Community Trust Bancorp, Inc. (NASDAQ: CTBI):

Earnings Summary (in thousands except per share data)

2Q

2018

1Q

2018

2Q

2017

6 Months

2018

6 Months

2017

Net income $11,599 $15,814 $11,541 $27,413 $22,818 Earnings per

share $0.66 $0.89 $0.65 $1.55 $1.29 Earnings per share - diluted

$0.66 $0.89 $0.65 $1.55 $1.29 Return on average assets 1.11%

1.55% 1.14% 1.33% 1.15% Return on average equity 8.56% 12.00% 8.97%

10.26% 9.00% Efficiency ratio 66.05% 59.24% 59.32% 62.67% 60.23%

Tangible common equity 11.51% 11.43% 11.19% Dividends

declared per share $0.33 $0.33 $0.32 $0.66 $0.64 Book value per

share $30.59 $30.33 $29.14 Weighted average shares 17,687

17,671 17,626 17,679 17,621 Weighted average shares - diluted

17,703 17,687 17,645 17,695 17,641

Community Trust Bancorp, Inc. (NASDAQ: CTBI) reports earnings

for the second quarter 2018 of $11.6 million, or $0.66 per basic

share, compared to $15.8 million, or $0.89 per basic share, earned

during the first quarter 2018 and $11.5 million, or $0.65 per basic

share, earned during the second quarter 2017. Earnings for the six

months ended June 30, 2018 were $27.4 million, or $1.55 per basic

share, compared to $22.8 million or $1.29 per basic share earned

during the six months ended June 30, 2017.

As disclosed by CTBI in Annual Reports on Form 10-K for the

years ended December 31, 2017 and 2016, and previous Quarterly

Reports on Form 10-Q, CTB will be required to make certain customer

reimbursements related to two deposit add-on products. CTBI further

disclosed in such filings that management had established a related

accrual, and that the actual reimbursement amount could materially

vary from the amount management had evaluated as most likely. On

June 14, 2018, CTBI filed a Form 8-K disclosing an increase in the

accrual from $1.2 million to $4.75 million to reflect a change in

the amount management determined to be the most likely amount as a

result of communications with regulatory agency representatives. As

a result of the increased accrual, a charge to earnings was

reflected in the second quarter 2018 financial results of $2.8

million after-tax, or $0.16 per share.

2nd Quarter 2018 Highlights

- Net interest income for the quarter of

$35.1 million was an increase of $0.6 million, or 1.6%, from first

quarter 2018 and $0.9 million, or 2.7%, from prior year second

quarter.

- Provision for loan losses for the

quarter ended June 30, 2018 increased $1.0 million from prior

quarter but decreased $0.8 million from prior year same

quarter.

- Our loan portfolio increased $50.8

million, an annualized 6.5%, during the quarter and $81.7 million,

or 2.6%, from June 30, 2017.

- Net loan charge-offs for the quarter

ended June 30, 2018 were $1.3 million, or 0.17% of average loans

annualized, compared to $1.9 million, or 0.25%, experienced for the

first quarter 2018 and $1.3 million, or 0.18%, for the second

quarter 2017.

- Nonperforming loans at $22.0 million

decreased $3.9 million from March 31, 2018 and $6.0 million from

June 30, 2017. Nonperforming assets at $52.3 million decreased $5.7

million from March 31, 2018 and $8.3 million from June 30,

2017.

- Deposits, including repurchase

agreements, decreased $6.3 million during the quarter but increased

$195.4 million from June 30, 2017.

- Noninterest income for the quarter

ended June 30, 2018 of $13.7 million was an increase of $0.4

million, or 3.2%, from prior quarter and $1.4 million, or 11.6%,

from prior year same quarter. The increase in noninterest income

was primarily due to a gain on the sale of a partnership interest

resulting from a low income housing tax credit recapture and

an increase in deposit service charges.

- Noninterest expense for the quarter

ended June 30, 2018 of $32.4 million increased $3.8 million, or

13.1%, from prior quarter, and $4.9 million, or 17.7%, from prior

year same quarter. The variance in noninterest expense from prior

quarter was primarily due to the above mentioned increase in the

customer reimbursement accrual. Additionally, personnel expense

increased from prior year same quarter with increases in bonuses

and the cost of group medical and life insurance.

- Income tax expense continues to be

positively impacted by the change in the corporate income tax rate

from 35% to 21%. We utilize various tax exempt investments and

loans, including municipal bonds, bank owned life insurance, and

low income housing projects, to lower our effective income tax

rate. With the current tax laws, our effective tax rate for the six

months ended June 30, 2018 was 16% compared to 28% for the six

months ended June 30, 2017.

Net Interest Income

Net interest income for the quarter of $35.1 million was an

increase of $0.6 million, or 1.6%, from first quarter 2018 and $0.9

million, or 2.7%, from prior year second quarter. Our net interest

margin at 3.61% decreased 4 basis points from prior quarter and 7

basis points from prior year same quarter, while our average

earning assets increased $57.8 million and $145.5 million,

respectively, during those same periods. Our yield on average

earning assets increased 3 basis points from prior quarter and 18

basis points from prior year same quarter, and our cost of funds

increased 11 basis points from prior quarter and 37 basis points

from prior year same quarter. Our ratio of average loans to

deposits, including repurchase agreements, was 88.1% for the

quarter ended June 30, 2018 compared to 88.6% for the quarter ended

March 31, 2018 and 89.9% for the quarter ended June 30, 2017.

Noninterest Income

Noninterest income for the quarter ended June 30, 2018 of $13.7

million was an increase of $0.4 million, or 3.2%, from prior

quarter and $1.4 million, or 11.6%, from prior year same quarter.

The increase in noninterest income was primarily due to a gain on

the sale of a partnership interest totaling $1.0 million related to

one of our tax credit investments. As a result of the sale of this

interest, a portion of the tax credits previously claimed was

recaptured during the current quarter totaling $0.8 million, which

was recorded in income tax expense. The variance in noninterest

income from prior quarter was also impacted by a $0.3 million

increase in deposit service charges and a $0.3 million decrease in

losses on the sale of securities, offset by a $1.0 million decrease

in bank owned life insurance income and a $0.2 million decrease in

loan related fees as a result of fluctuations in the fair value

adjustments of our mortgage servicing rights. The increase from

prior year same quarter was also positively impacted by a $0.2

million increase in trust revenue. Additionally, noninterest income

for the second quarter 2017 included a $0.6 million gain on the

repurchase of trust preferred securities. Noninterest income for

the six months ended June 30, 2018 was a $3.2 million, or 13.2%,

increase from prior year.

Noninterest Expense

Noninterest expense for the quarter ended June 30, 2018 of $32.4

million increased $3.8 million, or 13.1%, from prior quarter, and

$4.9 million, or 17.7%, from prior year same quarter. The variance

in noninterest expense from prior quarter was primarily due to the

above mentioned $3.6 million increase in the customer reimbursement

accrual. Personnel expense increased from prior year same quarter

with increases in bonuses ($0.7 million) and the cost of group

medical and life insurance ($0.4 million). Noninterest expense for

the six months ended June 30, 2018 was $61.1 million, a $5.9

million or 10.7% increase over the first six months of 2017,

primarily due to the same items detailed above.

Balance Sheet Review

CTBI’s total assets at $4.2 billion increased $9.4 million, or

0.9% annualized, from March 31, 2018 and $124.1 million, or 3.0%,

from June 30, 2017. Loans outstanding at June 30, 2018 were $3.2

billion, an increase of $50.8 million, or an annualized 6.5%, from

March 31, 2018 and $81.7 million, or 2.6%, from June 30, 2017. We

experienced an increase during the quarter of $16.1 million in the

commercial loan portfolio, $5.7 million in the residential loan

portfolio, $20.2 million in the indirect loan portfolio, and $8.8

million in the consumer direct loan portfolio. CTBI’s investment

portfolio decreased $19.1 million, or an annualized 12.7%, from

March 31, 2018 and $24.8 million, or 4.1%, from June 30, 2017.

Deposits, including repurchase agreements, at $3.6 billion

decreased $6.3 million, or an annualized 0.7%, from March 31, 2018

but increased $195.4 million, or 5.8%, from June 30, 2017.

Shareholders’ equity at June 30, 2018 was $542.2 million, a 3.5%

annualized increase from the $537.5 million at March 31, 2018 and a

5.3% increase from the $514.9 million at June 30, 2017. CTBI’s

annualized dividend yield to shareholders as of June 30, 2018 was

2.64%.

Asset Quality

CTBI’s total nonperforming loans, not including troubled debt

restructurings, were $22.0 million, or 0.69% of total loans, at

June 30, 2018 compared to $25.9 million, or 0.83% of total loans,

at March 31, 2018 and $28.0 million, or 0.91% of total loans, at

June 30, 2017. Accruing loans 90+ days past due decreased $1.8

million from prior quarter and $1.2 million from June 30, 2017.

Nonaccrual loans decreased $2.1 million during the quarter and $4.8

million from June 30, 2017. Accruing loans 30-89 days past due at

$23.5 million was an increase of $6.6 million from March 31, 2018

and $8.3 million from June 30, 2017. The increase in past due loans

30-89 days is due to one relationship which is well-collateralized,

and no loss is expected. Our loan portfolio management processes

focus on the immediate identification, management, and resolution

of problem loans to maximize recovery and minimize loss. Impaired

loans, loans not expected to meet contractual principal and

interest payments other than insignificant delays, at June 30, 2018

totaled $46.7 million, a $1.5 million decrease from the $48.2

million at March 31, 2018 and a $4.0 million decrease from the

$50.7 million at June 30, 2017.

Our level of foreclosed properties at $30.3 million at June 30,

2018 was a $1.7 million decrease from the $32.0 million at March

31, 2018 and a $2.4 million decrease from the $32.6 million at June

30, 2017. Sales of foreclosed properties for the quarter ended June

30, 2018 totaled $2.4 million while new foreclosed properties

totaled $1.6 million. At June 30, 2018, the book value of

properties under contracts to sell was $1.9 million; however, the

closings had not occurred at quarter-end. Write-downs on foreclosed

properties for the second quarter 2018 totaled $0.9 million

compared to $0.5 million in the first quarter 2018 and $1.4 million

in the second quarter 2017.

Net loan charge-offs for the quarter ended June 30, 2018 were

$1.3 million, or 0.17% of average loans annualized, compared to

$1.9 million, or 0.25%, experienced for the first quarter 2018 and

$1.3 million, or 0.18%, for the second quarter 2017. Of the net

charge-offs for the quarter, $0.5 million were in commercial loans,

$0.4 million were in indirect auto loans, $0.2 million were in

residential loans, and $0.2 million were in consumer direct loans.

Allocations to loan loss reserves were $1.9 million for the quarter

ended June 30, 2018 compared to $0.9 million for the quarter ended

March 31, 2018 and $2.8 million for the quarter ended June 30,

2017. Our reserve coverage (allowance for loan and lease loss

reserve to nonperforming loans) at June 30, 2018 was 162.6%

compared to 135.6% at March 31, 2018 and 132.6% at June 30, 2017.

Our loan loss reserve as a percentage of total loans outstanding

remained at 1.13% from March 31, 2018 to June 30, 2018, down from

the 1.20% at June 30, 2017.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. Community Trust

Bancorp, Inc.’s (“CTBI”) actual results may differ materially from

those included in the forward-looking statements. Forward-looking

statements are typically identified by words or phrases such as

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “may

increase,” “may fluctuate,” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” and “could.”

These forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets,

prevailing inflation and interest rates, realized gains from sales

of investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, changes in laws and

regulations, competition, and demographic changes on target market

populations’ savings and financial planning needs; industry changes

in information technology systems on which we are highly dependent;

failure of acquisitions to produce revenue enhancements or cost

savings at levels or within the time frames originally anticipated

or unforeseen integration difficulties; and the resolution of legal

proceedings and related matters. In addition, the banking industry

in general is subject to various monetary, operational, and fiscal

policies and regulations, which include, but are not limited to,

those determined by the Federal Reserve Board, the Federal Deposit

Insurance Corporation, the Consumer Financial Protection Bureau,

and state regulators, whose policies and regulations could affect

CTBI’s results. These statements are representative only on the

date hereof, and CTBI undertakes no obligation to update any

forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $4.2 billion, is

headquartered in Pikeville, Kentucky and has 70 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, four banking

locations in northeastern Tennessee, four trust offices across

Kentucky, and one trust office in Tennessee.

Additional information follows.

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) June 30, 2018 (in thousands except per share

data and # of employees)

Three Three Three Six Six Months Months Months Months

Months Ended Ended Ended Ended Ended June 30, 2018 March 31, 2018

June 30, 2017 June 30, 2018 June 30, 2017 Interest income $ 42,025

$ 40,580 $ 38,411 $ 82,605 $ 75,179 Interest expense 6,877

5,989 4,171 12,866

7,849 Net interest income 35,148 34,591 34,240 69,739

67,330 Loan loss provision 1,929 946 2,764 2,875 3,993 Gains

on sales of loans 304 279 251 583 507 Deposit service charges 6,480

6,221 6,199 12,701 12,159 Trust revenue 2,856 2,958 2,649 5,814

5,235 Loan related fees 919 1,144 773 2,063 1,778 Securities gains

(losses) 2 (288 ) 18 (286 ) 10 Other noninterest income

3,179 2,996 2,421 6,175

4,201 Total noninterest income 13,740 13,310

12,311 27,050 23,890 Personnel expense 15,422 15,619 14,044

31,041 28,968 Occupancy and equipment 2,770 2,833 2,720 5,603 5,533

Data processing expense 1,634 1,636 1,757 3,270 3,546 FDIC

insurance premiums 279 314 315 593 607 Other noninterest expense

12,334 8,279 8,730

20,613 16,556 Total noninterest expense 32,439

28,681 27,566 61,120 55,210 Net income before taxes 14,520

18,274 16,221 32,794 32,017 Income taxes 2,921

2,460 4,680 5,381 9,199

Net income $ 11,599 $ 15,814 $ 11,541 $

27,413 $ 22,818 Memo: TEQ interest income $

42,253 $ 40,804 $ 38,910 $ 83,057 $ 76,187 Average shares

outstanding 17,687 17,671 17,626 17,679 17,621 Diluted average

shares outstanding 17,703 17,687 17,645 17,695 17,641 Basic

earnings per share $ 0.66 $ 0.89 $ 0.65 $ 1.55 $ 1.29 Diluted

earnings per share $ 0.66 $ 0.89 $ 0.65 $ 1.55 $ 1.29 Dividends per

share $ 0.33 $ 0.33 $ 0.32 $ 0.66 $ 0.64

Average

balances: Loans $ 3,131,964 $ 3,111,116 $ 3,027,044 $ 3,121,597

$ 2,990,865 Earning assets 3,928,066 3,870,216 3,782,548 3,899,301

3,743,834 Total assets 4,196,693 4,144,105 4,052,791 4,170,544

4,014,155 Deposits, including repurchase agreements 3,556,340

3,511,260 3,366,489 3,533,925 3,364,651 Interest bearing

liabilities 2,818,168 2,782,467 2,731,147 2,800,416 2,696,164

Shareholders' equity 543,513 534,278 515,834 538,921 511,560

Performance ratios: Return on average assets 1.11 % 1.55 %

1.14 % 1.33 % 1.15 % Return on average equity 8.56 % 12.00 % 8.97 %

10.26 % 9.00 % Yield on average earning assets (tax equivalent)

4.31 % 4.28 % 4.13 % 4.30 % 4.10 % Cost of interest bearing funds

(tax equivalent) 0.98 % 0.87 % 0.61 % 0.93 % 0.59 % Net interest

margin (tax equivalent) 3.61 % 3.65 % 3.68 % 3.63 % 3.68 %

Efficiency ratio (tax equivalent) 66.05 % 59.24 % 59.32 % 62.67 %

60.23 % Loan charge-offs $ 2,526 $ 2,977 $ 2,189 $ 5,503 $

4,680 Recoveries (1,179 ) (1,069 ) (845 )

(2,248 ) (1,887 ) Net charge-offs $ 1,347 $ 1,908 $

1,344 $ 3,255 $ 2,793

Market Price: High $ 53.00 $

50.70 $ 46.90 $ 53.00 $ 50.40 Low $ 43.95 $ 43.00 $ 41.07 $ 43.00 $

41.07 Close $ 49.95 $ 45.20 $ 43.75 $ 49.95 $ 43.75 As of As

of As of June 30, 2018 March 31, 2018 June 30, 2017

Assets:

Loans $ 3,169,042 $ 3,118,241 $ 3,087,342 Loan loss reserve

(35,771 ) (35,189 ) (37,133 ) Net loans 3,133,271

3,083,052 3,050,209 Loans held for sale 1,093 1,145 4,624

Securities AFS 585,764 604,890 610,368 Securities HTM 659 659 858

Other equity investments 22,814 22,814 22,814 Other earning assets

150,880 159,608 90,711 Cash and due from banks 54,987 44,792 51,224

Premises and equipment 46,483 45,860 47,036 Goodwill and core

deposit intangible 65,490 65,490 65,543 Other assets 143,745

167,427 137,726

Total

Assets $ 4,205,186 $ 4,195,737 $ 4,081,113

Liabilities and Equity: NOW accounts $ 51,563 $

55,034 $ 48,476 Savings deposits 1,156,601 1,131,371 1,070,706 CD's

>=$100,000 694,641 705,978 592,794 Other time deposits

587,078 601,942 610,770 Total

interest bearing deposits 2,489,883 2,494,325 2,322,746 Noninterest

bearing deposits 819,525 825,345

782,864 Total deposits 3,309,408 3,319,670 3,105,610

Repurchase agreements 248,781 244,822 257,208 Other interest

bearing liabilities 68,121 67,241 167,455 Noninterest bearing

liabilities 36,701 26,515 35,925

Total liabilities 3,663,011 3,658,248 3,566,198

Shareholders' equity 542,175 537,489

514,915

Total Liabilities and Equity $

4,205,186 $ 4,195,737 $ 4,081,113

Ending shares outstanding 17,725 17,721 17,671 Memo: Market value

of HTM securities $ 660 $ 660 $ 858 30 - 89 days past due

loans $ 23,488 $ 16,914 $ 15,234 90 days past due loans 7,189 9,027

8,362 Nonaccrual loans 14,812 16,923 19,651 Restructured loans

(excluding 90 days past due and nonaccrual) 56,814 56,119 53,786

Foreclosed properties 30,262 32,004 32,638 Other repossessed assets

83 118 45 Common equity Tier 1 capital 15.80 % 15.73 % 14.91

% Tier 1 leverage ratio 13.11 % 13.14 % 12.72 % Tier 1 risk-based

capital ratio 17.67 % 17.62 % 16.81 % Total risk based capital

ratio 18.84 % 18.78 % 18.05 % Tangible equity to tangible assets

ratio 11.51 % 11.43 % 11.19 % FTE employees 988 986 1,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180718005473/en/

Community Trust Bancorp, Inc.Jean R. Hale,

606-437-3294Chairman, President, and C.E.O.

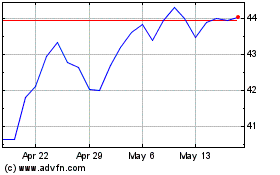

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

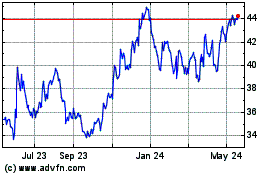

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024