- Announces Completion of Enrollment of RSVPEDs, a Phase 2 Study

of Zelicapavir in Pediatric Respiratory Syncytial Virus (RSV)

Patients; On Track to Report Topline Data in Q4 2024

- Announces Completion of EDP-323 Phase 2a Challenge Study in

RSV; On Track to Report Topline Data in Late Q3 2024

- Operations Supported by Cash and Marketable Securities Totaling

$272.6 Million at June 30, 2024, as well as Continuing Retained

Royalties

Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA), a clinical-stage

biotechnology company dedicated to creating small molecule drugs

for virology and immunology indications, today reported financial

results for its fiscal third quarter ended June 30, 2024.

“We are thrilled to announce that we have completed enrollment

of RSVPEDs, our first-in-pediatrics study of zelicapavir, an

N-protein inhibitor, and anticipate reporting topline data next

quarter. We thank all the patients, caregivers and investigators

involved in this important study for pediatric health,” said Jay R.

Luly, Ph.D., President and Chief Executive Officer at Enanta

Pharmaceuticals. “This is a key milestone in the ongoing

advancement of our robust clinical RSV portfolio, aimed at

addressing the significant unmet need in populations at high risk

for severe outcomes from RSV. As we advance two potentially

first-in-class oral antiviral replication inhibitors with

differentiated mechanisms of action, our potent L-protein

inhibitor, EDP-323, has completed the Phase 2a human challenge

study and we remain on track to announce topline data this

quarter.”

Fiscal Third Quarter Ended June 30, 2024 Financial

Results

Total revenue for the three months ended June 30, 2024 was $18.0

million and consisted of royalty revenue from worldwide net sales

of AbbVie’s hepatitis C virus (HCV) regimen MAVYRET®/MAVIRET®

(glecaprevir/pibrentasvir), compared to $18.9 million for the three

months ended June 30, 2023.

A portion (54.5%) of Enanta’s ongoing royalty revenue from

AbbVie’s net sales of MAVYRET®/MAVIRET® is paid to OMERS, one of

Canada’s largest defined benefit pension plans, pursuant to a

royalty sale transaction affecting royalties earned after June

2023. For financial reporting purposes, the transaction was treated

as debt, with the upfront purchase payment of $200.0 million

recorded as a liability. Each quarter, Enanta records 100% of the

royalty earned as revenue and then amortizes the debt liability

proportionally as 54.5% of the cash royalty payments are paid to

OMERS through June 30, 2032 subject to a cap of 1.42 times the

purchase payment, after which point 100% of the cash royalty

payments will be retained by Enanta. Interest expense from the

royalty sale was $2.4 million for the three months ended June 30,

2024.

Research and development expenses totaled $28.7 million for the

three months ended June 30, 2024, compared to $43.0 million for the

three months ended June 30, 2023. The decrease was primarily due to

a decrease in costs associated with Enanta’s COVID-19 program, as

the company announced previously that plans to pursue any future

COVID-19 efforts would be in the context of a collaboration. This

decrease was partially offset by increased costs associated with

Enanta’s immunology programs.

General and administrative expenses totaled $13.4 million for

the three months ended June 30, 2024, compared to $12.6 million for

the three months ended June 30, 2023. The increase was primarily

due to an increase in legal expenses related to the company’s

patent infringement lawsuit against Pfizer.

Enanta recorded income tax benefit of $0.4 million for the three

months ended June 30, 2024, due to interest earned on a pending

$28.0 million federal income tax refund, compared to an income tax

expense of $4.2 million for the three months ended June 30, 2023,

driven by the receipt of the $200.0 million from the royalty sale

agreement in April 2023 which was taxable for federal and state

purposes.

Net loss for the three months ended June 30, 2024 was $22.7

million, or a loss of $1.07 per diluted common share, compared to a

net loss of $39.1 million, or a loss of $1.86 per diluted common

share, for the corresponding period in 2023.

Enanta’s cash, cash equivalents and short-term and long-term

marketable securities totaled $272.6 million at June 30, 2024.

Enanta expects that its current cash, cash equivalents and

marketable securities and its continuing portion of cash from

future royalty revenue, should be sufficient to meet the

anticipated cash requirements of its existing business and

development programs through the third quarter of fiscal 2027.

Virology

RSV

- Enanta is progressing multiple clinical programs comprising a

robust antiviral portfolio aimed at treating populations at

high-risk for serious outcomes from RSV infection. This includes

zelicapavir, Enanta’s lead, oral N-protein inhibitor, and EDP-323,

its oral L-protein inhibitor.

- Zelicapavir is being evaluated in two Phase 2 clinical trials

in high-risk pediatric and adult populations.

- Enrollment is now complete in RSVPEDs, a first-in-pediatrics

Phase 2, randomized, double-blind, placebo-controlled study of

zelicapavir in hospitalized and non-hospitalized RSV patients that

are 28 days to three years of age. Enanta anticipates reporting

topline data in the fourth quarter of 2024.

- RSVHR is a Phase 2b, randomized, double-blind,

placebo-controlled study of zelicapavir in adults with RSV

infection who are at high risk of complications, including the

elderly and/or those with congestive heart failure, chronic

obstructive pulmonary disease or asthma. Enrollment in RSVHR is

progressing, and the company is targeting enrollment completion in

the upcoming Northern Hemisphere RSV season.

- Enanta completed its Phase 2a challenge study of EDP-323 and is

on track to announce topline data in late third quarter. This

randomized, double-blind, placebo-controlled, human challenge study

evaluated the safety, pharmacokinetics, and changes in viral load

measurements and symptoms in healthy adult subjects who were

infected with RSV.

Immunology

- Enanta continues to advance its initial immunology program

aimed at developing KIT inhibitors to treat chronic spontaneous

urticaria (CSU), a highly debilitating inflammatory skin disease

characterized by severe and recurrent hives that can last for

years. Enanta's goal is to address the significant unmet need in

CSU treatment by developing an oral KIT inhibitor therapy that

targets mast cells, which play a crucial role in the disease, and

potentially other mast cell driven diseases.

- Preclinical optimization of Enanta’s potent and selective oral

KIT inhibitors is ongoing. The company continues to evaluate

multiple compounds with the goal of nominating a best-in-class

clinical candidate in the fourth quarter of 2024.

- Enanta plans to expand its presence in immunology with the

introduction of a second program in the fourth quarter of

2024.

Corporate

- Enanta will not be holding a conference call with today’s

quarterly update. The company will provide its next update with the

release of the EDP-323 challenge study results, expected in late

third quarter of 2024.

Upcoming Events and Presentations

- H.C. Wainwright Annual Global Investment Conference, September

10, 2024

- Baird Global Healthcare Conference, September 11, 2024

- Cantor Global Healthcare Conference, September 17, 2024

- Enanta plans to issue its full year and fiscal fourth quarter

financial results press release on November 25, 2024.

About Enanta Pharmaceuticals, Inc.

Enanta is using its robust, chemistry-driven approach and drug

discovery capabilities to become a leader in the discovery and

development of small molecule drugs with an emphasis on indications

in virology and immunology. Enanta’s research and development

programs are currently focused on respiratory syncytial virus (RSV)

and chronic spontaneous urticaria (CSU) and the company has

previously advanced clinical-stage compounds for SARS-CoV-2

(COVID-19) and chronic hepatitis B virus (HBV) infection.

Glecaprevir, a protease inhibitor discovered by Enanta, is part

of one of the leading treatment regimens for curing chronic

hepatitis c virus (HCV) infection and is sold by AbbVie in numerous

countries under the tradenames MAVYRET® (U.S.) and MAVIRET®

(ex-U.S.) (glecaprevir/pibrentasvir). A portion of Enanta’s

royalties from HCV products developed under its collaboration with

AbbVie contribute ongoing funding to Enanta’s operations. Please

visit www.enanta.com for more information.

Forward Looking Statements

This press release contains forward-looking statements,

including statements with respect to the prospects for advancement

of Enanta’s clinical programs in RSV and its preclinical program in

CSU. Statements that are not historical facts are based on

management’s current expectations, estimates, forecasts and

projections about Enanta’s business and the industry in which it

operates and management’s beliefs and assumptions. The statements

contained in this release are not guarantees of future performance

and involve certain risks, uncertainties and assumptions, which are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed in such forward-looking

statements. Important factors and risks that may affect actual

results include: the impact of development, regulatory and

marketing efforts of others with respect to vaccines and

competitive treatments for RSV and CSU; the discovery and

development risks of Enanta’s programs in virology and immunology;

Enanta’s lack of clinical development experience; Enanta’s need to

attract and retain senior management and key research and

development personnel; Enanta’s need to obtain and maintain patent

protection for its product candidates and avoid potential

infringement of the intellectual property rights of others; and

other risk factors described or referred to in “Risk Factors” in

Enanta’s Form 10-K for the fiscal year ended September 30, 2023,

and any other periodic reports filed more recently with the

Securities and Exchange Commission. Enanta cautions investors not

to place undue reliance on the forward-looking statements contained

in this release. These statements speak only as of the date of this

release, and Enanta undertakes no obligation to update or revise

these statements, except as may be required by law.

ENANTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED (in thousands, except per share

amounts)

Three Months Ended Nine Months Ended June 30,

June 30,

2024

2023

2024

2023

Revenue

$

17,971

$

18,892

$

53,028

$

60,272

Operating expenses Research and development

28,742

42,987

100,698

127,357

General and administrative

13,414

12,618

44,167

39,092

Total operating expenses

42,156

55,605

144,865

166,449

Loss from operations

(24,185

)

(36,713

)

(91,837

)

(106,177

)

Interest expense

(2,355

)

(1,997

)

(8,359

)

(1,997

)

Interest and investment income, net

3,487

3,866

11,594

6,696

Loss before income taxes

(23,053

)

(34,844

)

(88,602

)

(101,478

)

Income tax benefit (expense)

395

(4,221

)

1,380

(4,231

)

Net loss

$

(22,658

)

$

(39,065

)

$

(87,222

)

$

(105,709

)

Net loss per share Basic

$

(1.07

)

$

(1.86

)

$

(4.12

)

$

(5.05

)

Diluted

$

(1.07

)

$

(1.86

)

$

(4.12

)

$

(5.05

)

Weighted average common shares outstanding Basic

21,180

21,054

21,145

20,939

Diluted

21,180

21,054

21,145

20,939

ENANTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS UNAUDITED

(in thousands)

June 30, September 30,

2024

2023

Assets Current assets Cash and cash equivalents

$

35,775

$

85,388

Short-term marketable securities

194,310

284,522

Accounts receivable

8,176

8,614

Prepaid expenses and other current assets

15,260

13,263

Income tax receivable

32,455

31,004

Short-term restricted cash

608

—

Total current assets

286,584

422,791

Long-term marketable securities

42,510

—

Property and equipment, net

25,051

11,919

Operating lease, right-of-use assets

41,211

22,794

Long-term restricted cash

3,360

3,968

Other long-term assets

105

803

Total assets

$

398,821

$

462,275

Liabilities and Stockholders' Equity Current liabilities Accounts

payable

$

10,675

$

4,097

Accrued expenses and other current liabilities

12,830

18,339

Liability related to the sale of future royalties

32,295

35,076

Operating lease liabilities

2,431

5,275

Total current liabilities

58,231

62,787

Liability related to the sale of future royalties, net of current

portion

141,889

159,429

Operating lease liabilities, net of current portion

48,136

21,238

Series 1 nonconvertible preferred stock

1,423

1,423

Other long-term liabilities

227

663

Total liabilities

249,906

245,540

Total stockholders' equity

148,915

216,735

Total liabilities and stockholders' equity

$

398,821

$

462,275

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240805540412/en/

Media and Investors: Jennifer Viera jviera@enanta.com

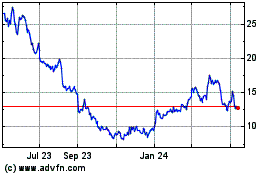

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

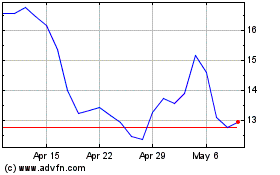

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Nov 2023 to Nov 2024