Cyclerion Therapeutics, Inc. (Nasdaq: CYCN) today announced

corporate updates and first quarter 2023 financial results.

Definitive Agreement Signed

On May 11, 2023 Cyclerion entered into a

definitive agreement to sell two of its sGC* stimulator assets,

zagociguat (formerly CY6463) and CY3018, to a new private company

(“NewCo”) formed by certain current Cyclerion shareholders and new

investors who have agreed to invest $81M to advance these assets.

Under the terms of the agreement, Cyclerion will receive an $8M

cash payment at closing, reimbursement for all expenses related to

zagociguat and CY3018 for the period between signing and closing of

the transaction, and 10% equity ownership in NewCo that is subject

to anti-dilution protection through $100M in post-money valuation.

Cyclerion will also have additional future equity purchase rights

in NewCo. The transaction is subject to approval by Cyclerion

shareholders and, once completed, will enable the assets to be

developed in NewCo with the capital and capabilities to advance

them while giving Cyclerion shareholders the opportunity to

participate in future value creation without having the obligation

to make direct investments and take on the risk of these

early-stage programs.

Go Forward Strategy

Previously, Cyclerion out-licensed the

peripherally active sGC stimulator praliciguat to Akebia

Therapeutics, Inc. (“Akebia”), a leading biopharmaceutical company

focused on kidney disease. Under the terms of that agreement, the

Company is eligible to receive up to $585M in development,

regulatory, and commercialization milestones, as well as

sales-based royalties. Cyclerion retains full rights to olinciguat,

an oral, once-daily, peripheral sGC stimulator, that has shown a

favorable safety and tolerability profile, drug characteristics,

and dose-dependent pharmacological activity in several placebo

controlled clinical studies. Olinciguat has a strong patent estate

with intellectual property exclusivity to the late 2030s. sGC

stimulators are now approved for PAH** and HFrEF*** (both

multibillion dollar opportunities). In similar fashion to today’s

transaction and the Akebia license, Cyclerion intends to identify a

partner with deep cardiovascular experience to maximize

olinciguat’s value while minimizing distraction and operating

expense.

These external development deals make up a

growing diverse portfolio of upside value for our shareholders and

the potential for non-dilutive funds from upfront and milestone

payments and/or monetization of equity positions and royalties. The

externalization of the initial sGC assets means that Cyclerion now

has the opportunity to bring in new assets to develop using its

highly efficient and externalized model. The Company will initially

target assets in the CNS therapeutic area that are at a later stage

of development and can be advanced to approval more quickly.

Upon approval of the current transaction by

Cyclerion shareholders, Peter Hecht will transition out of his

Cyclerion CEO role and join NewCo as its CEO. Dr. Hecht, a major

Cyclerion shareholder, will continue to serve as a Cyclerion

Director. Cyclerion has initiated a search to bring in a new leader

to drive the company’s strategy going forward.

Board of Directors

Current independent board member Errol De Souza

has been elected to serve as the chair of the Cyclerion Board

effective immediately. Dr. De Souza is a seasoned R&D and

business leader with broad experience - from large pharma to start

ups - in the discovery and development of therapeutics for the

treatment of CNS disorders.

“I am excited to have a unique platform from

which to exercise my passion for finding underappreciated and

undervalued neuro assets. I’ve been fortunate to have had multiple

successful opportunities to uncover important neuro therapies

through approval that are having profound impacts on patients’

lives, and I’ve done so in a variety of circumstances, including

small biotechs” said Errol De Souza, Chair of the Cyclerion Board

of Directors. “I am looking forward to the opportunity to take

learnings from each of those and apply them to Cyclerion alongside

a group of supportive, long-term, core investors.”

ADv Study Results

Cyclerion recently completed the analysis of its

signal-seeking clinical study of zagociguat for the potential

treatment of Alzheimer’s disease with vascular pathology (ADv)

(NCT04798989). This exploratory, randomized, placebo-controlled,

study of oral once-daily zagociguat was designed to evaluate

safety, tolerability, and pharmacokinetics as well as explore the

impact on biomarkers and cognitive performance over a twelve-week

dosing period. The total number of participants in the study was

capped at 12 participants due to challenges associated with

enrollment. Data from this study show that the safety and

tolerability profile of once-daily zagociguat was consistent with

prior studies. Given the small number of participants Cyclerion is

unable to draw any conclusions from the data generated in the

study.

Equity Investment

Signing of the definitive agreement today

triggered the previously announced $5M equity investment by CEO

Peter Hecht. This investment will take place on May 19, 2023 and

Hecht will receive a mix of common stock and nonvoting convertible

preferred stock of Cyclerion at a minimum purchase price of $0.434

per share, subject to adjustment for any reverse stock split or

similar event. The proceeds from this investment and the $8M

upfront from the sale of zagociguat and CY3018 are expected to

support ongoing operations for at least 12 months post-closing of

the transaction.

Financial Position

- Cash, cash equivalents, and

restricted cash balance on March 31, 2023 was approximately $7.2

million, as compared to approximately $13.4 million on December 31,

2022.

- Research and development expenses

were approximately $3.8 million for Q1 2023, as compared to

approximately $9.7 million for Q1 2022. The decrease of

approximately $6.0 million was primarily driven by decreases of

$3.1 million in external research and development costs related to

zagociguat and CY3018, $1.6 million in employee-related expenses,

$0.6 million in non-cash stock-based compensation, and $0.6 million

in professional services.

- General and administrative expenses

were approximately $3.3 million for Q1 2023, as compared to

approximately $4.0 million for Q1 2022. The decrease of

approximately $0.7 million was primarily driven by a decrease in

non-cash stock-based compensation.

- Net Loss: Net loss was

approximately $7.0 million for Q1 2023, as compared to

approximately $13.0 million for Q1 2022.

About Cyclerion

TherapeuticsCyclerion Therapeutics is a

clinical-stage biopharmaceutical company on a mission to develop

treatments for serious diseases. Cyclerion’s portfolio includes

novel sGC stimulators that modulate a key node in a fundamental

signaling network in both the CNS and the periphery. The

multidimensional pharmacology elicited by the stimulation of sGC

has the potential to impact a broad range of diseases. Zagociguat

is a CNS-penetrant sGC stimulator that has shown rapid improvements

across a range of endpoints reflecting multiple domains of disease

activity, including mitochondrial disease-associated biomarkers.

CY3018 is a CNS-targeted sGC stimulator in preclinical development

that preferentially localizes to the brain and has a pharmacology

profile that suggests its potential for the treatment of

neuropsychiatric diseases and disorders. Praliciguat is a systemic

sGC stimulator that is licensed to Akebia and being advanced in

rare kidney disease. Olinciguat is a vascular sGC stimulator that

the Company intends to out-license for cardiovascular diseases. For

more information about Cyclerion, please

visit https://www.cyclerion.com/ and follow us on Twitter

(@Cyclerion) and LinkedIn (www.linkedin.com/company/cyclerion).

Forward Looking

StatementCertain matters discussed in this press release

are “forward-looking statements”. We may, in some cases, use terms

such as “predicts,” “believes,” “potential,” “continue,”

“estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,”

“could,” “might,” “will,” “should”, “positive” or other words that

convey uncertainty of future events or outcomes to identify these

forward-looking statements. In particular, the Company’s statements

regarding the assessment of the best combination of capital,

capabilities, and transactions available to it resulting in the

Company pursuing a transaction or that any transaction, if pursued,

will be completed on attractive terms, the success of any such

potential transactions in delivering any future value to the

Company, the sufficiency of any expected revenues to provide

liquidity and capital resources to pursue any of our go-forward

business plans regarding any product candidate, the potential for

zagociguat in the treatment of mitochondrial diseases, the

potential for CY3018 in the treatment of CNS diseases, the

potential for olinciguat in the treatment of cardiovascular and

cardiopulmonary diseases, the potential for any successful

development of any of our assets, and other trends and potential

future results are examples of such forward-looking statements. The

forward-looking statements include risks and uncertainties,

including, but not limited to, the success of any transactions in

delivering any future value to the company, our ability to succeed

with any go-forward business, the sufficiency of any expected

proceeds to provide liquidity and capital resources to pursue any

of our go-forward business plans regarding any product candidate

(including without limitation our ability to fund additional

clinical trials); any ability to successfully demonstrate the

efficacy, safety and therapeutic effectiveness of any product

candidate; any results of clinical studies not necessarily being

indicative of or supported by the final results of subsequent

clinical trials; the timing of and ability to pursue, obtain and

maintain U.S. Food and Drug Administration (“FDA”) or other

regulatory authority approval of, or other action with respect to,

product candidates; the Company’s ability to successfully defend

its intellectual property or obtain necessary licenses at a cost

acceptable to the Company, if at all; the successful implementation

of the Company’s research and development programs and

collaborations; the success of the Company’s license agreements;

the acceptance by the market of the product candidates, if

approved; and other factors, including general economic conditions

and regulatory developments, not within the Company’s control. The

factors discussed herein could cause actual results and

developments to be materially different from those expressed in or

implied by such statements. The forward-looking statements are made

only as of the date of this press release and the Company

undertakes no obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstance.

* sGC (Soluble guanylate cyclase)

** PAH (Pulmonary arterial hypertension)

*** HFrEF (Heart failure with reduced ejection

fraction)

Investors and Media

Inquiries

Cyclerion Investor RelationsPhone:

857-327-8778Email: IR@cyclerion.com

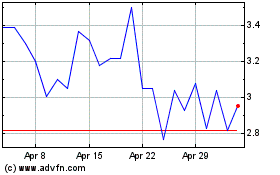

Cyclerion Therapeutics (NASDAQ:CYCN)

Historical Stock Chart

From Apr 2024 to May 2024

Cyclerion Therapeutics (NASDAQ:CYCN)

Historical Stock Chart

From May 2023 to May 2024