vesting or exercise and other factors that are

beyond our control and do not correlate to the operation of the

business.

- Amortization of acquired

intangibles. We exclude amortization of acquired intangibles, which

is a non-cash expense, from certain of our non-GAAP financial

measures. Our expenses for amortization of intangibles are

inconsistent in amount and frequency because they are significantly

affected by the timing, size of acquisitions and the inherent

subjective nature of purchase price allocations. We exclude these

amortization expenses because we do not believe these expenses have

a direct correlation to the operation of our business.

- Acquisition-related expenses. We

exclude transaction, integration, and retention expenses that are

directly related to business combinations from certain of our

non-GAAP financial measures because we believe that excluding these

items provides meaningful supplemental information regarding

operational performance and investors to make more meaningful

comparisons between our operating results and those of other

companies.

- Gain on sale of non-marketable

equity investments. We exclude gains on sale of non-marketable

equity investments from certain of our non-GAAP financial measures

because we believe they are unrelated to our ongoing operating

performance and are not expected to recur in our continuing

operating results.

We define free cash flow as net cash (used in)

provided by operating activities, less purchases of property and

equipment and capitalized internal-use software. We believe that

free cash flow is a useful indicator of liquidity as it measures

our ability to generate cash from our core operations after

purchases of property and equipment. Free cash flow is a measure to

determine, among other things, cash available for strategic

initiatives, including further investments in our business and

potential acquisitions of businesses.

Operating Metrics

Number of Customers Contributing More Than

$5,000 in ARR. We define ARR as the sum total of the revenue we

would contractually expect to recognize over the next 12 months

from all customers at a point in time, assuming no increases,

reductions or cancellations in their subscriptions. We define our

total customers contributing more than $5,000 in ARR as of a

particular date as the number of business entities or individuals,

represented by a unique domain or a unique email address, with one

or more paid subscriptions to one or more of our products that

contributed more than $5,000 in ARR.

Net Dollar Retention Rate. To calculate net

dollar retention rate as of a given date, we first determine

Entering ARR, which is ARR from the population of our customers as

of 12 months prior to the end of the reporting period. We then

calculate the Ending ARR from the same set of customers as of the

end of the reporting period. We then divide the Ending ARR by the

Entering ARR to arrive at our net dollar retention rate. Ending ARR

includes upsells, cross-sells, and renewals during the measurement

period and is net of any contraction or attrition over this

period.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements relate to, among other things, our GAAP and

non-GAAP estimates for the fourth quarter and full year 2021, our

financial outlook, our vision for our products to delight our

customers, the consistency and comparability of our financial

performance and the usefulness of the measures by which we evaluate

our business, among other things. These forward-looking statements

are based on Freshworks’ current expectations, estimates and

projections about its business and industry, management’s beliefs

and certain assumptions made by the company, all of which are

subject to change. Forward-looking statements generally can be

identified by the use of forward-looking terminology such as,

“future”, "believe," "expect," "may," "will," "intend," "estimate,"

"continue," “anticipate,” “could,” “would,” “projects,” “plans,”

“targets” or similar expressions or the negative of those terms or

expressions. Such statements involve risks and uncertainties, many

of which involve factors or circumstances that are beyond our

control, which could cause actual results to vary materially from

those expressed in or indicated by the forward-looking statements.

Factors that may cause actual results to differ materially include

our ability to achieve our long-term plans and key initiatives; our

ability to maintain or grow the momentum of our business and

operations; our ability to attract and retain customers or expand

sales to existing customers; delays in product development or

deployments or the success of such products; the failure to deliver

competitive service offerings and lack of market acceptance of any

offerings delivered; the impact to the economy, our customers and

our business due to the ongoing COVID-19 pandemic; the timeframes

for and severity of the impact of COVID-19 on our customers’

purchasing and renewal decisions, which may extend the length of

our sales cycles; any weakened global economic conditions that

adversely affect our industry; our history of net losses and

ability to achieve or sustain profitability; our ability to sustain

or manage any future growth effectively; potential interruptions or

performance problems, including a service outage, associated with

our technology; and the impact of challenges related to being a

newly listed public company, as well as the other potential factors

described under "Risk Factors" included in Freshworks’ final

prospectus dated September 21, 2021 relating to Freshworks’ initial

public offering and other documents of Freshworks Inc. on file with

the Securities and Exchange Commission (available at

www.sec.gov).

Freshworks cautions you not to place undue reliance on

forward-looking statements, which speak only as of the date hereof

and are based on information available to Freshworks at the time

the statements are made and/or management’s good faith belief as of

that time with respect to future events. Freshworks assumes no

obligation to update any forward-looking statements in order to

reflect events or circumstances that may arise after the date of

this release, except as required by law.

About Freshworks Inc.

Freshworks makes it fast and easy for businesses to delight

their customers and employees. We do this by taking a fresh

approach to building and delivering software that is affordable,

quick to implement, and designed for the end user. Headquartered in

San Mateo, California, Freshworks has a dedicated team operating

from 13 global locations to serve 50,000+ customers including

Bridgestone, Chargebee, DeliveryHero, ITV, Klarna, Multichoice,

OfficeMax, TaylorMade and Vice Media. For more information visit

www.freshworks.com.

Investor Relations Contact:Joon

Huhinvestor@freshworks.com650-988-5699

Media Relations Contact:Jayne

Gonzalezpress@freshworks.com408-348-1087

© 2021 Freshworks Inc. All Rights Reserved.

Freshworks and its associated logo is a trademark of Freshworks

Inc. All other company, brand and product names may be trademarks

or registered trademarks of their respective companies. Nothing in

this press release should be construed to the contrary, or as an

approval, endorsement or sponsorship by any first parties of

Freshworks Inc. or any aspect of this press release.

|

|

|

FRESHWORKS INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except per

share data)(unaudited) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Revenue |

$ |

96,614 |

|

|

|

$ |

66,187 |

|

|

|

$ |

265,542 |

|

|

|

$ |

176,658 |

|

|

| Cost of revenue |

22,236 |

|

|

|

13,163 |

|

|

|

57,632 |

|

|

|

37,020 |

|

|

| Gross profit |

74,378 |

|

|

|

53,024 |

|

|

|

207,910 |

|

|

|

139,638 |

|

|

| Operating expense: |

|

|

|

|

|

|

|

| Research and

development(1) |

57,087 |

|

|

|

13,249 |

|

|

|

91,377 |

|

|

|

53,062 |

|

|

| Sales and marketing(1) |

96,785 |

|

|

|

34,164 |

|

|

|

188,155 |

|

|

|

95,348 |

|

|

| General and

administrative(1) |

60,759 |

|

|

|

5,558 |

|

|

|

76,785 |

|

|

|

43,953 |

|

|

| Total operating expenses |

214,631 |

|

|

|

52,971 |

|

|

|

356,317 |

|

|

|

192,363 |

|

|

| (Loss) income from

operations |

(140,253 |

) |

|

|

53 |

|

|

|

(148,407 |

) |

|

|

(52,725 |

) |

|

| Interest and other income,

net |

22,923 |

|

|

|

1,239 |

|

|

|

23,428 |

|

|

|

862 |

|

|

| (Loss) income before income

taxes |

(117,330 |

) |

|

|

1,292 |

|

|

|

(124,979 |

) |

|

|

(51,863 |

) |

|

| (Benefit from) provision for

income taxes |

(9,915 |

) |

|

|

(95 |

) |

|

|

(7,720 |

) |

|

|

3,896 |

|

|

| Net (loss) income |

(107,415 |

) |

|

|

1,387 |

|

|

|

(117,259 |

) |

|

|

(55,759 |

) |

|

| Accretion of redeemable

convertible preferred stock |

(2,264,838 |

) |

|

|

(269,358 |

) |

|

|

(2,646,662 |

) |

|

|

(371,522 |

) |

|

| Net loss attributable to

common stockholders |

$ |

(2,372,253 |

) |

|

|

$ |

(267,971 |

) |

|

|

$ |

(2,763,921 |

) |

|

|

$ |

(427,281 |

) |

|

| |

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders - basic and diluted |

$ |

(24.72 |

) |

|

|

$ |

(3.49 |

) |

|

|

$ |

(32.96 |

) |

|

|

$ |

(5.56 |

) |

|

| |

|

|

|

|

|

|

|

| Weighted average shares used

in computing net loss per share attributable to common

stockholders - basic and diluted |

95,930 |

|

|

|

76,880 |

|

|

|

83,860 |

|

|

|

76,846 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________(1) Includes stock-based

compensation expense as follows (in thousands):

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Cost of revenue |

$ |

3,983 |

|

|

$ |

— |

|

|

$ |

3,983 |

|

|

$ |

— |

|

| Research and

development(2) |

36,823 |

|

|

— |

|

|

36,823 |

|

|

15,890 |

|

| Sales and marketing |

40,465 |

|

|

— |

|

|

40,465 |

|

|

7 |

|

| General and

administrative(2) |

42,988 |

|

|

— |

|

|

42,988 |

|

|

27,383 |

|

| Total stock-based compensation

expense |

$ |

124,259 |

|

|

$ |

— |

|

|

$ |

124,259 |

|

|

$ |

43,280 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________(2) Includes

stock-based compensation of $43.2 million recognized from the

secondary equity transactions in the first quarter of 2020, of

which $15.9 million was recorded in research and development and

$27.3 million was recorded in general and administrative.

|

|

|

FRESHWORKS INC.CONDENSED CONSOLIDATED

BALANCE SHEETS(in thousands) |

| |

| |

|

September 30,2021 |

|

December 31,2020 |

| |

|

(unaudited) |

|

|

| Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,179,958 |

|

|

|

$ |

95,382 |

|

|

| Marketable securities |

|

146,592 |

|

|

|

142,733 |

|

|

| Accounts receivable, net |

|

44,298 |

|

|

|

34,270 |

|

|

| Deferred contract acquisition

costs |

|

13,001 |

|

|

|

9,167 |

|

|

| Prepaid expenses and other

current assets |

|

37,956 |

|

|

|

30,852 |

|

|

| Total current assets |

|

1,421,805 |

|

|

|

312,404 |

|

|

| |

|

|

|

|

| Property and equipment,

net |

|

21,205 |

|

|

|

20,784 |

|

|

| Deferred contract acquisition

costs, noncurrent |

|

13,219 |

|

|

|

9,106 |

|

|

| Intangible assets, net |

|

2,985 |

|

|

|

6,223 |

|

|

| Goodwill |

|

6,181 |

|

|

|

6,181 |

|

|

| Deferred tax assets |

|

16,048 |

|

|

|

4,393 |

|

|

| Other assets |

|

6,062 |

|

|

|

8,333 |

|

|

| Total assets |

|

$ |

1,487,505 |

|

|

|

$ |

367,424 |

|

|

| Liabilities,

Redeemable Convertible Preferred Stock and

Stockholders' Equity (Deficit) |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Accounts payable |

|

$ |

3,184 |

|

|

|

$ |

3,710 |

|

|

| Accrued liabilities |

|

54,146 |

|

|

|

35,608 |

|

|

| Deferred revenue |

|

143,159 |

|

|

|

104,184 |

|

|

| Income tax payable |

|

865 |

|

|

|

8,740 |

|

|

| Total current liabilities |

|

201,354 |

|

|

|

152,242 |

|

|

| Other liabilities |

|

18,273 |

|

|

|

16,827 |

|

|

| Total liabilities |

|

219,627 |

|

|

|

169,069 |

|

|

| |

|

|

|

|

| Redeemable convertible

preferred stock |

|

— |

|

|

|

2,895,096 |

|

|

| |

|

|

|

|

| Stockholders' Equity

(Deficit) |

|

|

|

|

| Common stock |

|

— |

|

|

|

1 |

|

|

| Additional paid-in

capital |

|

4,464,100 |

|

|

|

— |

|

|

| Accumulated other

comprehensive (loss) income |

|

(20 |

) |

|

|

411 |

|

|

| Accumulated deficit |

|

(3,196,205 |

) |

|

|

(2,697,153 |

) |

|

| Total stockholders' equity

(deficit) |

|

1,267,878 |

|

|

|

(2,696,741 |

) |

|

| Total liabilities, redeemable

convertible preferred stock and stockholders'

equity (deficit) |

|

$ |

1,487,505 |

|

|

|

$ |

367,424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FRESHWORKS INC.CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS(in

thousands)(unaudited) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Cash Flows Operating

Activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(107,415 |

) |

|

|

$ |

1,387 |

|

|

|

$ |

(117,259 |

) |

|

|

$ |

(55,759 |

) |

|

| Adjustments to reconcile net

loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

3,374 |

|

|

|

2,837 |

|

|

|

9,792 |

|

|

|

8,215 |

|

|

|

Amortization of deferred contract acquisition costs |

3,416 |

|

|

|

1,986 |

|

|

|

9,085 |

|

|

|

5,374 |

|

|

|

Stock-based compensation |

124,259 |

|

|

|

— |

|

|

|

124,259 |

|

|

|

43,280 |

|

|

|

Premium amortization on marketable securities |

411 |

|

|

|

340 |

|

|

|

1,206 |

|

|

|

874 |

|

|

|

Gain realized on sale of marketable securities and non-marketable

equity investments |

(23,821 |

) |

|

|

(108 |

) |

|

|

(23,835 |

) |

|

|

(132 |

) |

|

|

Change in fair value of equity securities |

(35 |

) |

|

|

(107 |

) |

|

|

(100 |

) |

|

|

(44 |

) |

|

|

Deferred income taxes |

(11,721 |

) |

|

|

— |

|

|

|

(11,721 |

) |

|

|

— |

|

|

|

Other |

69 |

|

|

|

308 |

|

|

|

133 |

|

|

|

184 |

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

(3,929 |

) |

|

|

(3,705 |

) |

|

|

(10,039 |

) |

|

|

(6,116 |

) |

|

|

Deferred contract acquisition costs |

(6,032 |

) |

|

|

(3,307 |

) |

|

|

(17,032 |

) |

|

|

(9,935 |

) |

|

|

Prepaid expenses and other assets |

(12,963 |

) |

|

|

(941 |

) |

|

|

(14,823 |

) |

|

|

(6,312 |

) |

|

|

Accounts payable |

(4,513 |

) |

|

|

(3,634 |

) |

|

|

(542 |

) |

|

|

(2,529 |

) |

|

|

Accrued and other liabilities |

24,193 |

|

|

|

6,439 |

|

|

|

18,517 |

|

|

|

17,267 |

|

|

|

Deferred revenue |

12,661 |

|

|

|

11,266 |

|

|

|

38,975 |

|

|

|

24,682 |

|

|

| Net cash (used in)

provided by operating activities |

(2,046 |

) |

|

|

12,761 |

|

|

|

6,616 |

|

|

|

19,049 |

|

|

| Cash Flows from

Investing Activities: |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

(1,270 |

) |

|

|

(1,072 |

) |

|

|

(4,056 |

) |

|

|

(3,628 |

) |

|

|

Proceeds from sale of property and equipment |

8 |

|

|

|

— |

|

|

|

565 |

|

|

|

— |

|

|

|

Capitalized internal-use software |

(873 |

) |

|

|

(1,426 |

) |

|

|

(3,050 |

) |

|

|

(3,828 |

) |

|

|

Sale of non-marketable equity investments |

23,979 |

|

|

|

— |

|

|

|

23,979 |

|

|

|

— |

|

|

|

Purchases of marketable securities |

(43,988 |

) |

|

|

(33,147 |

) |

|

|

(154,828 |

) |

|

|

(99,058 |

) |

|

|

Sales of marketable securities |

2,076 |

|

|

|

10,659 |

|

|

|

36,831 |

|

|

|

15,658 |

|

|

|

Maturities and redemptions of marketable securities |

30,750 |

|

|

|

23,361 |

|

|

|

112,554 |

|

|

|

59,462 |

|

|

|

Acquired intangible assets |

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,750 |

) |

|

|

Business combination, net of cash acquired |

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,075 |

) |

|

| Net cash provided by

(used in) investing activities |

10,682 |

|

|

|

(1,625 |

) |

|

|

11,995 |

|

|

|

(38,219 |

) |

|

| Cash Flows from

Financing Activities: |

|

|

|

|

|

|

|

|

Proceeds from initial public offering, net of underwriting

discounts and offering expenses |

1,069,348 |

|

|

|

— |

|

|

|

1,069,348 |

|

|

|

— |

|

|

|

Proceeds from exercise of stock options |

12 |

|

|

|

110 |

|

|

|

43 |

|

|

|

121 |

|

|

|

Payment of deferred offering costs |

(3,067 |

) |

|

|

— |

|

|

|

(5,472 |

) |

|

|

— |

|

|

|

Payment of acquisition-related liabilities |

(900 |

) |

|

|

(1,200 |

) |

|

|

(900 |

) |

|

|

(1,200 |

) |

|

| Net cash provided by

(used in) financing activities |

1,065,393 |

|

|

|

(1,090 |

) |

|

|

1,063,019 |

|

|

|

(1,079 |

) |

|

| Net increase (decrease) in

cash, cash equivalents and restricted cash |

1,074,029 |

|

|

|

10,046 |

|

|

|

1,081,630 |

|

|

|

(20,249 |

) |

|

|

Cash, cash equivalents and restricted cash, beginning of

period |

105,932 |

|

|

|

48,840 |

|

|

|

98,331 |

|

|

|

79,135 |

|

|

| Cash, cash equivalents

and restricted cash, end of period |

$ |

1,179,961 |

|

|

|

$ |

58,886 |

|

|

|

$ |

1,179,961 |

|

|

|

$ |

58,886 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FRESHWORKS INC.RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES(in thousands,

except percentages and per share

data)(unaudited) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Reconciliation of

gross profit and gross margin: |

|

|

|

|

|

|

|

|

|

GAAP gross profit |

|

$ |

74,378 |

|

|

|

$ |

53,024 |

|

|

|

$ |

207,910 |

|

|

|

$ |

139,638 |

|

|

|

Add: stock-based compensation expense - employee awards |

|

3,983 |

|

|

|

— |

|

|

|

3,983 |

|

|

|

— |

|

|

|

Add: employer taxes on employee stock transactions |

|

523 |

|

|

|

— |

|

|

|

523 |

|

|

|

— |

|

|

|

Add: amortization of acquired intangibles |

|

990 |

|

|

|

1,026 |

|

|

|

2,939 |

|

|

|

2,848 |

|

|

| Non-GAAP gross profit |

|

$ |

79,874 |

|

|

|

$ |

54,050 |

|

|

|

$ |

215,355 |

|

|

|

$ |

142,486 |

|

|

| GAAP gross margin |

|

77.0 |

% |

|

|

80.1 |

% |

|

|

78.3 |

% |

|

|

79.0 |

% |

|

| Non-GAAP gross margin |

|

82.7 |

% |

|

|

81.7 |

% |

|

|

81.1 |

% |

|

|

80.7 |

% |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of

operating expenses: |

|

|

|

|

|

|

|

|

| GAAP research and

development |

|

$ |

57,087 |

|

|

|

$ |

13,249 |

|

|

|

$ |

91,377 |

|

|

|

$ |

53,062 |

|

|

|

Less: stock-based compensation expense - employee awards |

|

(36,823 |

) |

|

|

— |

|

|

|

(36,823 |

) |

|

|

(8 |

) |

|

|

Less: stock-based compensation expense - 2020 equity

transactions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(15,882 |

) |

|

|

Less: employer taxes on employee stock transactions |

|

(1,632 |

) |

|

|

— |

|

|

|

(1,632 |

) |

|

|

— |

|

|

| Non-GAAP research and

development |

|

$ |

18,632 |

|

|

|

$ |

13,249 |

|

|

|

$ |

52,922 |

|

|

|

$ |

37,172 |

|

|

| GAAP research and development

as percentage of revenue |

|

59.1 |

% |

|

|

20.0 |

% |

|

|

34.4 |

% |

|

|

30.0 |

% |

|

| Non-GAAP research and

development as percentage of revenue |

|

19.3 |

% |

|

|

20.0 |

% |

|

|

19.9 |

% |

|

|

21.0 |

% |

|

| |

|

|

|

|

|

|

|

|

| GAAP sales and marketing |

|

$ |

96,785 |

|

|

|

$ |

34,164 |

|

|

|

$ |

188,155 |

|

|

|

$ |

95,348 |

|

|

|

Less: stock-based compensation expense - employee awards |

|

(40,465 |

) |

|

|

— |

|

|

|

(40,465 |

) |

|

|

(7 |

) |

|

|

Less: employer taxes on employee stock transactions |

|

(4,409 |

) |

|

|

— |

|

|

|

(4,409 |

) |

|

|

— |

|

|

|

Less: amortization of acquired intangibles |

|

(101 |

) |

|

|

(100 |

) |

|

|

(299 |

) |

|

|

(300 |

) |

|

| Non-GAAP sales and

marketing |

|

$ |

51,810 |

|

|

|

$ |

34,064 |

|

|

|

$ |

142,982 |

|

|

|

$ |

95,041 |

|

|

| GAAP sales and marketing as

percentage of revenue |

|

100.2 |

% |

|

|

51.6 |

% |

|

|

70.9 |

% |

|

|

54.0 |

% |

|

| Non-GAAP sales and marketing

as percentage of revenue |

|

53.6 |

% |

|

|

51.5 |

% |

|

|

53.8 |

% |

|

|

53.8 |

% |

|

| |

|

|

|

|

|

|

|

|

| GAAP general and

administrative |

|

$ |

60,759 |

|

|

|

$ |

5,558 |

|

|

|

$ |

76,785 |

|

|

|

$ |

43,953 |

|

|

|

Less: stock-based compensation expense - employee awards |

|

(42,988 |

) |

|

|

— |

|

|

|

(42,988 |

) |

|

|

(29 |

) |

|

|

Less: stock-based compensation expense - 2020 equity

transactions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(27,354 |

) |

|

|

Less: employer taxes on employee stock transactions |

|

(6,815 |

) |

|

|

— |

|

|

|

(6,815 |

) |

|

|

— |

|

|

|

Less: acquisition-related expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(304 |

) |

|

| Non-GAAP general and

administrative |

|

$ |

10,956 |

|

|

|

$ |

5,558 |

|

|

|

$ |

26,982 |

|

|

|

$ |

16,266 |

|

|

| GAAP general and

administrative as percentage of revenue |

|

62.9 |

% |

|

|

8.4 |

% |

|

|

28.9 |

% |

|

|

24.6 |

% |

|

| Non-GAAP general and

administrative as percentage of revenue |

|

11.3 |

% |

|

|

8.4 |

% |

|

|

10.2 |

% |

|

|

9.2 |

% |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of

operating (loss) income and operating margin: |

|

|

|

|

|

|

|

|

| GAAP (loss) income from

operations |

|

$ |

(140,253 |

) |

|

|

$ |

53 |

|

|

|

$ |

(148,407 |

) |

|

|

$ |

(52,725 |

) |

|

|

Add: stock-based compensation expense - employee awards |

|

124,259 |

|

|

|

— |

|

|

|

124,259 |

|

|

|

44 |

|

|

|

Add: stock-based compensation expense - 2020 equity

transactions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

43,236 |

|

|

|

Add: employer taxes and employee stock transactions |

|

13,379 |

|

|

|

— |

|

|

|

13,379 |

|

|

|

— |

|

|

|

Add: amortization of acquired intangibles |

|

1,091 |

|

|

|

1,126 |

|

|

|

3,238 |

|

|

|

3,148 |

|

|

|

Add: acquisition-related expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

304 |

|

|

| Non-GAAP (loss) income from

operations |

|

$ |

(1,524 |

) |

|

|

$ |

1,179 |

|

|

|

$ |

(7,531 |

) |

|

|

$ |

(5,993 |

) |

|

| GAAP operating margin |

|

(145.2 |

)% |

|

|

0.1 |

% |

|

|

(55.9 |

)% |

|

|

(29.5 |

)% |

|

| Non-GAAP operating margin |

|

(1.6 |

)% |

|

|

1.8 |

% |

|

|

(2.8 |

)% |

|

|

(3.4 |

)% |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of net

(loss) income attributable to common stockholders -

basic: |

|

|

|

|

|

|

|

|

| GAAP net loss attributable to

common stockholders |

|

$ |

(2,372,253 |

) |

|

|

$ |

(267,971 |

) |

|

|

$ |

(2,763,921 |

) |

|

|

$ |

(427,281 |

) |

|

|

Add: accretion of redeemable convertible preferred stock |

|

2,264,838 |

|

|

|

269,358 |

|

|

|

2,646,662 |

|

|

|

371,522 |

|

|

|

Add: stock-based compensation expense - employee awards |

|

124,259 |

|

|

|

— |

|

|

|

124,259 |

|

|

|

44 |

|

|

|

Add: stock-based compensation expense - 2020 equity

transactions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

43,236 |

|

|

|

Add: employer taxes and employee stock transactions |

|

13,379 |

|

|

|

— |

|

|

|

13,379 |

|

|

|

— |

|

|

|

Add: amortization of acquired intangibles |

|

1,091 |

|

|

|

1,126 |

|

|

|

3,238 |

|

|

|

3,148 |

|

|

|

Add: acquisition-related expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

304 |

|

|

|

Less: gain on sale of non-marketable equity investments |

|

(23,830 |

) |

|

|

— |

|

|

|

(23,830 |

) |

|

|

— |

|

|

|

Less: income tax adjustments |

|

(11,555 |

) |

|

|

— |

|

|

|

(11,555 |

) |

|

|

— |

|

|

| Non-GAAP net (loss) income

attributable to common stockholders - basic |

|

$ |

(4,071 |

) |

|

|

$ |

2,513 |

|

|

|

$ |

(11,768 |

) |

|

|

$ |

(9,027 |

) |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of net

loss per share - basic: |

|

|

|

|

|

|

|

|

|

GAAP net loss per share attributable to common stockholders -

basic |

|

$ |

(24.72 |

) |

|

|

$ |

(3.49 |

) |

|

|

$ |

(32.96 |

) |

|

|

$ |

(5.56 |

) |

|

|

Add: accretion of redeemable convertible preferred stock |

|

23.61 |

|

|

|

3.50 |

|

|

|

31.56 |

|

|

|

4.84 |

|

|

|

Add: stock-based compensation expense - employee awards |

|

1.29 |

|

|

|

— |

|

|

|

1.48 |

|

|

|

— |

|

|

|

Add: stock-based compensation expense - 2020 equity

transactions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.56 |

|

|

|

Add: employer taxes and employee stock transactions |

|

0.14 |

|

|

|

— |

|

|

|

0.16 |

|

|

|

— |

|

|

|

Add: amortization of acquired intangibles |

|

0.01 |

|

|

|

0.02 |

|

|

|

0.04 |

|

|

|

0.04 |

|

|

|

Less: gain on sale of non-marketable equity investments |

|

(0.25 |

) |

|

|

— |

|

|

|

(0.28 |

) |

|

|

— |

|

|

|

Less: income tax adjustments |

|

(0.12 |

) |

|

|

— |

|

|

|

(0.14 |

) |

|

|

— |

|

|

|

Non-GAAP net (loss) income per share attributable to common

stockholders - basic |

|

$ |

(0.04 |

) |

|

|

$ |

0.03 |

|

|

|

$ |

(0.14 |

) |

|

|

$ |

(0.12 |

) |

|

|

Weighted-average shares used in computing GAAP and non-GAAP net

(loss) income per share attributable to common stockholders -

basic |

|

95,930 |

|

|

|

76,880 |

|

|

|

83,860 |

|

|

|

76,846 |

|

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of net

(loss) income and net (loss) income per share -

diluted: |

|

|

|

|

|

|

|

|

|

GAAP net loss attributable to common stockholders - diluted |

|

$ |

(2,372,253 |

) |

|

|

$ |

(267,971 |

) |

|

|

$ |

(2,763,921 |

) |

|

|

$ |

(427,281 |

) |

|

|

Add: accretion of redeemable convertible preferred stock |

|

2,264,838 |

|

|

|

269,358 |

|

|

|

2,646,662 |

|

|

|

371,522 |

|

|

|

Add: stock-based compensation expense - employee awards |

|

124,259 |

|

|

|

— |

|

|

|

124,259 |

|

|

|

44 |

|

|

|

Add: stock-based compensation expense - 2020 equity

transactions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

43,236 |

|

|

|

Add: employer taxes and employee stock transactions |

|

13,379 |

|

|

|

— |

|

|

|

13,379 |

|

|

|

— |

|

|

|

Add: amortization of acquired intangibles |

|

1,091 |

|

|

|

1,126 |

|

|

|

3,238 |

|

|

|

3,148 |

|

|

|

Add: acquisition-related expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

304 |

|

|

|

Less: gain on sale of non-marketable equity investments |

|

(23,830 |

) |

|

|

— |

|

|

|

(23,830 |

) |

|

|

— |

|

|

|

Less: income tax adjustments |

|

(11,555 |

) |

|

|

— |

|

|

|

(11,555 |

) |

|

|

— |

|

|

| Non-GAAP net (loss) income

attributable to common stockholders - diluted |

|

$ |

(4,071 |

) |

|

|

$ |

2,513 |

|

|

|

$ |

(11,768 |

) |

|

|

$ |

(9,027 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Denominator: |

|

|

|

|

|

|

|

|

| Weighted-average shares used

in computing GAAP and non-GAAP net (loss) income per share

attributable to common stockholders |

|

95,930 |

|

|

|

76,880 |

|

|

|

83,860 |

|

|

|

76,846 |

|

|

| Effect of potentially dilutive

securities: |

|

|

|

|

|

|

|

|

|

Stock options |

|

— |

|

|

|

2,822 |

|

|

|

— |

|

|

|

— |

|

|

|

Assumed conversion of redeemable convertible preferred stock at the

beginning of period |

|

— |

|

|

|

153,938 |

|

|

|

— |

|

|

|

— |

|

|

| Weighted-average shares used

in computing non-GAAP net (loss) income per share attributable

to common stockholders - diluted |

|

95,930 |

|

|

|

233,640 |

|

|

|

83,860 |

|

|

|

76,846 |

|

|

| Non-GAAP net (loss) income per

share attributable to common stockholders - diluted |

|

$ |

(0.04 |

) |

|

|

$ |

0.01 |

|

|

|

$ |

(0.14 |

) |

|

|

$ |

(0.12 |

) |

|

| |

|

|

|

|

|

|

|

|

| Computation of free

cash flow: |

|

|

|

|

|

|

|

|

| Net cash provided by (used in)

investing activities |

|

$ |

10,682 |

|

|

|

$ |

(1,625 |

) |

|

|

$ |

11,995 |

|

|

|

$ |

(38,219 |

) |

|

| Net cash provided by (used in)

financing activities |

|

$ |

1,065,393 |

|

|

|

$ |

(1,090 |

) |

|

|

$ |

1,063,019 |

|

|

|

$ |

(1,079 |

) |

|

| Net cash (used in) provided by

operating activities |

|

$ |

(2,046 |

) |

|

|

$ |

12,761 |

|

|

|

$ |

6,616 |

|

|

|

$ |

19,049 |

|

|

|

Less: purchases of property and equipment |

|

(1,270 |

) |

|

|

(1,072 |

) |

|

|

(4,056 |

) |

|

|

(3,628 |

) |

|

|

Less: capitalized internal-use software |

|

(873 |

) |

|

|

(1,426 |

) |

|

|

(3,050 |

) |

|

|

(3,828 |

) |

|

| Free cash flow |

|

$ |

(4,189 |

) |

|

|

$ |

10,263 |

|

|

|

$ |

(490 |

) |

|

|

$ |

11,593 |

|

|

| |

|

|

|

|

|

|

|

|

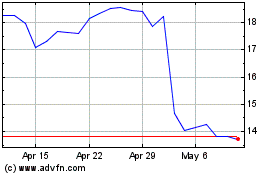

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jul 2023 to Jul 2024