Current Report Filing (8-k)

June 17 2020 - 4:07PM

Edgar (US Regulatory)

0001424929false00014249292020-06-172020-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 17, 2020

Date of Report (date of earliest event reported)

Fox Factory Holding Corp.

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36040

|

|

26-1647258

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

6634 Hwy 53

Braselton, GA 30517

(Address of Principal Executive Offices) (Zip Code)

(831) 274-6500

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.001 per share

|

FOXF

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On June 12, 2020, Fox Factory Holding Corp., a Delaware corporation (the “Company”), launched a process to amend (the “First Amendment”) the Company’s Amended and Restated Credit Agreement, dated March 11, 2020 (as amended and restated, the “Amended and Restated Credit Agreement”), by and among the Company, Bank of America, N.A., as Administrative Agent, Swingline Lender and L/C Issuer (the “Agent”), and a group of lenders referred to therein (collectively, the “Lenders”). As of June 17, 2020, the Company had secured approval from the requisite number of Lenders consenting to the terms of the First Amendment, subject to the execution of the First Amendment by all parties. The Company intends to enter into the First Amendment on June 19, 2020.

The First Amendment will, among other things, amend the Amended and Restated Credit Agreement to require the Company to maintain, as of the end of each fiscal quarter (commencing with the fiscal quarter ending July 3, 2020), a consolidated net leverage ratio not to exceed 4.25 to 1.00, decreasing to 4.00 to 1.00 for the second fiscal quarter of 2021 and quarterly thereafter. This consolidated net leverage ratio covenant will replace the financial covenant currently in the Amended and Restated Credit Agreement that requires the Company to maintain, as of the end of each fiscal quarter, a leverage ratio (which does not exclude unrestricted cash and cash equivalents from the numerator) not to exceed 3.75 to 1.00. Additionally, the First Amendment will permit the Company to enter into certain permitted hedge transactions and will allow the Company to add back up to $10 million in non-recurring relocation expenses to its consolidated EBITDA through June 4, 2021. In addition, the First Amendment will add a new tier of pricing when the consolidated net leverage ratio exceeds 3.50 to 1.00 and increases the minimum Eurodollar rate from 0% to 0.50%. The First Amendment will not change the aggregate amount or the final maturity date of the Amended and Restated Credit Agreement.

There can be no assurance that the Company will be able to complete the First Amendment on terms and conditions favorable to it or at all, and the Company may decide not to pursue the First Amendment before completion. Upon entering into the First Amendment, the Company will file a Current Report on Form 8-K with a summary of the material terms and conditions of the First Amendment, including the complete text of the First Amendment and the Amended and Restated Credit Agreement as an exhibit.

The information in this Item 7.01 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished herewith:

|

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

104

|

Cover Page Interactive Data File (embedded with the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fox Factory Holding Corp.

|

|

Date:

|

June 17, 2020

|

|

By:

|

/s/ Michael C. Dennison

|

|

|

|

|

|

|

|

|

|

|

|

Michael C. Dennison

|

|

|

|

|

|

Chief Executive Officer

|

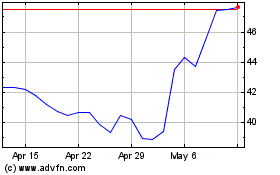

Fox Factory (NASDAQ:FOXF)

Historical Stock Chart

From Sep 2024 to Oct 2024

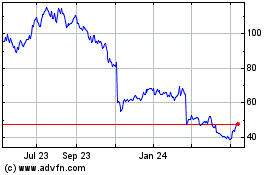

Fox Factory (NASDAQ:FOXF)

Historical Stock Chart

From Oct 2023 to Oct 2024