Community Trust Bancorp, Inc. (NASDAQ:CTBI):

Earnings

Summary

(in thousands except per share data)

2Q

2014

1Q

2014

2Q

2013

6 Months

2014

6 Months

2013

Net income $12,195 $10,140 $11,942 $22,335 $23,762 Earnings per

share $0.70 $0.59 $0.70 $1.29 $1.39 Earnings per share - diluted

$0.70 $0.58 $0.69 $1.28 $1.38 Return on average assets 1.33%

1.13% 1.31% 1.23% 1.31% Return on average equity 11.32% 9.72%

11.76% 10.53% 11.79% Efficiency ratio 56.96% 62.00% 55.21% 59.45%

56.44% Tangible common equity 10.26% 9.88% 9.35% Dividends

declared per share $0.290 $0.291 $0.286 $0.581 $0.572 Book value

per share $24.90 $24.23 $23.23 Weighted average shares

17,318 17,308 17,121 17,313 17,107 Weighted average shares -

diluted 17,393 17,403

17,205 17,393 17,188

Community Trust Bancorp, Inc. (NASDAQ:CTBI) reports earnings for

the second quarter 2014 of $12.2 million, or $0.70 per basic share,

compared to $11.9 million, or $0.70 per basic share, earned during

the second quarter 2013 and $10.1 million, or $0.59 per basic

share, earned during the first quarter 2014. The increased net

income for the quarter was primarily due to decreases in our loan

loss provision and noninterest expense with lower net other real

estate owned expense and fewer operating losses. Year-to-date

earnings for the six months ended June 30, 2014 were $22.3 million,

or $1.29 per basic share, compared to $23.8 million, or $1.39 per

basic share earned during the first six months of 2013. The

variance from prior year is due to decreased net interest income

and noninterest income, partially offset by decreases in our

provision for loan losses and noninterest expense.

On June 2, 2014, CTBI distributed a 10% stock dividend to

shareholders of record on May 15, 2014. All share data has been

restated accordingly.

2nd Quarter 2014 Highlights

- CTBI’s basic earnings per share for the

quarter was flat to prior year second quarter but increased $0.11

from first quarter 2014. Year-to-date basic earnings per share

decreased $0.10 from prior year.

- Net interest income for the quarter

decreased 1.5% from prior year second quarter but increased 0.2%

from prior quarter as our net interest margin decreased 7 basis

points and 5 basis points, respectively, for those time periods.

Average earning assets increased 0.6% from second quarter 2013 and

0.7% from prior quarter while our yield on average earning assets

decreased 14 basis points and 6 basis points, respectively. The

yield on all earning asset portfolios declined quarter over

quarter, while the cost of interest bearing funds remained stable.

Net interest income for the six months ended June 30, 2014

decreased 1.4% from prior year.

- Nonperforming loans at $44.5 million

increased $3.0 million from June 30, 2013 and $2.1 million from

March 31, 2014, primarily due to one credit relationship which

management has reviewed and considers to be well secured and in the

process of collection. Nonperforming assets at $77.6 million

decreased $7.1 million from June 30, 2013 and $1.1 million from

March 31, 2014.

- Net loan charge-offs for the quarter

ended June 30, 2014 were $0.7 million, or 0.11% of average loans

annualized, compared to $3.5 million, or 0.54%, experienced for the

second quarter 2013 and $1.7 million, or 0.27%, for the first

quarter 2014. Year-to-date net charge-offs declined from 0.38% of

average loans to 0.19%.

- Our loan loss provision for the quarter

decreased $2.9 million from prior year second quarter and $0.6

million from prior quarter. Year-to-date provision decreased $3.1

million. The decline in our loan loss provision was primarily due

to the trend of decreasing net losses to average loans resulting in

a 2 basis point reduction in our allowance for loan and lease

losses. The reduction in our allowance for loan and lease losses

impacted our second quarter 2014 earnings per basic share by

$0.02.

- Noninterest income decreased 17.3% for

the quarter ended June 30, 2014 compared to the same period in 2013

but increased 9.0% from prior quarter. Noninterest income for the

first six months of 2014 decreased 16.5% from prior year. The

decrease from prior year was primarily attributable to decreases in

gains on sales of loans, deposit service charges, loan related fees

resulting from the fluctuation in the fair value of our mortgage

servicing rights, and other noninterest income due to the prior

year death benefits received in bank owned life insurance.

- Noninterest expense for the quarter

ended June 30, 2014 decreased 2.8% from prior year second quarter

and 6.0% from prior quarter. The quarterly improvement is due to

decreases in net other real estate owned expense and operating

losses. Noninterest expense for the first six months of 2014

decreased 0.3% from prior year. Noninterest expense for the year

was positively impacted by the decrease in net other real estate

owned expense as well as adjustments totaling $0.8 million to

reduce the accrual for the Federal Reserve determination which was

previously disclosed in our annual report on Form 10-K for the year

ended December 31, 2013.

- Our loan portfolio increased $47.8

million from June 30, 2013 and $47.1 million during the

quarter.

- Our investment portfolio decreased

$39.8 million from June 30, 2013 and $2.6 million during the

quarter.

- Deposits, including repurchase

agreements, declined $21.7 million from June 30, 2013 and $36.7

million during the quarter. During the second quarter 2014,

substantially all decline was in interest bearing deposits. Year

over year interest bearing deposits, including repurchase

agreements, declined $48.9 million while noninterest bearing

deposits increased $27.1 million.

- Our tangible common equity/tangible

assets ratio increased to 10.26%.

Net Interest Income

Net interest income for the quarter decreased $0.5 million, or

1.5%, from prior year second quarter but increased $0.1 million, or

0.2% from prior quarter as our net interest margin decreased 7

basis points and 5 basis points, respectively, for those time

periods. The current low rate environment continues to have a

negative impact on our net interest margin. Average earning assets

increased 0.6% from second quarter 2013 and 0.7% from prior quarter

while our yield on average earning assets decreased 14 basis points

and 6 basis points, respectively. Loans represented 76.3% of our

average earning assets for the quarter ended June 30, 2014 compared

to 75.6% for the quarter ended June 30, 2013 and 76.6% for the

quarter ended March 31, 2014. The cost of interest bearing funds

decreased 6 basis points from prior year second quarter but

remained flat to prior quarter. Net interest income for the six

months ended June 30, 2014 decreased $1.0 million, or 1.4%, from

prior year.

Noninterest Income

Noninterest income decreased $2.3 million, or 17.3%, for the

quarter ended June 30, 2014 compared to the same period in 2013 but

increased $0.9 million, or 9.0%, from prior quarter. The decrease

from prior year second quarter included decreases in gains on sales

of loans, deposit service charges, loan related fees, and bank

owned life insurance income. The decrease in gains on sales of

loans from prior year was reflective of the decline in secondary

market residential real estate mortgage activity, and the decrease

in deposit service charges from prior year was a result of the

change in our processing of overdrafts. However, gains on sales of

loans increased $0.1 million from the first quarter 2014, and

deposit service charges increased $0.6 million from prior quarter

with increases in overdraft revenue and Visa debit fee income. Loan

related fees were impacted by the fluctuation in the fair value of

our mortgage servicing rights, and the decrease in other

noninterest income was due to the prior year death benefits

received in bank owned life insurance of $0.9 million.

Noninterest income for the first six months of 2014 decreased

$4.2 million, or 16.5%, from prior year. Gains on sales of loans

were $1.7 million below prior year, deposit service charges were

$0.5 million below prior year, and loan related fees were $1.0

million below prior year due to a $0.8 million change in fair value

adjustments in our mortgage servicing portfolio.

Noninterest Expense

Noninterest expense for the quarter ended June 30, 2014

decreased $0.7 million, or 2.8%, from prior year second quarter and

$1.6 million, or 6.0%, from prior quarter. The quarterly

improvement is due to decreases in net other real estate owned

expense and operating losses. Noninterest expense for the first six

months of 2014 decreased $0.2 million, or 0.3%, from prior year.

Noninterest expense for the year was positively impacted by a $0.8

million decrease in net other real estate owned expense as well as

adjustments totaling $0.8 million to the accrual for the Federal

Reserve determination, partially offset by increased personnel

expense of $0.5 million, an increase in operating losses of $0.4

million, and increased data processing expense of $0.3 million.

Balance Sheet Review

CTBI’s total assets at $3.7 billion increased $14.4 million, or

0.4%, from June 30, 2013 but decreased $16.0 million, or an

annualized 1.7%, during the quarter. Loans outstanding at June 30,

2014 were $2.6 billion, increasing $47.8 million, or 1.8%, from

June 30, 2013 and $47.1 million, or an annualized 7.3%, during the

quarter. We experienced growth during the quarter of $36.8 million

in the commercial loan portfolio, $6.9 million in the residential

loan portfolio, and $3.4 million in the consumer loan portfolio.

CTBI’s investment portfolio decreased $39.8 million, or 5.8%, from

June 30, 2013 and $2.6 million, or an annualized 1.6%, during the

quarter. Deposits in other banks decreased $62.9 million during the

quarter to fund loan growth. Deposits, including repurchase

agreements, at $3.1 billion decreased $21.7 million, or 0.7%, from

June 30, 2013 and $36.7 million, or an annualized 4.7%, from prior

quarter.

Shareholders’ equity at June 30, 2014 was $433.9 million

compared to $400.3 million at June 30, 2013 and $422.0 million at

March 31, 2014. CTBI’s annualized dividend yield to shareholders as

of June 30, 2014 was 3.39%.

Asset Quality

CTBI’s total nonperforming loans were $44.5 million at June 30,

2014, a 7.1% increase from the $41.6 million at June 30, 2013 and a

5.0% increase from the $42.4 million at March 31, 2014. Loans 90+

days past due increased $3.3 million for the quarter, partially

offset by a $1.2 million decrease in nonaccrual loans. The increase

in loans 90+ days past due was primarily the result of one credit

relationship totaling $2.6 million. Loans in the 90+ days past due

category are reviewed by management and are considered to be well

secured and in the process of collection; therefore, these loans

require no specific reserves to the allowance for loan and lease

losses. Loans 30-89 days past due at $21.5 million was an increase

of $5.0 million from June 30, 2013 but a decrease of $2.1 million

from March 31, 2014. Our loan portfolio management processes focus

on the immediate identification, management, and resolution of

problem loans to maximize recovery and minimize loss. Impaired

loans, loans not expected to meet contractual principal and

interest payments other than insignificant delays, at June 30, 2014

totaled $66.2 million, compared to $63.4 million at June 30, 2013

and $65.3 million at March 31, 2014.

We continue to experience improvement in other real estate

owned. Our level of foreclosed properties at $33.1 million at June

30, 2014 was a decrease from $43.1 million at June 30, 2013 and

$36.3 million at March 31, 2014. Sales of foreclosed properties for

the quarter ended June 30, 2014 totaled $5.1 million while new

foreclosed properties totaled $2.2 million. At June 30, 2014, the

book value of properties under contracts to sell was $2.6 million;

however, the closings had not occurred at quarter-end.

Net loan charge-offs for the quarter ended June 30, 2014 were

$0.7 million, or 0.11% of average loans annualized, compared to

$3.5 million, or 0.54%, experienced for the second quarter 2013 and

$1.7 million, or 0.27%, for the first quarter 2014. Of the total

net charge-offs for the quarter, $0.1 million were in commercial

loans, $0.2 million were in indirect auto loans, and $0.2 million

were in residential real estate mortgage loans. Year-to-date net

charge-offs declined from 0.38% of average loans to 0.19%.

Allocations to loan loss reserves were $0.7 million for the quarter

ended June 30, 2014 compared to $3.7 million for the quarter ended

June 30, 2013 and $1.3 million for the quarter ended March 31,

2014. Loan loss provision for the six months ended June 30, 2014

decreased $3.1 million. Our reserve coverage (allowance for loan

and lease loss reserve to nonperforming loans) at June 30, 2014 was

75.5% compared to 80.8% at June 30, 2013 and 79.2% at March 31,

2014. Our loan loss reserve as a percentage of total loans

outstanding decreased to 1.28% from the 1.30% at June 30, 2013 and

March 31, 2014. The decline in our loan loss provision was

primarily due to the trend of decreasing net losses to average

loans and a 2 basis point reduction in our allowance for loan and

lease losses. The reduction in our allowance for loan and lease

losses impacted our earnings per basic share by $0.02.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. CTBI’s actual

results may differ materially from those included in the

forward-looking statements. Forward-looking statements are

typically identified by words or phrases such as “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “may increase,” “may

fluctuate,” and similar expressions or future or conditional verbs

such as “will,” “should,” “would,” and “could.” These

forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations’ savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI’s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.7 billion, is

headquartered in Pikeville, Kentucky and has 71 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, four banking

locations in northeastern Tennessee, four trust offices across

Kentucky, and one trust office in Tennessee.

Additional information follows.

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) June 30, 2014 (in thousands except per share

data and # of employees)

Three Three Three Six Six Months Months

Months Months Months Ended Ended Ended Ended Ended

June 30, 2014

March 31, 2014

June 30, 2013

June 30, 2014 June 30, 2013 Interest income $ 35,811 $ 35,693 $

36,783 $ 71,504 $ 73,559 Interest expense 2,978

2,943 3,441 5,921

7,020 Net interest income 32,833 32,750 33,342 65,583 66,539

Loan loss provision 735 1,345 3,661 2,080 5,220 Gains on

sales of loans 288 190 755 478 2,152 Deposit service charges 5,987

5,431 6,182 11,418 11,949 Trust revenue 2,199 2,109 2,023 4,308

4,023 Loan related fees 766 679 1,496 1,445 2,444 Securities gains

(losses) (51 ) (60 ) (8 ) (111 ) (8 ) Other noninterest income

1,783 1,716 2,826

3,499 4,634 Total noninterest income 10,972

10,065 13,274 21,037 25,194 Personnel expense 13,274 13,417

13,214 26,691 26,196 Occupancy and equipment 2,875 3,064 2,960

5,939 5,865 Data processing expense 1,933 1,925 1,775 3,858 3,588

FDIC insurance premiums 558 649 637 1,207 1,239 Other noninterest

expense 6,616 7,806 7,401

14,422 15,398 Total noninterest expense

25,256 26,861 25,987 52,117 52,286 Net income before taxes

17,814 14,609 16,968 32,423 34,227 Income taxes 5,619

4,469 5,026 10,088

10,465 Net income $ 12,195 $ 10,140 $ 11,942

$ 22,335 $ 23,762 Memo: TEQ interest

income $ 36,298 $ 36,141 $ 37,230 $ 72,439 $ 74,451 Average

shares outstanding 17,318 17,308 17,121 17,313 17,107 Diluted

average shares outstanding 17,393 17,403 17,205 17,393 17,188 Basic

earnings per share $ 0.70 $ 0.59 $ 0.70 $ 1.29 $ 1.39 Diluted

earnings per share $ 0.70 $ 0.58 $ 0.69 $ 1.28 $ 1.38 Dividends per

share $ 0.290 $ 0.291 $ 0.286 $ 0.581 $ 0.572

Average

balances: Loans $ 2,604,064 $ 2,595,729 $ 2,566,536 $ 2,599,920

$ 2,559,537 Earning assets 3,413,628 3,389,490 3,393,342 3,401,626

3,393,593 Total assets 3,670,820 3,648,545 3,665,249 3,659,744

3,662,581 Deposits, including repurchase agreements 3,129,289

3,114,169 3,139,180 3,121,771 3,137,403 Interest bearing

liabilities 2,554,122 2,546,743 2,597,011 2,550,453 2,598,476

Shareholders' equity 432,211 423,175 407,203 427,718 406,381

Performance ratios: Return on average assets 1.33 % 1.13 %

1.31 % 1.23 % 1.31 % Return on average equity 11.32 % 9.72 % 11.76

% 10.53 % 11.79 % Yield on average earning assets (tax equivalent)

4.26 % 4.32 % 4.40 % 4.29 % 4.42 % Cost of interest bearing funds

(tax equivalent) 0.47 % 0.47 % 0.53 % 0.47 % 0.54 % Net interest

margin (tax equivalent) 3.92 % 3.97 % 3.99 % 3.94 % 4.01 %

Efficiency ratio (tax equivalent) 56.96 % 62.00 % 55.21 % 59.45 %

56.44 % Loan charge-offs $ 1,629 $ 2,545 $ 4,115 $ 4,174 $

6,303 Recoveries (896 ) (807 ) (662 )

(1,703 ) (1,439 ) Net charge-offs $ 733 $ 1,738 $ 3,453 $

2,471 $ 4,864

Market Price: High $ 38.60 $ 41.13 $

33.27 $ 41.13 $ 33.27 Low $ 32.33 $ 34.18 $ 29.23 $ 32.33 $ 29.23

Close $ 34.22 $ 37.71 $ 32.38 $ 34.22 $ 32.38

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) June 30, 2014 (in thousands except per share

data and # of employees)

As of As of As of June 30, 2014 March 31, 2014 June 30, 2013

Assets: Loans $ 2,632,609 $ 2,585,508 $ 2,584,801 Loan loss

reserve (33,617 ) (33,615 ) (33,601 ) Net

loans 2,598,992 2,551,893 2,551,200 Loans held for sale 895 1,610

2,991 Securities AFS 647,536 650,127 687,362 Securities HTM 1,662

1,662 1,662 Other equity investments 22,814 22,814 30,559 Other

earning assets 76,653 140,715 63,071 Cash and due from banks 72,637

64,386 56,100 Premises and equipment 50,552 51,182 52,703 Goodwill

and core deposit intangible 66,074 66,127 66,287 Other assets

114,787 118,062 126,316

Total Assets $ 3,652,602 $ 3,668,578 $

3,638,251

Liabilities and Equity: NOW accounts

$ 28,851 $ 27,819 $ 28,191 Savings deposits 911,073 931,135 874,800

CD's >=$100,000 601,602 605,478 641,979 Other time deposits

694,075 707,587 752,752

Total interest bearing deposits 2,235,601 2,272,019 2,297,722

Noninterest bearing deposits 651,588 652,170

624,451 Total deposits 2,887,189 2,924,189

2,922,173 Repurchase agreements 217,979 217,656 204,735 Other

interest bearing liabilities 77,774 71,321 76,763 Noninterest

bearing liabilities 35,782 33,369

34,236 Total liabilities 3,218,724 3,246,535

3,237,907 Shareholders' equity 433,878 422,043

400,344

Total Liabilities and Equity $

3,652,602 $ 3,668,578 $ 3,638,251

Ending shares outstanding 17,421 17,416 17,232 Memo: Market value

of HTM securities $ 1,632 $ 1,619 $ 1,621 30 - 89 days past

due loans $ 21,466 $ 23,532 $ 16,507 90 days past due loans 18,807

15,546 22,562 Nonaccrual loans 25,725 26,884 19,012 Restructured

loans (excluding 90 days past due and nonaccrual) 45,756 44,803

42,181 Foreclosed properties 33,062 36,299 43,080 Other repossessed

assets 5 5 Tier 1 leverage ratio 11.83 % 11.68 % 11.01 %

Tier 1 risk based ratio 16.66 % 16.57 % 15.52 % Total risk based

ratio 17.91 % 17.81 % 16.77 % Tangible equity to tangible assets

ratio 10.26 % 9.88 % 9.35 % FTE employees 1,016 1,024 1,045

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) June 30, 2014 (in thousands except per share

data and # of employees)

Community Trust Bancorp, Inc. reported

earnings for the three and six months ending June 30, 2014 and 2013

as follows:

Three Months Ended

Six Months Ended

June 30

June 30 2014 2013 2014 2013 Net income $ 12,195 $

11,942 $ 22,335 $ 23,762 Basic earnings per share $ 0.70 $

0.70 $ 1.29 $ 1.39 Diluted earnings per share $ 0.70 $ 0.69

$ 1.28 $ 1.38 Average shares outstanding 17,318 17,121

17,313 17,107 Total assets (end of period) $ 3,652,602 $

3,638,251 Return on average equity 11.32 % 11.76 % 10.53 %

11.79 % Return on average assets 1.33 % 1.31 % 1.23 % 1.31 %

Provision for loan losses $ 735 $ 3,661 $ 2,080 $ 5,220

Gains on sales of loans $ 288 $ 755 $ 478 $ 2,152

Community Trust Bancorp, Inc.Jean R. Hale,

606-437-3294Chairman, President, and C.E.O.

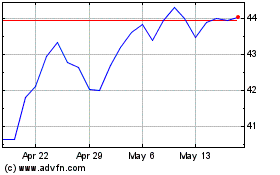

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

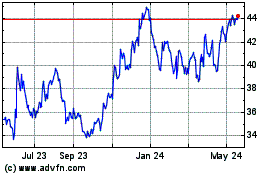

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024