Inside the New Emerging Market Consumer Growth ETF - ETF News And Commentary

October 03 2013 - 8:03AM

Zacks

WisdomTree, an ETF sponsor, added a new member to its fund family

in the emerging market space. The latest entrant –

WisdomTree Emerging Markets Consumer Growth Fund

(EMCG) – will trade on the NASDAQ Stock Market.

This might raise a few eyebrows since emerging markets have been

hit hard this year by domestic capacity constraints and falling

currencies. But these under-valued markets can turn out as good

bets over the long term, and especially so in the consumer

space.

WisdomTree certainly seems to believe that there is plenty of

pent-up demand in this highly promising, but currently beaten down,

corner of the ETF world. Earlier this year, the asset management

company filed for 3 Emerging Market ETFs, suggesting that EMCG may

just be the beginning of the trend (read: WisdomTree Files for 3

Emerging Market ETFs).

EMCG in Focus

This new ETF looks to track the WisdomTree Emerging Markets

Consumer Growth Index, which is designed to measure the performance

of 250 stocks of the consumer sector and non-consumer sectors based

on their combined ranking of growth, quality and valuation factors.

The fund seeks to ride on the consumption growth in emerging

territories (also read 3 Overlooked Emerging Market ETFs).

The securities are picked on the basis of earnings power. The index

reflects considerable amount of diversification. At annual index

rebalancing date, a single stock cap will be 5%, a country cap will

be 25%, 60% allocation will be to specific consumer sectors and 40%

allocation to other sectors.

The fund is a mix of consumer staples and discretionary stocks and

will charge 63 basis points a year in expenses. While the product

is governed by emerging markets with at least 60% focus, the U.S.,

Europe or Japan will have some exposure, but definitely not more

than 25%.

How might it fit in a portfolio?

This ETF could be an interesting option for an emerging market

play. Although emerging market ETFs have been lagging their

developed counterparts this year and have been among the worst

performing products, growth rates of these markets are still quite

high when compared to many of the developed nations.

As per Euromonitor, emerging markets are expected to grow 5.5% in

real GDP in 2013, more than twice the rate of developed markets.

Also, the latest projection by IMF for developing nations’ growth

is 6.2% by 2018 while for developed nations the same is as low as

2.5% (see all the broad Emerging Market ETFs here).

Notably, since 2010, 70% of growth in emerging markets came from

consumer sector, as per WisdomTree Research. This segment also

experienced very low volatility in the last few years.

Further, risks appear limited thanks to the favorable demographic

trend. Overall, population growth is much higher in emerging

countries than developed nations with younger population commanding

the market.

On average, over 50% of the population is under 30. Also, the rate

of urbanization is remarkably high – 10 times the developed

economies, according to Euromonitor.

The burgeoning middle income population and increasing disposable

income in emerging countries has enabled the residents to consume

in greater numbers which in turn forced several foreign brands to

shift their focus onto those nations.

The whole picture indicates that the underlying consumption growth

story remains intact and promising for emerging markets despite

some infrastructural bottlenecks at the current level (read Access

the $30 trillion consumer market with these ETFs).

Other Competition

There are limited choices in the emerging markets space especially

with a tilt toward broader consumer sector thereby leaving room for

new funds to accumulate considerable AUM. Among these, the biggest

competitor is likely to be the

EGShares Emerging Markets

Consumer ETF

(ECON) tracking

the Dow Jones Emerging Markets Consumer Titans 30 Index.

ECON has amassed $1.18 billion since its debut in September 2010.

ECON charges comparatively higher expenses ratio of 0.85%. The fund

holds 30 securities in the basket with a focus on Mexican and

South African firms, each having around 19% share, thus entailing

higher concentration risks.

Bottom Line

Emerging nations could offer nice entry points as their valuations

are quite favorable at current levels. Pent-up demand and booming

populations will drive the emerging markets’ growth ahead.

As for EMCG, a relatively favorable expense ratio and lower

concentration risks in contrast to the peer group opens up an

option for this newly launched fund to attract investors.

Volatility could be high in the near term though, but the long term

potential does seem to be immense for this growth-oriented

product.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

EMERG-GS DJ EMC (ECON): ETF Research Reports

WISDMTR-EM CGF (EMCG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

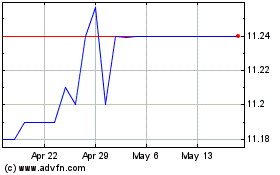

Embrace Change Acquisition (NASDAQ:EMCG)

Historical Stock Chart

From Oct 2024 to Nov 2024

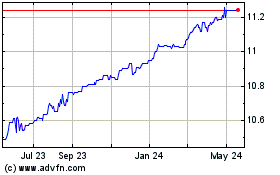

Embrace Change Acquisition (NASDAQ:EMCG)

Historical Stock Chart

From Nov 2023 to Nov 2024