Community Trust Bancorp, Inc. (NASDAQ:

CTBI):

Earnings Summary

(in

thousands except per share data)

3Q2016

2Q2016

3Q2015

9 Months2016

9 Months2015

Net income $12,312 $11,566 $11,222 $35,480 $34,562 Earnings

per share $0.70 $0.66 $0.64 $2.02 $1.98 Earnings per share -

diluted $0.70 $0.66 $0.64 $2.02 $1.98 Return on average

assets 1.25% 1.19% 1.18% 1.21% 1.23% Return on average equity 9.81%

9.46% 9.50% 9.63% 9.99% Efficiency ratio 57.45% 59.98% 60.53%

58.68% 58.82% Tangible common equity 11.24% 11.17% 10.82%

Dividends declared per share $0.32 $0.31 $0.31 $0.94 $0.91 Book

value per share $28.40 $28.11 $26.87 Weighted average shares

17,554 17,530 17,440 17,532 17,420 Weighted average shares -

diluted 17,569

17,542 17,491

17,548 17,472

Community Trust Bancorp, Inc. (NASDAQ: CTBI) reports earnings

for the third quarter 2016 of $12.3 million, or $0.70 per basic

share, compared to $11.2 million, or $0.64 per basic share, earned

during the third quarter 2015 and $11.6 million, or $0.66 per basic

share, earned during the second quarter 2016. Earnings for the nine

months ended September 30, 2016 were $35.5 million, or $2.02 per

basic share, compared to $34.6 million, or $1.98 per basic share

earned for the nine months ended September 30, 2015.

3rd Quarter 2016 Highlights

- Our loan portfolio increased $110.8

million from September 30, 2015 but decreased $0.1 million during

the quarter.

- Our investment portfolio increased

$54.0 million from September 30, 2015 and $51.6 million during the

quarter.

- Deposits, including repurchase

agreements, increased $84.9 million from September 30, 2015 and

$13.0 million during the quarter.

- Nonperforming loans at $28.3 million

decreased $4.4 million from September 30, 2015 but increased $3.6

million from June 30, 2016. Nonperforming assets at $66.1 million

decreased $1.4 million from September 30, 2015 but increased $3.5

million from June 30, 2016.

- Net loan charge-offs for the quarter

ended September 30, 2016 were $2.1 million, or 0.28% of average

loans annualized, compared to $2.2 million, or 0.31%, experienced

for the third quarter 2015 and $2.5 million, or 0.35%, for the

second quarter 2016.

Net Interest Income

Net interest income for the quarter of $33.2 million was an

increase of $0.3 million, or 0.8%, from prior year third quarter

and $0.2 million, or 0.5%, from prior quarter as we grew our

earning assets. Our net interest margin decreased 11 basis points

and 5 basis points during the respective time periods. The extended

low rate environment continues to have a negative impact on our net

interest margin as the yield on average earning assets continued to

decline while our cost of funds increased slightly. Average earning

assets increased $140.5 million, or 4.0%, from third quarter 2015

and $29.7 million, or 3.2%, annualized, from prior quarter, while

our yield on average earning assets decreased 6 basis points and 4

basis points, respectively, during these time periods. The cost of

interest bearing funds increased 6 basis points from prior year

third quarter and 1 basis point from prior quarter. Our ratio of

average loans to deposits, including repurchase agreements, for the

quarter ended September 30, 2016 was 88.3% compared to 87.5% for

the quarter ended September 30, 2015 and 88.1% for the quarter

ended June 30, 2016. Net interest income for the nine months ended

September 30, 2016 of $99.6 million was an increase of $0.6

million, or 0.6%, over the first nine months of 2015, although we

experienced a 13 basis point decline in our net interest

margin.

Noninterest Income

Noninterest income for the quarter ended September 30, 2016 of

$13.2 million was an increase of $1.2 million, or 9.6%, from prior

year same quarter and $1.4 million, or 12.0%, from prior quarter.

The increase for the quarter was primarily due to increases in

gains on sales of loans, deposit service charges, trust revenue,

loan related fees, and securities gains. Loan related fees were

affected by fluctuations in the fair value adjustments of our

mortgage servicing rights with an increase of $0.4 million from the

same quarter last year and an increase of $0.2 million quarter over

quarter. Noninterest income for the nine months ended September 30,

2016 of $35.9 million was an increase of $0.9 million, or 2.7%,

from the first nine months of 2015. The year-to-date increase in

noninterest income was primarily due to a $0.7 million increase in

deposit services charges, a $0.2 million increase in trust revenue,

and a $0.4 million increase in securities gains, partially offset

by declines in gains on sales of loans ($0.2 million) and loan

related fees ($0.1 million). Loan related fees decreased

year-to-date as a result of the $0.2 million decline in the fair

value of mortgage servicing rights.

Noninterest Expense

Noninterest expense for the quarter ended September 30, 2016 of

$26.7 million was a decrease of $0.8 million, or 3.1%, from prior

year third quarter and $0.5 million, or 1.9%, from prior quarter.

The decrease in noninterest expense from prior year same quarter

was primarily due to decreases in FDIC insurance, net other real

estate owned expense, and operating losses, partially offset by an

increase in personnel expense. The decrease from prior quarter in

FDIC insurance premiums and operating losses was combined with a

decrease in personnel expense, but was partially offset by an

increase in our net other real estate owned expense. The

fluctuation in our personnel expense is a result of changes in our

group medical insurance expense caused by differences in our claims

paid experience as a self-insured employer. Noninterest expense for

the nine months ended September 30, 2016 of $80.1 million was an

increase of $0.5 million, or 0.6%, compared to the first nine

months of 2015, primarily due to the $1.4 million increase in

personnel expense which included a $0.8 million increase in

salaries, a $1.1 million increase in the cost of group medical and

life insurance, and a $0.4 million decrease in bonuses. The

increase in personnel expense was partially offset by declines in

data processing expense ($0.5 million) and net other real estate

owned expense ($0.6 million).

Balance Sheet Review

CTBI’s total assets at $3.9 billion increased $122.1 million, or

3.2%, from September 30, 2015 and $34.9 million, or an annualized

3.6%, during the quarter. Loans outstanding at September 30, 2016

were $2.9 billion, increasing $110.8 million, or 3.9%, from

September 30, 2015 but decreasing $0.1 million during the quarter.

We experienced a decline during the quarter of $9.5 million in the

commercial loan portfolio and $5.7 million in the residential loan

portfolio, offset by increases of $12.6 million in the indirect

loan portfolio and $2.5 million in the consumer direct loan

portfolio. CTBI’s investment portfolio increased $54.0 million, or

9.3%, from September 30, 2015 and $51.6 million, or an annualized

35.3%, during the quarter. Excess cash on deposit at the Federal

Reserve was redeployed into short term investments offering higher

yields while maintaining the short duration position of our

investment portfolio. Deposits, including repurchase agreements, at

$3.3 billion increased $84.9 million, or 2.6%, from September 30,

2015 and $13.0 million, or an annualized 1.6%, from prior

quarter.

Shareholders’ equity at September 30, 2016 was $500.1 million

compared to $470.6 million at September 30, 2015 and $493.6 million

at June 30, 2016. CTBI’s annualized dividend yield to shareholders

as of September 30, 2016 was 3.45%.

Asset Quality

CTBI’s total nonperforming loans were $28.3 million at September

30, 2016, a 13.5% decrease from the $32.7 million at September 30,

2015 but a 14.6% increase from the $24.7 million at June 30, 2016.

Loans 90+ days past due increased $3.3 million during the quarter

but decreased $6.5 million from September 30, 2015. Nonaccrual

loans increased $0.4 million during the quarter and $2.1 million

from September 30, 2015. Loans 30-89 days past due at $19.8 million

was an increase of $0.8 million from June 30, 2016 and an increase

of $1.0 million from September 30, 2015. Our loan portfolio

management processes focus on the immediate identification,

management, and resolution of problem loans to maximize recovery

and minimize loss. Impaired loans, loans not expected to meet

contractual principal and interest payments other than

insignificant delays, at September 30, 2016 totaled $55.0 million,

an increase of $6.7 million from the $48.3 million at September 30,

2015 and $1.7 million from the $53.3 million at June 30, 2016.

While nonperforming loans and impaired loans increased during the

quarter, the increase was primarily in loans 90+ days past due and

still accruing. These loans are considered to be well secured and

in the process of collection. Management analyzes all loans that

are 90+ days past due or otherwise impaired to determine the amount

of impairment that should be recognized. During the quarter, the

amount of impairment recognized decreased by $0.2 million.

Our level of foreclosed properties at $37.7 million at September

30, 2016 was a $3.0 million increase from the $34.7 million at

September 30, 2015 but was relatively flat to June 30, 2016. Sales

of foreclosed properties for the quarter ended September 30, 2016

totaled $0.7 million while new foreclosed properties totaled $1.0

million. At September 30, 2016, the book value of properties under

contracts to sell was $4.7 million; however, the closings had not

occurred at quarter-end.

Net loan charge-offs for the quarter ended September 30, 2016

were $2.1 million, or 0.28% of average loans annualized, compared

to $2.2 million, or 0.31%, experienced for the third quarter 2015

and $2.5 million, or 0.35%, for the second quarter 2016. Of the net

charge-offs for the quarter, $0.8 million were in commercial loans,

$0.8 million were in indirect auto loans, $0.4 million were in

residential real estate mortgage loans, and $0.1 million were in

consumer direct loans. Allocations to loan loss reserves were $2.2

million for the quarter ended September 30, 2016 compared to $2.5

million for the quarter ended September 30, 2015 and $1.9 million

for the quarter ended June 30, 2016. Our reserve coverage

(allowance for loan and lease loss reserve to nonperforming loans)

at September 30, 2016 was 126.5% compared to 108.6% at September

30, 2015 and 144.6% at June 30, 2016. Our loan loss reserve as a

percentage of total loans outstanding remained at 1.22% at

September 30, 2016 compared to prior quarter, down from the 1.26%

at September 30, 2015.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. Community Trust

Bancorp, Inc.’s (“CTBI”) actual results may differ materially from

those included in the forward-looking statements. Forward-looking

statements are typically identified by words or phrases such as

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “may

increase,” “may fluctuate,” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” and “could.”

These forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets,

prevailing inflation and interest rates, realized gains from sales

of investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, changes in laws and

regulations, competition, and demographic changes on target market

populations’ savings and financial planning needs; industry changes

in information technology systems on which we are highly dependent;

failure of acquisitions to produce revenue enhancements or cost

savings at levels or within the time frames originally anticipated

or unforeseen integration difficulties; and the resolution of legal

proceedings and related matters. In addition, the banking industry

in general is subject to various monetary, operational, and fiscal

policies and regulations, which include, but are not limited to,

those determined by the Federal Reserve Board, the Federal Deposit

Insurance Corporation, the Consumer Financial Protection Bureau,

and state regulators, whose policies and regulations could affect

CTBI’s results. These statements are representative only on the

date hereof, and CTBI undertakes no obligation to update any

forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.9 billion, is

headquartered in Pikeville, Kentucky and has 70 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, four banking

locations in northeastern Tennessee, four trust offices across

Kentucky, and one trust office in Tennessee.

Additional information follows.

Community Trust Bancorp, Inc.

Financial Summary (Unaudited)

September 30, 2016

(in thousands except per share data and #

of employees)

Three Three Three Nine Nine Months Months Months Months

Months Ended Ended Ended Ended Ended September 30, 2016 June 30,

2016 September 30, 2015 September 30, 2016 September 30, 2015

Interest income $ 36,679 $ 36,374 $ 35,912 $ 109,580 $ 107,720

Interest expense 3,452 3,315

2,947 9,970 8,668 Net interest

income 33,227 33,059 32,965 99,610 99,052 Loan loss provision 2,191

1,873 2,520 5,829 6,740 Gains on sales of loans 595 446 462

1,357 1,575 Deposit service charges 6,563 6,272 6,348 18,680 17,976

Trust revenue 2,440 2,396 2,297 7,111 6,902 Loan related fees 1,260

739 641 2,610 2,747 Securities gains (losses) 458 (4 ) 12 522 142

Other noninterest income 1,870 1,920

2,275 5,646 5,657 Total

noninterest income 13,186 11,769 12,035 35,926 34,999

Personnel expense 14,216 14,322 13,975 42,671 41,242 Occupancy and

equipment 2,745 2,695 2,688 8,212 8,232 Data processing expense

1,601 1,559 1,577 4,729 5,204 FDIC insurance premiums 469 576 606

1,628 1,798 Other noninterest expense 7,656

8,040 8,688 22,881 23,189

Total noninterest expense 26,687 27,192 27,534 80,121 79,665

Net income before taxes 17,535 15,763 14,946 49,586 47,646

Income taxes 5,223 4,197 3,724

14,106 13,084 Net income $

12,312 $ 11,566 $ 11,222 $ 35,480 $

34,562 Memo: TEQ interest income $ 37,178 $ 36,880 $

36,414 $ 111,116 $ 109,250 Average shares outstanding 17,554

17,530 17,440 17,532 17,420 Diluted average shares outstanding

17,569 17,542 17,491 17,548 17,472 Basic earnings per share $ 0.70

$ 0.66 $ 0.64 $ 2.02 $ 1.98 Diluted earnings per share $ 0.70 $

0.66 $ 0.64 $ 2.02 $ 1.98 Dividends per share $ 0.32 $ 0.31 $ 0.31

$ 0.94 $ 0.91

Average balances: Loans $ 2,931,791 $

2,913,461 $ 2,803,332 $ 2,908,115 $ 2,773,249 Earning assets

3,664,598 3,634,945 3,524,058 3,640,043 3,506,303 Total assets

3,932,705 3,900,660 3,788,917 3,907,076 3,772,031 Deposits,

including repurchase agreements 3,319,608 3,307,591 3,203,122

3,294,233 3,184,151 Interest bearing liabilities 2,634,254

2,615,806 2,562,274 2,624,794 2,563,526

Shareholders’ equity

499,180 491,634 468,442 491,882 462,454

Performance

ratios: Return on average assets 1.25 % 1.19 % 1.18 % 1.21 %

1.23 % Return on average equity 9.81 % 9.46 % 9.50 % 9.63 % 9.99 %

Yield on average earning assets (tax equivalent) 4.04 % 4.08 % 4.10

% 4.08 % 4.17 % Cost of interest bearing funds (tax equivalent)

0.52 % 0.51 % 0.46 % 0.51 % 0.45 % Net interest margin (tax

equivalent) 3.66 % 3.71 % 3.77 % 3.71 % 3.84 % Efficiency ratio

(tax equivalent) 57.45 % 59.98 % 60.53 % 58.68 % 58.82 %

Loan charge-offs $ 2,962 $ 3,302 $ 2,899 $ 8,729 $ 7,819 Recoveries

(875 ) (797 ) (729 ) (2,607 )

(2,172 ) Net charge-offs $ 2,087 $ 2,505 $ 2,170 $ 6,122 $ 5,647

Market Price: High $ 37.49 $ 36.95 $ 37.63 $ 37.49 $

37.63 Low $ 33.71 $ 32.98 $ 33.62 $ 30.89 $ 31.53 Close $ 37.11 $

34.66 $ 35.51 $ 37.11 $ 35.51

Community Trust Bancorp, Inc.

Financial Summary (Unaudited)

September 30, 2016

(in thousands except per share data and #

of employees)

As of As of As of September 30, 2016 June 30, 2016 September

30, 2015

Assets: Loans $ 2,931,299 $ 2,931,385 $ 2,820,460

Loan loss reserve (35,801 ) (35,697 ) (35,540

) Net loans 2,895,498 2,895,688 2,784,920 Loans held for sale 2,075

1,707 1,983 Securities AFS 631,201 579,115 576,713 Securities HTM

1,181 1,661 1,661 Other equity investments 22,814 22,814 22,814

Other earning assets 74,419 81,894 116,754 Cash and due from banks

49,584 59,700 54,041 Premises and equipment 47,840 48,104 48,541

Goodwill and core deposit intangible 65,662 65,702 65,821 Other

assets 139,952 138,937 134,900

Total Assets $ 3,930,226 $ 3,895,322 $

3,808,148

Liabilities and Equity: NOW accounts

$ 45,834 $ 50,362 $ 32,249 Savings deposits 1,023,590 1,025,394

1,004,635

CD’s >=$100,000

597,417 574,657 561,856 Other time deposits 623,957

626,103 638,832 Total interest bearing

deposits 2,290,798 2,276,516 2,237,572 Noninterest bearing deposits

763,187 765,467 737,657

Total deposits 3,053,985 3,041,983 2,975,229 Repurchase agreements

262,295 261,298 256,153 Other interest bearing liabilities 69,110

66,674 71,640 Noninterest bearing liabilities 44,726

31,757 34,541 Total liabilities

3,430,116 3,401,712 3,337,563

Shareholders’ equity

500,110 493,610 470,585

Total Liabilities and Equity $ 3,930,226 $ 3,895,322

$ 3,808,148 Ending shares outstanding 17,608

17,560 17,513 Memo: Market value of HTM securities $ 1,182 $ 1,662

$ 1,651 30 - 89 days past due loans $ 19,765 $ 18,995 $

18,812 90 days past due loans 11,498 8,237 18,001 Nonaccrual loans

16,798 16,447 14,722 Restructured loans (excluding 90 days past due

and nonaccrual) 54,026 55,088 43,081 Foreclosed properties 37,665

37,740 34,654 Other repossessed assets 103 136 136 Common

equity Tier 1 capital 14.97 % 14.79 % 14.49 % Tier 1 leverage ratio

12.69 % 12.57 % 12.40 % Tier 1 risk-based capital ratio 17.05 %

16.88 % 16.63 % Total risk based capital ratio 18.30 % 18.13 %

17.88 % Tangible equity to tangible assets ratio 11.24 % 11.17 %

10.82 % FTE employees 991 998 980

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161019005769/en/

Community Trust Bancorp, Inc.Jean R. Hale, 606-437-3294Chairman,

President, and C.E.O.

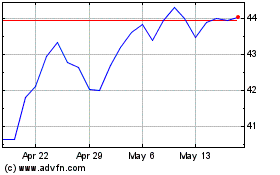

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

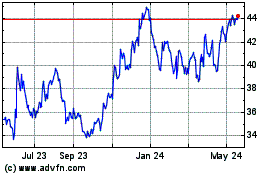

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024