UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024

Commission File Number: 001-39446

CureVac N.V.

(Exact Name of Registrant as Specified in Its

Charter)

Friedrich-Miescher-Strasse 15, 72076

Tübingen, Germany

+49 7071 9883 0

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

On May 24, 2024, CureVac N.V. (the “Company”)

convened the annual general meeting of shareholders to be held on June 24, 2024 and made available to its shareholders certain other materials

in connection with such meeting.

The information in this Form 6-K (including Exhibit

99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CUREVAC N.V. |

|

| |

|

|

|

| |

By: |

/s/ Alexander Zehnder |

|

| |

|

Chief Executive Officer |

|

Date: May 24, 2024

EXHIBIT INDEX

Exhibit 99.1

CONVENING NOTICE

This is the convening notice for the annual general

meeting of CureVac N.V. (the "Company") to be held at the offices of NautaDutilh N.V. (address: Beethovenstraat 400,

1082 PR Amsterdam, the Netherlands) on June 24, 2024 at 2:00 p.m. Central European Summer Time (the "AGM").

The agenda for the AGM is as follows:

| 2. | Discussion of the annual report over the financial year 2023 (discussion item) |

| 3. | Adoption of the annual accounts over the financial year 2023 (voting item) |

| 4. | Explanation of the dividend and reservation policy (discussion item) |

| 5. | Release of managing directors from liability for the exercise of their duties during the financial year

2023 (voting item) |

| 6. | Release of supervisory directors from liability for the exercise of their duties during the financial

year 2023 (voting item) |

| 7. | Appointment of Thaminda Ramanayake as member of the Company´s management board (voting item) |

| 8. | Reappointment of Malte Greune as member of the Company's management board (voting item) |

| 9. | Reappointment of Jean Stéphenne as member of the Company's supervisory board (voting item) |

| 10. | Reappointment of Mathias Hothum as member of the Company's supervisory board (voting item) |

| 11. | Appointment of Birgit Hofmann as member of the Company's supervisory board (voting item) |

| 12. | Reappointment of the external auditor for the financial year 2025 (voting item) |

No business shall be voted on at the AGM, except

such items as included in the abovementioned agenda.

The agenda with the explanatory notes thereto,

the annual report and annual accounts for the financial year 2023, and the other meeting information are available as of the date hereof

for inspection and can be obtained free of charge at the office address of the Company and from the Company's website (http://www.curevac.com).

The registration date for the AGM is May 27, 2024

(the "Registration Date"). Those who are shareholders of the Company, or who otherwise have voting rights and/or meeting

rights with respect to shares in the Company's capital, on the Registration Date and who are recorded as such in the Company's shareholders'

register and/or in the register maintained by the Company's U.S. transfer agent (the "Persons with Meeting Rights") may

attend and, if relevant, vote at the AGM and exercise their voting rights on the voting items as included in the abovementioned agenda.

Those who beneficially own shares in the Company's

capital in an account at a bank, broker, financial institution or other financial intermediary (the "Beneficial Owners")

on the Registration Date, must request a proxy from their bank, broker, financial institution or other financial intermediary authorizing

the relevant Beneficial Owner to attend and, if relevant, exercise voting rights at the AGM.

Persons with Meeting Rights and Beneficial Owners

who wish to attend the AGM, either in person or by proxy, must notify the Company of their identity and intention to attend the AGM by

sending notice to that effect to the Company by e-mail (addressed to agm2024@curevac.com). This notice must be received by the

Company no later than Friday, June 21, 2024 at 23:59 p.m. Central European Summer Time (the "Cut-off Time"). Persons

with Meeting Rights and Beneficial Owners who have not complied with this requirement may be refused entry to the AGM. Beneficial Owners

must enclose with their attendance notice (i) proof of their beneficial ownership of the relevant underlying shares in the Company's capital

as of the Registration Date, such as a recent account statement, and (ii) their signed proxy from the relevant bank, broker, financial

institution or other financial intermediary.

Persons with Meeting Rights and Beneficial Owners

who have duly registered for the AGM and who wish to have themselves represented at the AGM by a proxyholder, may do so through the use

of a written or electronically recorded proxy. They must submit their signed proxy to the Company no later than the Cut-off Time. A proxy

form can be downloaded from the Company's website (http://www.curevac.com). Persons with Meeting Rights and Beneficial Owners who have

duly registered for the AGM may also submit questions in advance of the AGM by sending an e-mail to the Company prior to the Cut-off Time

(addressed to agm2024@curevac.com), in which case the Company shall endeavor to respond to those questions at the AGM to the extent

possible and allowed.

Persons with Meeting Rights, Beneficial Owners

and their respective proxyholders who have not complied with these requirements may be refused entry to the AGM. In addition, only those

Persons with Meeting Rights and Beneficial Owners who have properly registered for the AGM are granted the possibility by the Company

to follow the AGM via webcast. In order to receive the link to stream the webcast, you will need to indicate to the Company by e-mail

(addressed to agm2024@curevac.com) prior to the Cut-off Time, that you would like to follow the AGM via webcast. It will not be

possible to vote or raise any questions during the live webcast.

EXPLANATORY NOTES TO THE AGENDA

These are the explanatory notes to the agenda

for the annual general meeting of CureVac N.V. (the "Company") to be held at the offices of NautaDutilh N.V. (address:

Beethovenstraat 400, 1082 PR Amsterdam, the Netherlands) on June 24, 2024 at 2:00 p.m. Central European Summer Time (the "AGM").

| 2. | Discussion of the annual report over the financial year 2023

(discussion item) |

The Company's annual report over the

financial year 2023 has been made available on the Company's website (www.curevac.com) and at the Company's office address.

| 3. | Adoption of the annual accounts over the financial year 2023

(voting item) |

The Company's annual accounts over

the financial year 2023 have been made available on the Company's website (www.curevac.com) and at the Company's office address. It is

proposed that these annual accounts be adopted.

| 4. | Explanation of the dividend and reservation policy (discussion

item) |

The Company has never paid or declared

any cash dividends on its ordinary shares, and the Company does not anticipate paying any cash dividends on its ordinary shares in the

foreseeable future. The Company's current dividend and reservation policy is to retain all available funds and any future earnings to

fund the development and expansion of the Company's business. Under Dutch law, the Company may only pay dividends to the extent its shareholders'

equity (eigen vermogen) exceeds the sum of the paid-in and called-up share capital plus the reserves required to be maintained

by Dutch law or by its articles of association and (if it concerns a distribution of profits) after adoption of the annual accounts by

the general meeting from which it appears that such dividend distribution is allowed. Subject to such restrictions, any future determination

to pay dividends will be at the discretion of the Company's management board with the approval of the Company's supervisory board and

will depend upon a number of factors, including the Company's results of operations, financial condition, future prospects, contractual

restrictions, restrictions imposed by applicable law and other factors the management board and supervisory board deem relevant.

| 5. | Release of managing directors from liability for the exercise of their duties during the financial

year 2023 (voting item) |

It is proposed that the Company's managing

directors be released from liability for the exercise of their duties during the financial year 2023. The scope of this release from liability

extends to the exercise of their respective duties insofar as these are reflected in the Company's annual report or annual accounts over

the financial year 2023 or in other public disclosures.

| 6. | Release of supervisory directors from liability for the exercise of their duties during the financial

year 2023 (voting item) |

It is proposed that the Company's supervisory

directors be released from liability for the exercise of their duties during the financial year 2023. The scope of this release from liability

extends to the exercise of their respective duties insofar as these are reflected in the Company's annual report or annual accounts over

the financial year 2023 or in other public disclosures.

| 7. | Appointment of Thaminda Ramanayake as member of the Company's management board (voting item) |

The Company's supervisory

board has made a binding nomination to appoint Thaminda Ramanayake as managing director of the Company for a period of three (3) years,

ending at the end of the annual general meeting of the Company to be held in the year 2027.

Thaminda Ramanayake,

MSc, MBA, age 48, will serve as the chief business officer for the company. He is an industry expert in biotechnology, corporate development

and transactions specialist who has over a decade of working experience. He has a strong track record in growth-companies, licensing-deals,

joint ventures, and (cross-border) Mergers & Acquisitions.

Mr. Thaminda previously

served as Vice President, Global Head of Business Development, Oncology at Sanofi, shaping the company’s oncology business strategy

and lead oncology search, evaluation, and transactions teams under the global business development organization.

Before Mr. Thaminda

joined Sanofi, he led and initiated global business development, alliance management and strategic corporate opportunities for BioMarin

Pharmaceutical Inc. Earlier in his career, he served in prominent senior positions in business development for Amgen, Grant Thornton,

Ernst & Young and Empire Valuation Consultants.

Mr. Thaminda holds

a Master of Science degree in immunology and a Master of Business Administration in Finance from the University of Rochester. Before he

earned a Bachelor of Arts degree in cellular, molecular & systems biology.

The Company's supervisory board has considered the diversity

objectives of the Company, such as nationality, age, gender, education and work background, in the preparation of this proposal.

| 8. | Reappointment of Malte Greune as member of the Company's management board (voting item) |

The Company's supervisory

board has made a binding nomination to reappoint Malte Greune as managing director of the Company for a period of three (3) years, ending

at the end of the annual general meeting of the Company to be held in the year 2027.

Malte Greune, Ph.D., age 59, has been

the Company´s chief operating officer since July 2021. Dr. Greune joined CureVac from Sanofi-Aventis Deutschland GmbH, where he

held various management positions for almost ten years. As General Manager and Vice President Cartridges, Devices & Insulin Technology

Group, he was responsible for several manufacturing sites in Frankfurt. Under his leadership, six isolator filling lines for insulins,

oncology drugs and biologics were set up including one for a COVID-19 vaccine. Prior to his position as Head of Diabetes, Oncology and

Devices at Sanofi, he worked as the Senior Vice President of Animal Health Manufacturing for the Merck Manufacturing Division, USA, where

he led an international network of 28 sites, including 18 integrated vaccine sites. Furthermore, he held various leadership roles at the

pharmaceutical companies Schering-Plough and Intervet International B.V. Dr. Greune started his career at Hoechst AG in Corporate Planning.

Dr. Greune received his Ph.D. in Economics from the University of Cologne, Germany, graduated from the University of Trier, Germany, and

completed a Master of Business Administration at Clark University in Worcester, USA.

The Company's supervisory board has

considered the diversity objectives of the Company, such as nationality, age, gender, education and work background, in the preparation

of this proposal.

| 9. | Reappointment of Jean Stéphenne as member of the Company's supervisory board (voting item) |

The Company's supervisory

board has made a binding nomination to reappoint Jean Stéphenne as supervisory director of the Company for a period of one (1)

year, ending at the end of the annual general meeting of the Company to be held in the year 2025.

Mr. Stéphenne,

MSc, MBA, age 75, is former Chairman and President of GSK Biologicals. He began his career with SmithKline-Rit where he became Chairman

and Chief Executive Officer. He served as the President of Union Wallonne des Entreprises (UWE) from 1997 to 2000. Furthermore, Jean Stéphenne

has been Chairman of BESIX Group S.A./N.V. and TiGenix N.V. Currently he serves on the Board of various life sciences companies including

Bone Therapeutics, Vaxxilon, and Bepharbel. He also heads the board of Nanocyl, a company specialized in carbon nanotubes for batteries

and polymers.

Mr. Stéphenne

holds 16,758 shares in the Company's share capital.

Mr. Stéphenne is being nominated

for reappointment in view of his knowledge of the Company and the dedication with which he has performed his duties as a supervisory director

during his previous term of office, his financial and management experience in international business, his knowledge and experience in

social and employment related matters, his understanding of corporate responsibility and his experience in disclosure and communication

matters.

If reappointed, Mr. Stéphenne

will receive compensation as a supervisory director of the Company consistent with the compensation package approved by the Company's

general meeting held on June 24, 2021.

| 10. | Reappointment of Mathias Hothum as member of the Company's supervisory board (voting item) |

dievini (as defined

in the articles of association of the Company) has made a binding nomination to reappoint Mathias Hothum as supervisory director of the

Company for a period of three (3) years, ending at the end of the annual general meeting of the Company to be held in the year 2027.

Mr. Hothum, Ph.D., age 57, is managing

director of dievini GmbH & Co. KG, advisors in health sciences. Dievini manages the biotech investments of SAP co-founder Dietmar

Hopp. He received his degree in Economics from the University of Mannheim and his doctorate from the University of Magdeburg.

For the past 20 years, he has worked

as an economist in the sectors of healthcare, health services and life sciences. Mathias specializes in pricing, reimbursement and the

evaluation of mid-sized companies, as well as of publicly-owned/market-listed companies. He is the owner and founder of HMM Consulting.

Furthermore, he serves as a member of the boards of Apogenix GmbH, Cytonet GmbH, Joimax GmbH, and Novaliq GmbH. He is also a supervisory

board member of Immatics N.V. and Heidelberg Pharma AG.

Mr. Hothum holds

106,349 shares in the Company's share capital.

Mr. Hothum is being nominated for reappointment

in view of his knowledge of the Company and the dedication with which he has performed his duties as a supervisory director during his

previous term of office, his financial and management experience in international business, his knowledge and experience in social and

employment related matters, his understanding of corporate responsibility and his experience in disclosure and communication matters.

If reappointed, Mr. Hothum will receive

compensation as a supervisory director of the Company consistent with the compensation package approved by the Company's general meeting

held on June 24, 2021.

| 11. | Appointment of Birgit Hofmann as member of the Company's supervisory board (voting item) |

KfW (as defined in the articles of

association of the Company) has made a binding nomination to appoint Birgit Hofmann as supervisory director of the Company for a period

of three (3) years, ending at the end of the annual general meeting of the Company to be held in the year 2027.

Ms. Hofmann, MA, age 58, is leading

the department for “Environmental innovations, Electromobility, Batteries” at the German Federal Ministry for Economic Affairs

and Climate Action. Her tasks include the support of the establishment of new technologies for the decarbonization and the digitization

of key industrial sectors in Germany and in Europe. She headed several task-forces for the establishment and scaling of new firms, as

well as for structural change and turnaround strategies. These involved responsibility for National and European Platforms of Action and

Dialog between the public, the administration and enterprises to create newly decarbonized and digitized industries.

Among other roles she was engaged in

the department for European Aspects of Industrial Policy and at the permanent representation of Germany at the OECD, Paris, prior to her

current leadership. For the past 28 years she was involved in important public functions to foster innovations, new technologies, founding

companies and strengthen economic conditions.

She holds a Master of Economics from

the University of Constance and was a visiting fellow of the department of economics at Harvard University, Cambridge, USA.

Ms. Hofmann does not hold any shares

in the Company's share capital.

Ms. Hofmann is being nominated for

appointment in view of her dedication with which she has performed her duties, her financial and management experience in administrative

and economic matters, her knowledge and experience in European and national regulatory framework conditions, social and employment related

matters, her understanding of corporate responsibility and her experience in disclosure and communication matters.

If appointed, Mrs. Birgit Hofmann will

receive compensation as a supervisory director of the Company consistent with the compensation package approved by the Company's general

meeting held on June 24, 2021.

| 12. | Reappointment of the external auditor for the financial year

2025 (voting item) |

It is proposed that KPMG N.V. will

be reappointed and instructed to audit the Company's statutory annual report and annual accounts and, to the extent relevant, the Company's

sustainability reporting for the financial year 2025.

Exhibit 99.2

CUREVAC N.V. FRIEDRICH-MIESCHER-STRASSE 15 TUEBINGEN

72076 GERMANY SCAN TO VIEW MATERIALS & VOTE VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit

your voting instructions and for electronic delivery of information. Vote by 23:59 p.m. CEST on 21 June 2024. Have your proxy card in

hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials,

you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To

sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you

agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone

to transmit your voting instructions. Vote by 23:59 p.m. CEST on 21 June 2024. Have the proxy card mailed to you in hand when you call

and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have

provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, by 23:59 p.m. CEST on 21 June 2024. VOTE

BY EMAIL Mark, sign and date your proxy card and return it via email to agm2024@curevac.com by 23:59 p.m. CEST on 21 June 2024. TO VOTE,

MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS V52100-P14297 DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. CUREVAC N.V. The Board of Directors recommends you vote FOR proposals 1 through

9. For Against Abstain 1. Adoption of the annual accounts over the financial year 2023 2. Release of managing directors from liability

for the exercise of their duties during the financial year 2023 3. Release of supervisory directors from liability for the exercise of

their duties during the financial year 2023 4. Appointment of Thaminda Ramanayake as member of the Company's management board 5. Reappointment

of Malte Greune as member of the Company's management board 6. Reappointment of Jean Stephenne as member of the Company's supervisory

board 7. Reappointment of Mathias Hothum as member of the Company's supervisory board 8. Appointment of Birgit Hofmann as member of the

Company's supervisory board 9. Reappointment of the external auditor for the financial year 2025 Please sign exactly as your name(s)

appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners

should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name

by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy

Materials for the Annual General Meeting: The Notice of Meeting is available at www.proxyvote.com V52101-P14297 CUREVAC N.V. Annual General

Meeting of Shareholders 24 June 2024 This proxy is solicited by the Board of Directors The undersigned hereby registers for the annual

general meeting of shareholders of CureVac N.V. to be held on 24 June 2024 at 2:00 p.m. Central European Summer Time (the "AGM") and,

for purposes of being represented at the AGM, grants a power of attorney to each civil law notary and candidate civil law notary working

with NautaDutilh N.V. (each, a "Proxyholder") to represent and to vote, as designated on the reverse side of this ballot, all of the

common shares of CureVac N.V. that the undersigned is entitled to vote at the AGM, and to exercise any other right of the undersigned

which the undersigned would be allowed to exercise at the AGM. This power of attorney is granted with full power of substitution. The

relationship between the undersigned and each Proxyholder is governed exclusively by the laws of the Netherlands. The AGM will be held

at the offices of NautaDutilh N.V. (address: Beethovenstraat 400, 1082 PR Amsterdam, the Netherlands). This proxy, when properly executed,

will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors'

recommendations. Continued and to be signed on reverse side

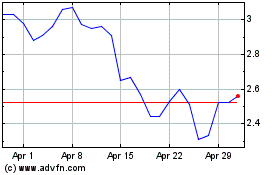

CureVac NV (NASDAQ:CVAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

CureVac NV (NASDAQ:CVAC)

Historical Stock Chart

From Dec 2023 to Dec 2024