Current Report Filing (8-k)

August 12 2020 - 5:01PM

Edgar (US Regulatory)

false0000840489

0000840489

2020-08-12

2020-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

August 12, 2020

(Date of Report - Date of Earliest Event Reported)

FIRSTCASH, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

001-10960

|

75-2237318

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1600 West 7th Street

|

|

Fort Worth

|

|

Texas

|

|

76126

|

|

|

(Address of principal executive offices, including zip code)

|

(817) 335-1100

(Registrant’s telephone number, including area code)

NONE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

FCFS

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On August 12, 2020, FirstCash, Inc. (the “Company”) issued a press release announcing the upsize and pricing of a private offering of $500 million of its 4.625% senior notes due 2028 (the “Notes”), representing an increase of $100 million in aggregate principal amount from the previously announced proposed offering size. The offering is exempt from registration under the Securities Act of 1933, as amended, and is expected to close on August 26, 2020, subject to customary closing conditions. The Notes will be unsecured senior obligations of the Company. In addition to certain customary restricted payment baskets, the indenture that will govern the Notes will permit the Company to make restricted payments in an unlimited amount if, after giving pro forma effect to the incurrence of any indebtedness to make such payment, the Company’s consolidated total debt ratio is less than 2.75 to 1.00. The Company’s consolidated total debt ratio will be generally defined in the indenture governing the Notes as the ratio of (1) the total consolidated debt of the Company minus cash and cash equivalents of the Company to (2) the Company’s consolidated EBITDA, as adjusted to exclude certain non-recurring expenses and giving pro forma effect to operations acquired during the measurement period, for the most recently ended four full fiscal quarters for which internal financial statements are available immediately preceding the date on which such event for which such calculation is being made. Additional covenants will be materially the same to the current senior notes due 2024.

The Company intends to use the net proceeds from the offering to redeem all of the $300 million aggregate principal amount of the Company’s outstanding 5.375% senior notes due 2024, at a redemption price equal to 102.688% of the principal amount of the notes being redeemed, plus accrued and unpaid interest to, but not including, September 11, 2020, the redemption date, and to repay a portion of the Company’s revolving unsecured credit facility with the remaining proceeds, after payment of fees and expenses related to the redemption and offering.

The Company is furnishing the information in this Current Report on Form 8-K to comply with Regulation FD. Such information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

(d) Exhibits:

|

|

|

|

|

|

|

|

|

99.1

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document contained in Exhibit 101)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

Dated: August 12, 2020

|

FIRSTCASH, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

/s/ R. DOUGLAS ORR

|

|

|

R. Douglas Orr

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

(As Principal Financial and Accounting Officer)

|

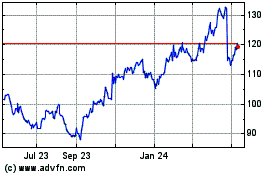

FirstCash (NASDAQ:FCFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

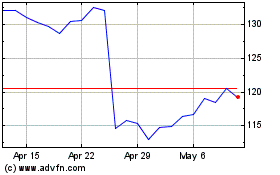

FirstCash (NASDAQ:FCFS)

Historical Stock Chart

From Jul 2023 to Jul 2024