UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange

Act of 1934

(Amendment

No.)

Filed by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

☐

|

Preliminary

Proxy Statement

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14(a)-6(e)

(2))

|

|

☒

|

Definitive

Proxy Statement

|

|

☐

|

Definitive

Additional Materials

|

|

☐

|

Soliciting

Material under Rule 14a-12

|

The Eastern Company

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No fee

required

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0- 11(Set forth the amount on

which the filing fee is calculated and state how it was

determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No. :

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

THE

EASTERN COMPANY

112 Bridge Street

P.O. Box 460

Naugatuck, CT 06770-0460

______________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 28, 2021

______________

The

Annual Meeting of Shareholders of The Eastern Company

(“Eastern” or the “Company”) will be held

on April 28, 2021 at 11:00 a.m., Eastern Time. In light of public

health concerns regarding the coronavirus outbreak, the Annual

Meeting will be held in a virtual meeting format only. You will not

be able to attend the Annual Meeting in person, but you will have

the same opportunities to participate in the virtual meeting format

as you would at an in-person meeting.

The

Annual Meeting of Shareholders of the Company will be held for the

following purposes:

1.

To elect seven

directors.

2.

To cast a

nonbinding advisory vote to approve the compensation of the named

executive officers.

3.

To ratify the Audit

Committee’s recommendation and the Board of Directors’

appointment of Fiondella, Milone & LaSaracina LLP as the

independent registered public accounting firm to audit the

consolidated financial statements of the Company and its

subsidiaries for fiscal year 2021.

4.

To transact such

other business as may properly come before the Annual Meeting of

Shareholders or any adjournment thereof.

The

Board of Directors has fixed March 1, 2021 as the record date for

the determination of shareholders entitled to notice of, and to

vote at, the Annual Meeting or any adjournment

thereof.

You can

access the Annual Meeting at https://agm.issuerdirect.com/eml.

Shareholders of record and beneficial holders as of the close of

business on March 1, 2021 may ask questions and vote their shares

during the Annual Meeting. If you were a shareholder of record as

of the close of business on March 1, 2021, to vote your shares

during the Annual Meeting or submit questions during the Annual

Meeting, you must log into the Annual Meeting using the control

number found on your proxy card, voting instruction form or notice

you previously received. Shareholders of record may vote during the

Annual Meeting by following the instructions available on the

meeting website during the Annual Meeting.

If you

were a beneficial owner as of the close of business on March 1,

2021 of shares held in “street name” through a broker,

bank or other nominee and you wish to vote your shares during the

Annual Meeting or submit questions during the Annual Meeting, you

will need to provide proof of your authority to vote (a legal

proxy), which you must obtain from such nominee reflecting your

holdings. You may forward an e-mail from your nominee or attach an

image of your legal proxy and transmit it via e-mail to Issuer

Direct at

proxy@issuerdirect.com, and you should

label the e-mail “Legal Proxy” in the subject line.

Requests for registration must be received by Issuer Direct no

later than 12:00 a.m., Eastern Time, on April 25, 2021. You will

then receive confirmation of your registration, with a control

number by e-mail from Issuer Direct. At the time of the Annual

Meeting, go to

https://agm.issuerdirect.com/eml and enter the first

13 digits of your control number.

If you

do not have a control number, you may attend the Annual Meeting as

a guest, but you will not have the option to vote your

shares.

Your

vote is very important. Whether or not you plan to attend the

virtual Annual Meeting of Shareholders or any adjournment thereof,

we urge you to submit your proxy as promptly as possible. If you

attend the virtual Annual Meeting and vote at the Annual Meeting

before your proxy is exercised, your proxy will be deemed revoked

and will not be used.

All

shareholders are cordially invited to attend the virtual Annual

Meeting of Shareholders or any adjournment thereof, and management

looks forward to having you there.

|

|

By

order of the Board of Directors,

Theresa

P. Dews

Secretary

|

|

March 16,

2021

|

|

PROXY STATEMENT

of

THE EASTERN COMPANY

for the Annual Meeting of Shareholders

To Be Held on April 28, 2021

The

Board of Directors of The Eastern Company (“Eastern,”

the “Company,” “we,” “us” or

“our”) is furnishing this proxy statement in connection

with its solicitation of proxies for use at the 2021 Annual Meeting

of Shareholders and at any adjournment thereof (the “Annual

Meeting”). This proxy statement is first being furnished to

shareholders on or about March 16, 2021.

GENERAL INFORMATION REGARDING VOTING AT THE ANNUAL

MEETING

The

Board of Directors of Eastern (the “Board”) has fixed

the close of business on March 1, 2021 as the record date for

determining the shareholders entitled to notice of, and to vote at,

the Annual Meeting. On the record date, there were 6,247,981 outstanding shares of Eastern

common stock, no par value (“Common Shares”), with each

Common Share entitled to one vote.

The

presence at the Annual Meeting, or representation by proxy, of

holders of a majority of the voting power of the Common Shares

entitled to vote at the Annual Meeting is necessary to constitute a

quorum.

If you

grant a proxy to the persons named on Eastern’s proxy card,

the Common Shares represented by your proxy will be voted at the

Annual Meeting, either in accordance with the directions indicated

on the proxy card, or, if no directions are indicated, in

accordance with the recommendations of the Board contained in this

Proxy Statement and on the form of proxy card. If a proxy is signed

and returned without specifying choices, the Common Shares

represented thereby will be voted (1) “FOR ALL” on the proposal to elect:

Mr. Fredrick D. DiSanto, Mr. John W. Everets, Mr. Charles W. Henry,

Mr. Michael A. McManus, Jr., Mr. James A. Mitarotonda, Mrs. Peggy

B. Scott and Mr. August M. Vlak to the Board, each for a one-year

term and until their successors have been duly elected and

qualified; (2) FOR the

approval, on an advisory basis, of the compensation of the named

executive officers; and (3) FOR the proposal to ratify the

appointment of Fiondella, Milone & LaSaracina LLP as the

Company’s independent registered public accounting firm for

the Company’s 2021 fiscal year. The Company is not aware of

any matters other than those set forth herein which will be

presented for action at the Annual Meeting. If other matters should

be presented, the persons named in the proxy intend to vote such

proxies in accordance with their best judgment.

If you

submit a proxy and then wish to change your vote, you will need to

revoke the proxy that you have submitted. A shareholder may revoke

his or her proxy at any time before it is exercised by voting at

the Annual Meeting or by timely delivery of a properly executed,

later-dated proxy card or a written revocation of his or her proxy.

A later-dated proxy card or written revocation must be received

before the Annual Meeting by the Corporate Secretary of the

Company, at 112 Bridge Street, P.O. Box 460, Naugatuck, CT

06770-0460. You may also revoke your proxy by submitting a new

proxy via the Internet at www.proxyvote.com

or by telephone, no later than 11:59 p.m. Eastern Time on April 27,

2021. Attendance at the Annual Meeting does not, without further

action, revoke the appointment of a proxy; however, your proxy may

be revoked either by giving notice of revocation or voting at the

Annual Meeting before your proxy is exercised.

The

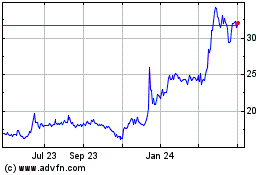

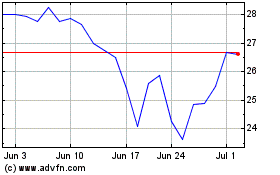

Common Shares are listed under the ticker symbol “EML”

on The NASDAQ Stock Market LLC (“NASDAQ”).

Solicitation of Proxies

The

cost of solicitation of proxies will be borne by the Company. On

approximately March 16, 2021, we mailed a Notice of Internet

Availability of Proxy Materials advising our shareholders that they

could view all of the proxy materials online or request a paper or

e-mail copy of the proxy materials. This online access format

expedites the delivery of materials, reduces printing and postage

costs and reduces the environmental impact of our Annual

Meeting.

How to Request a Paper or E-mail Copy of the Proxy

Materials

You may

receive a paper or e-mail copy of the proxy materials free of

charge by requesting a copy through one of the following

methods:

|

1) BY

INTERNET:

|

www.proxyvote.com

|

|

2) BY

TELEPHONE:

|

1-800-579-1639

|

|

3) BY

E-MAIL:

|

sendmaterial@proxyvote.com

|

How to Attend and Vote at the Annual Meeting

You can

access the Annual Meeting at https://agm.issuerdirect.com/eml

beginning at 10:45 a.m. Eastern Time on April 28, 2021.

Shareholders of record and beneficial holders as of the close of

business on March 1, 2021 may ask questions and vote their shares

during the Annual Meeting. If you were a shareholder of record as

of the close of business on March 1, 2021, to vote your shares

during the Annual Meeting or submit questions during the Annual

Meeting, you must log into the Annual Meeting using the control

number found on your proxy card, voting instruction form or notice

you previously received. Shareholders of record may vote during the

Annual Meeting by following the instructions available on the

meeting website during the Annual Meeting.

If you

were a beneficial owner as of the close of business on March 1,

2021 of shares held in “street name” through a broker,

bank or other nominee and you wish to vote your shares during the

Annual Meeting or submit questions during the Annual Meeting, you

will need to provide proof of your authority to vote (a legal

proxy), which you must obtain from such nominee reflecting your

holdings. You may forward an e-mail from your nominee or attach an

image of your legal proxy and transmit it via e-mail to Issuer

Direct at proxy@issuerdirect.com, and you

should label the e-mail “Legal Proxy” in the subject

line. Requests for registration must be received by Issuer Direct

no later than 12:00 a.m., Eastern Time, on April 25, 2021. You will

then receive confirmation of your registration, with a control

number by e-mail from Issuer Direct. At the time of the Annual

Meeting, go to www.issuerdirect.com/virtual-event/EML and enter the

first 13 digits of your control number.

If you

do not have a control number, you may attend the Annual Meeting as

a guest, but you will not have the option to vote your shares or

ask questions.

Online

access to the meeting will open 15 minutes prior to the start of

the meeting to allow time for participants to login and testing of

device audio systems. We encourage participants to access the

meeting in advance of the designated start time. After logging in,

please review the rules of conduct for the meeting posted on the

website.

Support

will be available 15 minutes prior to, and during, the meeting to

assist shareholders with any technical difficulties they may have

accessing or hearing the virtual meeting. If participants encounter

any difficulty, they should call the support team at the numbers

listed on the login screen.

Subject

to time constraints, we will answer relevant shareholder questions

during the meeting and will post the answers to all appropriate

questions received, even if not addressed at the meeting due to

time constraints, at www.easterncompany.com as soon as practicable

following the meeting. The questions and answers will remain

available for review on such website until we file the proxy

statement for our 2022 annual meeting of shareholders.

Voting at the Annual Meeting

Except

in the case of a contested election, directors will be elected by a

majority of the votes cast by the shares entitled to vote in the

election of directors at the annual meeting of shareholders if a

quorum is present. Consequently, a nominee will be elected as a

director if the votes cast for the nominee’s election as a

director exceed the votes cast against such nominee’s

election as a director. However, in a contested election, directors

will be elected by a plurality of the votes cast at the annual

meeting of shareholders. An election will be considered to be

contested if, as of the record date for the annual meeting of

shareholders, there are more nominees for election to the Board

than there are positions on the Board to be filled by election at

the annual meeting. Because the election of directors at this

year’s Annual Meeting is not a contested election, a nominee

for election as a director at the Annual Meeting will be elected if

the votes cast for the nominee exceed the votes cast against the

nominee.

If a

director is subject to reelection in an uncontested election by a

majority of the votes cast, but a majority of the votes are cast

against his or her reelection, then the Board will request that the

director tender his or her resignation. The Board will nominate for

election or reelection as a director only those candidates who

agree to tender, promptly following the annual meeting of

shareholders at which they are elected or reelected as a director,

irrevocable resignations that will be effective upon: (a) their

failure to receive the required vote at the annual meeting of

shareholders at which they face reelection; and (b) the acceptance

of such resignation by the Board. In addition, the Board will fill

vacancies on the Board and new directorships only with candidates

who agree to tender, promptly following their appointment to the

Board, the same form of resignation tendered by other directors. If

an incumbent director fails to receive the required vote for

reelection, the Board will act on an expedited basis to determine

whether to accept or reject the director’s resignation. A

director whose resignation is under consideration must abstain from

participating in any decision regarding that

resignation.

Each

matter to be acted upon at the Annual Meeting other than the

election of directors will be approved if the votes cast in favor

of the matter exceed the votes cast opposing the matter, assuming a

quorum is present.

A

broker “non-vote” occurs when a nominee holding shares

for a beneficial owner does not vote on a particular proposal

because the nominee does not have discretionary voting power with

respect to that item and has not received instructions from the

beneficial owner. An abstaining vote or a broker

“non-vote” is considered to be present for purposes of

determining a quorum but is not deemed to be a vote cast. As a

result, abstentions and broker “non-votes” are not

included in the tabulation of the voting results for the election

of directors or the other matters to be acted on at the Annual

Meeting, each of which requires the approval of a majority of the

votes cast, and therefore do not have the effect of votes of

opposition in such tabulations.

The

Board recommends voting:

“FOR ALL” on the proposal to elect Mr. Fredrick D.

DiSanto, Mr. John W. Everets, Mr. Charles W. Henry, Mr. Michael A.

McManus, Jr., Mr. James A. Mitarotonda, Mrs. Peggy B. Scott and Mr.

August M. Vlak as directors.

FOR

the approval, on an advisory basis, of the compensation of the

named executive officers.

FOR

the ratification of the appointment of Fiondella, Milone &

LaSaracina LLP as the Company’s independent registered public

accounting firm for the 2021 fiscal year.

Item No. 1

ELECTION OF DIRECTORS

At the

Annual Meeting, seven directors will be elected to serve for

one-year terms, which expire in 2022 or when a successor is duly

elected and qualified. Mr. Fredrick D. DiSanto, Mr. John W.

Everets, Mr. Charles W. Henry, Mr. Michael A. McManus, Jr., Mr.

James A. Mitarotonda, Mrs. Peggy B. Scott and Mr. August M. Vlak

are the Company’s nominees for election at the Annual

Meeting. All nominees are current directors whose terms expire in

2021.

Unless

otherwise specified in your proxy, the persons with power of

substitution named in the proxy card will vote your Common Shares

“FOR ALL” of the

Company’s nominees. If a nominee is unable or unwilling to

accept nomination, the proxies will be voted for the election of

such other person as may be recommended by the Board. However, the

Board has no reason to believe that the Company’s nominees

will be unavailable for election at the Annual Meeting. Approval of

this resolution requires the affirmative vote of a majority of the

votes duly cast by the Common Shares represented at the Annual

Meeting that are entitled to vote on the matter.

The Board recommends a vote “FOR

ALL” on the proposal

to elect Mr. Fredrick D. DiSanto, Mr. John W. Everets, Mr. Charles

W. Henry, Mr. Michael A. McManus, Jr., Mr. James A. Mitarotonda,

Mrs. Peggy B. Scott and Mr. August M. Vlak as

directors.

Each

director has furnished the biographical information set forth below

with respect to his or her present principal occupation, business

and other affiliations. Information regarding each director’s

beneficial ownership of equity securities of the Company is

provided under “Security Ownership” in this proxy

statement. Unless otherwise indicated, each director has been

employed in the principal occupation or employment listed for at

least the past five years.

Company Nominees for Election at the 2021 Annual

Meeting

For a one-year term expiring in 2022

Fredrick D. DiSanto, age 59, is the

Chairman and Chief Executive Officer of The Ancora Group, a holding

company that oversees three investment advisors, and has served in

such capacities since 2014 and 2006, respectively. Mr. DiSanto was

the President and Chief Operating Officer of Maxus Investment Group

from 1998 until December of 2000. In 2001, after Maxus Investment

Group was sold to Fifth Third Bank, Mr. DiSanto served as Executive

Vice President and Manager of Fifth Third Bank’s Investment

Advisor Division.

Mr.

DiSanto is an experienced public company director and has knowledge

and background in finance, strategic planning, governance and

international business. He currently serves as a director for

Regional Brands, Inc. and Alithya Group Inc. and previously served

on the respective Boards of Directors of Axia Net Media Corporation

and LNB Bancorp, Inc.

Mr.

DiSanto has served as a director of the Company since 2016. Mr.

DiSanto is Chairman of the Audit Committee and also serves on the

Nominating and Corporate Governance Committee.

John W. Everets, age 74, has been a

Partner in Arcturus Capital LLC, Boston since 2016. Mr. Everets was

the Chairman and Chief Executive Officer of SBM Financial in

Portland, Maine, from May 2010 until October 2016. Mr. Everets was

also Chairman and Chief Executive Officer of The Bank of Maine from

May 2010 until October 2016. Mr. Everets’ directorships at

public companies in the past five years include Independent

Director at Medallion Bank (since 2019), Medallion Financial Corp.

(since 2017) and The Bank of Maine (2010 to 2015), which merged

into Camden National Bank. Mr. Everets also serves on the Board of

Directors of Newman’s Own Foundation. Mr. Everets is a former

director of Financial Security Assurance, FSA, Dairy Mart and The

Martin Currie Business Trust Edinburgh. From 1993 to 2004, Mr.

Everets was the Chairman and Chief Executive Officer of HPSC, which

was acquired by GE in 2004. Mr. Everets became Chief Executive

Officer of GEHPSC from 2004 until 2006.

Mr.

Everets has served as a director of the Company since 1993 and

brings to the Board extensive knowledge of the Company’s

business. Mr. Everets serves on the Audit, Compensation and

Nominating and Corporate Governance Committees.

Charles W. Henry, age 71, is an attorney

and partner with the law firm Henry & Giardina, LLP located in

Woodbury, Connecticut.

Mr.

Henry brings to the Board extensive knowledge of the

Company’s business. Mr. Henry’s independent legal

expertise is valuable to the Company if, and when, matters of law

or regulation arise in the normal course of the Company’s

business. His law firm does not provide any services to the

Company.

Mr.

Henry has served as a director of the Company since 1989. Mr. Henry

serves on the Compensation, Executive, Nominating and Corporate

Governance and the Environment, Health and Safety

Committees.

Michael A. McManus, Jr., age 78, is the

former Chairman, President and Chief Executive Officer of Misonix,

Inc., a publicly traded medical device company. Mr. McManus

previously served as President and Chief Executive Officer of New

York Bankcorp, a New York Stock Exchange company, until its sale in

1998. Earlier, he served as President of Jamcor Pharmaceuticals, as

a Vice President of strategic planning at Pfizer, and as an

executive vice president of MacAndrews and Forbes, Revlon, Inc.,

and Pantry Pride.

Mr.

McManus is an

experienced public company director and has expertise in financial

matters, sales and marketing, strategic acquisitions, government

relations and international business matters. Mr.

McManus’ public

company directorships in the past five years include director of

Novavax, Inc., a vaccine company (since 1998). He previously served

on the respective Boards of Directors of the Communications

Satellite Corporation, Arrhythmia Research Technology, Inc.,

National Wireless Holdings, American Home Mortgage, A. Schulman,

Inc. and Guest Services, Inc.

Mr.

McManus has been a director of the Company since 2015. Mr. McManus

is the Chairman of the Company’s Compensation Committee and

also serves on the Audit, Environment, Health and Safety and

Executive Committees.

James A. Mitarotonda, age 66, has served

as the Chairman of the Board, President and Chief Executive Officer

of Barington Capital Group, L.P., an investment firm, since 1991.

Mr. Mitarotonda is an experienced public company director. Over the

past five years, Mr. Mitarotonda has served as a director of The

Pep Boys – Manny, Moe & Jack from 2006 to 2016 and was

Chairman of the Board from 2008 to 2009; A. Schulman, Inc. from

2005 to 2018; OMNOVA Solutions from 2015 to 2020; and Avon

Products, Inc. from 2018 to 2020. Mr. Mitarotonda also served as a

director of Barington/Hilco Acquisition Corp. from 2015 to 2018,

where he was Chairman of the Board from 2015 to 2017; and Chief

Executive Officer for a portion of 2015. Mr. Mitarotonda serves as

a member of the Board of Trustees for Queens College.

Mr.

Mitarotonda has served as a director of the Company since 2015. The

Board appointed Mr. Mitarotonda to serve as Chairman of the Board

effective January 2016. Mr. Mitarotonda is the Chairman of the

Nominating and Corporate Governance Committee and the Executive

Committee.

Peggy B. Scott, age 69, has served as

the Chairperson of the Board of Cleco Corporate Holdings LLC

(Cleco) (NASDAQ: CNL), a public utility holding company, since

April 2016. She also served as Interim Chief Executive Officer of

Cleco from February 2017 until January 2018. Mrs. Scott serves on

the board of Gresham Smith Partners and has been a director of the

Blue Cross Blue Shield of Louisiana Foundation since 2006, and

former Chairperson and President. Her recent public company service

includes Benefytt Technologies, Inc. (NASDAQ: BFYT) until its

acquisition in 2020.

Previously,

Mrs. Scott served as the Executive Vice President, Chief Operating

Officer, Chief Financial Officer and Treasurer of Blue Cross Blue

Shield of Louisiana (BCBS) from 2005 to 2015, and as Chief Strategy

Officer from 2005-2012, overseeing growth strategies and

operational performance in challenging markets. Prior to BCBS, she

held senior executive positions in U.S. and international companies

where she led transformations, growth strategies and operations in

seven foreign countries. Earlier, Mrs. Scott was an office Managing

Partner with Deloitte, a global public accounting firm, advising

diverse companies, including manufacturers and industrial

companies.

Mrs.

Scott has served as a director of the Company since May 2019. She

is Chairperson of the Environment, Health and Safety Committee and

serves on the Audit and Compensation Committees. Mrs. Scott is a

Certified Public Accountant (CPA) and also Certified in Valuations

(ABV and CVA) and Financial Forensics (CFF). She has expertise in

strategy, finance, operations, acquisitions and international

business.

August M. Vlak, age 54, was appointed

President and Chief Executive Officer of the Company on January 1,

2016. From 2012 to 2015, Mr. Vlak served as a senior advisor to

Barington Capital Group, L.P. Prior to that, he was a partner at

Katzenbach Partners, a senior advisor at Booz & Company, and a

consultant at McKinsey & Company. At his prior positions, Mr.

Vlak’s work focused on growth strategy and operational

performance improvement at more than 50 companies, including

leading domestic and global industrial enterprises. Mr. Vlak has

served as a director since 2017.

Item No. 2

ADVISORY VOTE ON THE COMPENSATION OF THE NAMED EXECUTIVE

OFFICERS

We ask

our shareholders to cast a non-binding advisory vote to approve the

compensation of our named executive officers (each a “named

executive officer” and collectively, the “named

executive officers”) described in the Compensation Discussion

and Analysis and in the tabular and accompanying narrative

disclosure regarding named executive officer compensation. We

encourage you to read the Compensation Discussion and Analysis and

the tables and narratives beginning on page 17 for the 2020

compensation of our named executive officers.

As

required by Section 14A(a)(1) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), our shareholders

are entitled to vote at the Annual Meeting to approve the

compensation of the Company’s named executive officers, as

disclosed in this proxy statement, pursuant to Item 402 of

Regulation S-K (“Say-on-Pay Vote”). At our 2017 annual

meeting of shareholders held on May 3, 2017, an advisory vote was

held on the frequency of the Say-on-Pay Vote. In such vote, the

Company’s shareholders voted to hold an advisory vote on the

compensation of the Company’s named executive officers

annually.

We

believe that the compensation of our named executive officers for

2020 was consistent with our compensation philosophy and our

performance described in the Compensation Discussion and Analysis.

We are asking our shareholders to indicate their support for our

named executive officers’ compensation arrangements as

described in this proxy statement. The vote is not intended to

address any specific item of compensation, but rather the overall

compensation of our named executive officers described in this

proxy statement.

While

our Board values the opinions expressed by shareholders and intends

to carefully consider the result of the shareholder vote on this

proposal, the vote is an advisory vote only, and is not binding on

the Company, the Board or the Compensation Committee. In

considering the outcome of this advisory vote, the Board will

review and consider all Common Shares voted in favor of the

proposal and not in favor of the proposal. Abstentions and broker

non-votes will have no impact on the outcome of this advisory

vote.

The

Board recommends that shareholders approve the 2020 compensation of

our named executive officers as disclosed in the Compensation

Discussion and Analysis, and in the tabular and accompanying

narrative disclosure of this proxy statement by voting FOR the

following resolution:

RESOLVED, that the

2020 compensation paid to the Company’s named executive

officers, as disclosed pursuant to Item 402 of Regulation S-K,

including the Compensation Discussion and Analysis, compensation

tables and narrative discussion, is hereby APPROVED, on a

non-binding advisory basis.

The Board recommends a vote FOR the approval,

on an advisory basis, of the 2020 compensation of our named

executive officers as disclosed in this proxy statement pursuant to

Item 402 of Regulation S-K. Proxies will be voted FOR the

proposal unless otherwise specified.

Item No. 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

The

Audit Committee has recommended, and the Board has approved,

continuing the services of Fiondella, Milone & LaSaracina LLP

for the 2021 fiscal year. These services may include an integrated

audit of the consolidated financial statements and internal control

over financial reporting of the Company; assistance in connection

with filing the Company’s Annual Report on Form 10-K with the

Securities and Exchange Commission (the “SEC”); a

review of the Company’s quarterly interim financial

statements; assistance in connection with the filing of the

Company’s Quarterly Reports on Form 10-Q; assistance on

financial accounting and reporting matters; preparation of state

and federal tax returns; audits of employee benefit plans; and

meetings with the Audit Committee. The Board recommends that

shareholders vote at the Annual Meeting FOR ratification of

the Audit

Committee’s recommendation and the Board’s appointment

of Fiondella, Milone & LaSaracina LLP to audit the consolidated

financial statements of the Company for the 2021 fiscal

year.

It is

the policy of our Audit Committee to approve all audit and

acceptable non-audit engagements provided by the independent

registered public accounting firm regarding the scope of the

services provided by the independent registered public accounting

firm. These services may include audit, audit-related, tax and

other services. The independent registered public accounting firm

and management are required to report to the Audit Committee

regarding the extent of services provided by the independent

registered public accounting firm in accordance with this

policy.

The

proposal to ratify the appointment of Fiondella, Milone &

LaSaracina LLP as the Company’s independent registered public

accounting firm will be approved if, at the Annual Meeting at which

a quorum is present, the votes cast in favor of the proposal exceed

the votes cast opposing the proposal. The Audit Committee will

consider the outcome of the shareholder vote in connection with the

selection of Fiondella, Milone & LaSaracina LLP but is not

bound by the vote, if the appointment is not ratified by

shareholders, the Audit Committee will consider and advise the

Board as to whether a different registered public accounting firm

should be selected.

We have

been advised that representatives of Fiondella, Milone &

LaSaracina LLP will be present at the Annual Meeting and will be

available to respond to appropriate questions. Such representatives

will have an opportunity to make a statement, if they desire to do

so.

All

fees related to audit services described below were approved in

advance by our Audit Committee.

|

|

|

|

|

Audit Fees –

Annual & quarterly reviews

|

$437,000

|

$506,000

|

|

Audit-Related Fees

– Employee Benefit Plans

|

$52,000

|

$51,139

|

|

Tax Fees –

Federal and State Return preparation

|

$209,000

|

$144,470

|

|

All Other Fees

– Non-audit services

|

$6,000

|

$53,833

|

Audit Fees: Audit

fees paid to Fiondella,

Milone & LaSaracina LLP include fees associated with the annual

integrated audit and the reviews of the Company’s quarterly

reports on Form 10-Q for the quarters ended March 28, 2020, June

27, 2020 and October 3, 2020.

Audit-Related Fees:

Audit-related fees paid to Fiondella,

Milone & LaSaracina LLP for 2020 primarily include audits of

the employee benefit plans of the Company.

Tax Fees: Tax fees

paid to Fiondella,

Milone & LaSaracina LLP for 2020 were for preparation of the

2019 federal and state income tax returns.

All Other Fees: All

Other Fees paid to Fiondella, Milone & LaSaracina LLP for 2020

were for non-audit services.

The Board recommends a vote FOR the

ratification of the appointment of Fiondella, Milone &

LaSaracina LLP as the

Company’s independent registered public accounting firm for

the 2021 fiscal year. Proxies will be voted FOR the proposal

unless otherwise specified.

AUDIT COMMITTEE FINANCIAL EXPERT

The

Board has determined that all audit committee members are

financially literate and are independent under the current listing

standards of NASDAQ. The Board has also determined that Fredrick D.

DiSanto, John W. Everets, Michael A. McManus, Jr. and Peggy B.

Scott qualify as “audit committee financial experts” as

defined by SEC rules adopted pursuant to the Sarbanes-Oxley Act of

2002.

REPORT OF THE AUDIT COMMITTEE

The Audit

Committee oversees the Company's financial reporting process on

behalf of the Board.

Management has the

primary responsibility for the financial statements and the

reporting process, including the system of internal control. The

independent registered public accounting firm is responsible for

expressing an opinion on the conformity of those statements with

generally accepted accounting principles in the United States.

Within this framework, the Audit Committee has reviewed and

discussed the audited financial statements included in the Annual

Report on Form 10-K with the independent registered public

accounting firm and management. In connection therewith, the Audit

Committee reviewed with the independent registered public

accounting firm their judgments as to the quality and the

acceptability of the Company’s accounting principles; the

reasonableness of significant judgments; the clarity of disclosures

in the financial statements; and other related matters as required

to be discussed under generally accepted auditing standards in the

United States.

In

addition, the Audit Committee has discussed with the independent

registered public accounting firm the independence of such firm

from management and from the Company, including the matters in the

written disclosures required by the Public Company Accounting

Oversight Board, including Auditing Standard No. 1301

(Communications with Audit Committees) and the Independence

Standards Board, and has considered the compatibility of non-audit

services with such firm’s independence.

The

Audit Committee also discussed with the Company’s independent

registered public accounting firm the overall scope and plan for

their audit, their evaluation of the Company’s internal

control and the overall quality of the Company’s financial

reporting. The Audit Committee held four meetings with the

Company’s independent registered public accounting firm, both

with and without management present, during fiscal year

2020.

In

reliance on the reviews and discussions referred to above, the

Audit Committee recommended to the Board that the audited

consolidated financial statements be included in the

Company’s Annual Report on Form 10-K for the year ended

January 2, 2021 for filing with the SEC. The Audit Committee has

recommended, and the Board has approved, subject to shareholder

ratification, the selection of Fiondella, Milone & LaSaracina

LLP as the Company’s independent registered public accounting

firm for the 2021 fiscal year.

Audit

Committee:

Fredrick D.

DiSanto, Chairman

John W.

Everets

Michael

A. McManus, Jr.

Peggy

B. Scott

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The

following table sets forth information, as of March 1, 2021,

(unless a different date is specified in the notes to the table),

with respect to (i) each person known by the Board to be the

beneficial owner of more than 5% of the Company’s outstanding

Common Shares, (ii) each current director of the Company and

nominee to be a director of the Company, (iii) each of the named

executive officers and (iv) all directors, nominees and executive

officers of the Company as a group. Except as set forth below, the

Company knows of no person or group that beneficially owns 5% or

more of the outstanding Common Shares. Unless set forth in the

following table, the address of each shareholder is c/o The Eastern

Company, 112 Bridge Street, Naugatuck, Connecticut

06770-0460.

|

Title of Class

|

Name and Address of Beneficial Owner

|

Amount and Natureof BeneficialOwnership (a)

|

Percent ofClass (b)

|

|

Common

Stock

|

GAMCO

Investors, Inc. (c)

One

Corporate Center

Rye, NY

10580

|

1,099,334

|

17.60%

|

|

Common

Stock

|

Barington

Companies Equity Partners, L.P. (d)

888

Seventh Avenue, 6th Floor

New

York, NY 10019

|

582,224

|

9.32%

|

|

Common

Stock

|

Dimensional

Fund Advisors LP (e)

6300

Bee Cave Road, Building One

Austin,

TX 78746

|

412,428

|

6.60%

|

|

Common

Stock

|

Minerva

Advisors LLC (f)50 Monument Road, Suite 201

Bala

Cynwyd, PA 19004

|

334,240

|

5.35%

|

|

Common

Stock

|

The

Vanguard Group (g)

100

Vanguard Blvd.

Malvern,

PA 19355

|

327,074

|

5.23%

|

|

|

|

|

|

|

Common

Stock

|

Fredrick

D. DiSanto (h)

|

59,767

|

0.96%

|

|

Common

Stock

|

John W.

Everets

|

121,153

|

1.94%

|

|

Common

Stock

|

Charles

W. Henry

|

66,934

|

1.07%

|

|

Common

Stock

|

James

A. Mitarotonda (i)

|

596,757

|

9.55%

|

|

Common

Stock

|

Michael

A. McManus, Jr.

|

15,581

|

0.25%

|

|

Common

Stock

|

Peggy

B. Scott

|

6,340

|

0.10%

|

|

Common

Stock

|

John L.

Sullivan III (j)

|

33,663

|

0.54%

|

|

Common

Stock

|

August

M. Vlak (k)

|

24,312

|

0.39%

|

|

Common

Stock

|

James

P. Woidke (l)

|

2,458

|

0.04%

|

|

Common

Stock

|

All

directors, nominees and executive

officers

as a group (9 persons)(m)

|

926,965

|

14.84%

|

(a)

The SEC has defined

“beneficial owner” of a security to include any person

who has or shares voting power or investment power with respect to

any such security or who has the right to acquire beneficial

ownership of any such security within 60 days. Unless otherwise

indicated, the amounts owned reflect direct beneficial ownership

and the person indicated

has sole voting and sole investment power with respect to the

Common Shares indicated as beneficially owned. As of March 1, 2021,

there were 6,247,981 Common Shares

outstanding.

Amounts

shown include the number of Common Shares (if any) subject to

outstanding options or stock appreciation rights granted under the

Company’s 2010 Executive Stock Incentive Plan (the

“2010 Plan”) that are exercisable within 60 days after

March 1, 2021.

Reported

shareholdings include, in certain cases, Common Shares owned by or

in trust for a director or nominee, and in which all beneficial

interest has been disclaimed by the director or the

nominee.

(b)

The percentages

shown for each of the directors and executive officers are

calculated on the basis that outstanding Common Shares include

Common Shares (if any) subject to outstanding options or stock

appreciation rights under the Company’s 2010 Plan that are

exercisable by such director or officer within 60 days after March

1, 2021.

(c)

Based on

information set forth in Amendment No. 10 to Schedule 13D filed

with the SEC on December 8, 2020 by Gabelli Funds, LLC, GAMCO Asset

Management Inc., Teton Advisors, Inc., GGCP, Inc., Mario J.

Gabelli, GAMCO Investors, Inc., Associated Capital Group, Inc.

Gabelli Funds, LLC is an investment adviser registered under the

Investment Advisers Act of 1940, as amended (the “Advisers

Act”), which provides advisory services for a variety of

investment funds, investment companies, investment trusts and other

investment entities. GAMCO Asset Management Inc., a wholly-owned

subsidiary of GAMCO Investors, Inc., is an investment adviser

registered under the Advisers Act that is an investment manager

providing discretionary managed account services for employee

benefit plans, private investors, endowments, foundations and

others. Teton Advisors, Inc. is an investment adviser registered

under the Advisers Act that provides discretionary advisory

services to The TETON Westwood Mighty Mitessm Fund, The TETON

Westwood Income Fund, The TETON Westwood SmallCap Equity Fund,

TETON Westwood Intermediate Bond Fund and The TETON Westwood

Mid-Cap Equity Fund. Mario J. Gabelli is deemed to have beneficial

ownership of the securities owned beneficially by each of the

foregoing persons. GAMCO Investors, Inc. and GGCP, Inc. are deemed

to have beneficial ownership of the securities owned beneficially

by each of the foregoing persons other than Mario J.

Gabelli.

(d)

Barington Companies

Equity Partners, L.P. (“BCEP”) beneficially owns

582,224 Common Shares. Mr. Mitarotonda beneficially owns 14,533

Common Shares granted to him under the Directors’ Fee

Program. He may also be deemed to beneficially own the 582,224

Common Shares beneficially owned by BCEP. Mr. Mitarotonda is the

sole stockholder and director of LNA Capital Corp

(“LNA”). LNA is the general partner of Barington

Capital Group, L.P., which is the majority member of Barington

Companies Investors, LLC (“BCI”). BCI is the general

partner of BCEP. Mr. Mitarotonda disclaims beneficial ownership of

the Common Shares beneficially owned by BCEP except to the extent

of his pecuniary interest therein.

(e)

Based on

information set forth in Amendment No. 8 to Schedule 13G filed with

the SEC on February 12, 2021 by Dimensional Fund Advisors LP

(“Dimensional”), an investment adviser registered under

Section 203 of the Advisers Act. Dimensional furnishes investment

advice to four investment companies registered under the Investment

Company Act of 1940, as amended, and serves as investment manager

or sub-adviser to certain other commingled funds, group trusts and

separate accounts (such investment companies, trusts and accounts,

collectively referred to as the “Dimensional Funds”).

In certain cases, subsidiaries of Dimensional may act as an adviser

or sub-adviser to certain Dimensional Funds. In its role as

investment adviser, sub-adviser and/or manager, Dimensional or its

subsidiaries (collectively, “Dimensional”) may possess

voting and/or investment power over the Common Shares that are

owned by the Dimensional Funds, and may be deemed to be the

beneficial owner of the Common Shares held by the Dimensional

Funds. However, all Common Shares are owned by the Dimensional

Funds, and Dimensional disclaims beneficial ownership of such

Common Shares.

(f)

Based on

information set forth in Amendment No. 5 to Schedule 13G filed with

the SEC on February 9, 2021 by Minerva Advisors LLC, Minerva Group,

LP, Minerva GP, LP, Minerva GP, Inc., and David P. Cohen. Each of

Minerva Advisors LLC, Minerva Group, LP, Minerva GP, LP, Minerva

GP, Inc., and David P. Cohen is deemed a beneficial owner of the

249,393 Common Shares held by Minerva Group, LP. David P. Cohen is

the beneficial owner of the 2,250 Common Shares that he owns

individually and is also deemed a beneficial owner of the 331,990

Common Shares beneficially owned by Minerva Advisors

LLC.

(g)

Based on

information set forth in a Schedule 13G filed with the SEC on

February 10, 2021 by The Vanguard Group. The Vanguard Group has

shared power to vote or direct to vote 3,746 shares; sole power to

dispose or to direct the disposition of 321,230 shares and shared

power to dispose of to direct the disposition of 5,844

shares.

(h)

Mr. DiSanto’s

shareholdings include direct ownership of 15,970 Common Shares and

shared voting power and investment power over an additional 43,797

Common Shares over which he has indirect beneficial

ownership.

(i)

Mr. Mitarotonda

beneficially owns 14,533 Common Shares granted to him under the

Directors’ Fee Program. He may also be deemed to beneficially

own 582,224 Common Shares beneficially owned by BCEP (see footnote

(d) above). Mr. Mitarotonda disclaims beneficial ownership of the

Common Shares beneficially owned by BCEP except to the extent of

his pecuniary interest therein.

(j)

Mr.

Sullivan’s security ownership includes 2,574 Common Shares

underlying stock appreciation rights granted on March 2, 2017 and

February 7, 2019 that became exercisable on February 1, 2018,

February 1, 2019, February 1, 2020 and February 1,

2021.

(k)

Mr. Vlak’s

security ownership includes 5,148 Common Shares underlying stock

appreciation rights granted on March 2, 2017 and February 7, 2019

that became exercisable on February 1, 2018, February 1, 2019,

February 1, 2020 and February 1, 2021.

(l)

Mr. Woidke’s

security ownership includes 2,458 Common Shares underlying stock

appreciation rights granted on March 2, 2017 and February 7, 2019

that became exercisable on February 1, 2018, February 1, 2019,

February 1, 2020 and February 1, 2021

(m)

Unless otherwise

indicated in the notes above, directors, nominees and named

executive officers have sole voting and investment power as to

926,965 Common Shares (14.84% of the outstanding

stock).

DELINQUENT SECTION 16(a) REPORTS

Section

16(a) of the Exchange Act requires the Company’s directors

and officers, and persons who beneficially own more than 10% of a

registered class of the Company’s equity securities, to file

reports of ownership and changes in ownership with the SEC. Based

on a review of the copies of such reports and written

representations from certain reporting persons that no such reports

were required for those persons, the Company believes that all

reports for the Company’s directors, officers and 10%

beneficial owners that were required to be filed under Section 16

during the fiscal year ended January 2, 2021 were timely

filed.

THE BOARD OF DIRECTORS AND COMMITTEES

The

Board is committed to sound corporate governance practices and

believes that our current corporate governance practices enhance

the Company’s ability to achieve its goals and enable the

Board to govern the Company with the highest standards of

integrity. In 2018, the Board adopted new Board Governance

Guidelines that codify its practices. The Board Governance

Guidelines, the Company’s Code of Business Conduct and

Ethics, as adopted by the Board on February 4, 2004 and the

charters of our Audit, Compensation and Nominating and Corporate

Governance Committees are available for review at the Company

website at www.easterncompany.com.

The

current leadership structure of the Board allows it to perform its

duties effectively and efficiently considering the relatively small

size of the Company. In 2020, the Board held eleven meetings. All

seven current directors attended 100% of the meetings

held.

The

Board conducts annual self-evaluations to assess the effectiveness,

processes, skills, functions and other matters relevant to the

Board as a whole or to each particular committee. Results of the

evaluations are summarized and discussed at Board and committee

meetings for the purpose of improving the effectiveness of the

Board and committees.

Because

of the Company’s diversified engineering, manufacturing and

marketing activities, risk oversight responsibilities are focused

generally on the Board’s overall assessment of broad and

general business and economic conditions in the market sectors in

which the Company operates. With Board oversight, the executive

management team’s planning and review and extensive

Sarbanes-Oxley compliance testing of internal controls

substantiates the credibility of the Company’s financial

reporting and operating controls.

The

Board is provided with detailed and timely financial and operating

communications, including the nature of significant capital

projects as well as other important business matters indicating

business trends and economic projections that might affect the

Company’s businesses.

Board’s Role in Company Strategy and Leadership

The

Board has an active role in the Company’s overall strategies.

Each year, the Board conducts a comprehensive, in-depth review of

the Company’s long-term strategy and annual operating plan

and actively monitors and reviews management’s progress in

executing both throughout the year. In addition, throughout the

year the Board conducts individual segment strategy reviews with

segment leadership.

The

Board recognizes that one of its most important duties is to endure

continuity in the Company’s senior leadership by overseeing

the development of executive talent and planning for the effective

succession of the Company’s CEO and the executive leadership

team. In order to ensure that the succession planning and

leadership development process supports and enhances the

Company’s strategic objectives, the Board regularly consults

with the CEO on the Company’s organizational needs, its

leadership pipeline and the succession plans for critical

leadership positions.

The Role of the Board in Corporate Social

Responsibility

Corporate social

responsibility is deeply ingrained in our work, and has been for

over a century. Our businesses are committed to solving

customers’ complex social responsibility challenges. Every

day, the products that our businesses design and manufacture

protect people who use them from injury, safeguard property against

damage or loss, and increase the reuse and recyclability of

packaging. Moreover, our businesses seek to minimize their

environmental impact and embrace sustainable material recycling

practices in our operations. We know that our first obligation is

to the people who come to work at each of our businesses, and we

are committed to our goal of zero reportable

accidents.

The

Board’s Environment, Health and Safety Committee reviews our

comprehensive program that ensures the health and safety of our

employees.

Board Committees

The

Company’s Board has five standing committees: the Executive

Committee, Audit Committee, Compensation Committee, Nominating and

Corporate Governance Committee and Environment, Health and Safety

Committee. Each committee is composed of four independent directors

except the Executive Committee and the Environment, Health and

Safety Committee, which have three independent

directors.

The

President and Chief Executive Officer is not a member of any of the

Committees.

Executive

Committee. The

Executive Committee, acting with the full authority of the Board,

is responsible for issues requiring immediate attention when the

Board is not in session, including approving minutes, monthly

operating reports, capital expenditures, banking matters, and other

issues. The members of the Executive Committee include Charles W.

Henry, Michael A. McManus, Jr. and James A. Mitarotonda (Chairman).

In 2020, the Executive Committee did not meet.

Audit Committee. The

Audit Committee advises the Board and provides oversight on matters

relating to the Company’s financial reporting process,

accounting functions and internal controls, and the qualifications,

independence, appointment, retention, compensation and performance

of the Company’s independent registered public accounting

firm. The Audit Committee also provides oversight with respect to

legal compliance, ethics programs, and cyber risk management. The

members of the Audit Committee include Fredrick D. DiSanto

(Chairman), John W. Everets, Michael A. McManus, Jr. and Peggy B.

Scott. During 2020, the Audit Committee held four

meetings.

Compensation

Committee. The Compensation Committee is responsible for

establishing basic management compensation, incentive plan goals,

and all related matters, as well as determining stock incentive

grants to employees. The Board adopted the charter of the

Compensation Committee on December 13, 2006. The members of the

Compensation Committee include John W. Everets, Charles W. Henry,

Michael A. McManus, Jr. (Chairman) and Peggy B. Scott. During 2020,

the Compensation Committee held five meetings.

Environment, Health and

Safety Committee. The Environment, Health and Safety

Committee’s responsibilities include reviewing environmental,

health and safety policies; overseeing the management and

implementation of systems necessary for compliance with the

policies; monitoring the effectiveness of policies, systems and

processes; monitoring trends; and, reviewing and monitoring the

overall environmental, health and safety performance of the

Company. The members of the Environment, Health and Safety

Committee include Charles W. Henry, Michael A. McManus, Jr., and

Peggy B. Scott (Chairperson). The Environment, Health and Safety

Committee held four meetings in 2020.

Nominating and Corporate

Governance Committee. The Board adopted the charter of the

Nominating and Corporate Governance Committee on May 21, 2015. As

defined by the rules and regulations of NASDAQ, the independent

members of the Board include all of the members of the Board other

than the President and Chief Executive Officer. The Nominating and

Corporate Governance Committee selects and recommends to the Board

the nomination of individuals for election to the Board. The

members of the Nominating and Corporate Governance Committee

include Fredrick D. DiSanto, John W. Everets, Charles W. Henry and

James A. Mitarotonda (Chairman). During 2020, the Nominating and

Corporate Governance Committee held four meetings.

Board Composition

Each

member of the Board must have the ability to apply sound business

judgment and must be able to exercise his or her duties of loyalty

and care. Candidates for the position of director must exhibit

proven leadership capabilities and high integrity, exercise high

level responsibilities within their chosen careers, and have an

ability to quickly grasp complex principles of business and

finance. In general, candidates will be preferred to the extent

they hold an established executive level position in business,

finance, law, education, research, government or civic activities.

When current members of the Board are considered for nomination for

reelection, their prior contributions to the Board, their

performance and their meeting attendance records are taken into

account.

With

the aim of developing a diverse, experienced and highly-qualified

Board, the Nominating and Corporate Governance Committee is

responsible for developing and recommending to the Board the

desired qualifications, expertise and characteristics of members of

the Board, including qualifications that the Nominating and

Corporate Governance Committee believes are necessary for one or

more of the members of the Board to possess.

Since

selecting qualified directors requires consideration of many

factors and will be influenced by the particular needs of the Board

from time to time, the Board has not adopted a specific set of

minimum qualifications, qualities or skills that are necessary for

a nominee to possess, other than those that are necessary to meet

U.S. legal, regulatory and NASDAQ listing requirements and the

provisions of our Restated Certificate of Incorporation (as

amended), our Bylaws (as amended), and the charters of the

committees of the Board. When considering nominees, the Nominating

and Corporate Governance Committee takes into consideration many

factors, including a candidate’s independence, integrity,

skills, financial and other expertise, experience, knowledge about

our business or the industries in which we operate and ability to

devote adequate time and effort to responsibilities of the Board.

The brief biographical description of each director set forth in

Item 1 of this Proxy Statement includes the individual experience,

qualifications, attributes and skill of each director that led to

the conclusion that each director should serve as a member of our

Board.

The

Board does not have a formal or informal policy with respect to

diversity, but believes that the Board, taken as a whole, should

embody a diverse set of skills, knowledge, experiences and

backgrounds appropriate in light of the Company’s needs, and

in this regard also subjectively takes into consideration the

diversity (with respect to race, gender and national origin) of the

Board when considering director nominees. The Company’s

nominees for election at the 2021 Annual Meeting for a one-year

term expiring in 2022 include one female nominee, who meets the

generally considered Board diversity criteria.

Pursuant to the

Company’s Corporate Governance Guidelines, the Board examines

whether the role of Chairman and Chief Executive Officer should be

combined and may determine to separate or combine the offices of

Chairman and CEO as it deems appropriate. Since January 1, 2016,

the Company has separated the positions of Chairman of the Board

and Chief Executive Officer. The Board believes that having a

separate Chairman allows the Chief Executive Officer to focus on

the day-to-day management of the Company, while enabling the Board

to maintain an independent perspective on the activities of the

Company and executive management.

Director Nomination Process

The

Nominating and Corporate Governance Committee considers director

nominees who are identified by the directors, by the shareholders,

or through another source. The Nominating and Corporate Governance

Committee may also use the services of a third party search firm to

assist in the identification or evaluation of director candidates,

as the committee deems necessary or appropriate.

Shareholders

wishing to submit the names of qualified candidates for possible

nomination to the Nominating and Corporate Governance Committee may

make such a submission by sending the information described in the

Company’s Bylaws to the Board (in care of the Secretary of

the Company). This information generally must be submitted not more

than 90 days nor less than 60 days prior to the first anniversary

of the preceding year’s annual meeting of

shareholders.

The

Nominating and Corporate Governance Committee will make a

preliminary assessment of each proposed nominee based upon his or

her resume and biographical information, the individual’s

willingness to serve as a director, and other background

information. When considering nominees, the Nominating and

Corporate Governance Committee takes into consideration many

factors, including a candidate’s independence, integrity,

skills, diversity, financial and other expertise, experience,

knowledge about our business or the industries in which we operate

and ability to devote adequate time and effort to responsibilities

of the Board. This information is evaluated against the criteria

described above and the specific needs of the Company at the time.

Based upon a preliminary assessment of the candidate(s), those who

appear best suited to meet the needs of the Company may be invited

to participate in a series of interviews, which are used as a

further means of evaluating potential candidates. On the basis of

information learned during this process, the Nominating and

Corporate Governance Committee will determine which nominee(s) they

will recommend for election to the Board. The Nominating and

Corporate Governance Committee use the same process for evaluating

all nominees, regardless of the original source of the

nomination.

Board Independence

The

Board is currently composed of seven members, six of whom are

independent. Our Corporate Governance and Nominating Committee

conducts an annual review and makes a recommendation to the full

Board as to whether each of our directors meets the applicable

independence standards of the NASDAQ Marketplace Rule 4200(a)(15).

In accordance with the NASDAQ standards, our Board has adopted

categorical standards for director independence, including

heightened standards applicable to members of our Audit and

Compensation Committees. A director will not be considered

independent unless the Board determines that the director has no

material relationship with the Company (directly, or a partner,

stockholder or officer of an organization that has a material

relationship with the Company). The Board has determined that each

of the current directors, except August M. Vlak, has no material

relationship with the Company other than as a director and is

independent within the listing standards of NASDAQ. In making its

independence determinations, the Board has broadly considered all

relevant facts and circumstances.

Summary of Annual Director Compensation

During

fiscal year 2020, the Company paid non-employee directors

individually in Common Shares as follows: the annual retainer for

the chairman of the board is $125,000; for directors it is $70,000;

the chairman of the Audit Committee received an additional $10,000;

the chairman of the Compensation and Environment, Health and Safety

Committees received an additional $7,500; the chairman of the

Nominating and Governance Committee received an additional $2,000.

In addition to the annual retainer fee, all non-employee directors

were compensated for all meetings in addition to the Board’s

five regularly scheduled meetings as follows: $1,500 for each

in-person meeting and $500 for each telephonic meeting. There will

be no change to the compensation given to the chairmen of

committees and compensation for meetings over the five regularly

scheduled meetings for fiscal year 2021.

Each

director receives their fees in the form of Company Shares. The

Company Shares are issued under the Directors’ Fee Program

(the “Directors’ Fee Program”) provided for in

The Eastern Company 2020 Stock Incentive Plan (the “2020

Plan”).

The

Company maintains a minimum share ownership requirement for

non-employee directors. The common stock ownership requirement will

be deemed to have been met once the total net realizable share

value held by a non-employee director exceeds five (5) times the

annual base retainer paid to the non-employee director.

Non-employee directors should attain this target within three (3)

years of becoming a member of the Board. Ms. Peggy Scott has not

achieved this target, however, she is still within the three (3)

year time frame of joining the Board. All other non-employee

directors have achieved this target.

DIRECTOR COMPENSATION IN FISCAL 2020

|

Name

(1)

|

Fees Earned or

Paid in Cash ($) (2) (4) Stock Awards ($)

|

|

Non-equity

Incentive Plan Compensation ($)

|

Change in pension

value and nonqualified deferred compensation earnings

($)

|

All

Other

Compensation

($)

(3)

|

|

|

Fredrick D.

DiSanto

|

$76,992

|

|

|

|

$258

|

$77,250

|

|

John W. Everets

|

67,483

|

|

|

|

-

|

67,483

|

|

Charles W.

Henry

|

64,013

|

|

|

|

-

|

64,013

|

|

Michael A. McManus,

Jr.

|

74,628

|

|

|

|

-

|

74,628

|

|

James A.

Mitarotonda

|

115,404

|

|

|

|

762

|

116,166

|

|

Peggy B. Scott

|

74,620

|

|

|

|

762

|

75,382

|

(1)

This table

discloses the compensation received by all non-employee directors

who served as a director in 2020. Mr. Vlak did not receive any

compensation for his service as a director of the

Company.

(2)

The amounts listed

could include adjustments for fractional shares from previous

periods. All Fees paid in newly issued stock of the

Company.

(3)

All non-employee

directors are provided a life insurance benefit. Messrs. DiSanto,

Mitarotonda and Mrs. Scott have a $50,000 benefit and Messrs.

Everets, Henry and McManus have a $25,000 benefit. The life

insurance benefit is reduced after age 70.

(4)

All directors

waived fees for the Board meetings related to the Company’s

response to the Covid-19 pandemic and accepted reduced fees in the

last half of 2020.

For

information on compensation for Mr. Vlak, a director and the

President and Chief Executive Officer of the Company, see the

executive compensation tables beginning on page 17.

POLICIES

AND PROCEDURES CONCERNING RELATED PERSONS TRANSACTIONS

Our

Code of Business Conduct and Ethics prohibits all conflicts of

interest between the Company and any of its directors, officers and

employees, except under guidelines approved by the Board or the

Board Committees. A conflict of interest exists whenever an

individual’s private interests interfere or conflict in any

way (or even appear to interfere or conflict) with the interests of

the Company. Employees are encouraged to report any conflicts of

interest, or potential conflicts of interest, to their supervisors

or superiors. However, if an employee does not believe it

appropriate or if he or she is not comfortable approaching his or

her supervisors or superiors, then the employee may contact either

the Chairman of the Audit Committee or Company

counsel.

To

identify related party transactions, each year the Company requires

our directors and executive officers to complete a questionnaire

that identifies any transaction with the Company or any of its

subsidiaries in which the director or executive officer or members

of his or her family have an interest. If any related party

transactions are reported, the Board reviews them to determine if

the potential for a prohibited conflict of interest exists. Prior

to its review, the Board will require full disclosure of all

material facts concerning the relationship and financial interest

of the relevant individuals in the transaction. Each year, our

directors and executive officers also review our Code of Business

Conduct and Ethics.

The

Board has determined that no transactions occurred since the

beginning of 2019 involving any director, director nominee or

executive officer of the Company, any known 5% shareholder of the

Company or any immediate family member of any of the foregoing

persons (together “related persons”) that would require

disclosure as a “related person

transaction.”

COMPENSATION DISCUSSION AND ANALYSIS

Our

named executive officers for fiscal year 2020 were:

|

August

M. Vlak

|

President and Chief

Executive Officer

|

|

John L.

Sullivan III

|

Vice

President and Chief Financial Officer

|

|

James

P. Woidke

|

Chief

Operating Officer

|

Compensation Governance

The

Compensation Committee recommends to the Board policies and

processes for the regular and orderly review of the performance and

compensation of the Company’s senior executive management

personnel, including the President and Chief Executive Officer. The

Compensation Committee reviews and approves corporate goals and

objectives relevant to compensation of the Company’s Chief

Executive Officer and other executive officers; recommends to the

Board and/or the Company’s Management with respect to

compensation of executives other than named executive officers and

administers the Company’s stock plan, The Eastern Company

2010 Executive Stock Incentive Plan, The Eastern Company 2020 Stock

Incentive Plan and all other equity-based plans from time to time.

The Compensation Committee regularly reviews, administers, and when

necessary recommends changes to the Company’s stock incentive

and performance-based compensation plans.

The

Compensation Committee is comprised of members of the Board, none

of whom may be an active or retired officer or employee of the

Company or any of its subsidiaries. Members of the Compensation

Committee are appointed annually by the Board. Messrs. Michael A.

McManus, Jr., John W. Everets and Charles W. Henry and Mrs. Peggy

B. Scott are the members of the Compensation Committee. Mr. McManus

has been the Chairman of the Compensation Committee since July 29,

2015. The Compensation Committee held five meetings during the

fiscal year ended January 2, 2021. Neither the Compensation

Committee nor management engaged any compensation consultant during

fiscal year 2020.

This

Compensation Discussion and Analysis focuses on:

●

The guiding

principles and objectives underlying the Company’s

compensation program, including the performance levels that the

program is designed to reward; and

●

A description of

each of the components of the compensation program, including an

explanation as to why these elements were selected as the preferred

means to achieve the compensation program’s objectives, and

how the amount of each element of compensation is

determined.