FirstCash Increases Capacity of Unsecured Bank Credit Facility; Maturity Date Extended to August 2029

August 08 2024 - 4:30PM

FirstCash Holdings, Inc. (“FirstCash” or the “Company”) (Nasdaq:

FCFS), the leading international operator of more than 3,000 retail

pawn stores and a leading provider of retail point-of-sale (“POS”)

payment solutions, today announced that it has amended the terms of

its long-term, unsecured bank credit facility to increase the size

of the commitment to $700 million and extend the maturity date to

August 2029.

With this amendment and extension, the size of

the facility has been increased from $640 million to $700 million,

while the maturity date of the facility was extended from August

2027 to August 2029. The amended facility provides for an increased

permitted leverage ratio of up to 3.25 times adjusted EBITDA for

the full term of the agreement while the other financial covenants

remain substantially unchanged.

Mr. Rick Wessel, chief executive officer,

stated, “The additional capacity and extension of the credit

facility provide us with five years of significant long-term

committed capital to further support our continued growth and

expansion in both the U.S. and Latin America. In addition, the

amended facility is expected to provide further capacity to support

ongoing shareholder payouts through cash dividends and share

repurchases. We would like to thank our commercial bank partners

for their continued confidence in FirstCash and our strategic

direction.”

About FirstCash

FirstCash is the leading international operator

of pawn stores focused on serving cash and credit-constrained

consumers. FirstCash’s more than 3,000 pawn stores in the U.S. and

Latin America buy and sell a wide variety of jewelry, electronics,

tools, appliances, sporting goods, musical instruments and other

merchandise, and make small non-recourse pawn loans secured by

pledged personal property. FirstCash’s pawn segments in the U.S.

and Latin America currently account for approximately 80% of

segment earnings, with the remainder provided by its wholly owned

subsidiary, AFF, which provides lease-to-own and retail finance

payment solutions for consumer goods and services.

FirstCash is a component company in both the

Standard & Poor’s MidCap 400 Index® and the

Russell 2000 Index®. FirstCash’s common stock

(ticker symbol “FCFS”) is traded on the Nasdaq,

the creator of the world’s first electronic stock market. For

additional information regarding FirstCash and the services it

provides, visit FirstCash’s websites located at

http://www.firstcash.com and

http://www.americanfirstfinance.com.

Forward-Looking Information

This release contains forward-looking statements

about the business, financial condition, outlook and prospects of

FirstCash Holdings, Inc. and its wholly owned subsidiaries

(together, the “Company”). Forward-looking statements, as that term

is defined in the Private Securities Litigation Reform Act of 1995,

can be identified by the use of forward-looking terminology such as

“outlook,” “believes,” “projects,” “expects,” “may,” “estimates,”

“should,” “plans,” “targets,” “intends,” “could,” “would,”

“anticipates,” “potential,” “confident,” “optimistic,” or the

negative thereof, or other variations thereon, or comparable

terminology, or by discussions of strategy, objectives, estimates,

guidance, expectations, outlook and future plans. Forward-looking

statements can also be identified by the fact that these statements

do not relate strictly to historical or current matters. Rather,

forward-looking statements relate to anticipated or expected

events, activities, trends or results. Because forward-looking

statements relate to matters that have not yet occurred, these

statements are inherently subject to risks and uncertainties.

These forward-looking statements are made to

provide the public with management’s current expectations with

regard to the credit facility amendment. While the Company believes

the expectations reflected in forward-looking statements are

reasonable, there can be no assurances such expectations will prove

to be accurate. Security holders are cautioned such forward-looking

statements involve risks and uncertainties. Certain factors may

cause results to differ materially from those anticipated by the

forward-looking statements made in this release. Such factors may

include, without limitation, risks, uncertainties and regulatory

developments discussed and described in the Company’s most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”), including the risks described in Part 1,

Item 1A, “Risk Factors” thereof, and other reports filed with the

SEC. Many of these risks and uncertainties are beyond the ability

of the Company to control, nor can the Company predict, in many

cases, all of the risks and uncertainties that could cause its

actual results to differ materially from those indicated by the

forward-looking statements. The forward-looking statements

contained in this release speak only as of the date of this

release, and the Company expressly disclaims any obligation or

undertaking to report any updates or revisions to any such

statement to reflect any change in the Company’s expectations or

any change in events, conditions or circumstances on which any such

statement is based, except as required by law.

For further information, please contact:

Gar JacksonGlobal IR GroupPhone: (817) 886-6998Email:

gar@globalirgroup.com

Doug Orr, Executive Vice President and Chief Financial

OfficerPhone: (817) 258-2650Email:

investorrelations@firstcash.comWebsite: investors.firstcash.com

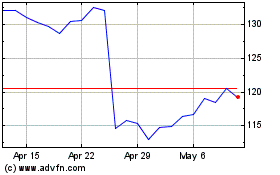

FirstCash (NASDAQ:FCFS)

Historical Stock Chart

From Dec 2024 to Jan 2025

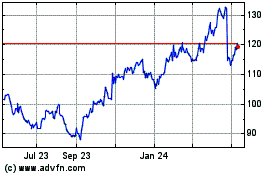

FirstCash (NASDAQ:FCFS)

Historical Stock Chart

From Jan 2024 to Jan 2025