Electra Announces Voting Results of its 2023 Annual Meeting of Shareholders

October 25 2023 - 5:30PM

Business Wire

Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V:

ELBM) (“Electra” or the “Company”) today announced voting

results of its 2023 annual general and special meeting of

shareholders held yesterday, October 24, in Toronto.

A total of 13,093,107 common shares in the capital of the

Company (“Common Shares”), or 23.5% of Electra’s issued and

outstanding Common Shares were represented in person or by proxy at

the meeting. Shareholders voted in favour of all items of business

put forth at the meeting, including the appointment of MNP LLP as

external auditors.

On a vote by ballot, each of the four director nominees listed

in the management circular were elected to serve until the next

annual meeting of shareholders or until their replacement is

named:

Nominee

Votes For

% of Votes For

Votes Against

% of Votes Against

Trent Mell

5,804,052

85.49%

985,356

14.51%

John Pollesel

6,241,496

91.93%

547,912

8.07%

CL “Butch” Otter

6,294,281

92.71%

495,127

7.29%

Susan Uthayakumar

6,265,519

92.28%

523,889

7.72%

2022 Amended and Restated LTIP

At the Meeting, shareholders also approved the 2022 amended and

restated LTIP (the “2022 Amended and Restated LTIP”). The

2022 Amended and Restated LTIP was last approved by shareholders on

November 10, 2022 and the LTIP Resolution does not amend the 2022

Amended and Restated LTIP, other than increasing the number of

awards issuable under the 2022 Amended and Restated LTIP from

1,416,667 Options to 3,000,000 Options; from 277,778 PSUs to

350,000 PSUs; from 250,000 RSUs to 350,000 RSUs; and from 388,888

DSUs to 400,000 DSUs, such that the maximum number of Common Shares

to be reserved for issuance under the 2022 Amended and Restated

LTIP be revised from 2,333,333 Common Shares to 4,100,000 Common

Shares.

The purpose of the 2022 Amended and Restated LTIP is to align

the interests of those directors, employees and consultants

designated by the Board as being eligible to participate in the

2022 Amended and Restated LTIP with those of the Company and its

shareholders and to assist in attracting, retaining and motivating

key employees by making a portion of the incentive compensation of

participating employees directly dependent upon the achievement of

key strategic, financial and operational objectives that are

critical to ongoing growth and increasing the long-term value of

the Company. In particular, the 2022 Amended and Restated LTIP is

designed to allow the Board to grant awards to promote the

long-term success of the Company and the creation of shareholder

value by: (a) encouraging the attraction and retention of

directors, key employees and consultants of the Company and its

subsidiaries; (b) encouraging such directors, key employees and

consultants to focus on critical long-term objectives; and (c)

promoting greater alignment of the interests of such directors, key

employees and consultants with the interests of the Company.

Historically, the Company has made use of long-term incentive

grants as an alternative to cash bonuses and salary increases as a

means of conserving capital, rewarding performance, retaining

personnel and aligning behaviour with shareholder interests.

ESP Plan

Shareholders also approved a new Employee Share Purchase Plan

for the Company (the “ESP Plan”). The ESP Plan provides

eligible employees of the Company and certain of the Company’s

designated affiliates, who wish to participate in the ESP Plan

(each, an “ESP Plan Participant”), with a cost-efficient vehicle to

acquire Common Shares and participate in the equity of the Company

through payroll deductions, for: (i) advancing the interests of the

Company through the motivation, attraction and retention of

employees and officers of the Company and its designated affiliates

in a competitive labour market; and (ii) aligning the interests of

the employees of the Company with those of the shareholders through

a culture of ownership and involvement. A maximum of 1,000,000

Common Shares are reserved for issuance under the ESP Plan,

provided, however, that the number of Common Shares reserved for

issuance under the ESP Plan and under all other security-based

compensation arrangements of the Company and its subsidiaries

shall, in the aggregate, not exceed 20% of the number of Common

Shares then issued and outstanding.

The 2022 Amended and Restated LTIP and ESP Plan were

conditionally approved by the TSX Venture Exchange (the

“TSXV”) on September 8, 2023 and remain subject to final

acceptance of the TSXV.

The Company’s full voting results at the meeting are available

on SEDAR+ at www.sedarplus.ca.

Acquisition of Easement

The Company is also pleased to announce that it has obtained an

easement (the “Easement”) on lands adjacent to the Company’s

refinery facility, located north of Toronto (the

“Refinery”), for the purpose of installing, operating and

maintaining certain electrical works servicing water pumping

facilities located on the Refinery in exchange for a total of

10,000 Common Shares at a deemed issue price of $0.74 per Common

Share, representing an aggregate purchase price of $7,400 based on

Electra’s closing price of October 24, 2023.

The Common Shares issued to obtain the Easement will be subject

to a four-month hold from the date of issue.

The acquisition of the Easement is an arm’s length transaction

for the purposes of the policies of the TSX Venture Exchange (the

“TSXV”), and no finder’s fees are payable in connection

therewith. The acquisition was completed as an “Expedited

Acquisition” under TSXV Policy 5.3 – Acquisitions and Dispositions

of Non-Cash Assets, and remains subject to the TSXV’s final

acceptance.

About Electra Battery Materials

Electra is a processor of low-carbon, ethically-sourced battery

materials. Currently constructing North America’s only cobalt

sulfate refinery, Electra is executing a multipronged strategy

focused on onshoring the electric vehicle supply chain. Keys to its

strategy are integrating black mass recycling and nickel sulfate

production at Electra’s Refinery located north of Toronto,

advancing Iron Creek, its cobalt-copper exploration-stage project

in the Idaho Cobalt Belt, and expanding cobalt sulfate processing

into Bécancour, Quebec. For more information visit

www.ElectraBMC.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231025403018/en/

Joe Racanelli Vice President, Investor Relations

info@ElectraBMC.com 1.416.900.3891

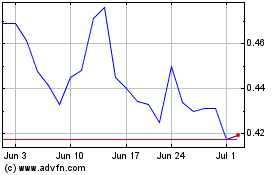

Electra Battery Materials (NASDAQ:ELBM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Electra Battery Materials (NASDAQ:ELBM)

Historical Stock Chart

From Nov 2023 to Nov 2024