FAT (Fresh. Authentic. Tasty.) Brands Inc. (NASDAQ: FAT) (“FAT

Brands” or the “Company”) today reported financial results for the

fiscal third quarter ended September 24, 2023.

Andy Wiederhorn, Chairman of FAT Brands,

commented, “With the acquisition of Smokey Bones early in the

fourth quarter, we have grown the FAT Brands portfolio to 18 iconic

restaurant brands with annualized system wide sales of $2.4

billion. Year to date through the third quarter, we have opened 96

restaurants, including 30 that opened in the third quarter, and are

on track to open 150 new restaurants in 2023. We are seeing strong

franchisee interest in development opportunities, having signed

over 200 development agreements in 2023, bringing our total

pipeline to over 1,100 units. This represents the potential for

over 50% EBITDA growth over the next several years.”

Rob Rosen, Co-Chief Executive Officer of FAT

Brands, commented, “While franchise interest remains high across

all of our brands, we continue to be focused on the expansion of

Twin Peaks. This year, we plan to open 15 to 17 new lodges, of

which 11 have been opened so far. We expect to end the year with

over 110 lodges, a 35% increase since acquiring the brand in 2021.

Our growth pipeline includes over 125 lodges and Smokey Bones’

healthy real estate portfolio provides us with the opportunity to

convert over 40 locations into Twin Peaks lodges, with the

potential to significantly accelerate the growth of the brand.”

Ken Kuick, Co-Chief Executive Officer of FAT

Brands, commented, “We believe there are significant opportunities

on the horizon for FAT Brands. Our seasoned leadership team and

strong brand management platform allow us to efficiently integrate

new brands while maintaining a healthy and evolving pipeline for

organic growth. These strengths position us for continued growth in

the future, which will help deleverage our balance sheet.”

Fiscal Third

Quarter 2023

Highlights

• Total revenue improved 6.0% to $109.4 million

compared to $103.2 million in the fiscal third quarter of 2022

◦ System-wide sales

growth of 0.8% in the fiscal third quarter of 2023 compared to the

prior year fiscal quarter◦ Year-to-date system-wide same-store

sales growth of 1.3% in the fiscal third quarter of 2023 compared

to the prior year◦ 30 new store openings during the fiscal third

quarter of 2023

• Net loss of $24.7 million, or $1.59 per

diluted share, compared to $23.4 million, or $1.52 per diluted

share, in the fiscal third quarter of 2022• Adjusted EBITDA(1) of

$21.9 million compared to $24.6 million in the fiscal third quarter

of 2022• Adjusted net loss(1) of $17.1 million, or $1.14 per

diluted share, compared to adjusted net loss of $16.3 million, or

$1.08 per diluted share, in the fiscal third quarter of 2022

(1) EBITDA, Adjusted EBITDA and adjusted

net loss are non-GAAP measures defined below, under “Non-GAAP

Measures”. Reconciliation of GAAP net loss to EBITDA, adjusted

EBITDA and adjusted net loss are included in the accompanying

financial tables.

Summary of Fiscal

Third Quarter

2023 Financial Results

Total revenue increased $6.2 million, or 6.0%,

in the third quarter of 2023 to $109.4 million compared to $103.2

million in the same period of 2022, driven by a 4.8% increase in

royalties, a 2.0% increase in company-owned restaurant revenues, a

228.5% increase in franchise fees and an 18.9% increase in revenues

from our manufacturing facility.

Costs and expenses consist of general and

administrative expense, cost of restaurant and factory revenues,

depreciation and amortization, refranchising net loss and

advertising fees. Costs and expenses remained largely unchanged in

the third quarter, increasing 0.5% in the third quarter of 2023

compared to the same period in the prior year.

General and administrative expense decreased

$4.3 million, or 14.9%, in the third quarter of 2023 compared to

the same period in the prior year, primarily due to the recognition

of $1.0 million related to Employee Retention Credits during the

third quarter of 2023 and lower professional fees related to

certain litigation matters.

Cost of restaurant and factory revenues

increased $3.9 million, or 7.1%, in the third quarter of 2023

compared to the same period in the prior year, primarily due to

Employee Retention Credits recognized during the third quarter of

2022 and higher company-owned restaurant and dough factory

revenues.

Depreciation and amortization increased $0.1

million, or 2.1% in the third quarter of 2023 compared to the same

period in the prior year, primarily due to depreciation of new

property and equipment at company-owned restaurant locations.

Advertising expenses in the third quarter of

2023 increased $0.5 million compared to the prior year period.

These expenses vary in relation to advertising revenues.

Total other expense, net, for the third quarter

of 2023 and 2022 was $32.6 million and $23.9 million, respectively,

which is inclusive of interest expense of $29.7 million and $24.5

million, respectively. Total other expense, net for the third

quarter of 2023 also included a $2.7 million net loss on

extinguishment of debt.

Adjusted net loss(1) of $17.1 million, or $1.14

per diluted share, compared to adjusted net loss of $16.3 million,

or $1.08 per diluted share, in the fiscal third quarter of

2022.

Key Financial Definitions

New store openings - The number of new store

openings reflects the number of stores opened during a particular

reporting period. The total number of new stores per reporting

period and the timing of stores openings has, and will continue to

have, an impact on our results.

Same-store sales growth - Same-store sales

growth reflects the change in year-over-year sales for the

comparable store base, which we define as the number of stores open

and in the FAT Brands system for at least one full fiscal year. For

stores that were temporarily closed, sales in the current and prior

period are adjusted accordingly. Given our focused marketing

efforts and public excitement surrounding each opening, new stores

often experience an initial start-up period with considerably

higher than average sales volumes, which subsequently decrease to

stabilized levels after three to six months. Additionally, when we

acquire a brand, it may take several months to integrate fully each

location of said brand into the FAT Brands platform. Thus, we do

not include stores in the comparable base until they have been open

and in the FAT Brands system for at least one full fiscal year.

System-wide sales growth - System wide sales

growth reflects the percentage change in sales in any given fiscal

period compared to the prior fiscal period for all stores in that

brand only when the brand is owned by FAT Brands. Because of

acquisitions, new store openings and store closures, the stores

open throughout both fiscal periods being compared may be different

from period to period.

Conference Call and Webcast

FAT Brands will host a conference call and

webcast to discuss its fiscal third quarter 2023 financial results

today at 4:30 PM ET. Hosting the conference call and webcast will

be Andy Wiederhorn, Chairman of the Board, and Ken Kuick, Co-Chief

Executive Officer and Chief Financial Officer.

The conference call can be accessed live over

the phone by dialing 1-844-826-3035 from the U.S. or 1-412-317-5195

internationally. A replay will be available after the call until

Thursday, November 16, 2023, and can be accessed by dialing

1-844-512-2921 from the U.S. or 1-412-317-6671 internationally. The

passcode is 10183290. The webcast will be available at

www.fatbrands.com under the “Investors” section and will be

archived on the site shortly after the call has concluded.

About FAT (Fresh. Authentic. Tasty.)

Brands

FAT Brands (NASDAQ: FAT) is a leading global

franchising company that strategically acquires, markets, and

develops fast casual, quick-service, casual dining, and polished

casual dining concepts around the world. The Company currently owns

18 restaurant brands: Round Table Pizza, Fatburger, Marble Slab

Creamery, Johnny Rockets, Fazoli’s, Twin Peaks, Smokey Bones, Great

American Cookies, Hot Dog on a Stick, Buffalo’s Cafe & Express,

Hurricane Grill & Wings, Pretzelmaker, Elevation Burger, Native

Grill & Wings, Yalla Mediterranean and Ponderosa and Bonanza

Steakhouses and franchises and owns approximately 2,300 units

worldwide. For more information, please visit

www.fatbrands.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements relating to the future

financial and operating results of the Company, estimates of future

EBITDA, the timing and performance of new store openings, future

reductions in cost of capital and leverage ratio, our ability to

conduct future accretive acquisitions and our pipeline of new store

locations. Forward-looking statements generally use words such as

“expect,” “foresee,” “anticipate,” “believe,” “project,” “should,”

“estimate,” “will,” “plans,” “forecast,” and similar expressions,

and reflect our expectations concerning the future. Forward-looking

statements are subject to significant business, economic and

competitive risks, uncertainties and contingencies, many of which

are difficult to predict and beyond our control, which could cause

our actual results to differ materially from the results expressed

or implied in such forward-looking statements. We refer you to the

documents that we file from time to time with the Securities and

Exchange Commission, such as our reports on Form 10-K, Form 10-Q

and Form 8-K, for a discussion of these and other risks and

uncertainties that could cause our actual results to differ

materially from our current expectations and from the

forward-looking statements contained in this press release. We

undertake no obligation to update any forward-looking statements to

reflect events or circumstances occurring after the date of this

press release.

Non-GAAP Measures

(Unaudited)

This press release includes the non-GAAP

financial measures of EBITDA, adjusted EBITDA and adjusted net

loss.

EBITDA is defined as earnings before interest,

taxes, and depreciation and amortization. We use the term EBITDA,

as opposed to income from operations, as it is widely used by

analysts, investors, and other interested parties to evaluate

companies in our industry. We believe that EBITDA is an appropriate

measure of operating performance because it eliminates the impact

of expenses that do not relate to business performance. EBITDA is

not a measure of our financial performance or liquidity that is

determined in accordance with generally accepted accounting

principles (“GAAP”), and should not be considered as an alternative

to net loss as a measure of financial performance or cash flows

from operations as measures of liquidity, or any other performance

measure derived in accordance with GAAP.

Adjusted EBITDA is defined as EBITDA (as defined

above), excluding expenses related to acquisitions, refranchising

loss, impairment charges, and certain non-recurring or non-cash

items that the Company does not believe directly reflect its core

operations and may not be indicative of the Company’s recurring

business operations.

Adjusted net loss is a supplemental measure of

financial performance that is not required by or presented in

accordance with GAAP. Adjusted net loss is defined as net loss plus

the impact of adjustments and the tax effects of such adjustments.

Adjusted net loss is presented because we believe it helps convey

supplemental information to investors regarding our performance,

excluding the impact of special items that affect the comparability

of results in past quarters to expected results in future quarters.

Adjusted net loss as presented may not be comparable to other

similarly titled measures of other companies, and our presentation

of adjusted net loss should not be construed as an inference that

our future results will be unaffected by excluded or unusual items.

Our management uses this non-GAAP financial measure to analyze

changes in our underlying business from quarter to quarter based on

comparable financial results.

Reconciliations of net loss presented in

accordance with GAAP to EBITDA, adjusted EBITDA and adjusted net

loss are set forth in the tables below.

Investor Relations:

ICRMichelle

Michalskiir-fatbrands@icrinc.com646-277-1224

Media Relations:Ali Lloyd

alloyd@fatbrands.com435-760-6168

FAT Brands Inc. Consolidated Statements of

Operations

| |

|

Thirteen Weeks Ended |

|

|

Thirty-Nine Weeks Ended |

|

| (In thousands) |

|

September 24, 2023 |

|

|

September 25, 2022 |

|

|

September 24, 2023 |

|

|

September 25, 2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties |

|

$ |

23,930 |

|

|

$ |

22,833 |

|

|

$ |

69,166 |

|

|

$ |

65,396 |

|

|

Restaurant sales |

|

|

62,578 |

|

|

|

61,352 |

|

|

|

187,957 |

|

|

|

179,473 |

|

|

Advertising fees |

|

|

9,960 |

|

|

|

9,479 |

|

|

|

28,979 |

|

|

|

28,408 |

|

|

Factory revenues |

|

|

9,323 |

|

|

|

7,839 |

|

|

|

28,174 |

|

|

|

24,588 |

|

|

Franchise fees |

|

|

2,477 |

|

|

|

754 |

|

|

|

4,042 |

|

|

|

2,763 |

|

|

Other revenue |

|

|

1,098 |

|

|

|

965 |

|

|

|

3,503 |

|

|

|

2,782 |

|

|

Total revenue |

|

|

109,366 |

|

|

|

103,222 |

|

|

|

321,821 |

|

|

|

303,410 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expense |

|

|

24,458 |

|

|

|

28,751 |

|

|

|

62,820 |

|

|

|

74,188 |

|

|

Cost of restaurant and factory revenues |

|

|

59,168 |

|

|

|

55,257 |

|

|

|

177,757 |

|

|

|

159,901 |

|

|

Depreciation and amortization |

|

|

7,040 |

|

|

|

6,895 |

|

|

|

21,217 |

|

|

|

20,076 |

|

|

Refranchising loss |

|

|

408 |

|

|

|

122 |

|

|

|

746 |

|

|

|

1,123 |

|

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

383 |

|

|

Advertising fees |

|

|

11,671 |

|

|

|

11,185 |

|

|

|

33,808 |

|

|

|

33,038 |

|

|

Total costs and expenses |

|

|

102,745 |

|

|

|

102,210 |

|

|

|

296,348 |

|

|

|

288,709 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

6,621 |

|

|

|

1,012 |

|

|

|

25,473 |

|

|

|

14,701 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expense) income,

net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(25,319 |

) |

|

|

(19,504 |

) |

|

|

(70,417 |

) |

|

|

(57,530 |

) |

|

Interest expense related to preferred shares |

|

|

(4,417 |

) |

|

|

(4,967 |

) |

|

|

(13,771 |

) |

|

|

(11,681 |

) |

|

Net loss on extinguishment of debt |

|

|

(2,723 |

) |

|

|

— |

|

|

|

(2,723 |

) |

|

|

— |

|

|

Other (expense) income, net |

|

|

(128 |

) |

|

|

538 |

|

|

|

137 |

|

|

|

3,919 |

|

|

Total other expense, net |

|

|

(32,587 |

) |

|

|

(23,933 |

) |

|

|

(86,774 |

) |

|

|

(65,292 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax

(benefit) provision |

|

|

(25,966 |

) |

|

|

(22,921 |

) |

|

|

(61,301 |

) |

|

|

(50,591 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax (benefit)

provision |

|

|

(1,310 |

) |

|

|

516 |

|

|

|

2,572 |

|

|

|

4,789 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(24,656 |

) |

|

$ |

(23,437 |

) |

|

$ |

(63,873 |

) |

|

$ |

(55,380 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(24,656 |

) |

|

$ |

(23,437 |

) |

|

$ |

(63,873 |

) |

|

$ |

(55,380 |

) |

| Dividends on preferred

shares |

|

|

(1,794 |

) |

|

|

(1,661 |

) |

|

|

(5,175 |

) |

|

|

(4,975 |

) |

| |

|

$ |

(26,450 |

) |

|

$ |

(25,098 |

) |

|

$ |

(69,048 |

) |

|

$ |

(60,355 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per

common share |

|

$ |

(1.59 |

) |

|

$ |

(1.52 |

) |

|

$ |

(4.17 |

) |

|

$ |

(3.67 |

) |

| Basic and diluted weighted

average shares outstanding |

|

|

16,613,840 |

|

|

|

16,528,327 |

|

|

|

16,553,528 |

|

|

|

16,441,555 |

|

| Cash dividends declared per

common share |

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.42 |

|

|

$ |

0.40 |

|

FAT Brands Inc. Consolidated EBITDA and Adjusted EBITDA

Reconciliation

| |

|

Thirteen Weeks Ended |

|

|

Thirty-Nine Weeks Ended |

|

| (In thousands) |

|

September 24, 2023 |

|

|

September 25, 2022 |

|

|

September 24, 2023 |

|

|

September 25, 2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(24,656 |

) |

|

$ |

(23,437 |

) |

|

$ |

(63,873 |

) |

|

$ |

(55,380 |

) |

|

Interest expense, net |

|

|

29,736 |

|

|

|

24,471 |

|

|

|

84,188 |

|

|

|

69,211 |

|

|

Income tax (benefit) provision |

|

|

(1,310 |

) |

|

|

516 |

|

|

|

2,572 |

|

|

|

4,789 |

|

|

Depreciation and amortization |

|

|

7,040 |

|

|

|

6,895 |

|

|

|

21,217 |

|

|

|

20,076 |

|

| EBITDA |

|

|

10,810 |

|

|

|

8,445 |

|

|

|

44,104 |

|

|

|

38,696 |

|

|

Bad debt (recovery) expense |

|

|

(630 |

) |

|

|

5,520 |

|

|

|

(12,701 |

) |

|

|

5,943 |

|

|

Share-based compensation expenses |

|

|

1,096 |

|

|

|

2,035 |

|

|

|

2,668 |

|

|

|

6,081 |

|

|

Non-cash lease expenses |

|

|

558 |

|

|

|

929 |

|

|

|

1,232 |

|

|

|

1,670 |

|

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

383 |

|

|

Refranchising loss |

|

|

408 |

|

|

|

122 |

|

|

|

746 |

|

|

|

1,123 |

|

|

Litigation costs |

|

|

4,780 |

|

|

|

6,906 |

|

|

|

19,448 |

|

|

|

14,170 |

|

|

Severance |

|

|

— |

|

|

|

— |

|

|

|

1,036 |

|

|

|

526 |

|

|

Net loss (gain) related to advertising fund deficit |

|

|

1,591 |

|

|

|

(7 |

) |

|

|

4,365 |

|

|

|

3 |

|

|

Net loss on extinguishment of debt |

|

|

2,723 |

|

|

|

— |

|

|

|

2,723 |

|

|

|

— |

|

|

Pre-opening expenses |

|

|

537 |

|

|

|

602 |

|

|

|

577 |

|

|

|

602 |

|

| Adjusted EBITDA |

|

$ |

21,874 |

|

|

$ |

24,552 |

|

|

$ |

64,197 |

|

|

$ |

69,197 |

|

FAT Brands Inc. Adjusted Net

Loss Reconciliation

| |

|

Thirteen Weeks Ended |

|

|

Thirty-Nine Weeks Ended |

|

| (In thousands, except share

and per share data) |

|

September 24, 2023 |

|

|

September 25, 2022 |

|

|

September 24, 2023 |

|

|

September 25, 2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(24,656 |

) |

|

$ |

(23,437 |

) |

|

$ |

(63,873 |

) |

|

$ |

(55,380 |

) |

|

Refranchising loss |

|

|

408 |

|

|

|

122 |

|

|

|

746 |

|

|

|

1,123 |

|

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

383 |

|

|

Net loss on extinguishment of debt |

|

|

2,723 |

|

|

|

— |

|

|

|

2,723 |

|

|

|

— |

|

|

Litigation costs |

|

|

4,780 |

|

|

|

6,906 |

|

|

|

19,448 |

|

|

|

14,170 |

|

|

Severance |

|

|

— |

|

|

|

— |

|

|

|

1,036 |

|

|

|

526 |

|

|

Tax adjustments, net (1) |

|

|

(398 |

) |

|

|

158 |

|

|

|

1,365 |

|

|

|

1,534 |

|

| Adjusted net loss |

|

$ |

(17,143 |

) |

|

$ |

(16,251 |

) |

|

$ |

(38,555 |

) |

|

$ |

(37,644 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(24,656 |

) |

|

$ |

(23,437 |

) |

|

$ |

(63,873 |

) |

|

$ |

(55,380 |

) |

| Dividends on preferred

shares |

|

|

(1,794 |

) |

|

|

(1,661 |

) |

|

|

(5,175 |

) |

|

|

(4,975 |

) |

| |

|

$ |

(26,450 |

) |

|

$ |

(25,098 |

) |

|

$ |

(69,048 |

) |

|

$ |

(60,355 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net loss |

|

$ |

(17,143 |

) |

|

$ |

(16,251 |

) |

|

$ |

(38,556 |

) |

|

$ |

(37,644 |

) |

| Dividends on preferred

shares |

|

|

(1,794 |

) |

|

|

(1,661 |

) |

|

|

(5,175 |

) |

|

|

(4,975 |

) |

| |

|

$ |

(18,937 |

) |

|

$ |

(17,912 |

) |

|

$ |

(43,731 |

) |

|

$ |

(42,619 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per basic and diluted

share |

|

$ |

(1.59 |

) |

|

$ |

(1.52 |

) |

|

$ |

(4.17 |

) |

|

$ |

(3.67 |

) |

| Adjusted net loss per basic

and diluted share |

|

$ |

(1.14 |

) |

|

$ |

(1.08 |

) |

|

$ |

(2.64 |

) |

|

$ |

(2.59 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average basic and

diluted shares outstanding |

|

|

16,613,840 |

|

|

|

16,528,327 |

|

|

|

16,553,528 |

|

|

|

16,441,555 |

|

(1) Reflects the tax impact of the adjustments using the

effective tax rate for the respective periods.

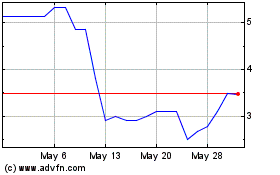

FAT Brands (NASDAQ:FATBW)

Historical Stock Chart

From Dec 2024 to Jan 2025

FAT Brands (NASDAQ:FATBW)

Historical Stock Chart

From Jan 2024 to Jan 2025