Dyne Therapeutics Announces Proposed Public Offering of Common Stock

January 03 2024 - 4:25PM

Dyne Therapeutics, Inc. (Nasdaq: DYN), a clinical-stage muscle

disease company focused on advancing innovative life-transforming

therapeutics for people living with genetically driven diseases,

today announced that it has commenced an underwritten public

offering of $175,000,000 of shares of its common stock. Dyne also

intends to grant the underwriters a 30-day option to purchase up to

an additional $26,250,000 of shares of its common stock. All of the

shares in the proposed offering are to be sold by Dyne.

Morgan Stanley, J.P. Morgan, Jefferies and Stifel are acting as

joint book-running managers for the offering. Oppenheimer & Co.

and Raymond James are acting as co-managers for the offering. The

proposed offering is subject to market and other conditions, and

there can be no assurance as to whether or when the offering may be

completed, or as to the actual size or terms of the offering.

The proposed offering is being made pursuant to a shelf

registration statement on Form S-3 that was previously filed with

and declared effective by the Securities and Exchange Commission

(“SEC”). This offering will be made only by means of a prospectus

supplement and accompanying prospectus that form a part of the

registration statement. A preliminary prospectus supplement

relating to and describing the terms of the offering is expected to

be filed with the SEC and, if and when filed, copies of the

preliminary prospectus supplement relating to the offering may be

obtained for free by visiting the SEC’s website at www.sec.gov.

Copies of the preliminary prospectus supplement and the

accompanying prospectus may also be obtained by contacting: Morgan

Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick

Street, 2nd Floor, New York, NY 10014, or by email at

prospectus@morganstanley.com; J.P. Morgan Securities LLC, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, by telephone at (866) 803-9204, or by email at

prospectus-eq_fi@jpmchase.com; Jefferies LLC, Attention: Equity

Syndicate Prospectus Department, 520 Madison Avenue, New York, NY

10022, by telephone at (877) 821-7388, or by email at

Prospectus_Department@Jefferies.com; or Stifel, Nicolaus &

Company, Incorporated, Attention: Prospectus Department, One

Montgomery Street, Suite 3700, San Francisco, CA 94104, by

telephone at (415) 364-2720 or by email at

syndprospectus@stifel.com. The final terms of the offering will be

disclosed in a final prospectus supplement to be filed with the

SEC.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Dyne Therapeutics

Dyne Therapeutics is a clinical-stage muscle disease company

focused on advancing innovative life-transforming therapeutics for

people living with genetically driven diseases. With its

proprietary FORCE™ platform, Dyne is developing modern

oligonucleotide therapeutics that are designed to overcome

limitations in delivery to muscle tissue. Dyne has a broad pipeline

for serious muscle diseases, including clinical programs for

myotonic dystrophy type 1 (DM1) and Duchenne muscular dystrophy

(DMD) and a preclinical program for facioscapulohumeral muscular

dystrophy (FSHD).

Forward-Looking Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. All statements, other

than statements of historical facts, contained in this press

release, including statements relating to the proposed underwritten

public offering, the anticipated terms of the proposed offering,

market and other conditions relating to the offering, constitute

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “might,” “objective,” “ongoing,” “plan,”

“predict,” “project,” “potential,” “should,” or “would,” or the

negative of these terms, or other comparable terminology are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Dyne

may not actually achieve the plans, intentions or expectations

disclosed in these forward-looking statements, and you should not

place undue reliance on these forward-looking statements. Actual

results or events could differ materially from the plans,

intentions and expectations disclosed in these forward-looking

statements as a result of various important factors, including: the

uncertainties related to market conditions and the completion of

the public offering on the anticipated terms or at all and other

factors discussed in the “Risk Factors” section of the preliminary

prospectus supplement to be filed with the SEC, as well as the

risks and uncertainties identified in Dyne’s filings with the SEC,

including Dyne’s most recent Form 10-Q and in subsequent filings

Dyne may make with the SEC. In addition, the forward-looking

statements included in this press release represent Dyne’s views as

of the date of this press release. Dyne anticipates that subsequent

events and developments will cause its views to change. However,

while Dyne may elect to update these forward-looking statements at

some point in the future, it specifically disclaims any obligation

to do so. These forward-looking statements should not be relied

upon as representing Dyne’s views as of any date subsequent to the

date of this press release.

Contacts:

InvestorsAmy

Reillyareilly@dyne-tx.com857-341-1203

MediaStacy

Nartkersnartker@dyne-tx.com781-317-1938

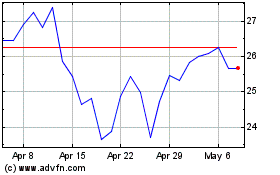

Dyne Therapeutics (NASDAQ:DYN)

Historical Stock Chart

From Oct 2024 to Nov 2024

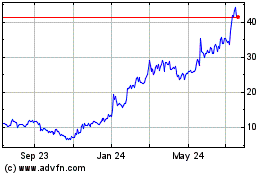

Dyne Therapeutics (NASDAQ:DYN)

Historical Stock Chart

From Nov 2023 to Nov 2024