false

0000038264

0000038264

2024-02-14

2024-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 14, 2024

Forward

Industries, Inc.

(Exact name of registrant as specified in its charter)

| New York |

|

001-34780 |

|

13-1950672 |

| (State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

700 Veterans Memorial

Hwy. Suite 100

Hauppauge, New York

11788

(Address of Principal Executive Office) (Zip Code)

(631)

547-3055

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

FORD |

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition |

On February 14, 2024, Forward Industries,

Inc. (the “Company”) issued a press release announcing its financial results for the first quarter ended December 31,

2023. A copy of such press release is furnished as Exhibit 99.1 to this report.

The information in Item 2.02 of this report,

including the information in the press release attached as Exhibit 99.1 to this report, is furnished pursuant to Item 2.02 of

Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities of that section. Furthermore, the information in Item 2.02 of this report, including the information

in the press release attached as Exhibit 99.1 to this report, shall not be deemed to be incorporated by reference in the filings

of the registrant under the Securities Act of 1933.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FORWARD INDUSTRIES, INC. |

|

| |

|

|

|

| Date: February 14, 2024 |

By: |

/s/ Kathleen Weisberg |

|

| |

|

Name: Kathleen Weisberg |

|

| |

|

Title: Chief Financial Officer |

|

Exhibit 99.1

FORWARD REPORTS FISCAL 2024 FIRST

QUARTER RESULTS

Hauppauge, NY – February 14, 2024 –

Forward Industries, Inc. (NASDAQ:FORD), a global design, sourcing and distribution group, today announced financial results for its first

quarter ended December 31, 2023.

First

Quarter Fiscal Year 2024 Financial Highlights

| · | Revenues were $7.2 million, a decrease of 26.7%

from $9.8 million for 2023. |

| · | Gross margin increased to 23.0% compared to 20.2%

for 2023. |

| · | Loss from continuing operations was $0.4 million

compared to $0.1 million in 2023 and net loss was $0.4 million compared to $0.4 million in 2023. |

| · | Basic and diluted loss per share from continuing

operations was $0.04 compared to $0.01 for 2023. |

| · | Cash balance of $3.0 million at December 31,

2023 compared to $3.2 million at September 30, 2023, a decrease of 5%. |

Terry Wise, Chief Executive Officer

of Forward Industries, stated “A relatively static quarter with a pleasing improvement in gross margin. Our effort to turnaround

the business into profitability continues with several initiatives now in place. We remain committed to the path of growth and recovery.”

The

tables below are derived from the Company’s condensed consolidated financial statements included in its Form 10-Q filed on February

14, 2024 with the Securities and Exchange Commission. Please refer to the Form 10-Q for complete financial statements and further information

regarding the Company’s results of operations and financial condition relating to the fiscal quarters ended December 31, 2023 and

2022. Please also refer to the Company’s Form 10-K for a discussion of risk factors applicable to the Company and its business.

Cautionary Note Regarding Forward-Looking

Statements

This

press release contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934 including statements regarding our optimism for improved performance in fiscal

year 2024 and profitability and growth in our businesses. Forward has tried to identify these forward-looking statements by using words

such as “may”, “should,” “expect,” “hope,” “anticipate,” “believe,”

“intend,” “plan,” “estimate” and similar expressions. These forward-looking statements are based on

information currently available to the Company and are subject to a number of risks, uncertainties and other factors that could cause

its actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking

statements. These risks include the inability to expand our customer base, loss of additional customers, competition, pricing pressures,

supply chain issues, inability of our design division’s customers to pay for our services, loss of talented employees, unanticipated

issues with our affiliated sourcing agent, and issues at Chinese factories that source our products. No assurance can be given that the

actual results will be consistent with the forward-looking statements. Investors should read carefully the factors described in the “Risk

Factors” section of the Company’s filings with the SEC, including the Company’s

Form 10-K for the year ended September 30, 2023 for information regarding risk

factors that could affect the Company’s results. Except as otherwise required by Federal securities laws, Forward undertakes no

obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed

circumstances or any other reason.

About Forward Industries

Forward is a global design, sourcing

and distribution group serving top tier medical and technology customers worldwide. Through its acquisitions of Intelligent Product Solutions,

Inc. and Kablooe Design, Inc., the Company has expanded its ability to design and develop solutions for its existing multinational client

base and expand beyond the diabetic product line into a variety of industries with a full spectrum of hardware and software product design

and engineering services.

For

more information, contact:

Kathleen

Weisberg, CFO, Forward Industries, Inc.

(631) 547-3055, kweisberg@forwardindustries.com

FORWARD INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

December 31, | | |

September 30, | |

| | |

2023 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 3,026,786 | | |

$ | 3,180,468 | |

| Accounts receivable, net | |

| 6,534,702 | | |

| 6,968,778 | |

| Inventories, net | |

| 405,229 | | |

| 334,384 | |

| Discontinued assets held for sale | |

| 135,604 | | |

| 508,077 | |

| Prepaid expenses and other current assets | |

| 392,282 | | |

| 378,512 | |

| Total current assets | |

| 10,494,603 | | |

| 11,370,219 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 265,346 | | |

| 274,046 | |

| Intangible assets, net | |

| 839,954 | | |

| 893,143 | |

| Goodwill | |

| 1,758,682 | | |

| 1,758,682 | |

| Operating lease right-of-use assets, net | |

| 2,916,385 | | |

| 3,021,315 | |

| Other assets | |

| 68,737 | | |

| 68,737 | |

| Total assets | |

$ | 16,343,707 | | |

$ | 17,386,142 | |

| | |

| | | |

| | |

| Liabilities and shareholders' equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Note payable to Forward China | |

$ | 850,000 | | |

$ | – | |

| Accounts payable | |

| 392,202 | | |

| 518,892 | |

| Due to Forward China | |

| 8,894,245 | | |

| 8,246,015 | |

| Deferred income | |

| 250,405 | | |

| 297,407 | |

| Current portion of operating lease liability | |

| 425,998 | | |

| 416,042 | |

| Accrued expenses and other current liabilities | |

| 494,724 | | |

| 1,357,743 | |

| Total current liabilities | |

| 11,307,574 | | |

| 10,836,099 | |

| | |

| | | |

| | |

| Other liabilities: | |

| | | |

| | |

| Note payable to Forward China | |

| – | | |

| 1,100,000 | |

| Operating lease liability, less current portion | |

| 2,723,281 | | |

| 2,833,782 | |

| Total other liabilities | |

| 2,723,281 | | |

| 3,933,782 | |

| Total liabilities | |

| 14,030,855 | | |

| 14,769,881 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders' equity: | |

| | | |

| | |

| Common stock, par value $0.01 per share; 40,000,000 shares authorized; 10,061,185 shares issued and outstanding at December 31, 2023 and September 30, 2023 | |

| 100,612 | | |

| 100,612 | |

| Additional paid-in capital | |

| 20,253,013 | | |

| 20,202,202 | |

| Accumulated deficit | |

| (18,040,773 | ) | |

| (17,686,553 | ) |

| Total shareholders' equity | |

| 2,312,852 | | |

| 2,616,261 | |

| Total liabilities and shareholders' equity | |

$ | 16,343,707 | | |

$ | 17,386,142 | |

FORWARD INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| |

| | |

For the Three Months Ended

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenues, net | |

$ | 7,151,951 | | |

$ | 9,752,684 | |

| Cost of sales | |

| 5,509,465 | | |

| 7,786,614 | |

| Gross profit | |

| 1,642,486 | | |

| 1,966,070 | |

| | |

| | | |

| | |

| Sales and marketing expenses | |

| 368,736 | | |

| 411,174 | |

| General and administrative expenses | |

| 1,654,071 | | |

| 1,682,812 | |

| Operating loss | |

| (380,321 | ) | |

| (127,916 | ) |

| | |

| | | |

| | |

| Fair value adjustment of earnout consideration | |

| – | | |

| (40,000 | ) |

| Interest income | |

| (17,469 | ) | |

| – | |

| Interest expense | |

| 19,010 | | |

| 27,958 | |

| Other income, net | |

| (687 | ) | |

| (24,560 | ) |

| Loss from continuing operations before income taxes | |

| (381,175 | ) | |

| (91,314 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| – | | |

| – | |

| Loss from continuing operations | |

| (381,175 | ) | |

| (91,314 | ) |

| Income / (loss) from discontinued operations, net of tax | |

| 26,955 | | |

| (338,961 | ) |

| Net loss | |

$ | (354,220 | ) | |

$ | (430,275 | ) |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Basic earnings/(loss) per share : | |

| | | |

| | |

| Basic loss per share from continuing operations | |

$ | (0.04 | ) | |

$ | (0.01 | ) |

| Basic earnings/(loss) per share from discontinued operations | |

| 0.00 | | |

| (0.03 | ) |

| Basic loss per share | |

$ | (0.04 | ) | |

$ | (0.04 | ) |

| | |

| | | |

| | |

| Diluted earnings/(loss) per share: | |

| | | |

| | |

| Diluted loss per share from continuing operations | |

$ | (0.04 | ) | |

$ | (0.01 | ) |

| Diluted earnings/(loss) per share from discontinued operations | |

| 0.00 | | |

| (0.03 | ) |

| Diluted loss per share | |

$ | (0.04 | ) | |

$ | (0.04 | ) |

| | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | |

| Basic | |

| 10,061,185 | | |

| 10,061,185 | |

| Diluted | |

| 10,061,185 | | |

| 10,061,185 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

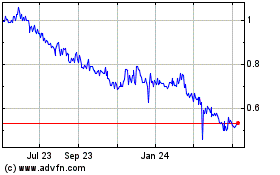

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Jan 2025 to Feb 2025

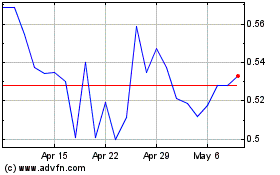

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Feb 2024 to Feb 2025