- Surpasses $4 billion ending ARR milestone, grows 27%

year-over-year to reach $4.02 billion

- Exceeds $1 billion quarterly total revenue milestone, grows 29%

year-over-year to reach $1.01 billion

- Delivers cash flow from operations of $326 million and free

cash flow of $231 million, achieving a free cash flow rule of

51

CrowdStrike Holdings, Inc. (Nasdaq: CRWD) today announced

financial results for the third quarter fiscal year 2025, ended

October 31, 2024.

“CrowdStrike surpassed $4 billion in ending ARR in the quarter -

the fastest and only pure play cybersecurity software company to

reach this reported milestone - as our single platform approach and

trailblazing innovation continue to resonate at-scale,” said George

Kurtz, Founder and CEO. “With over 97% gross retention, customers

remain committed to the technological superiority of the Falcon

platform and the benefits of cybersecurity consolidation.

Accelerating module adoption and customers embracing our

transformational Falcon Flex subscription model give us confidence

in CrowdStrike’s bright future as cybersecurity’s AI platform of

record.”

Commenting on the company’s financial results, Burt Podbere,

CrowdStrike’s chief financial officer, added, “Our third quarter

results reflect our focused execution and financial discipline,

which drove a strong finish and quarter-over-quarter increase in

pipeline, despite expected headwinds from the July 19th incident.

We saw incredible success with our customer commitment packages as

customers embraced the program and chose to deepen their

relationship with CrowdStrike.”

Third Quarter Fiscal 2025 Financial Highlights

- Revenue: Total revenue was $1,010.2 million, a 29%

increase, compared to $786.0 million in the third quarter of fiscal

2024. Subscription revenue was $962.7 million, a 31% increase,

compared to $733.5 million in the third quarter of fiscal

2024.

- Annual Recurring Revenue (ARR) grew 27% year-over-year

to $4.02 billion as of October 31, 2024, of which $153.0 million

was net new ARR added in the quarter.

- Subscription Gross Margin: GAAP subscription gross

margin was 78% for the third quarter of both fiscal 2025 and 2024.

Non-GAAP subscription gross margin was 80% for the third quarter of

both fiscal 2025 and 2024.

- Income/Loss from Operations: GAAP loss from operations

was $55.7 million, compared to income of $3.2 million in the third

quarter of fiscal 2024. Non-GAAP income from operations was $194.9

million, compared to $175.7 million in the third quarter of fiscal

2024.

- Net Income/Loss Attributable to CrowdStrike: GAAP net

loss attributable to CrowdStrike was $16.8 million, compared to

income of $26.7 million in the third quarter of fiscal 2024. GAAP

net loss per share attributable to CrowdStrike, diluted, was $0.07,

compared to income of $0.11 in the third quarter of fiscal 2024.

Non-GAAP net income attributable to CrowdStrike was $234.3 million,

compared to $199.2 million in the third quarter of fiscal 2024.

Non-GAAP net income attributable to CrowdStrike per share, diluted,

was $0.93, compared to $0.82 in the third quarter of fiscal

2024.

- Cash Flow: Net cash generated from operations was $326.1

million, compared to $273.5 million in the third quarter of fiscal

2024. Free cash flow was $230.6 million, compared to $239.0 million

in the third quarter of fiscal 2024.

- Cash and Cash Equivalents was $4.26 billion as of

October 31, 2024.

Recent Highlights

- CrowdStrike’s module adoption rates grew to 66%, 47%, 31%, and

20% for five or more, six or more, seven or more, and eight or more

modules, respectively, as of October 31, 20241.

- Named a Leader in the 2024 Gartner Magic Quadrant™ for Endpoint

Protection Platforms2 for the fifth consecutive time, positioned

furthest right for Completeness of Vision and highest for Ability

to Execute among all vendors evaluated.

- Received the highest scores among evaluated vendors for Core

Endpoint Protection and Managed Security Services Use Cases in the

2024 Gartner® Critical Capabilities for Endpoint Protection

Platforms (EPP) report3, for the second consecutive time.

- Recognized as a Frost Radar™ Leader in Cloud Workload

Protection Platforms4 for the Second Consecutive Year.

- Acknowledged as a Leader in the 2024 GigaOm Radar Report for

Cloud-Native Application Protection Platforms (CNAPPs)5.

- Positioned as a Leader in The Forrester Wave™: Attack Surface

Management Solutions, Q3 20246.

- Named a Major Player in the IDC MarketScape: Worldwide Security

Information and Event Management (SIEM) for Enterprise 2024 Vendor

Assessment report7.

- Unveiled a series of new and enhanced offerings during the

eighth annual Fal.Con cybersecurity conference. Announcements

included Endpoint Security; Cloud Security; Identity Protection;

Next-Gen SIEM; Exposure Management; Charlotte AI and Falcon for IT

innovations; Project Kestrel, a revolutionary new user experience

and CrowdStrike Financial Services.

- Acquired Adaptive Shield, a leader in SaaS security, making

CrowdStrike the only cybersecurity vendor to provide unified,

end-to-end protection against identity-based attacks across the

entire modern cloud ecosystem.

- Received new ISO/IEC 27001:2022 certification for newer

products made generally available, including Falcon Next-Gen SIEM,

Charlotte AI and Falcon for IT.

- Expanded Cybersecurity Startup Accelerator with AWS and NVIDIA

to support the next generation of global cloud security

companies.

- Announced a strategic partnership with Fortinet to unify

best-in-class endpoint and firewall protection.

- Partnered with Omnissa to deliver real-time threat detection

and automated remediation for Virtual Desktop Infrastructure (VDI)

and physical desktop environments while improving customers’

digital work experience and productivity.

- Established new strategic partnerships with CardinalOps, Nagomi

and Veriti to deliver intelligence-led threat defense across the

enterprise.

- Extended partnership with 1Password to simplify security for

150,000 customers, with a focus on small and midsize businesses

(SMBs).

- Announced the expansion of the CrowdStrike Marketplace, a

one-stop destination for the world-class ecosystem of

CrowdStrike-compatible security products.

Financial Outlook

CrowdStrike is providing the following guidance for the fiscal

fourth quarter of fiscal 2025 (ending January 31, 2025) and full

fiscal year 2025 (ending January 31, 2025).

Guidance for non-GAAP financial measures excludes stock-based

compensation expense, amortization expense of acquired intangible

assets (including purchased patents), amortization of debt issuance

costs and discount, mark-to-market adjustments on deferred

compensation liabilities, legal reserve and settlement charges or

benefits, July 19 Incident related costs and (recoveries), net,

acquisition-related provision (benefit) for income taxes, losses

(gains) and other income from strategic investments,

acquisition-related expenses (credits), net, and losses (gains)

from deferred compensation assets. The company has not provided the

most directly comparable GAAP measures because certain items are

out of the company's control or cannot be reasonably predicted.

Accordingly, a reconciliation for non-GAAP income from operations,

non-GAAP net income attributable to CrowdStrike, and non-GAAP net

income per share attributable to CrowdStrike common stockholders is

not available without unreasonable effort.

Q4 FY25

Full Year FY25

Guidance

Guidance

Total revenue

$1,028.7 - $1,035.4 million

$3,923.8 - $3,930.5 million

Non-GAAP income from operations

$184.0 - $189.0 million

$804.4 - $809.4 million

Non-GAAP net income attributable to

CrowdStrike

$210.9 - $215.8 million

$937.5 - $942.6 million

Non-GAAP net income per share attributable

to CrowdStrike common stockholders, diluted

$0.84 - $0.86

$3.74 - $3.76

Weighted average shares used in computing

non-GAAP net income per share attributable to common stockholders,

diluted

252 million

251 million

These statements are forward-looking and actual results may

differ materially as a result of many factors. Refer to the

Forward-Looking Statements safe harbor below for information on the

factors that could cause the company's actual results to differ

materially from these forward-looking statements.

Conference Call Information

CrowdStrike will host a conference call for analysts and

investors to discuss its earnings results for the third quarter of

fiscal 2025 and outlook for its fiscal fourth quarter and fiscal

year 2025 today at 2:00 p.m. Pacific time (5:00 p.m. Eastern time).

A recorded webcast of the event will also be available for one year

on the CrowdStrike Investor Relations website

ir.crowdstrike.com.

Date:

November 26, 2024

Time:

2:00 p.m. Pacific time / 5:00 p.m. Eastern

time

Webcast link:

crowdstrike-fiscal-third-quarter-2025-results-conference-call.open-exchange.net/registration

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks and uncertainties, including statements regarding

CrowdStrike’s future growth, and future financial and operating

performance, including CrowdStrike’s financial outlook for the

fourth quarter fiscal 2025, fiscal year 2025, and beyond. There are

a significant number of factors that could cause actual results to

differ materially from statements made in this press release,

including: risks associated with the content configuration update

CrowdStrike released on July 19, 2024 for its Falcon sensor that

resulted in system crashes for certain Windows systems (the “July

19 Incident”); risks associated with managing CrowdStrike’s rapid

growth; CrowdStrike’s ability to identify and effectively implement

necessary changes to address execution challenges; risks associated

with new products and subscription and support offerings, including

the risk of defects, errors, or vulnerabilities; CrowdStrike's

ability to respond to an intensely competitive market; length and

unpredictability of sales cycles; CrowdStrike’s ability to attract

new and retain existing customers; CrowdStrike’s ability to

successfully integrate acquisitions; the failure to timely develop

and achieve market acceptance of new products and subscriptions as

well as existing products and subscriptions and support;

CrowdStrike’s ability to collaborate and integrate its products

with offerings from other parties to deliver benefits to customers;

industry trends; rapidly evolving technological developments in the

market for security products and subscription and support

offerings; and general market, political, economic, and business

conditions, including those related to a deterioration in

macroeconomic conditions, inflation, geopolitical uncertainty and

conflicts, public health crises, and volatility in the banking and

financial services sector.

Additional risks and uncertainties that could affect

CrowdStrike’s financial results are included in the filings

CrowdStrike makes with the Securities and Exchange Commission

(“SEC”) from time to time, particularly under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” including CrowdStrike’s most

recently filed Annual Report on Form 10-K, most recently filed

Quarterly Report on Form 10-Q, and subsequent filings.

You should not rely on these forward-looking statements, as

actual outcomes and results may differ materially from those

contemplated by these forward-looking statements as a result of

such risks and uncertainties. All forward-looking statements in

this press release are based on information available to

CrowdStrike as of the date hereof, and CrowdStrike does not assume

any obligation to update the forward-looking statements provided to

reflect events that occur or circumstances that exist after the

date on which they were made.

Use of Non-GAAP Financial Information

CrowdStrike believes that the presentation of non-GAAP financial

information provides important supplemental information to

management and investors regarding financial and business trends

relating to CrowdStrike’s financial condition and results of

operations. For further information regarding these non-GAAP

measures, including the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures,

please refer to the financial tables below, as well as the

“Explanation of Non-GAAP Financial Measures” section of this press

release.

Channels for Disclosure of Information

CrowdStrike intends to announce material information to the

public through the CrowdStrike Investor Relations website

ir.crowdstrike.com, SEC filings, press releases, public conference

calls, and public webcasts. CrowdStrike uses these channels, as

well as social media and its blog, to communicate with its

investors, customers, and the public about the company, its

offerings, and other issues. It is possible that the information

CrowdStrike posts on social media and its blog could be deemed to

be material information. As such, CrowdStrike encourages investors,

the media, and others to follow the channels listed above,

including the social media channels listed on CrowdStrike’s

investor relations website, and to review the information disclosed

through such channels. Any updates to the list of disclosure

channels through which CrowdStrike will announce information will

be posted on the investor relations page on CrowdStrike’s

website.

Definition of Module Adoption Rates

1.

Module adoption rates are calculated by

taking the total number of customers with five or more, six or

more, seven or more, and eight or more modules, respectively,

divided by the total number of subscription customers (excluding

Falcon Go customers). Falcon Go customers are defined as customers

who have subscribed with the Falcon Go bundle, a package designed

for organizations with 100 endpoints or less.

Reports Referenced and Disclaimers

2.

Gartner, Magic Quadrant for Endpoint

Protection Platforms, Evgeny Mirolyubov, Franz Hinner, 23 September

2024

3.

Gartner, Critical Capabilities for

Endpoint Protection Platforms, Evgeny Mirolyubov, Franz Hinner,

Satarupa Patnaik, Deepak Mishra, Chris Silva, 28 October 2024

4.

2024 Frost Radar™: Global Cloud Workload

Protection Platform (CWPP)

5.

GigaOm Radar for Cloud-Native Application

Protection Platforms (CNAPPs), 29 October 2024

6.

The Forrester Wave™: Attack Surface

Management Solutions, Q3 2024

7.

IDC MarketScape: Worldwide Security

Information and Event Management (SIEM) for Enterprise 2024 Vendor

Assessment, September 2024, IDC #US51541324

GARTNER is a registered trademark and service mark of Gartner

and Magic Quadrant is a registered trademark of Gartner, Inc.

and/or its affiliates in the U.S. and internationally and are used

herein with permission. All rights reserved. Gartner does not

endorse any vendor, product or service depicted in its research

publications, and does not advise technology users to select only

those vendors with the highest ratings or other designation.

Gartner research publications consist of the opinions of Gartner’s

research organization and should not be construed as statements of

fact. Gartner disclaims all warranties, expressed or implied, with

respect to this research, including any warranties of

merchantability or fitness for a particular purpose.

The Gartner content described herein (the “Gartner Content”)

represents research opinion or viewpoints published, as part of a

syndicated subscription service, by Gartner, Inc. ("Gartner"), and

is not a representation of fact. Gartner Content speaks as of its

original publication date (and not as of the date of this earnings

presentation), and the opinions expressed in the Gartner Content

are subject to change without notice.

About CrowdStrike Holdings

CrowdStrike (Nasdaq: CRWD), a global cybersecurity leader, has

redefined modern security with the world’s most advanced

cloud-native platform for protecting critical areas of enterprise

risk – endpoints and cloud workloads, identity, and data.

Powered by the CrowdStrike Security Cloud and world-class AI,

the CrowdStrike Falcon® platform leverages real-time indicators of

attack, threat intelligence, evolving adversary tradecraft, and

enriched telemetry from across the enterprise to deliver

hyper-accurate detections, automated protection and remediation,

elite threat hunting, and prioritized observability of

vulnerabilities.

Purpose-built in the cloud with a single lightweight-agent

architecture, the Falcon platform delivers rapid and scalable

deployment, superior protection and performance, reduced

complexity, and immediate time-to-value.

CrowdStrike: We stop breaches.

For more information, please visit: ir.crowdstrike.com

© 2024 CrowdStrike, Inc. All rights reserved. CrowdStrike and

CrowdStrike Falcon are marks owned by CrowdStrike, Inc. and are

registered in the United States and other countries. CrowdStrike

owns other trademarks and service marks and may use the brands of

third parties to identify their products and services.

CROWDSTRIKE HOLDINGS,

INC.

Condensed Consolidated

Statements of Operations

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Revenue

Subscription

$

962,735

$

733,463

$

2,753,164

$

2,074,610

Professional services

47,443

52,551

141,922

135,610

Total revenue

1,010,178

786,014

2,895,086

2,210,220

Cost of revenue

Subscription (1)(2)

216,301

159,830

605,868

455,236

Professional services (1)

38,786

35,174

111,623

91,915

Total cost of revenue

255,087

195,004

717,491

547,151

Gross profit

755,091

591,010

2,177,595

1,663,069

Operating expenses

Sales and marketing (1)(2)(4)(6)

408,267

286,186

1,113,852

850,209

Research and development

(1)(2)(3)(4)(6)

275,602

196,072

761,759

554,499

General and administrative

(1)(2)(3)(4)(5)(6)

126,945

105,589

337,113

290,027

Total operating expenses

810,814

587,847

2,212,724

1,694,735

Income (loss) from operations

(55,723

)

3,163

(35,129

)

(31,666

)

Interest expense(7)

(6,587

)

(6,503

)

(19,647

)

(19,334

)

Interest income

52,201

40,086

149,577

107,245

Other income (expense), net(8)(9)

(429

)

(474

)

6,196

(1,978

)

Income (loss) before provision for income

taxes

(10,538

)

36,272

100,997

54,267

Provision for income taxes(10)

6,281

9,603

24,862

18,623

Net income (loss)

(16,819

)

26,669

76,135

35,644

Net income attributable to non-controlling

interest

3

4

3,124

16

Net income (loss) attributable to

CrowdStrike

$

(16,822

)

$

26,665

$

73,011

$

35,628

Net income (loss) per share attributable

to CrowdStrike common stockholders:

Basic

$

(0.07

)

$

0.11

$

0.30

$

0.15

Diluted

$

(0.07

)

$

0.11

$

0.29

$

0.15

Weighted-average shares used in computing

net income (loss) per share attributable to CrowdStrike common

stockholders:

Basic

245,536

239,297

244,017

237,890

Diluted

245,536

243,799

250,747

242,196

____________________________

(1) Includes stock-based compensation expense as follows (in

thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Subscription cost of revenue

$

18,613

$

11,477

$

49,261

$

30,575

Professional services cost of revenue

7,498

5,645

21,115

16,020

Sales and marketing

56,251

42,544

165,914

129,725

Research and development

81,874

52,388

224,467

143,754

General and administrative

44,652

47,560

132,133

135,173

Total stock-based compensation expense

$

208,888

$

159,614

$

592,890

$

455,247

(2) Includes amortization of acquired intangible assets,

including purchased patents, as follows (in thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Subscription cost of revenue

$

5,389

$

3,580

$

15,823

$

10,741

Sales and marketing

603

506

1,808

1,483

Research and development

—

468

—

468

General and administrative

341

83

1,034

221

Total amortization of acquired intangible

assets

$

6,333

$

4,637

$

18,665

$

12,913

(3) Includes acquisition-related expenses, net as follows (in

thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Research and development

$

—

$

379

$

477

$

750

General and administrative

1,393

3,277

4,075

3,204

Total acquisition-related expenses,

net

$

1,393

$

3,656

$

4,552

$

3,954

(4) Includes mark-to-market adjustments on deferred compensation

liabilities as follows (in thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Sales and marketing

$

41

$

(68

)

$

184

$

(33

)

Research and development

56

(34

)

202

(20

)

General and administrative

6

(15

)

27

(8

)

Total mark-to-market adjustments on

deferred compensation liabilities

$

103

$

(117

)

$

413

$

(61

)

(5) Includes legal reserve and settlement charges as follows (in

thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

General and administrative

$

—

$

4,700

$

—

$

6,797

Total legal reserve and settlement

charges

$

—

$

4,700

$

—

$

6,797

(6) Includes July 19 Incident related costs, net such as legal

fees, remediation costs, sensor testing costs, and insurance

receivables among others, as follows (in thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Sales and marketing

$

15,089

$

—

$

18,182

$

—

Research and development

3,549

—

4,550

—

General and administrative

15,284

—

16,322

—

Total July 19 Incident related costs,

net

$

33,922

$

—

$

39,054

$

—

(7) Includes amortization of debt issuance costs and discount as

follows (in thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Interest expense

$

547

$

547

$

1,640

$

1,640

Total amortization of debt issuance costs

and discount

$

547

$

547

$

1,640

$

1,640

(8) Includes gains and other income from strategic investments

as follows (in thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Other income, net

$

6

$

7

$

6,248

$

31

Total gains and other income from

strategic investments

$

6

$

7

$

6,248

$

31

(9) Includes gains (losses) on deferred compensation assets as

follows (in thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Other income (expenses), net

$

103

$

(117

)

$

413

$

(61

)

Total gains (losses) on deferred

compensation assets

$

103

$

(117

)

$

413

$

(61

)

(10) Includes benefit for income taxes related to acquisitions

as follows (in thousands):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Benefit for income taxes

$

—

$

(615

)

$

—

$

(615

)

Total benefit for income taxes

$

—

$

(615

)

$

—

$

(615

)

CROWDSTRIKE HOLDINGS,

INC.

Condensed Consolidated Balance

Sheets

(in thousands)

(unaudited)

October 31, 2024

January 31, 2024

Assets

Current assets:

Cash and cash equivalents

$

4,260,324

$

3,375,069

Short-term investments

—

99,591

Accounts receivable, net of allowance for

credit losses

813,922

853,105

Deferred contract acquisition costs,

current

294,229

246,370

Prepaid expenses and other current

assets

203,852

183,172

Total current assets

5,572,327

4,757,307

Strategic investments

68,246

56,244

Property and equipment, net

746,567

620,172

Operating lease right-of-use assets

46,289

48,211

Deferred contract acquisition costs,

noncurrent

421,773

335,933

Goodwill

722,016

638,041

Intangible assets, net

109,354

114,518

Other long-term assets

96,386

76,094

Total assets

$

7,782,958

$

6,646,520

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

79,214

$

28,180

Accrued expenses

176,598

125,896

Accrued payroll and benefits

324,889

234,624

Operating lease liabilities, current

15,658

14,150

Deferred revenue

2,363,258

2,270,757

Other current liabilities

40,763

23,672

Total current liabilities

3,000,380

2,697,279

Long-term debt

743,610

742,494

Deferred revenue, noncurrent

833,260

783,342

Operating lease liabilities,

noncurrent

32,683

36,230

Other liabilities, noncurrent

77,414

50,086

Total liabilities

4,687,347

4,309,431

Commitments and contingencies

Stockholders’ Equity

Common stock, Class A and Class B

124

121

Additional paid-in capital

4,045,660

3,364,328

Accumulated deficit

(985,825

)

(1,058,836

)

Accumulated other comprehensive loss

(2,026

)

(1,663

)

Total CrowdStrike Holdings, Inc.

stockholders’ equity

3,057,933

2,303,950

Non-controlling interest

37,678

33,139

Total stockholders’ equity

3,095,611

2,337,089

Total liabilities and stockholders’

equity

$

7,782,958

$

6,646,520

CROWDSTRIKE HOLDINGS,

INC.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Nine Months Ended October

31,

2024

2023

Operating activities

Net income

$

76,135

$

35,644

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

137,851

89,972

Amortization of intangible assets

18,665

12,913

Amortization of deferred contract

acquisition costs

227,713

173,158

Non-cash operating lease cost

11,100

9,725

Stock-based compensation expense

592,890

455,247

Deferred income taxes

(2,122

)

(2,355

)

Realized gains on strategic

investments

(6,227

)

—

Non-cash interest expense

2,748

2,337

Accretion of short-term investments

purchased at a discount

2,285

(1,934

)

Changes in operating assets and

liabilities, net of impact of acquisitions

Accounts receivable, net

39,184

65,858

Deferred contract acquisition costs

(361,412

)

(206,678

)

Prepaid expenses and other assets

(42,832

)

(21,972

)

Accounts payable

34,096

2,361

Accrued expenses and other liabilities

85,667

33,597

Accrued payroll and benefits

89,896

1,810

Operating lease liabilities

(11,812

)

(16,147

)

Deferred revenue

142,180

185,655

Net cash provided by operating

activities

1,036,005

819,191

Investing activities

Purchases of property and equipment

(167,641

)

(123,945

)

Capitalized internal-use software and

website development costs

(41,266

)

(38,605

)

Purchases of strategic investments

(12,702

)

(12,177

)

Proceeds from sales of strategic

investments

10,895

—

Business acquisitions, net of cash

acquired

(96,381

)

(238,749

)

Purchases of intangible assets

—

(526

)

Purchases of short-term investments

—

(195,581

)

Proceeds from maturities and sales of

short-term investments

97,300

250,000

Purchases of deferred compensation

investments

(1,815

)

(1,462

)

Proceeds from sales of deferred

compensation investments

41

—

Net cash used in investing activities

(211,569

)

(361,045

)

Financing activities

Proceeds from issuance of common stock

upon exercise of stock options

3,308

6,178

Proceeds from issuance of common stock

under the employee stock purchase plan

56,099

45,432

Distributions to non-controlling interest

holders

(4,085

)

—

Capital contributions from non-controlling

interest holders

5,500

8,088

Net cash provided by financing

activities

60,822

59,698

Effect of foreign exchange rates on cash,

cash equivalents and restricted cash

(641

)

(3,411

)

Net increase in cash, cash equivalents and

restricted cash

884,617

514,433

Cash, cash equivalents and restricted

cash, at beginning of period

3,377,597

2,456,924

Cash, cash equivalents and restricted

cash, at end of period

$

4,262,214

$

2,971,357

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations

(in thousands, except

percentages)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

GAAP subscription revenue

$

962,735

$

733,463

$

2,753,164

$

2,074,610

GAAP professional services revenue

47,443

52,551

141,922

135,610

GAAP total revenue

$

1,010,178

$

786,014

$

2,895,086

$

2,210,220

GAAP subscription gross profit

$

746,434

$

573,633

$

2,147,296

$

1,619,374

Stock based compensation expense

18,613

11,477

49,261

30,575

Amortization of acquired intangible

assets

5,389

3,580

15,823

10,741

Non-GAAP subscription gross profit

$

770,436

$

588,690

$

2,212,380

$

1,660,690

GAAP subscription gross margin

78

%

78

%

78

%

78

%

Non-GAAP subscription gross margin

80

%

80

%

80

%

80

%

GAAP professional services gross

profit

$

8,657

$

17,377

$

30,299

$

43,695

Stock based compensation expense

7,498

5,645

21,115

16,020

Non-GAAP professional services gross

profit

$

16,155

$

23,022

$

51,414

$

59,715

GAAP professional services gross

margin

18

%

33

%

21

%

32

%

Non-GAAP professional services gross

margin

34

%

44

%

36

%

44

%

Total GAAP gross margin

75

%

75

%

75

%

75

%

Total Non-GAAP gross margin

78

%

78

%

78

%

78

%

GAAP sales and marketing operating

expenses

$

408,267

$

286,186

$

1,113,852

$

850,209

Stock based compensation expense

(56,251

)

(42,544

)

(165,914

)

(129,725

)

Amortization of acquired intangible

assets

(603

)

(506

)

(1,808

)

(1,483

)

Mark-to-market adjustments on deferred

compensation liabilities

(41

)

68

(184

)

33

July 19 Incident related costs, net

(15,089

)

—

(18,182

)

—

Non-GAAP sales and marketing operating

expenses

$

336,283

$

243,204

$

927,764

$

719,034

GAAP sales and marketing operating

expenses as a percentage of revenue

40

%

36

%

38

%

38

%

Non-GAAP sales and marketing operating

expenses as a percentage of revenue

33

%

31

%

32

%

33

%

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations (continued)

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

GAAP research and development operating

expenses

$

275,602

$

196,072

$

761,759

$

554,499

Stock based compensation expense

(81,874

)

(52,388

)

(224,467

)

(143,754

)

Amortization of acquired intangible

assets

—

(468

)

—

(468

)

Acquisition-related expenses, net

—

(379

)

(477

)

(750

)

Mark-to-market adjustments on deferred

compensation liabilities

(56

)

34

(202

)

20

July 19 Incident related costs, net

(3,549

)

—

(4,550

)

—

Non-GAAP research and development

operating expenses

$

190,123

$

142,871

$

532,063

$

409,547

GAAP research and development operating

expenses as a percentage of revenue

27

%

25

%

26

%

25

%

Non-GAAP research and development

operating expenses as a percentage of revenue

19

%

18

%

18

%

19

%

GAAP general and administrative operating

expenses

$

126,945

$

105,589

$

337,113

$

290,027

Stock based compensation expense

(44,652

)

(47,560

)

(132,133

)

(135,173

)

Acquisition-related expenses, net

(1,393

)

(3,277

)

(4,075

)

(3,204

)

Amortization of acquired intangible

assets

(341

)

(83

)

(1,034

)

(221

)

Mark-to-market adjustments on deferred

compensation liabilities

(6

)

15

(27

)

8

Legal reserve and settlement charges

—

(4,700

)

—

(6,797

)

July 19 Incident related costs, net

(15,284

)

—

(16,322

)

—

Non-GAAP general and administrative

operating expenses

$

65,269

$

49,984

$

183,522

$

144,640

GAAP general and administrative operating

expenses as a percentage of revenue

13

%

13

%

12

%

13

%

Non-GAAP general and administrative

operating expenses as a percentage of revenue

6

%

6

%

6

%

7

%

GAAP income (loss) from operations

$

(55,723

)

$

3,163

$

(35,129

)

$

(31,666

)

Stock based compensation expense

208,888

159,614

592,890

455,247

Amortization of acquired intangible

assets

6,333

4,637

18,665

12,913

Acquisition-related expenses, net

1,393

3,656

4,552

3,954

Mark-to-market adjustments on deferred

compensation liabilities

103

(117

)

413

(61

)

Legal reserve and settlement charges

—

4,700

—

6,797

July 19 Incident related costs, net

33,922

—

39,054

—

Non-GAAP income from operations

$

194,916

$

175,653

$

620,445

$

447,184

GAAP operating margin

(6

)%

—

%

(1

)%

(1

)%

Non-GAAP operating margin

19

%

22

%

21

%

20

%

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations (continued)

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

GAAP net income (loss) attributable to

CrowdStrike

$

(16,822

)

$

26,665

$

73,011

$

35,628

Stock based compensation expense

208,888

159,614

592,890

455,247

Amortization of acquired intangible

assets

6,333

4,637

18,665

12,913

Acquisition-related expenses, net

1,393

3,656

4,552

3,954

Amortization of debt issuance costs and

discount

547

547

1,640

1,640

Mark-to-market adjustments on deferred

compensation liabilities

103

(117

)

413

(61

)

Legal reserve and settlement charges

—

4,700

—

6,797

July 19 Incident related costs, net

33,922

—

39,054

—

Benefit for income taxes1

—

(615

)

—

(615

)

Gains and other income from strategic

investments attributable to CrowdStrike

(3

)

(4

)

(3,124

)

(16

)

Losses (gains) on deferred compensation

assets

(103

)

117

(413

)

61

Non-GAAP net income attributable to

CrowdStrike

$

234,258

$

199,200

$

726,688

$

515,548

Weighted-average shares used in computing

GAAP basic net income (loss) per share attributable to CrowdStrike

common stockholders

245,536

239,297

244,017

237,890

GAAP basic net income (loss) per share

attributable to CrowdStrike common stockholders

$

(0.07

)

$

0.11

$

0.30

$

0.15

GAAP diluted net income (loss) per share

attributable to CrowdStrike common stockholders

$

(0.07

)

$

0.11

$

0.29

$

0.15

Stock-based compensation

0.83

0.65

2.36

1.88

Amortization of acquired intangible

assets

0.03

0.02

0.07

0.05

Acquisition-related expenses, net

0.01

0.01

0.02

0.02

Amortization of debt issuance costs and

discount

—

—

0.01

0.01

Mark-to-market adjustments on deferred

compensation liabilities

—

—

—

—

Legal reserve and settlement charges

—

0.02

—

0.03

July 19 Incident related costs, net

0.14

—

0.16

—

Benefit for income taxes1

—

—

—

—

Gains and other income from strategic

investments attributable to CrowdStrike

—

—

(0.01

)

—

Losses (gains) on deferred compensation

assets

—

—

—

—

Other2

(0.01

)

0.01

—

(0.01

)

Non-GAAP diluted net income per share

attributable to CrowdStrike common stockholders

$

0.93

$

0.82

$

2.90

$

2.13

Weighted-average shares used to calculate

Non-GAAP diluted net income per share attributable to CrowdStrike

common stockholders

250,777

243,799

250,747

242,196

__________________________

1. CrowdStrike uses its GAAP provision for

income taxes for the purpose of determining its non-GAAP income tax

expense. The tax costs for intellectual property integration

relating to acquisitions are included in the GAAP provision for

income taxes. The income tax benefits related to stock-based

compensation, amortization of acquired intangibles assets,

including purchased patents, acquisition related expenses,

amortization of debt issuance costs and discount, gains and other

income from strategic investments attributable to CrowdStrike, July

19 Incident related costs and (recoveries), net, and legal reserve

and settlement charges or benefits included in the GAAP provision

for income taxes were not material for all periods presented.

2. For periods in which CrowdStrike had

diluted non-GAAP net income per share attributable to CrowdStrike

common stockholders, the sum of the impact of individual

reconciling items may not total to diluted Non-GAAP net income per

share attributable to CrowdStrike common stockholders because of

rounding differences.

CROWDSTRIKE HOLDINGS,

INC.

GAAP to Non-GAAP

Reconciliations (continued)

(in thousands, except

percentages)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

GAAP net cash provided by operating

activities

$

326,136

$

273,518

$

1,036,005

$

819,191

Purchases of property and equipment

(78,704

)

(21,264

)

(167,641

)

(123,945

)

Capitalized internal-use software and

website development costs

(16,271

)

(12,630

)

(41,266

)

(38,605

)

Purchases of deferred compensation

investments

(606

)

(586

)

(1,815

)

(1,462

)

Proceeds from sales of deferred

compensation investments

—

—

(41

)

—

Free cash flow

$

230,555

$

239,038

$

825,242

$

655,179

GAAP net cash used in investing

activities

$

(105,581

)

$

(468,836

)

$

(211,569

)

$

(361,045

)

GAAP net cash provided by financing

activities

$

844

$

2,053

$

60,822

$

59,698

GAAP net cash provided by operating

activities as a percentage of revenue

32

%

35

%

36

%

37

%

Purchases of property and equipment as a

percentage of revenue

(8

)%

(3

)%

(6

)%

(6

)%

Capitalized internal-use software and

website development costs as a percentage of revenue

(2

)%

(2

)%

(1

)%

(2

)%

Purchases of deferred compensation

investments as a percentage of revenue

—

%

—

%

—

%

—

%

Proceeds from sale of deferred

compensation investments

—

%

—

%

—

%

—

%

Free cash flow margin

23

%

30

%

29

%

30

%

Explanation of Non-GAAP Financial Measures

In addition to determining results in accordance with U.S.

generally accepted accounting principles (“GAAP”), CrowdStrike

believes the following non-GAAP measures are useful in evaluating

its operating performance. CrowdStrike uses the following non-GAAP

financial information to evaluate its ongoing operations and for

internal planning and forecasting purposes. CrowdStrike believes

that non-GAAP financial information, when taken collectively, may

be helpful to investors because it provides consistency and

comparability with past financial performance and facilitates

period-to-period comparisons of operations, as these measures

eliminate the effects of certain variables unrelated to

CrowdStrike’s overall operating performance. However, non-GAAP

financial information is presented for supplemental informational

purposes only, has limitations as an analytical tool, and should

not be considered in isolation or as a substitute for financial

information presented in accordance with GAAP.

Other companies, including companies in CrowdStrike’s industry,

may calculate similarly titled non-GAAP measures differently or may

use other measures to evaluate their performance, all of which

could reduce the usefulness of CrowdStrike’s non-GAAP financial

measures as tools for comparison.

Investors are encouraged to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures

and not rely on any single financial measure to evaluate

CrowdStrike’s business.

Non-GAAP Subscription Gross Profit and Non-GAAP Subscription

Gross Margin

CrowdStrike defines non-GAAP subscription gross profit and

non-GAAP subscription gross margin as GAAP subscription gross

profit and GAAP subscription gross margin, respectively, excluding

stock-based compensation expense, and amortization of acquired

intangible assets.

Non-GAAP Income from Operations

CrowdStrike defines non-GAAP income from operations as GAAP

income (loss) from operations excluding stock-based compensation

expense, amortization of acquired intangible assets (including

purchased patents), acquisition-related expenses (credits), net,

mark-to-market adjustments on deferred compensation liabilities,

legal reserve and settlement charges or benefits, and July 19

Incident related costs and (recoveries), net.

Non-GAAP Net Income Attributable to CrowdStrike

The company defines non-GAAP net income attributable to

CrowdStrike as GAAP net income (loss) attributable to CrowdStrike

excluding stock-based compensation expense, amortization of

acquired intangible assets (including purchased patents),

acquisition-related expenses (credits), net, amortization of debt

issuance costs and discount, mark-to-market adjustments on deferred

compensation liabilities, legal reserve and settlement charges or

benefits, July 19 Incident related costs and (recoveries), net,

acquisition-related provision (benefit) for income taxes, losses

(gains) and other income from strategic investments, and losses

(gains) on deferred compensation assets.

Non-GAAP Net Income per Share Attributable to CrowdStrike

Common Stockholders, Diluted

CrowdStrike defines non-GAAP net income per share attributable

to CrowdStrike common stockholders, as non-GAAP net income

attributable to CrowdStrike divided by the weighted-average shares

outstanding, which includes the dilutive effect of potentially

dilutive common stock equivalents outstanding during the

period.

Free Cash Flow

Free cash flow is a non-GAAP financial measure that CrowdStrike

defines as net cash provided by operating activities less purchases

of property and equipment, capitalized internal-use software and

website development costs, purchases of deferred compensation

investments, and proceeds from sale of deferred compensation

investments. CrowdStrike monitors free cash flow as one measure of

its overall business performance, which enables CrowdStrike to

analyze its future performance without the effects of non-cash

items and allow CrowdStrike to better understand the cash needs of

its business. While CrowdStrike believes that free cash flow is

useful in evaluating its business, free cash flow is a non-GAAP

financial measure that has limitations as an analytical tool, and

free cash flow should not be considered as an alternative to, or

substitute for, net cash provided by operating activities in

accordance with GAAP. The utility of free cash flow as a measure of

CrowdStrike’s liquidity is further limited as it does not represent

the total increase or decrease in CrowdStrike’s cash balance for

any given period. In addition, other companies, including companies

in CrowdStrike's industry, may calculate free cash flow differently

or not at all, which reduces the usefulness of free cash flow as a

tool for comparison.

Explanation of Operational Measures

Annual Recurring Revenue

ARR is calculated as the annualized value of CrowdStrike’s

customer subscription contracts as of the measurement date,

assuming any contract that expires during the next 12 months is

renewed on its existing terms. To the extent that CrowdStrike is

negotiating a renewal with a customer after the expiration of the

subscription, CrowdStrike continues to include that revenue in ARR

if CrowdStrike is actively in discussion with such an organization

for a new subscription or renewal, or until such organization

notifies CrowdStrike that it is not renewing its subscription.

Magic Number

Magic Number is calculated by performing the following

calculation for the most recent four quarters and taking the

average: annualizing the difference between a quarter’s

Subscription Revenue and the prior quarter’s Subscription Revenue,

and then dividing the resulting number by the previous quarter’s

Non-GAAP Sales & Marketing Expense. Magic Number = Average of

previous four quarters: ((Quarter GAAP Subscription Revenue – Prior

Quarter GAAP Subscription Revenue) x 4) / Prior Quarter Non-GAAP

Sales & Marketing Expense.

Free Cash Flow Rule of 40

Free cash flow rule of 40 is calculated by taking the current

quarter total revenue year over year growth rate percentage and

summing it with the current quarter free cash flow margin

percentage.

Dollar-Based Gross Retention Rate

Dollar-based gross retention rate as of the period end is

calculated by starting with the ARR from all subscription customers

as of 12 months prior to such period, or Prior Period ARR. Then

deduct from the Prior Period ARR any ARR from subscription

customers who are no longer customers as of the current period end,

or Current Period Remaining ARR. Then divide the total Current

Period Remaining ARR by the total Prior Period ARR to arrive at our

dollar-based gross retention rate, which is the percentage of ARR

from all subscription customers as of the year prior that is not

lost to customer churn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241126970319/en/

Investor Relations Contact CrowdStrike Holdings, Inc.

Maria Riley, Vice President of Investor Relations

investors@crowdstrike.com 669-721-0742

Press Contact CrowdStrike Holdings, Inc. Jake Schuster,

Senior Director, Public Relations & Media Strategy

press@crowdstrike.com

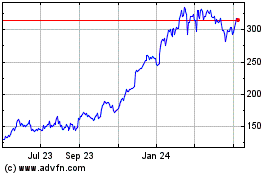

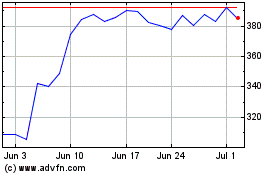

CrowdStrike (NASDAQ:CRWD)

Historical Stock Chart

From Nov 2024 to Dec 2024

CrowdStrike (NASDAQ:CRWD)

Historical Stock Chart

From Dec 2023 to Dec 2024