false000102914200010291422024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 08, 2024 |

Dynavax Technologies Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-34207 |

33-0728374 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2100 Powell Street, Suite 720 |

|

Emeryville, California |

|

94608 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 510 848-5100 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

DVAX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, Dynavax Technologies Corporation ("Dynavax") issued a press release announcing its financial results for the first quarter ended March 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this current report and is incorporated herein by reference.

The information with respect to item 2.02 in this current report and its accompanying exhibit shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this current report and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Dynavax, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Dynavax Technologies Corporation |

|

|

|

|

Date: |

May 8, 2024 |

By: |

/s/ Ryan Spencer |

|

|

|

Ryan Spencer

Chief Executive Officer and Interim Chief Financial Officer |

Exhibit 99.1

Dynavax Reports First Quarter 2024 Financial Results

and Provides Business Updates

•HEPLISAV-B® vaccine net product revenue grew 10% year-over-year to approximately $48 million in the first quarter of 2024

•Reaffirming full year 2024 HEPLISAV-B net product revenue guidance of $265 - $280 million

•Announces U.S. FDA clearance of IND application to initiate Phase 1/2 trial of Z-1018 shingles program

•Conference call today at 4:30 p.m. ET/1:30 p.m. PT

EMERYVILLE, CA – May 8, 2024 – Dynavax Technologies Corporation (Nasdaq: DVAX), a commercial-stage biopharmaceutical company developing and commercializing innovative vaccines, today reported financial results and provided a business update for the quarter ended March 31, 2024.

“The first quarter of 2024 saw continued year-over-year growth in quarterly HEPLISAV-B net product revenue. As we expected, growth in the U.S. hepatitis B vaccine market was slightly down during the first quarter compared to the fourth quarter due to an extended cough, cold and flu season which reduced the number of vaccination opportunities – a dynamic observed across other non-respiratory vaccine markets beyond hepatitis B. Despite this start to the year, we remain very encouraged about the hepatitis B market opportunity, both in 2024 and longer term. We are now seeing a pickup in the market as providers have begun to shift to non-respiratory vaccine campaigns in recent weeks, our retail pharmacy partners are expected to meet their demand expectations for this year, and several top IDN systems are planning to launch new hepatitis B focused initiatives. The U.S. adult hepatitis B vaccine opportunity remains significant with over 130 million patients eligible, one of the largest addressable patient populations in the U.S., and the vast majority remaining unvaccinated,” said Ryan Spencer, Chief Executive Officer of Dynavax.

“We’re also excited for several upcoming milestones from our novel vaccine pipeline, including the planned initiation of a mid-stage clinical trial in shingles this year, and data readouts from our plague and shingles vaccine programs expected across 2024 and 2025. In addition to this continued execution, and bolstered by our strong financial position, we continue to evaluate strategic opportunities to accelerate growth and further diversify our portfolio."

BUSINESS UPDATES

HEPLISAV-B® [Hepatitis B Vaccine (Recombinant), Adjuvanted]

HEPLISAV-B vaccine is the first and only adult hepatitis B vaccine approved in the U.S., the European Union and Great Britain that enables series completion with only two doses in one month. Hepatitis B vaccination is universally recommended for adults aged 19-59 in the U.S.

•HEPLISAV-B vaccine achieved net product revenue of $47.8 million for the first quarter of 2024, an increase of 10% compared to $43.5 million for the first quarter of 2023.

•HEPLISAV-B total estimated market share in the U.S. increased to approximately 41%, compared to approximately 37% at the end of the first quarter 2023.

•HEPLISAV-B estimated market share in the retail pharmacy segment increased to approximately 55%, compared to approximately 49% at the end of the first quarter of 2023.

•HEPLISAV-B estimated market share in the Integrated Delivery Networks (IDNs) and Large Clinics segment increased to approximately 55%, compared to approximately 49% at the end of the first quarter 2023.

•A supplemental Biologic License Application (sBLA) for HEPLISAV-B vaccination of adults on hemodialysis is currently under review by the U.S. Food and Drug Administration (FDA) with a Prescription Drug User Fee Act (PDUFA) action date planned for May 13, 2024.

•Driven by the Centers for Disease Control and Prevention's Advisory Committee of Immunization Practices (ACIP) universal recommendation for adult hepatitis B vaccination, the hepatitis B vaccine market continues to expand in the U.S. and Dynavax believes the U.S. market has the potential to grow to over $800 million by 2027, with HEPLISAV-B well-positioned to achieve a majority market share.

Clinical Pipeline

Dynavax is advancing a pipeline of differentiated product candidates that leverage its CpG 1018® adjuvant, which has demonstrated its ability to enhance the immune response with a favorable tolerability profile in a wide range of clinical trials and real-world commercial use.

Shingles vaccine program:

Z-1018 is an investigational vaccine candidate being developed for the prevention of shingles in adults aged 50 years and older.

•In March 2024, Dynavax received clearance of its Investigational New Drug Application (IND) by the U.S. FDA for its novel shingles vaccine program, Z-1018.

•Dynavax plans to initiate a randomized, active-controlled, dose escalation, multicenter Phase 1/2 trial to evaluate the safety, tolerability, and immunogenicity of Z-1018 compared to Shingrix® in approximately 440 healthy adults aged 50 to 69.

•Dynavax plans to initiate the Phase 1/2 trial in the second quarter of 2024 and expects to report top line immunogenicity and safety data in the second half of 2025.

Tdap vaccine program:

Tdap-1018 is an investigational vaccine candidate intended for active booster immunization against tetanus, diphtheria, and pertussis (Tdap).

•Prior to advancing Tdap-1018 into a previously announced Phase 2 human challenge trial, Dynavax plans to evaluate the persistence of pertussis immunogenicity of Tdap-1018 through a long-term follow-up study of participants that completed a Phase 1 trial of a booster dose of Tdap-1018 compared to an active control.

•The extension study is expected to follow participants for up to approximately three years following initial vaccination. Top line results from the Phase 1 extension study are expected in the fourth quarter of 2024.

Plague vaccine program:

Dynavax is developing a plague (rF1V) vaccine candidate adjuvanted with CpG 1018® currently in a Phase 2 clinical trial in collaboration with, and fully funded by, the U.S. Department of Defense.

•In March 2024, Dynavax and the U.S. Department of Defense executed a contract modification to add approximately $4 million to support CMC work for the plague vaccine candidate, with the agreement now totaling $38 million through 2025.

•Dynavax anticipates top line data from both the randomized, active-controlled Phase 2 clinical trial evaluating immunogenicity, safety, and tolerability, as well as the nonhuman primate challenge study of the plague vaccine candidate, in the fourth quarter of 2024.

FIRST QUARTER 2024 FINANCIAL HIGHLIGHTS

Total Revenues and Net Product Revenue.

•Total revenues for the first quarter of 2024 were $50.8 million, compared to $46.9 million for the first quarter of 2023.

•HEPLISAV-B vaccine net product revenue was $47.8 million for the first quarter of 2024, compared to $43.5 million for the first quarter of 2023.

•Other revenue was $2.9 million for the first quarter of 2024, compared to $3.5 million for the first quarter of 2023. Other revenue primarily includes revenue from the plague vaccine agreement with the U.S. Department of Defense.

Cost of Sales - Product. Cost of sales - product for HEPLISAV-B the first quarter of 2024 decreased to $11.0 million, compared to $14.7 million for the first quarter of 2023. The decrease was primarily due to lower per-unit manufacturing costs as the result of previous process improvements, partially offset by a $1.3 million inventory write-off charge recorded during the first quarter of 2024.

Research and Development Expenses (R&D). R&D expenses for the first quarter of 2024 decreased to $13.5 million, compared to $13.6 million for the first quarter of 2023. The decrease was primarily driven by the timing of clinical development costs due to the completion of clinical trials in early 2023 and activities for planned clinical trials in 2024, partially offset by increases related to investments in our CpG 1018 preclinical and clinical collaborations.

Selling, General, and Administrative Expenses (SG&A). SG&A expenses for the first quarter of 2024 increased to $44.1 million, compared to $36.5 million for the first quarter of 2023. The increase was primarily driven by increased headcount and other investments supporting our strategic growth, including an overall increase in targeted commercial and marketing efforts designed to increase HEPLISAV-B market share and maximize the opportunities presented by the ACIP's universal recommendation.

Net Loss. GAAP net loss was $8.7 million, or $0.07 per share (basic and diluted) in the first quarter of 2024, compared to GAAP net loss of $24.3 million, or $0.19 per share (basic and diluted) in the first quarter of 2023.

Cash and Marketable Securities. Cash, cash equivalents and marketable securities were $723.5 million as of March 31, 2024.

2024 FINANCIAL GUIDANCE

Dynavax is reaffirming the following full year 2024 financial guidance, based on the Company’s current operating plan:

•HEPLISAV-B net product revenue between approximately $265 - $280 million, including approximately $3 million in ex-U.S. sales through commercialization partnership in Germany

•HEPLISAV-B gross margin of approximately 80%

•Research and development expenses between approximately $60 - $75 million

•Selling, general and administrative expenses between approximately $160 - $180 million

•Expect cash, cash equivalents and marketable securities to be higher as of December 31, 2024, compared to December 31, 2023

Conference Call and Webcast Information

Dynavax will host a conference call and live audio webcast on Wednesday, May 8, 2024, at 4:30 p.m. ET/1:30 p.m. PT. The live audio webcast may be accessed through the "Events & Presentations" page on the "Investors" section of the Company's website at https://investors.dynavax.com/events-presentations. A replay of the webcast will be available for 30 days following the live event.

To dial into the call, participants will need to register for the call using the caller registration link at https://investors.dynavax.com/events-presentations and under the “Upcoming Events” section, click on "Listen to webcast." It is recommended that participants dial into the conference call or log into the webcast approximately 10 minutes prior to the call.

Important U.S. Product Information

HEPLISAV-B is indicated for the prevention of infection caused by all known subtypes of hepatitis B virus in adults aged 18 years and older.

For full U.S. Prescribing Information for HEPLISAV-B, please visit the following website at https://www.heplisavbhcp.com, and click the “Prescribing Information” link in the “Important Safety Information” section.

Important U.S. Safety Information (ISI)

Do not administer HEPLISAV-B to individuals with a history of a severe allergic reaction (e.g., anaphylaxis) after a previous dose of any hepatitis B vaccine or to any component of HEPLISAV-B, including yeast.

Appropriate medical treatment and supervision must be available to manage possible anaphylactic reactions following administration of HEPLISAV-B.

Immunocompromised persons, including individuals receiving immunosuppressant therapy, may have a diminished immune response to HEPLISAV-B.

Hepatitis B has a long incubation period. HEPLISAV-B may not prevent hepatitis B infection in individuals who have an unrecognized hepatitis B infection at the time of vaccine administration.

The most common patient-reported adverse reactions reported within 7 days of vaccination were injection site pain (23% to 39%), fatigue (11% to 17%), and headache (8% to 17%).

About Dynavax

Dynavax is a commercial-stage biopharmaceutical company developing and commercializing innovative vaccines to help protect the world against infectious diseases. The Company has two commercial products, HEPLISAV-B® vaccine [Hepatitis B Vaccine (Recombinant), Adjuvanted], which is approved in the U.S., the European Union and Great Britain for the prevention of infection caused by all known subtypes of hepatitis B virus in adults 18 years of age and older, and CpG 1018® adjuvant, currently used in HEPLISAV-B and multiple adjuvanted COVID-19 vaccines. Dynavax is advancing CpG 1018 adjuvant as a premier vaccine adjuvant with adjuvanted vaccine clinical programs for shingles and Tdap, and through global collaborations, currently focused on adjuvanted vaccines for COVID-19, plague, seasonal influenza and universal influenza. For more information about our marketed products and development pipeline, visit www.dynavax.com.

Forward-Looking Statements

This press release contains "forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to a number of risks and uncertainties. All statements that are not historical facts are forward-looking statements. Forward-looking statements can generally be identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “will,” “may,” “plan,” “project,” “potential,” “seek,” “should,” “think,” “toward,” “will,” “would” and similar expressions, or the negatives thereof, or they may use future dates. Forward-looking statements made in this document include statements regarding our expected financial results and market share as of and for the year ended December 31, 2024, expectations regarding future growth and market share, the timing of IND filings, initiation and completion of clinical studies, expected timing for data readouts, and interaction with regulators. Actual results may differ materially from those set forth in this press release due to the risks and uncertainties inherent in our business, including, the risk that actual demand for our products may differ from our expectations, risks relating to our ability to commercialize and supply HEPLISAV-B, risks related to the timing of completion and results of current clinical studies, risks related to the development and pre-clinical and clinical testing of vaccines containing CpG 1018 adjuvant, as well as other risks detailed in the "Risk Factors" section of our Quarterly Report on Form 10-Q for the three months ended March 31, 2024 and periodic filings made thereafter, as well as discussions of potential risks, uncertainties and other important factors in our other filings with the U.S. Securities and Exchange Commission. These forward-looking statements are made as of the date hereof, are qualified in their entirety by this cautionary statement and we undertake no obligation to revise or update information herein to reflect events or circumstances in the future, even if new information becomes

available. Information on Dynavax's website at www.dynavax.com is not incorporated by reference in our current periodic reports with the SEC.

For Investors/Media:

Paul Cox

pcox@dynavax.com

510-665-0499

Nicole Arndt

narndt@dynavax.com

510-665-7264

DYNAVAX TECHNOLOGIES CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

|

2023 |

Revenues: |

|

|

|

|

|

|

|

Product revenues, net |

|

$ |

47,845 |

|

|

$ |

43,451 |

Other revenue |

|

|

2,945 |

|

|

|

3,474 |

Total revenues |

|

|

50,790 |

|

|

|

46,925 |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

Cost of sales – product |

|

|

10,966 |

|

|

|

14,712 |

Research and development |

|

|

13,528 |

|

|

|

13,605 |

Selling, general and administrative |

|

|

44,065 |

|

|

|

36,543 |

Bad debt expense |

|

|

- |

|

|

|

12,313 |

Total operating expenses |

|

|

68,559 |

|

|

|

77,173 |

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(17,769) |

|

|

|

(30,248) |

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

Interest income |

|

|

9,468 |

|

|

|

6,597 |

Interest expense |

|

|

(1,695) |

|

|

|

(1,686) |

Sublease (expense) income |

|

|

(1,602) |

|

|

|

1,598 |

Other |

|

|

101 |

|

|

|

23 |

Net loss before income taxes |

|

|

(11,497) |

|

|

|

(23,716) |

Benefit from (provision for) income taxes |

|

|

2,776 |

|

|

|

(616) |

Net loss |

|

$ |

(8,721) |

|

|

$ |

(24,332) |

Net loss per share attributable to common |

|

|

|

|

|

|

|

stockholders: |

Basic |

|

$ |

(0.07) |

|

|

$ |

(0.19) |

Diluted |

|

$ |

(0.07) |

|

|

$ |

(0.19) |

Weighted-average shares used in computing net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

Basic |

|

|

130,200 |

|

|

|

127,921 |

Diluted |

|

|

130,200 |

|

|

|

127,921 |

DYNAVAX TECHNOLOGIES CORPORATION

SELECTED BALANCE SHEET DATA

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

|

|

2024 |

|

2023 |

Assets |

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ |

723,538 |

|

$ |

742,302 |

Inventories |

|

|

61,806 |

|

|

53,290 |

Other current assets |

|

|

65,942 |

|

|

63,528 |

Total current assets |

|

|

851,286 |

|

|

859,120 |

Total non-current assets |

|

|

135,279 |

|

|

137,976 |

Total assets |

|

$ |

986,565 |

|

$ |

997,096 |

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Total current liabilities |

|

$ |

56,002 |

|

$ |

62,195 |

Total long-term liabilities |

|

|

312,083 |

|

|

312,829 |

Stockholders’ equity |

|

|

618,480 |

|

|

622,072 |

Total liabilities and stockholders’ equity |

|

$ |

986,565 |

|

$ |

997,096 |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

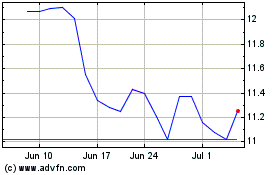

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Oct 2024 to Nov 2024

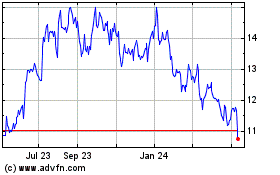

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Nov 2023 to Nov 2024