After being stressed over the past few years, the renewable energy

sector has fired on all cylinders and is the major gainer this

year, clearly outpacing the broad market. This is largely thanks to

a number of growth stocks in the space, which was backed by the

surging stock market, favorable green energy trends and Obama’s

‘Climate Change Action Plan’.

Obama Plan Proves Beneficial

In June, President Obama unveiled a broad environmental plan in

order to curb carbon pollution from coal-fired power plants and

make cleaner forms of American-made energy. The plan hinges on

three pillars – cutting carbon emissions, preparing for the impact

of climate change, and leading international efforts on the subject

(read: 3 ETFs to Buy for Obama's Climate Change Plan).

The strategy would definitely benefit a variety of clean energy

firms, as it would improve energy efficiency across the board while

reducing other non-carbon emissions. The surge can already be seen

in many renewable energy stocks like

First Solar

(FSLR) and

SolarCity

(SCTY), though trading

has been slightly choppy of late due to mixed earnings and

disappointing guidance by many firms.

Solid Industry Outlook

The depletion of fossil fuel reserves, higher oil and gas prices,

as well as more efficient alternative energy applications has made

clean power more viable, adding optimism into the sector. The

demand for renewable energy, in particular wind and solar, is

growing by leaps and bounds for electricity generation in the

U.S.

Currently, clean energy accounts for nearly 16% of U.S. electricity

generation and is expected to increase to 33% over the next three

years, as per the Energy Information Administration (EIA). This is

especially true given that global warming and high fuel emissions

issues have resulted in rising popularity of clean energy sources

(read: 5 Clean Energy ETFs Leading the Sector's Surge).

The new and advanced technologies are able to provide clean

environment and have reduced dependence on fossil fuels, coal or

other energy resources, suggesting a bullish outlook on the clean

energy stocks. Moreover, the EIA projects clean energy production

to grow at a faster rate through 2040. In fact, solar, wind and

geothermal production will likely double over the next 25

years.

Given the bright outlook and the firmer oil prices, the trend of a

bull run in the space is likely to continue into 2014. As such,

investors seeking to ride out this booming trend want to tap the

space in the ETF form.

For those investors, we have highlighted three ETFs that could be

worth a look if America continues to embrace green technology, and

energy efficiency (see: all the Alternative Energy ETFs here).

First Trust NASDAQ Clean Edge Green Energy Index Fund

(QCLN)

This fund tracks the Nasdaq Clean Edge Green Energy Index and

managed assets worth $90.7 million. It charges 60 bps in fees per

year while volume is light suggesting a wide bid/ask spread.

In total, the product holds 43 securities in its basket with

largest allocations to

Linear Technology

(LLTC),

FSLR and

ITC Holdings

(ITC). These firms

combined make up for 23% of total assets. From a sector look,

technology firms dominate this ETF, accounting for nearly

two-fifths of the assets while oil & gas, and industrials round

out the next two spots.

QCLN is up 83.6% in the year-to-date time frame and it has a Zacks

ETF Rank of 1 or ‘Strong Buy’ rating with a ‘High’ risk

outlook.

Market Vectors Global Alternative Energy ETF

(GEX)

This ETF provides global exposure to about 31 companies that are

primarily engaged in the business of alternative energy by tracking

the Ardour Global Index. The fund holds roughly 30 stocks in its

basket with AUM of $92.6 million while charging 62 bps in fees per

year. Average daily volume is also paltry for this fund (read: A

Comprehensive Guide to Alternative Energy ETFs).

The product is highly concentrated on the top firm –

Eaton

(ETN) – with 10% of

assets, closely followed by

Cree

(CREE) and

Vestas Wind Systems

(VWDRY) with at least 8%

share each. From a sector perspective, industrials take the largest

share with 47% while information technology (26.5%) and utilities

(14.7%) round off to the next two spots.

In terms of country exposure, the fund is skewed toward the U.S.

with 59% share while China, Denmark, Italy and many others receive

minor allocations. The ETF has gained over 62% year-to-date.

PowerShares WilderHill Clean Energy Portfolio Fund

(PBW)

This product follows the WilderHill Clean Energy Index, holding

about 51 stocks in its basket. The fund has amassed $202.4 million

in its asset base and sees solid volume of more than 420,000 shares

a day. The expense ratio comes in at 0.70%.

The ETF is pretty well spread out across various securities, as

each make up less than 4.6% of total assets.

Canadian Solar

(CSIQ),

SunEdison

(SUNE), and

FuelCell Energy

(FCEL) are the top three

elements in the basket. From a sector look, the focus is on

information technology firms (46%), but industrials and materials

also receive double-digit allocations.

PBW added nearly 51% in the year-to-date time frame (read: Can the

Clean Energy ETF Bull Run Continue?).

Bottom Line

Given strong fundamentals ahead, investors should ‘go green’ with

the above three products that are slightly tilted toward growth

stocks, and are expected to deliver above-average returns compared

to others in the space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

FIRST SOLAR INC (FSLR): Free Stock Analysis Report

MKT VEC-GLBL AE (GEX): ETF Research Reports

PWRSH-W CL EGY (PBW): ETF Research Reports

NASDAQ-CL EDG G (QCLN): ETF Research Reports

SOLARCITY CORP (SCTY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

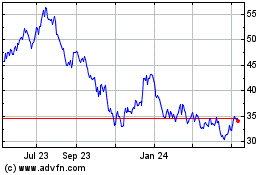

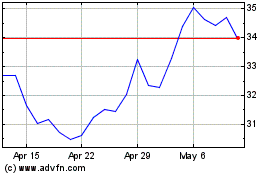

First Trust NASDAQ Clean... (NASDAQ:QCLN)

Historical Stock Chart

From Oct 2024 to Nov 2024

First Trust NASDAQ Clean... (NASDAQ:QCLN)

Historical Stock Chart

From Nov 2023 to Nov 2024