Cytek® Biosciences, Inc. (“Cytek Biosciences” or “Cytek”) (Nasdaq:

CTKB), a leading cell analysis solutions company, today reported

financial results for the first quarter ended March 31, 2024.

Recent Highlights

- Total revenue was $44.9 million, representing a 21%

increase over the corresponding period of 2023

- Organic revenue was $37.3 million, representing an increase of

11% compared to the first quarter of 2023

- First quarter revenue from the product lines acquired from

Luminex Corporation (“Luminex”) on February 28, 2023 was $7.6

million

- Opened a new 50,000-square-foot facility in Wuxi, China to meet

growing global demand for cutting-edge cell analysis solutions and

to drive operational performance

- Received China National Medical Products Association (NMPA)

approval for single-laser 6-color TBNK panel

- Registered 18 single-color reagents for IVD use with China NMPA

for clinical applications

- William McCombe appointed Chief Financial Officer

“We are encouraged with our positive start to 2024,

highlighted by increased organic revenue growth over the fourth

quarter and continued improvement in customer spending patterns. We

were also pleased to deliver strong growth in our services

business, driven by our increasing installed base of instruments,”

said Dr. Wenbin Jiang, CEO of Cytek Biosciences. “We continue to

focus on executing a balanced business strategy to drive

sustainable growth and profitability, and we are confident in our

path forward to deliver on our objectives.”

First Quarter 2024 Financial

Results

Total revenue for the first quarter of 2024 was

$44.9 million, a 21% increase over the first quarter of 2023.

Excluding the $7.6 million of revenue from the product lines

acquired from Luminex on February 28, 2023, organic revenue was

$37.3 million, an 11% increase compared to the same period of the

prior year.

Gross profit was $23.0 million for the first

quarter of 2024, an increase of 9% compared to a gross profit of

$21.0 million in the first quarter of 2023. Gross profit margin was

51% in the first quarter of 2024 compared to 57% in the first

quarter of 2023. Adjusted gross profit margin, after adjusting for

stock-based compensation expense and amortization of

acquisition-related intangibles, was 55% in the first quarter of

2024 compared to 59% in the first quarter of 2023.

Operating expenses were $33.7 million for the first

quarter of 2024, a 2% increase from $33.2 million in the first

quarter of 2023. The increase in operating expenses was primarily

driven by an increase in headcount and personnel-related

expenses.

Research and development expenses were $9.8 million

for the first quarter of 2024 compared to $10.0 million for the

first quarter of 2023.

Sales and marketing expenses were $12.5 million for

the first quarter of 2024 compared to $11.1 million for the first

quarter of 2023.

General and administrative expenses were $11.4

million for the first quarter of 2024 compared to $12.1 million for

the first quarter of 2023.

Loss from operations in the first quarter of 2024

was $10.7 million compared to loss from operations of $12.2 million

in the first quarter of 2023. Net loss in the first quarter of 2024

was $6.2 million compared to a net loss of $6.8 million in the

first quarter of 2023.

Adjusted EBITDA in the first quarter of 2024 was a

loss of $0.7 million compared to a loss of $2.5 million in the

first quarter of 2023, after adjusting for stock-based compensation

expense, foreign currency exchange impacts and acquisition-related

expenses.

Cash, restricted cash, and marketable securities

were approximately $270.4 million as of March 31, 2024, compared to

$262.7 million as of December 31, 2023.

2024 Outlook

Cytek Biosciences reaffirms its 2024 revenue

guidance, expecting full year 2024 revenue in the range of $203

million to $213 million, representing growth of 5% to 10% over full

year 2023, assuming no change in currency exchange rates. For the

year ending December 31, 2024, Cytek Biosciences expects to report

positive net income.

Webcast Information

Cytek will host a conference call to discuss the

first quarter 2024 financial results on Wednesday, May 8, 2024, at

1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time. A webcast of the

conference call can be accessed at investors.cytekbio.com.

About Cytek Biosciences, Inc.

Cytek Biosciences (Nasdaq: CTKB) is a leading cell analysis

solutions company advancing the next generation of cell analysis

tools by delivering high-resolution, high-content and

high-sensitivity cell analysis utilizing its patented Full Spectrum

Profiling™ (FSP™) technology. Cytek’s novel approach harnesses the

power of information within the entire spectrum of a fluorescent

signal to achieve a higher level of multiplexing with precision and

sensitivity. Cytek’s FSP platform includes its core instruments,

the Cytek Aurora™ and Northern Lights™ systems; its cell sorter,

the Cytek Aurora™ CS; the Cytek Orion™ reagent cocktail preparation

system; the flow cytometer and imaging products under the Amnis®

and Guava® brands; and reagents, software and services to provide a

comprehensive and integrated suite of solutions for its customers.

Cytek is headquartered in Fremont, California with offices and

distribution channels across the globe. More information about the

company and its products is available at www.cytekbio.com.

Cytek’s products are for research use only and not

for use in diagnostic procedures (other than Cytek’s Northern

Lights-CLC system and certain reagents, which are available for

clinical use in China and the European Union).

Cytek, Full Spectrum Profiling, FSP, Cytek Aurora,

Northern Lights, Cytek Orion, Amnis and Guava are trademarks of

Cytek Biosciences, Inc.

In addition to filings with the Securities and

Exchange Commission (SEC), press releases, public conference calls

and webcasts, Cytek uses its website (www.cytekbio.com), LinkedIn

page and X (formerly Twitter) account as channels of distribution

of information about its company, products, planned financial and

other announcements, attendance at upcoming investor and industry

conferences and other matters. Such information may be deemed

material information and Cytek may use these channels to comply

with its disclosure obligations under Regulation FD. Therefore,

investors should monitor Cytek’s website, LinkedIn page, and X

account in addition to following its SEC filings, news releases,

public conference calls and webcasts.

Statement Regarding Use of Non-GAAP

Financial Information

Cytek has presented certain financial information

in accordance with U.S. GAAP and also on a non-GAAP basis for the

three-month periods ended March 31, 2024 and March 31, 2023.

Management believes that non-GAAP financial measures, including

“Adjusted gross profit margin” and “Adjusted EBITDA” referenced

above, taken in conjunction with GAAP financial measures, provide

useful information for both management and investors by excluding

certain non-cash and other expenses that are not indicative of the

company’s core operating results. Management uses non-GAAP measures

to compare the company’s performance relative to forecasts and

strategic plans and to benchmark the company’s performance

externally against competitors. Non-GAAP information is not

prepared under a comprehensive set of accounting rules and should

only be used to supplement an understanding of the company’s

operating results as reported under U.S. GAAP. Cytek encourages

investors to carefully consider its results under GAAP, as well as

its supplemental non-GAAP information and the reconciliation

between these presentations, to more fully understand its business.

Reconciliations between GAAP and non-GAAP operating results are

presented in the accompanying tables of this release.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 as contained in Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, which are subject to the “safe harbor”

created by those sections. All statements, other than statements of

historical facts, may be forward-looking statements.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “may,” “might," "will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,”

“predict,” “potential” or “continue” or the negatives of these

terms or variations of them or similar terminology, but the absence

of these words does not mean that a statement is not

forward-looking. These forward-looking statements include

statements regarding Cytek’s plans and strategies to effectively

drive sustainable growth and deliver profitability; Cytek’s

business opportunities and market demand for advanced cell analysis

solutions; and Cytek’s expectations that total revenue for the full

year ended December 31, 2024 will be in the range of $203 million

to $213 million, assuming no change in currency exchange rates, and

positive net income for the full year ended December 31, 2024.

These statements are based on management’s current expectations,

forecasts, beliefs, assumptions and information currently available

to management. These statements also deal with future events and

involve known and unknown risks, uncertainties and other factors

that may cause actual results, performance or achievements to be

materially different from the information expressed or implied by

these forward-looking statements. Factors that could cause actual

results to differ materially include global economic and market

conditions; Cytek's ability to evaluate its prospects for future

viability and predict future performance; Cytek’s ability to

accurately forecast customer demand and adoption of its products;

Cytek’s ability to recognize the anticipated benefits of

collaborations; Cytek’s dependence on certain sole and single

source suppliers; competition; market acceptance of Cytek’s current

and potential products; Cytek’s ability to manage the growth and

complexity of its organization, maintain relationships with

customers and suppliers and retain key employees; Cytek’s ability

to maintain, protect and enhance its intellectual property; and

Cytek’s ability to continue to stay in compliance with its material

contractual obligations, applicable laws and regulations.. You

should refer to the section entitled “Risk Factors” set forth in

Cytek’s most recent Annual Report on Form 10-K filed with the SEC

on March 13, 2024, Cytek’s Quarterly Report on Form 10-Q to be

filed with the SEC on or about the date hereof and other filings

Cytek makes with the SEC from time to time for a discussion of

important factors that may cause actual results to differ

materially from those expressed or implied by Cytek’s

forward-looking statements. Although Cytek believes that the

expectations reflected in the forward-looking statements are

reasonable, it cannot provide any assurance that these expectations

will prove to be correct nor can it guarantee that the future

results, levels of activity, performance and events and

circumstances reflected in the forward-looking statements will be

achieved or occur. The forward-looking statements in this press

release are based on information available to Cytek as of the date

hereof, and Cytek disclaims any obligation to update any

forward-looking statements provided to reflect any change in its

expectations or any change in events, conditions, or circumstances

on which any such statement is based, except as required by law.

These forward-looking statements should not be relied upon as

representing Cytek’s views as of any date subsequent to the date of

this press release.

Media Contact:Stephanie OlsenLages

& Associates(949) 453-8080stephanie@lages.com

Investor Relations Contact:Paul D.

GoodsonHead of Investor Relationspgoodson@cytekbio.com

| |

|

|

|

Cytek Biosciences, Inc.Consolidated Statements of

Operations and Comprehensive Loss(unaudited) |

| |

|

|

| |

|

Three months ended March 31, |

|

(In thousands, except share and per share

data) |

|

|

2024 |

|

|

|

2023 |

|

|

Revenue, net: |

|

|

|

|

|

Product |

|

$ |

34,122 |

|

|

$ |

31,172 |

|

|

Service |

|

|

10,738 |

|

|

|

5,916 |

|

|

Total revenue, net |

|

|

44,860 |

|

|

|

37,088 |

|

| Cost of sales: |

|

|

|

|

|

Product |

|

|

16,746 |

|

|

|

12,677 |

|

|

Service |

|

|

5,101 |

|

|

|

3,373 |

|

|

Total cost of sales |

|

|

21,847 |

|

|

|

16,050 |

|

|

Gross profit |

|

|

23,013 |

|

|

|

21,038 |

|

| Operating expenses: |

|

|

|

|

|

Research and development |

|

|

9,796 |

|

|

|

9,974 |

|

|

Sales and marketing |

|

|

12,543 |

|

|

|

11,145 |

|

|

General and administrative |

|

|

11,408 |

|

|

|

12,081 |

|

|

Total operating expenses |

|

|

33,747 |

|

|

|

33,200 |

|

|

Loss from operations |

|

|

(10,734 |

) |

|

|

(12,162 |

) |

| Other income (expense): |

|

|

|

|

|

Interest expense |

|

|

(441 |

) |

|

|

(673 |

) |

|

Interest income |

|

|

1,359 |

|

|

|

2,143 |

|

|

Other income, net |

|

|

823 |

|

|

|

1,652 |

|

| Total other income, net |

|

|

1,741 |

|

|

|

3,122 |

|

| Loss before income taxes |

|

|

(8,993 |

) |

|

|

(9,040 |

) |

| Benefit from income taxes |

|

|

(2,824 |

) |

|

|

(2,233 |

) |

|

Net loss |

|

|

(6,169 |

) |

|

|

(6,807 |

) |

| Net loss, basic and diluted |

|

$ |

(6,169 |

) |

|

$ |

(6,807 |

) |

| Net loss per share, basic |

|

$ |

(0.05 |

) |

|

$ |

(0.05 |

) |

| Net loss per share, diluted |

|

$ |

(0.05 |

) |

|

$ |

(0.05 |

) |

| Weighted-average shares used in

calculating net loss per share, basic |

|

|

130,920,971 |

|

|

|

135,489,194 |

|

| Weighted-average shares used in

calculating net loss per share, diluted |

|

|

130,920,971 |

|

|

|

135,489,194 |

|

| Comprehensive loss: |

|

|

|

|

| Net loss |

|

$ |

(6,169 |

) |

|

$ |

(6,807 |

) |

| Foreign currency translation

adjustment, net of tax |

|

|

(244 |

) |

|

|

(42 |

) |

| Unrealized (loss) gain on

marketable securities |

|

|

(35 |

) |

|

|

152 |

|

|

Net comprehensive loss |

|

$ |

(6,448 |

) |

|

$ |

(6,697 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Cytek Biosciences, Inc.Consolidated

Balance Sheets |

| |

|

|

|

|

|

(In thousands, except share and per share

data) |

|

March 31,2024 |

|

December 31,2023 |

|

|

|

(unaudited) |

|

(audited) |

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

168,788 |

|

|

$ |

167,299 |

|

|

Restricted cash |

|

|

353 |

|

|

|

331 |

|

|

Marketable securities |

|

|

101,298 |

|

|

|

95,111 |

|

|

Trade accounts receivable, net |

|

|

50,306 |

|

|

|

55,928 |

|

|

Inventories |

|

|

54,742 |

|

|

|

60,877 |

|

|

Prepaid expenses and other current assets |

|

|

13,160 |

|

|

|

12,514 |

|

| Total current assets |

|

|

388,647 |

|

|

|

392,060 |

|

| Deferred income tax assets,

noncurrent |

|

|

32,708 |

|

|

|

30,487 |

|

| Property and equipment,

net |

|

|

18,247 |

|

|

|

18,405 |

|

| Operating lease right-of-use

assets |

|

|

9,949 |

|

|

|

10,853 |

|

| Goodwill |

|

|

16,183 |

|

|

|

16,183 |

|

| Intangible assets, net |

|

|

22,252 |

|

|

|

23,084 |

|

| Other noncurrent assets |

|

|

4,081 |

|

|

|

3,385 |

|

|

Total assets |

|

$ |

492,067 |

|

|

$ |

494,457 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Trade accounts payable |

|

$ |

3,725 |

|

|

$ |

3,032 |

|

|

Legal settlement liability, current |

|

|

2,550 |

|

|

|

2,561 |

|

|

Accrued expenses |

|

|

18,054 |

|

|

|

20,035 |

|

|

Other current liabilities |

|

|

8,228 |

|

|

|

7,903 |

|

|

Deferred revenue, current |

|

|

23,009 |

|

|

|

22,695 |

|

| Total current liabilities |

|

|

55,566 |

|

|

|

56,226 |

|

| Legal settlement liability,

noncurrent |

|

|

16,722 |

|

|

|

16,477 |

|

| Deferred revenue,

noncurrent |

|

|

15,164 |

|

|

|

15,132 |

|

| Operating lease liability,

noncurrent |

|

|

8,697 |

|

|

|

9,479 |

|

| Long term debt |

|

|

1,477 |

|

|

|

1,648 |

|

| Other noncurrent

liabilities |

|

|

1,827 |

|

|

|

2,431 |

|

| Total liabilities |

|

|

99,453 |

|

|

|

101,393 |

|

| Stockholders’ equity: |

|

|

|

|

| Common stock, $0.001 par

value; 1,000,000,000 authorized shares as of March 31, 2024 and

December 31, 2023, respectively; 131,254,181 and 130,714,906

issued and outstanding shares as of March 31, 2024 and

December 31, 2023, respectively. |

|

|

131 |

|

|

|

131 |

|

| Additional paid-in

capital |

|

|

429,384 |

|

|

|

423,386 |

|

| Accumulated deficit |

|

|

(35,347 |

) |

|

|

(29,178 |

) |

| Accumulated other

comprehensive loss |

|

|

(1,554 |

) |

|

|

(1,275 |

) |

|

Total stockholders’ equity |

|

|

392,614 |

|

|

|

393,064 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

492,067 |

|

|

$ |

494,457 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Cytek Biosciences, Inc. Reconciliation of

GAAP to Non-GAAP Measures

(Unaudited) |

| |

|

| |

Three Months Ended |

|

|

March 31, |

March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| (In thousands) |

|

|

| GAAP gross

profit |

$ |

23,013 |

|

|

$ |

21,038 |

|

| Stock Based Compensation |

|

945 |

|

|

|

692 |

|

| Amortization of

acquisition-related Intangible assets |

|

503 |

|

|

|

223 |

|

| Non-GAAP Gross

Profit |

$ |

24,461 |

|

|

$ |

21,953 |

|

| Non-GAAP gross profit

% |

|

55 |

% |

|

|

59 |

% |

| GAAP Net

Loss |

$ |

(6,169 |

) |

|

$ |

(6,807 |

) |

| Depreciation and

Amortization |

|

2,461 |

|

|

|

1,801 |

|

| Benefit from income taxes |

|

(2,824 |

) |

|

|

(2,233 |

) |

| Interest Income |

|

(1,359 |

) |

|

|

(2,143 |

) |

| Interest Expense |

|

441 |

|

|

|

673 |

|

| Foreign Currency exchange

loss |

|

1,131 |

|

|

|

1 |

|

| Stock Based Compensation |

|

5,640 |

|

|

|

4,699 |

|

| Acquisition related

expenses |

|

- |

|

|

|

1,485 |

|

| Adjusted

EBITDA |

$ |

(679 |

) |

|

$ |

(2,524 |

) |

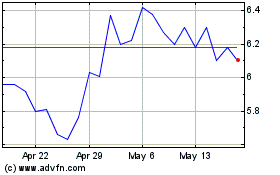

Cytek Biosciences (NASDAQ:CTKB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cytek Biosciences (NASDAQ:CTKB)

Historical Stock Chart

From Nov 2023 to Nov 2024