false

0000890821

0000890821

2025-01-30

2025-01-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

January

30, 2025

Date

of Report (Date of earliest event reported)

Enveric

Biosciences, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38286 |

|

95-4484725 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

Enveric

Biosciences, Inc.

4851

Tamiami Trail N, Suite 200

Naples,

FL 34103

(Address

of principal executive offices) (Zip code)

Registrant’s

telephone number, including area code: (239) 302-1707

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

ENVB |

|

The

Nasdaq Stock Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry Into a Material Definitive Agreement.

Securities

Purchase Agreement

On

January 30, 2025, Enveric Biosciences, Inc. (the “Company”) commenced a best efforts public offering (the “Offering”)

of an aggregate of (i) 1,229,330 shares (the “Shares”) of common stock, par value $0.01 per share (“Common Stock”),

of the Company, (ii) 437,336 pre-funded warrants (the “Pre-Funded Warrants”) to purchase 437,336 shares of Common Stock (the

“Pre-Funded Warrant Shares”), (iii) 1,666,666 Series A warrants (the “Series A Warrants”) to purchase 1,666,666

shares of Common Stock (the “Series A Warrant Shares”), and (iv) 1,666,666 Series B warrants (the “Series B Warrants,”

and together with the Series A Warrants, the “Warrants”) to purchase 1,666,666 shares of Common Stock (the “Series

B Warrant Shares”). Each Share or Pre-Funded Warrant was sold together with one Series A Warrant to purchase one share of Common

Stock and one Series B Warrant to purchase one share of Common Stock. The offering price for each Share and accompanying Warrants was

$3.00, and the offering price for each Pre-Funded Warrant and accompanying Warrants was $2.9999. The Pre-Funded Warrants have an exercise

price of $0.0001 per share, are exercisable immediately and will expire when exercised in full. Each Warrant has an exercise price of

$3.00 per share and will be exercisable immediately upon issuance (“Initial Exercise Date”). The Series A Warrants expire

on the five-year anniversary of the Initial Exercise Date. The Series B Warrants expire on the 18-month anniversary of the Initial Exercise

Date.

The

Offering closed on February 3, 2025. The net proceeds of the Offering, after deducting the fees and expenses of the Placement Agent (as

defined below), described in more detail below, and other offering expenses payable by the Company, but excluding the net proceeds, if

any, from the exercise of the Warrants, is approximately $4.3 million. The Company intends to use the net proceeds from the Offering

for working capital, EB-003 development, and general corporate purposes.

In

connection with the Offering, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with a

certain institutional investor. Pursuant to the Purchase Agreement, the Company agreed not to issue, enter into any agreement to issue

or announce the issuance or proposed issuance of any shares of Common Stock or any securities convertible into or exercisable or exchangeable

for shares of Common Stock or file any registration statement or prospectus, or any amendment or supplement thereto for 60 days after

the closing date of the Offering, subject to certain exceptions. In addition, the Company has agreed not to effect or enter into an agreement

to effect any issuance of Common Stock or any securities convertible into or exercisable or exchangeable for shares of Common Stock involving

a variable rate transaction (as defined in the Purchase Agreement) until the one-year anniversary of the closing date of the Offering,

subject to an exception.

The

Purchase Agreement contains customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification

obligations of the Company and the purchasers, including for liabilities arising under the Securities Act of 1933, as amended (the “Securities

Act”), other obligations of the parties and termination provisions. The representations, warranties and covenants contained in

the Purchase Agreement were made only for the purposes of such agreements and as of specific dates, were solely for the benefit of the

parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

A

holder will not have the right to exercise any portion of the Warrants or Pre-Funded Warrants if the holder (together with its affiliates)

would beneficially own in excess of 4.99% or 9.99%, as applicable, of the number of shares of Common Stock outstanding immediately after

giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants or the Pre-Funded

Warrants, respectively.

Pursuant

to an engagement agreement, as amended, (the “Engagement Agreement”) with H.C. Wainwright & Co., LLC (the “Placement

Agent”), the Company agreed to pay the Placement Agent in connection with the Offering (i) a cash fee equal to 7.0% of the aggregate

gross proceeds received in the Offering, (ii) a management fee equal to 1.0% of the aggregate gross proceeds received in the Offering,

(iii) a non-accountable expense allowance of $25,000, (iv) reimbursement of up to $100,000 for legal fees and expenses and other out

of pocket expenses and (v) up to $15,950 for the clearing expenses.

Also

pursuant to the Engagement Agreement, the Company, in connection with the Offering, agreed to issue to the Placement Agent or its designees

warrants (the “Placement Agent Warrants”) to purchase up to an aggregate of 116,666 shares of Common Stock (the “Placement

Agent Warrant Shares”) (which represents 7.0% of the Shares and Pre-Funded Warrants sold in the Offering). The Placement Agent

Warrants have an exercise price of $3.75 per share (which represents 125% of the public offering price per Share and accompanying Warrants),

expire on January 30, 2030, and are exercisable following the Initial Exercise Date.

The

Shares, the Pre-Funded Warrants, the Pre-Funded Warrant Shares, the Series A Warrants, the Series A Warrant Shares, Series B Warrants,

the Series B Warrant Shares, the Placement Agent Warrants, and the Placement Agent Warrant Shares were offered by the Company pursuant

to a Registration Statement on Form S-1 originally filed with the Securities and Exchange Commission on January 14, 2025, as amended

(including the prospectus forming a part of such Registration Statement), under the Securities Act (File No. 333-284277), and declared

effective by the SEC on January 30, 2025.

The

foregoing descriptions of the Purchase Agreement, the Pre-Funded Warrants, the Series A Warrants, the Series B Warrants, and the Placement

Agent Warrants are not complete and are qualified in their entirety by reference to the full text of the form of Purchase Agreement,

the form of Pre-Funded Warrant, the form of Series A Warrant, the form of Series B Warrant, and the form of Placement Agent Warrant,

copies of which are filed as Exhibits 10.1, 4.1, 4.2, 4.3, and 4.4, respectively, to this Current Report on Form 8-K and are incorporated

herein by reference.

Item

8.01 Other Events.

Press

Release

On

January 30, 2025, the Company issued a press release announcing the pricing of the Offering. A copy of such press release is attached

as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference herein.

On

February 3, 2025, the Company issued a press release announcing the closing of the Offering. A copy of such press release is attached

as Exhibit 99.2 to this Current Report on Form 8-K and is hereby incorporated by reference herein.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

Exhibit

Number |

|

Description |

| 4.1 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.14 of the Company’s Registration Statement on Form S-1/A, filed with the Commission on January 30, 2025) |

| 4.2 |

|

Form of Series A Warrant (incorporated by reference to Exhibit 4.15 of the Company’s Registration Statement on Form S-1/A, filed with the Commission on January 30, 2025) |

| 4.3 |

|

Form of Series B Warrant (incorporated by reference to Exhibit 4.16 of the Company’s Registration Statement on Form S-1/A, filed with the Commission on January 30, 2025) |

| 4.4 |

|

Form of Placement Agent Warrants (incorporated by reference to Exhibit 4.17 of the Company’s Registration Statement on Form S-1/A, filed with the Commission on January 30, 2025) |

| 10.1+ |

|

Form of Securities Purchase Agreement (incorporated by reference to Exhibit 10.33 of the Company’s Registration Statement on Form S-1/A, filed with the Commission on January 30, 2025) |

| 99.1 |

|

Press release, dated January 30, 2025 |

| 99.2 |

|

Press release, dated February 3, 2025 |

| 104 |

|

Cover

Page Interactive Data File (formatted as Inline XBRL) |

+

Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company undertakes to furnish supplemental

copies of any of the omitted schedules upon request by the U.S. Securities and Exchange Commission.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

February 3, 2025 |

ENVERIC

BIOSCIENCES, INC. |

| |

|

|

| |

By: |

/s/

Joseph Tucker |

| |

|

Joseph

Tucker |

| |

|

Chief

Executive Officer |

Exhibit 99.1

Enveric

Biosciences Announces Pricing of $5 Million Public Offering

CAMBRIDGE,

Mass., January 30, 2025 – Enveric Biosciences, Inc. (NASDAQ: ENVB) (“Enveric” or the “Company”), a biotechnology

company dedicated to the development of novel neuroplastogenic small-molecule therapeutics for the treatment of anxiety, depression,

and addiction disorders, today announced the pricing of a public offering of an aggregate of 1,666,666 shares of its common stock (or

common stock equivalents in lieu thereof), Series A warrants to purchase up to 1,666,666 shares of common stock and Series B warrants

to purchase up to 1,666,666 shares of common stock, at a combined public offering price of $3.00 per share (or per common stock equivalent

in lieu thereof) and accompanying warrants. The warrants will have an exercise price of $3.00 per share and will be exercisable immediately.

The Series A warrants will expire five years from the date of issuance and the Series B warrants will expire eighteen months from the

date of issuance. The closing of the offering is expected to occur on or about February 3, 2025, subject to the satisfaction of customary

closing conditions.

H.C.

Wainwright & Co. is acting as the exclusive placement agent for the offering.

The

gross proceeds from the offering, before deducting the placement agent’s fees and other offering expenses payable by the Company,

are expected to be approximately $5 million. The Company intends to use the net proceeds from this offering for product development,

working capital and general corporate purposes.

The

securities described above are being offered pursuant to a registration statement on Form S-1 (File No. 333-284277), which was declared

effective by the Securities and Exchange Commission (the “SEC”) on January 30, 2025. The offering is being made only by means

of a prospectus forming part of the effective registration statement relating to the offering. A preliminary prospectus relating to the

offering has been filed with the SEC. Electronic copies of the final prospectus, when available, may be obtained on the SEC’s website

at http://www.sec.gov and may also be obtained by contacting H.C. Wainwright & Co., LLC at 430 Park Avenue, 3rd Floor, New York,

NY 10022, by phone at (212) 856-5711 or e-mail at placements@hcwco.com.

This

press release shall not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein, nor

shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful

prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

About

Enveric Biosciences

Enveric

Biosciences (NASDAQ: ENVB) is a biotechnology company dedicated to the development of novel neuroplastogenic small-molecule therapeutics

for the treatment of depression, anxiety, and addiction disorders. Leveraging its unique discovery and development platform, the Psybrary™,

which houses proprietary information on the use and development of existing and novel molecules for specific mental health indications,

Enveric seeks to develop a robust intellectual property portfolio of novel drug candidates.. Enveric’s lead molecule, EB-003, is

a potential first-in-class neuroplastogen designed to promote neuroplasticity, without inducing hallucinations, in patients suffering

from difficult-to-address mental health disorders. Enveric is focused on advancing EB-003 towards clinical trials for the treatment of

neuropsychiatric disorders while out-licensing all other novel, patented Psybrary™ drug candidates to third-party licensees advancing

non-competitive market strategies for patient care. Enveric is headquartered in Naples, FL with offices in Cambridge, MA and Calgary,

AB Canada. For more information, please visit www.enveric.com.

Forward-Looking

Statements

This

press release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. These

statements relate to future events or future performance. All statements other than statements of historical fact may be forward-looking

statements or information. Generally, forward-looking statements and information may be identified by the use of forward-looking terminology

such as “plans,” “expects” or “does not expect,” “proposes,” “budgets,” “explores,”

“schedules,” “seeks,” “estimates,” “forecasts,” “intends,” “anticipates”

or “does not anticipate,” or “believes,” or variations of such words and phrases, or by the use of words or phrases

which state that certain actions, events or results may, could, should, would, or might occur or be achieved. Forward-looking statements

may include statements regarding beliefs, plans, expectations, or intentions regarding the future and are based on the beliefs of management

as well as assumptions made by and information currently available to management, including, but not limited to, statements regarding

the completion of the offering, the satisfaction of customary closing conditions related to the offering and the anticipated use of proceeds

therefrom. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors,

including, but not limited to, the ability of Enveric to: successfully outlicense patented Psybrary™ drug candidates to third-party

licensees; negotiate and finalize definitive agreements based on any of its out-licensing term sheets and for licensees to perform pursuant

to the terms thereof; finalize and submit its IND filing to the U.S. Food and Drug Administration; carry out successful clinical programs;

achieve the value creation contemplated by technical developments; avoid delays in planned clinical trials; establish that potential

products are efficacious or safe in preclinical or clinical trials; establish or maintain collaborations for the development of therapeutic

candidates; obtain appropriate or necessary governmental approvals to market potential products; obtain future funding for product development

and working capital on commercially reasonable terms; scale-up manufacture of product candidates; respond to changes in the size and

nature of competitors; hire and retain key executives and scientists; secure and enforce legal rights related to Enveric’s products,

including patent protection; identify and pursue alternative routes to capture value from its research and development pipeline assets;

continue as a going concern; and manage its future growth effectively.

Contacts

Investor

Relations

Tiberend

Strategic Advisors, Inc.

David

Irish

(231)

632-0002

dirish@tiberend.com

Media

Relations

Tiberend

Strategic Advisors, Inc.

Casey

McDonald

(646)

577-8520

cmcdonald@tiberend.com

Exhibit

99.2

Enveric

Biosciences Announces Closing of $5 Million Public Offering

CAMBRIDGE,

Mass., February 3, 2025 – Enveric Biosciences, Inc. (NASDAQ: ENVB) (“Enveric” or the “Company”), a biotechnology

company dedicated to the development of novel neuroplastogenic small-molecule therapeutics for the treatment of anxiety, depression,

and addiction disorders, today announced the closing of its previously announced public offering of an aggregate of 1,666,666 shares

of its common stock (or common stock equivalents in lieu thereof), Series A warrants to purchase up to 1,666,666 shares of common stock

and Series B warrants to purchase up to 1,666,666 shares of common stock, at a combined public offering price of $3.00 per share (or

per common stock equivalent in lieu thereof) and accompanying warrants. The warrants have an exercise price of $3.00 per share and are

exercisable immediately. The Series A warrants will expire five years from the date of issuance and the Series B warrants will expire

eighteen months from the date of issuance.

H.C.

Wainwright & Co. acted as the exclusive placement agent for the offering.

The

gross proceeds from the offering, before deducting the placement agent’s fees and other offering expenses payable by the Company,

were approximately $5 million. The Company intends to use the net proceeds from this offering for product development, working capital

and general corporate purposes.

The

securities described above were offered pursuant to a registration statement on Form S-1 (File No. 333-284277), which was declared effective

by the Securities and Exchange Commission (the “SEC”) on January 30, 2025. The offering was made only by means of a prospectus

forming part of the effective registration statement relating to the offering. A final prospectus relating to the offering has been filed

with the SEC. Electronic copies of the final prospectus may be obtained on the SEC’s website at http://www.sec.gov and may also

be obtained by contacting H.C. Wainwright & Co., LLC at 430 Park Avenue, 3rd Floor, New York, NY 10022, by phone at (212) 856-5711

or e-mail at placements@hcwco.com.

This

press release shall not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein, nor

shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful

prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

About

Enveric Biosciences

Enveric

Biosciences (NASDAQ: ENVB) is a biotechnology company dedicated to the development of novel neuroplastogenic small-molecule therapeutics

for the treatment of depression, anxiety, and addiction disorders. Leveraging its unique discovery and development platform, the Psybrary™,

which houses proprietary information on the use and development of existing and novel molecules for specific mental health indications,

Enveric seeks to develop a robust intellectual property portfolio of novel drug candidates. Enveric’s lead molecule, EB-003, is

a potential first-in-class neuroplastogen designed to promote neuroplasticity, without inducing hallucinations, in patients suffering

from difficult-to-address mental health disorders. Enveric is focused on advancing EB-003 towards clinical trials for the treatment of

neuropsychiatric disorders while out-licensing all other novel, patented Psybrary™ drug candidates to third-party licensees advancing

non-competitive market strategies for patient care. Enveric is headquartered in Naples, FL with offices in Cambridge, MA and Calgary,

AB Canada. For more information, please visit www.enveric.com.

Forward-Looking

Statements

This

press release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. These

statements relate to future events or future performance. All statements other than statements of historical fact may be forward-looking

statements or information. Generally, forward-looking statements and information may be identified by the use of forward-looking terminology

such as “plans,” “expects” or “does not expect,” “proposes,” “budgets,” “explores,”

“schedules,” “seeks,” “estimates,” “forecasts,” “intends,” “anticipates”

or “does not anticipate,” or “believes,” or variations of such words and phrases, or by the use of words or phrases

which state that certain actions, events or results may, could, should, would, or might occur or be achieved. Forward-looking statements

may include statements regarding beliefs, plans, expectations, or intentions regarding the future and are based on the beliefs of management

as well as assumptions made by and information currently available to management, including, but not limited to, statements regarding

the anticipated use of proceeds from the offering. Actual results could differ materially from those contemplated by the forward-looking

statements as a result of certain factors, including, but not limited to, the ability of Enveric to: successfully outlicense patented

Psybrary™ drug candidates to third-party licensees; negotiate and finalize definitive agreements based on any of its out-licensing

term sheets and for licensees to perform pursuant to the terms thereof; finalize and submit its IND filing to the U.S. Food and Drug

Administration; carry out successful clinical programs; achieve the value creation contemplated by technical developments; avoid delays

in planned clinical trials; establish that potential products are efficacious or safe in preclinical or clinical trials; establish or

maintain collaborations for the development of therapeutic candidates; obtain appropriate or necessary governmental approvals to market

potential products; obtain future funding for product development and working capital on commercially reasonable terms; scale-up manufacture

of product candidates; respond to changes in the size and nature of competitors; hire and retain key executives and scientists; secure

and enforce legal rights related to Enveric’s products, including patent protection; identify and pursue alternative routes to

capture value from its research and development pipeline assets; continue as a going concern; and manage its future growth effectively.

Contacts

Investor

Relations

Tiberend

Strategic Advisors, Inc.

David

Irish

(231)

632-0002

dirish@tiberend.com

Media

Relations

Tiberend

Strategic Advisors, Inc.

Casey

McDonald

(646)

577-8520

cmcdonald@tiberend.com

v3.25.0.1

Cover

|

Jan. 30, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 30, 2025

|

| Entity File Number |

001-38286

|

| Entity Registrant Name |

Enveric

Biosciences, Inc.

|

| Entity Central Index Key |

0000890821

|

| Entity Tax Identification Number |

95-4484725

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Enveric

Biosciences, Inc.

|

| Entity Address, Address Line Two |

4851

Tamiami Trail N

|

| Entity Address, Address Line Three |

Suite 200

|

| Entity Address, City or Town |

Naples

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

34103

|

| City Area Code |

(239)

|

| Local Phone Number |

302-1707

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.01 per share

|

| Trading Symbol |

ENVB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

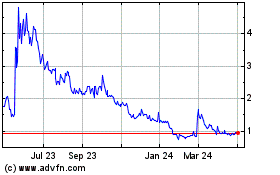

Enveric Biosciences (NASDAQ:ENVB)

Historical Stock Chart

From Jan 2025 to Feb 2025

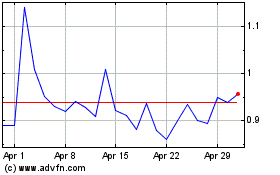

Enveric Biosciences (NASDAQ:ENVB)

Historical Stock Chart

From Feb 2024 to Feb 2025