Fifth Third Bancorp Announces Cash Dividends

February 27 2018 - 4:58PM

Business Wire

Board Approves Share Repurchase

Authorization of 100 million shares

Fifth Third Bancorp today declared cash dividends on its common

shares, Series J preferred shares, and Series I preferred

shares.

Fifth Third Bancorp (Nasdaq: FITB) declared a cash dividend on

its common shares of $0.16 for the first quarter of 2018. The

dividend is payable on April 16, 2018 to shareholders of record as

of March 30, 2018.

Fifth Third also declared a cash dividend on its 4.90%

Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series J, at the rate of $612.50 per preferred share, which equates

to approximately $24.50 for each depositary share. Each depositary

share represents a 1/25th ownership interest in a share of Series J

Preferred Stock. The Series J dividend is payable on April 2, 2018

to shareholders of record as of March 30, 2018.

Fifth Third also declared a cash dividend on its 6.625%

Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series I (Nasdaq: FITBI), at the rate of $414.06 per preferred

share, which equates to approximately $0.41406 for each depositary

share. Each depositary share represents a 1/1000th ownership

interest in a share of Series I Preferred Stock. The Series I

dividend is payable on April 2, 2018 to shareholders of record as

of March 30, 2018.

Fifth Third also announced that its Board of Directors approved

a new share repurchase authorization of up to 100 million shares,

which replaces the previous authorization from 2016 under which

approximately 14.5 million shares remain.

Future capital distributions prior to June 30, 2018 are subject

to the 2017 Comprehensive Capital Analysis & Review (“CCAR”)

authorization for Fifth Third announced on June 28, 2017. Capital

distributions beginning July 1, 2018 through June 30, 2019 will be

subject to the 2018 CCAR authorization that is expected to be

announced on or before June 30, 2018. Any future capital

distributions are subject to evaluation and approval by the Board

of Directors at any given time, Fifth Third’s performance, the

state of the economic environment, market conditions, regulatory

factors, and other risks and uncertainties.

The new repurchase authorization does not have an expiration

date, does not include specific price targets, may be executed

through open market purchases or one or more private negotiated

transactions, including Rule 10b5-1 programs, and may be suspended

at any time.

Fifth Third Bancorp is a diversified financial services company

headquartered in Cincinnati, Ohio. As of December 31, 2017, the

Company had $142 billion in assets and operates 1,154 full-service

Banking Centers, and 2,469 Fifth Third branded ATMs in Ohio,

Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West

Virginia, Georgia and North Carolina. In total, Fifth Third

provides its customers with access to more than 54,000 fee-free

ATMs across the United States. Fifth Third operates four main

businesses: Commercial Banking, Branch Banking, Consumer Lending,

and Wealth & Asset Management. Fifth Third is among the largest

money managers in the Midwest and, as of December 31, 2017, had

$362 billion in assets under care, of which it managed $37 billion

for individuals, corporations and not-for-profit organizations

through its Trust and Registered Investment Advisory businesses.

Investor information and press releases can be viewed at

www.53.com. Fifth Third’s common stock is traded on the NASDAQ®

Global Select Market under the symbol “FITB.”

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180227006684/en/

Fifth Third BancorpInvestors:Sameer Gokhale,

513-534-2219orMedia:Katrina Booker, 513-534-6858

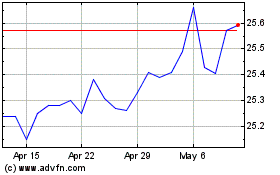

Fifth Third Bancorp (NASDAQ:FITBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

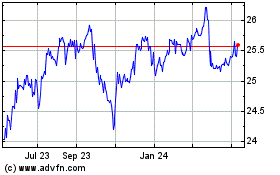

Fifth Third Bancorp (NASDAQ:FITBI)

Historical Stock Chart

From Nov 2023 to Nov 2024