UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 22)*

FIRST

INTERSTATE BANCSYSTEM, INC.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

32055Y

201

(CUSIP

Number)

James

R. Scott

c/o

First Interstate BancSystem, Inc.

401

North 31st Street

Billings,

Montana 59116

(406)

255-5390

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May

23, 2024

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

| * |

The

remainder of this cover page shall be filled out for a Reporting Person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 32055Y 201 |

13D |

Page 2 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with Risa K. Scott |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF;

OO |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With: |

7. |

Sole

Voting Power

400,756 |

| 8. |

Shared

Voting Power

85,836 |

| 9. |

Sole

Dispositive Power

400,756 |

| 10. |

Shared

Dispositive Power

85,836 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

486,592 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

0.47% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 3 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with James R. Scott |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

3,972,381 |

| 8. |

Shared

Voting Power

428,287 |

| 9. |

Sole

Dispositive Power

3,972,381 |

| 10. |

Shared

Dispositive Power

428,287 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

4,400,668 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

4.21% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 4 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with John M. Heyneman, Jr. |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

1,246,843 |

| 8. |

Shared

Voting Power

176,719 |

| 9. |

Sole

Dispositive Power

1,246,843 |

| 10. |

Shared

Dispositive Power

176,719 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

1,423,562 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

1.36% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 5 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with Julie Scott Rose |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

776,022 |

| 8. |

Shared

Voting Power

1,048,438 |

| 9. |

Sole

Dispositive Power

776,022 |

| 10. |

Shared

Dispositive Power

1,048,438 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

1,824,460 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

1.74% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 6 of 22 pages |

| 1. |

Names

of Reporting Persons

Homer

Scott Jr Trust, First Interstate Wealth Management Trustee |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

0 |

| 8. |

Shared

Voting Power

0 |

| 9. |

Sole

Dispositive Power

0 |

| 10. |

Shared

Dispositive Power

950,753 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

950,753 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

0.91% |

|

| 14. |

Type

of Reporting Person (See Instructions)

OO |

|

| CUSIP No. 32055Y 201 |

13D |

Page 7 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with Susan S. Heyneman |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

639,256 |

| 8. |

Shared

Voting Power

0 |

| 9. |

Sole

Dispositive Power

639,256 |

| 10. |

Shared

Dispositive Power

0 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

639,256 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

0.61% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 8 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with James R. Scott, Jr. |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF,

OO |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

132,738 |

| 8. |

Shared

Voting Power

0 |

| 9. |

Sole

Dispositive Power

132,738 |

| 10. |

Shared

Dispositive Power

0 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

132,738 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

0.13% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 9 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with Jonathan R. Scott |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF,

OO |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

621,873 |

| 8. |

Shared

Voting Power

50,000 |

| 9. |

Sole

Dispositive Power

621,873 |

| 10. |

Shared

Dispositive Power

50,000 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

671,873 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

0.64% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 10 of 22 pages |

| 1. |

Names

of Reporting Persons

Shareholders

affiliated with Jeremy Scott |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF,

OO |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

3,486,000 |

| 8. |

Shared

Voting Power

0 |

| 9. |

Sole

Dispositive Power

3,486,000 |

| 10. |

Shared

Dispositive Power

0 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

3,486,000 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

3.33% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN,

OO (See Item 2) |

|

| CUSIP No. 32055Y 201 |

13D |

Page 11 of 22 pages |

| 1. |

Names

of Reporting Persons

Geoffrey

D. Scott |

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

☒ (b) ☐ |

|

| 3. |

SEC

Use Only

|

|

| 4. |

Source

of Funds (See Instructions)

PF,

OO |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

☐ |

| 6. |

Citizenship

or Place of Organization

(See

Item 2) |

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With:

|

7. |

Sole

Voting Power

89,756 |

| 8. |

Shared

Voting Power

1,650 |

| 9. |

Sole

Dispositive Power

89,756 |

| 10. |

Shared

Dispositive Power

1,650 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

91,406 |

|

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) |

☐ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

0.09% |

|

| 14. |

Type

of Reporting Person (See Instructions)

IN |

|

| CUSIP No. 32055Y 201 |

13D |

Page 12 of 22 pages |

Explanatory

Note

This

Amendment No. 22 (“Amendment No. 22”) to Schedule 13D amends and supplements the Schedule 13D originally filed with

the United States Securities and Exchange Commission (the “SEC”) on February 2, 2011 (as amended to date, the “Schedule

13D”), with respect to the common stock, $0.00001 par value per share (“Common Stock”) of First Interstate

BancSystem, Inc., a Delaware corporation (the “Issuer”). Capitalized terms used in this Amendment No. 22 and not otherwise

defined shall have the same meanings ascribed to them in the Schedule 13D.

Except

as set forth herein, all items remain as previously reported in the Schedule 13D.

| ITEM

2. |

IDENTITY

AND BACKGROUND

|

Item

2 of the Schedule 13D is hereby amended and supplemented as follows:

Geoffrey

D. Scott is a shareholder of J&G Brothers Inc. Mr. Scott’s address is P.O. Box 7113, Billings, Montana 59103. Mr. Scott

is a citizen of the United States of America.

During

the last five years, Mr. Scott has never been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors)

or been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

| ITEM

3. |

SOURCE

AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

Item

3 of the Schedule 13D is hereby amended and supplemented as follows:

Mr.

Scott acquired the securities reported in this Schedule 13D through estate planning transactions, gifts from family, and in open market

purchases using personal funds.

| ITEM

4. |

PURPOSE

OF TRANSACTION |

Item

4 of the Schedule 13D is hereby amended and supplemented as follows:

Stockholders’

Agreement

On

May 23, 2024, Mr. Scott became an observer to the Board of Directors of the Issuer and entered into the Stockholders’ Agreement,

which was originally executed on September 15, 2021, and described in Amendment No. 18.

| CUSIP No. 32055Y 201 |

13D |

Page 13 of 22 pages |

| ITEM

5. |

INTEREST

IN SECURITIES OF THE ISSUER |

Item

5 of the Schedule 13D is hereby amended and supplemented as follows:

(a)

– (b) The Reporting Persons may be deemed to

beneficially own an aggregate of 14,107,308 shares of Common Stock, representing approximately 13.49% of the outstanding shares of Common

Stock, and an equal percentage of its voting power, based on 104,568,019 shares of Common Stock outstanding as of April 30, 2024, as

disclosed in the Issuer’s quarterly report on Form 10-Q filed with the SEC on May 3, 2024. This amount includes shares beneficially

owned as of the date hereof by each Reporting Person as set forth below.

| ● | Risa

K. Scott may be deemed to beneficially own 486,592 shares of Common Stock, representing 0.47%

of the outstanding Common Stock, which includes: |

| ■ | 400,756

shares of Common Stock held by Risa K Scott TTEE Risa K Scott Trust Dtd 12/4/15, over which

Risa K. Scott has sole voting and dispositive power; |

| | | |

| ■ | 85,836

shares of Common Stock held by Risa K. Scott & John Heyneman Jr., TTEEs FBO Risa K Scott

Exemption Trust Under the Scott Family 1996 Trust, over which Ms. Scott has shared voting

and dispositive power with John M. Heyneman, Jr. |

| ● | James

R. Scott may be deemed to beneficially own 4,400,668 shares of Common Stock, representing

4.21% of the outstanding Common Stock, which includes: |

| ■ | 12,651

shares of Common Stock held directly by James R. Scott. |

| | | |

| ■ | 15,661

shares of Common Stock held indirectly by James R. Scott through a 401(k) account. |

| | | |

| ■ | 1,970,031

shares of Common Stock held by James R Scott Trust, James R Scott & First Interstate

Wealth Management Co-TTEEs, over which Mr. Scott has sole voting and dispositive power. |

| | | |

| ■ | 35,240

shares of Common Stock held by James R and Christine M Scott Foundation, over which Mr. Scott

has shared voting and dispositive power with the board of the same. |

| | | |

| ■ | 1,901,036

shares of Common Stock held by JS Investments Limited Partnership, over which Mr. Scott has

sole voting and dispositive power. |

| | | |

| ■ | 343,599

shares of Common Stock held by Foundation for Community Vitality, over which Mr. Scott has

shared voting and dispositive power with the board of the same. |

| | | |

| ■ | 73,002

shares of Common Stock held by James F Heyneman Conservatorship, James Scott, Conservator,

over which Mr. Scott has sole voting and dispositive power. |

| | | |

| ■ | 7,096

shares of Common Stock held by James F Heyneman Trust, James Scott & First Interstate

Wealth Management Co-Trustees, over which Mr. Scott has shared voting and dispositive power. |

| | | |

| ■ | 42,352

shares of Common Stock held by James R. Scott’s spouse, over which Mr. Scott has shared

voting and dispositive power. |

| ● | John

M. Heyneman, Jr. may be deemed to beneficially own 1,423,562 shares of Common Stock, representing

1.36% of the outstanding Common Stock, which includes: |

| ■ | 5,558

shares of Common Stock held directly by John M. Heyneman, Jr. |

| | | |

| ■ | 155,493

shares of Common Stock held by John M Heyneman Jr. Trust, over which Mr. Heyneman has sole

voting and dispositive power. |

| | | |

| ■ | 85,836

shares of Common Stock held by Riki Rae Scott Davidson & John Heyneman Jr., Trustees

FBO Riki Scott Davidson Exemption Trust Under the Scott Family 1996 Trust, over which Mr.

Heyneman has shared voting and dispositive power with Riki Davidson. |

| | | |

| ■ | 85,836

shares of Common Stock held by Rae Ann Morss & John Heyneman Jr., Trustees FBO Rae Ann

Morss Exemption Trust Under the Scott Family 1996 Trust, over which Mr. Heyneman has shared

voting and dispositive power with Rae Ann Morss. |

| | | |

| ■ | 1,085,792

shares of Common Stock held by Towanda Investments Limited Partnership, over which Mr. Heyneman

has sole voting and dispositive power. |

| | | |

| ■ | 3,977

shares of Common Stock held by John M. Heyneman, Jr.’s spouse, over which Mr. Heyneman

has shared voting and dispositive power. |

| | | |

| ■ | 1,070

shares of Common Stock held by John M. Heyneman, Jr.’s daughter, over which Mr. Heyneman

has shared voting and dispositive power. |

| CUSIP No. 32055Y 201 |

13D |

Page 14 of 22 pages |

| ● | Julie

Scott Rose may be deemed to beneficially own 1,824,460 shares of Common Stock, representing

1.74% of the outstanding Common Stock, which includes: |

| ■ | 410,281

shares of Common Stock held by Julie A Scott Rose Trustee of the Julie A Scott Rose Trust

Dated 5-14-2002. |

| | | |

| ■ | 95,065

shares of Common Stock held by Juliana Sarah Scott Rose Trust, over which Ms. Rose has sole

voting and dispositive power. |

| | | |

| ■ | 95,064

shares of Common Stock held by Elizabeth Lauren Scott Rose Trust, over which Ms. Rose has

sole voting and dispositive power. |

| | | |

| ■ | 58,537

shares of Common Stock held by Holland Elizabeth Scott Trust, over which Ms. Rose has sole

voting and dispositive power. |

| | | |

| ■ | 58,537

shares of Common Stock held by Harper Grace Scott Trust, over which Ms. Rose has sole voting

and dispositive power. |

| | | |

| ■ | 58,538

shares of Common Stock held by Harrison William Scott Trust, over which Ms. Rose has sole

voting and dispositive power. |

| | | |

| ■ | 209,678

shares of Class A Stock held by IXL Limited Liability Company, over which Ms. Rose has shared

voting and dispositive power with Jonathan Scott. |

| | | |

| ■ | 838,760

shares of Common Stock held by The Thomas & Joan Scott Foundation, over which Ms. Rose

has shared voting power. |

| ● | Homer

Scott Jr Trust, First Interstate Wealth Management Trustee may be deemed to beneficially

own 950,753 shares of Common Stock, representing 0.91% of the outstanding Common Stock. |

| | |

| ● | Susan

S. Heyneman may be deemed to beneficially own 639,256 shares of Common Stock, representing

0.61% of the outstanding Common Stock, which includes: |

| ■ | 639,256

shares of Common Stock held by Susan Scott Heyneman Trust, Susan Heyneman & First Interstate

Wealth Management Co-Trustees, over which Ms. Heyneman has sole voting and dispositive power. |

| ● | James

R. Scott Jr. may be deemed to beneficially own 132,738 shares of Common Stock, representing

0.13% of the outstanding Common Stock, which includes: |

| ■ | 81,454

shares of Common Stock held directly by James R. Scott Jr. |

| | | |

| ■ | 25,642

shares of Common Stock held by First Interstate Bank TTEE for Dana S Andersson GST Exempt

Trust No 1 Dtd 12/11/2020, over which Mr. Scott, Jr. has sole voting and dispositive power. |

| | | |

| ■ | 25,642

shares of Common Stock held by First Interstate Bank TTEE for James R Scott Jr. GST Exempt

Trust No 1 Dtd 12/11/2020, over which Mr. Scott, Jr. has sole voting and dispositive power. |

| ● | Jonathan

R. Scott may be deemed to beneficially own 671,873 shares of Common Stock, representing 0.64%

of the outstanding Common Stock, which includes: |

| ■ | 5,736

shares of Common Stock held directly by Jonathan R. Scott. |

| | | |

| ■ | 616,137

shares of Common Stock held by Jonathan Scott as Trustee of the Jonathan R Scott Trust Dated

as of 4/21/04, over which Jonathan R. Scott has sole voting and dispositive power. |

| | | |

| ■ | 50,000

shares of Common Stock held by Jonathan R. Scott’s spouse, over which Mr. Scott has

shared voting and dispositive power. |

| CUSIP No. 32055Y 201 |

13D |

Page 15 of 22 pages |

| ● | Jeremy

Scott may be deemed to beneficially own 3,486,000 shares of Common Stock, representing 3.33%

of the outstanding Common Stock, which includes: |

| ■ | 69,892

shares of Common Stock held by Jeremy Scott TTEE, Jeremy Scott Revocable Trust Dtd 6/25/15,

over which Jeremy Scott has sole voting and dispositive power. |

| | | |

| ■ | 3,416,108

shares of Common Stock held by NBAR5 Limited Partnership, over which Jeremy Scott has sole

voting and dispositive power. |

| ● | Geoffrey

D. Scott may be deemed to beneficially own 91,406 shares of Common Stock, representing 0.09%

of the outstanding Common Stock, which includes: |

| ■ | 89,756

shares of Common Stock held directly by Geoffrey D. Scott. |

| | | |

| ■ | 1,650

shares of Common Stock held by Geoffrey D. Scott’s spouse, over which Mr. Scott has

shared voting and dispositive power. |

(c)

Other than as described in Item 4, the Reporting Persons have effected the following transactions in the Common Stock during the

past 60 days:

| ● | On

May 14, 2024, Julie A. Scott Rose Trustee of the Julie A. Scott Rose Trust Dated 5-14-2002,

sold 110,000 shares of Common Stock, the Juliana Sarah Scott Rose Trust sold 27,000 shares

of Common Stock, and the Elizabeth Lauren Scott Rose Trust sold 27,000 shares of Common Stock,

in a series of open market transactions at a weighted average price of $27.55 with a price

range of $27.44 to $27.71. The Reporting Person undertakes to provide to the Issuer or the

staff of the SEC, upon request, the full information regarding the number of shares sold

at each separate price within the ranges set forth above. |

| | | |

| ● | On

May 15, 2024, the Thomas & Joan Scott Foundation sold 36,300 shares of Common Stock in

a series of open market transactions at a weighted average price of $27.81 with a price range

of $27.66 to $28.02. |

(d)

None.

(e)

Not applicable.

| CUSIP No. 32055Y 201 |

13D |

Page 16 of 22 pages |

| ITEM

7. |

Material

to be Filed as Exhibits |

Item

7 of the Schedule 13D is hereby amended and supplemented as follows:

*

Previously filed.

| CUSIP No. 32055Y 201 |

13D |

Page 17 of 22 pages |

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

May 28, 2024 |

| |

Date |

| |

|

| |

* |

| |

Risa

K. Scott |

| |

|

| |

Risa K. Scott & John Heyneman Jr., TTEES FBO Risa K. Scott

exemption trust under the Scott family 1996 trust |

| |

|

|

| |

By: |

* |

| |

Name: |

Risa

K Scott |

| |

Title: |

Trustee |

| |

|

|

| |

Risa K Scott TTEE Risa K Scott Trust DTD 12/4/15 |

| |

|

|

| |

By: |

* |

| |

Name: |

Risa K Scott |

| |

Title: |

Trustee |

| |

|

|

| |

* |

| |

James R. Scott |

| |

|

| |

Foundation for Community Vitality |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott |

| |

Title: |

Director

|

| |

|

|

| |

James F Heyneman Conservatorship, James Scott, Conservator |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott |

| |

Title: |

Conservator |

| CUSIP No. 32055Y 201 |

13D |

Page 18 of 22 pages |

| |

James R Scott Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott |

| |

Title: |

Trustee |

| |

|

|

| |

James R And Christine M Scott Foundation |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott |

| |

Title: |

President |

| |

|

|

| |

JS Investments Limited Partnership |

| |

|

|

| |

By: |

* |

| |

Name: |

James R. Scott |

| |

Title: |

Managing Partner |

| |

|

|

| |

James R Scott Trust, James R Scott & First Interstate Wealth

Management Co-TTEEs |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott |

| |

Title: |

Trustee |

| |

|

|

| |

James F Heyneman Trust, James Scott & First Interstate Wealth

Management Co-Trustees |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott |

| |

Title: |

Trustee |

| |

|

|

| |

* |

| |

John M. Heyneman, Jr. |

| |

|

|

| |

Rae Ann Morss & John Heyneman Jr., Trustees FBO Rae Ann Morss

Exemption Trust under the Scott family 1996 Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

John

M. Heyneman Jr |

| |

Title: |

Co-Trustee |

| CUSIP No. 32055Y 201 |

13D |

Page 19 of 22 pages |

| |

Riki Rae Scott Davidson & John Heyneman Jr., trustees FBO Riki Scott Davidson Exemption Trust under the Scott family 1996 Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

John

M. Heyneman Jr |

| |

Title: |

Co-Trustee |

| |

|

|

| |

John M. Heyneman Jr. Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

John

M. Heyneman Jr |

| |

Title: |

Trustee |

| |

|

|

| |

Towanda Investments Limited Partnership |

| |

|

|

| |

By: |

* |

| |

Name: |

John

M. Heyneman Jr |

| |

Title: |

Managing

Partner |

| |

|

|

| |

* |

| |

Julie Scott Rose |

| |

|

|

| |

Elizabeth Lauren Scott Rose Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

Julie

Scott Rose |

| |

Title: |

Trust

Advisor |

| |

|

|

| |

Harper Grace Scott Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

Julie Scott Rose |

| |

Title: |

Trustee |

| CUSIP No. 32055Y 201 |

13D |

Page 20 of 22 pages |

| |

Harrison William Scott Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

Julie

Scott Rose |

| |

Title: |

Trustee |

| |

|

|

| |

Holland Elizabeth Scott Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

Julie

Scott Rose |

| |

Title: |

Trustee |

| |

|

|

| |

IXL Limited Liability Company |

| |

|

|

| |

By: |

* |

| |

Name: |

Julie

Scott Rose |

| |

Title: |

Designated

member |

| |

|

|

| |

Juliana Sarah Scott Rose Trust |

| |

|

|

| |

By: |

* |

| |

Name: |

Julie

Scott Rose |

| |

Title: |

Trust

Advisor |

| |

|

|

| |

Julie A Scott Rose Trustee of the Julie A Scott Rose Trust dated

5-14-2002 |

| |

|

|

| |

By: |

* |

| |

Name: |

Julie

Scott Rose |

| |

Title: |

Trustee |

| CUSIP No. 32055Y 201 |

13D |

Page 21 of 22 pages |

| |

Homer Scott Jr Trust, First Interstate Wealth Management Trustee |

| |

|

|

| |

By: |

* |

| |

Name: |

First

Interstate Bank Wealth Management |

| |

Title: |

Trustee |

| |

|

|

| |

* |

| |

Susan S. Heyneman |

| |

|

|

| |

Susan Scott Heyneman Trust, Susan Heyneman & First Interstate

Wealth Management Co-Trustees |

| |

|

|

| |

By: |

* |

| |

Name: |

Susan

Heyneman |

| |

Title: |

Trustee |

| |

|

|

| |

* |

| |

James R Scott, Jr. |

| |

|

|

| |

First Interstate Bank TTEE for Dana S Andersson GST Exempt Trust

No 1 DTD 12/11/2020 |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott Jr. |

| |

Title: |

Authorized Signatory |

| |

|

|

| |

By: |

*

|

| |

Name: |

Hannah

Wagner |

| |

Title: |

Trustee |

| |

|

|

| |

By: |

* |

| |

Name: |

Clarene

Westburg |

| |

Title: |

Trustee |

| |

|

|

| |

First Interstate Bank TTEE for James R Scott Jr. GST Exempt Trust

No 1 DTD 12/11/2020 |

| |

|

|

| |

By: |

* |

| |

Name: |

James

R. Scott Jr. |

| |

Title: |

Authorized

Signatory |

| CUSIP No. 32055Y 201 |

13D |

Page 22 of 22 pages |

| |

By: |

* |

| |

Name: |

Hannah

Wagner |

| |

Title: |

Trustee |

| |

|

|

| |

By: |

* |

| |

Name: |

Clarene Westburg |

| |

Title: |

Trustee |

| |

|

|

| |

* |

| |

Jonathan R. Scott |

| |

|

| |

Jonathan Scott as Trustee of the Jonathan R Scott Trust dated

as of 4/21/04 |

| |

|

|

| |

By: |

* |

| |

Name: |

Jonathan

Scott |

| |

Title: |

Trustee |

| |

|

|

| |

* |

| |

Jeremy Scott |

| |

|

|

| |

Jeremy Scott TTEE, Jeremy Scott Revocable Trust DTD 6/25/15 |

| |

|

|

| |

By: |

* |

| |

Name: |

Jeremy

Paul Scott |

| |

Title: |

Trustee |

| |

|

|

| |

NBar5 Limited Partnership |

| |

|

|

| |

By: |

* |

| |

Name: |

Jeremy Scott |

| |

Title: |

Managing

Member |

| |

|

|

| |

* |

| |

Geoffrey D. Scott |

| *By: |

/s/ TIMOTHY LEUTHOLD |

|

| Timothy Leuthold, as attorney-in-fact |

|

Exhibit

99.1

AMENDED

AND RESTATED JOINT FILING AGREEMENT

PURSUANT

TO RULE 13d-1(k)(1)

This

Amended and Restated Joint Filing Agreement (this “Agreement”) is made pursuant to Rule 13d-1(k)(1) under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), by and among the parties listed below, each referred to herein as

a “Joint Filer.” Each Joint Filer agrees that a statement of beneficial ownership as required by Section 13(d) of the Exchange

Act and the rules thereunder may be filed on each of their behalf on Schedule 13D or Schedule 13G, as appropriate, with respect to his,

her or its ownership of the Class A Common Stock and Class B Common Stock of First Interstate BancSystem, Inc., and that said joint filing

may thereafter be amended by further joint filings. Each Joint Filer states that he, she or it satisfied the requirements for making

a joint filing under Rule 13d-1. This Agreement may be executed in any number of counterparts, all of which taken together shall constitute

one and the same instrument.

IN

WITNESS WHEREOF, each of the undersigned hereby execute and deliver this Agreement as of this 1st day of July, 2020.

| |

|

|

|

JOINT

FILERS |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

James

R. Scott, Jr. |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

Jeremy

Scott |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

Jonathan

R. Scott |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

Risa

K. Scott |

| |

|

|

|

|

| |

|

|

|

N

Bar 5, Limited Partnership |

| |

|

|

|

|

| |

|

|

By: |

* |

| |

|

|

Name: |

Risa

K. Scott |

| |

|

|

Title: |

Managing

General Partner |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

James

R. Scott |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

John

M. Heyneman, Jr. |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

Julie

Scott Rose |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

Susan

S. Heyneman |

| |

|

|

|

|

| |

|

|

|

* |

| |

|

|

|

Geoffrey

D. Scott |

| |

|

|

|

|

| *By: |

/s/

TIMOTHY LEUTHOLD |

|

|

|

| |

Timothy

Leuthold, as attorney-in-fact |

|

|

|

Exhibit

99.2

POWER

OF ATTORNEY

With

respect to holdings of and transactions in securities issued by First Interstate BancSystem, a Montana corporation (the “Company”),

each of the undersigned hereby constitutes and appoints Timothy Leuthold with full power of substitution and resubstitution, to act as

each the undersigned’s true and lawful attorney-in-fact to:

1.

execute for and on behalf of each of the undersigned, Schedules 13D and 13G in accordance with Section 13 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), and the rules thereunder, and Forms 3, 4, and 5 in accordance

with Section 16 of the Exchange Act and the rules thereunder;

2.

do and perform any and all acts for and on behalf of each of the undersigned which may be necessary or desirable to complete and execute

any such Schedule 13D or 13G or Form 3, 4, or 5, complete and execute any amendment or amendments thereto, and timely file such schedule

or form with the SEC and any stock exchange or similar authority; and

3.

take any other action of any type whatsoever in connection with the foregoing which, in the opinion of such attorney-in-fact, may be

of benefit to, in the best interest of, or legally required by, each of the undersigned, it being understood that the documents executed

by such attorney-in-fact on behalf of each of the undersigned pursuant to this Power of Attorney shall be in such form and shall contain

such terms and conditions as such attorney-in-fact may approve in such attorney-in-fact’s discretion.

Each

of the undersigned hereby grants to each such attorney-in-fact full power and authority to do and perform any and every act and thing

whatsoever requisite, necessary, or proper to be done in the exercise of any of the rights and powers herein granted, as fully to all

intents and purposes as each of the undersigned might or could do if personally present, with full power of substitution and resubstitution

or revocation, hereby ratifying and confirming all that such attorney-in-fact substitutes, shall lawfully do or cause to be done by virtue

of this Power of Attorney and the rights and powers herein granted.

Each

of the undersigned acknowledges that the foregoing attorney-in-fact, in serving in such capacity at the request of each of the undersigned,

is not assuming, nor is the Company assuming, any of each of the undersigned’s responsibilities to comply with Section 13 and Section

16 of the Exchange Act.

This

Power of Attorney shall remain in full force and effect until each of the undersigned is no longer required to file Schedule 13D and

13G and Forms 3, 4, and 5 with respect to each of the undersigned’s holdings of and transactions in securities issued by the Company,

unless earlier revoked by each of the undersigned in a signed writing delivered to the foregoing attorney-in-fact.

[Remainder

of page intentionally blank]

| |

RISA

KAE SCOTT |

| |

|

|

| |

By: |

/s/

Risa K Scott |

| |

Name:

|

Risa

K Scott, as an individual |

| |

|

|

| |

RISA

K. SCOTT & JOHN HEYNEMAN JR., TTEES FBO RISA K. SCOTT EXEMPTION TRUST UNDER THE SCOTT FAMILY 1996 TRUST |

| |

|

|

| |

By: |

/s/

Risa K Scott |

| |

Name:

|

Risa

K Scott |

| |

Title:

|

Trustee |

| |

|

|

| |

RISA

K SCOTT TTEE RISA K SCOTT TRUST DTD 12/4/15 |

| |

|

|

| |

By: |

/s/

Risa K Scott |

| |

Name:

|

Risa

K Scott |

| |

Title:

|

Trustee |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

JAMES

R. SCOTT |

| |

|

|

| |

By: |

/s/

James R. Scott |

| |

Name:

|

James

R. Scott, as an individual |

| |

|

|

| |

FOUNDATION

FOR COMMUNITY VITALITY |

| |

|

|

| |

By: |

/s/ James R. Scott |

| |

Name:

|

James

R. Scott |

| |

Title:

|

Director |

| |

|

|

| |

JAMES

F HEYNEMAN CONSERVATORSHIP, JAMES SCOTT, CONSERVATOR |

| |

|

|

| |

By:

|

/s/ James R. Scott |

| |

Name:

|

James

R. Scott |

| |

Title:

|

Conservator |

| |

|

|

| |

JAMES

R SCOTT TRUST |

| |

|

|

| |

By:

|

/s/James R. Scott |

| |

Name:

|

James

R. Scott |

| |

Title:

|

Trustee |

| |

|

|

| |

JAMES

R AND CHRISTINE M SCOTT FOUNDATION |

| |

|

|

| |

By: |

/s/

James R. Scott |

| |

Name:

|

James

R. Scott |

| |

Title:

|

President |

| |

|

|

| |

JS

INVESTMENTS LIMITED PARTNERSHIP |

| |

|

|

| |

By: |

/s/

James R. Scott |

| |

Name:

|

James

R. Scott |

| |

Title:

|

Managing

Partner |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

JOHN

HEYNEMAN JR. |

| |

|

|

| |

By: |

/s/

John M. Heyneman Jr. |

| |

Name:

|

John

M. Heyneman Jr., as an individual |

| |

|

|

| |

RAE

ANN MORSS & JOHN HEYNEMAN JR., TRUSTEES FBO RAE ANN MORSS EXEMPTION |

| |

TRUST

UNDER THE SCOTT FAMILY 1996 TRUST |

| |

|

|

| |

By:

|

/s/

John M. Heyneman Jr. |

| |

Name:

|

John

M. Heyneman Jr. |

| |

Title:

|

Co-Trustee |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

RIKI

RAE SCOTT DAVIDSON & JOHN HEYNEMAN JR., TRUSTEES FBO RIKI SCOTT DAVIDSON EXEMPTION TRUST UNDER THE SCOTT FAMILY 1996 TRUST |

| |

|

|

| |

By: |

/s/

John M. Heyneman Jr. |

| |

Name:

|

John

M. Heyneman Jr. |

| |

Title:

|

Co-Trustee |

| |

|

|

| |

TOWANDA

INVESTMENTS LIMITED PARTNERSHIP |

| |

|

|

| |

By:

|

/s/

John M. Heyneman Jr. |

| |

Name:

|

John

M. Heyneman Jr. |

| |

Title:

|

Managing

Partner |

| |

|

|

| |

JULIE

SCOTT ROSE |

| |

|

|

| |

By: |

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose, as an individual |

| |

|

|

| |

ELIZABETH

LAUREN SCOTT ROSE TRUST |

| |

|

|

| |

By: |

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose |

| |

Title:

|

Trust

Advisor |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

HARPER

GRACE SCOTT TRUST |

| |

|

|

| |

By:

|

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose |

| |

Title:

|

Trustee |

| |

|

|

| |

HARRISON

WILLIAM SCOTT TRUST |

| |

|

|

| |

By: |

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose |

| |

Title:

|

Trustee |

| |

|

|

| |

HOLLAND

ELIZABETH SCOTT TRUST |

| |

|

|

| |

By: |

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose |

| |

Title:

|

Trustee |

| |

|

|

| |

IXL

LIMITED LIABILITY COMPANY |

| |

|

|

| |

By: |

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose |

| |

Title:

|

Designated

member |

| |

|

|

| |

JULIANA

SARAH SCOTT ROSE TRUST |

| |

|

|

| |

By: |

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose |

| |

Title:

|

Trust

Advisor |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

JULIE

A SCOTT ROSE TRUSTEE OF THE JULIE A SCOTT ROSE TRUST DATED 5- 14-2002 |

| |

|

|

| |

By: |

/s/

Julie Scott Rose |

| |

Name:

|

Julie

Scott Rose |

| |

Title:

|

Trustee |

| |

|

|

| |

HOMER

SCOTT JR. |

| |

|

|

| |

By:

|

/s/

Homer Scott Jr. |

| |

Name:

|

Homer

Scott Jr., as an individual |

| |

|

|

| |

HOMER

SCOTT JR. TRUST DTD 12/4/78 |

| |

|

|

| |

By: |

/s/

Homer Scott Jr. |

| |

Name:

|

Homer

Scott Jr. |

| |

Title:

|

Trustee |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

JAMES

R SCOTT JR. |

| |

|

|

| |

By: |

/s/

James R. Scott Jr. |

| |

Name:

|

James

R. Scott Jr., as an individual |

| |

|

|

| |

FIRST

INTERSTATE BANK TTEE FOR DANA S ANDERSSON GST EXEMPT TRUST NO 1 DTD 12/11/2020 |

| |

|

|

| |

By: |

/s/

James R. Scott Jr. |

| |

Name:

|

James

R. Scott Jr. |

| |

Title:

|

Authorized

Signatory |

| |

|

|

| |

By: |

/s/

Hanna Wagner |

| |

Name:

|

Hanna

Wagner |

| |

Title:

|

Trustee |

| |

|

|

| |

By: |

/s/

Clarene Westburg |

| |

Name:

|

Clarene

Westburg |

| |

Title:

|

Trustee |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

FIRST

INTERSTATE BANK TTEE FOR JAMES R. SCOTT JR. GST EXEMPT TRUST NO 1 DTD 12/11/2020 |

| |

|

|

| |

By: |

/s/

James R. Scott Jr. |

| |

Name:

|

James

R. Scott Jr. |

| |

Title:

|

Authorized

Signatory |

| |

|

|

| |

By: |

/s/

Hanna Wagner |

| |

Name:

|

Hanna

Wagner |

| |

Title:

|

Trustee |

| |

|

|

| |

By: |

/s/

Clarene Westburg |

| |

Name:

|

Clarene

Westburg |

| |

Title:

|

Trustee |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

JONATHAN

SCOTT |

| |

|

|

| |

By: |

/s/

Jonathan Scott |

| |

Name:

|

Jonathan

Scott, as an individual |

| |

|

|

| |

JONATHAN

SCOTT AS TRUSTEE OF THE JONATHAN R SCOTT TRUST DATED AS OF 4/21/04 |

| |

|

|

| |

By:

|

/s/

Jonathan Scott |

| |

Name:

|

Jonathan

Scott |

| |

Title:

|

Trustee |

| |

|

|

| |

JEREMY PAUL SCOTT |

| |

|

|

| |

By:

|

/s/

Jeremy Paul Scott |

| |

Name:

|

Jeremy

Paul Scott, as an individual |

| |

|

|

| |

JEREMY

SCOTT TTEE, JEREMY SCOTT REVOCABLE TRUST

DTD 6/25/15 |

| |

|

|

| |

By:

|

/s/

Jeremy Paul Scott |

| |

Name:

|

Jeremy

Paul Scott |

| |

Title:

|

Trustee |

| |

|

|

| |

NBAR5

Limited Partnership |

| |

|

|

| |

By: |

/s/

Jeremy Paul Scott |

| |

Name:

|

Jeremy

Paul Scott |

| |

Title:

|

Managing

Member |

| |

|

|

| |

SUSAN

S. HEYNEMAN Trust |

| |

|

| |

|

/s/

Susan Heyneman |

| |

Name:

|

Susan

Heyneman |

| |

Title:

|

Trustee |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

JAMES

R SCOTT TRUST, JAMES R SCOTT & FIRST INTERSTATE WEALTH MANAGEMENT COTTEES |

| |

|

|

| |

|

/s/

James R Scott |

| |

Name:

|

James

R Scott |

| |

Title:

|

Trustee |

| |

|

|

| |

JAMES

F HEYNEMAN TRUST, JAMES SCOTT & FIRST INTERSTATE WEALTH MANAGEMENT CO-TRUSTEES |

| |

|

| |

|

/s/

James R Scott |

| |

Name:

|

James

R Scott |

| |

Title:

|

Trustee |

| |

|

|

| |

SUSAN

SCOTT HEYNEMAN TRUST, SUSAN HEYNEMAN & FIRST INTERSTATE WEALTH |

| |

MANAGEMENT

CO-TRUSTEES |

| |

|

|

| |

|

/s/

Susan Heyneman |

| |

Name:

|

Susan

Heyneman |

| |

Title:

|

Trustee |

| |

|

|

| |

HOMER

SCOTT JR TRUST, HOMER SCOTT JR. & FIRST INTERSTATE WEALTH MANAGEMENT CO TRUSTEES |

| |

|

|

| |

|

/s/

Homer Scott Jr. |

| |

Name:

|

Homer

Scott Jr. |

| |

Title:

|

Trustee |

| |

|

|

| |

JOHN

M HEYNEMAN JR. TRUST |

| |

|

|

| |

|

/s/

John M Heyneman Jr. |

| |

Name:

|

John

M Heyneman Jr. |

| |

Title:

|

Trustee |

[Signature

page to Scott Family FIBK Shareholder Group POA]

| |

Geoffrey D. Scott |

| |

|

|

| |

|

/s/

Geoffrey D Scott |

| |

Name:

|

Geoffrey

D Scott, as an individual |

[Signature

page to Scott Family FIBK Shareholder Group POA]

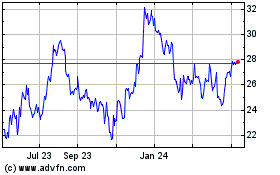

First Interstate BancSys... (NASDAQ:FIBK)

Historical Stock Chart

From Jan 2025 to Feb 2025

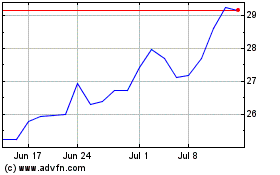

First Interstate BancSys... (NASDAQ:FIBK)

Historical Stock Chart

From Feb 2024 to Feb 2025