Esperion (NASDAQ: ESPR) today reported financial results for the

fourth quarter and full year ended December 31, 2021 and provided a

business update.

“In 2021, Esperion strengthened its balance

sheet and established a strong and efficient operating model that

will serve as the foundation for our next phase of growth,” said

Sheldon Koenig, President and CEO of Esperion. “We enter 2022

reinvigorated, as it will be an exciting year for Esperion as we

expect to achieve 100% MACE accumulation of our unprecedented CLEAR

Outcomes trial during the second half of the year and progress

towards a topline readout in the first quarter of 2023. With over

$300 million in capital on our balance sheet as of the end of the

year, we significantly extended our cash runway beyond the CLEAR

Outcomes topline results. As the first and only outcomes study to

focus predominantly on statin intolerant patients, CLEAR has

potential to demonstrate to physicians and payers that NEXLETOL®

improves cardiovascular outcomes in these high-risk patients,

irrespective of statins, and thus be practice changing in the

treatment of cardiovascular disease.”

2021 Key Accomplishments and Recent

Highlights

- Achieved 90% MACE Accumulation in

the CLEAR Outcomes Trial in February 2022

- Secured approximately $209 million

of net proceeds in December 2021 equity offering, extending cash

runway beyond CLEAR Outcomes top-line readout

- Announced transformative strategic

plan to optimize Esperion’s organizational structure and market

approach for better alignment with the current environment in order

to support long-term growth of NEXLETOL and NEXLIZET while

generating $80 million in annualized expense savings

- Expanded Daiichi Sankyo partnership

to additional countries across Asia, Middle East and Latin America

and continued European rollout of NILEMDO® and NUSTENDI® with

Daiichi Sankyo into UK and most recently Austria in January 2022;

over 45,000 European patients now on therapy as of December

2021

- Otsuka dosed first patient in

Japanese Phase II clinical trial of bempedoic acid; clinical trial

fully enrolled as of December 31, 2021

Fourth Quarter and Full Year 2021 Financial

Results

U.S. net product revenue was $12.2 million for

the fourth quarter of 2021 and $40.0 million for the full year

ended December 31, 2021, compared to $8.2 million and $13.0 million

for the comparable periods in 2020. Royalty revenue for the fourth

quarter 2021 was $0.8 million and $3.6 million for the full year

ended December 31, 2021, compared to $0.2 million for the

comparable periods in 2020. Total revenue for the fourth quarter of

2021 was $15.4 million and $78.4 million for the full year ended

December 31, 2021, compared to $9.6 million and $227.5 million for

the comparable periods in 2020. The decrease in total revenue for

the full year of 2021 was primarily attributable to a reduction in

one-time collaboration revenue from our partnerships.

Research and development expenses were $27.6

million for the fourth quarter of 2021 and $106.0 million for the

full year ended December 31, 2021, compared to $42.0 million and

$146.9 million for the comparable periods in 2020. The decrease in

expenses was primarily attributable to a decline in contract

research organization and compensation expense.

Selling, general and administrative expenses

were $38.3 million for the fourth quarter of 2021 and $185.0

million for the full year ended December 31, 2021, compared to

$61.6 million and $199.6 million for the comparable periods in

2020. The decrease in the fourth quarter and full year 2021 was

primarily attributable to a decrease in advertising and commercial

compensation expense.

Esperion had net losses of $65.1 million for the

fourth quarter of 2021 and $269.1 million for the full year ended

December 31, 2021, compared to net losses of $104.5 million and

$143.6 million for the comparable periods in 2020. Esperion had

basic and diluted net losses per share of $1.77 for the fourth

quarter of 2021 and $9.31 for the full year ended December 31,

2021, compared to basic and diluted net losses per share of $3.89

and $5.23, respectively for the comparable periods in 2020.

As of December 31, 2021, cash, cash equivalents,

restricted cash and investment securities available-for-sale

totaled $309.3 million compared with $305.0 million on December 31,

2020.

Esperion ended the year with approximately 60.9

million shares of common stock outstanding, after accounting for

2.0 million treasury shares to be purchased in the prepaid forward

transaction as part of the convertible debt financing.

2022 Financial Outlook

Research and Development expenses for the full

year 2022 are expected to be $100 million to $110 million. Selling,

General and Administrative expenses for the full year 2022 are

expected to be $120 million to $130 million.

Esperion expects full-year 2022 operating

expenses to be approximately $220 million to $240 million,

inclusive of $25 million of non-cash, stock-based compensation

expense.

Conference Call and Webcast

InformationEsperion will host a conference call and

webcast today, February 22, 2022, at 8:00 A.M. Eastern Time to

discuss fourth quarter and full year 2021 financial results and

provide a company update. The call can be accessed by dialing

877-831-3840 (domestic) or

253-237-1184 (international) five minutes prior to

the start of the call and providing the access code

7349619.

A live audio webcast can be accessed on the

investors and media section of the Esperion website at

investor.esperion.com. Access to the webcast replay will be

available approximately two hours after completion of the call and

will be archived on the Esperion website for approximately 90

days.

CLEAR Cardiovascular Outcomes

TrialThe effect of bempedoic acid on cardiovascular

morbidity and mortality has not been determined. Esperion initiated

a global cardiovascular outcomes trial (CVOT) to assess the effects

of bempedoic acid on the occurrence of major cardiovascular events

in patients with, or at high risk for, cardiovascular disease (CVD)

who are only able to tolerate less than the lowest approved daily

starting dose of a statin and are considered "statin averse." The

CVOT — known as CLEAR Cardiovascular Outcomes Trial — is an

event-driven, global, randomized, double-blind, placebo-controlled

study that completed enrollment in August 2019 of over 14,000

patients with hypercholesterolemia and high CVD risk at over 1,200

sites in 32 countries.

Esperion TherapeuticsEsperion

works hard to make our medicines easy to get, easy to take and easy

to have. We discover, develop, and commercialize innovative

medicines and combinations to lower cholesterol, especially for

patients whose needs aren’t being met by the status quo. Our

entrepreneurial team of industry leaders is inclusive, passionate

and resourceful. We are singularly focused on managing cholesterol

so you can improve your health easily. Esperion commercializes

NEXLETOL® (bempedoic acid) and NEXLIZET® (bempedoic acid and

ezetimibe) Tablets and is the leader in the development of

convenient oral, once-daily non-statin LDL-cholesterol lowering

drugs for patients with high levels of bad cholesterol. For more

information, please visit www.esperion.com and follow us on Twitter

at www.twitter.com/EsperionInc.

Esperion Therapeutics’ Commitment to

Patients with HyperlipidemiaHigh levels of LDL-C can lead

to a build-up of fat and cholesterol in and on artery walls (known

as atherosclerosis), potentially leading to cardiovascular events,

including heart attack and stroke. In the U.S., 96 million people,

or more than 37 percent of the adult population, have elevated

LDL-C. There are approximately 18 million people in the U.S. living

with elevated levels of LDL-C despite taking maximally tolerated

lipid-modifying therapy — including individuals considered statin

averse — leaving them at high risk for cardiovascular events1. In

the United States, more than 50 percent of atherosclerotic

cardiovascular disease (ASCVD) patients and heterozygous familial

hypercholesterolemia (HeFH) patients who are not able to reach

their guideline recommended LDL-C levels with statins alone need

less than a 40 percent reduction to reach their LDL-C threshold

goal2.

Forward-Looking StatementsThis

press release contains forward-looking statements that are made

pursuant to the safe harbor provisions of the federal securities

laws, including statements regarding marketing strategy and

commercialization plans, restructuring and current and planned

operational expenses, future operations, commercial products,

clinical development including the timing, designs and plans for

the CLEAR Outcomes study and its results, plans for potential

future product candidates, financial condition and outlook,

including expected cash runway, and other statements containing the

words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “suggest,” “target,”

“potential,” “will,” “would,” “could,” “should,” “continue,” and

similar expressions. Any express or implied statements contained in

this press release that are not statements of historical fact may

be deemed to be forward-looking statements. Forward-looking

statements involve risks and uncertainties that could cause

Esperion’s actual results to differ significantly from those

projected, including, without limitation, the impact of the ongoing

COVID-19 pandemic on our business, revenues, results of operations

and financial condition, the net sales, profitability, and growth

of Esperion’s commercial products, clinical activities and results,

supply chain, commercial development and launch plans, and the

risks detailed in Esperion’s filings with the Securities and

Exchange Commission. Any forward-looking statements contained in

this press release speak only as of the date hereof, and Esperion

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained in this press release, other

than to the extent required by law.

References(1) Esperion market research on file:

research project interviewing 350 physicians. Esperion

Therapeutics, Inc. Sept-Oct 2018.(2) Data on file: analysis of

NHANES database. Esperion Therapeutics, Inc. 2018.

Contact:Corporate CommunicationsBen Church/Kaitlyn

Broscobchurch@esperion.com / kbrosco@esperion.com

Esperion

Therapeutics, Inc.Balance Sheet

Data(In

thousands)(Unaudited)

| |

December 31,2021 |

|

December 31,2020 |

|

Cash and cash equivalents |

$ |

208,892 |

|

|

$ |

304,962 |

|

| Restricted cash |

50,000 |

|

|

— |

|

| Investments |

50,441 |

|

|

— |

|

| Working capital |

255,620 |

|

|

251,827 |

|

| Total assets |

381,590 |

|

|

353,258 |

|

| Revenue interest

liability |

257,039 |

|

|

176,604 |

|

| Convertible notes, net of

issuance costs |

258,280 |

|

|

179,367 |

|

| Common stock |

61 |

|

|

26 |

|

| Accumulated deficit |

(1,106,377 |

) |

|

(838,817 |

) |

| Total stockholders'

deficit |

(196,944 |

) |

|

(96,134 |

) |

| |

|

|

|

|

|

Esperion

Therapeutics, Inc.Statement of

Operations(In thousands, except share and per

share data)(Unaudited)

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenues: |

|

|

|

|

|

|

|

|

Product sales, net |

$ |

12,192 |

|

|

$ |

8,167 |

|

|

$ |

40,047 |

|

|

$ |

12,965 |

|

|

Collaboration revenue |

3,209 |

|

|

1,471 |

|

|

38,400 |

|

|

214,582 |

|

| Total Revenues |

15,401 |

|

|

9,638 |

|

|

78,447 |

|

|

227,547 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Cost of goods sold |

5,075 |

|

|

1,688 |

|

|

14,217 |

|

|

2,392 |

|

|

Research and development |

27,616 |

|

|

41,964 |

|

|

105,975 |

|

|

146,936 |

|

|

Selling, general and administrative |

38,338 |

|

|

61,555 |

|

|

184,985 |

|

|

199,615 |

|

| Total operating expenses |

71,029 |

|

|

105,207 |

|

|

305,177 |

|

|

348,943 |

|

| |

|

|

|

|

|

|

|

| Loss from

operations |

(55,628 |

) |

|

(95,569 |

) |

|

(226,730 |

) |

|

(121,396 |

) |

| |

|

|

|

|

|

|

|

| Interest expense |

(13,430 |

) |

|

(8,931 |

) |

|

(46,353 |

) |

|

(22,670 |

) |

| Other income, net |

3,939 |

|

|

24 |

|

|

3,975 |

|

|

515 |

|

| Net loss |

$ |

(65,119 |

) |

|

$ |

(104,476 |

) |

|

$ |

(269,108 |

) |

|

$ |

(143,551 |

) |

| |

|

|

|

|

|

|

|

| Net loss per common share –

basic and diluted |

$ |

(1.77 |

) |

|

$ |

(3.89 |

) |

|

$ |

(9.31 |

) |

|

$ |

(5.23 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average shares

outstanding – basic and diluted |

36,845,550 |

|

|

26,882,830 |

|

|

28,902,507 |

|

|

27,473,873 |

|

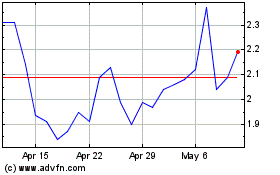

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Nov 2023 to Nov 2024