Diversified Healthcare Trust Prices $941 Million Zero Coupon Senior Secured Notes with a Maturity Date of January 15, 2026 and a One-Year Extension Option

December 19 2023 - 7:00AM

Business Wire

Proceeds Will be Used to Repay in Full All 2024

Maturities, Including $450 Million Secured Credit Facility and $250

Million of Senior Unsecured Notes

Will Immediately Regain Compliance with Debt

Incurrence Covenants upon Closing

Diversified Healthcare Trust (Nasdaq: DHC) today announced that

it has priced an aggregate principal amount of $941 million of

senior secured notes due January 2026, with a 12-month extension

option, subject to the satisfaction of certain conditions and

payment of an extension fee. The notes will generate approximately

$750 million in gross proceeds before issuance costs and will

accrete at a rate of 11.25% annually, compounded semi-annually. If

the 12-month extension option is exercised, interest payments will

be due semi-annually during the extension period at an initial

interest rate of 11.25% with increases of 50 basis points every 90

days that the notes remain outstanding. The closing is expected to

occur on December 21, 2023, subject to the satisfaction of

customary closing conditions. The notes will be guaranteed on a

joint, several and senior secured basis by subsidiaries of DHC that

own the properties comprising the collateral for the notes and on a

joint, several and unsecured basis by all subsidiaries of DHC that

guarantee its existing senior notes due 2025 and 2031. DHC believes

that the collateral properties have an estimated fair value of

approximately $1.57 billion.

The net proceeds from this transaction, after initial purchaser

discounts and offering costs, are expected to be $732 million and

used to repay all of DHC’s outstanding debt maturing in 2024, and

for general business purposes. The debt being repaid includes DHC’s

$450 million secured credit facility and its outstanding 4.750%

Senior Notes due in May 2024. The offering is expected to close on

December 21, 2023, subject to customary closing conditions.

Following the closing of this transaction and the repayment of

these outstanding debts, DHC will immediately regain compliance

with the incurrence covenants under its remaining public debt

agreements.

The notes have not and will not be registered under the

Securities Act of 1933, as amended (the “Securities Act”), any

state securities laws or the securities laws of any other

jurisdiction, and may not be offered or sold in the United States

absent registration or an applicable exemption from registration

under the Securities Act or any applicable state securities laws.

The new notes will be offered only to persons reasonably believed

to be qualified institutional buyers under Rule 144A under the

Securities Act and outside the United States only to non-U.S.

investors in compliance with Regulation S under the Securities

Act.

This press release does not constitute an offer to sell, or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction. This press release also does not constitute a notice

of redemption with respect to the redemption of DHC’s 4.750% Senior

Notes due 2024.

About Diversified Healthcare Trust:

DHC is a real estate investment trust focused on owning

high-quality healthcare properties located throughout the United

States. DHC seeks diversification across the health services

spectrum by care delivery and practice type, by scientific research

disciplines and by property type and location. As of September 30,

2023, DHC’s approximately $7.2 billion portfolio included 376

properties in 36 states and Washington, D.C., occupied by

approximately 500 tenants, and totaling approximately 9 million

square feet of life science and medical office properties and more

than 27,000 senior living units. DHC is managed by The RMR Group

(Nasdaq: RMR), a leading U.S. alternative asset management company

with approximately $36 billion in assets under management as of

September 30, 2023 and more than 35 years of institutional

experience in buying, selling, financing and operating commercial

real estate. To learn more about DHC, visit www.dhcreit.com.

WARNING CONCERNING

FORWARD-LOOKING STATEMENTS

This press release contains statements, including our statements

about the expected settlement date of the offering of the new notes

and the use of proceeds therefrom, that constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and other securities laws. Also, whenever DHC

uses words such as “believe”, “expect”, “anticipate”, “intend”,

“plan”, “estimate”, “will”, “may” and negatives or derivatives of

these or similar expressions, DHC is making forward-looking

statements. These forward-looking statements are based upon DHC’s

present intent, beliefs or expectations, but forward-looking

statements are not guaranteed to occur and may not occur. The

settlement of the offering is subject to various customary

conditions and contingencies. If these conditions are not satisfied

or the specified contingencies do not occur, this offering may not

close. Further, DHC’s current intentions with respect to the use of

the net proceeds from the offering to repay DHC’s secured credit

facility and to fund the redemption of its outstanding 4.750%

Senior Notes due in May 2024 is dependent on the closing of the

offering and may not occur. In addition, although DHC will

immediately be in compliance with the debt incurrence covenants

under its remaining public debt agreements as a result of this

transaction and the repayment of these outstanding debts, DHC may

not be able to execute on additional financing strategies or have

sufficient liquidity available to fund its capital projects as it

currently expects, and DHC may not be able to continue to invest in

the growth and recovery of its senior living communities as a

result of economic and market conditions or other reasons.

Actual results may differ materially from those contained in or

implied by DHC’s forward-looking statements. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors, some of which are beyond DHC’s control.

The information contained in DHC’s filings with the Securities

and Exchange Commission (the “SEC”), including under “Risk Factors”

in DHC’s periodic reports, or incorporated therein, identifies

other important factors that could cause DHC’s actual results to

differ materially from those stated in or implied by DHC’s

forward-looking statements. DHC’s filings with the SEC are

available on the SEC's website at www.sec.gov.

You should not place undue reliance upon forward-looking

statements.

Except as required by law, DHC does not intend to update or

change any forward-looking statements as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231218370542/en/

Melissa McCarthy, Manager, Investor Relations (617) 796-8234

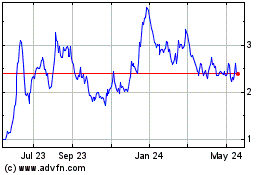

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Jan 2025 to Feb 2025

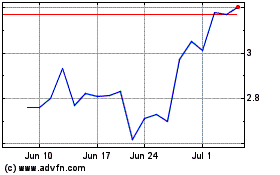

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Feb 2024 to Feb 2025